0000016732

false

0000016732

2023-08-07

2023-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of Earliest Event Reported):

August 7, 2023

CAMPBELL SOUP COMPANY

| New Jersey |

1-3822 |

21-0419870 |

| State of Incorporation |

Commission File Number |

I.R.S. Employer

Identification No.

|

One Campbell Place

Camden, New Jersey 08103-1799

Principal Executive Offices

Telephone Number: (856) 342-4800

Check the appropriate box below if the form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

| Capital Stock, par value $.0375 |

|

CPB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry into a Material Definitive Agreement.

Agreement and Plan of Merger

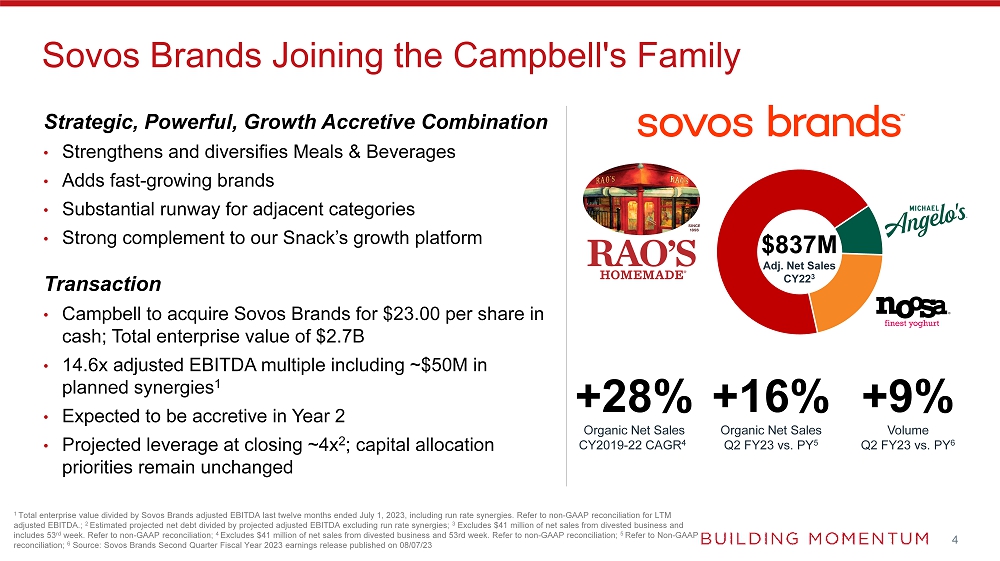

On August 7, 2023, Campbell Soup Company, a New

Jersey corporation (“Campbell” or the “Company”), Sovos Brands, Inc., a Delaware corporation (“Sovos”),

and Premium Products Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”),

entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which, among other things, on the

terms and subject to the conditions set forth therein, Merger Sub will merge with and into Sovos, with Sovos surviving as a wholly owned

subsidiary of the Company (the “Merger”).

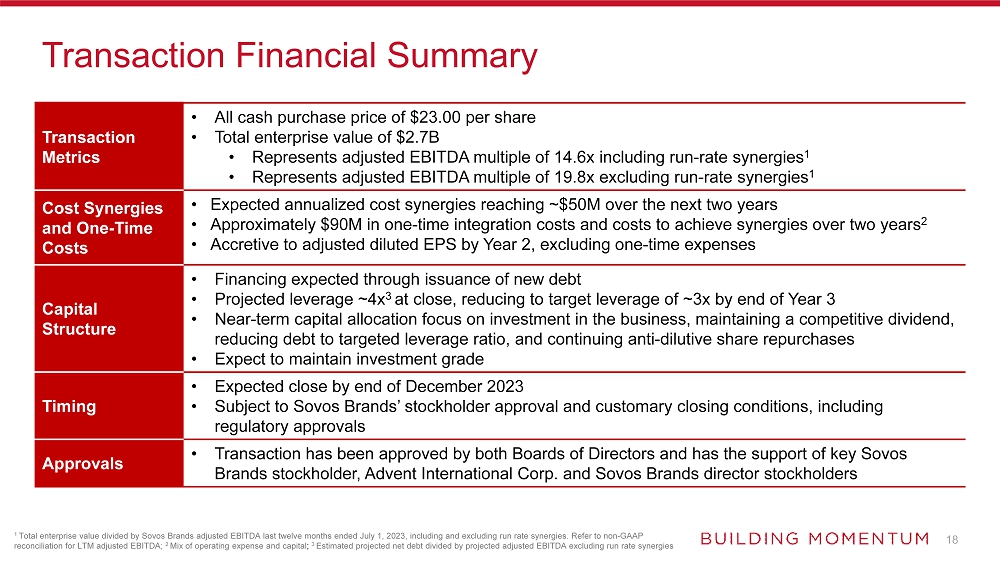

Subject to the terms and conditions set forth

in the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of common stock, par

value $0.001 per share of Sovos (“Sovos Common Stock”) (other than shares of Sovos Common Stock (i) held by Sovos as

treasury stock or owned by the Company or Merger Sub immediately prior to the Effective Time, (ii) held by any subsidiary of either Sovos

or the Company (other than Merger Sub) immediately prior to the Effective Time and (iii) any dissenting Sovos Common Stock) will be converted

into the right to receive an amount in cash equal to (x) $23.00 per share of Sovos Common Stock, without interest; plus (y) if

applicable, $0.00182 multiplied by the number of calendar days elapsed after nine months after the date of execution of the Merger

Agreement until and excluding the closing date of the Merger (the “Merger Consideration”).

Pursuant to the Merger Agreement, at the Effective

Time:

| · | Each restricted share of Sovos Common Stock that is outstanding as of immediately prior to the Effective

Time (each, “Sovos Restricted Stock”) will be canceled in exchange for the Merger Consideration; provided that each

share of Sovos Restricted Stock which vests solely based on the achievement of a performance condition and for which the applicable performance

condition remains unsatisfied (after giving effect to the Merger) shall, in accordance with its existing terms, be forfeited to the Sovos

Brands Limited Partnership as of immediately prior to the closing for no consideration to the applicable holder thereof and thereafter

shall be converted into the Merger Consideration in accordance with, and subject to the terms of, the Merger Agreement; and |

| · | Each outstanding award of restricted stock units in respect of shares of Sovos Common Stock, including

awards of performance-based restricted stock units (each, a “Sovos RSU Award”), that is held by any non-employee director

or former service provider of Sovos will be canceled at the Effective Time in exchange for the Merger Consideration. All other Sovos RSU

Awards will be converted upon the Effective Time into time-vesting restricted stock unit awards in respect of common stock of Campbell,

par value $0.0375 per share, having equivalent value and terms (including time-based vesting schedule). In the case of Sovos RSU Awards

subject to a performance-based vesting condition, such performance conditions will be deemed achieved at the target level (i.e., 100%),

or if applicable under the existing terms of such awards, the actual level of performance calculated as of the Effective Time (if greater). |

The consummation of the Merger (the “Closing”)

is subject to certain customary mutual conditions, including (i) the absence of any injunction or other order issued by a court of competent

jurisdiction in the United States or applicable law or legal prohibition in the United States that prohibits or makes illegal the consummation

of the Merger, (ii) the approval of Sovos’s shareholders holding at least a majority of the outstanding shares of Sovos Common Stock

entitled to vote on the adoption of the Merger Agreement (the “Requisite Sovos Vote”) and (iii) the expiration or termination

of any waiting period (and any extension thereof) applicable to the consummation of the Merger under the Hart-Scott-

Rodino Antitrust Improvements Act of 1976, as

amended (the “HSR Act”). The obligation of each party to consummate the Merger is also conditioned upon (a) the accuracy

of the representations and warranties of the other party as of the Closing (subject to customary materiality qualifiers), (b) compliance

by the other party in all material respects with its pre-Closing obligations and covenants under the Merger Agreement and (c) in Company’s

case, the absence of a material adverse effect with respect to Sovos.

