Brandywine Realty Trust (NYSE:BDN) today reported its financial and

operating results for the three and nine-month periods ended

September 30, 2024.

Management Comments

“During the third quarter we made strong

progress on our 2024 business plan highlighted by exceeding many of

our targets and for the second consecutive quarter raising both our

speculative revenue target and our annual tenant retention rate,”

stated Gerard H. Sweeney, President and Chief Executive Officer for

Brandywine Realty Trust. “Based on our 2024 leasing activity,

we are raising our speculative revenue target to $26.3 million and

this revised target is 100% achieved and represents a 7% increase

over our original business plan. In addition, we increased our

annual tenant retention rate by 3.0% placing us over 10 percentage

points above our original 2024 business plan target. Turning to the

capital markets, we made progress on our asset sales target by

selling an office portfolio in the Pennsylvania suburbs for $65.5

million and, at the midpoint, we have raised our 2024 asset sales

target from $90 million to $150 million. Despite continued

improvement in the real estate sales market, we are removing land

sales from our 2024 business plan that were projected to generate

approximately $5.0 million of earnings, or $0.03 per share. Based

on the changes made to our 2024 business plan we are adjusting and

further narrowing our FFO range from $0.91 to $0.96 per share to

$0.89 to $0.92 per share.”

Third Quarter Highlights

Financial Results

- Net loss

available to common shareholders: $(165.5) million, or $(0.96) per

share. Our results include $(161.4) million, or $(0.93) per share,

of non-cash impairment charges.

- Funds from

Operations (FFO): $39.8 million, or $0.23 per diluted share.

Portfolio Results

- Core Portfolio:

87.2% occupied and 88.7% leased.

- New and Renewal

Leases Signed: 298,000 square feet wholly-owned and 558,000 square

feet including our joint ventures.

- Tenant

Retention Ratio: 42%.

- Rental Rate

Mark-to-Market: Increased 14.9% on an accrual basis and 8.9% on a

cash basis.

- Same Store

Results: Decreased (2.0%) on an accrual basis and increased 1.6% on

a cash basis.

Disposition Activity

- On September

26, 2024, we completed the sale of five Class-B office properties

in Plymouth Meeting, Pennsylvania for a gross sales price of $65.5

million. After closing costs and credits, we received net cash

proceeds of $44.1 million and provided seller financing to the

buyer. The seller financing totaled $15.5 million and has an

initial interest rate of 8.25% and matures in 2034 and is

subordinate to a first mortgage. Prior to the sale we recognized an

impairment loss of $3.3 million on the properties based upon the

executed purchase and sale agreement during the third quarter of

2024.

Joint Venture Activity

- On August 26,

2024, we entered into an agreement to pay down $23 million of the

preferred equity position from our current partner in our Commerce

Square joint venture, increasing our total interest in the venture

to 84%. In connection with the agreed upon transaction, we obtained

a 3rd party appraisal, which resulted in the venture impairing our

common equity position down to the appraised value. We recorded a

$(116.5) million impairment through its equity in loss of

unconsolidated real estate ventures during the third quarter as a

result of the impairment. During 2020 when we sold a preferred

equity interest in the Commerce Square joint venture, we recognized

a net gain on disposition of real estate totaling $271.9

million.

Finance Activity

- We had $40.0

million outstanding balance on our $600.0 million unsecured

revolving credit facility as of September 30, 2024.

- We had $36.5

million of cash and cash equivalents on-hand as of September 30,

2024.

Results for the Three and Nine-Month

Periods Ended September 30, 2024

Net loss allocated to common shares totaled

$(165.5) million or $(0.96) per share in the third quarter of 2024

compared to a net loss of $(21.7) million or $(0.13) per diluted

share in the third quarter of 2023. The 2024 results include

impairment losses totaling $(161.4) million, or $(0.93) per share.

The 2023 results include an impairment loss totaling $(11.7)

million, or $(0.07) per share.

FFO available to common shares and units in the

third quarter of 2024 totaled $39.8 million or $0.23 per diluted

share versus $50.6 million or $0.29 per diluted share in the third

quarter of 2023. Our third quarter 2024 payout ratio ($0.15 common

share distribution / $0.23 FFO per diluted share) was 65.2%.

Net loss allocated to common shares totaled

$(152.3) million or $(0.88) per share for the first nine months of

2024 compared to net loss of $(39.9) million or $(0.23) per diluted

share in the first nine months of 2023. The 2024

results include impairment losses totaling $(167.8) million or

$(0.97) per share and one-time, non-cash income related to the

reversal of our negative investment balance in an unconsolidated

joint venture totaling $53.8 million, or $0.31 per share. The 2023

results include impairment losses totaling $(16.1) million, or

$(0.09) per share.

Our FFO available to common shares and units for

the first nine months of 2024 totaled $119.0 million, or $0.68 per

diluted share compared to FFO available to common shares and units

of $151.1 million, or $0.87 per diluted share, for the first nine

months of 2023. Our first nine months 2024 FFO payout

ratio ($0.45 common share distribution / $0.68 FFO per diluted

share) was 66.2%.

