UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section14(a) of the Securities Exchange Act of 1934

(Amendment No. ) | | | | | |

| x | Filed by the Registrant |

| o | Filed by a Party other than the Registrant |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

MULTIPLAN CORPORATION

| | |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1)Title of each class of securities to which transaction applies: |

| 2)Aggregate number of securities to which transaction applies: |

| 3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4)Proposed maximum aggregate value of transaction: |

| 5)Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1)Amount previously paid: |

| 2)Form, Schedule or Registration Statement No.: |

| 3)Filing Party: |

| 4)Date Filed: |

Notice of Special Meeting of Stockholders of MultiPlan Corporation

Dear Stockholders, we would like to invite you to attend a Special Meeting (the “Special Meeting”) of the Stockholders of MultiPlan Corporation (“MultiPlan,” “our,” “us,” or “we”) at 9:00 a.m., Eastern Time, on Monday, September 9, 2024. Holders of record of our Class A common stock as of July 17, 2024 are entitled to notice of, and to vote at, the Special Meeting. As described further in this proxy statement, this meeting has been called primarily to approve a proposal that would give our Board of Directors (the “Board”) the authority to file an amendment to our Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of each share of our issued Class A common stock within the range of 1/40 to 1/15 of a share, at the Board’s discretion. Your vote is important and we encourage you to study our proxy materials carefully.

Background

| | | | | | | | |

| | |

| | |

| DATE AND TIME | LOCATION | WHO CAN VOTE |

Monday, September 9, 2024

at 9:00 a.m. EDT | Online only at: www.virtualshareholdermeeting.com/MPLN2024SM | The record date for determining Stockholders entitled to receive notice of and to vote at the Special Meeting is July 17, 2024* |

*A list of these stockholders will be open for examination by any stockholder for any purpose germane to the Special Meeting for a period of 10 days prior to the Special Meeting at 115 5th Ave., New York, NY 10003. In addition, this list will be available electronically during the Special Meeting at www.virtualshareholdermeeting.com/MPLN2024SM.

Voting Items

| | | | | | | | |

| | Board

Recommendation |

Proposal 1: | To approve a proposal to give our Board the authority, at its discretion, to file an amendment to our Second Amended and Restated Certificate of Incorporation to effect a reverse split of each share of our issued Class A common stock within the range of 1/40 to 1/15 of a share, without reducing the authorized number of shares of our Class A common stock, with the exact ratio to be selected by our Board in its discretion and to be effected, if at all, in the sole discretion of our Board at any time following stockholder approval of the amendment to our Second Amended and Restated Certificate of Incorporation and before September 9, 2025 (the “Reverse Stock Split Proposal”) |  FOR FOR |

Proposal 2: | To approve a proposal to permit the Board’s proxyholders to adjourn the Special Meeting to solicit additional proxies in favor of the Reverse Stock Split Proposal if there are not sufficient votes to approve such proposal |  FOR FOR |

Advance Voting Methods

| | | | | | | | |

| | |

| | |

| TELEPHONE | INTERNET | MAIL |

| 1-800-690-6903 | www.proxyvote.com | Vote Processing, c/o Broadridge,

51 Mercedes Way, Edgewood, New York 11717 |

Kent W. Bartholomew

Assistant Secretary

This proxy statement and accompanying proxy card are first being made available on or about July 29, 2024.

| | |

|

Whether or not you expect to virtually attend the Special Meeting, please submit your proxy as soon as possible. If you do virtually attend the Special Meeting, you may revoke your proxy and vote in person. Most stockholders have three options for submitting their proxies prior to the Special Meeting: (1) via the internet, (2) by phone, or (3) by signing and returning the enclosed proxy. If you have internet access, we encourage you to appoint your proxy on the internet. It is convenient, and it saves the company significant postage and processing costs. |

Table of Contents

| | | | | |

PROPOSAL 1: Approval of the Amendment to the Second Amended and Restated Certificate of Incorporation to Effect a Reverse Stock Split | |

PROPOSAL 2: Approval of Adjournment of the Special Meeting to Solicit Additional Proxies in Favor of the Reverse Stock Split Proposal if there are Not Sufficient Votes to Approve Such Proposal | |

| |

| |

| |

| |

| |

| |

| Annex A - Proposed Certificate of Amendment | |

| | | | | | | | | | | |

| | | |

| PROPOSAL 1 | |

| APPROVAL OF THE AMENDMENT TO THE SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT | |

| | |

| | |

| | THE BOARD RECOMMENDS A VOTE FOR | |

| | | |

Our Board has approved, subject to stockholder approval, and is recommending to our stockholders for approval, an amendment to our Second Amended and Restated Certificate of Incorporation (the “Amendment”) to effect a reverse stock split pursuant to which each outstanding share of our Class A common stock will be combined into not less than 1/40th and not more than 1/15th of a share of our Class A common stock (the “Reverse Stock Split”). If approved by our stockholders, the exact ratio within that range and the Effective Time (as defined below) of the Reverse Stock Split would be determined by our Board at any time within one year of the date of this Special Meeting (the “Reverse Stock Split Proposal”). Prior to filing the Amendment, the Board would publicly disclose the Reverse Stock Split ratio being implemented by the Amendment. The full text of the proposed Amendment is set forth in Annex A to this proxy statement.

If stockholders approve the Reverse Stock Split Proposal, our Board will cause the Amendment to be filed with the Delaware Secretary of State and effect the Reverse Stock Split only if the Board determines that the Reverse Stock Split would be in the best interests of MultiPlan and its stockholders. The Reverse Stock Split could become effective as soon as the business day immediately following this Special Meeting. Our Board also may determine in its discretion not to effect the Reverse Stock Split and not to file the Amendment. No further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split.

As of July 17, 2024, a total of 658,127,871 shares of our Class A common stock were issued and outstanding and 29,714,372 shares were held in treasury. Based on such number of shares of our Class A common stock issued and outstanding, immediately following the effectiveness of the Reverse Stock Split (and without giving any effect to the payment of cash in lieu of fractional shares), we will have, depending on the reverse stock split ratio selected by our Board, issued and outstanding shares of Class A common stock as illustrated in the table below under the heading “-Effects of the Reverse Stock Split-Effect on Shares of Common Stock.”

The Amendment will not result in a reduction of the total number of shares of our Class A common stock that MultiPlan is authorized to issue by a corresponding ratio, and, as a result, the number of authorized shares of Class A common stock available for issuance will increase. See “-Effects of the Reverse Stock Split-Effect on Shares of Common Stock” for the number of shares of Class A common stock authorized but not outstanding or reserved that will remain available for issuance immediately following the effectiveness of the Reverse Stock Split.

All holders of our Class A common stock will be affected proportionately by the Reverse Stock Split. No fractional shares of Class A common stock will be issued as a result of the Reverse Stock Split. Instead, any stockholder who would have been entitled to receive a fractional share as a result of the Reverse Stock Split will receive cash payments in lieu of such fractional shares. Each Class A common stockholder will hold the same percentage of the outstanding Class A common stock immediately following the Reverse Stock Split as that stockholder did immediately prior to the Reverse Stock Split, except to the extent that the Reverse Stock Split results in stockholders receiving cash in lieu of fractional shares. The par value of our Class A common stock will continue to be $0.0001 per share (see “-Effects of the Reverse Stock Split-Reduction in Stated Capital”).

