Citizens Announces Key Leadership Appointments for Consumer Banking Team

November 18 2024 - 12:31PM

Business Wire

New Heads of Mortgage, Consumer Lending and

Retail Banking bring deep experience to accelerate ongoing

transformation and meet customers’ evolving needs

Citizens is pleased to announce the appointment of three key

executives to accelerate the bank’s ongoing transformation and

commitment to deliver the best experience for customers. Raman

Muralidharan has been appointed as the Head of Mortgage, and two

accomplished senior executives have been promoted: Adam Boyd to

Head of Lending and Nuno Dos Santos to Head of Retail Banking.

These leadership appointments will bolster Citizens’ growth plans

while enhancing its relationship-based banking model.

"The appointment of three highly experienced senior executives

underscores our commitment to deliver a superior customer

experience and cultivate deeper relationships across mortgage,

lending and retail banking,” said Brendan Coughlin, Vice Chair and

Head of Consumer Banking for Citizens. "Raman, Adam and Nuno’s deep

expertise and impressive track records will accelerate our progress

and position the bank for continued success through

customer-centric innovation to meet evolving banking and financial

needs.”

Raman Muralidharan, Head of Mortgage, leads all aspects

of mortgage originations and servicing, including sales,

operations, strategy, and technology, reporting to Coughlin. He

brings two decades of extensive mortgage industry experience,

having previously served as President and Senior Executive Vice

President of New Financial Products at Guaranteed Rate. Prior to

this role, he had an extensive career at HSBC where he held various

senior leadership roles in marketing, technology, and mortgage

banking. He has also been an executive at Capital One and a partner

at the management consulting firm Booz Allen.

Adam Boyd, Head of Lending, leads all aspects of consumer

lending, including home equity products, credit cards, Citizens

Pay, student lending, partner lending, consumer credit analytics,

and consumer lending strategy and operations, reporting to

Coughlin. Most recently, he led the transformation of the home

equity lending business with the debut of Citizens’ FastLine®

making the process faster and easier for borrowers. This produced

record volume growth in recent years and ranked the company as one

of the top nationwide home equity leaders. He also led the overhaul

of the credit card business strategy, which is positioned for

profitable growth in 2025, and beyond. Over the past decade, Boyd

held several leadership positions in Analytics and Product

Management for checking, deposits, payment, and fee income. Prior

to Citizens, he served in leadership roles at TD Bank and Bank of

America.

Nuno Dos Santos, Head of Retail Banking, oversees more

than 5,000 colleagues across 1,000 retail branch locations. For the

past two years, he served as the Retail Director for the Tri-State

Metro market that includes New York, New Jersey and Connecticut. In

this role, he led top-quartile household and deposit growth in the

most competitive market in the country. Previously, he served as

Retail Director for New England markets. Prior to Citizens, he

spent more than two decades in leadership positions at Citi,

Santander and Bank of America. He joins the Core Banking leadership

team reporting to Mark Rendulic, Interim Head of Core Banking.

For more information about Citizens, please visit the Citizens

website.

About Citizens Financial Group, Inc.

Citizens Financial Group, Inc. is one of the nation’s oldest and

largest financial institutions, with $219.7 billion in assets as of

September 30, 2024. Headquartered in Providence, Rhode Island,

Citizens offers a broad range of retail and commercial banking

products and services to individuals, small businesses,

middle-market companies, large corporations and institutions.

Citizens helps its customers reach their potential by listening to

them and by understanding their needs in order to offer tailored

advice, ideas and solutions. In Consumer Banking, Citizens provides

an integrated experience that includes mobile and online banking, a

full-service customer contact center and the convenience of

approximately 3,100 ATMs and approximately 1,000 branches in 14

states and the District of Columbia. Consumer Banking products and

services include a full range of banking, lending, savings, wealth

management and small business offerings. In Commercial Banking,

Citizens offers a broad complement of financial products and

solutions, including lending and leasing, deposit and treasury

management services, foreign exchange, interest rate and commodity

risk management solutions, as well as loan syndication, corporate

finance, merger and acquisition, and debt and equity capital

markets capabilities. More information is available at

www.citizensbank.com or visit us on X (formerly Twitter), LinkedIn

or Facebook.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118304140/en/

Media Michelle King Savio 781-375-0035

michelle.l.kingsavio@citizensbank.com

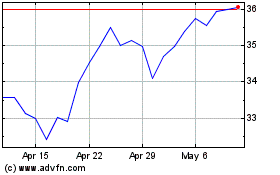

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Nov 2024 to Dec 2024

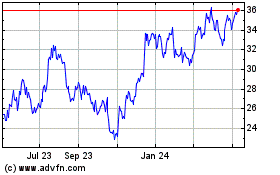

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Dec 2023 to Dec 2024