Operating and Leasing

Activity

In the third quarter of 2024, our Net Operating

Income (NOI), excluding termination revenues, bad debt expense and

other income items, decreased (2.0)% on an accrual basis and

increased 1.6% on a cash basis for our 63 same store properties,

which were 87.0% and 89.0% occupied on September 30, 2024 and 2023,

respectively.

We leased approximately 298,000 square feet and

commenced occupancy on 175,000 square feet during the third quarter

of 2024. The third quarter occupancy activity includes 102,000

square feet of renewals and 73,000 square feet of new leases. We

have an additional 185,000 square feet of executed new leasing

scheduled to commence subsequent to September 30, 2024.

Our tenant retention ratio was 42% in our core

portfolio with net negative absorption of (68,000) square feet

during the third quarter of 2024. Third quarter accrual rental rate

growth increased 14.3% on our renewal leasing and 18.0% on new

leasing.

At September 30, 2024 our core portfolio of 64

properties comprising 12.2 million square feet was 87.2% occupied

and 88.7% leased (reflecting new leases commencing after September

30, 2024) as of October 18, 2024.

Distributions

On September 25, 2024, our Board of Trustees

declared a quarterly dividend distribution of $0.15 per common

share that will be paid on October 24, 2024 to shareholders of

record as of October 9, 2024.

2024 Earnings and FFO

Guidance

Based on current plans and assumptions and

subject to the risks and uncertainties more fully described in our

Securities and Exchange Commission filings, we are adjusting our

2024 loss per share guidance from $(0.01) - $0.04 to $(1.01) -

$(0.98) per share and adjusting our 2024 FFO guidance from $0.91 -

$0.96 to $0.89 - $0.92 per diluted share. This guidance is provided

for informational purposes and is subject to change. The following

is a reconciliation of the calculation of 2024 FFO and earnings per

diluted share:

| Guidance for 2024 |

Range |

|

|

|

|

|

|

Loss per diluted share allocated to common

shareholders |

$(1.01) |

to |

$(0.98) |

|

Plus: real estate depreciation, amortization |

1.24 |

|

1.24 |

|

Plus: real estate impairments |

0.97 |

|

0.97 |

|

Less: net gain on real estate venture transactions |

(0.31) |

|

(0.31) |

|

FFO per diluted share |

$0.89 |

to |

$0.92 |

| |

Our 2024 FFO key assumptions include:

- Year-end Core

Occupancy Range: 87-88%;

- Year-end Core

Leased Range: 88-89%;

- Rental Rate

Growth (accrual): 12-13%;

- Rental Rate

Growth (cash): 1-2%;

- Same Store

(accrual) NOI Growth Range: (1)-1%;

- Same Store

(cash) NOI Growth Range: 1-3%;

-

Speculative Revenue Target: Increased $0.8 million from $25.0 -

$26.0 million midpoint to $26.3 million, 100% achieved as of

October 18, 2024;

- Tenant

Retention Rate Range: 59-60% increased to 62-63%: 300

Basis Point Improvement at the mid-point and a 10% improvement as

compared to our initial business plan;

- Interest

Expense Range: $125 - $130 million;

- Property

Acquisition Activity: None;

- Property Sales

Activity (excluding land): Increased to $140 - $160 million from

$80 - $100 million;

- Joint Venture

Activity: Completed the refinancing/recapitalization of our MAP,

Cira Square and Mid-Atlantic joint ventures and formation of a new

50/50 joint venture;

- Development

Starts: None;

- Land Sale

Income: reduced from $5.0 million to None;

- Financing

Activity: Completed the refinance of our 2024 Notes ($335.1 million

outstanding);

- Share Buyback

Activity: None;

- Annual

earnings and FFO per diluted share based on 176.0 million fully

diluted weighted average common shares.

About Brandywine Realty

Trust

Brandywine Realty Trust (NYSE: BDN) is one of

the largest, publicly traded, full-service, integrated real estate

companies in the United States with a core focus in the

Philadelphia and Austin markets. Organized as a real estate

investment trust (REIT), we own, develop, lease and manage an

urban, town center and transit-oriented portfolio comprising 147

properties and 21.1 million square feet as of September 30, 2024.

Our purpose is to shape, connect and inspire the world around us

through our expertise, the relationships we foster, the communities

in which we live and work, and the history we build together. For

more information, please visit www.brandywinerealty.com.

Conference Call and Audio

Webcast

We will release our third quarter earnings after

the market close on Tuesday, October 22, 2024 and will hold our

third quarter conference call on Wednesday, October 23, 2024 at

9:00 a.m. Eastern Time. To access the conference call by

phone, please visit this link here, and you will be provided with

dial in details. A live webcast of the conference call will

also be available on the Investor Relations page of our website at

www.brandywinerealty.com.

