0001694426false00016944262024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 27, 2024

Date of Report (Date of earliest event reported)

DELEK US HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-38142 | 35-2581557 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | | |

310 Seven Springs Way, Suite 500 | Brentwood | Tennessee | 37027 |

(Address of Principal Executive) | | | (Zip Code) |

(615) 771-6701

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | DK | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition

On February 27, 2024, Delek US Holdings, Inc. (the “Company”) announced its financial results for the quarter ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 hereto.

The information in the attached Exhibit is being furnished pursuant to Item 2.02 “Results of Operations and Financial Condition” on Form 8-K. The information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On February 27, 2024, the Company will use the materials included in Exhibit 99.2 (the "Earnings Call Slides") to this report in connection with the fourth quarter earnings call. The Earnings Call Slides are incorporated into this Item 7.01 by this reference and will also be available on the Company's website at www.delekus.com.

The information in this Item 7.01 is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Item 7.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

Dated: February 27, 2024 | DELEK US HOLDINGS, INC

|

| |

| /s/ Reuven Spiegel |

| Name: Reuven Spiegel |

| Title: Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

Delek US Holdings Reports Fourth Quarter 2023 Results and 2024 Capital Program

Fourth Quarter

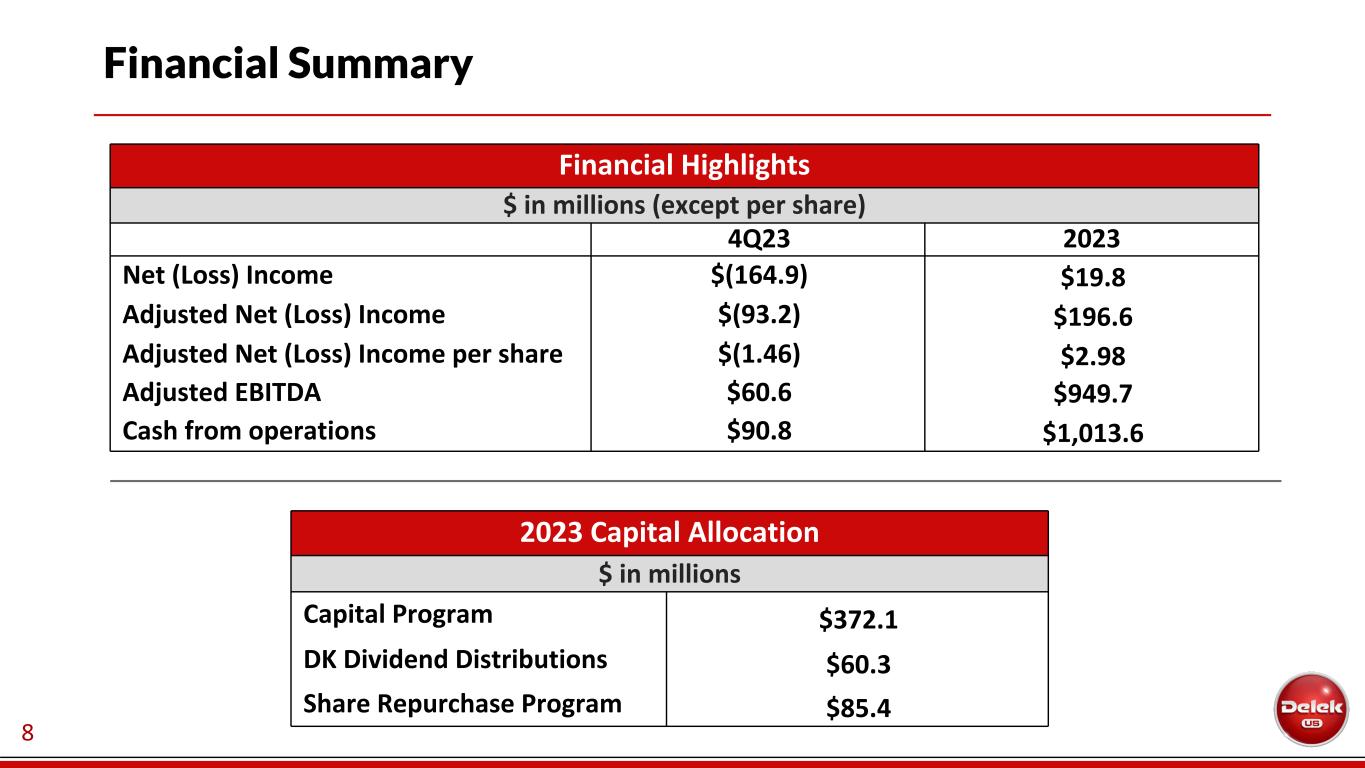

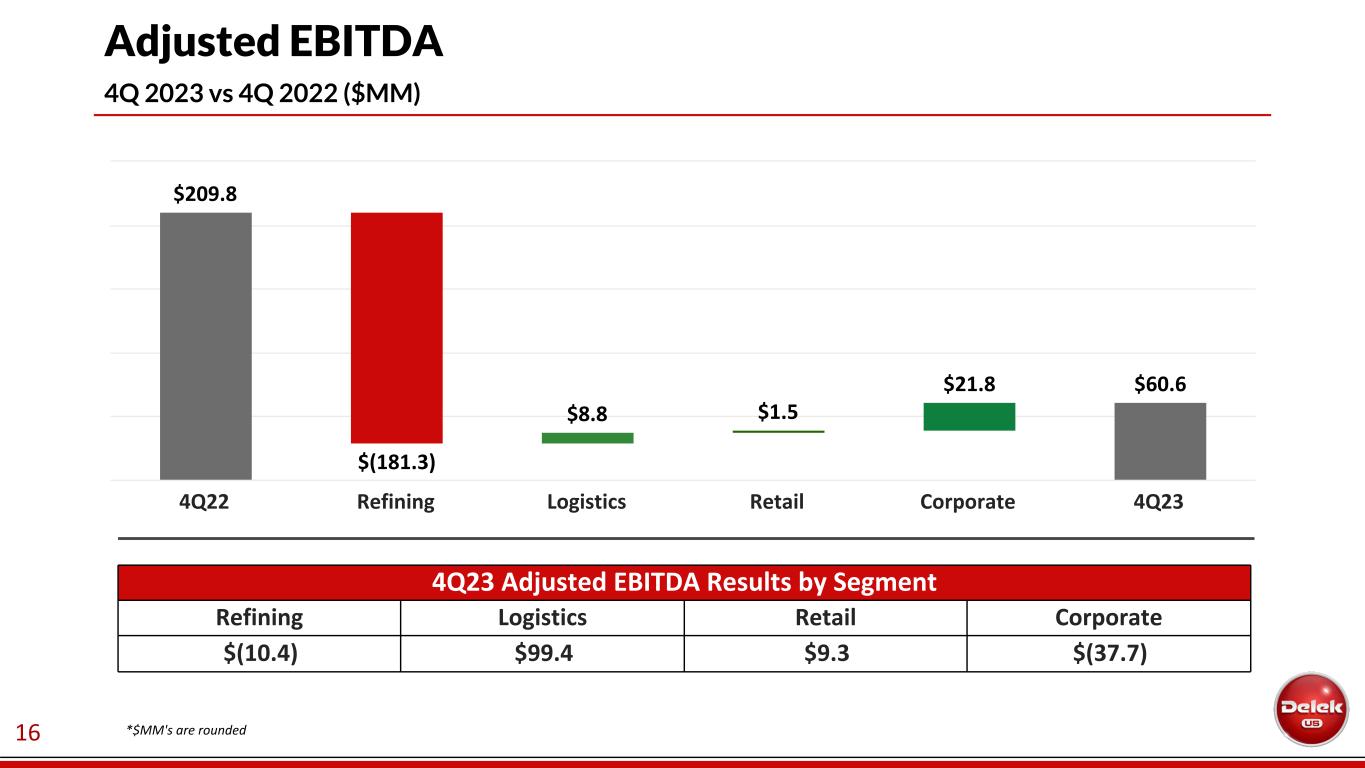

•Net loss of $164.9 million or $2.57 per share, adjusted net loss of $93.2 million or $1.46 per share, adjusted EBITDA of $60.6 million

•Returned $35.4 million to shareholders through dividends and share buybacks

•Reduced debt by $38.2 million

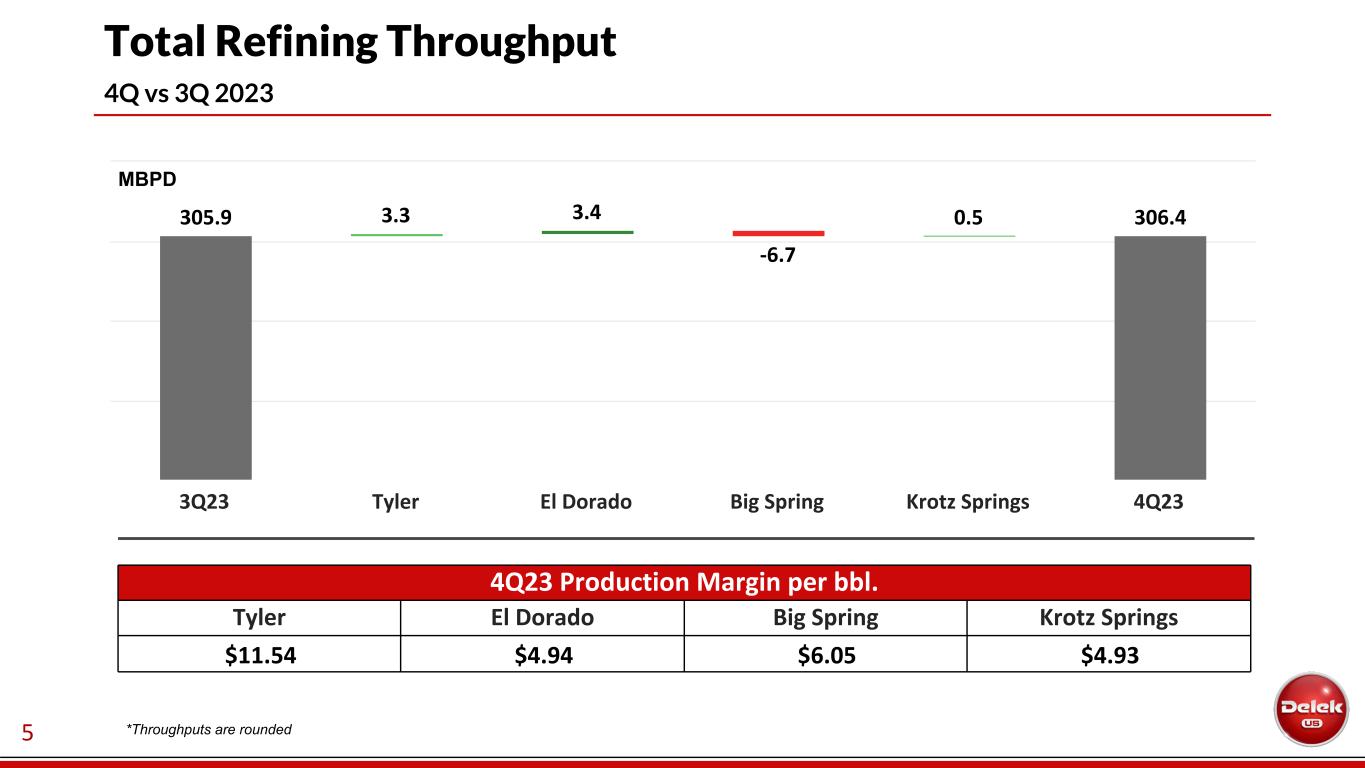

•Refining delivered record total throughput rate

•Logistics achieved another record quarter

•Increased regular quarterly dividend to $0.245 per share in February

Full-Year 2023

•Net income of $19.8 million or $0.30 per share, adjusted net income of $196.6 million or $2.98 per share, adjusted EBITDA of $949.7 million

•Returned $145.7 million to shareholders through dividends and share buybacks

•Reduced debt by $453.9 million

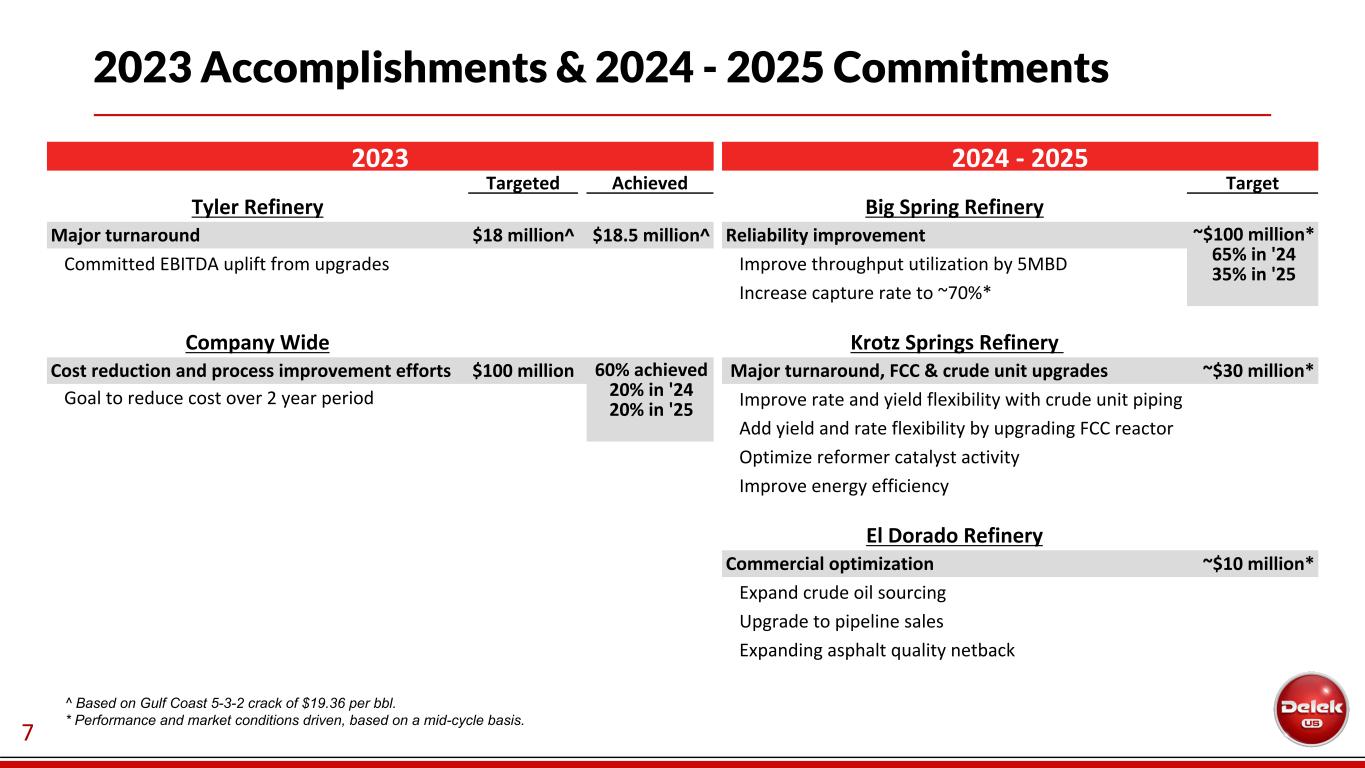

•Successfully executed major turnaround at Tyler Refinery and ran refining system at record total throughput