Reasons for the Reverse Stock Split

Reverse Stock Split

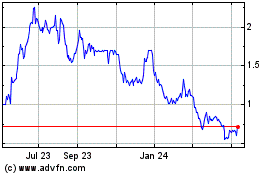

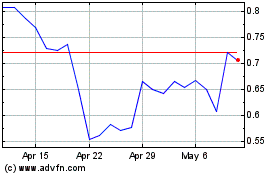

Our Board has determined that it is in the best interests of MultiPlan and our stockholders to consider a possible Reverse Stock Split within the range of 1/40 and 1/15 per outstanding share of Class A common stock, as determined by our Board at a later date, in order to reduce the number of shares of Class A common stock outstanding. Our Board may authorize the reverse split of our Class A common stock with the primary intent of increasing the per share trading price of our Class A common stock in order to meet the NYSE’s price criteria for continued listing on that exchange. Our Class A common stock is publicly traded and listed on the NYSE under the symbol “MPLN.” Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Stock Split is in MultiPlan and our stockholders’ best interests.

On March 28, 2024, we were notified in writing by the NYSE that the average closing trading price of our Class A common stock was below the criteria of the NYSE’s continued listing standards, as the average per share closing price of our Class A common

stock over a consecutive 30-trading-day period was less than $1.00. In the letter, the NYSE stated that we have a six-month cure period that started on March 28, 2024 to bring the price of our Class A common stock and the 30-trading-day average closing price of our Class A common stock above $1.00. In the letter, the NYSE further stated that in the event a $1.00 share price and a $1.00 average share price over the preceding 30 trading days are not attained at the expiration of the six-month cure period, the NYSE will commence suspension and delisting procedures. The NYSE has reserved the right to reevaluate its continued listing determinations relating to companies who are notified of non-compliance like MultiPlan with respect to the NYSE’s qualitative listing standards, including if our shares trade at sustained levels that are considered to be abnormally low. We promptly responded to the NYSE with respect to our intent to cure the deficiency by considering available alternatives to regain compliance.

In addition to bringing the per-share trading price of our Class A common stock back above $1.00, we also believe that the Reverse Stock Split may make our Class A common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our Class A common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.

Reducing the number of outstanding shares of our Class A common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share trading price of our Class A common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the per share trading price of our Class A common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the per share trading price of our Class A common stock will increase following the Reverse Stock Split or that the per share trading price of our Class A common stock will not decrease in the future.

Criteria to Be Used for Determining Whether to Implement the Reverse Stock Split

In determining whether to implement the Reverse Stock Split and which reverse stock split ratio to implement, if any, following receipt of stockholder approval of the Reverse Stock Split Proposal, the Board may consider, among other things, various factors, such as:

•The historical trading price and trading volume of our Class A common stock;

•The NYSE Continued Listing Standards requirements;

•The then-prevailing trading price and trading volume of our Class A common stock and the expected impact of the Reverse Stock Split on the trading market for our Class A common stock in the short- and long-term; and

•Prevailing general market and economic conditions.

Certain Risks and Potential Disadvantages Associated with the Reverse Stock Split

We Cannot Assure You that the Proposed Reverse Stock Split Will Increase our Stock Price

We expect that the Reverse Stock Split will increase the per share trading price of our Class A common stock. However, the effect of the Reverse Stock Split on the per share trading price of our Class A common stock cannot be predicted with any certainty, and the history of reverse stock splits for other companies is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the per share trading price of our Class A common stock after the Reverse Stock Split will not increase in the same proportion as the reduction in the number of our outstanding shares of Class A common stock following the Reverse Stock Split, and the Reverse Stock Split may not result in a per share trading price that would attract investors who do not trade in lower priced stocks. In addition, although we believe the Reverse Stock Split may enhance the marketability of our Class A common stock to certain potential investors, we cannot assure you that, if implemented, our Class A common stock will be more attractive to investors. Even if we implement the Reverse Stock Split, the per share trading price of our Class A common stock may decrease due to factors unrelated to the Reverse Stock Split, including our future performance. If the Reverse Stock Split is consummated and the per share trading price of the Class A common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

The Proposed Reverse Stock Split May Decrease the Liquidity of our Common Stock and Result in Higher Transaction Costs

The liquidity of our Class A common stock may be negatively impacted by the Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split is implemented, it will increase the number of our stockholders who own “odd lots” of fewer than 100 shares of Class A common stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of Class A common stock. Accordingly, the Reverse Stock Split may not achieve the desired results of increasing marketability of our Class A common stock as described above.

Potential Anti-Takeover Effect

The Reverse Stock Split would result in an increased proportion of unissued authorized shares to issued shares, which could have possible anti-takeover effects and could be used by us to oppose a hostile takeover attempt or to delay or prevent changes in our control or management (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of us with another company). These authorized but unissued shares could (within the limits imposed by applicable law) be issued in one or more transactions that could make a change of control of the Company more difficult, and therefore more unlikely, or used to resist or frustrate a third-party transaction that is favored by a majority of the independent stockholders. For example, without further stockholder approval, our Board could (within the limits imposed by applicable law) strategically sell shares of Class A common stock in a private transaction to purchasers who would oppose a takeover or favor our then current Board, or the shares could be available for potential issuance pursuant to a shareholder rights plan. The additional authorized shares could be used to discourage persons from attempting to gain control of us by diluting the voting power of shares then outstanding or increasing the voting power of persons that would support the Board in a potential takeover situation, including by preventing or delaying a proposed business combination that is opposed by our Board although perceived to be desirable by some stockholders. The issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. Despite these possible anti-takeover effects, this Reverse Stock Split Proposal has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt or any effort of which we are aware to accumulate our stock or to obtain control of our company by means of a merger, tender offer, solicitation in opposition to management or otherwise (nor is our Board currently aware of any such attempts directed at us). Nevertheless, stockholders should be aware that approval of this proposal could facilitate future efforts by us to deter or prevent changes in our control, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

Effective Time

The effective time of the Reverse Stock Split (the “Effective Time”), if approved by stockholders and implemented by MultiPlan, will be the date and time set forth in the Amendment that is filed with the Delaware Secretary of State. Such filing may take place as soon as promptly following the Special Meeting, assuming the stockholders approve the Amendment and, as a result, the Effective Time could occur as soon as the business day immediately following the Special Meeting. However, the exact timing of the filing of the Amendment will be determined by our Board based on its evaluation as to when such action will be the most advantageous to the Company and our stockholders. Prior to filing the Amendment, the Board will publicly disclose the Reverse Stock Split ratio being implemented by the Amendment.

If, at any time prior to the Effective Time of the Amendment with the Delaware Secretary of State, notwithstanding stockholder approval, and without further action by the stockholders, the Board, in its sole discretion, determines that it is in MultiPlan’s best interests and the best interests of our stockholders to delay the filing of the Amendment or abandon the Reverse Stock Split, the Reverse Stock Split may be delayed or abandoned.

Fractional Shares

Stockholders will not receive fractional shares of Class A common stock in connection with the Reverse Stock Split. Instead, the transfer agent will aggregate all fractional shares and sell them as soon as practicable after the Effective Time at the then-prevailing prices on the open market, on behalf of those stockholders who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split. We expect that the transfer agent will conduct the sale in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional shares of our Class A common stock. After the transfer agent’s completion of such sale, stockholders who would have been entitled to a fractional share will instead receive a cash payment from the transfer agent in an amount equal to their respective pro rata shares of the total proceeds of that sale net of any brokerage costs incurred by the transfer agent to sell such stock.

