0000721371false00007213712023-11-032023-11-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2023

Cardinal Health, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Ohio | 1-11373 | | 31-0958666 |

(State or other

jurisdiction of incorporation) | (Commission File Number)

| | (IRS Employer

Identification No.) |

| | | | | | | | | |

7000 Cardinal Place, Dublin, Ohio 43017

(614) 757-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares (without par value) | CAH | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. p

Item 2.02: Results of Operations and Financial Condition

On November 3, 2023, Cardinal Health, Inc. (the "Company") issued a news release announcing its results for the quarter ended September 30, 2023. A copy of the news release is included as Exhibit 99.1 to this report.

Item 7.01: Regulation FD Disclosure

During a webcast scheduled to be held at 8:30 a.m. Eastern time on November 3, 2023, the Company's Chief Executive Officer and Chief Financial Officer will discuss the Company's results for the quarter ended September 30, 2023 and outlook for the fiscal year ending June 30, 2024. The slide presentation for the webcast will be available on the Investors page at ir.cardinalhealth.com. An audio replay of the webcast also will be available on the Investors page at ir.cardinalhealth.com.

Item 9.01: Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit

Number | Exhibit Description |

| 99.1 | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Cardinal Health, Inc. |

| | (Registrant) |

| | | |

| Date: | November 3, 2023 | By: | /s/ AARON E. ALT |

| | | Aaron E. Alt |

| | | Chief Financial Officer |

FOR IMMEDIATE RELEASE

Cardinal Health Reports First Quarter Fiscal 2024 Results and Raises Fiscal 2024 Outlook

•Revenue increased 10% to $54.8 billion

•GAAP1 operating loss was $14 million and GAAP diluted EPS was $0.02, driven by a Medical segment goodwill impairment

•Non-GAAP operating earnings increased 35% to $571 million, driven by significant increases in both Pharmaceutical segment profit and Medical segment profit; non-GAAP diluted EPS increased 44% to $1.73

•Pharmaceutical segment profit grew 18% to $507 million and the Medical segment delivered $71 million in segment profit

•Fiscal 2024 non-GAAP EPS guidance raised to $6.75 to $7.00, from $6.50 to $6.75

DUBLIN, Ohio, November 3, 2023 - Cardinal Health (NYSE: CAH) today reported first quarter fiscal 2024 revenue of $54.8 billion, an increase of 10% from the first quarter of last year. First quarter GAAP operating loss was $14 million due to a non-cash, pre-tax goodwill impairment of $581 million related to the Medical segment, due to an increase in the discount rate.2 GAAP diluted earnings per share (EPS) were $0.02, primarily due to this impairment, net of tax effects. Non-GAAP operating earnings increased 35% to $571 million in the quarter, driven by significant increases in both Pharmaceutical segment profit and Medical segment profit. Non-GAAP diluted EPS increased 44% to $1.73, reflecting the increase in non-GAAP operating earnings, a lower share count and lower interest and other expense, partially offset by a higher non-GAAP effective tax rate.

"With strong first quarter results and an improved outlook for the year, we are continuing our operating momentum into fiscal 2024,” said Jason Hollar, CEO of Cardinal Health. “In Q1, we delivered significant profit growth in both the Pharmaceutical and Medical segments, which along with our favorable capital structure and opportunistic capital deployment, gives us confidence to raise fiscal 2024 non-GAAP EPS guidance. Across the enterprise, we continue to prioritize focused execution to best serve our customers and create value for our shareholders."

Q1 FY24 summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 FY24 | | Q1 FY23 | | Y/Y | | | | | | | | | | | | |

| Revenue | $54.8 billion | | $49.6 billion | | 10% | | | | | | | | | | | | |

| Operating earnings/(loss) | $(14) million | | $137 million | | N.M. | | | | | | | | | | | | |

| Non-GAAP operating earnings | $571 million | | $423 million | | 35% | | | | | | | | | | | | |

| Net earnings attributable to Cardinal Health, Inc. | $5 million | | $110 million | | N.M. | | | | | | | | | | | | |

| Non-GAAP net earnings attributable to Cardinal Health, Inc. | $433 million | | $328 million | | 32% | | | | | | | | | | | | |

