Brookfield Completes Acquisition of Chemelex

February 03 2025 - 6:45AM

Brookfield Asset Management (NYSE: BAM, TSX: BAM) through one of

its private equity funds, together with its listed affiliate

Brookfield Business Partners (NYSE: BBU, BBUC; TSX: BBU.UN, BBUC),

today announced that it has completed the acquisition of Chemelex

(“the business”) from nVent Electric Plc for a purchase price of

$1.7 billion.

Chemelex is a global leader in the design and

manufacturing of electric heat trace systems, the specialized

wiring systems that regulate the temperature of pipes in industrial

plants and commercial buildings. With high barriers to entry and

strong brand recognition as the inventor of electric heat tracing

in 1972, the business sells its products into the industrial,

commercial and residential, traditional and clean energy, and

infrastructure markets.

Dave Gregory, a Managing Partner in Brookfield’s

Private Equity Group, said “Chemelex is a global market leader

providing an essential product and service with extensive

connectivity to the Brookfield ecosystem through its end markets.

We’re excited to draw on our deep expertise in industrials and

corporate carve-outs as we partner with the team to enhance

operations and unlock its full potential as an independent

business.”

Brookfield brings deep global expertise of

investing in and driving operational transformation in industrials

and manufacturing businesses. Previous investments include Clarios,

the global leader in advanced low-voltage batteries, Westinghouse,

a leader in providing mission-critical technologies, products and

service to the nuclear power industry and GrafTech, a global

manufacturer of graphite electrodes.

Funding

Brookfield’s investment was funded with

approximately $830 million of equity, of which Brookfield Business

Partners invested approximately $210 million for a 25% interest.

The balance was funded by institutional partners.

Brookfield Asset Management

(NYSE: BAM, TSX: BAM) is a leading global alternative asset

manager, headquartered in New York, with over $1

trillion of assets under management. We invest client capital

for the long-term with a focus on real assets and essential service

businesses that form the backbone of the global economy. We offer a

range of alternative investment products to investors around the

world — including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors.

Brookfield’s private equity business, which

manages over $140 billion of assets under management, focuses on

driving operational transformation in businesses providing

essential products and services.

Brookfield Business Partners is

the flagship listed vehicle of Brookfield’s private equity group.

It is a global business services and industrials company focused on

owning and operating high-quality businesses that provide essential

products and services and benefit from a strong competitive

position.

Investors have flexibility to invest in

Brookfield Business Partners either through Brookfield Business

Partners L.P. (NYSE: BBU; TSX: BBU.UN), a limited partnership or

Brookfield Business Corporation (NYSE, TSX: BBUC), a corporation.

For more information, please visit https://bbu.brookfield.com.

For more information, please contact:

|

Investor Relations:Alan FlemingTel: +1 416 645

2736Email: alan.fleming@brookfield.com |

Media:Marie FullerTel: +44 207 408 875Email:

marie.fuller@brookfield.com |

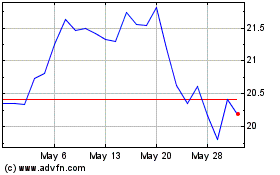

Brookfield Business (NYSE:BBUC)

Historical Stock Chart

From Feb 2025 to Mar 2025

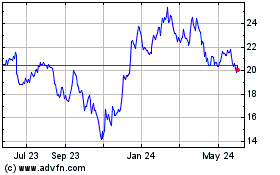

Brookfield Business (NYSE:BBUC)

Historical Stock Chart

From Mar 2024 to Mar 2025