Devon Energy Announces Strategic Acquisition in the Williston Basin and Expands Share-Repurchase Authorization by 67 Percent to $5 Billion

July 08 2024 - 7:05AM

Devon Energy (NYSE: DVN) announced today it has entered into a

definitive purchase agreement to acquire the Williston Basin

business of Grayson Mill Energy in a transaction valued at $5

billion, consisting of $3.25 billion of cash and $1.75 billion of

stock to the sellers. The transaction is subject to customary terms

and conditions, including various purchase price adjustments, and

is expected to close by the end of the third quarter of 2024, with

an effective date of June 1, 2024.

“The acquisition of Grayson Mill is an excellent strategic fit

for Devon that allows us to efficiently expand our oil production

and operating scale while capturing a meaningful runway of highly

economic drilling inventory,” stated Rick Muncrief, Devon’s

president and CEO. “This transaction also creates immediate value

within our financial framework by delivering sustainable accretion

to earnings and free cash flow that will result in higher

distributions to shareholders over time.”

TRANSACTION HIGHLIGHTS

- Immediately accretive to financial metrics –

The transaction is immediately accretive to Devon’s key per-share

financial measures, including earnings, cash flow, free cash flow

and net asset value. The assets were acquired at less than 4-times

EBITDAX, with an estimated free cash flow yield of 15 percent at an

$80 WTI oil price.

- Enhances scale and scope of operations – The

acquisition adds a high-margin production mix that further

positions Devon as one of the largest oil producers in the U.S. Pro

forma for the transaction, the company estimates its oil production

to average 375,000 barrels per day, with total production reaching

an average of 765,000 oil-equivalent barrels (Boe) per day across

its diversified portfolio of assets.(1)

- Transforms Williston Basin business – The

transaction significantly expands the company’s position in the

Williston Basin with the addition of 307,000 net acres (70 percent

working interest). Production from the acquired properties is

expected to be maintained at approximately 100,000 Boe per day (55

percent oil) in 2025. With enhanced scale in the basin, Devon

expects to realize up to $50 million in average annual cash flow

savings from operating efficiencies and marketing synergies. The

acquisition also adds 500 gross locations and 300 high-quality

refrac candidates that effectively compete for capital in the

company’s portfolio. On a pro forma basis, Devon will possess an

inventory life of up to 10 years in the Williston Basin at a

constant development pace of three operated rigs.

- Midstream ownership enhances margin – The

acquired business generates peer-leading operating margins in the

Williston Basin that benefit from midstream infrastructure

ownership in 950 miles of gathering systems, an extensive network

of disposal wells and crude storage terminals. This midstream

ownership creates a margin uplift of more than $125 million of

EBITDAX annually and provides marketing optionality to capture

higher pricing through access points to multiple end use

markets.

- Improves outlook for return of capital to

shareholders – Due to the accretive nature of this

transaction to free cash flow, Devon’s board of directors has

expanded its share-repurchase authorization by 67 percent to $5

billion through mid-year 2026. The company also expects this

acquisition to be accretive to the company’s dividend payout in

2025 and beyond.

- Maintains strong financial position – The

transaction structure supports Devon retaining its strong

investment-grade credit ratings with a projected net

debt-to-EBITDAX ratio of approximately 1.0 times upon closing. The

company plans to improve its financial strength by allocating up to

30 percent of its annual free cash flow towards reducing $2.5

billion of debt over the next two years.

(1) Pro forma production is a combination of Devon’s 2024

guidance and Grayson Mill’s 2025e volumes of ~100 MBOED (~55%

oil).

FINANCING DETAILS

Devon will fund the $5 billion acquisition with $3.25 billion of

cash and issue 37 million shares of common stock valued at $1.75

billion. The company plans to finance the cash portion of the

purchase price through a combination of cash on hand and debt.

2024 OUTLOOK

Devon will provide updated forward-looking guidance for 2024

upon closing of the transaction.