Effective Tax Rate3 | 122.5% | | (0.7)% | | | | | | | | | | | | | | |

| Non-GAAP Effective Tax Rate | 22.5% | | 16.9% | | | | | | | | | | | | | | |

| Diluted EPS attributable to Cardinal Health, Inc. | $0.02 | | $0.40 | | N.M. | | | | | | | | | | | | |

| Non-GAAP diluted EPS attributable to Cardinal Health, Inc. | $1.73 | | $1.20 | | 44% | | | | | | | | | | | | |

Segment results

Pharmaceutical segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 FY24 | | Q1 FY23 | | Y/Y | | | | | | | | | | | | |

| Revenue | $51.0 billion | | $45.8 billion | | 11% | | | | | | | | | | | | |

| Segment profit | $507 million | | $431 million | | 18% | | | | | | | | | | | | |

First quarter revenue for the Pharmaceutical segment increased 11% to $51.0 billion, driven by brand and specialty pharmaceutical sales growth from existing customers.

Pharmaceutical segment profit increased 18% to $507 million in the first quarter, driven by a higher contribution from brand and specialty products, including distribution of COVID-19 vaccines, and positive generics program performance.

Medical segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 FY24 | | Q1 FY23 | | Y/Y | | | | | | | | | | | | |

| Revenue | $3.8 billion | | $3.8 billion | | —% | | | | | | | | | | | | |

Segment profit | $71 million | | $(8) million | | N.M. | | | | | | | | | | | | |

First quarter revenue for the Medical segment was flat at $3.8 billion. This reflects lower PPE volumes and pricing, offset by growth in at-Home Solutions and inflationary impacts, including mitigation initiatives. PPE volumes and pricing includes the impact from the prior year exit of our non-healthcare gloves portfolio in connection with our simplification strategy.

Medical segment profit increased to $71 million in the first quarter, driven by an improvement in net inflationary impacts, including mitigation initiatives.

Fiscal year 2024 outlook1

The company raised its fiscal 2024 guidance range for non-GAAP diluted earnings per share attributable to Cardinal Health, Inc. to $6.75 to $7.00, from $6.50 to $6.75.

This guidance includes an update to the company's Pharmaceutical segment profit outlook for fiscal 2024 to 7% to 9% growth, from 4% to 6% growth. Additionally, the company updated expectations for interest and other to $100 million to $120 million, from $110 million to $130 million, and for diluted weighted average shares outstanding of approximately 249 million, from 250 million to 253 million.

The company does not provide forward-looking guidance on a GAAP basis as certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. See "Use of Non-GAAP Measures" following the attached schedules for additional explanation.

Recent highlights

•Cardinal Health initiated a $500M accelerated share repurchase program in the first quarter, which was completed in October.

•Cardinal Health began distributing the recently commercialized COVID-19 vaccines to customers following FDA approval in September.

•Cardinal Health launched its Kangaroo OMNI™ Enteral Feeding Pump in the U.S., designed to help provide enteral feeding patients with more options to meet their personalized needs throughout their enteral feeding journey.

•Cardinal Health was named to the 100 Best Corporate Citizens ranking by 3BL Media based on an assessment of environmental, social and governance (ESG) transparency and performance of the 1,000 largest public companies in the U.S.

•Cardinal Health was named to Seramount’s 2023 lists of 100 Best Companies, Top Companies for Executive Women, and Best Companies for Multicultural Women.

Upcoming webcasted investor events

•Evercore ISI Healthcare Conference at 10:00 a.m. EST, November 29, 2023

•J.P. Morgan Healthcare Conference, January 8-11, 2024

Webcast

Cardinal Health will host a webcast today at 8:30 a.m. EST to discuss first quarter results. To access the webcast and corresponding slide presentation, go to the Investor Relations page at ir.cardinalhealth.com. No access code is required.

Presentation slides and a webcast replay will be available on the Investor Relations page for 12 months.

About Cardinal Health

Cardinal Health is a distributor of pharmaceuticals, a global manufacturer and distributor of medical and laboratory products, and a provider of performance and data solutions for healthcare facilities. With more than 50 years in business, operations in more than 30 countries and approximately 48,000 employees globally, Cardinal Health is essential to care. Information about Cardinal Health is available at cardinalhealth.com.

Contacts

Media: Erich Timmerman, Erich.Timmerman@cardinalhealth.com and 614.757.8231

Investors: Matt Sims, Matt.Sims@cardinalhealth.com and 614.553.3661

1 GAAP refers to U.S. generally accepted accounting principles. This news release includes GAAP financial measures as well as non-GAAP financial measures, which are financial measures not calculated in accordance with GAAP. See "Use of Non-GAAP Measures" following the attached schedules for definitions of the non-GAAP financial measures presented in this news release and see the attached schedules for reconciliations of the differences between the non-GAAP financial measures and their most directly comparable GAAP financial measures.