•Significantly grew logistics gathering and processing volumes

•Delivered one of Delek's safest years

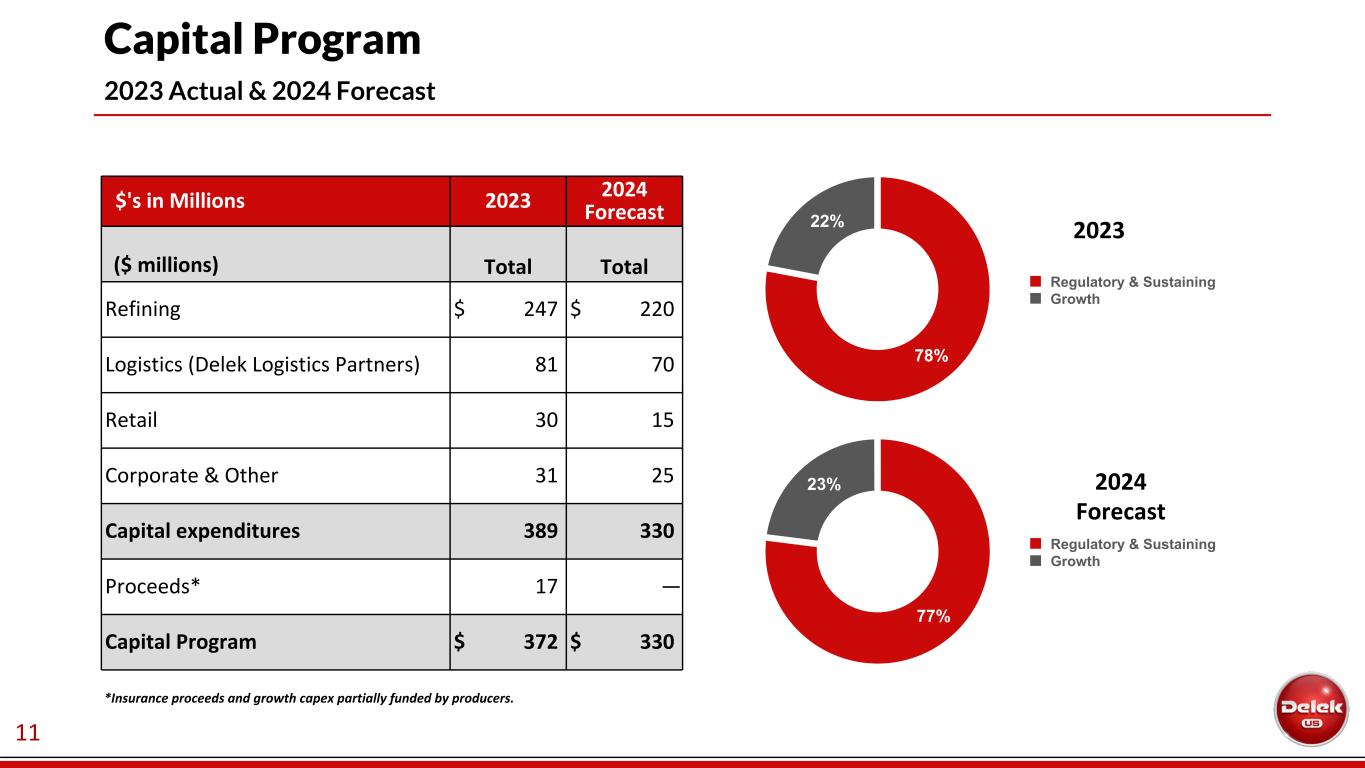

2024 Capital Program

•2024 capital expenditures are estimated to be approximately $330 million, including $220 million for refining and $70 million for logistics

BRENTWOOD, Tenn.-- February 27, 2024 -- Delek US Holdings, Inc. (NYSE: DK) (“Delek US”, "Company") today announced financial results for its fourth quarter ended December 31, 2023.

"During the fourth quarter, we operated well, achieving record total throughput in refining," said Avigal Soreq, President and Chief Executive Officer of Delek US. "The market environment was less than favorable, but we remained focused on what we could control."

"Our employees delivered a strong performance in 2023, successfully managing both opportunities and challenges to drive results," Soreq added. "Throughout the year, we made strategic investments to strengthen our foundation. We focused on people, processes, and equipment to support safe and reliable operations. At the same time, we drove long-term shareholder value and improved our financial strength by returning $146 million of capital to shareholders and reducing our net debt by $435 million during the year."

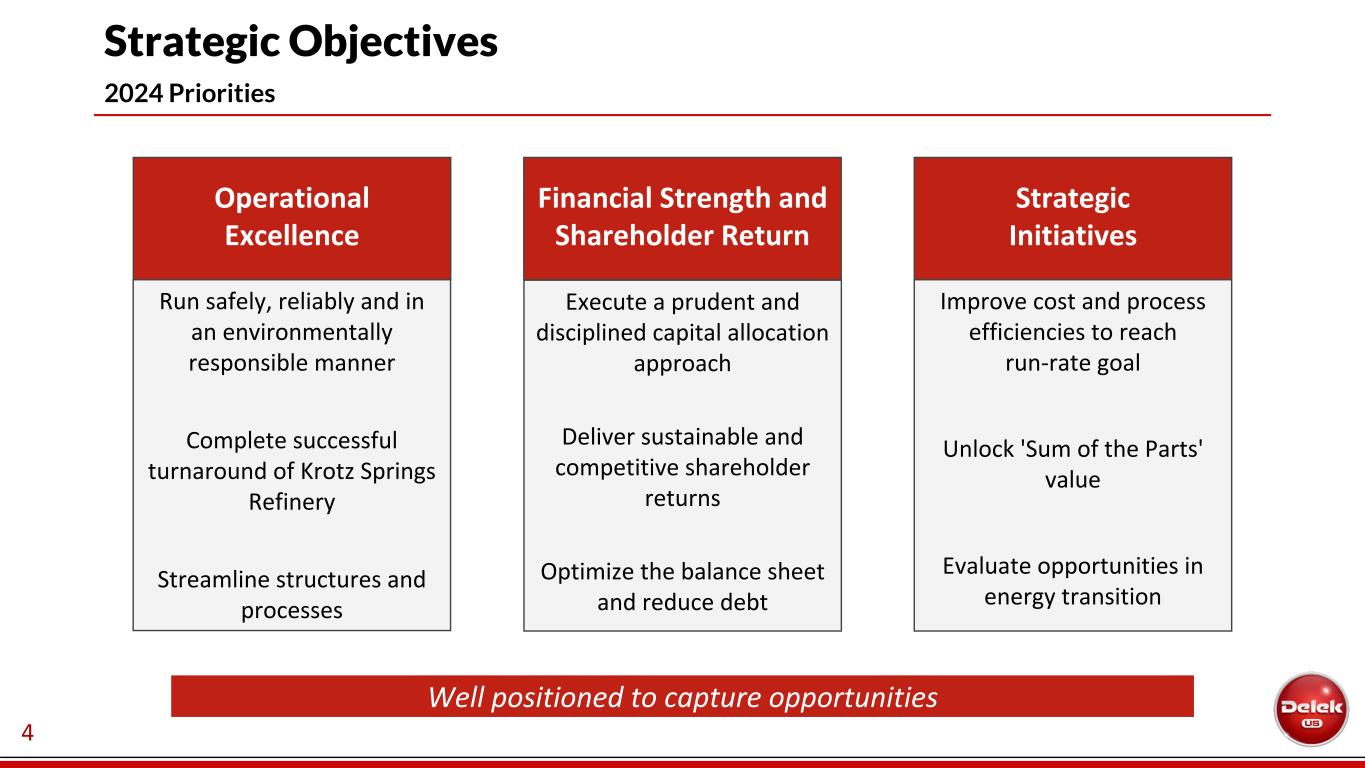

"Our guiding principles in 2024 are focused execution and a disciplined approach to capital allocation. The strategic initiatives we started in 2023 are gaining momentum and delivering results," Soreq continued. "We are making significant progress towards unlocking value intrinsic in our business and continue to focus on our stakeholders as we advance this initiative. For 2024, we estimate our capital program to be lower than 2023 at approximately $330 million. The capital program reflects our dedication to maintaining safe and reliable operations, enhancing our portfolio with strategic growth projects, and delivering shareholder value while maintaining our financial strength and flexibility. We believe we are well positioned from both an operational and financial standpoint to deliver competitive returns,” Soreq concluded.

Delek US Results

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| ($ in millions, except per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) income attributable to Delek US | | $ | (164.9) | | | $ | (118.7) | | | $ | 19.8 | | | $ | 257.1 | |

| Diluted (loss) income per share | | $ | (2.57) | | | $ | (1.73) | | | $ | 0.30 | | | $ | 3.59 | |

| Adjusted net (loss) income | | $ | (93.2) | | | $ | 52.4 | | | $ | 196.6 | | | $ | 513.5 | |

| Adjusted net (loss) income per share | | $ | (1.46) | | | $ | 0.76 | | | $ | 2.98 | | | $ | 7.17 | |

| Adjusted EBITDA | | $ | 60.6 | | | $ | 209.8 | | | $ | 949.7 | | | $ | 1,169.8 | |