ADVISORS

Citi is serving as financial advisor and Kirkland & Ellis

LLP is serving as legal advisor to Devon.

CONFERENCE CALL WEBCAST AND ADDITIONAL

MATERIALS

Devon will host a conference call and webcast today at 7:30 a.m.

Central Time (8:30 a.m. Eastern Time) to discuss this announcement.

The webcast and related presentation materials may be accessed from

Devon's homepage at www.devonenergy.com.

ABOUT DEVON ENERGY

Devon Energy is a leading oil and gas producer in the U.S. with

a premier multi-basin portfolio headlined by a world-class acreage

position in the Delaware Basin. Devon’s disciplined cash-return

business model is designed to achieve strong returns, generate free

cash flow and return capital to shareholders, while focusing on

safe and sustainable operations.

Devon Investor

Contacts Scott

Coody,

405-552-4735 Chris

Carr, 405-228-2496

Devon Media Contact

Brooke

Baum,

405-552-3448

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements within

the meaning of the federal securities laws. Such statements are

subject to a number of assumptions, risks and uncertainties, many

of which are beyond the control of the company. These risks

include, but are not limited to: the delay or failure to consummate

the transaction due to unsatisfied closing conditions, such as

regulatory approvals, or other factors; the ultimate amount of cash

consideration to be paid or equity consideration to be issued in

the transaction due to purchase price adjustments or otherwise; the

risk that, if acquired, the Grayson Mill Energy business does not

perform consistent with our expectations, including with respect to

future production or drilling inventory; and the other risks

identified in the Company’s 2023 Annual Report on Form 10-K and its

other filings with the Securities and Exchange Commission (SEC).

Investors are cautioned that any such statements are not guarantees

of future performance and that actual results or developments may

differ materially from those projected in the forward-looking

statements. The forward-looking statements in this press release

are made as of the date hereof, and the company does not undertake

any obligation to update the forward-looking statements as a result

of new information, future events or otherwise.

NON-GAAP DISCLOSURES

This press release includes non-GAAP (generally accepted

accounting principles) financial measures, including projections of

the non-GAAP financial measures of EBITDAX and free cash flow on an

as-combined basis. Due to the high variability and difficulty in

making accurate forecasts and projections of some of the

information excluded from these projected measures, together with

some of the components of the calculations being inherently

unpredictable, Devon is unable to quantify certain amounts that

would be required to be included in the most directly comparable

GAAP financial measures without unreasonable effort. Consequently,

no disclosure of estimated comparable GAAP measures is included and

no reconciliation of the forward-looking non-GAAP financial

measures is included. Such non-GAAP measures are not

alternatives to GAAP measures, and you should not consider these

non-GAAP measures in isolation or as a substitute for analysis of

results as reported under GAAP. For additional disclosure

regarding Devon’s historical non-GAAP measures, including how we

define such measures, please refer to Devon’s first-quarter 2024

earnings materials and related Form 10-Q filed with the SEC.

CAUTIONARY NOTE ON RESERVES AND RESOURCE

ESTIMATES

The SEC permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves. Any

reserve estimates provided in this press release that are not

specifically designated as being estimates of proved reserves may

include estimated reserves or locations not necessarily calculated

in accordance with, or contemplated by, the SEC’s latest reserve

reporting guidelines. You are urged to consider closely the oil and

gas disclosures in the Company’s 2023 Annual Report on Form 10-K

and our other reports and filings with the SEC.

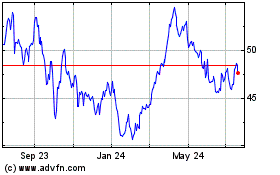

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Jan 2025 to Feb 2025

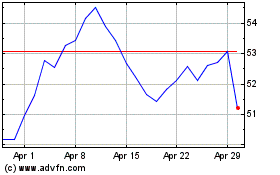

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Feb 2024 to Feb 2025