Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 08 2022 - 8:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2022

Commission File Number: 001-14370

COMPANIA DE MINAS BUENAVENTURA S.A.A.

(Exact name of registrant as specified in its charter)

BUENAVENTURA

MINING COMPANY INC.

(Translation of registrant’s name into English)

LAS BEGONIAS

415 FLOOR 19,

SAN ISIDRO,

LIMA 27, PERU

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

TRANSLATION

February 7,

2022

Messrs.

Superintendence of Capital Markets

Ref: Notice of Material Information

Dear Sirs:

As required by the Regulation on Material and

Reserved Information (Resolution SMV No. 005-2014-SMV/01), we inform you that:

On

the date hereof, Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or “the

Company”) entered into certain definitive agreements with Newmont Corporation (“Newmont”) to sell its total stake in

Minera Yanacocha S.R.L. (“Yanacocha”), held through Compañía Minera Condesa S.A., which represents 43.65% of

Yanacocha’s equity, for a consideration equal to US$ 300 million plus certain contingent payments of up to US$ 100 million linked

to the production of the sulfides project that Yanacocha is planning to develop and as well as to future increases in mineral prices.

Additionally, the Company’s subsidiary Sociedad

Minera de Responsabilidad Limitada Chaupiloma Dos de Cajamarca (“Chaupiloma”) will transfer all of its mining concessions

to Yanacocha, in exchange for a royalty in an amount equal to the royalty currently perceived from such operations by Chaupiloma as well

as two additional royalties in respect of future projects in certain concessions.

Further, Newmont will transfer its quotas in Minera

La Zanja S.R.L. to Buenaventura, in exchange for a royalty in respect of such mining unit’s future production. Newmont will also

make a one-time payment to the Company in an amount of US$45 million, as partial contribution to the future costs relating to the closure

plan for the La Zanja Mining Unit.

With these transactions, Buenaventura seeks to focus

on its asset portfolio, decrease its leverage and increase shareholder returns.

Yours faithfully,

Daniel Domínguez Vera

Stock Exchange Representative

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

|

|

|

|

|

|

Date: February 8, 2022

|

By:

|

/s/ DANIEL DOMÍNGUEZ VERA

|

|

|

Name:

|

Daniel Domínguez Vera

|

|

|

Title:

|

Market Relations Officer

|

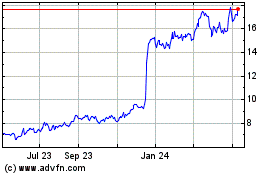

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

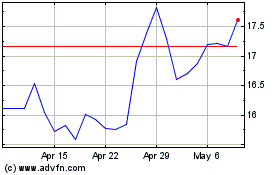

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jan 2024 to Jan 2025