Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

November 20 2024 - 12:07PM

Edgar (US Regulatory)

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4) |

| |

| Carrier Global Corporation |

| (Name of Issuer) |

| |

| Common Stock, par value $0.01 per share |

| (Title of Class of Securities) |

| |

| 14448C104 |

| (CUSIP Number) |

| |

|

Viessmann Generations Group GmbH &

Co. KG

Im Birkenried 1

35088 Battenberg (Eder)

Germany

+49 (0) 6452 9296 000

With a copy to:

Leo Borchardt

Davis Polk & Wardwell London LLP

5 Aldermanbury Square

London EC2V 7HR

United Kingdom

Telephone: +44 20 7418 1334 |

|

(Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications) |

| |

| November 19, 2024 |

| (Date of Event which Requires Filing of this Statement) |

| |

|

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-l(f)

or 240.13d-l(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See § 240.13d-7(b) for other parties to whom copies are to be sent. |

| |

| *The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

| |

| The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). |

| 1 |

Name of Reporting Person

Viessmann Generations Group GmbH & Co. KG

|

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

| 3 |

SEC Use Only

|

|

| 4 |

Source of Funds

OO

|

|

| 5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

o |

| 6 |

Citizenship or Place of Organization

Germany

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

58,608,959 (See item 5)

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

58,608,959 (See item 5)

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

58,608,959 (See item 5)

|

|

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

6.53% (See item 5)

|

|

| 14 |

Type of Reporting Person (See Instructions)

PN

|

|

| 1 |

Names of Reporting Person

Viessmann Komplementär B.V.

|

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

| 3 |

SEC Use Only

|

|

| 4 |

Source of Funds

OO

|

|

| 5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

o |

| 6 |

Citizenship or Place of Organization

The Netherlands

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

58,608,959 (See item 5)

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

58,608,959 (See item 5)

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

58,608,959 (See item 5)

|

|

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

6.53% (See item 5)

|

|

| 14 |

Type of Reporting Person (See Instructions)

CO

|

|

| 1 |

Names of Reporting Person

Viessmann Zweite Beteiligungs B.V.

|

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

| 3 |

SEC Use Only

|

|

| 4 |

Source of Funds

OO

|

|

| 5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

o |

| 6 |

Citizenship or Place of Organization

The Netherlands

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

58,608,959 (See item 5)

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

58,608,959 (See item 5)

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

58,608,959 (See item 5)

|

|

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

6.53% (See item 5)

|

|

| 14 |

Type of Reporting Person (See Instructions)

CO

|

|

| 1 |

Names of Reporting Person

Maximilian Viessmann

|

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

| 3 |

SEC Use Only

|

|

| 4 |

Source of Funds

OO

|

|

| 5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

o |

| 6 |

Citizenship or Place of Organization

Germany

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

58,608,959 (See item 5)

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

58,608,959 (See item 5)

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

58,608,959 (See item 5)

|

|

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

6.53% (See item 5)

|

|

| 14 |

Type of Reporting Person (See Instructions)

IN

|

|

| 1 |

Names of Reporting Person

Viessmann Traeger HoldCo GmbH

|

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

| 3 |

SEC Use Only

|

|

| 4 |

Source of Funds

OO

|

|

| 5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

o |

| 6 |

Citizenship or Place of Organization

Germany

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

52,748,063 (See item 5)

|

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

52,748,063 (See item 5)

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

52,748,063 (See item 5)

|

|

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

5.88% (See item 5)

|

|

| 14 |

Type of Reporting Person (See Instructions)

OO

|

|

Explanatory Note

This Amendment No. 4 (this “Amendment”) amends and

supplements the Schedule 13D originally filed with the Securities and Exchange Commission (the “SEC”) on January 9,

2024 (the “Original Schedule 13D”), as amended by Amendment No. 1 as filed with the SEC on March 21, 2024 (the “Amendment

No. 1”), as amended by Amendment No. 2 as filed with the SEC on November 13, 2024 (the “Amendment No. 2”),

as amended by Amendment No. 3 as filed with the SEC on November 15, 2024 (the “Amendment No. 3”) (as so amended, the

“Schedule 13D”), and is being filed jointly by (i) Viessmann Generations Group GmbH & Co. KG, a limited partnership

(Kommanditgesellschaft) organized under the laws of Germany (“Viessmann Group KG”), (ii) its sole general partner,

Viessmann Komplementär B.V., a limited liability company (besloten venootschap met beperkte aansprakelijkheid) organized under

the laws of the Netherlands (“Viessmann GP”), (iii) its managing limited partner, Viessmann Zweite Beteiligungs B.V.,

a limited liability company (besloten venootschap met beperkte aansprakelijkheid) organized under the laws of the Netherlands (“Viessmann

LP”), (iv) Maximilian Viessmann, as a director and the controlling stockholder of each of Viessmann GP and Viessmann LP, and

(v) Viessmann Traeger HoldCo GmbH, a limited liability company (Gesellschaft mit beschränkter Haftung) organized under the

laws of Germany and a direct wholly owned subsidiary of Viessmann Group KG (“Viessmann HoldCo”).