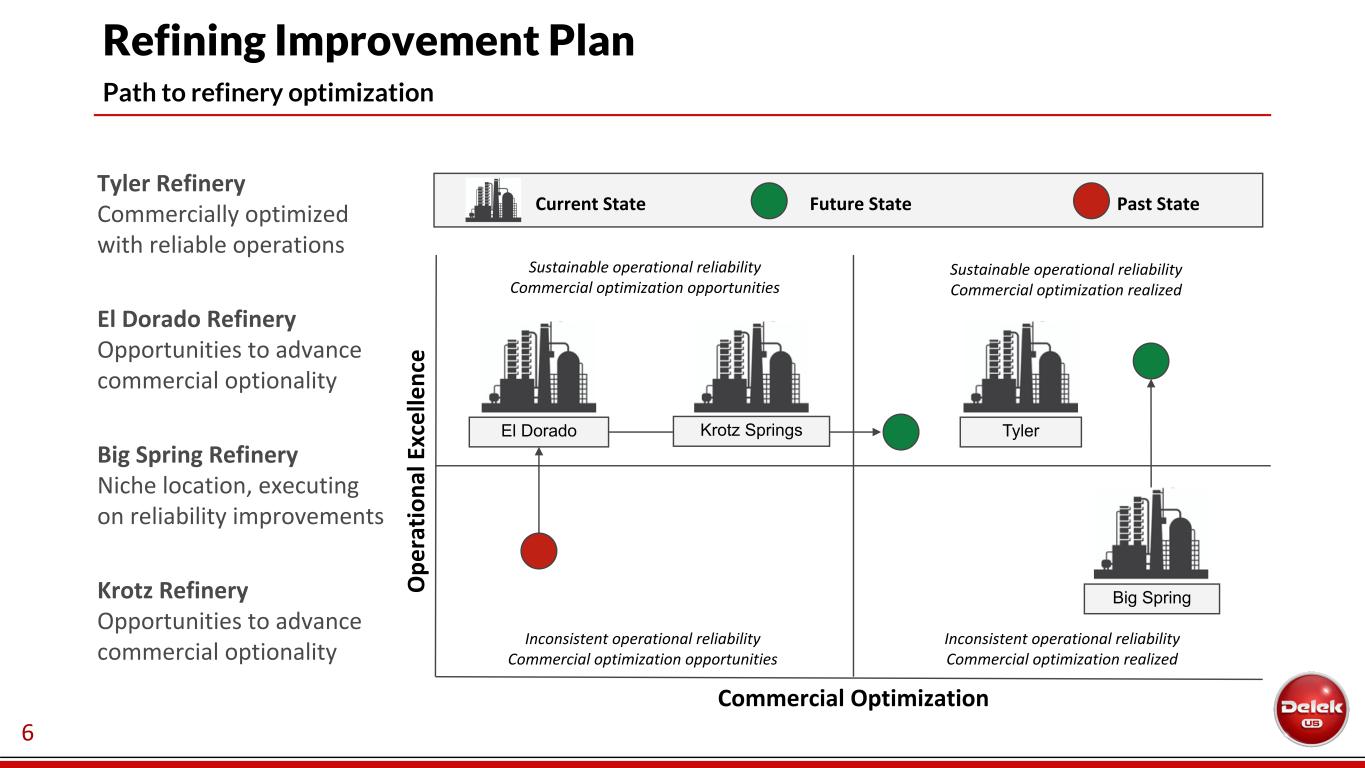

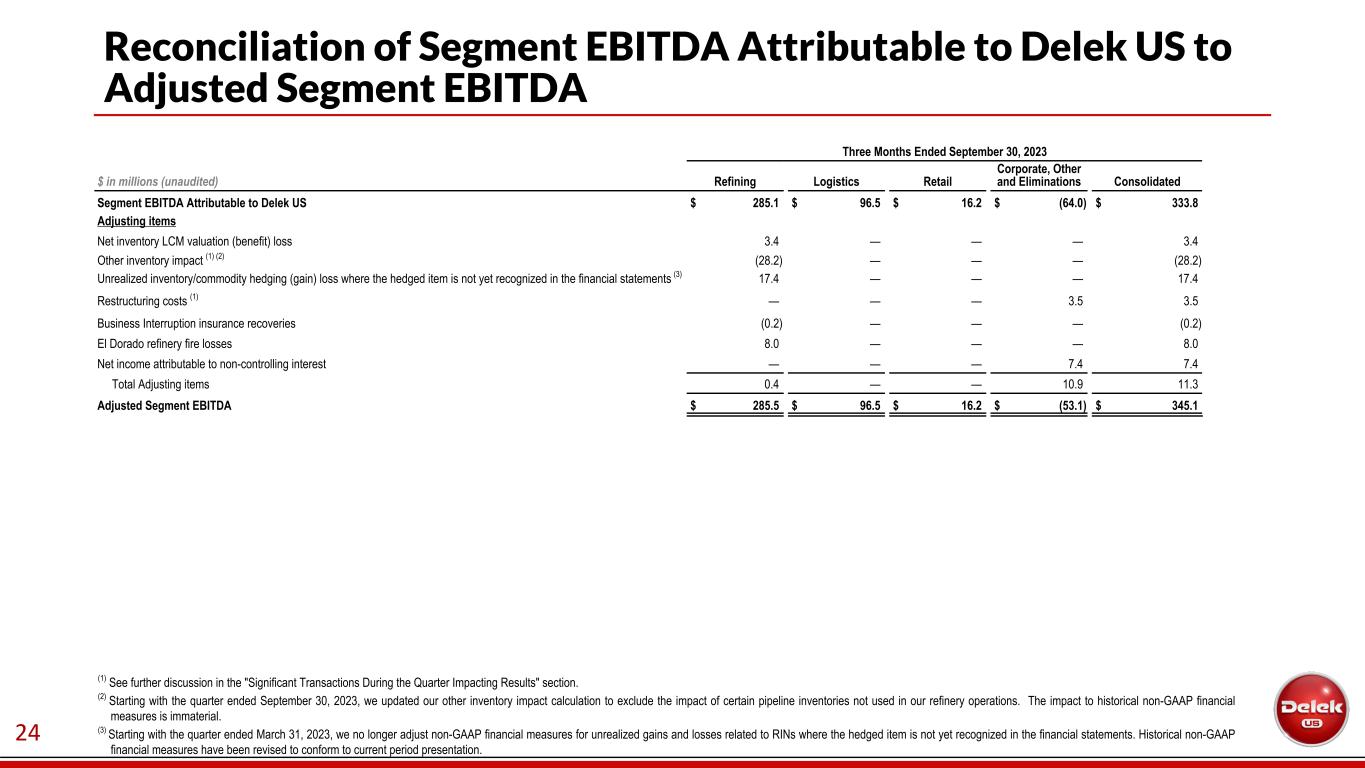

Refining Segment

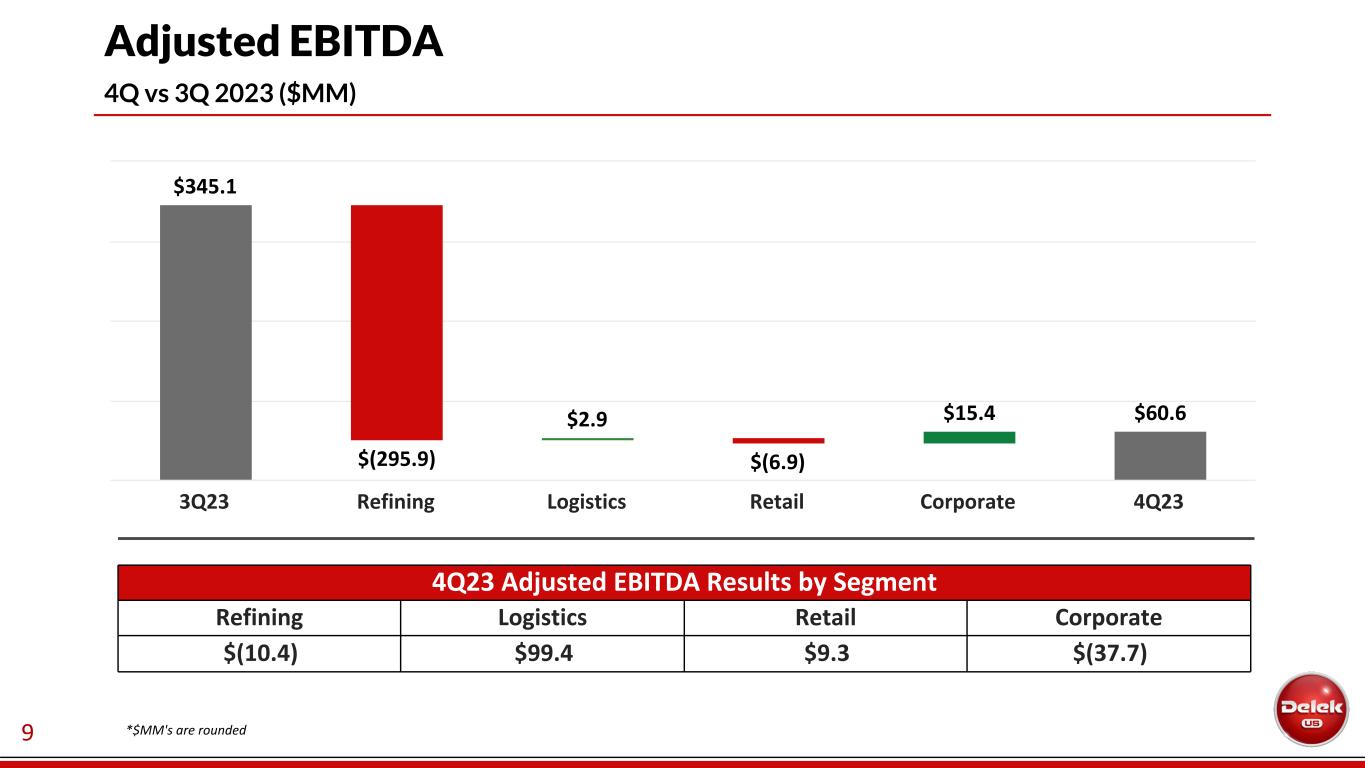

The refining segment Adjusted EBITDA was $(10.4) million in the fourth quarter 2023 compared with $170.9 million in the same quarter last year, which reflects other inventory impacts of $48.6 million and $193.6 million for fourth quarter 2023 and 2022, respectively. The decrease over 2022 is primarily due to lower refining crack spreads, partially offset by higher sales volume. During the fourth quarter 2023, Delek US's benchmark crack spreads were down an average of 50.7% from prior-year levels.

Logistics Segment

The logistics segment Adjusted EBITDA in the fourth quarter 2023 was $99.4 million compared with $90.6 million in the prior year quarter. The increase over last year's fourth quarter was driven by strong contributions from the Midland Gathering and Delaware Gathering systems in addition to annual rate increases.

Retail Segment

For the fourth quarter 2023, Adjusted EBITDA for the retail segment was $9.3 million compared with $7.8 million in the prior-year period. The increase was primarily driven by higher inside store margins and total retail fuel gallons sold.

Corporate and Other Activity

Adjusted EBITDA from Corporate, Other and Eliminations was a loss of $(37.7) million in the fourth quarter 2023 compared with a loss of $(59.5) million in the prior-year period. The improvement was driven by lower general and administrative costs, primarily related to employee benefit expenses.

Shareholder Distributions

On February 20, 2024, the Board of Directors approved the regular quarterly dividend of $0.245 per share that will be paid on March 8, 2024 to shareholders of record on March 1, 2024.

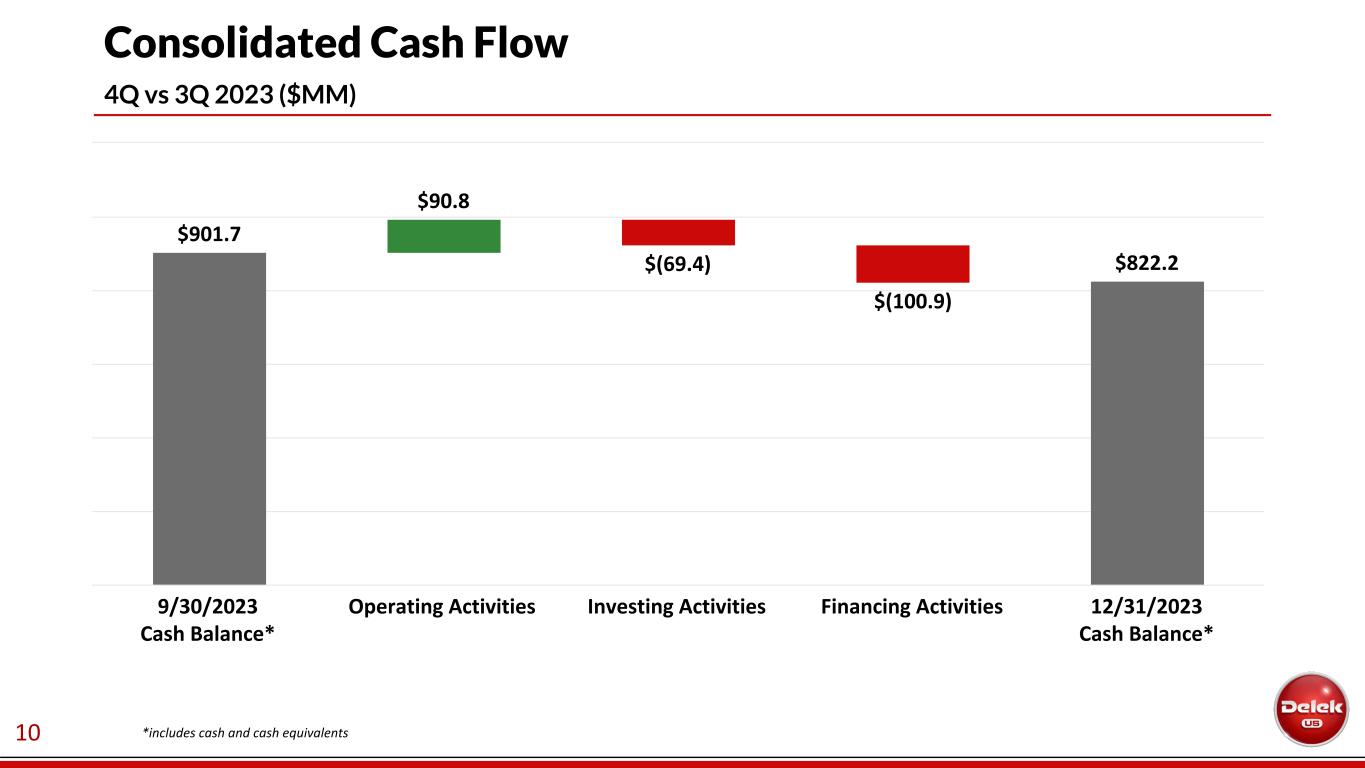

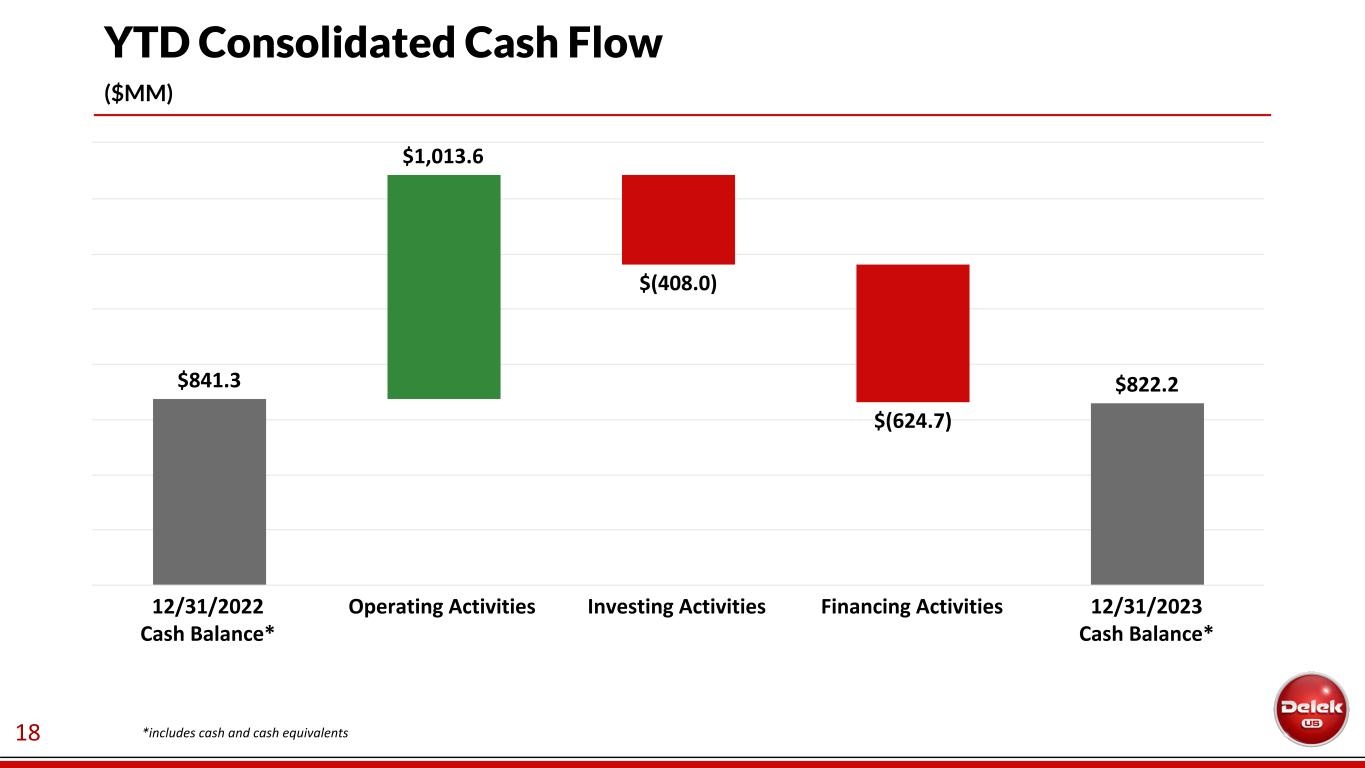

Liquidity

As of December 31, 2023, Delek US had a cash balance of $822.2 million and total consolidated long-term debt of $2,599.8 million, resulting in net debt of $1,777.6 million. As of December 31, 2023, Delek Logistics Partners, LP (NYSE: DKL) ("Delek Logistics") had $3.8 million of cash and $1,703.8 million of total long-term debt, which are included in the consolidated amounts on Delek US' balance sheet. Excluding Delek Logistics, Delek US had $818.4 million in cash and $896.0 million of long-term debt, or a $77.6 million net debt position.

