Current Report Filing (8-k)

December 21 2022 - 4:35PM

Edgar (US Regulatory)

PA00007908160001060386false 0000790816 2022-12-20 2022-12-20 0000790816 srt:SubsidiariesMember 2022-12-20 2022-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 21, 2022 (

December 20, 2022

)

BRANDYWINE OPERATING PARTNERSHIP, L.P.

(Exact name of registrant as specified in charter)

| |

|

|

|

|

Maryland (Brandywine Realty Trust) |

|

|

|

|

| |

|

|

Delaware (Brandywine Operating Partnership, L.P.) |

|

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

file number) |

|

(I.R.S. Employer

Identification Number) |

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

Common Shares of Beneficial Interest |

|

BDN |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company

☐

Brandywine Operating Partnership, L.P.

:

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Brandywine Realty Trust

: ☐

Brandywine Operating Partnership, L.P.

: ☐

Item 2.04 |

Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

On December 21, 2022, Brandywine Realty Trust, a Maryland real estate investment trust (the “Company”), issued a press release announcing that its operating partnership, Brandywine Operating Partnership, L.P. (the “Operating Partnership”), gave notice under the Indenture, dated as of October 22, 2004 (as modified or supplemented from time to time, the “Indenture”), as supplemented by the First Supplemental Indenture dated as of May 25, 2005, and the Third Supplemental Indenture dated as of April 5, 2011, among the Company, the Operating Partnership and The Bank of New York Mellon (formerly known as The Bank of New York), as trustee, for the redemption of all of the outstanding aggregate principal amount of its 3.95% Guaranteed Notes due 2023 (the “2023 Notes”) following its previously announced cash tender offer (the “Tender Offer”) of its 2023 Notes. The expected redemption date will be January 20, 2023 (the “Redemption Date”).

The 2023 Notes will be redeemed at a redemption price equal to 100% of the principal amount of the 2023 Notes being redeemed plus accrued and unpaid interest on the principal amount of 2023 Notes being redeemed to the Redemption Date.

The redemption notice was distributed to holders of the 2023 Notes or about December 21, 2022. The Operating Partnership intends to use a portion of the net proceeds from the previously announced offering and sale of $350.0 million in aggregate principal amount of the 7.550% Guaranteed Notes due 2028 (the “Notes Offering”) to fund the redemption.

The press release announcing the redemption of the 2023 Notes is attached hereto as Exhibit 99.1 and is incorporated in this Item 2.04 by this reference.

On December 20, 2022, the Company announced the completion of the Tender Offer. The Tender Offer expired at 5:00 p.m., New York City time, on Tuesday, December 20, 2022 (the “Expiration Date”). As of the expiration of the Tender Offer, $295,699,000 or 84.49% of the $350,000,000 aggregate principal amount of the 2023 Notes outstanding prior to the Tender Offer had been validly tendered and not withdrawn in the Tender Offer (excluding $634,000 in aggregate principal amount of the 2023 Notes submitted pursuant to the guaranteed delivery procedures described in the Operating Partnership’s Offer to Purchase, dated December 14, 2022 (the “Offer to Purchase”) and the related Notice of Guaranteed Delivery). The Operating Partnership accepted for purchase all of the 2023 Notes validly tendered and delivered (and not validly withdrawn) in the Tender Offer at or prior to the Expiration Date. Payment for the 2023 Notes purchased pursuant to the Tender Offer was made on December 21, 2022 (the “Payment Date”).

The consideration paid under the Tender Offer was $1,000 per $1,000 principal amount of 2023 Notes, plus accrued and unpaid interest to, but not including, the Payment Date. The total Tender Offer consideration of $299,787,038.90

including accrued and unpaid interest (excluding consideration and accrued and unpaid interest for the 2023 Notes delivered pursuant to the Notice of Guaranteed Delivery) was funded from a portion of the net proceeds from the Notes Offering.

The 2023 Notes validly tendered by the Notice of Guaranteed Delivery and accepted for purchase are expected to be purchased on the second business day after the Payment Date, but payment of accrued and unpaid interest on such 2023 Notes will only be made to, but not including, the Payment Date.

The Tender Offer was made pursuant to the Offer to Purchase and the related Letter of Transmittal and Notice of Guaranteed Delivery. BofA Securities, Inc. and Citigroup Global Markets Inc. acted as Dealer Managers for the Tender Offer. This Current Report on Form

8-K

is neither an offer to purchase nor a solicitation to buy any of the 2023 Notes nor is it a solicitation for acceptance of the Tender Offer.

The press release announcing the expiration of the Tender Offer is attached hereto as Exhibit 99.2 and is incorporated in this Item 8.01 by this reference.

Item 9.01. |

Financial Statements and Exhibits |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

|

| B RANDYWINE REALTY TRUST |

| |

|

| By: |

|

/s/ Gerard H. Sweeney |

| |

|

Gerard H. Sweeney |

| |

|

President and Chief Executive Officer |

| |

| B RANDYWINE OPERATING PARTNERSHIP , L.P. |

| |

|

| By: |

|

B RANDYWINE REALTY TRUST , ITS GENERAL PARTNER |

| |

|

| By: |

|

/s/ Gerard H. Sweeney |

| |

|

Gerard H. Sweeney |

| |

|

President and Chief Executive Officer |

Date: December 21, 2022

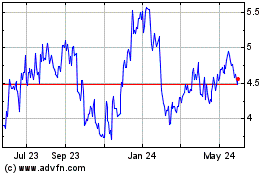

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Jul 2024 to Aug 2024

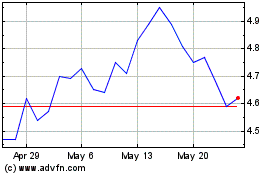

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Aug 2023 to Aug 2024