The purpose of this Amendment is to report that, as a result of an

internal reorganization and pursuant to that certain Contribution Agreement dated November 19, 2024 by and between Viessmann Group KG

and Viessmann HoldCo (the “Contribution Agreement”), Viessmann Group KG transferred an additional 5,860,896 shares

of Common Stock to Viessmann HoldCo in the form of a contribution to the capital of Viessmann HoldCo. The internal reorganization resulted

in no change to the aggregate number of shares of Common Stock beneficially owned by the Reporting Persons.

Except as specifically provided herein, this Amendment does not modify

any of the information previously reported on the Schedule 13D. All disclosure in respect of items contained in the Schedule 13D where

no new information is provided for such item in this Amendment is incorporated herein by reference. Capitalized terms not otherwise defined

in this Amendment shall have the same meanings ascribed thereto in the Schedule 13D.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended and supplemented by adding

the following paragraph at the end thereof:

On November 19, 2024, Viessmann Group KG and Viessmann Holdco entered

into the Contribution Agreement, pursuant to which Viessmann Group KG transferred an additional 5,860,896 shares of Common Stock to Viessmann

HoldCo in the form of a contribution to the capital of Viessmann HoldCo.

Item 5: Interest in Securities of the Issuer

Item 5(a)-(b) of the Schedule 13D is hereby

amended and supplemented as follows:

(a)-(b) As of November 20, 2024, the Reporting

Persons may be deemed to have beneficially owned an aggregate of 58,608,959 shares of Common Stock, representing approximately 6.53% of

the total outstanding shares of Common Stock (such percentage is calculated based on 897,227,361 shares of Common Stock outstanding as

of October 15, 2024 according to the Issuer’s quarterly report on Form 10-Q for the three and nine months ended September 30, 2024

filed with the SEC on October 25, 2024). As of November 20, 2024, Viessmann Group KG was the record and beneficial owner of 5,860,896

shares of Common Stock and Viessmann HoldCo was the record and beneficial owner of 52,748,063 shares of Common Stock. Each of Viessmann

GP, as the sole general partner of Viessmann Group KG, Viessmann LP, as the managing limited partner of Viessmann Group KG, and Mr. Viessmann,

as the director and controlling stockholder of each of Viessmann GP and Viessmann LP, may be deemed to be the beneficial owner of the

shares of Common Stock held by each of Viessmann Group KG and Viessmann HoldCo. In addition, Viessmann Group KG, as the sole stockholder

of Viessmann HoldCo, may be deemed to be the beneficial owner of the shares of Common Stock held by Viessmann HoldCo.

Item 6: Contracts, Arrangements, Understandings

or Relationships With Respect to Securities of the Issuer

Item 6 of the Schedule 13D is hereby amended

and supplemented by adding the following paragraph at the end thereof:

Contribution Agreement

On November 19, 2024, Viessmann Group KG and Viessmann HoldCo entered

into the Contribution Agreement, pursuant to which Viessmann Group KG transferred an additional 5,860,896 shares of Common Stock to Viessmann

HoldCo in the form of a contribution to the capital of Viessmann HoldCo.

Item 7: Material to be Filed as Exhibits

Item 7 of the Schedule 13D is hereby amended

and restated in its entirety as follows:

| Exhibit 99.1 |

Joint Filing Agreement, dated as of November 13, 2024, by and among Viessmann Traeger HoldCo GmbH, Viessmann Generations Group GmbH & Co. KG, Viessmann Komplementär B.V., Viessmann Beteiligungs AG, Viessmann Zweite Beteiligungs B.V. and Maximilian Viessmann (incorporated by reference to Exhibit 99.1 to the Amendment No. 2). |

| Exhibit 99.2 |

Share Purchase Agreement, dated as of April 25, 2023, by and among Carrier Global Corporation, Blitz F23-620 GmbH (subsequently renamed Johann Purchaser GmbH) and Viessmann Group GmbH & Co. KG (incorporated by reference to Exhibit 99.2 to the Original Schedule 13D). |

| Exhibit 99.3 |

Post-Closing Amendment to Share Purchase Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation, Johann Purchaser GmbH and Viessmann Group GmbH & Co. KG. (incorporated by reference to Exhibit 99.3 to the Original Schedule 13D). |

| Exhibit 99.4 |

Investor Rights Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation and Viessmann Group GmbH & Co. KG (incorporated by reference to Exhibit 99.4 to the Original Schedule 13D). |

| Exhibit 99.5 |

License Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation, Viessmann Group GmbH & Co. KG and Carrier Innovative Technologies GmbH (incorporated by reference to Exhibit 99.5 to the Original Schedule 13D). |

| Exhibit 99.6 |

Transitional Services Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation, Viessmann Climate Solutions SE and Viessmann Group GmbH & Co. KG. (incorporated by reference to Exhibit 99.6 to the Original Schedule 13D). |