Stockholders will not be entitled to receive interest for the period of time between the Effective Time and the date payment is made for their fractional share interest. You should also be aware that, under the escheat laws of certain jurisdictions, sums due for fractional interests that are not timely claimed after the funds are made available may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they were paid.

If you believe that you may not hold sufficient shares of MultiPlan’s Class A common stock at the Effective Time to receive at least one share in the Reverse Stock Split and you want to continue to hold our Class A common stock after the Reverse Stock Split, you may do so by either:

•purchasing a sufficient number of shares of our Class A common stock; or

•if you have shares of our Class A common stock in more than one account, consolidating your accounts;

in each case, so that you hold a number of shares of our Class A common stock in your account prior to the Reverse Stock Split that would entitle you to receive at least one share of Class A common stock in the Reverse Stock Split assuming a 1/40 split ratio

which is the lowest ratio being authorized in the Amendment. Shares of our Class A common stock held in registered form and shares of our Class A common stock held in “street name” (that is, through a broker, bank or other holder of record) for the same stockholder will be considered held in separate accounts and will not be aggregated when effecting the Reverse Stock Split.

Effects of the Reverse Stock Split

General

After the Effective Time of the Reverse Stock Split, if implemented by the Board, each stockholder will own a reduced number of shares of Class A common stock. The principal effect of the Reverse Stock Split will be to proportionately decrease the number of outstanding shares of our Class A common stock based on the reverse stock split ratio selected by our Board.

Voting rights and other rights of the holders of our Class A common stock will not be affected by the Reverse Stock Split, other than as a result of the treatment of fractional shares as described above. For example, a holder of 2% of the voting power of the outstanding shares of our Class A common stock immediately prior to the effectiveness of the Reverse Stock Split will generally continue to hold 2% (assuming there is no impact as a result of the payment of cash in lieu of issuing fractional shares) of the voting power of the outstanding shares of our Class A common stock after the Reverse Stock Split. The number of stockholders of record will not be affected by the Reverse Stock Split (except to the extent any are cashed out as a result of holding fractional shares). If approved and implemented, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of our Class A common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. Our Board believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Because the proposed Amendment does not result in a reduction in the total number of shares of Class A common stock that we are authorized to issue, the implementation of the Reverse Stock Split will have the effect of increasing the number of available authorized shares of Class A common stock. The resulting increase in such availability in the authorized number of shares of Class A common stock could have a number of effects on our stockholders depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. Because holders of our Class A common stock have no preemptive rights to purchase or subscribe for any unissued Class A common stock of MultiPlan, the issuance of additional shares of authorized Class A common stock that will become newly available as a result of the implementation of the Reverse Stock Split will reduce the current stockholders’ percentage ownership interest in the total outstanding shares of our Class A common stock.

Effect on Shares of Common Stock

The following table contains approximate information relating to our outstanding Class A common stock based on reverse stock split ratios within the proposed range and information regarding our authorized shares assuming that the Reverse Stock Split Proposal is approved and the Reverse Stock Split is implemented, in each case based on share information as of July 17, 2024 and without giving any effect to the payment of cash in lieu of fractional shares in the Reverse Stock Split.

| | | | | | | | | | | | | | | | | |

| | Number of Shares of Common Stock Issued and Outstanding Prior to Reverse Stock Split | Number of Shares of Common Stock Issued and Outstanding After Reverse Stock Split | Number of Shares of Common Stock Authorized for Issuance After Reverse Stock Split | Number of Shares of Common Stock Authorized and Available for Issuance After Reverse Stock Split¹ |

| 1/15-for-1 Reverse Stock Split | | 658,127,871 | 43,875,191 | 1,500,000,000 | 1,434,971,518 |

| 1/20-for-1 Reverse Stock Split | | 658,127,871 | 32,906,394 | 1,500,000,000 | 1,451,228,638 |

| 1/25-for-1 Reverse Stock Split | | 658,127,871 | 26,325,115 | 1,500,000,000 | 1,460,982,910 |

| 1/30-for-1 Reverse Stock Split | | 658,127,871 | 21,937,596 | 1,500,000,000 | 1,467,485,759 |

| 1/35-for-1 Reverse Stock Split | | 658,127,871 | 18,803,653 | 1,500,000,000 | 1,472,130,651 |

| 1/40-for-1 Reverse Stock Split | | 658,127,871 | 16,453,197 | 1,500,000,000 | 1,475,614,319 |

(1) Based on (i) 162,345,516 shares of Class A common stock reserved for future issuance under the Stock Plans (as defined below), inclusive of outstanding equity awards; (ii) 58,500,000 shares of Class A common stock reserved for future issuance upon the exercise of outstanding warrants to purchase shares of our Class A common stock; and (iii) 96,453,847 shares of Class A common stock reserved for future issuance upon conversion of the Senior Convertible PIK Notes (as defined below), in each case, on a pre-Reverse Stock Split basis as of July 17, 2024.

After the Effective Time of the Reverse Stock Split that our Board elects to implement, our Class A common stock would have a new Committee on Uniform Securities Identification Procedures number, or CUSIP number, used to identify our Class A common stock.

Our Class A common stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934, or the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect the registration of our Class A common stock under the Exchange Act or the listing of our Class A common stock on the NYSE. Following the Reverse Stock Split, our Class A common stock will continue to be listed on the NYSE under the symbol “MPLN,” although it will be considered a new listing with a new CUSIP number.

No Effect on Preferred Stock Authorization

Our Second Amended and Restated Certificate of Incorporation currently authorizes the issuance of 10,000,000 shares of preferred stock, $0.0001 par value per share, none of which is currently issued or outstanding. The proposed Reverse Stock Split would not increase the authorized number of shares of our preferred stock.

No Effect on Par Value

The proposed Amendment will not affect the par value of our Class A common stock, which will remain at $0.0001.

Reduction in Stated Capital

As a result of the Reverse Stock Split, upon the Effective Time, the stated capital on our balance sheet attributable to our Class A common stock, which consists of the par value per share of our Class A common stock multiplied by the aggregate number of shares of our Class A common stock issued and outstanding, will be reduced in proportion to the size of the Reverse Stock Split, subject to a minor adjustment in respect of the treatment of fractional shares, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, will remain unchanged.

Effect on MultiPlan’s Stock Plans

Under our 2020 Omnibus Incentive Plan and our 2023 Employee Stock Purchase Plan (collectively, our “Stock Plans”), the Compensation Committee of our Board (the “Compensation Committee”) has the power to determine the adjustment that it deems equitable to, among other things, the awards granted and shares reserved for issuance under our Stock Plans in the event of a reverse stock split. Accordingly, if the Reverse Stock Split is approved and effected, we expect that the Compensation Committee will proportionately adjust the number of shares available for issuance under the Stock Plans, as well as the number of shares subject to any outstanding award under the Stock Plans, and the exercise, grant price or purchase price relating to any such award or right under the Stock Plans to reflect the Reverse Stock Split. The Compensation Committee will also determine the treatment of fractional shares subject to stock options and other outstanding awards under the Stock Plans. In addition, pursuant to the authority provided under the Stock Plans, the Compensation Committee is expected to authorize the Company to effect any other changes necessary, desirable or appropriate to give effect to the Reverse Stock Split, including any applicable technical, conforming changes to our Stock Plans.