Capital Program

The Delek US 2024 Capital Program is forecasted to be approximately $330 million, with $255 million for sustaining and regulatory capital and $75 million for growth capital. The 2024 Capital Program compares with the 2023 Capital Program of $372 million, which includes $17 million of insurance proceeds, growth capital partially funded by producers, as well as other reimbursements. Excluding these proceeds, 2023 capital expenditures were $389 million.

For 2024, in the Refining segment, Delek US plans to invest $220 million, with 93% of the capital dedicated towards sustaining and regulatory projects and 7% for projects focused on improving the efficiency and yield of Delek refineries. Most of Refining’s capital expenditures are for the Krotz Spring Refinery major turnaround scheduled during the fourth quarter of 2024, as well as projects at Big Spring Refinery to improve capture rates.

In the Logistics segment, the company expects the capital program to be approximately $70 million. This includes approximately $20 million of sustaining and regulatory capital, and $50 million of growth capital. Growth capital is to advance new connections in both the Midland and Delaware gathering systems, enabling continued volume growth at the partnership.

The Retail segment capital expenditures are expected to be approximately $15 million. Funds are dedicated to maintaining Delek’s 250 convenience stores, including interior rebranding and reimaging initiatives.

The Corporate and Other segment includes approximately $25 million of capital expenditures, which is primarily to fund IT improvements.

| | | | | | | | | | | | | | | | | |

($ millions) | Sustaining & Regulatory | |

Growth | |

Total |

| Refining | $ | 205 | | | $ | 15 | | | $ | 220 | |

| Logistics (Delek Logistics Partners) | 20 | | | 50 | | | 70 | |

| Retail | 5 | | | 10 | | | 15 | |

| Corporate & Other | 25 | | | — | | | 25 | |

| 2024 Capital Program | $ | 255 | | | $ | 75 | | | $ | 330 | |

Fourth Quarter 2023 Results | Conference Call Information

Delek US will hold a conference call to discuss its fourth quarter 2023 results on Tuesday, February 27, 2024 at 10:00 a.m. Central Time. Investors will have the opportunity to listen to the conference call live by going to www.DelekUS.com and clicking on the Investor Relations tab. Participants are encouraged to register at least 15 minutes early to download and install any necessary software. Presentation materials accompanying the call will be available on the investor relations tab of the Delek US website approximately ten minutes prior to the start of the call. For those who cannot listen to the live broadcast, the online replay will be available on the website for 90 days.

Investors may also wish to listen to Delek Logistics’ (NYSE: DKL) fourth quarter 2023 earnings conference call that will be held on Tuesday February 27, 2024 at 11:30 a.m. Central Time and review Delek Logistics’ earnings press release. Market trends and information disclosed by Delek Logistics may be relevant to the logistics segment reported by Delek US. Both a replay of the conference call and press release for Delek Logistics will be available online at www.deleklogistics.com.

About Delek US Holdings, Inc.

Delek US Holdings, Inc. is a diversified downstream energy company with assets in petroleum refining, logistics, pipelines, renewable fuels and convenience store retailing. The refining assets consist primarily of refineries operated in Tyler and Big Spring, Texas, El Dorado, Arkansas and Krotz Springs, Louisiana with a combined nameplate crude throughput capacity of 302,000 barrels per day. Pipeline assets include an ownership interest in the 650-mile Wink to Webster long-haul crude oil pipeline. The convenience store retail segment operates approximately 250 convenience stores in West Texas and New Mexico.

The logistics operations include Delek Logistics Partners, LP (NYSE: DKL). Delek Logistics Partners, LP is a growth-oriented master limited partnership focused on owning and operating midstream energy infrastructure assets. Delek US Holdings, Inc. and its subsidiaries owned approximately 78.7% (including the general partner interest) of Delek Logistics Partners, LP at December 31, 2023.

Safe Harbor Provisions Regarding Forward-Looking Statements

This press release contains forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These statements contain words such as “possible,” “believe,” “should,” “could,” “would,” “predict,” “plan,” “estimate,” “intend,” “may,” “anticipate,” “will,” “if", “potential,” “expect” or similar expressions, as well as statements in the future tense. These forward-looking statements include, but are not limited to, statements regarding throughput at the Company’s refineries; crude oil prices, discounts and quality and our ability to benefit therefrom; cost reductions; growth; scheduled turnaround activity; projected capital expenditures and investments into our business; the performance and execution of our midstream growth initiatives, including the Permian Gathering System, the Red River joint venture and the Wink to Webster long-haul crude oil pipeline, and the flexibility, benefits and the expected returns therefrom; projected benefits of the Delaware Gathering Acquisition, renewable identification numbers ("RINs") waivers and tax credits and the value and benefit therefrom; cash and liquidity; emissions reductions; opportunities and anticipated performance and financial position.

Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include, but are not limited to: uncertainty related to timing and amount of future share repurchases and dividend payments; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, uncertainties regarding future decisions by the Organization of Petroleum Exporting Countries ("OPEC") regarding production and pricing disputes between OPEC members and Russia; risks and uncertainties related to the integration by Delek Logistics of the Delaware Gathering business following its acquisition; Delek US' ability to realize cost reductions; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, gathering, production and transportation capacity; gains and losses

from derivative instruments; risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; the possibility of litigation challenging renewable fuel standard waivers; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability to grow the Permian Gathering System; the ability of the Red River joint venture to complete the expansion project to increase the Red River pipeline capacity; the ability of the joint venture to construct the Wink to Webster long haul crude oil pipeline; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks described in Delek US’ filings with the United States Securities and Exchange Commission (the “SEC”), including risks disclosed in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings and reports with the SEC.

Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management's good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Delek US undertakes no obligation to update or revise any such forward-looking statements to reflect events or circumstances that occur, or which Delek US becomes aware of, after the date hereof, except as required by applicable law or regulation.

Non-GAAP Disclosures:

Our management uses certain “non-GAAP” operational measures to evaluate our operating segment performance and non-GAAP financial measures to evaluate past performance and prospects for the future to supplement our financial information presented in accordance with United States ("U.S.") Generally Accepted Accounting Principles ("GAAP"). These financial and operational non-GAAP measures are important factors in assessing our operating results and profitability and include:

•Adjusting items - certain identified infrequently occurring items, non-cash items, and items that are not attributable to or indicative of our on-going operations or that may obscure our underlying results and trends;

•Adjusted net income (loss) - calculated as net income (loss) attributable to Delek US adjusted for relevant Adjusting items recorded during the period;

•Adjusted net income (loss) per share - calculated as Adjusted net income (loss) divided by weighted average shares outstanding, assuming dilution, as adjusted for any anti-dilutive instruments that may not be permitted for consideration in GAAP earnings per share calculations but that nonetheless favorably impact dilution;

•Earnings before interest, taxes, depreciation and amortization ("EBITDA") - calculated as net income (loss) attributable to Delek US adjusted to add back interest expense, income tax expense, depreciation and amortization;

•Adjusted EBITDA - calculated as EBITDA adjusted for the relevant identified Adjusting items in Adjusted net income (loss) that do not relate to interest expense, income tax expense, depreciation or amortization, and adjusted to include income (loss) attributable to non-controlling interests;

•Refining margin - calculated as gross margin (which we define as sales minus cost of sales) adjusted for operating expenses and depreciation and amortization included in cost of sales;

•Adjusted refining margin - calculated as refining margin adjusted for other inventory impacts, net inventory LCM valuation loss (benefit) and unrealized hedging (gain) loss;

•Refining production margin - calculated based on the regional market sales price of refined products produced, less allocated transportation, Renewable Fuel Standard volume obligation and associated feedstock costs. This measure reflects the economics of each refinery exclusive of the financial impact of inventory price risk mitigation programs and marketing uplift strategies;

•Refining production margin per throughput barrel - calculated as refining production margin divided by our average refining throughput in barrels per day (excluding purchased barrels) multiplied by 1,000 and multiplied by the number of days in the period; and

•Net debt - calculated as long-term debt including both current and non-current portions (the most comparable GAAP measure) less cash and cash equivalents as of a specific balance sheet date.

We believe these non-GAAP operational and financial measures are useful to investors, lenders, ratings agencies and analysts to assess our ongoing performance because, when reconciled to their most comparable GAAP financial measure, they provide improved relevant comparability between periods, to peers or to market metrics through the inclusion of retroactive regulatory or other adjustments as if they had occurred in the prior periods they relate to, or through the exclusion of certain items that we believe are not indicative of our core operating performance and that may obscure our underlying results and trends. “Net debt,” also a non-GAAP financial measure, is an important measure to monitor leverage and evaluate the balance sheet.

Non-GAAP measures have important limitations as analytical tools, because they exclude some, but not all, items that affect net earnings and operating income. These measures should not be considered substitutes for their most directly comparable U.S. GAAP financial measures. Additionally, because Adjusted net income or loss, Adjusted net income or loss per share, EBITDA and Adjusted EBITDA, Adjusted Refining Margin and Refining Production Margin or any of our other identified non-GAAP measures may be defined differently by other companies in its industry, Delek US' definition may not be comparable to similarly titled measures of other companies. See the accompanying tables in this earnings release for a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures.

| | | | | | | | | | | | | | |

| Delek US Holdings, Inc. |

Condensed Consolidated Balance Sheets (Unaudited) |

($ in millions, except share and per share data) |

| | December 31, 2023 | | December 31, 2022 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 822.2 | | | $ | 841.3 | |

| Accounts receivable, net | | 783.7 | | | 1,234.4 | |

| | | | |

| Inventories, net of inventory valuation reserves | | 981.9 | | | 1,518.5 | |

| | | | |

| Other current assets | | 78.2 | | | 122.7 | |

| Total current assets | | 2,666.0 | | | 3,716.9 | |

| Property, plant and equipment: | | | | |

| Property, plant and equipment | | 4,690.7 | | | 4,349.0 | |

| Less: accumulated depreciation | | (1,845.5) | | | (1,572.6) | |

| Property, plant and equipment, net | | 2,845.2 | | | 2,776.4 | |

| Operating lease right-of-use assets | | 148.2 | | | 179.5 | |

| Goodwill | | 729.4 | | | 744.3 | |

| Other intangibles, net | | 296.2 | | | 315.6 | |

| Equity method investments | | 360.7 | | | 359.7 | |

| Other non-current assets | | 126.1 | | | 100.4 | |

| Total assets | | $ | 7,171.8 | | | $ | 8,192.8 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 1,814.3 | | | $ | 1,745.6 | |

| | | | |

| Current portion of long-term debt | | 44.5 | | | 74.5 | |

| Current portion of obligation under Inventory Intermediation Agreement | | 0.4 | | | 49.9 | |

| | | | |

| Current portion of operating lease liabilities | | 54.7 | | | 49.6 | |

| Accrued expenses and other current liabilities | | 771.2 | | | 1,166.8 | |

| Total current liabilities | | 2,685.1 | | | 3,086.4 | |

| Non-current liabilities: | | | | |

| Long-term debt, net of current portion | | 2,555.3 | | | 2,979.2 | |

| Obligation under Inventory Intermediation Agreement | | 407.2 | | | 491.8 | |

| Environmental liabilities, net of current portion | | 110.9 | | | 111.5 | |

| Asset retirement obligations | | 43.3 | | | 41.8 | |

| Deferred tax liabilities | | 264.1 | | | 266.5 | |

| Operating lease liabilities, net of current portion | | 111.2 | | | 122.4 | |

| Other non-current liabilities | | 35.0 | | | 23.7 | |

| Total non-current liabilities | | 3,527.0 | | | 4,036.9 | |

| Stockholders’ equity: | | | | |

| Preferred stock, $0.01 par value, 10,000,000 shares authorized, no shares issued and outstanding | | — | | | — | |

| Common stock, $0.01 par value, 110,000,000 shares authorized, 81,539,871 shares and 84,509,517 shares issued at December 31, 2023 and December 31, 2022, respectively | | 0.8 | | | 0.9 | |

