Statement of Changes in Beneficial Ownership (4)

January 28 2020 - 4:32PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Farrar James Thomas |

2. Issuer Name and Ticker or Trading Symbol

City Office REIT, Inc.

[

CIO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Executive Officer |

|

(Last)

(First)

(Middle)

666 BURRARD STREET, SUITE 3210 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/24/2020 |

|

(Street)

VANCOUVER, A1 V6C 2X8

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | (1) | 1/24/2020 | | A | | 1792 | | (2) | (2) | Common Stock | 1792 (3) | (1) | 106096 | D | |

| Restricted Stock Units | (1) | 1/27/2020 | | A | | 40000 | | (4) | (4) | Common Stock | 40000 (3) | (1) | 146096 | D | |

| Performance Restricted Stock Units | (1) | 1/27/2020 | | A | | 40000 | | (5) | (5) | Common Stock | 40000 (3) | (1) | 40000 | D | |

| Explanation of Responses: |

| (1) | In accordance with the Company's Equity Incentive Plan (the "Equity Incentive Plan"), Restricted Stock Units (as defined in the Equity Incentive Plan) convert into common stock on a one-for-one basis. |

| (2) | The units represent Restricted Stock Units issuable to the reporting person as a dividend equivalency payment with respect to Restricted Stock Units previously issued to the reporting person which vest in three substantially equal installments on each of the first three annual anniversaries of the initial grant date, generally subject to the reporting person's continued service through each applicable vesting date. The Restricted Stock Units reported herein shall vest on the same date and under the same terms as the underlying Restricted Stock Units with respect of which these dividend equivalency units vest. |

| (3) | Vested shares will be delivered to the reporting person promptly upon vesting of the related restricted stock units. |

| (4) | In accordance with the Equity Incentive Plan, the Restricted Stock Units (and related dividend equivalent rights) shall vest in three substantially equal installments on each of the first three annual anniversaries of their initial grant date, generally subject to the grantee's continued employment through each applicable vesting date. |

| (5) | On January 27, 2020, the reporting person was granted 40,000 Performance Restricted Stock Units. Pursuant to the terms of the award agreement governing the Performance Restricted Stock Units, the number of underlying shares of the Company's common stock that the reporting person may ultimately become entitled to receive at the time of vesting will range from 50% to 150% of the number of Performance Restricted Stock Units initially granted, subject to certain relative total stockholder return conditions being met during the measurement period that begins on January 1, 2020 and ends on December 31, 2022. Dividend equivalent rights accrue with respect to these Performance Restricted Stock Units when and as dividends are paid on the Company's common stock. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Farrar James Thomas

666 BURRARD STREET, SUITE 3210

VANCOUVER, A1 V6C 2X8 | X |

| Chief Executive Officer |

|

Signatures

|

| /s/ James Farrar | | 1/28/2020 |

| **Signature of Reporting Person | Date |

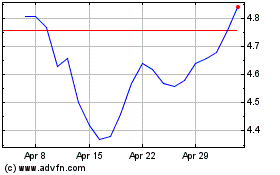

City Office REIT (NYSE:CIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

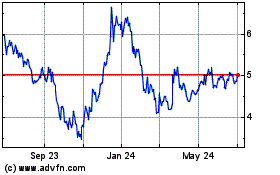

City Office REIT (NYSE:CIO)

Historical Stock Chart

From Nov 2023 to Nov 2024