Total Revenue of $49.1 million, increased 19%

year over year;

Subscription Revenue of $42.7 million,

increased 23% year over year

C3.ai, Inc. (NYSE: AI), a leading provider of enterprise AI

applications software today announced results for its fiscal third

quarter ended January 31, 2021.

“We continue to establish our leadership as the only enterprise

AI software pure play," said CEO Thomas M. Siebel. “This is a large

and rapidly growing market; we continue to innovate; we continue to

expand our market-partner ecosystem and associated distribution

capacity; and we continue to demonstrate technology leadership. I

believe that we are increasingly well-positioned to establish a

global market leadership position in enterprise AI software.”

Third Quarter Financial Highlights

- Revenue: Total revenue for the quarter was $49.1

million, up from $41.3 million one year ago, an increase of 19%

year over year.

- Subscription revenue: Subscription revenue for the

quarter was $42.7 million, up from $34.6 million one year ago, an

increase of 23% year over year. Subscription revenue increased to

87% of total revenue, up from 84% of total revenue one year

ago.

- Professional Services revenue: Professional Services

revenue for the quarter was $6.4 million compared to $6.7 million

one year ago, a 4% decrease. Year over year, professional services

revenue decreased from 16% to 13% of total revenue.

- Gross Margin and non-GAAP Gross Margin: Gross margin for

the quarter was $36.9 million, or 75%, compared to $30.4 million,

or 74% one year ago, an increase of 22% year over year. Non-GAAP

gross margin was $37.3 million, or 76%, an increase from $30.5

million, or 74% one year ago, an increase of 22% year over

year.

- Loss from Operations and Non-GAAP Loss from Operations:

Loss from operations for the quarter was $18.5 million, compared to

$10.4 million one year ago. Non-GAAP operating loss for the third

quarter was $11.9 million, compared to $8.4 million one year

ago.

Recent Business Highlights

- The C3 AI Digital Transformation footprint in Oil & Gas,

Manufacturing, Financial Services, Aerospace, Utilities, and Energy

Sustainability continues to expand with new enterprise production

deployments at Shell, the US Air Force, US Army, New York Power

Authority, ConEd, Bank of America, and Johnson Controls.

- C3 AI significantly expanded its market-partner ecosystem to

broaden its distribution and service network globally. In addition

to expanding its market partnership activities with Microsoft,

Baker Hughes, and ENGIE, C3 AI extended our relationship with

Raytheon to serve the defense and intelligence communities; with

FIS, a global financial services software company, to serve the

banking and financial services industries; and with Infor to serve

the global ERP market.

- C3 AI demonstrated continued product leadership in enterprise

AI. In the third quarter, the company released C3 AI v7.17,

offering significant functional enhancements, performance

improvements, and a new Integrated Development Suite (IDS) to

accelerate AI application development. In partnership with

Microsoft and Adobe, C3 AI announced the availability of C3 AI CRM,

a family of industry-specific AI-enabled CRM applications. In

addition, C3 AI released C3 AI Ex Machina, a mass-market,

cloud-native, low-code/no-code application that enables the

democratization of data science.

- The US Patent Office awarded C3 AI an important patent titled,

“Systems, methods, and devices for an enterprise AI application

development platform” (No.10,817,530). This patent secures the

fundamental concepts of applying a model-driven software

architecture for enterprise AI applications as C3 AI intellectual

property.

- C3 AI expanded its investments and market penetration in the

increasingly critical climate and energy sustainability market. In

partnership with Shell, Microsoft, and Baker Hughes, C3 AI formed

the Open Energy AI Initiative, an open marketplace for C3 AI energy

applications. C3 AI increased its investment in the C3.ai Digital

Transformation Institute (DTI), funding seminal AI COVID research

and issuing a new call for papers to fund innovative research in

applying AI and digital transformation to energy and climate

security.