2 The first quarter fiscal 2024 impairment charge related to the Medical segment reflects an increase in the risk-free interest rate used in the company’s goodwill impairment analysis.

3 The first quarter fiscal 2024 and 2023 GAAP effective tax rates primarily reflect the tax effects of the goodwill impairment charge included in the company's estimated annual effective tax rate for each year.

Cardinal Health uses its website as a channel of distribution for material company information. Important information, including news releases, financial information, earnings and analyst presentations, and information about upcoming presentations and events is routinely posted and accessible on the Investor Relations page at ir.cardinalhealth.com. In addition, the website allows investors and other interested persons to sign up automatically to receive email alerts when the company posts news releases, SEC filings and certain other information on its website.

Cautions Concerning Forward-Looking Statements

This news release contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. These statements may be identified by words such as "expect," "anticipate," "intend," "plan," "believe," “will," "should," "could," "would," "project," "continue,” "likely," and similar expressions, and include statements reflecting future results or guidance, statements of outlook and various accruals and estimates. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. These risks and uncertainties include risks arising from ongoing inflationary pressures, including the risk that our plans to mitigate such effects may not be as successful as we anticipate or that costs could remain elevated; the possibility that our Medical unit goodwill could be further impaired due to additional changes to our long-term financial plan, increases in global interest rates or unfavorable changes in the U.S. statutory tax rate; risks associated with our ongoing review of our operations, portfolio and businesses, including the risk that our management team could become distracted or that the outcome of such review may have unintended consequences; competitive pressures in Cardinal Health's various lines of business, including the risk that customers may reduce purchases made under their contracts with us or terminate or not renew their contracts; the performance of our generics program, including the amount or rate of generic deflation and our ability to offset generic deflation and maintain other financial and strategic benefits through our generic sourcing venture or other components of our generics programs; ongoing risks associated with the distribution of opioids, including the financial impact associated with the settlements with governmental authorities and the risk that challenges to tax deductions for opioid-related losses could adversely impact our financial results; risks arising from the Department of Justice investigation which we believe concerns our anti-diversion program and risks associated with the injunctive relief requirements under the national settlement, including the risk that we may incur higher costs or operational challenges in the implementation and maintenance of the required changes; risks associated with the manufacture and sourcing of certain products, including risks related to our ability and the ability of third-party

manufacturers to import or export certain products or component parts and to comply with applicable regulations; our ability to manage uncertainties associated with the pricing of branded pharmaceuticals; uncertainties related to the timing, magnitude and profit impact of the distribution of recently commercially available COVID-19 vaccines; and risks associated with business process initiatives, such as the Medical Improvement Plan, including the possibility that they could fail to achieve the intended results. Cardinal Health is subject to additional risks and uncertainties described in Cardinal Health's Form 10-K, Form 10-Q and Form 8-K reports and exhibits to those reports. This news release reflects management’s views as of November 3, 2023. Except to the extent required by applicable law, Cardinal Health undertakes no obligation to update or revise any forward-looking statement. Forward-looking statements are aspirational and not guarantees or promises that goals, targets or projections will be met, and no assurance can be given that any commitment, expectation, initiative or plan in this news release can or will be achieved or completed.

Schedule 1

Cardinal Health, Inc. and Subsidiaries

Condensed Consolidated Statements of Earnings (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| First Quarter | | |

| (in millions, except per common share amounts) | 2024 | | 2023 | | % Change | | | | | | |

| Revenue | $ | 54,763 | | | $ | 49,603 | | | 10 | % | | | | | | |

| Cost of products sold | 52,995 | | | 47,989 | | | 10 | % | | | | | | |

| | | | | | | | | | | |

| Gross margin | 1,768 | | | 1,614 | | | 10 | % | | | | | | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Distribution, selling, general and administrative expenses | 1,197 | | | 1,197 | | | — | % | | | | | | |

| Restructuring and employee severance | 25 | | | 29 | | | | | | | | | |

| Amortization and other acquisition-related costs | 64 | | | 71 | | | | | | | | | |