| Exhibit 99.7 |

Limited Power of Attorney of Maximilian Viessmann, dated as of November 13, 2024 (incorporated by reference to Exhibit 99.7 to the Amendment No. 2). |

| Exhibit 99.8 |

Contribution Agreement, dated as of March 21, 2024, by and among Viessmann Group GmbH & Co. KG and Johanna 391 Vermögensverwaltungs GmbH (subsequently renamed to Viessmann Traeger HoldCo GmbH) (incorporated by reference to Exhibit 99.8 to the Amendment No. 1). |

| Exhibit 99.9 |

Contribution Agreement, dated as of November 12, 2024, by and among Viessmann Generations Group GmbH & Co. KG and Viessmann Traeger HoldCo GmbH (incorporated by reference to Exhibit 99.9 to the Amendment No. 2). |

| Exhibit 99.10 |

Contribution Agreement, dated as of November 14, 2024, by and among Viessmann Generations Group GmbH & Co. KG and Viessmann Traeger HoldCo GmbH (incorporated by reference to Exhibit 99.10 to the Amendment No. 3). |

| Exhibit 99.11 |

Contribution Agreement, dated as of November 19, 2024, by and among Viessmann Generations Group GmbH & Co. KG and Viessmann Traeger HoldCo GmbH. |

| |

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

Date: November 20, 2024

| |

VIESSMANN GENERATIONS GROUP GMBH & CO. KG |

| |

|

| |

By: Viessmann Komplementär B.V.,

its sole general partner |

| |

|

| |

|

| |

By: |

/s/ Maximilian Viessmann |

| |

|

Name: |

Maximilian Viessmann |

| |

|

Title: |

President and Chief Executive Officer |

| |

|

|

| |

|

|

| |

VIESSMANN KOMPLEMENTÄR B.V. |

| |

|

| |

|

| |

By: |

/s/ Maximilian Viessmann |

| |

|

Name: |

Maximilian Viessmann |

| |

|

Title: |

President and Chief Executive Officer |

| |

|

|

| |

|

| |

VIESSMANN ZWEITE BETEILIGUNGS B.V. |

| |

|

| |

|

| |

By: |

/s/ Maximilian Viessmann |

| |

|

Name: |

Maximilian Viessmann |

| |

|

Title: |

President and Chief Executive Officer |

| |

|

|

| |

|

| |

/s/ Maximilian Viessmann |

| |

MAXIMILIAN VIESSMANN |

| |

|

| |

|

|

| |

VIESSMANN TRAEGER HOLDCO GMBH |

| |

|

|

| |

By: |

/s/ Maximilian Viessmann |

| |

|

Name: |

Maximilian Viessmann |

| |

|

Title: |

Managing Director |

EXHIBIT INDEX

| Exhibit 99.1 |

Joint Filing Agreement, dated as of November 13, 2024, by and among Viessmann Traeger HoldCo GmbH, Viessmann Generations Group GmbH & Co. KG, Viessmann Komplementär B.V., Viessmann Beteiligungs AG, Viessmann Zweite Beteiligungs B.V. and Maximilian Viessmann (incorporated by reference to Exhibit 99.1 to the Amendment No. 2). |

| Exhibit 99.2 |

Share Purchase Agreement, dated as of April 25, 2023, by and among Carrier Global Corporation, Blitz F23-620 GmbH (subsequently renamed Johann Purchaser GmbH) and Viessmann Group GmbH & Co. KG (incorporated by reference to Exhibit 99.2 to the Original Schedule 13D). |

| Exhibit 99.3 |

Post-Closing Amendment to Share Purchase Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation, Johann Purchaser GmbH and Viessmann Group GmbH & Co. KG. (incorporated by reference to Exhibit 99.3 to the Original Schedule 13D). |

| Exhibit 99.4 |

Investor Rights Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation and Viessmann Group GmbH & Co. KG (incorporated by reference to Exhibit 99.4 to the Original Schedule 13D). |

| Exhibit 99.5 |

License Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation, Viessmann Group GmbH & Co. KG and Carrier Innovative Technologies GmbH (incorporated by reference to Exhibit 99.5 to the Original Schedule 13D). |

| Exhibit 99.6 |

Transitional Services Agreement, dated as of January 2, 2024, by and among Carrier Global Corporation, Viessmann Climate Solutions SE and Viessmann Group GmbH & Co. KG. (incorporated by reference to Exhibit 99.6 to the Original Schedule 13D). |

| Exhibit 99.7 |

Limited Power of Attorney of Maximilian Viessmann, dated as of November 13, 2024 (incorporated by reference to Exhibit 99.7 to the Amendment No. 2). |

| Exhibit 99.8 |

Contribution Agreement, dated as of March 21, 2024, by and among Viessmann Group GmbH & Co. KG and Johanna 391 Vermögensverwaltungs GmbH (subsequently renamed to Viessmann Traeger HoldCo GmbH) (incorporated by reference to Exhibit 99.8 to the Amendment No. 1). |

| Exhibit 99.9 |

Contribution Agreement, dated as of November 12, 2024, by and among Viessmann Generations Group GmbH & Co. KG and Viessmann Traeger HoldCo GmbH (incorporated by reference to Exhibit 99.9 to the Amendment No. 2). |

| Exhibit 99.10 |

Contribution Agreement, dated as of November 14, 2024, by and among Viessmann Generations Group GmbH & Co. KG and Viessmann Traeger HoldCo GmbH (incorporated by reference to Exhibit 99.10 to the Amendment No. 3). |

| Exhibit 99.11 |

Contribution Agreement, dated as of November 19, 2024, by and among Viessmann Generations Group GmbH & Co. KG and Viessmann Traeger HoldCo GmbH. |