- C3 AI expanded the company’s leadership with the addition of

Jim Snabe, former co-CEO of SAP, to its Board of Directors. In

addition, C3 AI enhanced its global advisory board with the

additions of Sajid Javid, Member of Parliament and former Home

Secretary and former Chancellor of the Exchequer in the UK; former

U.S. Assistant Secretary of the Navy, Admiral Dennis McGinn; former

Deputy Director of the NSA, Rick Ledgett; former President of SAP,

Franck Cohen and former President and COO of Alteryx, George

Mathew.

Financial Outlook:

Our guidance includes GAAP and non-GAAP financial measures.

The following table summarizes our guidance for the fourth

quarter of fiscal 2021 and full-year fiscal 2021:

(in millions)

Fourth Quarter Fiscal

2021

Guidance

Full Year Fiscal 2021

Guidance

Total revenue

$50.0 - $51.0

$180.9 - $181.9

Non-GAAP loss from operations

($28.0) - ($27.0)

($50.1) - ($49.1)

Historically, the difference between GAAP and non-GAAP measures

has been limited to stock-based compensation expense. Beginning

with guidance for the fourth quarter of fiscal 2021 and full-year

fiscal 2021, and in future periods, the difference between GAAP and

non-GAAP measures will include stock-based compensation and

employer payroll tax expense related to employee stock-based

compensation.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty regarding, and the

potential variability of, expenses that may be incurred in the

future. Stock-based compensation expense-related charges, including

employer payroll tax-related items on employee stock transactions,

are impacted by the timing of employee stock transactions, the

future fair market value of our common stock, and our future hiring

and retention needs, all of which are difficult to predict and

subject to constant change. We have provided a reconciliation of

GAAP to non-GAAP financial measures in the financial statement

tables for our historical non-GAAP results included in this press

release. Our fiscal year ends April 30, and numbers are rounded for

presentation purposes.

Conference Call Details

What:

C3 AI Third Quarter Fiscal 2021 Financial

Results Conference Call

When:

Monday, March 1, 2021

Time:

2:00 p.m. PT / 5:00 p.m. ET

Live Call:

(833) 979-2768, Domestic

(236) 714-2883, International

Conference ID: 4668908

Webcast:

https://event.on24.com/wcc/r/3015157/885F1E2FD850F2DBC977CC64443C1836

(live and replay)

Investor Presentation Details

An investor presentation providing additional information and

analysis can be found at our investor relations page at

ir.c3.ai.

Statement Regarding Use of non-GAAP Financial

Measures

We report the following non-GAAP financial measures, which have

not been prepared in accordance with generally accepted accounting

principles in the United States (GAAP), in addition to, and not as

a substitute for, or superior to, financial measures calculated in

accordance with GAAP.

- Non-GAAP gross profit, non-GAAP gross margin, and non-GAAP

loss from operations. Our non-GAAP gross profit, non-GAAP gross

margin, and non-GAAP loss from operations measures exclude the

effect of stock-based compensation expense-related charges. We

believe the presentation of operating results that exclude these

non-cash items provides useful supplemental information to

investors and facilitates the analysis of our operating results and

comparison of operating results across reporting periods.

We use these non-GAAP financial measures internally for

financial and operational decision-making purposes and as a means

to evaluate period-to-period comparisons. Non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP financial measures and should be

read only in conjunction with our condensed consolidated financial

statements prepared in accordance with GAAP. Our presentation of

non-GAAP financial measures may not be comparable to similar

measures used by other companies. We encourage investors to

carefully consider our results under GAAP, as well as our

supplemental non-GAAP information and the reconciliation between

these presentations, to more fully understand our business. Please

see the tables included at the end of this release for the

reconciliation of GAAP to non-GAAP results.