Supplemental Information

We produce supplemental information that

includes details regarding the performance of the portfolio,

financial information, non-GAAP financial measures, same-store

information and other useful information for investors. The

supplemental information is available via our website,

www.brandywinerealty.com, through the “Investor Relations”

section.

Looking Ahead – Fourth Quarter 2024

Conference Call

We expect to release our fourth quarter 2024

earnings on Tuesday, February 4, 2025 after the market close and

will host our fourth quarter 2024 conference call on Wednesday,

February 5, 2025 at 9:00 a.m. Eastern. We expect to issue a press

release in advance of these events to reconfirm the dates and times

and provide all related information.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “will,” “strategy,” “expects,”

“seeks,” “believes,” “potential,” or other similar words. Because

such statements involve known and unknown risks, uncertainties and

contingencies, actual results may differ materially from the

expectations, intentions, beliefs, plans or predictions of the

future expressed or implied by such forward-looking statements.

These forward-looking statements, including our 2024 guidance, are

based upon the current beliefs and expectations of our management

and are inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and not within our control. Such risks,

uncertainties and contingencies include, among others: risks

related to the impact of other potential future outbreaks of

infectious diseases on our financial condition, results of

operations and cash flows and those of our tenants as well as on

the economy and real estate and financial markets; reduced demand

for office space and pricing pressures, including from competitors,

changes to tenant work patterns that could limit our ability to

lease space or set rents at expected levels or that could lead to

declines in rent; uncertainty and volatility in capital and credit

markets, including changes that reduce availability, and increase

costs, of capital or that delay receipt of future debt financings

and refinancings; the effect of inflation and interest rate

fluctuations, including on the costs of our planned debt financings

and refinancings; the potential loss or bankruptcy of tenants or

the inability of tenants to meet their rent and other lease

obligations; risks of acquisitions and dispositions, including

unexpected liabilities and integration costs; delays in completing,

and cost overruns incurred in connection with, our developments and

redevelopments; disagreements with joint venture partners;

unanticipated operating and capital costs; uninsured casualty

losses and our ability to obtain adequate insurance, including

coverage for terrorist acts; additional asset impairments; our

dependence upon certain geographic markets; changes in governmental

regulations, tax laws and rates and similar matters; unexpected

costs of REIT qualification compliance; costs and disruptions as

the result of a cybersecurity incident or other technology

disruption; reliance on key personnel; and failure to maintain an

effective system of internal control, including internal control

over financial reporting. The declaration and payment of future

dividends (both timing and amount) is subject to the determination

of our Board of Trustees, in its sole discretion, after considering

various factors, including our financial condition, historical and

forecast operating results, and available cash flow, as well as any

applicable laws and contractual covenants and any other relevant

factors. Our Board’s practice regarding declaration of dividends

may be modified at any time and from time to time. Additional

information on factors which could impact us and the

forward-looking statements contained herein are included in our

filings with the Securities and Exchange Commission, including our

Form 10-K for the year ended December 31, 2023 and our Form 10-Q

for the quarter ended June 30, 2024. We assume no obligation to

update or supplement forward-looking statements that become untrue

because of subsequent events except as required by law.

Non-GAAP Supplemental Financial

Measures

We compute our financial results in accordance

with generally accepted accounting principles (GAAP). Although FFO

and NOI are non-GAAP financial measures, we believe that FFO and

NOI calculations are helpful to shareholders and potential

investors and are widely recognized measures of real estate

investment trust performance. At the end of this press release, we

have provided a reconciliation of the non-GAAP financial measures

to the most directly comparable GAAP measure.

Funds from Operations (FFO)

We compute FFO in accordance with standards

established by the National Association of Real Estate Investment

Trusts (NAREIT), which may not be comparable to FFO reported by

other REITs that do not compute FFO in accordance with the NAREIT

definition, or that interpret the NAREIT definition differently

than us. NAREIT defines FFO as net income (loss) before

non-controlling interests and excluding gains (losses) on sales of

depreciable operating property, impairment losses on depreciable

consolidated real estate, impairment losses on investments in

unconsolidated real estate ventures and extraordinary items

(computed in accordance with GAAP); plus real estate related

depreciation and amortization (excluding amortization of deferred

financing costs), and after similar adjustments for unconsolidated

joint ventures. Net income, the GAAP measure that we believe to be

most directly comparable to FFO, includes depreciation and

amortization expenses, gains or losses on property sales,

extraordinary items and non-controlling interests. To facilitate a

clear understanding of our historical operating results, FFO should

be examined in conjunction with net income (determined in

accordance with GAAP) as presented in the financial statements

included elsewhere in this release. FFO does not represent cash

flow from operating activities (determined in accordance with GAAP)

and should not be considered to be an alternative to net income

(loss) (determined in accordance with GAAP) as an indication of our

financial performance or to be an alternative to cash flow from

operating activities (determined in accordance with GAAP) as a

measure of our liquidity, nor is it indicative of funds available

for our cash needs, including our ability to make cash

distributions to shareholders. We generally consider FFO and FFO

per share to be useful measures for understanding and comparing our

operating results because, by excluding gains and losses related to

sales of previously depreciated operating real estate assets,

impairment losses and real estate asset depreciation and

amortization (which can differ across owners of similar assets in

similar condition based on historical cost accounting and useful

life estimates), FFO and FFO per share can help investors compare

the operating performance of a company’s real estate across

reporting periods and to the operating performance of other

companies.