Under the Merger Agreement, Sovos is subject

to customary “no-shop” restrictions on Sovos’s ability to solicit alternative acquisition proposals, to furnish

information to, and participate in discussions or negotiations with, third parties regarding any alternative acquisition proposals,

subject to a customary “fiduciary out” provision that allows Sovos, under certain specified circumstances, to furnish

information to, and participate in discussions or negotiations with, third parties with respect to an unsolicited, written

acquisition proposal from another third party if the board of directors of Sovos determines in good faith, after consultation with

its financial advisors and outside legal counsel, that such alternative acquisition proposal either (i) constitutes a superior

proposal or (ii) would reasonably be expected to lead to a superior proposal, and that failure to engage in negotiations or

discussions with such third parties would be inconsistent with its fiduciary duties. Under the Merger Agreement, Sovos is also

required to pay a termination fee of approximately $71 million to Campbell if the Merger Agreement is terminated due to Sovos’

board of directors changing its recommendation, if Sovos terminates the Merger Agreement to enter into an agreement for a Superior

Proposal, or if an alternative acquisition proposal has been publicly disclosed (and not withdrawn), the Merger Agreement is

terminated and Sovos consummates an alternative acquisition proposal, or signs a definitive agreement for an alternative acquisition proposal (that is subsequently

consummated), within twelve months of such termination.

The Merger Agreement contains certain customary

termination rights for the Company and Sovos, including the right of either party to terminate the Merger Agreement if the Merger is not

consummated on or before February 7, 2025 (the “End Date”) or on a change of recommendation of the Merger by Sovos’

board of directors.

If the Merger Agreement is terminated by either

party because (i) the Merger has not been consummated by the End Date or (ii) a court of competent jurisdiction or other governmental

authority in the United States issued an injunction, order or decree that prohibits or makes illegal consummation of the Merger or permanently

enjoins the Company, Merger Sub or Sovos from consummating the Merger, in each case, solely as a result of failure to obtain the expiration

or termination of the applicable waiting period relating to the Merger under the HSR Act or the issuance of an injunction, order or decree

relating to antitrust laws in the United States, then, in each case, the Company will be obligated to pay to Sovos a one-time fee equal

to $145 million in cash, minus any Reimbursed Expenses (as defined below).

Sovos has made customary representations,

warranties and covenants in the Merger Agreement, including, among others, covenants (i) to use reasonable best efforts to carry on

its business in all material respects in the ordinary course of business substantially consistent with past practice during the

period between the execution of the Merger Agreement and the consummation of the Merger and (ii) not to engage in specified types of

transactions or take specified actions during this period unless agreed to in writing by the Company.

The Company is required to reimburse Sovos for

up to $10 million of the reasonable and documented fees and expenses incurred by Sovos in connection with obtaining (or seeking to obtain)

the expiration or termination of the applicable waiting period under the HSR Act (the “Reimbursed Expenses”).

If the Merger is consummated, the Sovos Common

Stock will be delisted from NASDAQ and deregistered under the Securities Exchange Act of 1934 as promptly as practicable after the Effective

Time.

In addition, concurrently with the execution

of the Merger Agreement, and as a condition and inducement to the willingness of the Company and Merger Sub to enter into the Merger

Agreement, each of the members of the board of directors of Sovos that hold shares of Sovos Common Stock and certain shareholders

named on Exhibit A to the Merger Agreement (together, the “Supporting Shareholders”), have entered into Voting

Agreements (collectively, the “Voting Agreements”), pursuant to which such Supporting Shareholders agree, among

other things, to vote in favor of the adoption of the Merger Agreement. In the aggregate, the Voting Agreements obligate the

Supporting Shareholders to vote approximately 34% of the outstanding shares of Sovos Common Stock, as of the date hereof, in favor of adoption of the Merger

Agreement for so long as Sovos’s board of directors recommends the Merger. A copy of the Voting Agreement with certain

shareholders named on Exhibit A to the Merger Agreement and the form of Voting Agreement with each of the members of the board of

directors of Sovos that hold shares of Sovos Common Stock are attached as Exhibit 10.1 and 10.2, respectively.

The Merger Agreement and the Voting Agreements

and the above descriptions have been included to provide investors with information regarding each of their terms and conditions. They

are not intended to provide any other factual information about the Company, Sovos or any of their respective subsidiaries or affiliates

or to modify or supplement any factual disclosures about the Company or Sovos included in their public reports filed with the SEC. The

representations, warranties and covenants contained in the Merger Agreement and the Voting Agreements were made only for purposes of the

Merger Agreement and the Voting Agreements, as applicable, and, as of specific dates, were solely for the benefit of the parties to the

Merger Agreement and the Voting Agreements, as applicable, may be subject to limitations agreed upon by the contracting parties, including

being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement

and the Voting Agreements, as applicable, instead of establishing these matters as facts, and may be subject to standards of materiality

that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions

thereof as characterizations of the actual state of facts or condition of the Company, Sovos or any of their respective subsidiaries or

affiliates.

The foregoing description of the Merger Agreement,

the Voting Agreements and the transactions contemplated thereby, including the Merger, does not purport to be complete and is qualified

in its entirety by reference to the actual Merger Agreement and Voting Agreements. A copy of the Merger Agreement is filed as Exhibit

2.1 to this Current Report on Form 8-K and incorporated herein by reference. A copy of the Voting Agreement with certain shareholders

named on Exhibit A to the Merger Agreement and the form of Voting Agreement with each of the members of the board of directors of Sovos

that hold shares of Sovos Common Stock are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and incorporated herein

by reference.

