Coeur Mining, Inc. (the "Company" or "Coeur") (NYSE: CDE) today

announced second quarter 2018 production of 3.2 million ounces of

silver and 94,052 ounces of gold, or 8.8 million silver equivalent1

ounces. Metal sales for the quarter of 3.2 million ounces of silver

and 94,602 ounces of gold, or 8.9 million silver equivalent1

ounces, were in line with production.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20180709005488/en/

Quarterly Production Results. Note: On

February 28, 2018, Coeur divested the San Bartolomé mine through

the sale of its 100%-owned Bolivian subsidiary. As a result, San

Bartolomé is excluded from consolidated operating statistics for

all periods presented unless otherwise noted. (Graphic: Business

Wire)

The Company has raised its full-year production guidance to 37.3

- 40.5 million silver equivalent1 ounces, increasing silver

production guidance to 13.2 - 14.6 million ounces from 12.2 - 13.8

million ounces and gold production guidance to 360,000 - 380,000

ounces from 355,000 - 375,000 ounces due to higher grades at its

Palmarejo operation.

Operations

Second quarter 2018 production and sales highlights for each of

Coeur's operations are provided below.

Palmarejo, Mexico

2Q

2018 1Q 2018 4Q 2017 3Q

2017 2Q 2017 Tons milled

344,073 359,893

389,524 413,086 335,428 Average silver grade (oz/t)

6.86

6.88 6.92 5.53 4.98 Average gold grade (oz/t)

0.11 0.10 0.10

0.08 0.08 Average recovery rate – Ag

87.5% 81.4% 87.0% 83.6%

87.3% Average recovery rate – Au

89.9% 80.4% 92.0% 83.1%

91.1% Ounces Produced Silver (000's)

2,066 2,013 2,346 1,908

1,457 Gold

33,702 29,896 37,537 28,948 24,292 Silver

equivalent1 (000's)

4,088 3,807 4,600 3,644 2,914 Ounces

Sold Silver (000's)

2,092 2,031 2,343 1,794 1,484 Gold

31,207 30,888 38,953 26,554 25,191 Silver equivalent1

(000's)

3,964 3,884 4,681 3,387 2,996 Silver equivalent1

(average spot) (000's)

4,557 4,479 5,331 3,809 3,324

- Second quarter silver equivalent1

production of 4.1 million ounces was 7% higher compared to the

first quarter, with silver production of 2.1 million ounces

relatively flat and gold production of 33,702 ounces 13% higher.

Compared to the same period the prior year, silver and gold

production increased 42% and 39%, respectively

- Production continued to benefit from

higher-than-projected grades at Independencia, offsetting lower

mining rates caused by the ongoing installation of ground support.

During the second half, these underground improvements are expected

to facilitate a return to mining rates above 4,500 tons per day

("tpd") while expected lower grade stopes are mined

- The new on-site absorption, desorption,

and recovery ("ADR") plant began processing run-of-mine and carbon

inventory, which was stockpiled in the first quarter. Average

recovery rates normalized during the second quarter as this

inventory was processed

- The ADR plant is expected to reach

operational steady-state by year-end and has begun generating

savings in refinery and freight costs as well as reducing the

amount of carbon purchases

- Development towards the La Nación

deposit, located between the Independencia and Guadalupe

underground mines, has commenced and the Company anticipates

production beginning in early 2019. Preliminary plans contemplate

La Nación contributing approximately 400 tpd of mill feed once

ramped up

- Approximately 32% of Palmarejo's gold

sales in both the second quarter and first half of 2018 (or 9,834

and 19,739 ounces, respectively) were to Franco-Nevada at a price

of $800 per ounce. The Company anticipates a similar percentage of

Palmarejo's gold sales to be to Franco-Nevada in the second half of

the year

- The Company is increasing Palmarejo's

full-year 2018 production guidance to 7.5 - 7.9 million ounces of

silver and 115,000 - 120,000 ounces of gold, or 14.4 - 15.1 million

silver equivalent1 ounces, from 6.5 - 7.1 million ounces of silver

and 110,000 - 115,000 ounces of gold, or 13.1 - 14.0 million silver

equivalent1 ounces

Rochester, Nevada

2Q

2018 1Q 2018 4Q 2017 3Q

2017 2Q 2017 Tons placed

4,083,028

4,351,131 4,171,451 4,262,011 4,493,100 Average silver grade (oz/t)

0.53 0.54 0.50 0.53 0.53 Average gold grade (oz/t)

0.004 0.003 0.003 0.004 0.003 Ounces Produced Silver (000's)

1,125 1,157 1,361 1,070 1,156 Gold

12,273 11,487

18,995 10,955 10,745 Silver equivalent

1 (000's)

1,861

1,846 2,500 1,727 1,801 Ounces Sold Silver (000's)

1,097

1,119 1,457 1,050 1,135 Gold

12,030 11,163 20,002 10,390

10,658 Silver equivalent1 (000's)

1,819 1,789 2,658 1,674

1,774 Silver equivalent1 (average spot) (000's)