Net Operating Income (NOI)

NOI (accrual basis) is a financial measure equal

to net income available to common shareholders, the most directly

comparable GAAP financial measure, plus corporate general and

administrative expense, depreciation and amortization, interest

expense, non-controlling interest in the Operating Partnership and

losses from early extinguishment of debt, less interest income,

development and management income, gains from property

dispositions, gains on sale from discontinued operations, gains on

early extinguishment of debt, income from discontinued operations,

income from unconsolidated joint ventures and non-controlling

interest in property partnerships. In some cases we also present

NOI on a cash basis, which is NOI after eliminating the effects of

straight-lining of rent and deferred market intangible

amortization. NOI presented by us may not be comparable to NOI

reported by other REITs that define NOI differently. NOI should not

be considered an alternative to net income as an indication of our

performance or to cash flows as a measure of the Company's

liquidity or its ability to make distributions. We believe NOI is a

useful measure for evaluating the operating performance of our

properties, as it excludes certain components from net income

available to common shareholders in order to provide results that

are more closely related to a property's results of operations. We

use NOI internally to evaluate the performance of our operating

segments and to make decisions about resource allocations. We

concluded that NOI provides useful information to investors

regarding our financial condition and results of operations, as it

reflects only the income and expense items incurred at the property

level, as well as the impact on operations from trends in occupancy

rates, rental rates, operating costs and acquisition and

development activity on an unlevered basis.

Same Store Properties

In our analysis of NOI, particularly to make

comparisons of NOI between periods meaningful, it is important to

provide information for properties that were in-service and owned

by us throughout each period presented. We refer to properties

acquired or placed in-service prior to the beginning of the

earliest period presented and owned by us through the end of the

latest period presented as Same Store Properties. Same Store

Properties therefore exclude properties placed in-service,

acquired, repositioned, held for sale or in development or

redevelopment after the beginning of the earliest period presented

or disposed of prior to the end of the latest period presented.

Accordingly, it takes at least one year and one quarter after a

property is acquired for that property to be included in Same Store

Properties.

Core Portfolio

Our core portfolio is comprised of our

wholly-owned properties, excluding any properties currently in

development, re-development or re-entitlement.

Speculative Revenue

Speculative Revenue represents the amount of

rental revenue the company projects to be recorded during the

current calendar year from new and renewal leasing activity in its

core portfolio that has yet to be executed as of the beginning of

the year. This revenue is primarily attributable to the absorption

of core portfolio square footage that was either vacant at the

beginning of the year or the renewal of existing tenants due to

expire during the current year.