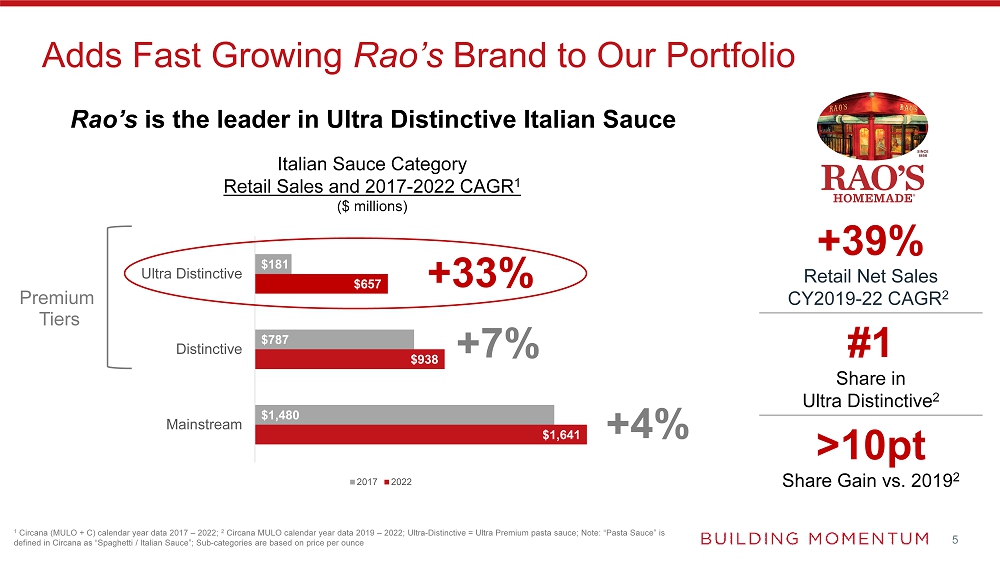

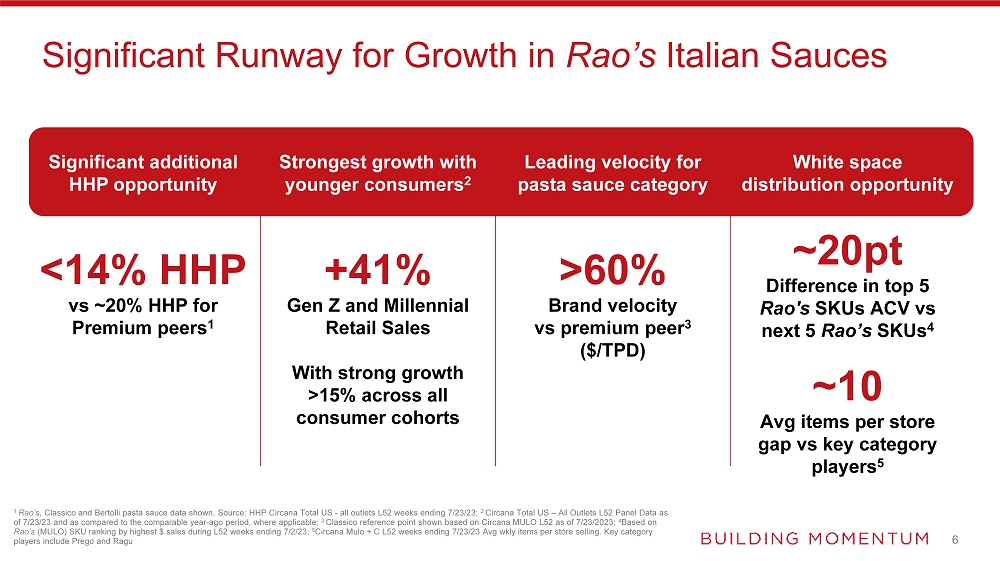

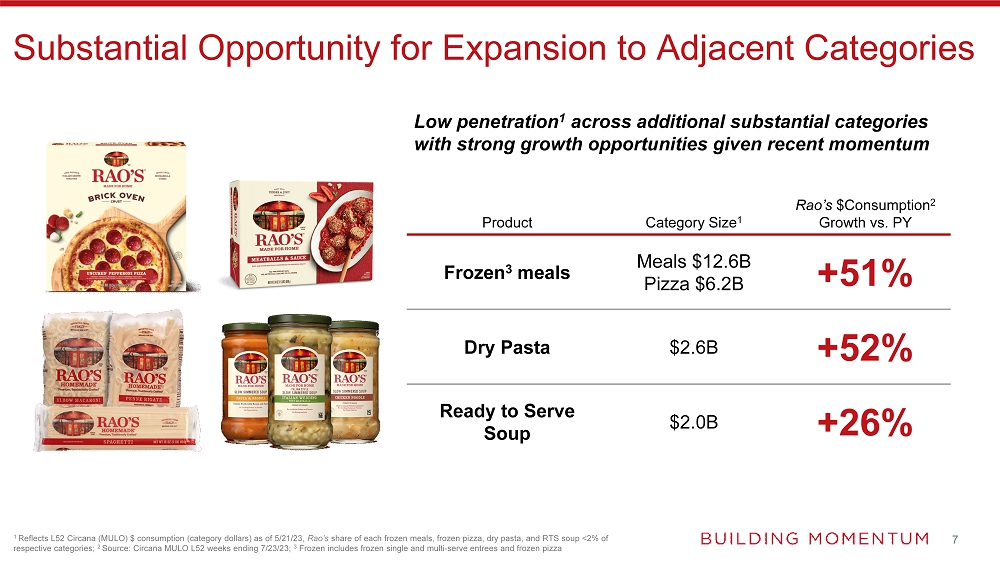

Item 7.01. Regulation FD Disclosure.

Investor Presentation

On August 7, 2023, Campbell

posted on its website, www.campbellsoupcompany.com, under "Investor Center," an investor presentation (the "Investor

Presentation"). A copy of the Investor Presentation that was posted by Campbell is furnished as Exhibit 99.1 hereto and is incorporated

in this Item 7.01 by reference.

Press Release

On August 7, 2023, Campbell

issued a press release announcing the entry into the Merger Agreement. The press release is attached hereto as Exhibit 99.2 hereto and

is incorporated in this Item 7.01 by reference.

The

information contained in this Item 7.01 and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

This Report contains "forward-looking"

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current

expectations regarding our future results of operations, economic performance, financial condition and achievements. These forward-looking

statements can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend,"

"plan," "pursue," "strategy," "target," "will" and similar expressions. One can also

identify forward-looking statements by the fact that they do not relate strictly to historical or current facts, and may reflect anticipated

cost savings or implementation of our strategic plan. These statements reflect our current plans and expectations and are based on information

currently available to us. They rely on several assumptions regarding future events and estimates which could be inaccurate and which

are inherently subject to numerous risks and uncertainties.

We wish to caution the reader that the following

important factors and those important factors described in our other Securities and Exchange Commission filings, or in our 2022 Annual

Report on Form 10-K, could affect our actual results and could cause such results to vary materially from those expressed in any forward-looking

statements made by, or on behalf of, us:

| · | the conditions to the completion of the Sovos transaction, including obtaining Sovos stockholder approval, may not be satisfied, or

the regulatory approvals required for the transaction may not be obtained on the terms expected, on the anticipated schedule, or at all; |

| · | long-term financing for the Sovos transaction may not be obtained on favorable terms, or at all; |

| · | closing of the Sovos transaction may not occur or be delayed, either as a result of litigation related to the transaction or otherwise

or result in significant costs of defense, indemnification and liability; |

| · | the risk that the cost savings and any other synergies from the Sovos transaction may not be fully realized or may take longer or

cost more to be realized than expected, including that the Sovos transaction may not be accretive within the expected timeframe or the

extent anticipated; |

| · | completing the Sovos transaction may distract the Company’s management from other important matters; |

| · | the risks related to the availability of, and cost inflation in, supply chain inputs, including labor, raw materials, commodities,

packaging and transportation; |

| · | the Company’s ability to execute on and realize the expected benefits from its strategy, including growing sales in snacks and

growing/maintaining its market share position in soup; |

| · | the impact of strong competitive responses to the Company’s efforts to leverage its brand power with product innovation, promotional programs and new advertising;

|

| · |

the risks associated with trade and consumer acceptance of product improvements, shelving initiatives, new products and pricing and promotional strategies; |

| · | the ability to realize projected cost savings and benefits from cost savings initiatives and the integration of recent acquisitions; |

| · | disruptions in or inefficiencies to the Company’s or Sovos’ supply chain and/or operations, including reliance on key

supplier relationships; |

| · | the impacts of, and associated responses to, the COVID-19 pandemic on the Company’s and/or Sovos’s business,

suppliers, customers, consumers and employees; |

| · | the risks related to the effectiveness of the Company's hedging activities and the Company's ability to respond to volatility in commodity

prices; |

| · | the Company’s ability to manage changes to its organizational structure and/or business processes, including selling, distribution, manufacturing and information management systems or processes;

|

| · |

changes in consumer demand for the Company’s and/or Sovos’s products and

favorable perception of the Company’s and/or Sovos’s brands; |

| · | changing inventory management practices by certain of the Company’s and Sovos’ key customers; |

| · | a changing customer landscape, with value and e-commerce retailers expanding their market presence, while certain of the Company’s

key customers maintain significance to the Company’s business; product quality and safety issues, including recalls and product

liabilities; |

| · | the possible disruption to the independent contractor distribution models used by certain of the Company’s businesses, including

as a result of litigation or regulatory actions affecting their independent contractor classification; |

| · | the uncertainties of litigation and regulatory actions against the Company or Sovos; |

| · | the costs, disruption and diversion of management’s attention associated with activist investors; |

| · | a disruption, failure or security breach of the Company’s or the Company's vendors' information technology systems, including

ransomware attacks; |

| · | impairment to goodwill or other intangible assets; |

| · | the Company’s and Sovos’ ability to protect their respective intellectual property rights; |

| · | increased liabilities and costs related to the Company’s defined benefit pension plans; |

| · | the Company’s and Sovos’ ability to attract and retain key talent; |

| · | goals and initiatives related to, and the impacts of, climate change, including weather-related events; |

| · | negative changes and volatility in financial and credit markets, |

| · | deteriorating economic conditions and other external factors, including changes in laws and regulations; |

| · | unforeseen business disruptions or other impacts due to political instability, civil disobedience, terrorism, armed hostilities (including

the ongoing conflict between Russia and Ukraine), extreme weather conditions, natural disasters, other pandemics or other calamities;

and |

| · | other factors described in the Company’s most recent Form 10-K and subsequent Securities and Exchange Commission filings. |

This discussion of uncertainties is by no means exhaustive but is designed

to highlight important factors that may impact our outlook. The Company disclaims any obligation or intent to update the forward-looking

statements in order to reflect events or circumstances after the date of this release.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit No.

|

Description. |

| |

|

| 2.1* |

Agreement and Plan of Merger, dated as of August 7, 2023, by and among Campbell Soup Company, Premium Products Merger Sub, Inc. and Sovos Brands, Inc. |

| 10.1* |

Voting Agreement, dated as of August 7, 2023, by and among Campbell Soup Company and the stockholders of Sovos Brands, Inc. parties thereto |

| 10.2 |

Form of Voting Agreement |

| 99.1 |

Investor Presentation |

| 99.2 |

Press Release, dated as of August 7, 2023 |

| 104 |

Cover Page Interactive Data File (embedded within the inline XBRL document) |

| |

|

| * Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation

S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CAMPBELL SOUP COMPANY |

| |

|

|

|

|

| Date: August 7, 2023 |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Carrie L. Anderson |

|

| |

|

Name: |

Carrie L. Anderson |

|

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

|

Exhibit

2.1

Execution Version

AGREEMENT AND

PLAN OF MERGER

dated as of

August 7, 2023

among

Sovos Brands, Inc.,

Campbell Soup Company

and

Premium Products Merger Sub, Inc.