Specifically, it is expected that the number of shares subject to awards under the Stock Plans will be adjusted in each case to equal the product of the number of shares subject to the applicable award immediately prior to the Reverse Stock Split multiplied by the Reverse Stock Split ratio (rounded down to the nearest whole share), that the exercise price of any stock option will be adjusted to equal the quotient of the number of shares subject to the applicable stock option immediately prior to the Reverse Stock Split divided by the Reverse Stock Split ratio (rounded up to the nearest whole cent), and that the stock price goal of any performance-based restricted stock units will be adjusted in each case to equal the product of the applicable price goal in effect immediately prior to the Reverse Stock Split multiplied by the Reverse Stock Split ratio (rounded up to the nearest whole cent).

Effect on Warrants

If the Reverse Stock Split is approved and effected, our outstanding warrants to purchase shares of our Class A common stock will be proportionately adjusted to reflect the Reverse Stock Split, including the number of shares purchasable upon exercise of such warrants and their exercise prices.

Effect on Senior Convertible PIK Notes

As of June 30, 2024, we had $1,253,890,000 in aggregate principal amount of our 6.00% / 7.00% Convertible Senior PIK Toggle Notes due 2027 (the “Senior Convertible PIK Notes”) outstanding, which Senior Convertible PIK Notes are convertible into shares of our Class A common stock. If the Reverse Stock Split is approved and effective, the conversion rate on the Senior Convertible PIK Notes will be adjusted to equal (i) the conversion rate in effect immediately prior to the open of business on the Effective Time of the Reverse Stock Split, multiplied by (ii) the number of shares of our Class A common stock outstanding immediately after giving effect to the Reverse Stock Split, divided by (iii) the number of shares of our Class A common stock outstanding

immediately prior to the open of business on the Effective Time of the Reverse Stock Split (before giving effect thereto). The conversion rate will be automatically adjusted effective at the open of business on the date of the Reverse Stock Split.

Shares Held in Book-Entry and Through a Broker, Bank, or Other Holder of Record

If you hold registered shares of our Class A common stock in a book-entry form, you do not need to take any action to receive your post-Reverse Stock Split shares of our Class A common stock in registered book-entry form or your cash payment in lieu of fractional shares, if applicable. If you are entitled to post-Reverse Stock Split shares of our Class A common stock, a transaction statement will automatically be sent to your address of record as soon as practicable after the Effective Time indicating the number of shares of our Class A common stock you hold. In addition, if you are entitled to a payment of cash in lieu of fractional shares, a check will be mailed to you at your registered address as soon as practicable after the Effective Time. By signing and cashing this check, you will warrant that you owned the shares of our Class A common stock for which you received a cash payment.

At the Effective Time, we intend to treat stockholders holding shares of our Class A common stock in “street name” (that is, through a broker, bank or other holder of record) in the same manner as registered stockholders whose shares of our Class A common stock are registered in their names. Brokers, banks or other holders of record will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our Class A common stock in “street name”; however, these brokers, banks or other holders of record may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of our Class A common stock with a broker, bank or other holder of record, and you have any questions in this regard, we encourage you to contact your holder of record.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a general summary of certain U.S. federal income tax consequences of the Reverse Stock Split that may be relevant to holders of our Class A common stock that hold such stock as a capital asset for U.S. federal income tax purposes (generally, property held for investment). This summary is based upon the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated thereunder, administrative rulings and judicial decisions as of the date hereof, all of which may change, possibly with retroactive effect, resulting in U.S. federal income tax consequences that may differ from those discussed below.

This discussion applies only to holders that are U.S. Holders (as defined below) and does not address all aspects of U.S. federal income taxation that may be relevant to such holders in light of their particular circumstances or to holders that may be subject to special tax rules, including: (i) holders subject to alternative minimum tax; (ii) banks, insurance companies, or other financial institutions; (iii) tax-exempt organizations; (iv) dealers in securities or currencies; (v) regulated investment companies or real estate investment trusts; (vi) partnerships or other pass-through entities for U.S. federal income tax purposes (and their partners or members); (vii) traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; (viii) U.S. Holders whose “functional currency” is not the U.S. dollar; (ix) persons holding our Class A common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other integrated transaction; (x) persons who acquire shares of our Class A common stock in connection with employment or other performance of services; or (xi) U.S. expatriates. If a partnership (including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds shares of our Class A common stock, the tax treatment of a holder that is a partner in the partnership generally will depend upon the status of the partner and the activities of the partnership.

We have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service (“IRS”) regarding the U.S. federal income tax consequences of the Reverse Stock Split and there can be no assurance that the IRS will not challenge the statements and conclusions set forth below or a court would not sustain any such challenge. The following summary does not address any U.S. state or local or any foreign tax consequences, any estate, gift or other non-income tax consequences, or the Medicare tax on net investment income.

EACH HOLDER OF COMMON STOCK SHOULD CONSULT SUCH HOLDER’S TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

For purposes of the discussion below, a “U.S. Holder” is a beneficial owner of shares of our Class A common stock that for U.S. federal income tax purposes is: (1) an individual citizen or resident of the United States; (2) a corporation (including any entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia; (3) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (4) a trust, if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (ii) the trust has a valid election in effect to be treated as a U.S. person.

The Reverse Stock Split is intended to be treated as a “recapitalization” for U.S. federal income tax purposes. As a result, a U.S. Holder generally should not recognize gain or loss upon the Reverse Stock Split, except with respect to cash received in lieu of a fractional share of our Class A common stock, as discussed below. A U.S. Holder’s aggregate tax basis in the shares of our Class A common stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of our Class A

common stock surrendered (excluding any portion of such basis that is allocated to any fractional share of our Class A common stock), and such U.S. Holder’s holding period in the shares of our Class A common stock received should include the holding period in the shares of our Class A common stock surrendered. Treasury regulations promulgated under the Code provide detailed rules for allocating the tax basis and holding period of the shares of our Class A common stock surrendered to the shares of our Class A common stock received pursuant to the Reverse Stock Split. Holders of shares of our Class A common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

A U.S. Holder that receives cash in lieu of a fractional share of our Class A common stock pursuant to the Reverse Stock Split should generally recognize capital gain or loss in an amount equal to the difference between the amount of cash received and the U.S. Holder’s tax basis in the shares of our Class A common stock surrendered that is allocated to such fractional share. Such capital gain or loss should generally be long-term capital gain or loss if the U.S. Holder’s holding period for our Class A common stock surrendered exceeded one year at the Effective Time.

Information returns generally will be required to be filed with the IRS with respect to payments to a U.S. Holder of cash in lieu of a fractional share of our Class A common stock pursuant to the Reverse Stock Split, unless the U.S. Holder establishes that it is an exempt recipient. In addition, a U.S. Holder may be subject to backup withholding (at the current applicable rate of 24%) on such cash payments if such U.S. Holder does not provide its correct taxpayer identification numbers in the manner required or otherwise fails to comply with applicable backup withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or allowed as a credit against the U.S. Holder’s U.S. federal income tax liability, provided the required information is timely furnished to the IRS.

No Appraisal Rights

Under the Delaware law, stockholders are not entitled to appraisal rights with respect to the Reverse Stock Split, and we will not independently provide our stockholders with any such right.