|

|

|

BRANDYWINE REALTY TRUSTCONSOLIDATED

BALANCE SHEETS(unaudited, in thousands, except

share and per share data) |

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

|

|

Real estate investments: |

|

|

|

|

|

Operating properties |

|

$ |

3,421,599 |

|

|

$ |

3,542,232 |

|

|

Accumulated depreciation |

|

|

(1,162,471 |

) |

|

|

(1,131,792 |

) |

|

Right of use asset - operating leases, net |

|

|

18,565 |

|

|

|

19,031 |

|

|

Operating real estate investments, net |

|

|

2,277,693 |

|

|

|

2,429,471 |

|

|

Construction-in-progress |

|

|

157,288 |

|

|

|

135,529 |

|

|

Land held for development |

|

|

78,259 |

|

|

|

82,510 |

|

|

Prepaid leasehold interests in land held for development, net |

|

|

27,762 |

|

|

|

27,762 |

|

|

Total real estate investments, net |

|

|

2,541,002 |

|

|

|

2,675,272 |

|

|

Cash and cash equivalents |

|

|

36,498 |

|

|

|

58,319 |

|

|

Restricted cash and escrow |

|

|

6,195 |

|

|

|

9,215 |

|

|

Accounts receivable |

|

|

8,669 |

|

|

|

11,977 |

|

|

Accrued rent receivable, net of allowance of $1,332 and $2,672 as

of September 30, 2024 and December 31, 2023, respectively |

|

|

187,873 |

|

|

|

186,708 |

|

|

Investment in unconsolidated real estate ventures |

|

|

602,700 |

|

|

|

601,227 |

|

|

Deferred costs, net |

|

|

88,865 |

|

|

|

95,984 |

|

|

Intangible assets, net |

|

|

6,249 |

|

|

|

7,694 |

|

|

Other assets |

|

|

121,509 |

|

|

|

86,051 |

|

|

Total assets |

|

$ |

3,599,560 |

|

|

$ |

3,732,447 |

|

| LIABILITIES AND

BENEFICIARIES' EQUITY |

|

|

|

|

|

Secured debt, net |

|

$ |

272,181 |

|

|

$ |

255,671 |

|

|

Unsecured credit facility |

|

|

40,000 |

|

|

|

— |

|

|

Unsecured term loan, net |

|

|

331,797 |

|

|

|

318,499 |

|

|

Unsecured senior notes, net |

|

|

1,617,795 |

|

|

|

1,564,662 |

|

|

Accounts payable and accrued expenses |

|

|

137,406 |

|

|

|

123,825 |

|

|

Distributions payable |

|

|

26,230 |

|

|

|

26,017 |

|

|

Deferred income, gains and rent |

|

|

21,453 |

|

|

|

24,248 |

|

|

Intangible liabilities, net |

|

|

7,558 |

|

|

|

8,270 |

|

|

Lease liability - operating leases |

|

|

23,502 |

|

|

|

23,369 |

|

|

Other liabilities |

|

|

16,908 |

|

|

|

63,729 |

|

|

Total liabilities |

|

$ |

2,494,830 |

|

|

$ |

2,408,290 |

|

|

Brandywine Realty Trust's Equity: |

|

|

|

|

|

Common Shares of Brandywine Realty Trust's beneficial interest,

$0.01 par value; shares authorized 400,000,000; 172,665,995 and

172,097,661 issued and outstanding as of September 30, 2024

and December 31, 2023, respectively |

|

|

1,724 |

|

|

|

1,719 |

|

|

Additional paid-in-capital |

|

|

3,178,214 |

|

|

|

3,163,949 |

|

|

Deferred compensation payable in common shares |

|

|

20,456 |

|

|

|

19,965 |

|

|

Common shares in grantor trust, 1,221,333 and 1,194,127 issued and

outstanding as of September 30, 2024 and December 31,

2023, respectively |

|

|

(20,456 |

) |

|

|

(19,965 |

) |

|

Cumulative earnings |

|

|

827,991 |

|

|

|

979,406 |

|

|

Accumulated other comprehensive income |

|

|

(3,773 |

) |

|

|

(668 |

) |

|

Cumulative distributions |

|

|

(2,905,554 |

) |

|

|

(2,827,022 |

) |

|

Total Brandywine Realty Trust's equity |

|

|

1,098,602 |

|

|

|

1,317,384 |

|

|

Noncontrolling interests |

|

|

6,128 |

|

|

|

6,773 |

|

|

Total beneficiaries' equity |

|

$ |

1,104,730 |

|

|

$ |

1,324,157 |

|

|

Total liabilities and beneficiaries' equity |

|

$ |

3,599,560 |

|

|

$ |

3,732,447 |

|

| |

|

|

|

|

|

BRANDYWINE REALTY TRUSTCONSOLIDATED

STATEMENTS OF OPERATIONS(unaudited, in thousands,

except share and per share data) |

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

Rents |

|

$ |

117,958 |

|

|

$ |

121,661 |

|

|

$ |

354,975 |

|

|

$ |

360,642 |

|

|

Third party management fees, labor reimbursement and leasing |

|

|

6,093 |

|

|

|

6,553 |

|

|

|

17,685 |

|

|

|

18,782 |

|

|

Other |

|

|

7,731 |

|

|

|

1,158 |

|

|

|

10,952 |

|

|

|

5,057 |

|

|

Total revenue |

|

|

131,782 |

|

|

|

129,372 |

|

|

|

383,612 |

|

|

|

384,481 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

Property operating expenses |

|

|

31,900 |

|

|

|

31,123 |

|

|

|

95,532 |

|

|

|

96,608 |

|

|

Real estate taxes |

|

|

11,892 |

|

|

|

12,808 |

|

|

|

37,019 |

|

|

|

38,981 |

|

|

Third party management expenses |

|

|

2,487 |

|

|

|

2,468 |

|

|

|

7,456 |

|

|

|

7,664 |

|

|

Depreciation and amortization |

|

|

44,301 |

|

|

|

48,966 |

|

|

|

133,530 |

|

|

|

141,645 |

|

|

General and administrative expenses |

|

|

12,681 |

|

|

|

8,069 |

|

|

|

32,726 |

|

|

|

26,911 |

|

|

Provision for impairment |

|

|

37,980 |

|

|

|

11,666 |

|

|

|

44,407 |

|

|

|

16,134 |

|

|

Total operating expenses |

|

|

141,241 |

|

|

|

115,100 |

|

|

|

350,670 |

|

|

|

327,943 |

|

| Gain on sale of real

estate |

|

|

|

|

|

|

|

|

|

Net gain on sale of undepreciated real estate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