Exhibit 99.11

| |

Einlage- und

Abtretungsvertrag |

|

Contribution

and Transfer

Agreement |

| |

|

|

| zwischen |

|

by and between |

| |

|

|

der Viessmann Generations

Group

GmbH & Co. KG

mit Sitz in Battenberg (Eder)

(Amtsgericht Marburg, HRA 3389)

(die „Group KG“) |

|

Viessmann Generations

Group

GmbH & Co. KG

with registered office in Battenberg (Eder)

(local court of Marburg, HRA 3389)

(“Group KG”) |

| |

|

|

| und |

|

and |

| |

|

|

der Viessmann Traeger

HoldCo GmbH

mit Sitz in Battenberg (Eder)

(Amtsgericht Marburg, HRB 8493)

(die „HoldCo“) |

|

Viessmann Traeger HoldCo

GmbH

with registered office in Battenberg (Eder)

(local court of Marburg, HRB 8493)

(“HoldCo”) |

| |

|

|

| vom 19. November 2024 |

|

of 19 November 2024 |

| |

|

|

I.

Vorbemerkung |

|

I.

Recitals |

| |

|

|

| (1) Die

CARRIER GLOBAL CORPORATION ist eine nach dem Recht des Bundesstaates Delaware, U.S.A., errichtete Kapitalgesellschaft (corporation)

mit Aktennummer (file number) 7286518 und mit Hauptsitz der Geschäftsführung (principal executive offices)

in 13995 Pasteur Boulevard, Palm Beach Gardens, Florida 33418, U.S.A. („Carrier“). |

|

(1) CARRIER

GLOBAL CORPORATION is a corporation incorporated under the laws of Delaware, U.S.A., with file number: 7286518, with its principal

executive offices located at 13995 Pasteur Boulevard, Palm Beach Gardens, Florida 33418, U.S.A. (“Carrier”). |

| (2) Die

Group KG hält 11.721.792 voll eingezahlte, auf den Namen lautende Aktien (common shares) der Carrier mit einem Nominalwert

(par value) von je USD 0,01 (Gesamtnominalwert: USD 117.217,92) (zusammen die „Carrier-Aktien“). |

|

(2) Group

KG holds 11,721,792 fully paid registered common shares, par value USD 0.01 (total par value: USD 117,217.92), in Carrier (the “Carrier

Shares”). |

| |

|

|

| (3) Die

Group KG ist die alleinige Gesellschafterin der HoldCo. Die Group KG beabsichtigt, von ihren Carrier-Aktien einen Teil, nämlich

5.860.896 (Gesamtnominalwert: USD 58.608,96) (die „Ziel-Aktien“) ohne Gegenleistung zur Stärkung des Eigenkapitals

der HoldCo als sonstige freiwillige Zuzahlung in das Eigenkapital gem. § 272 Abs. 2 Nr. 4 HGB in die HoldCo einzulegen

und an diese abzutreten. |

|

(3) Group

KG is the sole shareholder of HoldCo. Group KG intends to contribute a portion of its Carrier Shares, namely 5,860,896 (total par

value: USD 58,608.96) (the "Target Shares") to HoldCo as a voluntary additional payment into the equity capital

of HoldCo pursuant to Sec. 272(2) no. 4 of the German Commercial Code (Handelsgesetzbuch – “HGB”),

without consideration, to strengthen HoldCo's equity capital and to transfer the Target Shares to HoldCo. |

| |

|

|

II.

Einlage- und

Abtretungsvertrag |

|

II.

Contribution and Transfer

Agreement |

| |

|

|

§ 1

Einlage und Abtretung |

|

§ 1

Contribution and Transfer |

| 1.1 Die

Group KG legt hiermit die Ziel-Aktien mit sofortiger wirtschaftlicher Wirkung (der „Stichtag“) in die HoldCo ein.

Das bedeutet, dass alle wirtschaftlichen Chancen und Risiken der Ziel-Aktien mit sofortiger Wirkung auf die HoldCo übergehen.

