UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | |

|

FORM 10-K/A |

| AMENDMENT NO.1 |

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2022

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-11590

| | | | | | | | |

| | |

CHESAPEAKE UTILITIES CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | |

| State of Delaware | | 51-0064146 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

500 Energy Lane, Dover, Delaware 19901

(Address of principal executive offices, including zip code)

302-734-6799

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock—par value per share $0.4867 | CPK | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common shares held by non-affiliates of Chesapeake Utilities Corporation as of June 30, 2022, the last business day of its most recently completed second fiscal quarter, based on the last sale price on that date, as reported by the New York Stock Exchange, was approximately $2.2 billion.

The number of shares of Chesapeake Utilities Corporation's common stock outstanding as of February 17, 2023 was 17,741,418

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Chesapeake Utilities Corporation Proxy Statement for the 2023 Annual Meeting of Shareholders are incorporated by reference in Part II and Part III.

EXPLANATORY NOTE

Chesapeake Utilities Corporation (the “Company”) is filing this Amendment No. 1 (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2022, originally filed with the Securities and Exchange Commission (the “SEC”) on February 22, 2023 (the “Original 10-K”). This Amendment is being filed solely for correcting administrative errors related to an inaccurate date contained in the table of contents and language appearing in the Critical Audit Matter section of the Report of Independent Registered Public Accounting Firm on the Consolidated Financial Statements and Internal Control over Financial Reporting.

As required by Rule 12b-15 under the Exchange Act, the Company is including in this Amendment certifications from its Principal Executive Officer and Principal Financial Officer as required by Rule 13a-14(a) or Rule 15d-14(a) of the Exchange Act as exhibits to this Amendment. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5, of the certifications have been omitted.

Except as described above, this Amendment does not modify or update disclosures in, or exhibits to, the Original Form 10-K. Furthermore, this Amendment does not change any previously reported financial results, nor does it reflect events occurring after the filing of the Original Form 10-K. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and the Company’s filings with the SEC subsequent to the filing of the Original Form 10-K.

CHESAPEAKE UTILITIES CORPORATION

FORM 10-K

YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

| | | | | |

| | Page |

Part I | 1 | |

Item 1. Business | 3 | |

Item 1A. Risk Factors | 14 | |

Item 1B. Unresolved Staff Comments | 22 | |

Item 2. Properties | 23 | |

Item 3. Legal Proceedings | 23 | |

Item 4. Mine Safety Disclosures | 24 | |

| 24 | |

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 24 | |

| 26 | |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 27 | |

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 49 | |

Item 8. Financial Statements and Supplementary Data | 51 | |

Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 101 | |

Item 9A. Controls and Procedures | 101 | |

Item 9B. Other Information | 103 | |

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspection | 103 |

Part III | 103 | |

Item 10. Directors, Executive Officers of the Registrant and Corporate Governance | 103 | |

Item 11. Executive Compensation | 103 | |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 103 | |

Item 13. Certain Relationships and Related Transactions, and Director Independence | 103 | |

Item 14. Principal Accounting Fees and Services | 103 | |

Part IV | 103 | |

Item 15. Exhibits, Financial Statement Schedules | 103 | |

Item 16. Form 10-K Summary | 109 | |

Signatures | 109 | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Chesapeake Utilities Corporation

Opinions on the Consolidated Financial Statements and Internal Control over Financial Reporting

We have audited the accompanying consolidated balance sheets of Chesapeake Utilities Corporation and Subsidiaries (the "Company") as of December 31, 2022 and 2021, the related consolidated statements of income, comprehensive income, stockholders' equity, and cash flows, for each of the years in the three-year period ended December 31, 2022, and the related notes and financial statement schedule listed in Item 15(a)2 (collectively referred to as the "consolidated financial statements"). We also have audited the Company’s internal control over financial reporting as of December 31, 2022, based on criteria established in Internal Control - Integrated Framework: (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”).

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2022, in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2022, based on criteria established in Internal Control - Integrated Framework: (2013) issued by COSO.

Basis for Opinion

The Company’s management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management's Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company's consolidated financial statements and an opinion on the Company’s internal control over financial reporting based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud, and whether effective internal control over financial reporting was maintained in all material respects.