Interests of Directors and Executive Officers

None of MultiPlan’s directors or executive officers have any substantial interest, directly or indirectly, in this proposal except to the extent of their ownership of shares of our Class A common stock and/or securities exercisable for, or convertible into, shares of our Class A common stock, as set forth in the “Security Ownership of Certain Beneficial Owners and Management” section of this proxy statement. We do not believe that our directors or executive officers have interests in this proposal that are different from or greater than those of any of our other stockholders.

Vote Required

Approval of this Proposal 1 requires that more shares of Class A common stock be cast “FOR” this proposal than are cast “AGAINST” it. Votes to “ABSTAIN” will be counted as present at the Special Meeting for purposes of obtaining a quorum, but will have no impact on the outcome of this Proposal 1. We expect that this proposal will be considered a “routine” matter under NYSE rules and, as a result, if you hold shares of our Class A common stock in street name, in the absence of instructions, your broker, bank or other nominee may vote your shares on this proposal. Broker non-votes, if any, will have no effect on the outcome of this proposal.

Recommendation

OUR BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF AN AMENDMENT TO OUR SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT.

| | | | | | | | | | | |

| | | |

| PROPOSAL 2 | |

| APPROVAL OF ADJOURNMENT OF THE SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES IN FAVOR OF THE REVERSE STOCK SPLIT PROPOSAL IF THERE ARE NOT SUFFICIENT VOTES TO APPROVE SUCH PROPOSAL | |

| | |

| | |

| | THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL. | |

| | | |

General

In this Proposal 2, the Board is asking our stockholders to authorize the holder of any proxy solicited by the Board to adjourn the Special Meeting to another time and place to solicit additional proxies if there are not sufficient votes to approve the Reverse Stock Split Proposal at the Special Meeting. If our stockholders approve this proposal, we could adjourn the Special Meeting without a vote on the Reverse Stock Split Proposal to solicit additional proxies and/or to seek to convince stockholders to change their votes in favor of such proposal. Additionally, approval of this proposal could mean that, in the event we receive proxies indicating that a majority of the voting power of the outstanding shares of our Class A common stock entitled to vote on the Reverse Stock Split Proposal have voted against the Reverse Stock Split Proposal, we could adjourn the Special Meeting without a vote on the Reverse Stock Split Proposal and use the additional time to solicit the holders of those shares to change their vote in favor of the Reverse Stock Split Proposal.

If the Special Meeting is adjourned, notice need not be given of the adjourned meeting if the time, place, if any, thereof (and the means of remote communication, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such adjourned meeting) are announced at the Special Meeting or displayed, during the time scheduled for the Special Meeting, on the same electronic network used to enable stockholders and proxy holders to participate in the meeting by means of remote communication. However, if the adjournment is for more than 30 days, a notice of the adjourned meeting will be given to each stockholder of record entitled to vote at the Special Meeting. In addition, if after the adjournment a new record date for stockholders entitled to vote is fixed for the adjourned meeting, notice of the adjourned meeting will be given to each stockholder of record entitled to vote at such adjourned meeting as of the record date fixed for notice of such adjourned meeting. At the adjourned meeting, we may transact any business which might have been transacted at the original meeting.

Interests of Directors and Executive Officers

None of MultiPlan’s directors or executive officers have any substantial interest, directly or indirectly, in this proposal except to the extent of their ownership of shares of our Class A common stock and/or securities exercisable for, or convertible into, shares of our Class A common stock, as set forth in the “Security Ownership of Certain Beneficial Owners and Management” section of this proxy statement. We do not believe that our directors or executive officers have interests in this proposal that are different from or greater than those of any of our other stockholders.

Vote Required

Approval of this Proposal 2 requires the affirmative vote (i.e., a “FOR” vote) of a majority of the voting power of the shares of Class A common stock present in person or represented by proxy and entitled to vote on this proposal. A vote to “ABSTAIN” will have the same effect as a vote “AGAINST” this Proposal 2. We expect that this Proposal 2 will be considered a “routine” matter under NYSE rules and, as a result, if you hold shares of our Class A common stock in street name, in the absence of instructions, your broker, bank or other nominee may vote your shares on this proposal. Broker non-votes, if any, will have no effect on the outcome of this proposal.

Recommendation

OUR BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE THE REVERSE STOCK SPLIT PROPOSAL.

Stock Ownership Information

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information known to us regarding the beneficial ownership of our Class A common stock as of the close of business on July 17, 2024, also referred to as the “Record Date”, by:

•Each person who is the beneficial owners of more than 5% of the outstanding shares of our Class A common stock;

•Each of our named executive officers and directors; and

•All of our executive officers and directors as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days. Except as described in the footnotes below and subject to applicable community property laws and similar laws, we believe that each person listed in the table below has sole voting and investment power with respect to such shares.

The beneficial ownership of our Class A common stock is based on 658,127,871 shares of Class A common stock issued and outstanding as of July 17, 2024, excluding 29,714,372 shares held by the Company as treasury shares.

| | | | | | | | |

Name and Address of Beneficial Owner(1) | Number of Shares | Percent Owned (%) |

| Five Percent Holders: | | |

GIC Investor(2) | 49,612,794 | 7.5 | |

Green Equity Investors(3) | 38,449,957 | 5.8 | |

H&F Investors(4) | 215,514,491 | 32.7 | |

Michael S. Klein(5) | 38,388,846 | 5.6 | |

Oak Hill Advisors Entities(6) | 41,937,803 | 6.0 | |

The Public Investment Fund of the Kingdom of Saudi Arabia(7) | 61,750,000 | 9.2 | |

The Vanguard Group(8) | 36,563,785 | | 5.6 | |

| Executive Officers and Directors: | | |

| Travis S. Dalton | — | | * |

Dale A. White(9) | 11,964,401 | | 1.8 | |

James M. Head (10) | 1,987,436 | | * |

Jerome W. Hogge, III | — | | * |

Jeffrey A. Doctoroff(11) | 657,067 | | * |

Michael C. Kim(12) | 549,495 | | * |

Carol H. Nutter(13) | 92,250 | | * |

Michael A. Attal(14) | — | | * |

Glenn R. August(6)(15)(16) | 147,669 | | * |

Richard A. Clarke(17) | 147,669 | | * |

Anthony Colaluca, Jr.(18) | 367,669 | | * |

C. Martin Harris(19) | 145,590 | | * |

Julie D. Klapstein(20) | 158,758 | | * |

Michael S. Klein(5) | 38,388,846 | | 5.6 | |

P. Hunter Philbrick(14) | — | | * |

John M. Prince(21) | 40,761 | | * |

Allen R. Thorpe(14) | — | | * |

All executive officers and directors or nominees as a group (17 persons) | 54,647,611 | | 8.0 | |

* Less than 1%

Stock Ownership Information

(1)Unless otherwise noted, the address of each of the entities or individuals listed in this table is c/o MultiPlan Corporation, 115 Fifth Avenue, New York, New York 10003.

(2)The following information is based on a Schedule 13G/A filed on February 11, 2022 by GIC Private Limited, GIC Special Investments Private Limited, and Viggo Investment Pte. Ltd. (collectively, the “GIC Investor”). Interests shown consist of 49,612,794 shares of Class A common stock held by Viggo Investment Pte. Ltd. Viggo Investment Pte. Ltd. shares the power to vote and the power to dispose of these shares with GIC Special Investments Private Limited and GIC Private Limited. GIC Special Investments Private Limited is wholly owned by GIC Private Limited and is the private equity investment arm of GIC Private Limited. The business address for the GIC Investor is 168 Robinson Road, #37-01 Capital Tower, Singapore 068912.