Use of Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release other than

statements of historical facts, including our market leadership

position, plans to license certain technologies, financial outlook,

our business strategies, plans, and objectives for future

operations, are forward-looking statements. The words “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “intend,” “may,”

“will” and similar expressions are intended to identify

forward-looking statements. We have based these forward-looking

statements largely on our current expectations and projections

about future events and trends that we believe may affect our

financial condition, results of operations, business strategy,

short-term and long-term business operations and objectives, and

financial needs. These forward-looking statements are subject to a

number of risks and uncertainties. Some of these risks are

described in greater detail in our filings with the Securities and

Exchange Commission (the “SEC”), including our final prospectus

filed on December 9, 2020, although new and unanticipated risks may

arise. The future events and trends discussed in this press release

may not occur and actual results could differ materially and

adversely from those anticipated or implied in the forward-looking

statements. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance, achievements, or

events and circumstances reflected in the forward-looking

statements will occur. Except to the extent required by law, we do

not undertake to update any of these forward-looking statements

after the date of this press release to conform these statements to

actual results or revised expectations.

About C3.ai, Inc.

C3.ai, Inc. (NYSE:AI) is a leading provider of enterprise AI

software for accelerating digital transformation. C3 AI delivers a

family of fully integrated products: C3 AI® Suite, an end-to-end

platform for developing, deploying, and operating large-scale AI

applications; C3 AI Applications, a portfolio of industry-specific

SaaS AI applications; C3 AI CRM, a suite of industry-specific CRM

applications designed for AI and machine learning; and C3 AI Ex

Machina, a no-code AI solution to apply data science to everyday

business problems. The core of the C3 AI offering is an open,

model-driven AI architecture that dramatically simplifies data

science and application development. Learn more at: www.c3.ai.

Source: C3.ai, Inc.

C3.AI, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(unaudited)

Three Months Ended January

31,

Nine Months Ended January

31,

2021

2020

2021

2020

Revenue

Subscription(1)

$

42,699

$

34,629

$

114,248

$

98,627

Professional services(2)

6,410

6,654

16,685

16,421

Total revenue

49,109

41,283

130,933

115,048

Cost of revenue

Subscription

7,023

8,862

22,694

23,493

Professional services

5,203

2,069

10,113

5,785

Total cost of revenue

12,226

10,931

32,807

29,278

Gross profit

36,883

30,352

98,126

85,770

Operating expenses

Sales and marketing

28,450

23,162

64,898

60,385

Research and development

18,748

12,331

48,145

47,122

General and administrative

8,184

5,291

21,433

19,541

Total operating expenses

55,382

40,784

134,476

127,048

Loss from operations

(18,499

)

(10,432

)

(36,350

)

(41,278

)

Interest income

129

1,136

997

3,115

Other (expense) income, net

1,721

(402

)

4,163

(498

)

Net loss before provision for income

taxes

(16,649

)

(9,698

)

(31,190

)

(38,661

)

Provision for income taxes

203

98

456

283

Net loss

$

(16,852

)

$

(9,796

)

$

(31,646

)

$

(38,944

)

Net loss attributable to Class A common

shareholders, basic and diluted

$

(0.23

)

$

(0.27

)

$

(0.64

)

$

(1.11

)

Net loss attributable to Class A-1 common

shareholders, basic and diluted

$

(0.10

)

$

(0.27

)

$

(0.52

)

$

(1.11

)

Net loss attributable to Class B common

shareholders, basic and diluted

$

(0.13

)

$

—

$

(0.12

)

$

—

Weighted-average shares used in computing

net loss per share attributable to Class A common stockholders,

basic and diluted

68,648,229

30,132,463

43,480,533

28,478,395

Weighted-average shares used in computing

net loss per share attributable to Class A-1 common stockholders,

basic and diluted

6,666,665

6,666,666

6,666,665

6,666,666

Weighted-average shares used in computing

net loss per share attributable to Class B common stockholders,

basic and diluted

3,499,992

—

3,499,992

—

(1) Including related party revenue of

$7,951, $9,865, $21,571 and $30,560 for the three and nine months

ended January 31, 2021 and 2020, respectively.

(2) Including related party revenue of $0,

$112, $0 and $210 for the three and nine months ended January 31,

2021 and 2020, respectively.