TABLE OF CONTENTS

Page

| Article

1 Definitions |

1 |

| Section

1.01. Definitions |

1 |

| Section

1.02. Other Definitional and Interpretative Provisions |

13 |

| Article

2 The Merger |

14 |

| Section

2.01. The Merger |

14 |

| Section

2.02. Conversion of Shares |

15 |

| Section

2.03. Surrender and Payment |

15 |

| Section

2.04. Dissenting Shares |

17 |

| Section

2.05. Company Equity Awards |

18 |

| Section

2.06. Adjustments |

20 |

| Section

2.07. Withholding Rights |

21 |

| Section

2.08. Lost Certificates |

21 |

| Article

3 The Surviving Corporation |

21 |

| Section

3.01. Certificate of Incorporation |

21 |

| Section

3.02. Bylaws |

21 |

| Section

3.03. Directors and Officers |

21 |

| Article

4 Representations and Warranties of the Company |

22 |

| Section

4.01. Corporate Existence and Power |

22 |

| Section

4.02. Corporate Authorization |

22 |

| Section

4.03. Governmental Authorization |

23 |

| Section

4.04. Non-contravention |

23 |

| Section

4.05. Capitalization |

24 |

| Section

4.06. Subsidiaries |

25 |

| Section

4.07. SEC Filings and the Sarbanes-Oxley Act |

26 |

| Section

4.08. Financial Statements |

28 |

| Section

4.09. Disclosure Documents |

28 |

| Section

4.10. Absence of Certain Changes |

28 |

| Section

4.11. No Undisclosed Material Liabilities |

28 |

| Section

4.12. Compliance with Laws, Permits and Court Orders |

29 |

| Section

4.13. Insurance |

30 |

| Section

4.14. Litigation |

30 |

| Section

4.15. Properties |

30 |

| Section

4.16. Intellectual Property |

31 |

| Section

4.17. Data Privacy & Cybersecurity |

32 |

| Section

4.18. Taxes |

33 |

| Section

4.19. Employee Benefit Plans |

34 |

| Section

4.20. Labor Matters |

36 |

| Section

4.21. Environmental Matters |

38 |

| Section

4.22. Material Contracts |

38 |

| Section

4.23. Affiliate Transactions |

41 |

| Section

4.24. Customers; Suppliers |

41 |

| Section

4.25. Food Regulatory Matters |

42 |

| Section

4.26. Finders’ Fees |

43 |

| Section

4.27. Opinion of Financial Advisor |

44 |

| Section

4.28. Antitakeover Statutes |

44 |

| Section

4.29. No Other Representations or Warranties |

44 |

| Article

5 Representations and Warranties of Parent |

45 |

| Section

5.01. Corporate Existence and Power |

45 |

| Section

5.02. Corporate Authorization |

45 |

| Section

5.03. Governmental Authorization |

46 |

| Section

5.04. Non-contravention |

46 |

| Section

5.05. Capitalization of Merger Sub |

46 |

| Section

5.06. Financing |

46 |

| Section

5.07. Disclosure Documents |

46 |

| Section

5.08. Not an Interested Stockholder |

47 |

| Section

5.09. Finders’ Fees |

47 |

| Section

5.10. No Other Representations or Warranties |

47 |

| Article

6 Covenants of the Company |

48 |

| Section

6.01. Conduct of the Company |

48 |

| Section

6.02. Access to Information |

52 |

| Section

6.03. No Solicitation; Other Offers |

53 |

| Article

7 Covenants of Parent |

57 |

| Section

7.01. Obligations of Merger Sub |

57 |

| Section

7.02. Director and Officer Liability |

57 |

| Section

7.03. Employee Matters |

59 |

| Article

8 Covenants of Parent and the Company |

62 |

| Section

8.01. Reasonable Best Efforts |

62 |

| Section

8.02. Certain Filings |

65 |

| Section

8.03. Proxy Statement; Company Meeting |

65 |

| Section

8.04. Public Announcements |

67 |

| Section

8.05. Further Assurances |

68 |

| Section

8.06. Section 16 Matters |

68 |

| Section

8.07. Notices of Certain Events |

68 |

| Section

8.08. Stock Exchange De-listing |

69 |

| Section

8.09. Takeover Statutes |

69 |

| Section

8.10. Stockholder Litigation |

69 |

| Section

8.11. Financing Cooperation |

69 |

| Article

9 Conditions to the Merger |

73 |

| Section

9.01. Conditions to the Obligations of Each Party |

73 |

| Section

9.02. Conditions to the Obligations of Parent and Merger Sub |

73 |

| Section

9.03. Conditions to the Obligations of the Company |

74 |

| Article

10 Termination |

75 |

| Section

10.01. Termination |

75 |

| Section

10.02. Effect of Termination |

76 |

| Article

11 Miscellaneous |

77 |

| Section

11.01. Notices |

77 |

| Section

11.02. Survival of Representations, Warranties, Covenants and Agreements |

78 |

| Section

11.03. Amendments and Waivers |

78 |

| Section

11.04. Expenses |

79 |

| Section

11.05. Disclosure Schedule and SEC Document References |

80 |

| Section

11.06. Binding Effect; Benefit; Assignment |

81 |

| Section

11.07. Governing Law |

81 |

| Section

11.08. Jurisdiction |

81 |

| Section

11.09. WAIVER OF JURY TRIAL |

82 |

| Section

11.10. Counterparts; Effectiveness |

82 |

| Section

11.11. Entire Agreement |

82 |

| Section

11.12. Severability |

82 |

| Section

11.13. Specific Performance |

83 |

| Section

11.14. Financing Matters |

83 |

Exhibit A – Voting Agreement Parties

Exhibit B – Certificate of Incorporation

of Surviving Corporation

AGREEMENT AND

PLAN OF MERGER

AGREEMENT AND PLAN

OF MERGER (as amended in accordance with the terms and conditions hereof, this “Agreement”) dated as of August 7,

2023 by and among Sovos Brands, Inc., a Delaware corporation (the “Company”), Campbell Soup Company, a New Jersey

corporation (“Parent”), and Premium Products Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary

of Parent (“Merger Sub”).

W I T N E S

S E T H :

WHEREAS, the respective

boards of directors of the Company, Parent and Merger Sub have approved and declared advisable the acquisition of the Company by Parent

by means of a merger of Merger Sub with and into the Company on the terms and subject to the conditions set forth in this Agreement;

and

WHEREAS, concurrently

with the execution of this Agreement, and as a condition and inducement to the willingness of Parent and Merger Sub to enter into this

Agreement, each of the members of the Board of Directors (the “Board of Directors”) of the Company who holds Shares

and each of the Persons set forth on Exhibit A has entered into a Voting Agreement (the “Voting Agreement”)

with Parent pursuant to which each such Person has agreed to vote the number of Shares beneficially owned by it and set forth in the

Voting Agreement, in favor of the Merger and the approval and adoption of this Agreement, in accordance with the terms and conditions

thereof.

NOW, THEREFORE,

in consideration of the foregoing and the representations, warranties, covenants and agreements contained herein, and for other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally

bound agree as follows:

Article

1

Definitions

Section 1.01.

Definitions. (a) As used herein, the following terms have the following meanings:

“1933 Act”

means the Securities Act of 1933.

“1934 Act”

means the Securities Exchange Act of 1934.

“Acquisition

Proposal” means any proposal or offer (other than any proposal or offer by Parent or any of its Affiliates) with respect to

(i) any acquisition or purchase, direct or indirect, of 15% or more of the consolidated assets of the Company or 15% or more of any class

of equity or voting securities of the Company or any of its Subsidiaries whose assets, individually or in the aggregate, constitute 15%

or more of the consolidated assets of the Company, (ii) any tender offer (including a self-tender offer) or exchange offer that, if consummated,

would result in any Third Party beneficially owning 15% or more of any class of equity or voting securities of the Company or any of

its Subsidiaries

whose assets, individually or in the

aggregate, constitute 15% or more of the consolidated assets of the Company, or (iii) a merger, consolidation, share exchange, business

combination, sale of substantially all the assets, reorganization, recapitalization, liquidation, dissolution or other similar transaction

involving the Company or any of its Subsidiaries whose assets, individually or in the aggregate, constitute 15% or more of the consolidated

assets of the Company.

“Action”

means any action, cause of action, suit, audit, investigation, litigation, arbitration, mediation, complaint, citation, claim (including

any crossclaim or counterclaim), written demand, subpoena, enforcement action or proceeding (including any civil, criminal, administrative,

regulatory, appellate or other proceeding), whether at equity or at law, in contract, in tort or otherwise, by or before, or overseen

by, issued by, filed with or submitted to, any court or other Governmental Authority or any arbitrator or arbitral body.