| Additional paid-in capital | | 1,113.6 | | | 1,134.1 | |

| Accumulated other comprehensive loss | | (4.8) | | | (5.2) | |

| Treasury stock, 17,575,527 shares, at cost, at December 31, 2023 and December 31, 2022, respectively | | (694.1) | | | (694.1) | |

| Retained earnings | | 430.0 | | | 507.9 | |

| Non-controlling interests in subsidiaries | | 114.2 | | | 125.9 | |

| Total stockholders’ equity | | 959.7 | | | 1,069.5 | |

| Total liabilities and stockholders’ equity | | $ | 7,171.8 | | | $ | 8,192.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delek US Holdings, Inc. |

| Condensed Consolidated Statements of Income (Unaudited) |

| ($ in millions, except share and per share data) | | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 (1) | | 2023 | | 2022 (1) |

| Net revenues | | $ | 4,049.1 | | | $ | 4,479.2 | | | $ | 16,917.4 | | | $ | 20,245.8 | |

| Cost of sales: | | | | | | | | |

| Cost of materials and other | | 3,783.7 | | | 4,204.5 | | | 15,112.0 | | | 18,355.6 | |

| Operating expenses (excluding depreciation and amortization presented below) | | 193.4 | | | 181.7 | | | 770.6 | | | 718.1 | |

| Depreciation and amortization | | 79.7 | | | 71.8 | | | 322.8 | | | 263.8 | |

| Total cost of sales | | 4,056.8 | | | 4,458.0 | | | 16,205.4 | | | 19,337.5 | |

| Insurance proceeds | | (7.0) | | | (3.9) | | | (20.3) | | | (31.2) | |

| Operating expenses related to retail and wholesale business (excluding depreciation and amortization presented below) | | 25.7 | | | 17.2 | | | 106.5 | | | 106.8 | |

| General and administrative expenses | | 67.1 | | | 100.7 | | | 286.4 | | | 332.5 | |

| Depreciation and amortization | | 7.8 | | | 6.0 | | | 28.8 | | | 23.2 | |

| | | | | | | | |

| Asset impairment | | 37.9 | | | — | | | 37.9 | | | — | |

| Other operating (income) expense, net | | (1.5) | | | 4.7 | | | (7.2) | | | (12.5) | |

| Total operating costs and expenses | | 4,186.8 | | | 4,582.7 | | | 16,637.5 | | | 19,756.3 | |

| Operating (loss) income | | (137.7) | | | (103.5) | | | 279.9 | | | 489.5 | |

| Interest expense, net | | 79.0 | | | 62.6 | | | 318.2 | | | 195.3 | |

| Income from equity method investments | | (19.1) | | | (13.3) | | | (86.2) | | | (57.7) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other expense (income), net | | 0.9 | | | 0.5 | | | (3.9) | | | (2.5) | |

| Total non-operating expense, net | | 60.8 | | | 49.8 | | | 228.1 | | | 135.1 | |

| (Loss) income before income tax (benefit) expense | | (198.5) | | | (153.3) | | | 51.8 | | | 354.4 | |

| Income tax (benefit) expense | | (38.4) | | | (43.6) | | | 5.1 | | | 63.9 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net (loss) income | | (160.1) | | | (109.7) | | | 46.7 | | | 290.5 | |

| Net income attributed to non-controlling interests | | 4.8 | | | 9.0 | | | 26.9 | | | 33.4 | |

| Net (loss) income attributable to Delek | | $ | (164.9) | | | $ | (118.7) | | | $ | 19.8 | | | $ | 257.1 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic (loss) income per share | | $ | (2.57) | | | $ | (1.73) | | | $ | 0.30 | | | $ | 3.63 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted (loss) income per share | | $ | (2.57) | | | $ | (1.73) | | | $ | 0.30 | | | $ | 3.59 | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | 64,046,868 | | | 68,697,820 | | | 65,406,089 | | | 70,789,458 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted | | 64,046,868 | | | 68,697,820 | | | 65,975,301 | | | 71,516,361 | |

| | | | | | | | |

| | | | | | | | |

(1) In the first quarter 2023, we reassessed the classification of certain expenses and made certain reclassification adjustments to better represent the nature of those expenses. Accordingly, we have made reclassifications to the prior period in order to conform to this revised current period classification, which resulted in a decrease in the prior period general and administrative expenses and an increase in the prior period operating expenses of approximately $6.1 million and $16.3 million for the three and twelve months ended December 31, 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Condensed Cash Flow Data (Unaudited) |

| ($ in millions) | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash provided by (used in) operating activities | | $ | 90.8 | | | $ | (290.8) | | | $ | 1,013.6 | | | $ | 425.3 | |

| Cash flows from investing activities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in investing activities | | (69.4) | | | (111.7) | | | (408.0) | | | (931.6) | |

| Cash flows from financing activities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash (used in) provided by financing activities | | (100.9) | | | 90.0 | | | (624.7) | | | 491.1 | |

| Net decrease in cash and cash equivalents | | (79.5) | | | (312.5) | | | (19.1) | | | (15.2) | |

| Cash and cash equivalents at the beginning of the period | | 901.7 | | | 1,153.8 | | | 841.3 | | | 856.5 | |

| | | | | | | | |

| | | | | | | | |

| Cash and cash equivalents at the end of the period | | $ | 822.2 | | | $ | 841.3 | | | $ | 822.2 | | | $ | 841.3 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Significant Transactions During the Quarter Impacting Results:

Restructuring Costs

In 2022, we announced that we are progressing a business transformation focused on enterprise-wide opportunities to improve the efficiency of our cost structure. For the fourth quarter 2023, we recorded restructuring costs totaling $31.4 million ($24.3 million after-tax) associated with our business transformation. The fourth quarter 2023 included a $23.1 million impairment related to leased crude oil tanks in Canada that were not needed to support the future growth of our business. Restructuring costs of $23.1 million are recorded in asset impairment, $7.1 million are recorded in general and administrative expenses and $1.2 million are included in cost of materials and other in our consolidated statements of income.

Other Inventory Impact

"Other inventory impact" is primarily calculated by multiplying the number of barrels sold during the period by the difference between current period weighted average purchase cost per barrel directly related to our refineries and per barrel cost of materials and other for the period recognized on a FIFO basis directly related to our refineries. It assumes no beginning or ending inventory, so that the current period average purchase cost per barrel is a reasonable estimate of our market purchase cost for the current period, without giving effect to any build or draw on beginning inventory. These amounts are based on management estimates using a methodology including these assumptions. However, this analysis provides management with a means to compare hypothetical refining margins to current period average crack spreads, as well as provides a means to better compare our results to peers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income (Loss) Attributable to Delek US to Adjusted Net Income (Loss) |

| | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| $ in millions (unaudited) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | |

| Reported net income (loss) attributable to Delek US | | $ | (164.9) | | | $ | (118.7) | | | $ | 19.8 | | | $ | 257.1 | |

Adjusting items (1) | | | | | | | | |

| Inventory LCM valuation (benefit) loss | | 6.6 | | | (17.2) | | | 0.4 | | | 1.9 | |

| Tax effect | | (1.5) | | | 3.9 | | | (0.1) | | | (0.4) | |

| Inventory LCM valuation (benefit) loss, net | | 5.1 | | | (13.3) | | | 0.3 | | | 1.5 | |

| Other inventory impact | | 48.6 | | | 193.6 | | | 194.0 | | | 331.1 | |

| Tax effect | | (11.0) | | | (44.2) | | | (43.7) | | | (75.7) | |

Other inventory impact, net (2) (3) | | 37.6 | | | 149.4 | | | 150.3 | | | 255.4 | |

| Business interruption insurance recoveries | | — | | | (5.2) | | | (10.0) | | | (31.1) | |

| Tax effect | | — | | | 1.2 | | | 2.3 | | | 7.0 | |

| Business interruption insurance recoveries, net | | — | | | (4.0) | | | (7.7) | | | (24.1) | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (4) | | (9.5) | | | 39.0 | | | (17.6) | | | 8.1 | |

| Tax effect | | 2.2 | | | (9.5) | | | 4.0 | | | (2.0) | |

| Unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements, net | | (7.3) | | | 29.5 | | | (13.6) | | | 6.1 | |

| Transaction related expenses | | — | | | — | | | — | | | 10.6 | |

| Tax effect | | — | | | — | | | — | | | (2.6) | |

| Transaction related expenses, net | | — | | | — | | | — | | | 8.0 | |

| Restructuring costs | | 31.4 | | | 12.5 | | | 37.8 | | | 12.5 | |

| Tax effect | | (7.1) | | | (3.0) | | | (8.5) | | | (3.0) | |

Restructuring costs, net (2) | | 24.3 | | | 9.5 | | | 29.3 | | | 9.5 | |

| El Dorado refinery fire losses | | 0.7 | | | — | | | 8.7 | | | — | |

| Tax effect | | (0.2) | | | — | | | (2.0) | | | — | |

| El Dorado refinery fire losses, net | | 0.5 | | | — | | | 6.7 | | | — | |

| Goodwill impairment | | 14.8 | | | — | | | 14.8 | | | — | |

| Tax effect | | (3.3) | | | — | | | (3.3) | | | — | |

| Goodwill impairment, net | | 11.5 | | | — | | | 11.5 | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total adjusting items (1) | | 71.7 | | | 171.1 | | | 176.8 | | | 256.4 | |

| Adjusted net (loss) income | | $ | (93.2) | | | $ | 52.4 | | | $ | 196.6 | | | $ | 513.5 | |

(1) All adjustments have been tax effected using the estimated marginal income tax rate, as applicable.

(2) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section.

(3) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial.

(4) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

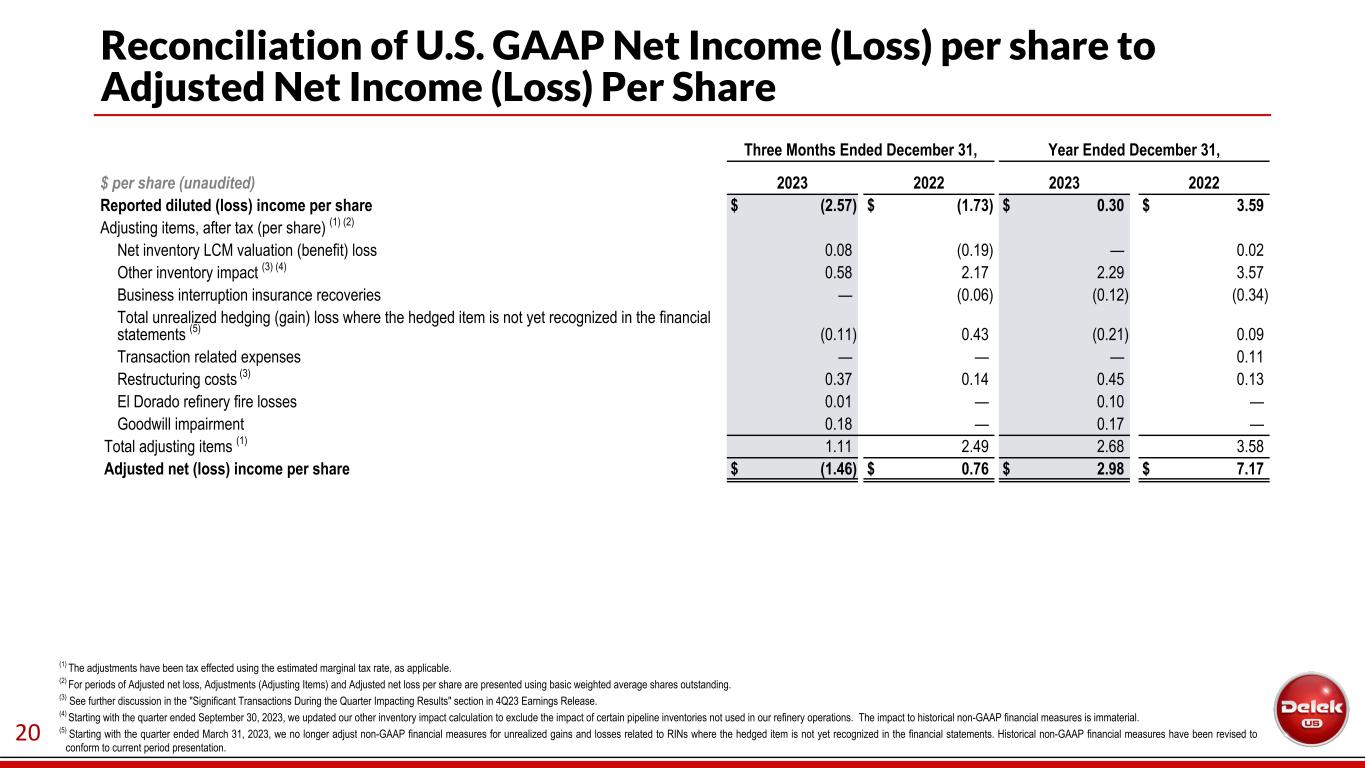

| Reconciliation of U.S. GAAP Income (Loss) per share to Adjusted Net Income (Loss) per share |

| | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| $ per share (unaudited) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | |

| Reported diluted income per share | | $ | (2.57) | | | $ | (1.73) | | | $ | 0.30 | | | $ | 3.59 | |

Adjusting items, after tax (per share) (1) (2) | | | | | | | | |

| | | | | | | | |

| Net inventory LCM valuation (benefit) loss | | 0.08 | | | (0.19) | | | — | | | 0.02 | |

Other inventory impact (3) (4) | | 0.58 | | | 2.17 | | | 2.29 | | | 3.57 | |

| Business interruption insurance recoveries | | — | | | (0.06) | | | (0.12) | | | (0.34) | |

Total unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements (5) | | (0.11) | | | 0.43 | | | (0.21) | | | 0.09 | |

| Transaction related expenses | | — | | | — | | | — | | | 0.11 | |

Restructuring costs (3) | | 0.37 | | | 0.14 | | | 0.45 | | | 0.13 | |

| El Dorado refinery fire losses | | 0.01 | | | — | | | 0.10 | | | — | |

| Goodwill impairment | | 0.18 | | | — | | | 0.17 | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total adjusting items (1) | | 1.11 | | | 2.49 | | | 2.68 | | | 3.58 | |

| Adjusted net (loss) income per share | | $ | (1.46) | | | $ | 0.76 | | | $ | 2.98 | | | $ | 7.17 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) The adjustments have been tax effected using the estimated marginal tax rate, as applicable.