(3)The following information is based on a Schedule 13D filed on October 13, 2020 by Green Equity Investors VI, L.P. and the other reporting persons named therein. Interests shown consist of 23,447,087 shares of Class A common stock held by Green Equity Investors VI, L.P., 13,992,386 shares of Class A common stock held by Green Equity Investors Side VI, L.P., 62,670 shares of Class A common stock held by LGP Associates VI-A LLC and 917,814 shares of Class A common stock held by LGP Associates VI-B LLC (each a “Green Equity Investor”). Voting and investment power may also be deemed to be shared with certain affiliated entities and investors whose holdings are included in the above amount; and each of the foregoing entities’ address is c/o Leonard Green & Partners, L.P., 11111 Santa Monica Boulevard, Suite 2000, Los Angeles, California 90025.

(4)Interests shown consist of 1,712,045 shares of Class A common stock held by Music Investments, L.P. (“Music Investments”), 112,593,413 shares of Class A common stock held by Hellman & Friedman Capital Partners VIII, L.P., 50,532,114 shares of Class A common stock held by Hellman & Friedman Capital Partners VIII (Parallel), L.P., 9,549,505 shares of Class A common stock held by HFCP VIII (Parallel-A), L.P., 2,953,631 shares of Class A common stock held by H&F Executives VIII, L.P. and 496,709 shares of Class A common stock held by H&F Associates VIII, L.P. (collectively, the “H&F VIII Funds”) and 37,677,074 shares of Class A common stock held by H&F Polaris Partners, L.P. (“Polaris Partners” and, collectively with Music Investments and the H&F VIII Funds, the “H&F Investors”) pursuant to a Schedule 13D filed by the H&F Investors on October 13, 2020, as amended through May 13, 2022 (the “H&F 13D”). Pursuant to the H&F 13D, H&F Parallel-A is the managing member of Music Investments, GP, LLC, which is the general partner of Music Investments, H&F Polaris Partners GP, LLC (“Polaris Partners GP”) is the general partner of Polaris Partners; Hellman & Friedman Capital Partners VIII, L.P. is the managing member of Polaris Partners GP; Hellman & Friedman Investors VIII, L.P. (“H&F Investors VIII”) is the general partner of the H&F VIII Funds; H&F Corporate Investors VIII, Ltd. (“H&F VIII”) is the general partner of H&F Investors VIII; and as the general partner of H&F Investors VIII, H&F VIII may be deemed to have beneficial ownership of the shares beneficially owned by the H&F Investors. Pursuant to the H&F 13D, voting and investment determinations with respect to shares held by the H&F Investors are made by the board of directors of H&F VIII, which consists of Philip U. Hammarskjold, David R. Tunnell and Allen R. Thorpe, and each of the members of the board of directors of H&F VIII disclaims beneficial ownership of such shares. Pursuant to the H&F 13D, the address of each entity named in this footnote is c/o Hellman & Friedman LLC, 415 Mission Street, Suite 5700, San Francisco, California 94105.

(5)Michael S. Klein. Interests shown consist of: (i) 147,669 shares of Class A common stock owned directly by Mr. Klein, which settled upon the vesting of restricted stock units awarded to Mr. Klein for service on our Board, (ii) 12,404,080 shares of Class A common stock owned directly by Churchill Sponsor III, LLC (the "Sponsor"), (iii) 15,300,000 shares of Class A common stock issuable upon the exercise of an equal number of warrants directly owned by Sponsor (with 8,000,000 of such warrants being subject to an option to purchase held by The PIF as noted in clause, (iii) of footnote (7) of this table), (iv) 150,000 shares of Class A common stock owned directly by M. Klein Associates, Inc., (v) 7,669,619 shares of Class A common stock and 2,717,478 shares of Class A common stock issuable upon the exercise of an equal number of warrants directly owned by an entity of which Mr. Klein is the managing member. All 12,404,080 of such shares of Class A common stock owned directly by the Sponsor and 4,800,000 of such warrants owned directly by the Sponsor unvested as of October 8, 2020 and will revest at such time as, during the 4-year period starting on October 8, 2021 and ending on October 8, 2025, the closing price of our Class A common stock exceeds $12.50 for any 40 trading days in a 60 consecutive day period. Shares of Class A common stock owned by Sponsor (the "Unvested Founder Shares") and M. Klein Associates, Inc. may be deemed to be indirectly owned by Mr. Klein, who is the controlling stockholder of M. Klein Associates, Inc., the managing member of Sponsor. As a result of this relationship, Mr. Klein may be deemed to have or share beneficial ownership of the securities held directly by Sponsor and M. Klein Associates, Inc. Michael S. Klein is the controlling stockholder of M. Klein Associates, Inc., which is the managing member of Sponsor. The shares beneficially owned by Sponsor may also be deemed to be beneficially owned by Mr. Klein. The business address for Mr. Klein is c/o Churchill Sponsor III LLC, 640 Fifth Avenue, 12th Floor, New York, New York 10019. Excludes 2,622,711 shares of our Class A common stock owned by M. Klein & Company, an entity in which Mr. Klein has a minority interest. The information in this footnote is based on a Schedule 13G/A filed on February 14, 2024 by Mr. Klein.

(6)Interests shown are held by certain client accounts (the “Oak Hill Advisors Entities”) advised by Oak Hill Advisors, L.P. and/or one of its subsidiary investment advisers (individually and collectively, “OHA”). As an advisor to the Oak Hill Advisors Entities, OHA may be deemed to have the power to vote or direct the vote of, and the power to dispose or to direct the disposition of, the shares of Class A common stock held by the Oak Hill Advisors Entities. OHA is a subsidiary business of T. Rowe Price Associates, Inc. The OHA beneficial ownership does not include any shares that are beneficially owned by T. Rowe Price Associates, Inc, if any. Glenn R. August is the Founder and Chief Executive Officer of OHA. Other than OHA, the foregoing disclaim beneficial ownership of shares of our Class A common stock beyond their respective pecuniary interest in the Oak Hill Advisor Entities for purposes of Section 16 under the Exchange Act. Interests shown consist of (i) 3,351,265 shares of Class A common stock, (ii) warrants to purchase 125,000 shares of Class A common stock and (iii) 38,461,538 shares of Class A common stock that may be acquired upon conversion of Senior Convertible PIK Notes. Each warrant entitles the holder thereof to purchase one share of Class A common stock at a price of $12.50 per share, subject to adjustment. The Senior Convertible PIK Notes are convertible into shares of Class A common stock based on a $13.00 conversion price, subject to customary anti-dilution adjustments. Excludes 147,669 shares of Class A common stock beneficially owned by Mr. August directly, as discussed in footnote (16) below, and 3,933,137 shares of Class A common stock in which certain principals of OHA have an economic interest (or deemed economic interest), as discussed in footnote (15) below. The business address for OHA and OHA c/o the Oak Hill Advisors Entities is One Vanderbilt Avenue, 16th Floor, New York, New York 10017.