“Additional

Consideration” means an amount in cash equal to (i) $0.00182 multiplied by (ii) the number of calendar days elapsed

after the Additional Consideration Date to and excluding the Closing Date; provided, however, “Additional Consideration”

means $0 if the Closing Date occurs on or prior to the Additional Consideration Date.

“Additional

Consideration Date” means the date that is nine months after the date of this Agreement.

“Advent”

means, collectively, all of the Persons identified under the heading “Advent” on Exhibit A.

“Affiliate”

means, with respect to any Person, any other Person who directly or indirectly controls, is controlled by or is under common control

with such Person.

“Applicable

Data Protection Laws” means all Applicable Laws relating to data privacy, data protection, cybersecurity and/or the processing

of Personal Information, including the California Consumer Privacy Act of 2018 (as amended by the California Privacy Rights Act of 2020),

the EU 2016/679 General Data Protection Regulation and the equivalent thereof under the laws of the United Kingdom.

“Applicable

Data Protection Requirements” means all (i) Applicable Data Protection Laws and (ii) published external-facing privacy notices,

binding industry standards and restrictions and requirements contained in any Contract to which the Company or any of its Subsidiaries

is bound, in each case, under this clause (ii), relating to data privacy, data protection, cybersecurity and/or the processing of Personal

Information.

“Applicable

Law” means, with respect to any Person, any federal, state, local, foreign, international or transnational law (statutory,

common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, permit, injunction, judgment, award,

decree or ruling enacted, adopted, promulgated or applied by a Governmental Authority (having competent jurisdiction) that is binding

on or applicable to such Person.

“Business

Day” means a day, other than Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or

required by Applicable Law to close.

“COBRA”

means the Consolidated Omnibus Budget Reconciliation Act of 1985.

“Code”

means the Internal Revenue Code of 1986.

“Collective

Bargaining Agreement” means any agreement, memorandum of understanding or other contractual obligation between the Company

or any of its Subsidiaries and any labor or trade union or organization, works council or other authorized employee representative representing

Company Employees in their capacities as such.

“Company

10-K” means the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2022.

“Company

10-Q” means the Company’s quarterly report on Form 10-Q for the quarterly period ended April 1, 2023.

“Company

Balance Sheet” means the unaudited consolidated balance sheet of the Company as of the Company Balance Sheet Date and the footnotes

thereto set forth in the Company 10-Q.

“Company

Balance Sheet Date” means April 1, 2023.

“Company

Disclosure Schedule” means the disclosure schedule dated the date hereof regarding this Agreement that has been provided by

the Company to Parent and Merger Sub.

“Company

Employee” means, as of any time, any employee of the Company or any of its Subsidiaries.

“Company

Equity Awards” means the Company RSUs, the Company PSUs and the Company Restricted Stock.

“Company

Material Adverse Effect” means a material adverse effect on the condition (financial or otherwise), business, assets, or results

of operations of the Company and its Subsidiaries, taken as a whole, excluding any event, change, circumstance, effect, occurrence, condition,

state of facts or development to the extent arising or resulting from or relating to (i) changes, developments or conditions after the

date hereof in financial or securities markets in the United States or in any other location throughout the world relevant to the operation

of the Company and its Subsidiaries or in the general economic or political conditions in the United States or in any other location

throughout the world relevant to the operation of the Company and its Subsidiaries, or in the industry in which the Company and its Subsidiaries

operate, (ii) any adoption, implementation, enforcement, promulgation, repeal, amendment, interpretation, reinterpretation or other changes,

or proposed adoption, implementation, enforcement,

promulgation, repeal, amendment, interpretation,

reinterpretation or other changes in Applicable Law or GAAP after the date hereof, (iii) acts of war (whether or not declared), the commencement,

continuation or escalation of a war, acts of armed hostility, sabotage or terrorism or any material worsening of such conditions threatened

or existing as of the date of this Agreement or natural disasters, calamities or force majeure events, (iv) any epidemic or pandemic

(including the COVID-19 pandemic), (v) the execution, public announcement or pendency of this Agreement or the transactions contemplated

hereby or the consummation of such transactions (including the identity of Parent or any of its Affiliates as the acquiror of the Company),

or communication by Parent or any Affiliate of Parent with respect to the post-Closing conduct of the business or deployment or disposition

of any of the assets of the Company or any of its Subsidiaries (it being understood that this clause (v) shall not apply to a breach

of any representation or warranty contained in Sections 4.04, 4.16(b)(iv) or 4.19(e) related to the announcement or consummation of the

transactions contemplated hereby or the failure to satisfy the condition in Section 9.02(b) as a result of any breach of any such representation

or warranty), (vi) any failure of the Company or any of its Subsidiaries to meet, with respect to any period or periods, any internal

projections, forecasts, estimates of earnings or revenues or business plans (but not the underlying facts or basis for such failure to

meet projections, forecasts, estimates of earnings or revenues or business plans, which, unless otherwise excepted pursuant to clauses

(i)-(v) or (vii)-(ix) of this definition, may be taken into account in determining whether there has been or would reasonably be expected

to be a Company Material Adverse Effect), (vii) any decline in the market price or trading volume of the Company’s common stock

(but not the underlying facts or basis for such decline, which, unless otherwise excepted pursuant to clauses (i)-(vi) or (viii)-(ix)

of this definition, may be taken into account in determining whether there has been or would reasonably be expected to be a Company Material

Adverse Effect), (viii) any actions taken by the Company or any of its Subsidiaries as required by this Agreement or (ix) any action

explicitly required under this Agreement or any action taken or omitted to be taken at the written request of Parent; provided,

however, that if any event, change, circumstance, effect, occurrence, condition, state of facts or development described in any

of clauses (i) through (iii) has a disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to the other

participants in the industry in which the Company and its Subsidiaries operate, such disproportionate effect shall be taken into account

in determining whether there has been, or would reasonably be expected to be, a Company Material Adverse Effect.

“Company

Modified IPO PSUs” means the performance-based restricted stock units granted pursuant to the Equity Plans that were modified

to provide that the award shall vest upon the earlier of a fixed date and the achievement of a volume-weighted average trading price

performance-based vesting condition.

“Company

Performance-Based Restricted Stock” means an award of Shares granted pursuant to the Equity Plans, including pursuant to an

agreement to which the Company is a party, that is subject to performance-based vesting conditions but that is not Company Time- and

Performance-Based Restricted Stock.

“Company

Post-IPO PSUs” means the performance-based restricted stock units granted pursuant to the Equity Plans that are not Company

Modified IPO PSUs or Company Unmodified IPO PSUs.

“Company

PSUs” means, collectively, the Company Modified IPO PSUs, the Company Unmodified IPO PSUs and the Company Post-IPO PSUs.

“Company

Restricted Stock” means, collectively, the Company Time-Based Restricted Stock, the Company Time- and Performance-Based Restricted

Stock and the Company Performance-Based Restricted Stock.

“Company

RSUs” means the time-based restricted stock units granted pursuant to the Equity Plans.

“Company

Time- and Performance-Based Restricted Stock” means an award of Shares granted pursuant to the Equity Plans, including pursuant

to an agreement to which the Company is a party, that is scheduled to vest upon the earlier of a fixed date and the achievement of a

performance-based vesting condition.

“Company

Time-Based Restricted Stock” means an award of Shares granted pursuant to the Equity Plans, including pursuant to an agreement

to which the Company is a party, that is subject only to time-based vesting conditions.

“Company

Unmodified IPO PSUs” means the performance-based restricted stock units granted pursuant to the Equity Plans that vest based

solely on the achievement of a volume-weighted average trading price performance-based vesting condition (and which, for the avoidance

of doubt, were not subsequently modified).

“Continuing

Employee” means each Company Employee employed by the Company or any of its Subsidiaries immediately prior to the Effective

Time whose employment with the Surviving Corporation (or Parent or any of its Affiliates) continues after the Effective Time.

“Contract”

means any contract, binding letter of intent, lease, sublease, occupancy agreement, license, sublicense, indenture, note, bond, loan,

mortgage, agreement, deed of trust, franchise, license or other binding instrument, commitment or undertaking, including any exhibits,

annexes, appendices or attachments thereto, and any amendments, modifications, supplements, extensions or renewals thereto, excluding

sale and purchase orders.

“control”

(including the terms “controlled,” “controlled by” and “under common control with”) means the possession,

directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the

ownership of voting securities, by contract or otherwise.

“COVID-19

Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing,

shut down, closure, sequester or any other Applicable Law related to COVID-19.

“COVID-19

Responses” means any reasonable action that is necessary to be taken in response to any COVID-19 Measures, including the establishment

of any reasonably necessary policy, procedure or protocol.