Die Group KG wird ab dem Stichtag bis zum dinglichen Übergang der Aktien (§ 1.2) alle Rechte, insbesondere die Stimmrechte,

und Verpflichtungen, die mit den Ziel-Aktien verbunden sind, ausschließlich auf Anweisung der HoldCo ausüben bzw. die

HoldCo wird die Group KG im Innenverhältnis von Verpflichtungen freistellen. Eine anderweitige Verfügung über die

Ziel-Aktien durch die Group KG ist ab sofort unzulässig. |

|

1.1 Group

KG hereby contributes the Target Shares to HoldCo with immediate economic effect (“Effective Date”). This means

that all economic opportunities and risks of the Target Shares are transferred to HoldCo with immediate effect. From the Effective

Date until the transfer in rem of the shares (§ 1.2), Group KG will exercise all rights, in particular the voting rights,

and obligations associated with the Target Shares exclusively on the instructions of HoldCo or HoldCo will indemnify Group KG internally

from obligations. Any other disposal of the Target Shares by Group KG is not permitted as of now. |

| |

|

|

| 1.2 Die

Group KG tritt hiermit die Ziel-Aktien mit dinglicher Wirkung auf den Zeitpunkt, zu dem die Eintragung des Übergangs der Ziel-Aktien

in den Büchern der Computershare Trust Company, N.A., als Übertragungsstelle (transfer agent) von Carrier vollzogen

wird, an die HoldCo ab. |

|

1.2 Group

KG hereby transfers the Target Shares to HoldCo with effect in rem on the date on which the transfer of the Target Shares

is recorded in the books of Computershare Trust Company, N.A., as Carrier’s transfer agent. |

| |

|

|

| 1.3 Die

Abtretung der Ziel-Aktien nach diesem Einlage- und Abtretungsvertrag erfolgt mit allen Rechten, insbesondere den Stimmrechten, und

Verpflichtungen, die mit den Ziel-Aktien verbunden sind, soweit in diesem Vertrag nicht ausdrücklich etwas anderes geregelt

ist. Insbesondere umfasst die Abtretung die Dividendenansprüche aus den Ziel-Aktien bzgl. der Gewinne des laufenden Geschäftsjahres

sowie vergangener Geschäftsjahre der Carrier, soweit sie nicht bereits ausgeschüttet wurden oder ihre Ausschüttung

vor dem Stichtag (§ 1.1) beschlossen worden ist. § 101 BGB wird ausgeschlossen. |

|

1.3 The

transfer of the Target Shares pursuant to this Contribution and Transfer Agreement includes the transfer of all rights, especially

the voting rights, and obligations pertaining thereto, unless expressly provided otherwise in this Agreement. In particular, the

transfer includes the dividend rights from the Target Shares with regard to the profits of the current financial year and previous

financial years of Carrier, unless they have already been distributed or their distribution has been resolved prior to the Effective

Date (§ 1.1). Sec. 101 of the German Civil Code (Bürgerliches Gesetzbuch – “BGB”) is excluded. |

| 1.4 Die

HoldCo nimmt die Einlage und Abtretung der Ziel-Aktien nach Maßgabe der vorstehenden Absätze 1.1, 1.2 und 1.3 hiermit

an. |

|

1.4 HoldCo

hereby accepts the contribution and transfer of the Target Shares according to the preceding paragraphs 1.1, 1.2 and 1.3. |

| |

|

|

§ 2

Keine Gegenleistung |

|

§ 2

No Consideration |

| |

|

|

| Die Abtretung gemäß

§ 1 dieses Vertrages erfolgt, wie in Ziff. (3) der Vorbemerkung näher beschrieben, ohne Gegenleistung als sonstige

freiwillige Zuzahlung der Group KG in das Eigenkapital der HoldCo gem. § 272 Abs. 2 Nr. 4 HGB. Eine Gegenleistung

wird der Group KG jeweils nicht gewährt. |

|

The transfer pursuant to

§ 1 of this Agreement shall be made without consideration as a voluntary additional payment (andere freiwillige Zuzahlung)

by Group KG into the equity of HoldCo pursuant to Sec. 272(2) no. 4 HGB, as described in more detail in item (3) of the recitals.

No consideration is granted to Group KG. |

| |

|

|

§ 3

Handelsbilanzieller

Wertansatz |

|

§ 3

Commercial Accounting Valuation |

| |

|

|

| Die nach § 1 dieses

Vertrags abgetretenen Ziel-Aktien sind bei der HoldCo für handelsbilanzielle Zwecke in der Kapitalrücklage gemäß

§ 272 Abs. 2 Nr. 4 HGB zu erfassen. Der handelsbilanzielle Wertansatz erfolgt auf Basis der handelsrechtlichen

Anschaffungskosten der Ziel-Aktien, wie sie von der Group KG getragen wurden. |

|

The

Target Shares transferred pursuant to § 1 of this Agreement are to be recognized by HoldCo in the capital reserve for commercial

accounting purposes in accordance with Sec. 272(2) no. 4 HGB. The commercial balance sheet valuation is based on the acquisition

costs of the Target Shares under commercial law as borne by the Group KG. |

§ 4

Haftung |

|

§ 4

Liability |

| |

|

|

| 4.1 Die

Group KG versichert der HoldCo in Bezug auf die Ziel-Aktien in der Form eines selbständigen Garantieversprechens (§ 311