Impairments and (gain)/loss on disposal of assets, net 1 | 537 | | | 153 | | | | | | | | | |

| Litigation (recoveries)/charges, net | (41) | | | 27 | | | | | | | | | |

| Operating earnings/(loss) | (14) | | | 137 | | | N.M. | | | | | | |

| | | | | | | | | | | |

| Other (income)/expense, net | (2) | | | 2 | | | | | | | | | |

| Interest expense, net | 14 | | | 25 | | | (44) | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Earnings/(loss) before income taxes | (26) | | | 110 | | | N.M. | | | | | | |

| | | | | | | | | | | |

Benefit from income taxes 2 | (32) | | | (1) | | | N.M. | | | | | | |

| Net earnings | 6 | | | 111 | | | N.M. | | | | | | |

| | | | | | | | | | | |

| Less: Net earnings attributable to noncontrolling interests | (1) | | | (1) | | | | | | | | | |

| Net earnings attributable to Cardinal Health, Inc. | $ | 5 | | | $ | 110 | | | N.M. | | | | | | |

| | | | | | | | | | | |

| Earnings per common share attributable to Cardinal Health, Inc.: | | | | | | | | | | | |

| Basic | $ | 0.02 | | | $ | 0.41 | | | N.M. | | | | | | |

| Diluted | 0.02 | | | 0.40 | |

| N.M. | | | | | | |

| | | | | | | | | | | |

| Weighted-average number of common shares outstanding: | | | | | | | | | | | |

| Basic | 249 | | 271 | | | | | | | | |

| Diluted | 250 | | 273 | | | | | | | | |

1 For the three months ended September 30, 2023 and 2022, impairments and (gain)/loss on disposal of assets, net include pre-tax goodwill impairment charges of $581 million and $154 million, respectively, related to the Medical segment.

2 For fiscal 2024 and 2023, the net tax benefits related to these impairment charges were $45 million and $12 million and were included in the annual effective tax rate. As a result, the tax benefits for the three months ended September 30, 2023 and 2022 increased approximately by an incremental $99 million and $22 million, respectively, and will increase the provision for income taxes during the remainder of fiscal 2024 and 2023, respectively.

Schedule 2

Cardinal Health, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

| | | | | | | | | | | |

| (in millions) | September 30,

2023 | | June 30,

2023 |

| (Unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and equivalents | $ | 3,854 | | | $ | 4,043 | |

| Trade receivables, net | 11,265 | | | 11,344 | |

| Inventories, net | 16,987 | | | 15,940 | |

| Prepaid expenses and other | 2,582 | | | 2,362 | |

| Assets held for sale | — | | | 144 | |

| Total current assets | 34,688 | | | 33,833 | |

| | | |

| Property and equipment, net | 2,441 | | | 2,462 | |

| Goodwill and other intangibles, net | 5,432 | | | 6,081 | |

| | | |

| Other assets | 1,149 | | | 1,041 | |

| Total assets | $ | 43,710 | | | $ | 43,417 | |

| | | |

| Liabilities and Shareholders’ Deficit | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 31,540 | | | $ | 29,813 | |

| Current portion of long-term obligations and other short-term borrowings | 788 | | | 792 | |

| Other accrued liabilities | 2,737 | | | 3,059 | |

| Liabilities related to assets held for sale | — | | | 42 | |

| Total current liabilities | 35,065 | | | 33,706 | |

| | | |

| Long-term obligations, less current portion | 3,890 | | | 3,909 | |

| Deferred income taxes and other liabilities | 8,245 | | | 8,653 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total shareholders’ deficit | (3,490) | | | (2,851) | |

| Total liabilities and shareholders’ deficit | $ | 43,710 | | | $ | 43,417 | |

Schedule 3

Cardinal Health, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

| | | | | | | | | | | | | | | |

| First Quarter | | |

| (in millions) | 2024 | | 2023 | | | | |

| Cash flows from operating activities: | | | | | | | |

| Net earnings | $ | 6 | | | $ | 111 | | | | | |

| | | | | | | |

| Adjustments to reconcile net earnings to net cash provided by/(used in) operating activities: | | | | | | | |

| Depreciation and amortization | 172 | | | 171 | | | | | |

| | | | | | | |

| | | | | | | |

| Impairments and (gain)/loss on disposal of assets, net | 537 | | | 153 | | | | | |

| | | | | | | |

| Share-based compensation | 29 | | | 23 | | | | | |

| | | | | | | |

| Provision for bad debts | 29 | | | 29 | | | | | |

| | | | | | | |

| | | | | | | |

| Change in operating assets and liabilities, net of effects from acquisitions and divestitures: | | | | | | | |