“Debt Financing

Sources” means the lenders, agents, underwriters, commitment parties and arrangers of any New Debt Financing, together with

their respective Affiliates and Debt Financing Sources Representatives and their successors and assigns, including any successors or

assigns via joinder agreements, indentures or credit agreements relating thereto.

“Debt Financing

Sources Representative” means, with respect to any Debt Financing Source, such Debt Financing Source’s directors, officers,

partners, principals, employees, counsel, financial advisors, auditors, agents and other authorized representatives.

“DGCL”

means the General Corporation Law of the State of Delaware.

“Employee

Plan” means any (i) “employee benefit plan” as defined in Section 3(3) of ERISA (regardless of whether such

plan is subject to ERISA), (ii) compensation, employment, independent contractor, severance, termination protection, change in control,

transaction bonus, retention or similar plan, agreement, arrangement, program or policy or (iii) other plan, agreement, arrangement,

program or policy providing for compensation, bonuses, profit-sharing, equity or equity-based compensation or other forms of incentive

or deferred compensation, vacation benefits, insurance (including any self-insured arrangement), medical, dental, vision, prescription

or fringe benefits, life insurance, relocation or expatriate benefits, perquisites, disability or sick leave benefits, employee assistance

program, or post-employment or retirement benefits (including compensation, pension, health, medical or insurance benefits), including,

for the avoidance of doubt, any Company Equity Award, in each case, whether or not written that is sponsored, maintained, administered,

contributed to (or required to be contributed to), or entered into, by the Company or any of its Subsidiaries for the current or future

benefit of any current or former Service Provider or with respect to which the Company or any of its Subsidiaries has or would reasonably

be expected to have any direct or indirect liability.

“Environment”

means any air (whether ambient outdoor or indoor), surface water, drinking water, groundwater, land surface, wetland, subsurface strata,

soil, sediment, plant or animal life and any other natural resources.

“Environmental

Laws” means any Applicable Laws (including common law) or any legally binding consent order or decree issued by any Governmental

Authority, relating to (i) protection of the Environment, (ii) the prevention of pollution, (iii) the containment, clean-up, preservation,

protection and reclamation of the Environment, (iv) health and safety (as it relates to exposure to Hazardous Substances) or (v) the

generation, use, management, transportation, storage, disposal, treatment or release of Hazardous Substances.

“Environmental

Permits” means all Permits required under Environmental Laws.

“Equity

Award Exchange Ratio” means the quotient obtained by dividing (i) the Merger Consideration by (ii) the volume-weighted average

closing price per share of Parent Common Stock on the New York Stock Exchange for the five consecutive trading day period ending on the

last trading day preceding the Closing Date.

“Equity

Plans” means the Sovos Brands Limited Partnership 2017 Equity Incentive Plan and the Sovos Brands, Inc. 2021 Equity Incentive

Plan.

“ERISA”

means the Employee Retirement Income Security Act of 1974.

“ERISA

Affiliate” of any entity means any other entity that, together with such entity, would be treated as a single employer under

Section 414 of the Code.

“GAAP”

means generally accepted accounting principles in the United States.

“Governmental

Authority” means any transnational, domestic or foreign federal, state, provincial, local or other governmental, regulatory

or administrative authority, department, court, agency, commission or official, including any political subdivision thereof, or any other

governmental or quasi-governmental (including self-regulatory) authority or instrumentality.

“Hazardous

Substance” means any pollutant, contaminant, waste or chemical or any toxic, radioactive, ignitable, corrosive, reactive or

otherwise hazardous substance, waste or material, or any substance, waste or material displaying any of the foregoing characteristics,

in each case, that is regulated under any Environmental Law, including (i) petroleum and petroleum products, including crude oil and

any fractions thereof, (ii) natural gas, synthetic gas and any mixtures thereof, (iii) polychlorinated biphenyls, (iv) asbestos or asbestos-containing

materials, (v) radioactive materials, (vi) produced waters and (vii) per- and polyfluoroalkyl substances.

“HSR Act”

means the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“Indebtedness”

means, with respect to any Person, without duplication, all obligations or undertakings by such Person: (a) for borrowed money; (b) evidenced

by bonds, debentures, notes or similar instruments; (c) pursuant to securitization or factoring programs or arrangements; (d) pursuant

to guarantees of any Indebtedness of any other Person (other than between or among any of the Company and its wholly owned Subsidiaries);

(e) net cash payment obligations of such Person under swaps, options, derivatives and other hedging Contracts or arrangements that will

be payable upon termination thereof (assuming termination on the date of determination); (f) letters of credit and bank guarantees entered

into by or on behalf of such Person; or (g) guarantees of any of the foregoing clauses (a)-(c) and (e).

“Intellectual

Property” means any and all intellectual property rights or similar proprietary rights arising from or under the Applicable

Laws of the United States or any

other jurisdiction, including rights

in all of the following: (a) trademarks, service marks, trade names, logos, brand names, corporate names, trade dress, domain names,

social media identifiers and all other indications of origin (whether registered or not), including all goodwill associated with any

of the foregoing and all applications, registrations and renewals in connection therewith; (b) inventions, whether patentable or not,

all improvements thereto, patents and patent applications (together with any and all divisions, reissuances, continuations, continuations-in-part,

revisions, provisionals, renewals, extensions and reexaminations thereof); (c) Trade Secrets; (d) works of authorship, copyrights (whether

registered or not), all registrations or applications therefor and any and all renewals, extensions, reversions, restorations, derivative

works and moral rights in connection with any of the foregoing; (e) data, database and data collection rights; (f) design rights; and

(g) computer software (including source code, object code, firmware, operating systems and specifications).

“IT Assets”

means any and all computers, software, firmware, middleware, servers, networks, workstations, routers, hubs, circuits, switches, data

communications lines and all other information technology assets and equipment (including laptops and mobile devices), and documentation

related to any of the foregoing, in each case, owned by, or licensed or leased to (or purported to be owned by or licensed or leased

to) the Company or its Subsidiaries.

“Key Employee”

means a Company Employee who either (i) is an officer or director subject to the reporting requirements of Section 16(a) of the 1934

Act with respect to the Company or (ii) has a title of vice president (or a more senior title) with the Company or any of its Subsidiaries.

“Knowledge”

means, with respect to the Company, the actual knowledge after reasonable investigation or inquiry (which shall include inquiry of the

applicable individual’s direct reports of the subject matter in question) of the individuals listed on Section

1.01(a) of the Company Disclosure Schedule.

“Licensed

Intellectual Property” means any and all Intellectual Property owned by a third party and licensed or sublicensed to the Company

or any of its Subsidiaries or for which the Company or any of its Subsidiaries has obtained a covenant not to be sued.

“Lien”

means, with respect to any property or asset, any mortgage, deed of trust, lien, license, pledge, option, hypothecation, adverse right,

restriction, charge, security interest, right of first refusal, right of first offer, restriction on transfer and assignment, easement,

servitude, encumbrance or other adverse claim of any kind, whether contingent or absolute, or any agreement, option, right or privilege

(whether by Applicable Law, Contract or otherwise) that would reasonably be expected (with notice or the lapse of time or both) to become

any of the foregoing, in respect of such property or asset. For purposes of this Agreement, a Person shall be deemed to own, subject

to a Lien, any property or asset that it has acquired or holds subject to the interest of a vendor or lessor under any conditional sale

agreement, capital lease or other title retention agreement relating to such property or asset.

“Multiemployer

Plan” means a “multiemployer plan” as defined in Section 3(37) of ERISA.

“NASDAQ”

means Nasdaq Stock Market, LLC.

“New Debt

Financing” means the public offering of Parent’s debt securities or other incurrence of Indebtedness by Parent after

the date hereof and prior to the Closing, the proceeds of which would be used, in whole or in part, to pay the Merger Consideration.

“ordinary

course of business” means any action taken by the Company or any of its Subsidiaries in the ordinary course of the Company’s

and its applicable Subsidiaries’ business.

“Owned

Intellectual Property” means any and all Intellectual Property owned or purported to be owned by the Company or any of its

Subsidiaries.

“Parent

Common Stock” means capital stock of Parent, par value $0.0375 per share.

“Parent

Material Adverse Effect” means a material adverse effect on Parent’s or Merger Sub’s ability to consummate the

transactions contemplated by this Agreement, including to make all payments of the Merger Consideration in accordance with Section 2.02

in full.

“Partnership”

means the Sovos Brands Limited Partnership.

“PBGC”

means the Pension Benefit Guaranty Corporation.