781 |

|

|

Total gain on sale of real estate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

781 |

|

| Operating income

(loss) |

|

|

(9,459 |

) |

|

|

14,272 |

|

|

|

32,942 |

|

|

|

57,319 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

Interest and investment income |

|

|

639 |

|

|

|

293 |

|

|

|

2,572 |

|

|

|

1,318 |

|

|

Interest expense |

|

|

(30,561 |

) |

|

|

(24,355 |

) |

|

|

(85,104 |

) |

|

|

(70,677 |

) |

|

Interest expense - amortization of deferred financing costs |

|

|

(1,247 |

) |

|

|

(1,110 |

) |

|

|

(3,753 |

) |

|

|

(3,251 |

) |

| Equity in loss of

unconsolidated real estate ventures |

|

|

(125,862 |

) |

|

|

(10,739 |

) |

|

|

(153,957 |

) |

|

|

(24,504 |

) |

|

Net gain on real estate venture transactions |

|

|

770 |

|

|

|

— |

|

|

|

54,503 |

|

|

|

181 |

|

|

Gain on early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

941 |

|

|

|

— |

|

| Net loss before income

taxes |

|

|

(165,720 |

) |

|

|

(21,639 |

) |

|

|

(151,856 |

) |

|

|

(39,614 |

) |

|

Income tax benefit (provision) |

|

|

— |

|

|

|

3 |

|

|

|

(11 |

) |

|

|

(35 |

) |

| Net loss |

|

|

(165,720 |

) |

|

|

(21,636 |

) |

|

|

(151,867 |

) |

|

|

(39,649 |

) |

| Net loss attributable to

noncontrolling interests |

|

|

500 |

|

|

|

82 |

|

|

|

452 |

|

|

|

140 |

|

| Net loss attributable

to Brandywine Realty Trust |

|

|

(165,220 |

) |

|

|

(21,554 |

) |

|

|

(151,415 |

) |

|

|

(39,509 |

) |

| Nonforfeitable dividends

allocated to unvested restricted shareholders |

|

|

(276 |

) |

|

|

(159 |

) |

|

|

(889 |

) |

|

|

(433 |

) |

| Net loss attributable

to Common Shareholders of Brandywine Realty Trust |

|

$ |

(165,496 |

) |

|

$ |

(21,713 |

) |

|

$ |

(152,304 |

) |

|

$ |

(39,942 |

) |

| PER SHARE

DATA |

|

|

|

|

|

|

|

|

| Basic loss per Common

Share |

|

$ |

(0.96 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.88 |

) |

|

$ |

(0.23 |

) |

| Basic weighted average shares

outstanding |

|

|

172,668,731 |

|

|

|

172,097,661 |

|

|

|

172,480,325 |

|

|

|

171,912,552 |

|

| Diluted loss per Common

Share |

|

$ |

(0.96 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.88 |

) |

|

$ |

(0.23 |

) |

| Diluted weighted average

shares outstanding |

|

|

172,668,731 |

|

|

|

172,097,661 |

|

|

|

172,480,325 |

|

|

|

171,912,552 |

|

|

|

|

BRANDYWINE REALTY TRUSTFUNDS FROM

OPERATIONS(unaudited, in thousands, except share

and per share data) |

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss attributable

to common shareholders |

|

$ |

(165,496 |

) |

|

$ |

(21,713 |

) |

|

$ |

(152,304 |

) |

|

$ |

(39,942 |

) |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interests - LP units |

|

|

(497 |

) |

|

|

(62 |

) |

|

|

(455 |

) |

|

|

(119 |

) |

|

Nonforfeitable dividends allocated to unvested restricted

shareholders |

|

|

276 |

|

|

|

159 |

|

|

|

889 |

|

|

|

433 |

|

|

Net loss on real estate venture transactions |

|

|

(7,929 |

) |

|

|

— |

|

|

|

(61,662 |

) |

|

|

(181 |

) |

|

Provision for impairment |

|

|

37,426 |

|

|

|

11,666 |

|

|

|

43,853 |

|

|

|

16,134 |

|

|

Company's share of impairment of an unconsolidated real estate

venture |

|

|

123,376 |

|

|

|

— |

|

|

|

123,376 |

|

|

|

— |

|

|

Depreciation and amortization: |

|

|

|

|

|

|

|

|

|

Real property |

|

|

38,584 |

|

|

|

40,493 |

|

|

|

116,069 |

|

|

|

118,242 |

|

|

Leasing costs including acquired intangibles |

|

|

4,862 |

|

|

|

7,594 |

|

|

|

14,785 |

|

|

|

20,837 |

|

|

Company’s share of unconsolidated real estate ventures |

|

|

9,636 |

|

|

|

12,840 |

|

|

|

35,782 |

|

|

|

36,549 |

|

|

Partners’ share of consolidated real estate ventures |

|

|

(6 |

) |

|

|

(8 |

) |

|

|

(6 |

) |

|

|

(16 |

) |

| Funds from operations |

|

$ |

40,232 |

|

|

$ |

50,969 |

|

|

$ |

120,327 |

|

|

$ |

151,937 |

|

|

Funds from operations allocable to unvested restricted

shareholders |

|

|

(420 |

) |

|

|

(347 |

) |