| (Increase)/decrease in trade receivables | 50 | | | (508) | | | | | |

| Increase in inventories | (1,057) | | | (264) | | | | | |

| Increase in accounts payable | 1,727 | | | 1,234 | | | | | |

| Other accrued liabilities and operating items, net | (948) | | | (926) | | | | | |

| Net cash provided by operating activities | 545 | | | 23 | | | | | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Additions to property and equipment | (92) | | | (70) | | | | | |

| Proceeds from disposal of property and equipment | 1 | | | 2 | | | | | |

| Purchases of investments | (1) | | | (3) | | | | | |

| Proceeds from investments | 1 | | | 1 | | | | | |

| Proceeds from net investment hedge terminations | 28 | | | — | | | | | |

| | | | | | | |

| Net cash used in investing activities | (63) | | | (70) | | | | | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Reduction of long-term obligations | (7) | | | (7) | | | | | |

| Net tax withholdings from share-based compensation | (28) | | | (14) | | | | | |

| | | | | | | |

| Dividends on common shares | (131) | | | (142) | | | | | |

| Purchase of treasury shares | (500) | | | (1,000) | | | | | |

| Net cash used in financing activities | (666) | | | (1,163) | | | | | |

| | | | | | | |

| Effect of exchange rates changes on cash and equivalents | (5) | | | (15) | | | | | |

| | | | | | | |

| | | | | | | |

| Net decrease in cash and equivalents | (189) | | | (1,225) | | | | | |

| Cash and equivalents at beginning of period | 4,043 | | | 4,717 | | | | | |

| Cash and equivalents at end of period | $ | 3,854 | | | $ | 3,492 | | | | | |

Schedule 4

Cardinal Health, Inc. and Subsidiaries

Segment Information

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Quarter |

| | | | | | | | |

| | | | |

| (in millions) | 2024 | | 2023 | | (in millions) | 2024 | | 2023 |

| Pharmaceutical | | | | | Medical | | | |

| | | | | | | | |

| Revenue | | | | | Revenue | | | |

| Amount | $ | 51,006 | | | $ | 45,828 | | | Amount | $ | 3,760 | | | $ | 3,778 | |

| Growth rate | 11 | % | | 15 | % | | Growth rate | — | % | | (9) | % |

| | | | | | | | |

| Segment profit | | | | | Segment profit | | | |

| Amount | $ | 507 | | | $ | 431 | | | Amount | $ | 71 | | | $ | (8) | |

| Growth rate | 18 | % | | 6 | % | | Growth rate | N.M. | | N.M. |

| Segment profit margin | 0.99 | % | | 0.94 | % | | Segment profit margin | 1.89 | % | | (0.21) | % |

The sum of the components and certain computations may reflect rounding adjustments.

Schedule 5

Cardinal Health, Inc. and Subsidiaries

GAAP / Non-GAAP Reconciliation1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | Earnings/ | | | | | | |

| | Gross | | | | Operating | (Loss) | Provision for/ | | Net | | | Diluted |

| | Margin | | SG&A2 | Operating | Earnings | Before | (Benefit from) | | Earnings3 | Effective | | EPS3 |

| Gross | Growth | | Growth | Earnings/ | Growth | Income | Income | Net | Growth | Tax | Diluted | Growth |

| (in millions, except per common share amounts) | Margin | Rate | SG&A2 | Rate | (Loss) | Rate | Taxes | Taxes | Earnings3 | Rate | Rate | EPS3 | Rate |

| First Quarter 2024 |

| GAAP | $ | 1,768 | | 10 | % | $ | 1,197 | | — | % | $ | (14) | | N.M. | $ | (26) | | $ | (32) | | $ | 5 | | N.M. | 122.5 | % | $ | 0.02 | | N.M. |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Restructuring and employee severance | — | | | — | | | 25 | | | 25 | | 7 | | 18 | | | | 0.07 | | |

| Amortization and other acquisition-related costs | — | | | — | | | 64 | | | 64 | | 17 | | 47 | | | | 0.19 | | |