Abs. 1 BGB), dass die folgenden Aussagen am Stichtag (§ 1.1) und beim dinglichen Übergang der Aktien (§ 1.2)

zutreffend sind: |

|

4.1 Group

KG guarantees HoldCo in relation to the Target Shares in the form of an independent guarantee promise (selbständiges Garantieversprechen)

(Sec. 311(1) BGB) that the following statements are correct at the Effective Date (§ 1.1) and when the Target Shares are transferred

in rem (§ 1.2): |

| |

|

|

| 4.1.1

dass sie alleinige Inhaberin der Ziel-Aktien ist; |

|

4.1.1

it is the sole owner of the Target Shares; |

| |

|

|

| 4.1.2 sie

über die Ziel-Aktien frei verfügen kann; |

|

4.1.2 it

can freely dispose of the Target Shares; |

| |

|

|

| 4.1.3 die

Ziel-Aktien frei von dinglichen Rechten Dritter und auch nicht Gegenstand von An-, Vorkaufs- oder sonstigen obligatorischen Rechten

Dritter sind; |

|

4.1.3 the

Target Shares are free from third-party rights in rem and are also not subject to third-party rights of purchase, pre-emption,

or other obligatory rights; |

| |

|

|

| 4.1.4 die

Ziel-Aktien voll eingezahlt sind, die hierauf geleisteten Einlagen weder offen noch verdeckt zurückgewährt wurden und diese

Aktien frei von Nachzahlungs-, Nebenleistungs- oder sonstigen Verpflichtungen oder Beschränkungen sind; |

|

4.1.4 the

Target Shares are fully paid, the contributions made on them have not been repaid either openly or covertly and these shares are

free of any obligations or restrictions to make subsequent payments, ancillary payments or other obligations or restrictions; |

| 4.1.5 Für

das Angebot und die Einlage der Ziel-Aktien durch die Group KG an bzw. in die HoldCo in der in diesem Einlage- und Abtretungsvertrag

vorgesehenen Weise ist keine Registrierung nach dem Securities Act von 1933 in seiner jeweils gültigen Fassung (der "Securities

Act") erforderlich. Die Ziel-Aktien (i) wurden der HoldCo nicht durch eine allgemeine Aufforderung oder eine allgemeine

Werbung angeboten und (ii) werden der HoldCo nicht in einer Weise angeboten, die ein öffentliches Angebot gemäß dem

Securities Act oder den Wertpapiergesetzen einer anwendbaren Rechtsordnung darstellt, oder in einer Weise vertrieben, die gegen eines

dieser Gesetze verstößt. Weder die Group KG noch irgendeine in ihrem Namen handelnde Person hat in Verbindung mit einem

Angebot oder Verkauf der Ziel-Aktien irgendeine Form von allgemeiner Aufforderung ausgesprochen oder allgemeiner Werbung gemacht,

jeweils im Sinne von Regulation D des Securities Act, oder wird dies tun. Weder die Group KG noch irgendeine in ihrem Namen handelnde

Person hat irgendeine Maßnahme ergriffen oder wird irgendeine Maßnahme ergreifen, die die Ausgabe oder den Verkauf der

Ziel-Aktien den Registrierungserfordernissen von Section 5 des Securities Act oder von Wertpapier- oder Blue-Sky-Gesetzen einer anwendbaren

Rechtsordnung unterwerfen würde. |

|

4.1.5 No

registration under the Securities Act of 1933, as amended (the “Securities Act”) is required for the offer and

contribution of the Target Shares by Group KG to HoldCo in the manner contemplated by this Contribution and Transfer Agreement. The

Target Shares (i) were not offered to HoldCo by any form of general solicitation or general advertising and (ii) are not being offered

to HoldCo in a manner involving a public offering under, or in a distribution in violation of, the Securities Act or the securities

laws of any applicable jurisdiction. Neither Group KG nor any person acting on its behalf has engaged or will engage in any form

of general solicitation or general advertising (within the meaning of Regulation D of the Securities Act) in connection with any

offer or sale of the Target Shares, or has taken, or will take, any action that would subject the issuance or sale of the Target

Shares to the registration requirements of Section 5 of the Securities Act or to the registration requirements of any securities

or blue sky laws of any applicable jurisdiction. |

| |

|

|

| 4.2 Die

Group KG haftet für die ordnungsgemäße Erfüllung der Einlagepflicht sowie für den rechtsmangelfreien Erwerb

der Ziel-Aktien. Eine Haftung wegen Vorsatz und Arglist bleibt stets unberührt. |

|

4.2 Group

KG is liable for the proper fulfillment of the contribution obligation and for the acquisition of the Target Shares free of legal

defects. Liability for intent and fraudulent conduct always remains unaffected. |

| |

|

|

| 4.3 Die

HoldCo versichert der Group KG in Bezug auf die Ziel-Aktien in der Form eines selbständigen Garantieversprechens (§ 311