C3.AI, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except for

share and per share data)

(unaudited)

January 31,

April 30,

2021

2020

Assets

Current assets

Cash and cash equivalents

$

960,122

$

33,104

Short-term investments

162,880

211,874

Accounts receivable, net of allowance of

$762 and $755 as of January 31, 2021 and April 30, 2020,

respectively(1)

30,231

30,827

Prepaid expenses and other current

assets

13,503

5,400

Total current assets

1,166,736

281,205

Property and equipment, net

6,844

8,723

Goodwill

625

625

Long-term investments

—

725

Other assets, non-current

10,369

13,830

Total assets

$

1,184,574

$

305,108

Liabilities, redeemable convertible

preferred stock, redeemable convertible Class A-1 common stock and

stockholders’ (deficit) equity

Current liabilities

Accounts payable

$

12,608

$

4,726

Accrued compensation and employee

benefits

17,996

13,693

Deferred revenue, current(2)

59,950

53,537

Accrued and other current liabilities

13,544

9,083

Total current liabilities

104,098

81,039

Deferred revenue, non-current

2,360

6,758

Other long-term liabilities

4,004

6,001

Total liabilities

110,462

93,798

Commitments and contingencies

Redeemable convertible preferred stock,

$0.001 par value. No shares and 233,107,379 shares authorized as of

January 31, 2021 and April 30, 2020, respectively; no shares and

37,128,768 shares issued and outstanding as of January 31, 2021 and

April 30, 2020, respectively; Liquidation preference of $376,178 as

of April 30, 2020

—

375,207

Redeemable convertible class A-1 common

stock, $0.001 par value. No shares and 6,666,667 shares authorized

as of January 31, 2021 and April 30, 2020, respectively; no shares

and 6,666,665 shares issued and outstanding as of January 31, 2021

and April 30, 2020, respectively; Liquidation preference of $18,800

as of April 30, 2020

—

18,800

Stockholders’ (deficit) equity

Class A common stock, $0.001 par value.

1,000,000,000 and 390,000,000 shares authorized as of January 31,

2021 and April 30, 2020, respectively; 97,431,675 and 31,210,159

shares issued and outstanding as of January 31, 2021 and April 30,

2020 respectively

98

31

Class B common stock, $0.001 par value;

3,500,000 and 21,000,000 shares authorized as of January 31, 2021

and April 30, 2020, respectively; 3,499,992 and no shares issued

and outstanding as of January 31, 2021 and April 30, 2020,

respectively

3

—

Additional paid-in capital

1,399,281

110,485

Accumulated other comprehensive income

13

424

Accumulated deficit

(325,283

)

(293,637

)

Total stockholders’ (deficit) equity

1,074,112

(182,697

)

Total liabilities, redeemable convertible

preferred stock, redeemable convertible Class A-1 common stock and

stockholders’ (deficit) equity

$

1,184,574

$

305,108

(1) Including amounts from a related party

of $1,030 and $250 as of January 31, 2021 and April 30, 2020,

respectively.

(2) Including amounts from a related party

of $9,358 and $1,499 as of January 31, 2021 and April 30, 2020,

respectively.

C3.AI, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

Nine Months Ended January

31,

2021

2020

Cash flows from operating

activities:

Net loss

$

(31,646

)

$

(38,944

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

3,189

566

Non-cash operating lease cost

2,474

2,267

Stock-based compensation expense

14,270

5,424

Other

(115

)

(324

)

Changes in operating assets and

liabilities

Accounts receivable(1)

588

33,744

Prepaid expenses, other current assets and

other assets

(6,931

)

(6,928

)

Accounts payable

7,447

(917

)

Accrued compensation and employee

benefits

4,303

1,081

Lease liability

(2,636

)

(2,344

)

Other liabilities

1,213

(397

)

Deferred revenue(2)

2,016

(20,335

)

Net cash used in operating activities

(5,828

)

(27,107

)

Cash flows from investing

activities:

Purchase of property and equipment

(1,166

)

(1,629

)

Capitalized software development costs

—

(581

)

Proceeds from sale of non-marketable

equity security

725

—

Purchase of investments

(232,287

)

(197,067

)