Impairments and (gain)/loss on disposal of assets, net 4 | — | | | — | | | 537 | | | 537 | | 146 | | 391 | | | | 1.57 | | |

| Litigation (recoveries)/charges, net | — | | | — | | | (41) | | | (41) | | (12) | | (29) | | | | (0.12) | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-GAAP | $ | 1,768 | | 10 | % | $ | 1,197 | | 1 | % | $ | 571 | | 35 | % | $ | 560 | | $ | 126 | | $ | 433 | | 32 | % | 22.5 | % | $ | 1.73 | | 44 | % |

| | | | | | | | | | | | | |

| First Quarter 2023 |

| GAAP | $ | 1,614 | | (2) | % | $ | 1,197 | | 7 | % | $ | 137 | | (67) | % | $ | 110 | | $ | (1) | | $ | 110 | | (59) | % | (0.7) | % | $ | 0.40 | | (57) | % |

| | | | | | | | | | | | | |

Shareholder cooperation

agreement costs | — | | | (6) | | | 6 | | | 6 | | 2 | | 4 | | | | 0.01 | | |

| Restructuring and employee severance | — | | | — | | | 29 | | | 29 | | 7 | | 22 | | | | 0.08 | | |

| Amortization and other acquisition-related costs | — | | | — | | | 71 | | | 71 | | 18 | | 53 | | | | 0.20 | | |

Impairments and (gain)/loss on disposal of assets, net 4 | — | | | — | | | 153 | | | 153 | | 34 | | 119 | | | | 0.44 | | |

| Litigation (recoveries)/charges, net | — | | | — | | | 27 | | | 27 | | 7 | | 20 | | | | 0.07 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-GAAP | $ | 1,614 | | (2) | % | $ | 1,191 | | 7 | % | $ | 423 | | (20) | % | $ | 396 | | $ | 67 | | $ | 328 | | (12) | % | 16.9 | % | $ | 1.20 | | (7) | % |

1For more information on these measures, refer to the Use of Non-GAAP Measures and Definitions schedules.

2Distribution, selling, general and administrative expenses.

3Attributable to Cardinal Health, Inc.

4 For the three months ended September 30, 2023 and 2022, impairments and (gain)/loss on disposals of assets, net includes pre-tax goodwill impairment charges of $581 million and $154 million, respectively, related to the Medical segment. For fiscal 2024 and 2023, the net tax benefits related to these impairment charges were $45 million and $12 million, respectively, and were included in the annual effective tax rate. As a result, the tax benefits for the three months ended September 30, 2023 and 2022 increased approximately by an incremental $99 million and $22 million, respectively, and will increase the provision for income taxes during the remainder of fiscal 2024 and 2023, respectively.

The sum of the components and certain computations may reflect rounding adjustments.

We generally apply varying tax rates depending on the item's nature and tax jurisdiction where it is incurred.

Schedule 6

Cardinal Health, Inc. and Subsidiaries

GAAP / Non-GAAP Reconciliation - GAAP Cash Flow to Non-GAAP Adjusted Free Cash Flow

| | | | | | | | | | | |

| | | |

| First Quarter | |

| (in millions) | 2024 | 2023 | |

| GAAP - Cash Flow Categories | | | |

| Net cash provided by operating activities | $ | 545 | | $ | 23 | | |

| Net cash used in investing activities | (63) | | (70) | | |

| Net cash used in financing activities | (666) | | (1,163) | | |

| Effect of exchange rates changes on cash and equivalents | (5) | | (15) | | |

| | | |

| Net decrease in cash and equivalents | $ | (189) | | $ | (1,225) | | |

| | | |

| Non-GAAP Adjusted Free Cash Flow | | | |

| Net cash provided by operating activities | $ | 545 | | $ | 23 | | |

| Additions to property and equipment | (92) | | (70) | | |

| Payments related to matters included in litigation (recoveries)/charges, net | 542 | | 389 | | |

| | | |

| | | |

| | | |

| Non-GAAP Adjusted Free Cash Flow | $ | 995 | | $ | 342 | | |

| | | |

| | | |

For more information on these measures, refer to the Use of Non-GAAP Measures and Definitions schedules.

Cardinal Health, Inc. and Subsidiaries

Use of Non-GAAP Measures

This earnings release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP").

In addition to analyzing our business based on financial information prepared in accordance with GAAP, we use these non-GAAP financial measures internally to evaluate our performance, engage in financial and operational planning, and determine incentive compensation because we believe that these measures provide additional perspective on and, in some circumstances are more closely correlated to, the performance of our underlying, ongoing business. We provide these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on our financial and operating results on a year-over-year basis and in comparing our performance to that of our competitors. However, the non-GAAP financial measures that we use may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by us should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth below should be carefully evaluated.