Abs. 1 BGB), dass: |

|

4.3 HoldCo

guarantees Group KG in relation to the Target Shares in the form of an independent guarantee promise (selbständiges Garantieversprechen)

(Sec. 311(1) BGB) that: |

| 4.3.1

sie versteht, dass die Ziel-Aktien im Rahmen einer Transaktion angeboten werden, die kein öffentliches Angebot im Sinne

des Securities Act darstellt, und dass die Ziel-Aktien nicht gemäß dem Securities Act oder den Wertpapiergesetzen einer

anwendbaren Rechtsordnung registriert wurden. Die HoldCo versteht, dass es sich bei den Ziel-Aktien um „restricted securities"

(im Sinne von Rule 144 des Securities Act) handelt, die ohne eine wirksame Registrierungserklärung nach dem Securities Act nicht

weiterverkauft, übertragen, verpfändet oder anderweitig veräußert werden dürfen, außer (i) an Carrier

oder eine Tochtergesellschaft von Carrier, (ii) an Nicht-US-Personen im Rahmen von Angeboten und Verkäufen, die im Rahmen einer

„Offshore-Transaktion“, wie definiert in und unter den Voraussetzungen von Regulation S des Securities Act, erfolgen,

(iii) gemäß Rule 144 des Securities Act, sofern deren sämtliche anwendbaren Bedingungen erfüllt sind, oder (iv)

gemäß einer anderen anwendbaren Befreiung von den Registrierungsanforderungen des Securities Act, jeweils in Übereinstimmung

mit den anwendbaren Wertpapiergesetzen eines Bundesstaates der Vereinigten Staaten oder einer anderen anwendbaren Rechtsordnung,

und dass die Buchungsbelege (book-entry records), die die Ziel-Aktien repräsentieren, eine entsprechende Kennzeichnung

enthalten; |

|

4.3.1

it understands that the Target Shares are being offered in a transaction not involving any public offering within the meaning of

the Securities Act and that the Target Shares have not been registered under the Securities Act or the securities laws of any applicable

jurisdiction. HoldCo understands that the Target Shares are “restricted securities” (as defined in Rule 144 under the

Securities Act) and may not be resold, transferred, pledged or otherwise disposed of absent an effective registration statement under

the Securities Act, except (i) to Carrier or a subsidiary thereof, (ii) to non-U.S. persons pursuant to offers and sales

that occur in an “offshore transaction” as defined in, and meeting the requirements of, Regulation S under the Securities

Act, (iii) pursuant to Rule 144 under the Securities Act, provided that all of the applicable conditions thereof have been met

or (iv) pursuant to another applicable exemption from the registration requirements of the Securities Act, in each case in accordance

with any applicable securities laws of any state of the United States or other applicable jurisdiction, and that the book-entry records

representing the Target Shares shall contain a legend to such effect; |

| |

|

|

| 4.3.2 sie

von der Absicht der Group KG, die Ziel-Aktien anzubieten, ausschließlich durch direkten Kontakt zwischen ihr und der Group

KG erfahren hat. Die HoldCo hat von dem Angebot der Ziel-Aktien nicht auf andere Weise erfahren. Sie wurden ihr auch nicht auf andere

Weise angeboten. |

|

4.3.2 it

became aware of Group KG’s intention to offer the Target Shares solely by means of direct contact between it and Group KG.

HoldCo did not become aware of the offering of the Target Shares, nor were the Target Shares offered to HoldCo, by any other means.

|

| 4.4 Sowohl

die Group KG als auch die HoldCo erkennen an und erklären sich damit einverstanden, dass (i) die Ziel-Aktien Gegenstand des

Investor Rights Agreements vom 2. Januar 2024 zwischen Carrier und der Group KG (das „Investor Rights Agreement“)

sind, (ii) die Buchungsbelege (book-entry records), die die Ziel-Aktien repräsentieren, eine entsprechende Kennzeichnung

enthalten, (iii) die HoldCo gemäß den Bestimmungen des Investor Rights Agreements verpflichtet ist, sich schriftlich zu

Gunsten von Carrier den Bestimmungen des Investor Rights Agreement zu unterwerfen, und (iv) die Abtretung der Ziel-Aktien von der

Group KG an die HoldCo gemäß diesem Einlage- und Abtretungsvertrag ein „Permitted Transfer“ (gemäß

der Definition dieses Begriffs in dem Investor Rights Agreement) ist. |

|

4.4 Each

of Group KG and HoldCo acknowledges and agrees that (i) the Target Shares are subject to that certain Investor Rights Agreement,

dated as of January 2, 2024, by and between Carrier and Group KG (the “Investor Rights Agreement”), (ii) the book-entry

records representing the Target Shares shall contain a legend to such effect, (iii) HoldCo is required, pursuant to the terms of

the Investor Rights Agreement, to agree in a writing for the benefit of Carrier to be bound by the terms thereof and (iv) the transfer

of the Target Shares from Group KG to HoldCo pursuant to this Contribution and Transfer Agreement is a “Permitted Transfer”

(as such term is defined in the Investor Rights Agreement). |

| |

|

|

| 4.5 Ansonsten

enthält dieser Vertrag keine Beschaffenheitsangaben, Gewährleistungen oder Garantien hinsichtlich der Ziel-Aktien, der

Carrier oder des Unternehmens der Carrier, insbesondere nicht hinsichtlich der Werthaltigkeit und Ertragsfähigkeit der Ziel-Aktien.

