MultiPlan Announces Extension of $100 Million Share Repurchase Program

November 08 2023 - 8:00AM

Business Wire

MultiPlan Corporation (NYSE:MPLN) (“MultiPlan” or the

“Company”), a leading provider of data analytics and

technology-enabled end-to-end cost management, payment and revenue

integrity solutions to the U.S. healthcare industry, today

announced that its Board of Directors has extended its current $100

million program to repurchase shares of the Company’s Class A

common stock (the “Common Stock”) through December 31, 2024. To

date, the Company has repurchased $13.1 million in shares of its

Common Stock, leaving up to $86.9 million in authorized repurchases

through the remainder of the program, as extended.

Commenting on the extension of the stock repurchase program,

Dale White, President and Chief Executive Officer, said, “We

continue to be committed to strategically deploying our capital to

drive long-term value for stockholders. Although the focus of our

capital allocation strategy continues to be on investing in the

business for growth and debt pay-down, we believe that repurchasing

our stock opportunistically may be an attractive cash deployment

option. For that reason and in light of the current expiration of

our current program at the end of this year, our board has approved

an extension of the program through the end of 2024. This extension

demonstrates our continued confidence in the strength of

MultiPlan’s business and cash flow.”

MultiPlan may repurchase shares from time to time using a

variety of methods, which may include open market purchases, in

privately negotiated transactions or by other means, including

through the use of preset trading plans meeting the requirements of

Rule 10b5-1 under the Securities Exchange Act of 1934, which would

permit shares to be repurchased during periods the Company might

otherwise be precluded from doing so under insider trading laws.

The timing and amount of any share repurchases will be determined

by the Company’s management based on its evaluation of market

conditions and other factors. Repurchased shares will be held in

treasury shares and will be available for use in connection with

the Company’s stock plans and for other corporate purposes. There

is no guarantee as to the number of shares that will be

repurchased. The repurchase program, as extended, expires on

December 31, 2024, and the repurchase program may be further

extended, suspended or discontinued at any time without prior

notice at the Company’s discretion. Share repurchases will be

funded using the Company’s cash on hand and cash from

operations.

Forward-Looking Statements

This press release includes statements that express our

management’s opinions, expectations, beliefs, plans, objectives,

assumptions or projections regarding future events or future

results and therefore are, or may be deemed to be, “forward-looking

statements”. These forward-looking statements can generally be

identified by the use of forward-looking terminology, including the

terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,”

“projects,” “forecasts,” “intends,” “plans,” “may,” “will” or

“should” or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

all matters that are not historical facts, including, without

limitation, statements regarding the Company’s capital allocation

strategy and plans. Such forward-looking statements are based on

available current market information and management’s expectations,

beliefs and forecasts concerning future events impacting the

business. Although we believe that these forward-looking statements

are based on reasonable assumptions at the time they are made, you

should be aware that these forward-looking statements involve a

number of risks, uncertainties (some of which are beyond our

control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements. These factors include:

the ongoing COVID-19 pandemic and its related effects on our

results of operations, financial performance, liquidity or other

financial metrics; loss of our customers, particularly our largest

customers; trends in the U.S. healthcare system, including recent

trends of unknown duration of reduced healthcare utilization and

increased patient financial responsibility for services; inability

to preserve or increase our existing market share or the size of

our preferred provider networks; effects of competition; effects of

pricing pressure; the inability of our customers to pay for our

services; decreases in discounts from providers; the loss of our

existing relationships with providers; the loss of key members of

our management team or inability to maintain sufficient qualified

personnel; pressure to limit access to preferred provider networks;

the ability to achieve the goals of our strategic plans and

recognize the anticipated strategic, operational, growth and

efficiency benefits when expected; our ability to enter new lines

of business and broaden the scope of our services; our ability to

identify, complete and successfully integrate acquisitions; our

ability to obtain additional financing; changes in our industry and

in industry standards and technology; interruptions or security

breaches of our information technology systems and other

cybersecurity attacks; our ability to protect proprietary

information, processes and applications; our ability to maintain

the licenses or rights of use for the software we use; our

inability to expand our network infrastructure; changes in

accounting principles or the incurrence of impairment charges; our

ability to remediate any material weaknesses or maintain effective

internal controls over financial reporting; our ability to continue

to attract, motivate and retain a large number of skilled

employees, and adapt to the effects of inflationary pressure on

wages; changes in our regulatory environment, including healthcare

law and regulations; the expansion of privacy and security laws;

heightened enforcement activity by government agencies; our ability

to pay interest and principal on our notes and other indebtedness;

lowering or withdrawal of our credit ratings; the possibility that

we may be adversely affected by other political, economic,

business, and/or competitive factors; adverse outcomes related to

litigation or governmental proceedings; other factors disclosed in

our Securities and Exchange Commission (“SEC”) filings from time to

time, including, without limitation, those factors described in our

Annual Report on Form 10-K for the fiscal year ended December 31,

2022 and our subsequent Quarterly Reports on Form 10-Q; and other

factors beyond our control. Should one or more of these risks or

uncertainties materialize, or should any of the assumptions prove

incorrect, actual results may vary in material respects from those

projected in these forward-looking statements.

There can be no assurance that future developments affecting our

business will be those that we have anticipated. Forward-looking

statements speak only as of the date made.

We do not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

About MultiPlan

MultiPlan is committed to helping healthcare payors manage the

cost of care, improve their competitiveness, and inspire positive

change. Leveraging sophisticated technology, data analytics, and a

team rich with industry experience, MultiPlan interprets customers'

needs and customizes innovative solutions that combine its payment

and revenue integrity, network-based, and analytics-based services.

MultiPlan is a trusted partner to over 700 healthcare payors in the

commercial health, government, and property and casualty markets.

For more information, visit www.multiplan.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108347870/en/

Investor Relations Luke Montgomery, CFA SVP, Finance and

Investor Relations MultiPlan 866-909-7427

investor@multiplan.com

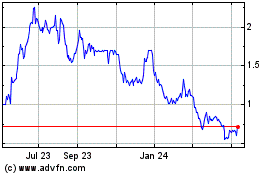

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

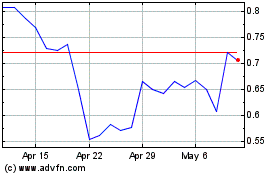

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Jan 2024 to Jan 2025