Exclusions from Non-GAAP Financial Measures

Management believes it is useful to exclude the following items from the non-GAAP measures presented in this report for its own and for investors’ assessment of the business for the reasons identified below:

•LIFO charges and credits are excluded because the factors that drive last-in first-out ("LIFO") inventory charges or credits, such as pharmaceutical manufacturer price appreciation or deflation and year-end inventory levels (which can be meaningfully influenced by customer buying behavior immediately preceding our fiscal year-end), are largely out of our control and cannot be accurately predicted. The exclusion of LIFO charges and credits from non-GAAP metrics facilitates comparison of our current financial results to our historical financial results and to our peer group companies’ financial results. We did not recognize any LIFO charges or credits during the periods presented.

•State opioid assessments related to prior fiscal years is the portion of state assessments for prescription opioid medications that were sold or distributed in periods prior to the period in which the expense is incurred. This portion is excluded from non-GAAP financial measures because it is retrospectively applied to sales in prior fiscal years and inclusion would obscure analysis of the current fiscal year results of our underlying, ongoing business. Additionally, while states' laws may require us to make payments on an ongoing basis, the portion of the assessment related to sales in prior periods are contemplated to be one-time, nonrecurring items. Income from state opioid assessments related to prior fiscal years represents reversals of accruals due to changes in estimates or when the underlying assessments were invalidated by a Court or reimbursed by manufacturers.

•Shareholder cooperation agreement costs includes costs such as legal, consulting and other expenses incurred in relation to the agreement (the "Cooperation Agreement") entered into among Elliott Associates, L.P., Elliott International, L.P. (together, "Elliott") and Cardinal Health, including costs incurred to negotiate and finalize the Cooperation Agreement and costs incurred by the Business Review Committee of the Board of Directors, which was formed under this Cooperation Agreement. We have excluded these costs from our non-GAAP metrics because they do not occur in or reflect the ordinary course of our ongoing business operations and may obscure analysis of trends and financial performance.

•Restructuring and employee severance costs are excluded because they are not part of the ongoing operations of our underlying business and include, but are not limited to, costs related to divestitures, closing and consolidating facilities, changing the way we manufacture or distribute our products, moving manufacturing of a product to another location, changes in production or business process outsourcing or insourcing, employee severance and realigning operations.

•Amortization and other acquisition-related costs, which include transaction costs, integration costs, and changes in the fair value of contingent consideration obligations, are excluded because they are not part of the ongoing operations of our underlying business and to facilitate comparison of our current financial results to our historical financial results and to our peer group companies' financial results. Additionally, costs for amortization of acquisition-related intangible assets are non-cash amounts, which are variable in amount and frequency and are significantly impacted by the timing and size of acquisitions, so their exclusion facilitates comparison of historical, current and forecasted financial results. We also exclude other acquisition-related costs, which are directly related to an acquisition but do not meet the criteria to be recognized on the acquired entity’s initial balance sheet as part of the purchase price allocation. These costs are also significantly impacted by the timing, complexity and size of acquisitions.

•Impairments and gain or loss on disposal of assets, net are excluded because they do not occur in or reflect the ordinary course of our ongoing business operations and are inherently unpredictable in timing and amount, and in the case of impairments, are non-cash amounts, so their exclusion facilitates comparison of historical, current and forecasted financial results.

•Litigation recoveries or charges, net are excluded because they often relate to events that may have occurred in prior or multiple periods, do not occur in or reflect the ordinary course of our business and are inherently unpredictable in timing and amount.

•Loss on early extinguishment of debt is excluded because it does not typically occur in the normal course of business and may obscure analysis of trends and financial performance. Additionally, the amount and frequency of this type of charge is not consistent and is significantly impacted by the timing and size of debt extinguishment transactions.

The tax effect for each of the items listed above is determined using the tax rate and other tax attributes applicable to the item and the jurisdiction(s) in which the item is recorded. The gross, tax and net impact of each item are presented with our GAAP to non-GAAP reconciliations.

Non-GAAP adjusted free cash flow: We provide this non-GAAP financial measure as a supplemental metric to assist readers in assessing the effects of items and events on our cash flow on a year-over-year basis and in comparing our performance to that of our peer group companies. In calculating this non-GAAP metric, certain items are excluded from net cash provided by operating activities because they relate to significant and unusual or non-recurring events and are inherently unpredictable in timing and amount. We believe adjusted free cash flow is important to management and useful to investors as a supplemental measure as it indicates the cash flow available for working capital needs, debt repayments, dividend payments, share repurchases, strategic acquisitions, or other strategic uses of cash. A reconciliation of our GAAP financial results to Non-GAAP adjusted free cash flow is provided in Schedule 6 of the financial statement tables included with this release.