Maturity and sale of investments

280,997

58,625

Net cash provided by (used in) investing

activities

48,269

(140,652

)

Cash flows from financing

activities:

Proceeds from initial public offering and

private placements, net of underwriting discounts

851,859

—

Proceeds from repayment of shareholder

loan

26,003

—

Proceeds from issuance of Series G, net of

issuance costs

—

25,333

Proceeds from issuance of Series H, net of

issuance costs

—

49,836

Repurchase of common stock and options in

tender offer

—

(3,548

)

Payment of deferred offering costs

(6,710

)

—

Proceeds from issuance of common stock

—

44,028

Proceeds from exercise of Class A common

stock options

13,825

3,846

Net cash provided by financing

activities

884,977

119,495

Net increase (decrease) in cash, cash

equivalents and restricted cash

927,418

(48,264

)

Cash, cash equivalents and restricted cash

at beginning of period

33,604

99,107

Cash, cash equivalents and restricted cash

at end of period

$

961,022

$

50,843

Cash and cash equivalents

$

960,122

$

50,343

Restricted cash included in other

assets

900

500

Total cash, cash equivalents and

restricted cash

$

961,022

$

50,843

Supplemental disclosures of cash flow

information—cash paid for income taxes

$

435

$

541

Supplemental disclosure of non-cash

investing and financing activities:

Purchases of property and equipment

included in accounts payable and accrued liabilities

$

349

$

—

Deferred offering costs included in

accounts payable and accrued liabilities

$

503

$

—

Vesting of early exercised stock

options

$

2,073

$

427

(1) Including changes in related party

balances of $(780) and $19,826 for the nine months ended January

31, 2021 and 2020, respectively.

(2) Including changes in related party

balances of $7,859 and $(8,596) for the nine months ended January

31, 2021 and 2020, respectively.

C3.AI, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, except

percentages)

(unaudited)

Three Months Ended January

31,

Nine Months Ended January

31,

2021

2020

2021

2020

Gross profit on a GAAP basis

$

36,883

$

30,352

$

98,126

$

85,770

Stock-based compensation expense(1)

378

134

858

339

Gross profit on a NON-GAAP basis

$

37,261

$

30,486

$

98,984

$

86,109

Gross margin on a GAAP basis

75

%

74

%

75

%

75

%

Gross margin on a NON-GAAP basis

76

%

74

%

76

%

75

%

Loss from operations on a GAAP basis

$

(18,499

)

$

(10,432

)

$

(36,350

)

$

(41,278

)

Stock-based compensation expense(1)

6,589

2,061

14,270

5,424

Loss from operations on a NON-GAAP

basis

$

(11,910

)

$

(8,371

)

$

(22,080

)

$

(35,854

)

(1) Stock-based compensation expense for

gross profits and gross margin includes costs of subscription and

cost of professional services as follows. Stock-based compensation

expense for loss from operations includes total stock-based

compensation expense as follows:

Three Months Ended January

31,

Nine Months Ended January

31,

2021

2020

2021

2020

Cost of subscription

$

214

$

104

$

557

$

246

Cost of professional services

164

30

301

93

Sales and marketing

2,790

613

5,835

1,894

Research and development

846

308

1,952

910

General and administrative

2,575

1,006

5,625

2,281

Total stock-based compensation expense

$

6,589

$

2,061

$

14,270

$

5,424

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210301005994/en/

Investor Contact ir@c3.ai

Press Contact Lisa Kennedy (415) 914-8336 pr@c3.ai

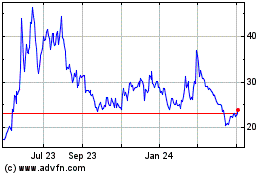

C3 AI (NYSE:AI)

Historical Stock Chart

From Dec 2024 to Jan 2025

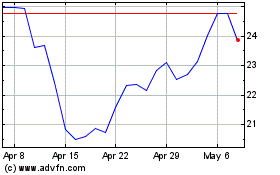

C3 AI (NYSE:AI)

Historical Stock Chart

From Jan 2024 to Jan 2025