(2) For periods of Adjusted net loss, Adjustments (Adjusting items) and Adjusted net loss per share are presented using basic weighted average shares outstanding.

(3) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section.

(4) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial.

(5) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income (Loss) attributable to Delek US to Adjusted EBITDA |

| | Three Months Ended December 31, | | Year Ended December 31, |

| $ in millions (unaudited) | | 2023 | | 2022 | | 2023 | | 2022 |

| Reported net (loss) income attributable to Delek US | | $ | (164.9) | | | $ | (118.7) | | | $ | 19.8 | | | $ | 257.1 | |

| Add: | | | | | | | | |

| Interest expense, net | | 79.0 | | | 62.6 | | | 318.2 | | | 195.3 | |

| | | | | | | | |

| Income tax expense (benefit) | | (38.4) | | | (43.6) | | | 5.1 | | | 63.9 | |

| Depreciation and amortization | | 87.5 | | | 77.8 | | | 351.6 | | | 287.0 | |

| EBITDA attributable to Delek US | | (36.8) | | | (21.9) | | | 694.7 | | | 803.3 | |

| Adjusting items | | | | | | | | |

| Net inventory LCM valuation (benefit) loss | | 6.6 | | | (17.2) | | | 0.4 | | | 1.9 | |

Other inventory impact (1) (2) | | 48.6 | | | 193.6 | | | 194.0 | | | 331.1 | |

| Business interruption insurance recoveries | | — | | | (5.2) | | | (10.0) | | | (31.1) | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) | | (9.5) | | | 39.0 | | | (17.6) | | | 8.1 | |

| Transaction related expenses | | — | | | — | | | — | | | 10.6 | |

Restructuring costs (1) | | 31.4 | | | 12.5 | | | 37.8 | | | 12.5 | |

| El Dorado refinery fire losses | | 0.7 | | | — | | | 8.7 | | | — | |

| Goodwill impairment | | 14.8 | | | — | | | 14.8 | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income attributable to non-controlling interest | | 4.8 | | | 9.0 | | | 26.9 | | | 33.4 | |

| Total Adjusting items | | 97.4 | | | 231.7 | | | 255.0 | | | 366.5 | |

| Adjusted EBITDA | | $ | 60.6 | | | $ | 209.8 | | | $ | 949.7 | | | $ | 1,169.8 | |

(1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section.

(2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial.

(3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

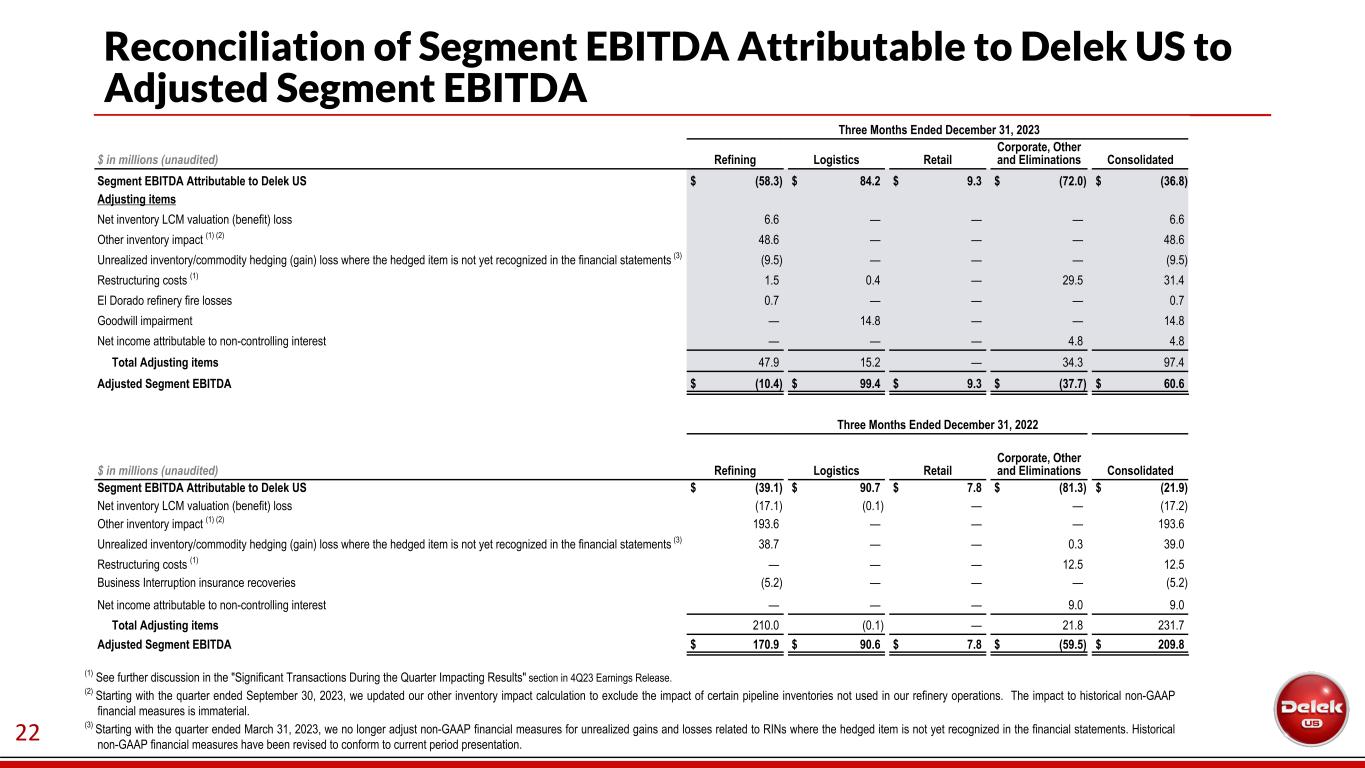

| Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA |

| | Three Months Ended December 31, 2023 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate, Other and Eliminations | | Consolidated |

| Segment EBITDA Attributable to Delek US | | $ | (58.3) | | | $ | 84.2 | | | $ | 9.3 | | | $ | (72.0) | | | $ | (36.8) | |

| Adjusting items | | | | | | | | | | |

| Net inventory LCM valuation (benefit) loss | | 6.6 | | | — | | | — | | | — | | | 6.6 | |

Other inventory impact (1) (2) | | 48.6 | | | — | | | — | | | — | | | 48.6 | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) | | (9.5) | | | — | | | — | | | — | | | (9.5) | |

| | | | | | | | | | |

| | | | | | | | | | |

Restructuring costs (1) | | 1.5 | | | 0.4 | | | — | | | 29.5 | | | 31.4 | |

| | | | | | | | | | |

| El Dorado refinery fire losses | | 0.7 | | | — | | | — | | | — | | | 0.7 | |

| Goodwill impairment | | — | | | 14.8 | | | — | | | — | | | 14.8 | |

| Net income attributable to non-controlling interest | | — | | | — | | | — | | | 4.8 | | | 4.8 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Adjusting items | | 47.9 | | | 15.2 | | | — | | | 34.3 | | | 97.4 | |

| Adjusted Segment EBITDA | | $ | (10.4) | | | $ | 99.4 | | | $ | 9.3 | | | $ | (37.7) | | | $ | 60.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2022 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate, Other and Eliminations | | Consolidated |

| Segment EBITDA Attributable to Delek US | | $ | (39.1) | | | $ | 90.7 | | | $ | 7.8 | | | $ | (81.3) | | | $ | (21.9) | |

| Adjusting items | | | | | | | | | | |

| Net inventory LCM valuation (benefit) loss | | (17.1) | | | (0.1) | | | — | | | — | | | (17.2) | |

Other inventory impact (1) (2) | | 193.6 | | | — | | | — | | | — | | | 193.6 | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) | | 38.7 | | | — | | | — | | | 0.3 | | | 39.0 | |

| | | | | | | | | | |

| | | | | | | | | | |

Restructuring costs (1) | | — | | | — | | | — | | | 12.5 | | | 12.5 | |

| Business Interruption insurance recoveries | | (5.2) | | | — | | | — | | | — | | | (5.2) | |

| Net income attributable to non-controlling interest | | — | | | — | | | — | | | 9.0 | | | 9.0 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Adjusting items | | 210.0 | | | (0.1) | | | — | | | 21.8 | | | 231.7 | |

| Adjusted Segment EBITDA | | $ | 170.9 | | | $ | 90.6 | | | $ | 7.8 | | | $ | (59.5) | | | $ | 209.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

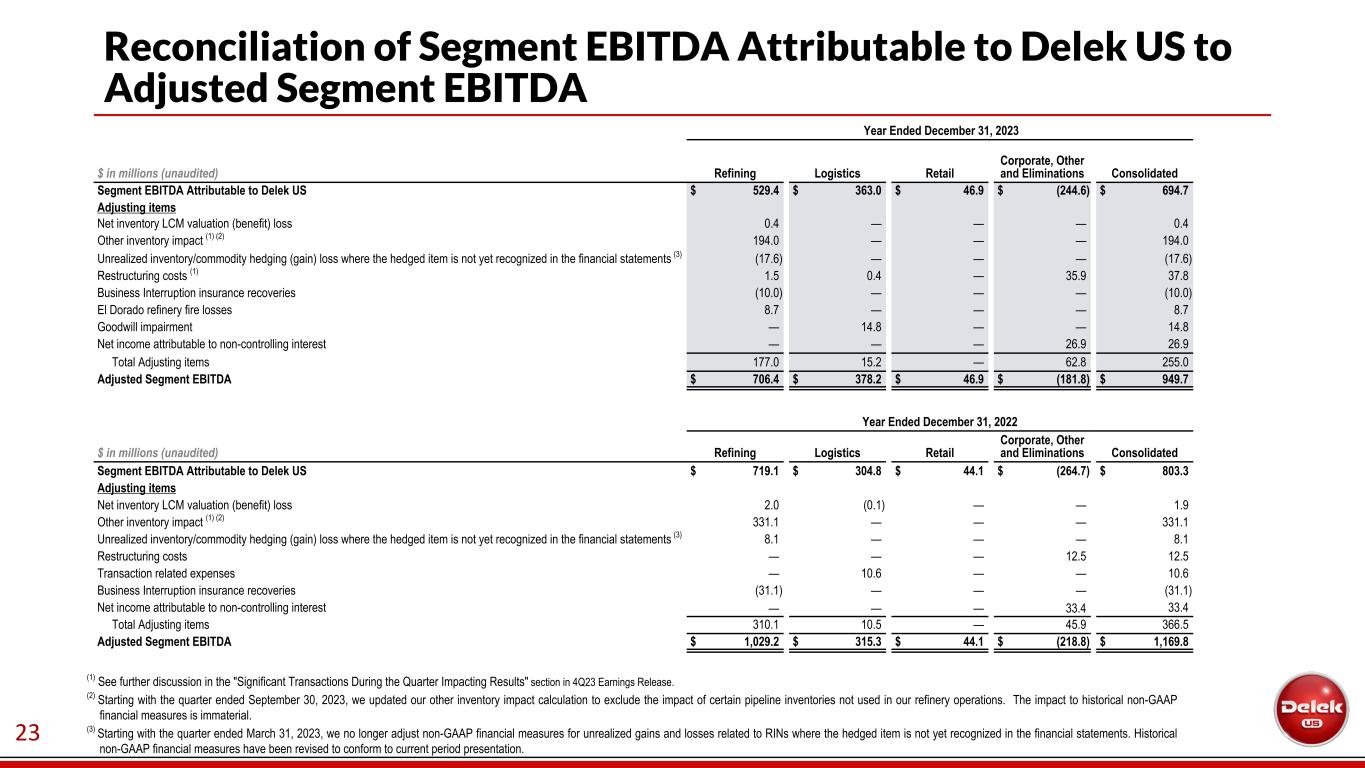

| Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA |

| | Year Ended December 31, 2023 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate, Other and Eliminations | | Consolidated |

| Segment EBITDA Attributable to Delek US | | $ | 529.4 | | | $ | 363.0 | | | $ | 46.9 | | | $ | (244.6) | | | $ | 694.7 | |

| Adjusting items | | | | | | | | | | |

| Net inventory LCM valuation (benefit) loss | | 0.4 | | | — | | | — | | | — | | | 0.4 | |

Other inventory impact (1) (2) | | 194.0 | | | — | | | — | | | — | | | 194.0 | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) | | (17.6) | | | — | | | — | | | — | | | (17.6) | |

| Restructuring costs | | 1.5 | | | 0.4 | | | — | | | 35.9 | | | 37.8 | |

| | | | | | | | | | |

| Business Interruption insurance recoveries | | (10.0) | | | — | | | — | | | — | | | (10.0) | |

| El Dorado refinery fire losses | | 8.7 | | | — | | | — | | | — | | | 8.7 | |

| Goodwill impairment | | — | | | 14.8 | | | — | | | — | | | 14.8 | |

| Net income attributable to non-controlling interest | | — | | | — | | | — | | | 26.9 | | | 26.9 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Adjusting items | | 177.0 | | | 15.2 | | | — | | | 62.8 | | | 255.0 | |

| Adjusted Segment EBITDA | | $ | 706.4 | | | $ | 378.2 | | | $ | 46.9 | | | $ | (181.8) | | | $ | 949.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | Year Ended December 31, 2022 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate, Other and Eliminations | | Consolidated |

| Segment EBITDA Attributable to Delek US | | $ | 719.1 | | | $ | 304.8 | | | $ | 44.1 | | | $ | (264.7) | | | $ | 803.3 | |

| Adjusting items | | | | | | | | | | |

| Net inventory LCM valuation (benefit) loss | | 2.0 | | | (0.1) | | | — | | | — | | | 1.9 | |

Other inventory impact (1) (2) | | 331.1 | | | — | | | — | | | — | | | 331.1 | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) | | 8.1 | | | — | | | — | | | — | | | 8.1 | |

| Restructuring costs | | — | | | — | | | — | | | 12.5 | | | 12.5 | |

| Transaction related expenses | | — | | | 10.6 | | | — | | | — | | | 10.6 | |

| Business Interruption insurance recoveries | | (31.1) | | | — | | | — | | | — | | | (31.1) | |

| Net income attributable to non-controlling interest | | — | | | — | | | — | | | 33.4 | | | 33.4 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Adjusting items | | 310.1 | | | 10.5 | | | — | | | 45.9 | | | 366.5 | |

| Adjusted Segment EBITDA | | $ | 1,029.2 | | | $ | 315.3 | | | $ | 44.1 | | | $ | (218.8) | | | $ | 1,169.8 | |

(1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section.