Forward Looking Non-GAAP Measures

In this document, the Company presents certain forward-looking non-GAAP metrics. The Company does not provide outlook on a GAAP basis because the items that the Company excludes from GAAP to calculate the comparable non-GAAP measure can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of the Company’s routine operating activities. Additionally, management does not forecast many of the excluded items for internal use and therefore cannot create or rely on outlook done on a GAAP basis.

The occurrence, timing and amount of any of the items excluded from GAAP to calculate non-GAAP could significantly impact the Company’s fiscal 2024 GAAP results. Over the past five fiscal years, the excluded items have impacted the Company’s EPS from $0.75 to $18.06, which includes a $17.54 charge related to the opioid litigation we recognized in fiscal 2020.

Definitions

Growth rate calculation: growth rates in this report are determined by dividing the difference between current-period results and prior-period results by prior-period results.

Interest and Other, net: other (income)/expense, net plus interest expense, net.

Segment Profit: segment revenue minus (segment cost of products sold and segment distribution, selling, general, and administrative expenses).

Segment Profit margin: segment profit divided by segment revenue.

Non-GAAP gross margin: gross margin, excluding LIFO charges/(credits).

Non-GAAP distribution, selling, general and administrative expenses or Non-GAAP SG&A: distribution, selling, general and administrative expenses, excluding state opioid assessment related to prior fiscal years and shareholder cooperation agreement costs.

Non-GAAP operating earnings: operating earnings/(loss) excluding (1) LIFO charges/(credits), (2) state opioid assessment related to prior fiscal years, (3) shareholder cooperation agreement costs, (4) restructuring and employee severance, (5) amortization and other acquisition-related costs, (6) impairments and (gain)/loss on disposal of assets, net, and (7) litigation (recoveries)/charges, net.

Non-GAAP earnings before income taxes: earnings/(loss) before income taxes excluding (1) LIFO charges/(credits), (2) state opioid assessment related to prior fiscal years, (3) shareholder cooperation agreement costs, (4) restructuring and employee severance, (5) amortization and other acquisition-related costs, (6) impairments and (gain)/loss on disposal of assets, net, (7) litigation (recoveries)/charges, net and (8) loss on early extinguishment of debt.

Non-GAAP net earnings attributable to Cardinal Health, Inc.: net earnings attributable to Cardinal Health, Inc. excluding (1) LIFO charges/(credits), (2) state opioid assessment related to prior fiscal years, (3) shareholder cooperation agreement costs, (4) restructuring and employee severance, (5) amortization and other acquisition-related costs, (6) impairments and (gain)/loss on disposal of assets, net, (7) litigation (recoveries)/charges, net and (8) loss on early extinguishment of debt.

Non-GAAP effective tax rate: provision for/(benefit from) income taxes adjusted for the tax impacts of (1) LIFO charges/(credits), (2) state opioid assessment related to prior fiscal years, (3) shareholder cooperation agreement costs, (4) restructuring and employee severance, (5) amortization and other acquisition-related costs, (6) impairments and (gain)/loss on disposal of assets, net, (7) litigation (recoveries)/charges, net and (8) loss on early extinguishment of debt divided by (earnings before income taxes adjusted for the eight items above).

Non-GAAP diluted earnings per share attributable to Cardinal Health, Inc.: non-GAAP net earnings attributable to Cardinal Health, Inc. divided by diluted weighted-average shares outstanding.

Non-GAAP adjusted free cash flow: net cash provided by operating activities less payments related to additions to property and equipment, excluding settlement payments and receipts related to matters included in litigation (recoveries)/charges, net, as defined above, or other significant and unusual or non-recurring cash payments or receipts.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

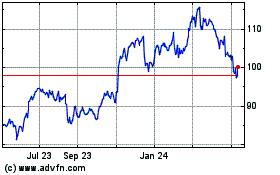

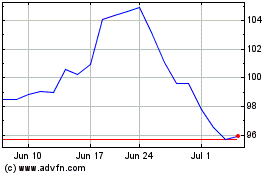

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Jul 2023 to Jul 2024