|

|

(1,306 |

) |

|

|

(880 |

) |

| Funds from operations

available to common share and unit holders (FFO) |

|

$ |

39,812 |

|

|

$ |

50,622 |

|

|

$ |

119,021 |

|

|

$ |

151,057 |

|

| FFO per share - fully

diluted |

|

$ |

0.23 |

|

|

$ |

0.29 |

|

|

$ |

0.68 |

|

|

$ |

0.87 |

|

| Weighted-average shares/units

outstanding — fully diluted |

|

|

175,997,959 |

|

|

|

173,236,769 |

|

|

|

175,238,507 |

|

|

|

172,954,267 |

|

| Distributions paid per common

share |

|

$ |

0.15 |

|

|

$ |

0.19 |

|

|

$ |

0.45 |

|

|

$ |

0.57 |

|

| FFO payout ratio

(distributions paid per common share/FFO per diluted share) |

|

|

65 |

% |

|

|

66 |

% |

|

|

66 |

% |

|

|

66 |

% |

| |

BRANDYWINE REALTY

TRUSTSAME STORE OPERATIONS –

3rd QUARTER(unaudited and

in thousands)

Of the 67 properties owned by the Company as of

September 30, 2024, a total of 63 properties ("Same Store

Properties") containing an aggregate of 11.9 million net rentable

square feet were owned for the entire three months ended September

30, 2024 and 2023. As of September 30, 2024, two properties

were recently completed, and two properties were in

development/redevelopment. The Same Store Properties were 87.0% and

89.0% occupied as of September 30, 2024 and 2023,

respectively. The following table sets forth revenue and expense

information for the Same Store Properties:

| |

|

Three Months Ended September 30, |

| |

|

2024 |

|

2023 |

| Revenue |

|

|

|

|

|

Rents |

|

$ |

107,250 |

|

|

$ |

108,450 |

|

|

Other |

|

|

267 |

|

|

|

233 |

|

|

Total revenue |

|

|

107,517 |

|

|

|

108,683 |

|

| Operating

expenses |

|

|

|

|

|

Property operating expenses |

|

|

27,815 |

|

|

|

27,662 |

|

|

Real estate taxes |

|

|

10,787 |

|

|

|

11,631 |

|

|

Net operating income |

|

$ |

68,915 |

|

|

$ |

69,390 |

|

|

Net operating income - percentage change over prior

year |

|

|

(0.7 |

)% |

|

|

|

Net operating income, excluding other items |

|

$ |

68,326 |

|

|

$ |

69,719 |

|

|

Net operating income, excluding other items - percentage

change over prior year |

|

|

(2.0 |

)% |

|

|

| Net operating

income |

|

$ |

68,915 |

|

|

$ |

69,390 |

|

|

Straight line rents & other |

|

|

1,019 |

|

|

|

(878 |

) |

|

Above/below market rent amortization |

|

|

(225 |

) |

|

|

(268 |

) |

|

Amortization of tenant inducements |

|

|

213 |

|

|

|

136 |

|

|

Non-cash ground rent expense |

|

|

239 |

|

|

|

249 |

|

|

Cash - Net operating income |

|

$ |

70,161 |

|

|

$ |

68,629 |

|

|

Cash - Net operating income - percentage change over prior

year |

|

|

2.2 |

% |

|

|

|

Cash - Net operating income, excluding other

items |

|

$ |

69,317 |

|

|

$ |

68,197 |

|

|

Cash - Net operating income, excluding other items -

percentage change over prior year |

|

|

1.6 |

% |

|

|

| |

|

Three Months Ended September 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

| Net loss: |

|

$ |

(165,720 |

) |

|

$ |

(21,636 |

) |

| Add/(deduct): |

|

|

|

|

|

Interest and investment income |

|

|

(639 |

) |

|

|

(293 |

) |

|

Interest expense |

|

|

30,561 |

|

|

|

24,355 |

|

|

Interest expense - amortization of deferred financing costs |

|

|

1,247 |

|

|

|

1,110 |

|

|

Equity in loss of unconsolidated real estate ventures |

|

|

125,862 |

|

|

|

10,739 |

|

|

Net gain on real estate venture transactions |

|

|

(770 |

) |

|

|

— |

|

|

Depreciation and amortization |

|

|

44,301 |

|

|

|

48,966 |

|

|

General & administrative expenses |

|

|

12,681 |

|

|

|

8,069 |

|

|

Income tax provision |

|

|

— |

|

|

|

(3 |

) |

|

Provision for impairment |

|

|

37,980 |

|

|

|

11,666 |

|

|

Consolidated net operating income |

|

|

85,503 |

|

|

|

82,973 |

|

| Less: Net operating income of

non-same store properties and elimination of non-property specific

operations |

|

|

(16,588 |

) |

|

|

(13,583 |

) |

|

Same store net operating income |

|

$ |

68,915 |

|

|

$ |

69,390 |

|

| |

|

|

|

|

BRANDYWINE REALTY

TRUSTSAME STORE OPERATIONS – NINE

MONTHS(unaudited and in

thousands)