“Permits”

means each grant, license, franchise, permit, easement, variance, exception, exemption, waiver, consent, certificate, certification,

registration, accreditation, approval, order, qualification or other similar authorization of any Governmental Authority.

“Permitted

Liens” means (a) carriers’, warehousemen’s, mechanics’, materialmen’s, landlords’, laborers’,

suppliers’ and vendors’ liens and other similar Liens, if any, arising or incurred in the ordinary course of business that

do not, individually or in the aggregate, impair or interfere with the present use of the assets or otherwise impair present business

operations; (b) Liens for Taxes not yet delinquent or, if delinquent, that are being contested in good faith by appropriate actions and

that are adequately reserved for as of the date hereof in the applicable financial statements of the Company in accordance with GAAP;

(c) applicable zoning, planning, entitlement, conservation restrictions, land use restrictions, building codes and other governmental

rules and regulations imposed by a Governmental Authority having jurisdiction over the real property, none of which are violated by the

current use and operation of the real

property nor which would reasonably

be expected to have an adverse impact on the Company’s conduct of its business; (d) with respect to real property or any other

assets, Liens that do not materially interfere with the business as presently conducted and would not be reasonably expected to materially

detract from the use or operation of the property or other assets subject thereto as currently used or operated by the Company or any

of its Subsidiaries (or the value thereof); (e) Liens that affect the underlying fee interest of any Leased Real Property; and (f) non-exclusive

licenses to Intellectual Property.

“Person”

means an individual, corporation, partnership, limited liability company, association, trust or other entity or organization, including

a Governmental Authority or any “group” within the meaning of Section 13(d) of the 1934 Act.

“Personal

Information” means “personal information,” “personally identifiable information,” “personal data,”

and any terms of similar import, in each case as defined under Applicable Laws relating to data privacy, data protection, cybersecurity

and/or the processing of such information or data.

“Required

Financial Statements” means (a) the audited consolidated balance sheets of the Company and related consolidated statements

of operations, stockholders’ equity and cash flows, for each of the three most recently completed fiscal years ended at least 60

days before Closing and (b) as soon as available and in any event within forty-five (45) days after the end of each subsequent fiscal

quarter, an unaudited consolidated balance sheet of the Company and the related consolidated statements of operations, stockholders’

equity and cash flows for such fiscal quarter and for the elapsed interim period following the last completed fiscal year and for the

comparable periods of the prior fiscal year, in each case which has been reviewed by the Company’s auditors as provided by AS 4105,

Reviews of Interim Financial Information; provided, however, that financial statements of the Company shall only be provided to

the extent that such financial statements would be required by Rule 3-05 and Article 11 of Regulation S-X for an offering of securities

conducted on Form S-1 (even if the Company conducts an offering pursuant to Rule 144A) (it being understood and agreed by the parties

hereto that the Company’s public filing of any required financial statements with the SEC shall satisfy the requirements of clauses

(a) and (b), unless the Company’s auditors have withdrawn any audit opinion with respect to any such financial statements).

“Sarbanes-Oxley

Act” means the Sarbanes-Oxley Act of 2002.

“SEC”

means the U.S. Securities and Exchange Commission.

“Service

Provider” means any director, officer, employee or individual independent contractor or consultant or other individual service

provider of the Company or any of its Subsidiaries.

“Subsidiary”

means, with respect to any Person, any other Person of which securities or other ownership interests having ordinary voting power to

elect a majority of the board of directors or other Persons performing similar functions are at any time directly or indirectly owned

or controlled by such Person.

“Tax”

means (i) all taxes, assessments, duties, levies, imposts or other similar charges imposed by a Governmental Authority (whether payable

directly or by withholding and whether or not requiring the filing of a tax return), including income, gross receipts, license, payroll,

employment, excise, escheat, abandoned property, severance, stamp, occupation, premium, windfall profits, environmental, customs duties,

capital stock, franchise profits, withholding (including backup withholding), social security, unemployment, disability, real property,

personal property, sales, use, transfer, registration, ad valorem, value added, alternative or add-on minimum or estimated tax or any

other tax of any kind whatsoever, together with any interest, penalty, addition to tax or additional amount, whether disputed or not.

“Tax Return”

means any report, return, document, claim for refund, information return, schedule, declaration or statement or filing supplied or required

to be filed with a Governmental Authority with respect to Taxes (and any amendments thereof).

“Tax Sharing

Agreement” means any agreement or arrangement binding the Company or any of its Subsidiaries that provides for the allocation,

apportionment, sharing, indemnification or assignment of any Tax liability (other than customary Tax sharing or indemnification provisions

contained in an agreement (i) in conjunction with an acquisition or divestiture or (ii) entered into in the ordinary course of business,

in each case, the primary subject matter of which does not relate to Taxes).

“Third

Party” means any Person other than Parent or any of its Subsidiaries.

“Title

IV Plan” means any Employee Plan (including any Multiemployer Plan) that is subject to Title IV of ERISA.

“Trade

Secrets” means any and all of the following that are protected under applicable law as a trade secret: know-how (including

manufacturing and production processes and research and development information), confidential information, technical data, algorithms,

recipes, formulae, concepts, methods, techniques, procedures, processes, schematics, protocols, prototypes, models, designs, results

of experimentation and testing, and business information (including financial and marketing plans, customer and supplier lists, and pricing

and cost information), in each case, in any jurisdiction.

“WARN”

means the Worker Adjustment and Retraining Notification Act (29 U.S.C. § 2101) and any similar applicable foreign, state or local

law.

“Willful

Breach” means a material breach of this Agreement that is a consequence of an act undertaken or a failure to take an act by

the breaching party with the knowledge that the taking of such act or the failure to take such act would cause, or would reasonably be

expected to cause, a breach of this Agreement.

(b)

Each of the following terms is defined in the Section set forth opposite such term:

| Term |

Section |

| Adverse Recommendation Change |

6.03(a) |

| Agreement |

Preamble |

| Board of Directors |

Recitals |

| Burdensome Condition |

8.01(c) |

| Certificates |

2.03(a) |

| Closing |

2.01(b) |

| Closing Date |

2.01(b) |

| Company |

Preamble |

| Company Board Recommendation |

4.02(b) |

| Company Disclosure Documents |

4.09(a) |

| Company Meeting |

4.03 |

| Company SEC Documents |

4.07(a) |

| Company Securities |

4.05(b) |

| Company Subsidiary Securities |

4.06(b) |

| Confidentiality Agreement |

6.02 |

| Continuation Period |

7.03(a) |

| D&O Indemnification Documents |

7.02(a) |

| D&O Insurance |

7.02(c) |

| Data Breach |

4.17 |

| Effective Time |

2.01(c) |

| Electronic Delivery |

11.10 |

| End Date |

10.01(b) |

| Exchange Agent |

2.03(a) |

| FDA |

4.25(a) |

| Food Authorities |

4.25(a) |

| FTC |

4.25(a) |

| Indemnified Person |

7.02(a) |

| Indemnity Proceedings |

7.02(a) |

| Intervening Event |

6.03(b) |

| Lease |

4.15(b) |

| Leased Real Property |

4.15(b) |

| Material Contract |

4.22(b) |

| Merger |

2.01(a) |

| Merger Consideration |

2.02(a) |

| Merger Sub |

Preamble |

| Parent |

Preamble |

| Parent Related Party |

11.04(c) |

| Parent RSU |

2.05(b) |

| Proxy Statement |

4.03 |

| Registered Intellectual Property |

4.16 |

| Representatives |

6.02 |

| Requisite Company Vote |

4.02(a) |

| Reverse Termination Fee |

11.04(c) |

| Sanctions |

4.12(c) |

| Shares |

2.02(a) |

| Superior Proposal |

6.03(e) |

| Surviving Corporation |

2.01(a) |

| Surviving Economic Provisions |

10.02 |

| Terminating Company PSU |

2.05(c) |

| Terminating Company PSU Consideration |

2.05(c) |

| Terminating Company Restricted Stock |

2.05(a) |

| Terminating Company Restricted Stock Consideration |

2.05(a) |

| Terminating Company RSU |

2.05(b) |

| Terminating Company RSU Consideration |

2.05(b) |

| Termination Fee |

11.04(b) |

| Uncertificated Shares |

2.03(a) |

| USDA |

4.25(a) |

| Voting Agreement |

Recitals |

Section 1.02.