Our audits of the consolidated financial statements included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

Definition and Limitations of Internal Control Over Financial Reporting

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Chesapeake Utilities Corporation 2022 Form 10-K/A Page 1

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging subjective, or complex judgments. The communication of the critical audit matter does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing separate opinions on the critical audit matter or on the accounts or disclosures to which they relate.

Goodwill Impairment Assessment - Energy Transmission and Supply Services (Aspire Energy), Propane Distribution and Marlin Gas Services - Unregulated Energy Segment - Refer to Notes 2 and 10 to the consolidated financial statements

Critical Audit Matter Description

As described in Notes 2 and 10 to the consolidated financial statements, the Company has recorded goodwill within the Unregulated Energy reportable segment as of December 31, 2022, all of which relates to the three reporting units listed above. To test goodwill for impairment, the Company uses a present value technique based on discounted cash flows to estimate the fair value of its reporting units. Management’s testing of goodwill as of December 31, 2022 indicated no impairment.

We determined the goodwill impairment assessment for the three reporting units listed above was a critical audit matter because the fair value estimates require significant estimates and assumptions by management, including those relating to future revenue and operating margin forecasts and discount rates. Testing these estimates involved increased auditor judgment and effort.

How the Critical Audit Matter was Addressed in the Audit

The primary procedures we performed to address this critical audit matter included:

•We obtained an understanding, evaluated the design, and tested the operating effectiveness of controls over management’s goodwill impairment evaluation, including those over the determination of the fair value of the reporting units within the Unregulated Energy reportable segment.

•We evaluated the appropriateness of management’s valuation methodology, including testing the mathematical accuracy of the calculation.

•We assessed the historical accuracy of management’s revenue and operating margin forecasts.

•We compared the significant assumptions used by management to current industry and economic trends, current and historical performance of each reporting unit, and other relevant factors.

•We performed sensitivity analyses of the significant assumptions to evaluate the changes in the fair value of the reporting units that would result from changes in the assumptions.

•We evaluated whether the assumptions were consistent with evidence obtained in other areas of the audit, including testing the Company’s fair value of all reporting units, inclusive of the Regulated and Unregulated Energy reporting units, in relation to the market capitalization of the Company and assessed the results.

/s/ Baker Tilly US, LLP

We have served as the Company's auditor since 2007.

Philadelphia, Pennsylvania

February 22, 2023

Chesapeake Utilities Corporation 2022 Form 10-K/A Page 2

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

The following documents are filed as part of this Annual Report:

SIGNATURES

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, Chesapeake Utilities Corporation has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| CHESAPEAKE UTILITIES CORPORATION |

| | |

| By: | | /s/ JEFFRY M. HOUSEHOLDER |

| | | Jeffry M. Householder |

| | | President, Chief Executive Officer and Director |

| | | October 23, 2023 |

Chesapeake Utilities Corporation 2022 Form 10-K/A Page 3

EXHIBIT 31.1

CERTIFICATE PURSUANT TO RULE 13A-14(A)

UNDER THE SECURITIES EXCHANGE ACT OF 1934

I, Jeffry M. Householder, certify that:

1.I have reviewed this Amendment to the annual report on Form 10-K for the year ended December 31, 2022 of Chesapeake Utilities Corporation;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

Date: October 23, 2023

| | |

/S/ JEFFRY M. HOUSEHOLDER |

Jeffry M. Householder

President and Chief Executive Officer |

EXHIBIT 31.2

CERTIFICATE PURSUANT TO RULE 13A-14(A)

UNDER THE SECURITIES EXCHANGE ACT OF 1934

I, Beth W. Cooper, certify that:

1.I have reviewed this Amendment to the annual report on Form 10-K for the year ended December 31, 2022 of Chesapeake Utilities Corporation;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

Date: October 23, 2023

| | |

/S/ BETH W. COOPER |

Beth W. Cooper

Executive Vice President, Chief Financial Officer,Treasurer, and Assistant Corporate Secretary

|

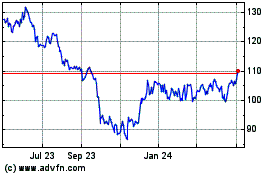

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Oct 2024 to Nov 2024

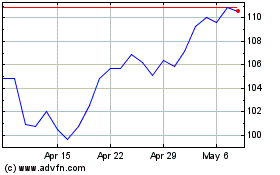

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Nov 2023 to Nov 2024