Cinemark Holdings, Inc. (NYSE:CNK) (the “Company” or “Cinemark”)

announced today the pricing terms of the previously announced cash

tender offer by its wholly-owned subsidiary, Cinemark USA, Inc.

(“Cinemark USA”), to purchase any and all of Cinemark USA’s 5.875%

senior notes due 2026 (the “notes”). As of July 9, 2024, Cinemark

USA had $405,000,000 aggregate principal amount of notes

outstanding.

The tender offer is being made pursuant to an offer to purchase,

dated as of July 9, 2024 (the “Offer to Purchase”), and a notice of

guaranteed delivery. The tender offer will expire at 5:00 p.m., New

York City time, on July 15, 2024, unless extended or earlier

terminated as described in the offer to purchase (such time and

date, as they may be extended, the “Expiration Date”).

Holders of the notes who validly tender, and do not validly

withdraw, their notes at or prior to the Expiration Date, or who

deliver to the tender agent and information agent a properly

completed and duly executed notice of guaranteed delivery in

accordance with the instructions described in the offer to

purchase, will be eligible to receive (1) consideration for each

$1,000 principal amount of notes validly tendered and accepted for

purchase, as determined in the manner described in the Offer to

Purchase by reference to the fixed spread for the notes specified

below plus the yield based on the bid-side price of the U.S.

Treasury Reference Security specified below, as quoted on the

applicable Bloomberg Reference Page specified below, at 10:00 a.m.,

New York City time, today, but in no event less than $1,000 and (2)

a cash amount equal to accrued and unpaid interest up to, but not

including, the settlement date, which is expected to occur on July

18, 2024.

Title of Security

CUSIP Numbers

Aggregate Principal Amount

Outstanding

U.S. Treasury Reference

Security

Bloomberg Reference

Page

Reference Yield

Fixed Spread

Purchase Price

5.875% Senior Notes due 2026

144A: 172441 BD8

Reg S: U17176 AK1

$405,000,000

1.750% U.S. Treasury due March

15, 2025

FIT3

5.093%

50 bps

$1,001.71

Tendered notes may be withdrawn at any time at or prior to the

Expiration Date. Cinemark USA reserves the right to terminate,

withdraw or amend the tender offer at any time, subject to

applicable law.

The tender offer is subject to the satisfaction or waiver of

certain conditions, including Cinemark USA’s completion of one more

or more debt financing transactions in an amount that is sufficient

to fund the purchase of all of the outstanding notes and to pay all

fees and expenses associated with such financing and the tender

offer. The tender offer is not conditioned on any minimum amount of

notes being tendered.

The tender offer is being made pursuant to the terms and

conditions contained in the offer to purchase and notice of

guaranteed delivery, copies of which may be obtained from D.F. King

& Co., Inc., the information agent for the offer, by telephone

at (800) 347-4826 (toll-free) or for banks and brokers, at (212)

269-5550 (Banks and Brokers only), by e-mail at cinemark@dfking.com

or at the following web address: www.dfking.com/cinemark.

Persons with questions regarding the tender offer should contact

the dealer manager: Wells Fargo Securities, LLC, Collect: (704)

410-4235, Toll-Free by telephone at (866) 309-6316.

None of the Company, Cinemark USA, the dealer manager, the

tender offer agent, the information agent or the trustee for the

notes, or any of their respective affiliates, is making any

recommendation as to whether holders should tender any notes in

response to the tender offer. Holders must make their own decision

as to whether to tender any of their notes and, if so, the

principal amount of notes to tender.

This press release is not an offer to purchase or a solicitation

of an offer to sell any securities, and does not constitute a

redemption notice for any securities. The tender offer is being

made solely by means of the offer to purchase.

About Cinemark:

Headquartered in Plano, TX, Cinemark (NYSE: CNK) is one of the

largest and most influential movie theatre companies in the world.

Cinemark’s circuit, comprised of various brands that also include

Century, Tinseltown and Rave, as of March 31, 2024 operated 502

theatres with 5,708 screens in 42 states domestically and 13

countries throughout South and Central America. Cinemark

consistently provides an extraordinary guest experience from the

initial ticket purchase to the closing credits, including Movie

Club, the first U.S. exhibitor-launched subscription program; the

highest Luxury Lounger recliner seat penetration among the major

players; XD - the No. 1 exhibitor-brand premium large format; and

expansive food and beverage options to further enhance the

moviegoing experience.

Forward-looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on information

currently available as well as management’s assumptions and beliefs

today. These statements are subject to numerous risks and

uncertainties that could cause actual results to differ materially

from the results expressed or implied by the statements, and

investors should not place undue reliance on them. Risks and

uncertainties that could cause actual results to differ materially

from such statements include:

- future revenue, expenses and profitability;

- currency exchange rate and inflationary impacts;

- the future development and expected growth of our

business;

- projected capital expenditures;

- access to capital resources;

- attendance at movies generally or in any of the markets in

which we operate;

- the number and diversity of popular movies released, the length

of exclusive theatrical release windows, and our ability to

successfully license and exhibit popular films;

- national and international growth in our industry;

- competition from other exhibitors, alternative forms of

entertainment and content delivery via streaming and other

formats;

- determinations in lawsuits in which we are a party; and

- the ongoing recovery of our business and the motion picture

exhibition industry from the effects of the COVID-19 pandemic and

the 2023 writers' and actors' guilds strikes.

You can identify forward-looking statements by the use of words

such as “may,” “should,” “could,” “estimates,” “predicts,”

“potential,” “continue,” “anticipates,” “believes,” “plans,”

“expects,” “future” and “intends” and similar expressions which are

intended to identify forward-looking statements. These statements

are not guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond our

control and difficult to predict. Such risks and uncertainties

could cause actual results to differ materially from those

expressed or forecasted in the forward-looking statements. In

evaluating forward-looking statements, you should carefully

consider the risks and uncertainties described in the “Risk

Factors” section or other sections in the Company's Annual Report

on Form 10-K filed February 16, 2024. All forward-looking

statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by these cautionary

statements and risk factors. Forward-looking statements contained

in this press release reflect our view only as of the date of this

press release. We undertake no obligation, other than as required

by law, to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240715319507/en/

Investor Relations Contact: Chanda

Brashears (972) 665-1671 cbrashears@cinemark.com

Media Contact: Julia McCartha (972)

665-1322 pr@cinemark.com

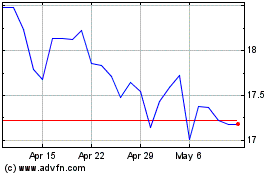

Cinemark (NYSE:CNK)

Historical Stock Chart

From Oct 2024 to Nov 2024

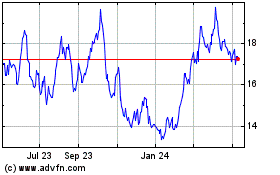

Cinemark (NYSE:CNK)

Historical Stock Chart

From Nov 2023 to Nov 2024