Other Definitional and Interpretative Provisions. The words “hereof”, “herein” and “hereunder”

and words of like import used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this

Agreement. The captions herein are included for convenience of reference only and shall be ignored in the construction or interpretation

hereof. References to Articles, Sections, Exhibits and Schedules are to Articles, Sections, Exhibits and Schedules of this Agreement

unless otherwise specified. All Exhibits and Schedules (including the Company Disclosure Schedule)

annexed hereto or referred to herein are hereby incorporated in and made a part of this Agreement as if set forth in full herein. Any

capitalized terms used in any Exhibit or Schedule but not otherwise defined therein, shall have the meaning as defined in this Agreement.

Any singular term in this Agreement shall be deemed to include the plural, and any plural term the singular. Whenever the words “include”,

“includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without

limitation”, whether or not they are in fact followed by those words or words of like import. “Writing”, “written”

and comparable terms refer to printing, typing and other means of reproducing words (including electronic media) in a visible form. References

to any statute shall be deemed to refer to such statute as amended from time to time and, if applicable, to any rules, regulations or

interpretations promulgated thereunder. References to any agreement or contract are to that agreement or contract as amended, modified,

supplemented extended or renewed from time to time in accordance with the terms hereof and thereof, provided that, with respect

to any agreement or contract listed on any schedule hereto, all amendments, modifications, supplements, extensions or renewals are also

listed in the appropriate schedule to the extent that any such amendment(s), modification(s), supplement(s), extension(s) or renewal(s)

are material to the agreement or contract to which it or they relate. References to any Person include the successors and permitted assigns

of that Person. References to a “party” or the “parties” means a party or the parties to this Agreement unless

the context otherwise requires. References from or through any date mean, unless otherwise specified, from and including or through and

including, respectively. The parties hereto have participated jointly in the negotiation and drafting of this Agreement and each has

been represented by counsel of its choosing and,

in the event of an ambiguity or question

of intent or interpretation arises, this Agreement will be construed as if drafted jointly by such parties and no presumption or burden

of proof will arise favoring or disfavoring any party due to the authorship of any provision of this Agreement. Further, prior drafts

of this Agreement or the fact that any clauses have been added, deleted or otherwise modified from any prior drafts of this Agreement

will not be used as an aide of construction or otherwise constitute evidence of the intent of the parties, and no presumption or burden

of proof will arise favoring or disfavoring any party by virtue of any such prior drafts. Unless otherwise specifically indicated, all

references to “dollars” and “$” will be deemed references to the lawful money of the United States of America.

The words “made available” shall be deemed to mean made continuously available or accessible to Parent or its representatives

not later than 5:00 pm Eastern Time two calendar days prior to the date hereof in the virtual data room (with anything in the “Clean

Room” folder therein being deemed to be included in such virtual data room) established by the Company and hosted by Datasite.

The phrase “substantially consistent with past practice” shall be disregarded in any case where there is no applicable past

practice.

Article

2

The Merger

Section 2.01.

The Merger. (a) At the Effective Time, Merger Sub shall merge (the “Merger”) with and into the Company

in accordance with the DGCL, whereupon, the separate existence of Merger Sub shall cease and the Company shall be the surviving corporation

as a wholly owned Subsidiary of Parent (the “Surviving Corporation”).

(b)

Subject to the provisions of Article 9, the closing

of the Merger (the “Closing”) shall take place via the electronic exchange of documents and signature pages at 10:00

a.m., New York City time, as soon as possible, but in any event no later than two Business Days after the date the conditions set forth

in Article 9 (other than conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or, to the

extent permissible, written waiver of such conditions at the Closing by the party or parties entitled to the benefit of such conditions)

have been satisfied or, to the extent permissible, waived in writing by the party or parties entitled to the benefit of such conditions,

or at such other place (or by means of remote communication), at such other time or on such other date as Parent and the Company may

mutually agree. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date.”

(c)

At the Closing, the Company and Merger Sub shall file a certificate of merger with the Delaware Secretary of State and make all

other filings or recordings required by the DGCL in connection with the Merger. The Merger shall become effective at such time (the “Effective

Time”) as the certificate of merger is duly filed with the Delaware Secretary of State (or at such later time as may be specified

in the certificate of merger).

(d)

From and after the Effective Time, the Surviving Corporation shall possess all the rights, powers, privileges and franchises and

be subject to all of the

obligations, liabilities, restrictions

and disabilities of the Company and Merger Sub, all as provided under the DGCL.

Section 2.02.

Conversion of Shares. At the Effective Time, by virtue of the Merger and automatically without any action on the part

of the holders thereof or the parties hereto:

(a)

Except as otherwise provided in Section 2.02(b),

Section 2.02(c), Section 2.02(d) or

Section 2.04, each share of common stock of the Company, par value $0.001 per share (each a “Share” and

collectively, the “Shares”), outstanding immediately prior to the Effective Time (excluding each Share of Company

Restricted Stock, which Shares are subject to Section 2.05) shall be converted into the right to receive: (i) $23.00 in cash, without

interest; plus (ii) if applicable, the Additional Consideration (collectively, (i) and (ii)the “Merger Consideration”).

As of the Effective Time, all such Shares shall no longer be outstanding and shall automatically be canceled and retired and shall cease

to exist, and shall thereafter represent only the right to receive the Merger Consideration on the terms and conditions set forth herein.

(b)

Each Share held by the Company as treasury stock (other than Shares in an Employee Plan of the Company) or owned by Parent or

Merger Sub immediately prior to the Effective Time shall be canceled, and no payment shall be made with respect thereto.

(c)

Each share of common stock of Merger Sub outstanding immediately prior to the Effective Time shall be converted into and become

one share of common stock of the Surviving Corporation with the same rights, powers and privileges as the shares so converted and shall

constitute the only outstanding shares of capital stock of the Surviving Corporation.

(d)

Each Share held by any Subsidiary of either the Company or Parent (other than Merger Sub) immediately prior to the Effective Time

shall be converted into such number of shares of common stock of the Surviving Corporation such that each such Subsidiary owns the same

percentage of the outstanding capital stock of the Surviving Corporation immediately following the Effective Time as such Subsidiary

owned of the Company immediately prior to the Effective Time.

Section 2.03.

Surrender and Payment. (a) Prior to the Effective Time, Parent shall appoint an agent reasonably acceptable to the

Company (the “Exchange Agent”) for the purpose of exchanging for the Merger Consideration (i) certificates representing

Shares (the “Certificates”) or (ii) uncertificated Shares (the “Uncertificated Shares”). Parent

shall, at or prior to the Effective Time, deposit or cause to be deposited with the Exchange Agent cash sufficient to make all payments

of the Merger Consideration payable in respect of the Certificates and the Uncertificated Shares in accordance with Section 2.02. The

cash amount deposited with the Exchange Agent in accordance with this Section 2.03(a) shall not be used for any purpose other than as

set forth in this Article 2. The Exchange Agent shall invest the cash amount deposited with the Exchange Agent in accordance with this

Section 2.03(a) as directed by Parent solely in (A) direct short-term obligations of the United States of America, (B) obligations for

which the full faith

and credit of the United States of America

is pledged to provide for the payment of principal and interest, (C) commercial paper rated P-1 or A-1 or better by Moody’s Investors

Service, Inc. or Standard & Poor’s Corporation, respectively, (D) certificates of deposit, bank repurchase agreements or banker’s

acceptances of commercial banks with capital exceeding $1,000,000,000, (E) money market funds having a rating in the highest investment

category granted by a nationally recognized credit rating agency at the time of acquisition or (F) a combination of any of the foregoing,

provided that, in any such case, no such instrument shall have a maturity exceeding three months. No investment or losses of any

of the cash amounts deposited with the Exchange Agent in accordance with this Section 2.03(a) shall relieve Parent, the Surviving Corporation

or the Exchange Agent from making the payments required by this Article 2 or affect the amount of Merger Consideration payable to holders

of Shares, and to the extent that there are any losses with respect to any such investments, or the cash amount deposited with the Exchange

Agent diminishes for any reason below the level required for the Exchange Agent to make prompt cash payment in accordance with Section

2.02, Parent shall promptly provide additional cash to the Exchange Agent so as to ensure that the Exchange Agent has at and after the

Effective Time cash at a level sufficient for the Exchange Agent to make all payments in accordance with Section 2.02 that remain unpaid.

Parent shall pay all charges and expenses of the Exchange Agent in connection with the exchange of Shares for the Merger Consideration.

Promptly after the Effective Time (and in any event, not later than the fifth Business Day following the Effective Time), Parent shall

send, or shall cause the Exchange Agent to send, to each holder of Shares as of immediately prior to the Effective Time a letter of transmittal

and instructions in customary form (which shall specify that the delivery shall be effected, and risk of loss and title shall pass, only