Soweit gesetzlich zulässig, sind alle über die in diesem Vertrag geregelten Ansprüche und Rechte der HoldCo hinausgehenden

Ansprüche und Rechte unabhängig von ihrer Entstehung, ihrem Umfang und ihrer rechtlichen Grundlage ausgeschlossen. |

|

4.5 Otherwise,

this Agreement does not contain any representations, warranties or guarantees with respect to the Target Shares, Carrier or Carriers'

business, in particular with respect to the value and profitability of the Target Shares. To the extent permitted by law, all claims

and rights of HoldCo beyond those regulated in this Agreement are excluded, irrespective of their origin, scope and legal basis. |

| |

|

|

§ 5

Rechtswahl, Sprache |

|

§ 5

Choice of Law, Language |

| |

|

|

| 5.1 Dieser

Vertrag unterliegt deutschem Recht. |

|

5.1 This

Agreement shall be governed by the laws of Germany. |

| 5.2 Diesem

Vertrag in Deutsch ist in der rechten Spalte eine englische Übersetzung beigefügt, die nicht Teil des Vertrags ist und

lediglich Informationszwecken dient. Die deutsche Sprachfassung ist die allein maßgebliche und rechtlich bindende Sprachfassung.

Werden in der deutschen Sprachfassung Übersetzungen von englischen Rechtsbegriffen verwendet, ist einer etwaigen Auslegung dieses

Vertrags der jeweilige englische Rechtsbegriff zugrunde zu legen. |

|

5.2 This

Agreement in German is accompanied by an English translation in the right-hand column, which is not part of the Agreement and is

for information purposes only. The German version is the sole authoritative and legally binding version. If translations of English

legal terms are used in the German language version, any interpretation of this Agreement shall be based on the respective English

legal term. |

| |

|

|

§ 6

Schlussbestimmungen |

|

§ 6

Final Provisions |

| |

|

|

| 6.1 Änderungen

dieses Vertrages bedürfen zu ihrer Wirksamkeit der Schriftform, soweit nicht eine strengere Form gesetzlich vorgeschrieben ist.

Dies gilt auch für Änderungen dieses Absatzes. |

|

6.1 Amendments

to this Agreement must be made in writing to be effective, unless a stricter form is prescribed by law. This also applies to amendments

to this paragraph. |

| |

|

|

| 6.2 Sollten

einzelne oder mehrere Bestimmungen dieses Vertrages unwirksam oder undurchführbar sein oder werden oder sollte dieser Vertrag

eine oder mehrere Regelungslücken enthalten, wird hierdurch die Gültigkeit der übrigen Bestimmungen dieses Vertrages

nicht berührt. Statt der unwirksamen oder undurchführbaren Bestimmung soll eine Bestimmung gelten, die dem wirtschaftlichen

Ergebnis der unwirksamen oder undurchführbaren Bestimmung in zulässiger Weise am nächsten kommt. Statt der lückenhaften

Regelung soll eine Regelung gelten, die von den Parteien im Hinblick auf ihre wirtschaftliche Absicht getroffen worden wäre,

wenn sie die Regelungslücke erkannt hätten. |

|

6.2 Should

one or more provisions of this Agreement be or become invalid or unenforceable or should this Agreement contain one or more loopholes,

this shall not affect the validity of the remaining provisions of this Agreement. The invalid or unenforceable provision shall be

replaced by a provision that comes as close as possible to the economic result of the invalid or unenforceable provision in a permissible

manner. Instead of the incomplete provision, a provision shall apply which would have been agreed by the parties with regard to their

economic intention if they had recognized the loophole. |

München, den

/ the 19 November 2024

Für die / For

Group KG,

vertreten durch ihre Komplementärin / represented by its general partner

Viessmann Komplementär B.V.:

/s/ Maximilian Viessmann

_____________________________________

Maximilian Viessmann

Präsident und CEO der Komplementärin /

President and CEO of the general partner

Für die / For

HoldCo:

/s/ Maximilian Viessmann

_____________________________________

Maximilian Viessmann

Geschäftsführer /

Managing Director

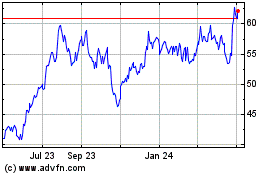

Carrier Global (NYSE:CARR)

Historical Stock Chart

From Dec 2024 to Jan 2025

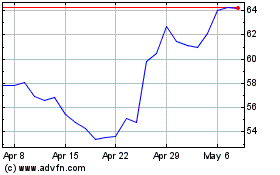

Carrier Global (NYSE:CARR)

Historical Stock Chart

From Jan 2024 to Jan 2025