Metropoulos to Invest in Utz Quality Foods

October 18 2016 - 4:50PM

Dow Jones News

The financier that brought back the company behind treats such

as Twinkies and Ding Dongs is investing more than $146 million in a

95-year-old, family-owned snack company.

Private-equity firm Metropoulos & Co., which brought Hostess

Brands out of liquidation three years ago, is the first outside

investor in Utz Quality Foods Inc., which makes potato chips,

pretzels and cheese snacks under several brands. Metropoulos has

also made bets on companies that produce Pabst Blue Ribbon beer,

Bumble Bee Foods tuna and Chef Boyardee pasta over the years.

With $800 million in sales anticipated next year, Hanover,

Penn.-based Utz is the largest privately held and family-run salty

snack company in the U.S.

Mergers, acquisitions and investments in the food industry have

been on the rise, as big food makers look to expand into brands

that are perceived to be fresher and more natural.

The private-equity investment will be used to fund Utz's $146

million recent acquisition of Alabama-based chip and popcorn maker

Golden Enterprises, according to Utz Chief Executive Dylan

Lissette. The Rice family, which has owned and operated Utz for

four generations and will remain the majority shareholders, has

made several acquisitions in the past five years, such as Good

Health pretzels and veggie straws and Zapp's kettle-style potato

chips.

"Utz has quietly become a near century-old snack powerhouse,"

said principal Evan Metropoulos.

The food sector has seen rampant deal activity in the last

couple of years. More than $116 billion worth of deals involving

U.S. companies were announced last year, the largest total dollar

amount in at least two decades, according to data from Dealogic.

They include Hormel Foods' $775 million purchase of organic-meats

company Applegate Farms LLC and Campbell Soup Co.'s $231 million

acquisition of Garden Fresh Gourmet Inc. From January through June,

more than $43 billion worth of food and beverage deals had been

disclosed.

Daren Metropoulos, principal of Metropoulos, said the

combination of growth potential and heritage makes Utz appealing to

his firm, which specializes in expanding and reviving iconic

American brands. Metropoulos says the Utz transaction is the

largest initial private equity transaction for a U.S. snack company

since 2013, when Metropoulos and Apollo Global Management bought

Hostess out of liquidation at a deal, valued at $2.3 billion

including cash, equity and debt. That deal required an initial cash

investment of $185 million, The Wall Street Journal has

reported.

As Hostess prepares to become a public company again,

Metropoulos and Apollo stand to make returns of more than 10 times

their original investment.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

October 18, 2016 16:35 ET (20:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

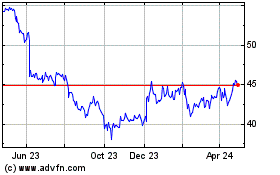

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Dec 2024 to Jan 2025

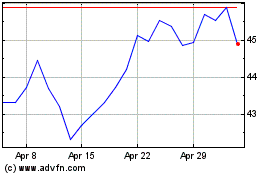

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Jan 2024 to Jan 2025