(7)Interests shown consists of (i) 51,250,000 shares of Class A common stock, (ii) warrants to purchase 2,500,000 shares of Class A common stock, and (iii) an option to purchase warrants exercisable for 8,000,000 shares of Class A common stock held by The Public Investment Fund of the Kingdom of Saudi Arabia (“The PIF”) pursuant to a Schedule 13G, as amended, filed by The PIF on February 12, 2024 (“The PIF 13G”). The option to purchase warrants referenced in clause (iii) above are held by the Sponsor and are also referenced in clause (iii) of footnote (5)

Stock Ownership Information

of this table. Pursuant to The PIF 13G, the business address for The PIF is The Public Investment Fund Tower, King Abdullah Financial District (KAFD), Al Aqiq District, Riyadh, The Kingdom of Saudi Arabia.

(8)The following information is based on a Schedule 13G/A filed on February 13, 2024 by The Vanguard Group. The Vanguard Group has shared voting power with respect to 234,523 of the indicated shares of Class A common stock, sole dispositive power with respect to 36,044,764 of the indicated shares of Class A common stock, and shared dispositive power with respect to 519,021 of the indicated shares of Class A common stock. The Vanguard Group, Inc.'s clients, including investment companies registered under the Investment Company Act of 1940 and other managed accounts, have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities. The address of the principal business office of The Vanguard Group is 100 Vanguard Blvd., Malvern, Pennsylvania, 19355.

(9)Dale A. White. Interests shown consist of: (i) 9,504,451 shares of Class A common stock held; and (ii) 2,459,950 shares related to vested but unexercised non-qualified stock options.

(10)James M. Head. Interests shown consist of: (i) 628,558 shares of Class A common stock held; and (ii) 1,358,878 shares related to vested but unexercised non-qualified stock options.

(11)Jeffrey A. Doctoroff. Interests shown consist of: (i) 495,305 shares of Class A common stock held; and (ii) 161,762 shares related to vested but unexercised non-qualified stock options. Mr. Doctoroff departed from MultiPlan at the end of June 2024.

(12)Michael C. Kim. Interests shown consist of: (i) 412,721 shares of Class A common stock held; (ii) 136,774 shares related to vested but unexercised non-qualified stock options.

(13)Carol H. Nutter. Interests shown consist of 92,250 shares of Class A common stock held.

(14)Business address is c/o Hellman & Friedman LLC, 415 Mission Street, Suite 5700, San Francisco, California 94105.

(15)Glenn R. August has an economic interest (or deemed economic interest) in shares of our Class A common stock through their respective ownership of membership interests in Sponsor, but does not beneficially own any of the shares of our Class A common stock held by Sponsor. The indirect ownership interest via Sponsor is reflected solely under the row for the Sponsor’s controlling person, Michael Klein. Mr. August and certain principals of Oak Hill Advisors, L.P. have economic interests (or deemed economic interests) in 3,933,137 of the founder shares held by Sponsor.

(16)Glenn R. August. Interests shown consist of 147,669 shares of Class A common stock held. Pursuant to the policies of Oak Hill Advisors, L.P., the restricted stock units received by Mr. August are held for the benefit of the Oak Hill Advisors Entities.

(17)Richard A. Clarke. Interests shown consist of 147,669 shares of Class A common stock held.

(18)Anthony Colaluca, Jr. Interests shown consist of 367,669 shares of Class A common stock held.

(19)C. Martin Harris. Interests shown consist of 145,590 shares of Class A common stock held.

(20)Julie D. Klapstein. Interests shown consist of 158,758 shares of Class A common stock held.

(21)John M. Prince. Interests shown consist of 40,761 shares of Class A common stock held.

Stock Ownership Information

Voting and Other Information

Who is asking for my vote?

Our Board is soliciting proxies for use at the Special Meeting of Stockholders, and any adjournments or postponements of the meeting. Costs of the solicitation are being borne by the Company.

What is the quorum requirement for holding the Special Meeting?

The holders of a majority of the total shares of our Class A common stock issued and outstanding on July 17, 2024, entitled to vote at the Special Meeting, must be present in person or represented by proxy for the meeting to be held. Virtual attendance at our Special Meeting constitutes presence in person for purposes of a quorum at the meeting. The shares held by each stockholder who properly submits a proxy, shares represented by broker non-votes that are present in person or represented by proxy and entitled to vote at the Special Meeting and votes to “ABSTAIN” will be counted for purposes of determining the presence of a quorum at the meeting. As of the close of business on July 17, 2024, we had 658,127,871 shares of Class A common stock outstanding and entitled to vote at the Special Meeting.

What am I voting on and what is the vote required to pass?

| | | | | | | | | | | |

| Voting Item | Board Recommendation | Voting

Standard | Effect of

Abstentions |

Approval of Certificate of Amendment to Certificate of Incorporation of MultiPlan Corporation | FOR | Majority of Votes Cast | No Effect |

Approval of Adjournment of the Special Meeting to Solicit Additional Proxies in Favor of the Reverse Stock Split Proposal if there are Not Sufficient Votes to Approve Such Proposal | FOR | Majority of Votes Present or Represented by Proxy and Entitled to Vote on the Matter | Same Effect as Votes “AGAINST” this Proposal |

Are broker non-votes counted at the meeting?

Brokers, banks or other nominee have discretionary authority to vote shares in the absence of instructions on matters the NYSE considers “routine.” They do not have discretionary authority to vote shares in the absence of instructions on “non-routine” matters. We expect that each proposal described in this proxy statement will be considered a “routine” matter under NYSE rules and, as a result, if you hold shares of our Class A common stock in street name, in the absence of instructions, your broker, banker or nominee may vote your shares on each proposal described in this proxy statement. As a result, we do not expect broker non-votes on either proposal.

What happens if I abstain on a proposal?

If you choose “ABSTAIN” on a proposal, your shares will count towards a quorum. Abstentions will have no impact on the outcome of Proposal 1 (the Reverse Stock Split Proposal). Abstentions will have the same effect as a vote “AGAINST” Proposal 2 (the adjournment proposal).

Who can vote at the Special Meeting?

You may vote if you were the holder of record of shares of our Class A common stock at the close of business on July 17, 2024, also referred to as the “Record Date.” Only holders of record at the Record Date will be entitled to notice of, and to vote at, the Special Meeting. You are entitled to one vote on each matter presented at the Special Meeting for each share of our Class A common stock for which you were the holder of record on the Record Date. If you held shares of our Class A common stock in “street name” (usually through a bank, broker, or other nominee) on the Record Date, the record holder of your shares will generally vote those shares in accordance with your instructions.

How do I vote?

The process for voting your shares of our Class A common stock depends on how your shares are held. Generally, you may hold shares in your name as a “record holder” (that is, in your own name) or in “street name” (that is, through a nominee, such as a broker or bank).

Record Holders. If you are a record holder, you may vote your shares using one of the following methods:

| | | | | |

| Over the Internet. Go to www.proxyvote.com. You can use the Internet 24 hours a day, seven days a week, to submit your voting instructions and for electronic delivery of information up until 11:59 PM Eastern time on September 8, 2024. Have your proxy card or Notice of Internet Availability of Proxy Materials in hand when you access the web site and follow the instructions to obtain your records and create an electronic voting instruction form. |

| By telephone. Call (800) 690-6903. You can use any touch-tone telephone to transmit your voting instructions up until 11:59 PM Eastern time on September 8, 2024. Have your proxy card or Notice of Internet Availability of Proxy Materials in hand when you call and follow the instructions. |

| By mail. If you received a printed copy of the proxy materials, you may submit your vote by completing, signing and mailing your proxy card and returning it in the prepaid envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. Sign your name exactly as it appears on the proxy card. Proxy cards submitted by mail must be received no later than September 8, 2024 to be voted at the Special Meeting. |

| In person at the Special Meeting. Record holders are invited to attend the Special Meeting and vote virtually at the Special Meeting. You may vote and submit questions while attending the live audio webcast. You will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials) in order to be able to enter the meeting. |

If you submit your proxy to have your shares voted via the Internet or by telephone, your electronic vote authorizes the named proxies in the same manner as if you signed, dated and returned a proxy card. If you vote via the Internet or by telephone, do not return a proxy card.