2,048 2,004

2,969 1,839 1,913

- Total tons placed decreased 6%

quarter-over-quarter and 9% year-over-year primarily due to fewer

run-of-mine tons placed

- Gold production increased 7% compared

to the prior quarter and 14% year-over-year and was driven by the

placement of higher gold grade ore close to the liner on the

newly-expanded Stage IV leach pad. Quarterly silver production of

1.1 million ounces was in line with the prior quarter and the

second quarter of 2017

- Higher production during the second

half is expected to be driven by the ongoing ramp up of the Stage

IV leach pad and continued placement of higher grade gold ore

- The Company is maintaining full-year

2018 production guidance of 4.2 - 4.7 million ounces of silver and

45,000 - 50,000 ounces of gold, or 6.9 - 7.7 million silver

equivalent1 ounces

Wharf, South Dakota

2Q

2018 1Q 2018 4Q 2017 3Q

2017 2Q 2017 Tons placed

1,075,820

1,076,395 1,124,785 1,150,308 993,167 Average gold grade (oz/t)

0.023 0.022 0.029 0.029 0.024 Ounces produced Gold

22,507 17,936 27,292 25,849 21,358 Silver (000's)

13

12 16 15 13 Gold equivalent1

22,729 18,133 27,560 26,096

21,568 Ounces sold Gold

23,053 17,339 28,975 23,855 21,314

Silver (000's)

14 11 16 14 11 Gold equivalent1

23,282

17,522 29,256 24,085 21,495

- Quarterly tons placed were comparable

to the first quarter and were impacted by scheduled maintenance

downtime and weather. As anticipated, gold production increased 25%

quarter-over-quarter and 5% year-over-year to 22,507 ounces due to

timing of leach pad recoveries

- During the second half of the year,

sustained higher mining and crushing rates are expected to drive

increased production levels while average grade is expected to

remain relatively constant. Planned higher stripping rates for the

remainder of 2018 are expected to provide access to higher grade

material in subsequent years

- The Company is maintaining full-year

2018 production guidance of 85,000 - 90,000 ounces of gold

Kensington, Alaska

2Q

2018 1Q 2018 4Q 2017 3Q

2017 2Q 2017 Tons milled

168,751 158,706

167,631 172,038 163,163 Average gold grade (oz/t)

0.16 0.17

0.22 0.17 0.17 Average recovery rate

92.6% 94.0% 92.8% 94.1%

93.2% Gold ounces produced

25,570 26,064 34,932 27,541

26,424 Gold ounces sold

28,312 27,763 35,634 29,173 29,031

- As anticipated, second quarter gold

production of 25,570 ounces was consistent quarter-over-quarter due

to lower planned grades related to mine sequencing

- Dewatering efforts at Jualin remain

on-schedule and are expected to be completed during the third

quarter, facilitating ramp up of production through year-end. As a

result, production for the remainder of 2018 is expected to be

weighted towards the fourth quarter

- The Company is maintaining full-year

2018 production guidance of 115,000 - 120,000 ounces of gold

Silvertip, British Columbia

- After successfully commissioning the

mill in March, throughput rates steadily climbed throughout the

second quarter. During the second half of June, throughput averaged

slightly above 300 metric tonnes per day and in the final days of

the month achieved 500 metric tonnes per day

- Mining activities remain focused on

underground rehabilitation and development while surface activities

are focused on the planning, construction and commissioning of

various process optimization projects and infrastructure

upgrades

- Exploration at Silvertip targeting

resource conversion is progressing ahead of schedule with over

40,000 meters (133,000 feet) drilled since the program began in

late 2017. Results have been positive, and the Company anticipates

publishing an exploration update in late July in addition to a

technical report later this year

- The Company submitted a permit

amendment application to operate at 1,000 metric tonnes per day

earlier in the quarter and anticipates receiving approval around

year-end

- The Company is maintaining full-year

2018 production guidance of 1.5 - 2.0 million ounces of silver and

23.0 - 28.0 million pounds of both zinc and lead

2018 Production Guidance

Coeur's 2018 production guidance has been revised to reflect

higher expected silver and gold production at Palmarejo due to

higher-than-projected grades during the first half of the year.

Silver Gold Zinc

Lead Silver Equivalent1

(K oz) (oz) (K lbs) (K

lbs) (K oz) Palmarejo 7,500 - 7,900

115,000 - 120,000 — — 14,400 - 15,100

Rochester 4,200 -

4,700 45,000 - 50,000 — — 6,900 - 7,700

Kensington — 115,000

- 120,000 — — 6,900 - 7,200

Wharf — 85,000 - 90,000 — —

5,100 - 5,400

Silvertip 1,500 - 2,000 —

23,000 - 28,000 23,000 - 28,000 4,030 - 5,080

Total 13,200 - 14,600 360,000 - 380,000

23,000 - 28,000 23,000 - 28,000 37,330 - 40,480

Financial Results and Conference Call

Coeur will report its second quarter 2018 financial results on

July 25, 2018 after the New York Stock Exchange closes for trading.

There will be a conference call on July 26, 2018 at 11:00 a.m.