(2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial.

(3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Refining Segment Selected Financial Information | | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total Refining Segment | | (Unaudited) | | (Unaudited) |

| Days in period | | 92 | | | 92 | | | 365 | | | 365 | |

Total sales volume - refined product (average barrels per day ("bpd")) (1) | | 308,932 | | | 274,148 | | | 298,617 | | | 299,004 | |

| Total production (average bpd) | | 304,939 | | | 278,384 | | | 291,802 | | | 290,041 | |

| | | | | | | | |

| Crude oil | | 286,898 | | | 257,937 | | | 278,231 | | | 281,205 | |

| Other feedstocks | | 19,508 | | | 22,492 | | | 15,998 | | | 10,558 | |

| Total throughput (average bpd) | | 306,406 | | | 280,429 | | | 294,229 | | | 291,763 | |

| | | | | | | | |

| Total refining production margin per bbl total throughput | | $ | 6.86 | | | $ | 15.68 | | | $ | 12.02 | | | $ | 18.22 | |

| Total refining operating expenses per bbl total throughput | | $ | 5.62 | | | $ | 5.35 | | | $ | 5.54 | | | $ | 5.53 | |

| | | | | | | | |

| Total refining production margin ($ in millions) | | $ | 193.3 | | | $ | 404.7 | | | $ | 1,291.0 | | | $ | 1,940.1 | |

Supply, marketing and other ($ millions) (2) | | (43.4) | | | (73.5) | | | 51.6 | | | (248.7) | |

| Total adjusted refining margin ($ in millions) | | $ | 149.9 | | | $ | 331.2 | | | $ | 1,342.6 | | | $ | 1,691.4 | |

| | | | | | | | |

| Total crude slate details | | | | | | | | |

| Total crude slate: (% based on amount received in period) | | | | | | | | |

| WTI crude oil | | 72.2 | % | | 72.1 | % | | 73.0 | % | | 68.2 | % |

| Gulf Coast Sweet crude | | 5.4 | % | | 5.9 | % | | 4.3 | % | | 7.8 | % |

| Local Arkansas crude oil | | 3.5 | % | | 4.2 | % | | 4.0 | % | | 4.1 | % |

| Other | | 18.9 | % | | 17.8 | % | | 18.7 | % | | 19.9 | % |

| | | | | | | | |

Crude utilization (% based on nameplate capacity) (5) | | 95.0 | % | | 85.4 | % | | 92.1 | % | | 93.1 | % |

| | | | | | | | |

| Tyler, TX Refinery | | | | | | | | |

| Days in period | | 92 | | | 92 | | | 365 | | | 365 | |

| Products manufactured (average bpd): | | | | | | | | |

| Gasoline | | 41,433 | | | 42,267 | | | 33,442 | | | 36,847 | |

| Diesel/Jet | | 33,698 | | | 32,487 | | | 28,670 | | | 31,419 | |

| Petrochemicals, LPG, NGLs | | 2,142 | | | 1,979 | | | 2,341 | | | 2,114 | |

| Other | | 1,201 | | | 1,771 | | | 1,691 | | | 1,825 | |

| Total production | | 78,474 | | | 78,504 | | | 66,144 | | | 72,205 | |

| Throughput (average bpd): | | | | | | | | |

| Crude oil | | 74,577 | | | 72,427 | | | 63,210 | | | 70,114 | |

| Other feedstocks | | 4,727 | | | 7,266 | | | 3,617 | | | 2,604 | |

| Total throughput | | 79,304 | | | 79,693 | | | 66,827 | | | 72,718 | |

| | | | | | | | |

| Tyler refining production margin ($ in millions) | | $ | 84.2 | | | $ | 144.6 | | | $ | 413.9 | | | $ | 586.4 | |

| Per barrel of throughput: | | | | | | | | |

| Tyler refining production margin | | $ | 11.54 | | | $ | 19.72 | | | $ | 16.97 | | | $ | 22.09 | |

Operating expenses (3) | | $ | 5.13 | | | $ | 3.64 | | | $ | 5.08 | | | $ | 5.24 | |

| Crude Slate: (% based on amount received in period) | | | | | | | | |

| WTI crude oil | | 82.8 | % | | 80.8 | % | | 79.5 | % | | 84.7 | % |

| East Texas crude oil | | 17.2 | % | | 18.0 | % | | 20.5 | % | | 15.0 | % |

| Other | | | | 1.2 | % | | — | % | | 0.3 | % |

| | | | | | | | |

Capture rate (4) | | 65.8 | % | | 61.1 | % | | 62.8 | % | | 66.2 | % |

| El Dorado, AR Refinery | | | | | | | | |

Days in period | | 92 | | | 92 | | | 365 | | | 365 | |

| Products manufactured (average bpd): | | | | | | | | |

| Gasoline | | 43,777 | | | 38,119 | | | 38,868 | | | 38,738 | |

| Diesel | | 32,585 | | | 27,931 | | | 30,061 | | | 30,334 | |

| Petrochemicals, LPG, NGLs | | 1,290 | | | 1,102 | | | 1,495 | | | 1,255 | |

| Asphalt | | 8,579 | | | 7,310 | | | 7,711 | | | 7,782 | |

| Other | | 409 | | | 2,347 | | | 877 | | | 1,200 | |

| Total production | | 86,640 | | | 76,809 | | | 79,012 | | | 79,309 | |

| Throughput (average bpd): | | | | | | | | |

| Crude oil | | 83,767 | | | 72,862 | | | 77,423 | | | 76,806 | |

| Other feedstocks | | 3,881 | | | 5,106 | | | 3,262 | | | 3,646 | |

| Total throughput | | 87,648 | | | 77,968 | | | 80,685 | | | 80,452 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Refining Segment Selected Financial Information (continued) | | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| El Dorado refining production margin ($ in millions) | | $ | 39.8 | | | $ | 107.4 | | | $ | 270.8 | | | $ | 458.2 | |

| Per barrel of throughput: | | | | | | | | |

| El Dorado refining production margin | | $ | 4.94 | | | $ | 14.97 | | | $ | 9.20 | | | $ | 15.60 | |

Operating expenses (3) | | $ | 4.58 | | | $ | 4.72 | | | $ | 4.59 | | | $ | 4.61 | |

| Crude Slate: (% based on amount received in period) | | | | | | | | |

| WTI crude oil | | 66.4 | % | | 64.7 | % | | 67.3 | % | | 55.1 | % |

| Local Arkansas crude oil | | 11.9 | % | | 14.7 | % | | 14.0 | % | | 15.3 | % |

| Other | | 21.7 | % | | 20.6 | % | | 18.7 | % | | 29.6 | % |

| | | | | | | | |

Capture rate (4) | | 28.2 | % | | 46.4 | % | | 34.0 | % | | 46.8 | % |

| Big Spring, TX Refinery | | | | | | | | |

Days in period | | 92 | | 92 | | 365 | | 365 |

| Products manufactured (average bpd): | | | | | | | | |

| Gasoline | | 28,324 | | | 20,605 | | | 32,386 | | | 30,689 | |

| Diesel/Jet | | 19,593 | | | 12,815 | | | 22,390 | | | 22,125 | |

| Petrochemicals, LPG, NGLs | | 4,465 | | | 1,387 | | | 3,593 | | | 2,942 | |

| Asphalt | | 2,430 | | | 1,895 | | | 1,983 | | | 1,721 | |

| Other | | 2,673 | | | 1,887 | | | 3,129 | | | 1,481 | |

| Total production | | 57,485 | | | 38,589 | | | 63,481 | | | 58,958 | |

| Throughput (average bpd): | | | | | | | | |

| Crude oil | | 52,828 | | | 35,798 | | | 60,236 | | | 59,476 | |

| Other feedstocks | | 5,380 | | | 3,327 | | | 4,223 | | | 191 | |

| Total throughput | | 58,208 | | | 39,125 | | | 64,459 | | | 59,667 | |

| | | | | | | | |

| Big Spring refining production margin ($ in millions) | | $ | 32.4 | | | $ | 49.7 | | | $ | 312.7 | | | $ | 420.1 | |

| Per barrel of throughput: | | | | | | | | |

| Big Spring refining production margin | | $ | 6.05 | | | $ | 13.80 | | | $ | 13.29 | | | $ | 19.29 | |

Operating expenses (3) | | $ | 8.98 | | | $ | 10.50 | | | $ | 7.92 | | | $ | 7.48 | |

| Crude Slate: (% based on amount received in period) | | | | | | | | |

| WTI crude oil | | 67.4 | % | | 74.3 | % | | 68.5 | % | | 70.1 | % |

| WTS crude oil | | 32.6 | % | | 25.7 | % | | 31.5 | % | | 29.9 | % |

| | | | | | | | |

Capture rate (4) | | 38.5 | % | | 47.2 | % | | 51.3 | % | | 61.4 | % |

| Krotz Springs, LA Refinery | | | | | | | | |

Days in period | | 92 | | | 92 | | | 365 | | | 365 | |

| Products manufactured (average bpd): | | | | | | | | |

| Gasoline | | 41,848 | | | 41,073 | | | 40,805 | | | 34,370 | |

| Diesel/Jet | | 30,982 | | | 31,691 | | | 31,589 | | | 31,576 | |

| Heavy oils | | 2,440 | | | 5,323 | | | 3,785 | | | 2,418 | |

| Petrochemicals, LPG, NGLs | | 6,568 | | | 6,156 | | | 6,525 | | | 6,749 | |

| Other | | 503 | | | 238 | | | 460 | | | 4,458 | |

| Total production | | 82,341 | | | 84,481 | | | 83,164 | | | 79,571 | |

| Throughput (average bpd): | | | | | | | | |

| Crude oil | | 75,726 | | | 76,850 | | | 77,361 | | | 74,808 | |

| Other feedstocks | | 5,520 | | | 6,793 | | | 4,896 | | | 4,118 | |

| Total throughput | | 81,246 | | | 83,643 | | | 82,257 | | | 78,926 | |

| | | | | | | | |

| Krotz Springs refining production margin ($ in millions) | | $ | 36.9 | | | $ | 103.0 | | | $ | 293.5 | | | $ | 475.5 | |

| Per barrel of throughput: | | | | | | | | |

| Krotz Springs refining production margin | | $ | 4.93 | | | $ | 13.39 | | | $ | 9.78 | | | $ | 16.51 | |

Operating expenses (3) | | $ | 4.83 | | | $ | 5.16 | | | $ | 4.96 | | | $ | 5.25 | |

| Crude Slate: (% based on amount received in period) | | | | | | | | |

| WTI Crude | | 72.6 | % | | 70.3 | % | | 77.4 | % | | 63.4 | % |

| Gulf Coast Sweet Crude | | 20.2 | % | | 19.6 | % | | 15.1 | % | | 29.8 | % |

| Other | | 7.2 | % | | 10.1 | % | | 7.5 | % | | 6.8 | % |

| | | | | | | | |

Capture rate (4) | | 55.7 | % | | 56.2 | % | | 66.5 | % | | 64.1 | % |

(1) Includes sales to other segments which are eliminated in consolidation.

(2) Supply, marketing and other activities include refined product wholesale and related marketing activities, asphalt and intermediates marketing activities, optimization of inventory and the execution of risk management programs to capture the physical and financial opportunities that extend from our refining operations. Formally known as Trading & Supply.

(3) Reflects the prior period conforming reclassification adjustment between operating expenses and general and administrative expenses.

(4) Defined as refining production margin divided by the respective crack spread. See page 18 for crack spread information.