Held in Street Name. If you hold shares of our Class A common stock in the name of a broker, bank or other nominee, you should follow the instructions in the Notice of Internet Availability of Proxy Materials or voting instructions provided by the broker, bank or other nominee to instruct your broker, bank or other nominee on how to vote your shares.

Your broker, bank or other nominee is permitted to vote your shares with respect to “routine” proposals without your instruction as to how to vote. We expect each of the proposals included herein to be considered “routine” by the NYSE. In the event either or both proposal is treated as a “non-routine” proposal, however, your broker, bank or other nominee will not be permitted to vote your shares with respect to such “non-routine” proposal(s) at the Special Meeting without your instructions as to how to vote. Your broker, bank or other nominee is permitted to vote your shares with respect to “routine” proposals without your instruction as to how to vote. We expect each of the proposals included herein to be considered “routine” by the NYSE. In the event either or both proposal is treated as a “non-routine” proposal, however, your broker, bank or other nominee will not be permitted to vote your shares with respect to such “non-routine” proposal(s) at the Special Meeting without your instructions as to how to vote.

Can I vote in person at the Special Meeting?

To vote at the Special Meeting, log in at www.virtualshareholdermeeting.com/MPLN2024SM. You will need your unique 16-digit control number shown on the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions you received in the mail. If you are the beneficial owner of shares held through a broker, or other nominee, please follow the instructions provided by your broker, trustee or nominee.

Why is the meeting being held virtually?

The Special Meeting is being held on a virtual-only basis to enable participation by a broader number of stockholders. We believe that hosting a virtual meeting will facilitate stockholder attendance by enabling stockholders to safely participate in the special meeting. We have designed the virtual meeting to provide stockholders substantially the same opportunities to participate as they would have at an in-person meeting.

How do I participate in the Special Meeting?

The live audio webcast of the Special Meeting will begin promptly at 9:00 a.m., Eastern Time, on Monday, September 9, 2024. Online access to the audio webcast will open approximately 15 minutes prior to the start of the meeting to allow time for you to log in and test the computer audio system. To attend the virtual Special Meeting, log in at www.virtualshareholdermeeting.com/MPLN2024SM. You will need your 16-digit control number shown on the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions you received in the mail. If you do not have a control number, please contact your bank, broker or other nominee as soon as possible so you can be provided with a control number and gain access to the meeting.

The format of the virtual meeting has been designed to ensure that our stockholders who attend our Special Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools. You will be able to submit questions during the meeting by typing in your question into the “ask a question” box on the meeting page. We will read and respond to appropriate questions during the meeting. Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions regarding personal matters, including those related to employment or service issues, are not pertinent to meeting matters and therefore will not be answered.

We will provide a toll-free technical support “help line” that can be accessed by any stockholder who is having challenges logging into or participating in the virtual Special Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support line number that will be posted on the Virtual Shareholder Meeting login page.

What if I do not specify a choice for a matter when returning a proxy?

If you did not indicate otherwise (excluding broker non-votes), the persons named as proxies on the proxy card will vote your shares of our Class A common stock in accordance with the Board recommendations indicated above.

Can I revoke my proxy or change my vote?

Yes, you may revoke your proxy or change your vote if you are a record holder by:

•delivering a written notice of revocation to us at or prior to the Special Meeting;

•signing a proxy bearing a later date than the proxy being revoked and delivering it to us before the Special Meeting; or

•voting in person at the Special Meeting.

If your shares of our Class A common stock are held in street name through a broker, bank, or other nominee, you should contact the record holder of your shares regarding how to revoke your proxy or change your vote.

Why did I receive a Notice of Internet Availability of Proxy Materials?

We have elected to take advantage of SEC rules that allow us to provide stockholders access to our proxy materials over the Internet. We believe furnishing proxy materials through the Internet will allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the Special Meeting. As a result, instead of a paper copy of our proxy materials, a Notice of Availability of Proxy Materials will be delivered to all of our stockholders, except for those who have previously requested to receive a paper copy of the proxy materials. This notice explains how you can access our proxy materials over the Internet and also describes how to request a printed copy of these materials. The Notice of Internet Availability of Proxy Materials only identifies the items to be voted on at the Special Meeting. You cannot vote by marking the Notice of Internet Availability of Proxy Materials and returning it. The Notice of Internet Availability of Proxy Materials provides instructions on how to cast your vote.

How can I access the proxy materials over the Internet?

You can access this proxy statement at https://investors.multiplan.com. If you wish to help reduce the costs incurred by us in mailing proxy materials, you can consent to receiving all proxy materials for future meetings of stockholders electronically by e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. The information contained on or available through this website is not a part of, or incorporated by reference into, this proxy statement.

How may I obtain a paper or e-mail copy of the proxy materials?

If you received a Notice of Internet Availability of Proxy Materials, you will find instructions about how to obtain a paper or e-mail copy of the proxy materials in your notice. We will mail paper copies of these documents to all stockholders to whom we do not send a Notice Regarding Internet Availability of Proxy Materials.

What should I do if I receive more than one Notice of Internet Availability of Proxy Materials or more than one paper copy of the proxy materials?

Certain stockholders may receive more than one Notice of Internet Availability of Proxy Materials or more than one paper copy of the proxy materials, including multiple proxy cards. For example, if you hold shares of our Class A common stock in more than one brokerage account, you may receive a separate notice or a separate voting instruction card for each brokerage account in which you hold shares. If you are a holder of record and your shares of our Class A common stock are registered in more than one name, you may receive a separate notice or a separate set of paper proxy materials and proxy card for each name in which you hold shares. To vote all of your shares of our Class A common stock, you must complete, sign, date, and return each proxy card you receive or vote the shares to which each proxy card relates. If you hold shares of our Class A common stock in one or more

street names, you must complete, sign, date, and return to each bank, broker or other nominee through whom you hold shares each instruction card received from that bank, broker or other nominee.

Where can I find the voting results for the Special Meeting?

We will report the voting results in a Current Report on Form 8-K filed with the SEC within four business days following our Special Meeting. You can access this report at https://investors.multiplan.com under “Financials - SEC Filings”.

Miscellaneous Matters

Submitting Proposals for 2025 Annual Meeting

The table below summarizes the requirements for stockholders to submit proposals, including director nominations, for next year’s annual meeting. Stockholders are encouraged to consult SEC Rule 14a-8 under the Exchange Act, SEC Rule 14a-19 under the Exchange Act or our bylaws, as applicable, to see all applicable requirements. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any director nomination or stockholder proposal that does not comply with our bylaws and other applicable requirements. Our bylaws are included as an exhibit to our Annual Report on Form 10-K as filed with the SEC on February 29, 2024.

| | | | | | | | |

| Proposals for Inclusion

in the 2025 Proxy Statement | Other Proposals/Nominees to be Presented