Eastern Time.

Dial-In Numbers: (855) 560-2581

(U.S.) (855) 669-9657 (Canada) (412) 542-4166 (International)

Conference ID: Coeur Mining

Hosting the call will be Mitchell J. Krebs, President and Chief

Executive Officer of Coeur, who will be joined by Peter C.

Mitchell, Senior Vice President and Chief Financial Officer, Frank

L. Hanagarne, Jr., Senior Vice President and Chief Operating

Officer, Hans Rasmussen, Senior Vice President of Exploration, and

other members of management. A replay of the call will be available

through August 9, 2018.

Replay numbers: (877) 344-7529

(U.S.) (855) 669-9658 (Canada) (412) 317-0088 (International)

Conference ID: 101 20 458

About Coeur

Coeur Mining, Inc. is a well-diversified, growing precious

metals producer with five mines in North America. Coeur produces

from its wholly-owned operations: the Palmarejo silver-gold complex

in Mexico, the Silvertip silver-zinc-lead mine in British Columbia,

the Rochester silver-gold mine in Nevada, the Kensington gold mine

in Alaska, and the Wharf gold mine in South Dakota. In addition,

the Company has interests in several precious metals exploration

projects throughout North America.

Cautionary Statement

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding anticipated production, grades,

mining rates, crushing rates, sales under Palmarejo's gold stream

agreement, expectations regarding the ADR plant at Palmarejo,

development efforts at Palmarejo and Kensington, operations at

Rochester, stripping rates at Wharf, dewatering efforts at

Kensington and activities at Silvertip. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause Coeur's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

risk that anticipated production levels are not attained, the risks

and hazards inherent in the mining business (including risks

inherent in developing large-scale mining projects, environmental

hazards, industrial accidents, weather or geologically related

conditions), changes in the market prices of gold, silver, zinc,

and lead and a sustained lower price environment, the uncertainties

inherent in Coeur's production, exploratory and developmental

activities, including risks relating to permitting and regulatory

delays, ground conditions, grade variability, any future labor

disputes or work stoppages, the uncertainties inherent in the

estimation of gold and silver reserves, changes that could result

from Coeur's future acquisition of new mining properties or

businesses, the loss of any third-party smelter to which Coeur

markets its production, the effects of environmental and other

governmental regulations, the risks inherent in the ownership or

operation of or investment in mining properties or businesses in

foreign countries, Coeur's ability to raise additional financing

necessary to conduct its business, make payments or refinance its

debt, as well as other uncertainties and risk factors set out in

filings made from time to time with the United States Securities

and Exchange Commission, and the Canadian securities regulators,

including, without limitation, Coeur's most recent reports on Form

10-K and Form 10-Q. Actual results, developments and timetables

could vary significantly from the estimates presented. Readers are

cautioned not to put undue reliance on forward-looking statements.

Coeur disclaims any intent or obligation to update publicly such

forward-looking statements, whether as a result of new information,

future events or otherwise. Additionally, Coeur undertakes no

obligation to comment on analyses, expectations or statements made

by third parties in respect of Coeur, its financial or operating

results or its securities.

Christopher Pascoe, Coeur's Director, Technical Services and a

qualified person under Canadian National Instrument 43-101,

approved the scientific and technical information concerning

Coeur's mineral projects in this news release. For a description of

the key assumptions, parameters and methods used to estimate

mineral reserves and resources, as well as data verification

procedures and a general discussion of the extent to which the

estimates may be affected by any known environmental, permitting,

legal, title, taxation, socio-political, marketing or other

relevant factors, Canadian investors should refer to the Technical

Reports for each of Coeur's properties as filed on SEDAR at

sedar.com.

Notes

- Silver and gold equivalence assumes a

60:1 silver-to-gold ratio, except where noted as average spot

prices. Please see the table below for average applicable spot

prices and corresponding ratios. Silver and zinc equivalence

assumes a 0.06:1 silver-to-zinc ratio. Silver and lead equivalence

assumes a 0.05:1 silver-to-lead ratio.

Average Spot Prices

2Q

2018 1Q 2018 4Q 2017 3Q

2017 2Q 2017 Average Silver Spot Price Per

Ounce $ 16.53 $ 16.77 $ 16.73 $ 16.84 $ 17.21

Average Gold Spot Price Per Ounce $ 1,306 $

1,329 $ 1,275 $ 1,278 $ 1,257

Average Silver to Gold Spot

Equivalence 79:1 79:1 76:1 76:1 73:1

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180709005488/en/

Coeur Mining, Inc.Jonathan Chung, Associate, Investor

RelationsPhone: (312) 489-5800www.coeur.com

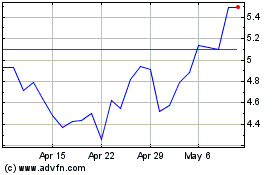

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jun 2024 to Jul 2024

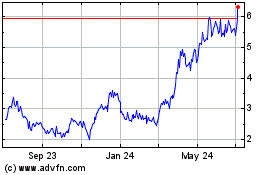

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jul 2023 to Jul 2024