BrightSpire Capital, Inc. (NYSE: BRSP) (“BrightSpire Capital” or

the “Company”) today announced its financial results for the third

quarter 2024 and certain updates. The Company reported third

quarter 2024 GAAP net income attributable to common stockholders of

$12.7 million, or $0.10 per share, Distributable Earnings of $17.9

million, or $0.14 per share, and Adjusted Distributable Earnings of

$27.0 million, or $0.21 per share. The Company reported GAAP net

book value of $8.39 per share and undepreciated book value of $9.11

per share as of September 30, 2024.

Michael J. Mazzei, Chief Executive Officer, commented, “The

Company had a productive quarter highlighted by the successful

execution on a new CRE CLO, share repurchases, reinstated loan

originations and watchlist reductions. As we look towards the

remainder of 2024 and into 2025, we expect to continue to resolve

watchlist and REO assets and grow the portfolio and earnings

through new loan originations.”

Supplemental Financial

Report

A Third Quarter 2024 Supplemental Financial Report is available

on the Shareholders – Events and Presentations section of the

Company’s website at www.brightspire.com. This information will be

furnished to the SEC in a Current Report on Form 8-K.

We refer to “Distributable Earnings” and “Adjusted Distributable

Earnings”, which are non-GAAP financial measures, in this release.

A reconciliation to net income/(loss) attributable to BrightSpire

Capital common stockholders, the most directly comparable GAAP

measure, is included in our full detailed Third Quarter 2024

Supplemental Financial Report and is available on our website at

www.brightspire.com.

Third Quarter 2024 Conference

Call

The Company will conduct a conference call to discuss the

results on Wednesday, October 30, 2024, at 10:00 a.m. ET / 7:00

a.m. PT. To participate in the event by telephone, please dial

(877) 300-8521 ten minutes prior to the start time (to allow time

for registration). International callers should dial (412)

317-6026. The call will also be broadcast live over the Internet

and can be accessed on the ‘Shareholders’ section of the Company’s

website at www.brightspire.com. A webcast of the call will be

available for 90 days on the Company’s website.

For those unable to participate during the live call, a replay

will be available starting October 30, 2024, at 12:00 p.m. ET /

9:00 a.m. PT, through November 6, 2024, at 11:59 p.m. ET / 8:59

p.m. PT. To access the replay, dial (844) 512-2921 and use

conference ID code 10193027. International callers should dial

(412) 317-6671 and enter the same conference ID.

Dividend Announcement

On July 30, 2024, the Company’s Board of Directors declared a

quarterly cash dividend of $0.16 per share to holders of Class A

common stock for the third quarter of 2024, which was paid on

October 15, 2024, to common stockholders of record as of September

30, 2024.

About BrightSpire Capital,

Inc.

BrightSpire Capital, Inc. (NYSE: BRSP) is internally managed and

one of the largest publicly traded commercial real estate (CRE)

credit REITs, focused on originating, acquiring, financing and

managing a diversified portfolio consisting primarily of CRE debt

investments and net leased properties predominantly in the United

States. CRE debt investments primarily consist of first mortgage

loans, which we expect to be the primary investment strategy.

BrightSpire Capital is organized as a Maryland corporation and

taxed as a REIT for U.S. federal income tax purposes. For

additional information regarding the Company and its management and

business, please refer to www.brightspire.com.

Cautionary Statement Regarding

Forward-Looking Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond our control, and may cause

actual results to differ significantly from those expressed in any

forward-looking statement. Among others, the following

uncertainties and other factors could cause actual results to

differ from those set forth in the forward-looking statements:

operating costs and business disruption may be greater than

expected; the impacts of the COVID-19 pandemic; the Company's

operating results may differ materially from the information

presented in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, as well as in the Company’s

other filings with the Securities and Exchange Commission; defaults

by borrowers in paying debt service on outstanding indebtedness;

borrowers’ abilities to manage and stabilize properties;

deterioration in the performance of the properties securing our

investments (including the impact of higher interest expense,

depletion of interest and other reserves or payment-in-kind

concessions in lieu of current interest payment obligations,

population shifts and migration, reduced demand for office,

multifamily, hospitality or retail space) that may cause

deterioration in the performance of our investments and,

potentially, principal losses to us; the fair value of the

Company's investments may be subject to uncertainties (including

impacts associated with inflationary trends, the volatility of

interest rates, credit spreads and the transition from LIBOR to

SOFR, increased market volatility affecting commercial real estate

businesses and public securities); the Company's use of leverage

and interest rate mismatches between the Company’s assets and

borrowings could hinder its ability to make distributions and may

significantly impact its liquidity position; the timing of and

ability to generate additional liquidity and deploy available

liquidity, including in senior mortgage loans; whether the Company

will achieve its anticipated Distributable Earnings per share (as

adjusted), or maintain or produce higher Distributable Earnings per

share (as adjusted) in the near term or ever; the Company’s ability

to maintain or grow the dividend at all in the future; adverse

impacts on the Company's corporate revolver, including covenant

compliance and borrowing base capacity; adverse impacts on the

Company's liquidity, including available capacity under and margin

calls on master repurchase facilities; lease payment defaults or

deferrals, demands for protective advances and capital

expenditures; the ability of the Company to refinance certain

mortgage debt on similar terms to those currently existing or at

all; the ability to execute CRE CLO’s on a go forward basis,

including at a reduced cost of capital; the impact of legislative,

regulatory, tax and competitive changes, regime changes and the

actions of government authorities and in particular those affecting

the commercial real estate finance and mortgage industry or our

business; and the ongoing impacts of global geopolitical

uncertainties and unforeseen public health crises on the real

estate market. The foregoing list of factors is not exhaustive.

Additional information about these and other factors can be found

in Part I, Item 1A of the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, as well as in BrightSpire

Capital’s other filings with the Securities and Exchange

Commission. Moreover, each of the factors referenced above are

likely to also be impacted directly or indirectly by the ongoing

impact of COVID-19 and investors are cautioned to interpret

substantially all of such statements and risks as being heightened

as a result of the ongoing impact of the COVID-19.

We caution investors not to unduly rely on any forward-looking

statements. The forward-looking statements speak only as of the

date of this press release. BrightSpire Capital is under no duty to

update any of these forward-looking statements after the date of

this press release, nor to conform prior statements to actual

results or revised expectations, and BrightSpire Capital does not

intend to do so.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029980182/en/

Investor Relations

BrightSpire Capital, Inc. Addo Investor Relations Anne

McGuinness 310-829-5400 brsp@addo.com

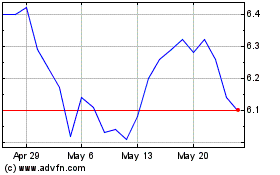

BrightSpire Capital (NYSE:BRSP)

Historical Stock Chart

From Nov 2024 to Dec 2024

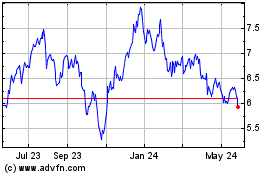

BrightSpire Capital (NYSE:BRSP)

Historical Stock Chart

From Dec 2023 to Dec 2024