Of the 67 properties owned by the Company as of

September 30, 2024, a total of 63 properties ("Same Store

Properties") containing an aggregate of 11.9 million net

rentable square feet were owned for the entire nine months ended

September 30, 2024 and 2023. As of September 30, 2024, two

properties were recently completed, and two properties were in

development/redevelopment. The Same Store Properties were 87.0% and

89.0% occupied as of September 30, 2024 and 2023,

respectively. The following table sets forth revenue and expense

information for the Same Store Properties:

| |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

| Revenue |

|

|

|

|

|

Rents |

|

$ |

321,266 |

|

|

$ |

324,026 |

|

|

Other |

|

|

798 |

|

|

|

757 |

|

|

Total revenue |

|

|

322,064 |

|

|

|

324,783 |

|

| Operating

expenses |

|

|

|

|

|

Property operating expenses |

|

|

84,022 |

|

|

|

84,668 |

|

|

Real estate taxes |

|

|

33,871 |

|

|

|

34,934 |

|

|

Net operating income |

|

$ |

204,171 |

|

|

$ |

205,181 |

|

|

Net operating income - percentage change over prior

year |

|

|

(0.5 |

)% |

|

|

|

Net operating income, excluding other items |

|

$ |

204,262 |

|

|

$ |

205,322 |

|

|

Net operating income, excluding other items - percentage

change over prior year |

|

|

(0.5 |

)% |

|

|

| Net operating

income |

|

$ |

204,171 |

|

|

$ |

205,181 |

|

|

Straight line rents & other |

|

|

(173 |

) |

|

|

(5,704 |

) |

|

Above/below market rent amortization |

|

|

(706 |

) |

|

|

(839 |

) |

|

Amortization of tenant inducements |

|

|

563 |

|

|

|

398 |

|

|

Non-cash ground rent expense |

|

|

722 |

|

|

|

753 |

|

|

Cash - Net operating income |

|

$ |

204,577 |

|

|

$ |

199,789 |

|

|

Cash - Net operating income - percentage change over prior

year |

|

|

2.4 |

% |

|

|

|

Cash - Net operating income, excluding other

items |

|

$ |

203,762 |

|

|

$ |

197,829 |

|

|

Cash - Net operating income, excluding other items -

percentage change over prior year |

|

|

3.0 |

% |

|

|

| |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

| Net loss: |

|

$ |

(151,867 |

) |

|

$ |

(39,649 |

) |

| Add/(deduct): |

|

|

|

|

|

Interest income |

|

|

(2,572 |

) |

|

|

(1,318 |

) |

|

Interest expense |

|

|

85,104 |

|

|

|

70,677 |

|

|

Interest expense - amortization of deferred financing costs |

|

|

3,753 |

|

|

|

3,251 |

|

|

Equity in loss of unconsolidated real estate ventures |

|

|

153,957 |

|

|

|

24,504 |

|

|

Net gain on real estate venture transactions |

|

|

(54,503 |

) |

|

|

(181 |

) |

|

Net gain on sale of undepreciated real estate |

|

|

— |

|

|

|

(781 |

) |

|

Gain on early extinguishment of debt |

|

|

(941 |

) |

|

|

— |

|

|

Depreciation and amortization |

|

|

133,530 |

|

|

|

141,645 |

|

|

General & administrative expenses |

|

|

32,726 |

|

|

|

26,911 |

|

|

Income tax provision |

|

|

11 |

|

|

|

35 |

|

|

Provision for impairment |

|

|

44,407 |

|

|

|

16,134 |

|

|

Consolidated net operating income |

|

|

243,605 |

|

|

|

241,228 |

|

| Less: Net operating income of

non-same store properties and elimination of non-property specific

operations |

|

|

(39,434 |

) |

|

|

(36,047 |

) |

|

Same store net operating income |

|

$ |

204,171 |

|

|

$ |

205,181 |

|

|

|

Company / Investor Contact:Tom WirthEVP & CFO610-832-7434

tom.wirth@bdnreit.com

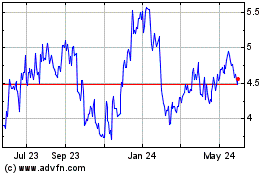

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Nov 2024 to Dec 2024

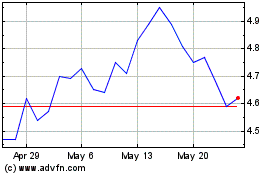

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Dec 2023 to Dec 2024