(5) Crude throughput as % of total nameplate capacity of 302,000 bpd.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Logistics Segment Selected Information | | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) |

| Gathering & Processing: (average bpd) | | | | | | | | |

| Lion Pipeline System: | | | | | | | | |

| Crude pipelines (non-gathered) | | 73,438 | | | 68,798 | | | 67,003 | | | 78,519 | |

| Refined products pipelines | | 68,552 | | | 35,585 | | | 58,181 | | | 56,382 | |

| SALA Gathering System | | 13,329 | | | 13,136 | | | 13,782 | | | 15,391 | |

| East Texas Crude Logistics System | | 40,798 | | | 25,154 | | | 32,668 | | | 21,310 | |

Midland Gathering Assets (1) | | 229,179 | | | 191,119 | | | 230,471 | | | 128,725 | |

| Plains Connection System | | 254,224 | | | 234,164 | | | 250,140 | | | 183,827 | |

Delaware Gathering Assets: (2) | | | | | | | | |

Natural gas gathering and processing (Mcfd) (3) | | 67,292 | | | 60,669 | | | 71,239 | | | 60,971 | |

| Crude oil gathering (average bpd) | | 112,522 | | | 91,526 | | | 111,335 | | | 87,519 | |

| Water disposal and recycling (average bpd) | | 94,686 | | | 80,028 | | | 102,340 | | | 72,056 | |

| | | | | | | | |

| Wholesale Marketing & Terminalling: | | | | | | | | |

East Texas - Tyler Refinery sales volumes (average bpd) (4) | | 68,735 | | | 64,825 | | | 60,626 | | | 66,058 | |

| Big Spring wholesale marketing throughputs (average bpd) | | 76,408 | | | 74,238 | | | 77,897 | | | 71,580 | |

| West Texas wholesale marketing throughputs (average bpd) | | 10,511 | | | 10,835 | | | 10,032 | | | 10,206 | |

| West Texas wholesale marketing margin per barrel | | $ | 4.73 | | | $ | 5.64 | | | $ | 5.18 | | | $ | 4.45 | |

Terminalling throughputs (average bpd) (5) | | 105,933 | | | 127,277 | | | 113,803 | | | 132,262 | |

(1) Formerly known as the Permian Gathering System.

(2) Formally known as 3 Bear, which was acquired June 1, 2022.

(3) Mcfd - average thousand cubic feet per day.

(4) Excludes jet fuel and petroleum coke.

(5) Consists of terminalling throughputs at our Tyler, Big Spring, Big Sandy and Mount Pleasant, Texas terminals, El Dorado and North Little Rock, Arkansas terminals and Memphis and Nashville, Tennessee terminals.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Retail Segment Selected Information | | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) |

| Number of stores (end of period) | | 250 | | | 249 | | | 250 | | | 249 | |

| Average number of stores | | 250 | | | 249 | | | 250 | | | 249 | |

| Average number of fuel stores | | 245 | | | 244 | | | 245 | | | 244 | |

| Retail fuel sales (thousands of gallons) | | 43,631 | | | 41,523 | | | 172,452 | | | 170,668 | |

| Average retail gallons sold per average number of fuel stores (in thousands) | | 178 | | | 171 | | | 704 | | | 701 | |

| Average retail sales price per gallon sold | | $ | 3.07 | | | $ | 3.37 | | | $ | 3.29 | | | $ | 3.76 | |

Retail fuel margin ($ per gallon) (1) | | $ | 0.29 | | | $ | 0.32 | | | $ | 0.33 | | | $ | 0.33 | |

| Merchandise sales (in millions) | | $ | 74.4 | | | $ | 77.4 | | | $ | 316.1 | | | $ | 314.7 | |

| Merchandise sales per average number of stores (in millions) | | $ | 0.3 | | | $ | 0.3 | | | $ | 1.3 | | | $ | 1.3 | |

| Merchandise margin % | | 33.3 | % | | 32.1 | % | | 33.7 | % | | 33.3 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Same-Store Comparison (2) | | (Unaudited) | | (Unaudited) |

| | | | | | | | |

| Change in same-store fuel gallons sold | | 3.9 | % | | (1.8) | % | | 0.7 | % | | 2.5 | % |

| Change in same-store merchandise sales | | (4.4) | % | | 2.5 | % | | 0.6 | % | | 0.3 | % |

(1)Retail fuel margin represents gross margin on fuel sales in the retail segment, and is calculated as retail fuel sales revenue less retail fuel cost of sales. The retail fuel margin per gallon calculation is derived by dividing retail fuel margin by the total retail fuel gallons sold for the period.

(2)Same-store comparisons include period-over-period changes in specified metrics for stores that were in service at both the beginning of the earliest period and the end of the most recent period used in the comparison.

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Information | | | | | | |

| Schedule of Selected Segment Financial Data, Pricing Statistics Impacting our Refining Segment, and Other Reconciliations of Amounts Reported Under U.S. GAAP | | | | | | |

| | | | | | |

| | | | |

| | | | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Segment Financial Data | | Three Months Ended December 31, 2023 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate,

Other and Eliminations | | Consolidated |

| Net revenues (excluding intercompany fees and revenues) | | $ | 3,735.9 | | | $ | 104.7 | | | $ | 208.5 | | | $ | — | | | $ | 4,049.1 | |

| Inter-segment fees and revenues | | 199.5 | | | 149.4 | | | — | | | (348.9) | | | — | |

| Total revenues | | $ | 3,935.4 | | | $ | 254.1 | | | $ | 208.5 | | | $ | (348.9) | | | $ | 4,049.1 | |

| Cost of sales | | 4,049.9 | | | 179.9 | | | 171.1 | | | (344.1) | | | 4,056.8 | |

| Gross margin | | $ | (114.5) | | | $ | 74.2 | | | $ | 37.4 | | | $ | (4.8) | | | $ | (7.7) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate,

Other and Eliminations | | Consolidated |

| Net revenues (excluding intercompany fees and revenues) | | $ | 4,096.6 | | | $ | 164.9 | | | $ | 217.2 | | | $ | 0.5 | | | $ | 4,479.2 | |

| Inter-segment fees and revenues | | 231.8 | | | 104.1 | | | — | | | (335.9) | | | — | |

| Total revenues | | $ | 4,328.4 | | | $ | 269.0 | | | $ | 217.2 | | | $ | (335.4) | | | $ | 4,479.2 | |

| Cost of sales | | 4,420.9 | | | 203.4 | | | 179.2 | | | (345.5) | | | 4,458.0 | |

| Gross margin | | $ | (92.5) | | | $ | 65.6 | | | $ | 38.0 | | | $ | 10.1 | | | $ | 21.2 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate,

Other and Eliminations | | Consolidated |

| Net revenues (excluding intercompany fees and revenues) | | $ | 15,578.1 | | | $ | 456.6 | | | $ | 882.7 | | | $ | — | | | $ | 16,917.4 | |

| Inter-segment fees and revenues | | 828.8 | | | 563.8 | | | — | | | (1,392.6) | | | — | |

| Total revenues | | $ | 16,406.9 | | | $ | 1,020.4 | | | $ | 882.7 | | | $ | (1,392.6) | | | $ | 16,917.4 | |

| Cost of sales | | 16,095.7 | | | 735.5 | | | 719.2 | | | (1,345.0) | | | 16,205.4 | |

| Gross margin | | $ | 311.2 | | | $ | 284.9 | | | $ | 163.5 | | | $ | (47.6) | | | $ | 712.0 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2022 |

| $ in millions (unaudited) | | Refining | | Logistics | | Retail | | Corporate,

Other and Eliminations | | Consolidated |

| Net revenues (excluding intercompany fees and revenues) | | $ | 18,730.9 | | | $ | 557.0 | | | $ | 956.9 | | | $ | 1.0 | | | $ | 20,245.8 | |

| Inter-segment fees and revenues | | 1,032.1 | | | 479.4 | | | — | | | (1,511.5) | | | — | |

| Total revenues | | $ | 19,763.0 | | | $ | 1,036.4 | | | $ | 956.9 | | | $ | (1,510.5) | | | $ | 20,245.8 | |

| Cost of sales | | 19,240.4 | | | 787.0 | | | 796.3 | | | (1,486.2) | | | 19,337.5 | |

| Gross margin | | $ | 522.6 | | | $ | 249.4 | | | $ | 160.6 | | | $ | (24.3) | | | $ | 908.3 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pricing Statistics | | Three Months Ended December 31, | | Year Ended December 31, |

| (average for the period presented) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | |

| | | | | | | | |

| WTI — Cushing crude oil (per barrel) | | $ | 78.69 | | | $ | 82.82 | | | $ | 77.69 | | | $ | 94.62 | |

| WTI — Midland crude oil (per barrel) | | $ | 79.71 | | | $ | 83.97 | | | $ | 78.90 | | | $ | 95.93 | |

| WTS — Midland crude oil (per barrel) | | $ | 78.43 | | | $ | 81.55 | | | $ | 77.61 | | | $ | 94.29 | |

| LLS (per barrel) | | $ | 81.26 | | | $ | 85.47 | | | $ | 80.18 | | | $ | 96.85 | |

| Brent (per barrel) | | $ | 82.94 | | | $ | 88.63 | | | $ | 82.21 | | | $ | 99.06 | |

| | | | | | | | |

U.S. Gulf Coast 5-3-2 crack spread (per barrel) (1) | | $ | 17.52 | | | $ | 32.25 | | | $ | 27.02 | | | $ | 33.36 | |

U.S. Gulf Coast 3-2-1 crack spread (per barrel) (1) | | $ | 15.71 | | | $ | 29.27 | | | $ | 25.93 | | | $ | 31.41 | |

U.S. Gulf Coast 2-1-1 crack spread (per barrel) (1) | | $ | 8.85 | | | $ | 23.81 | | | $ | 14.70 | | | $ | 25.73 | |

| | | | | | | | |

| U.S. Gulf Coast Unleaded Gasoline (per gallon) | | $ | 2.03 | | | $ | 2.32 | | | $ | 2.34 | | | $ | 2.77 | |

| Gulf Coast Ultra low sulfur diesel (per gallon) | | $ | 2.68 | | | $ | 3.37 | | | $ | 2.72 | | | $ | 3.46 | |

| U.S. Gulf Coast high sulfur diesel (per gallon) | | $ | 2.01 | | | $ | 2.66 | | | $ | 1.85 | | | $ | 2.90 | |

| Natural gas (per MMBTU) | | $ | 2.92 | | | $ | 6.09 | | | $ | 2.66 | | | $ | 6.54 | |

(1) For our Tyler and El Dorado refineries, we compare our per barrel refining product margin to the Gulf Coast 5-3-2 crack spread consisting of (Argus pricing) WTI Cushing crude, U.S. Gulf Coast CBOB gasoline and U.S. Gulf Coast Pipeline No. 2 heating oil (ultra low sulfur diesel). For our Big Spring refinery, we compare our per barrel refining margin to the Gulf Coast 3-2-1 crack spread consisting of (Argus pricing) WTI Cushing crude, U.S. Gulf Coast CBOB gasoline and Gulf Coast ultra-low sulfur diesel. Starting in Q1 2023, for our Krotz Springs refinery, we compare our per barrel refining margin to the Gulf Coast 2-1-1 crack spread consisting of (Argus pricing) LLS crude oil, (Argus pricing) U.S. Gulf Coast CBOB gasoline and 50% of (Argus pricing) U.S. Gulf Coast Pipeline No. 2 heating oil (high sulfur diesel) and 50% of (Platts pricing) U.S. Gulf Coast Pipeline No. 2 heating oil (high sulfur diesel). Historical Gulf Coast 2-1-1 crack spread measures have been revised to conform to current period presentation. The Tyler refinery's crude oil input is primarily WTI Midland and East Texas, while the El Dorado refinery's crude input is primarily a combination of WTI Midland, local Arkansas and other domestic inland crude oil. The Big Spring refinery’s crude oil input is primarily comprised of WTS and WTI Midland. The Krotz Springs refinery’s crude oil input is primarily comprised of LLS and WTI Midland.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Reconciliations of Amounts Reported Under U.S. GAAP |

| $ in millions (unaudited) | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| Reconciliation of gross margin to Refining margin to Adjusted refining margin | | 2023 | | 2022 | | 2023 | | 2022 |

| Gross margin | | $ | (114.5) | | | $ | (92.5) | | | $ | 311.2 | | | $ | 522.6 | |

| Add back (items included in cost of sales): | | | | | | | | |

| Operating expenses (excluding depreciation and amortization) | | 159.8 | | | 155.0 | | | 619.2 | | | 622.5 | |

| Depreciation and amortization | | 57.7 | | | 53.5 | | | 234.2 | | | 205.1 | |

| Refining margin | | $ | 103.0 | | | $ | 116.0 | | | $ | 1,164.6 | | | $ | 1,350.2 | |

| Adjusting items | | | | | | | | |

| Net inventory LCM valuation loss (benefit) | | 6.6 | | | (17.1) | | | 0.4 | | | 2.0 | |

Other inventory impact (1) (2) | | 48.6 | | | 193.6 | | | 194.0 | | | 331.1 | |

Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) | | (9.5) | | | 38.7 | | | (17.6) | | | 8.1 | |

Restructuring costs (1) | | 1.2 | | | — | | | 1.2 | | | — | |

| Total adjusting items | | 46.9 | | | 215.2 | | | 178.0 | | | 341.2 | |

| Adjusted refining margin | | $ | 149.9 | | | $ | 331.2 | | | $ | 1,342.6 | | | $ | 1,691.4 | |

(1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section.

(2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial.

(3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

| | | | | | | | | | | | | | |

| Calculation of Net Debt | | December 31, 2023 | | December 31, 2022 |

| Long-term debt - current portion | | $ | 44.5 | | | $ | 74.5 | |

| Long-term debt - non-current portion | | 2,555.3 | | | 2,979.2 | |

| Total long-term debt | | 2,599.8 | | | 3,053.7 | |

| Less: Cash and cash equivalents | | 822.2 | | | 841.3 | |

| Net debt - consolidated | | 1,777.6 | | | 2,212.4 | |

| Less: DKL net debt | | 1,700.0 | | | 1,653.6 | |

| Net debt, excluding DKL | | $ | 77.6 | | | $ | 558.8 | |

Investor/Media Relations Contacts:

Rosy Zuklic, Vice President of Investor Relations and Market Intelligence

investor.relations@delekus.com; rosy.zuklic@delekus.com; 615-767-4344

Information about Delek US Holdings, Inc. can be found on its website (www.delekus.com), investor relations webpage (ir.delekus.com), news webpage (www.delekus.com/news) and its Twitter account (@DelekUSHoldings).

Fourth Quarter 2023 Earnings Conference Call February 27, 2024 Exhibit 99.2