UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2018

BRADY CORPORATION

(Exact name of registrant as specified in its charter) Commission File Number 1-14959

|

| | |

| | |

Wisconsin | | 39-0971239 |

(State of Incorporation) | | (IRS Employer Identification No.) |

6555 West Good Hope Road

Milwaukee, Wisconsin 53223

(Address of Principal Executive Offices and Zip Code)

(414) 358-6600

(Registrant’s Telephone Number) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 or the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

| |

Item 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On February 22, 2018, Brady Corporation (the “Company”) issued a press release announcing its fiscal 2018 second quarter financial results. A copy of the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 attached hereto and is incorporated herein by reference.

|

| |

Item 7.01 | REGULATION FD DISCLOSURE |

On February 22, 2018, the Company hosted a conference call related to its fiscal 2018 second quarter financial results. A copy of the slides referenced in the conference call, which is also posted on the Corporation’s website, is being furnished to the Securities and Exchange Commission as Exhibit 99.2 attached hereto and is incorporated herein by reference.

|

| |

Item 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

|

| |

EXHIBIT NUMBER | DESCRIPTION |

99.1 | |

99.2 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | BRADY CORPORATION |

| | |

| | |

Date: February 22, 2018 | | /s/ AARON J. PEARCE |

| | Aaron J. Pearce |

| | Chief Financial Officer and Treasurer |

EXHIBIT 99.1

For More Information:

Investor contact: Ann Thornton 414-438-6887

Media contact: Kate Venne 414-358-5176

Brady Corporation Reports Fiscal 2018 Second Quarter Results and Increases its Fiscal 2018 EPS Guidance

| |

• | Earnings before income taxes increased 20.4 percent, finishing at $35.0 million in the second quarter of fiscal 2018 compared to $29.1 million in the second quarter of fiscal 2017. This marks the 10th consecutive quarter of growth. |

| |

• | Earnings per diluted Class A Nonvoting Common Share were $0.08 in the second quarter of fiscal 2018 compared to $0.49 in the same quarter of the prior year. Results were reduced by approximately $0.40 per diluted Class A Nonvoting Common Share due to tax charges primarily related to U.S. tax legislation enacted during the quarter. |

| |

• | Total revenues increased 7.4 percent, which consisted of organic revenue growth of 3.2 percent and an increase of 4.2 percent due to foreign currency translation. |

| |

• | Earnings per diluted Class A Common Share guidance for the full year ending July 31, 2018 was increased to a range of $1.90 to $2.00, exclusive of tax charges primarily related to the enactment of the U.S. tax legislation. |

MILWAUKEE (February 22, 2018)--Brady Corporation (NYSE: BRC) (“Brady” or “Company”), a world leader in identification solutions, today reported its financial results for its fiscal 2018 second quarter ended January 31, 2018.

Quarter Ended January 31, 2018 Financial Results:

Earnings before income taxes increased 20.4 percent, finishing at $35.0 million for the second quarter of fiscal 2018 compared to $29.1 million for the second quarter of fiscal 2017.

Net earnings for the quarter ended January 31, 2018, were $4.3 million compared to $25.3 million in the same quarter last year. During the quarter ended January 31, 2018, net earnings were reduced by $21.1 million due to income tax charges primarily related to the passage of the U.S. Tax Cuts and Jobs Act of 2017. The prior year quarter ended January 31, 2017 was impacted by a cash repatriation which resulted in a lower than normal income tax rate.

Earnings per diluted Class A Nonvoting Common Share were $0.08 for the quarter ended January 31, 2018, compared to $0.49 in the same quarter last year. Income tax expense in the prior year quarter ended January 31, 2017 was impacted by a cash repatriation which increased earnings per diluted Class A Nonvoting Common Share by approximately $0.09, whereas the impact on income tax expense for the quarter ended January 31, 2018 from tax

charges primarily related to the enactment of the U.S. tax legislation was a reduction in earnings per diluted Class A Nonvoting Common Share of approximately $0.40.

Sales for the quarter ended January 31, 2018 increased 7.4 percent to $287.8 million compared to $268.0 million in the same quarter last year. By segment, sales increased 8.1 percent in Identification Solutions and 5.6 percent in Workplace Safety, which consisted of organic sales growth of 4.7 percent in Identification Solutions and an organic sales decline of 0.5 percent in Workplace Safety.

Six-Month Period Ended January 31, 2018 Financial Results:

Earnings before income taxes increased 16.1 percent, finishing at $69.8 million for the six-month period ended January 31, 2018, compared to $60.1 million for the six-month period ended January 31, 2017.

Net earnings for the six-month period ended January 31, 2018 were $30.1 million compared to $47.9 million for the six-month period ended January 31, 2017. During the six-month period ended January 31, 2018, net earnings were reduced by $21.1 million due to tax charges primarily related to the passage of the U.S. Tax Cuts and Jobs Act of 2017. The prior year six-month period ended January 31, 2017 was impacted by a cash repatriation which resulted in a lower than normal income tax rate.

Earnings per diluted Class A Nonvoting Common Share were $0.57 for the six-month period ended January 31, 2018, compared to $0.93 in the same six-month period last year. Income tax expense in the prior year six-month period ended January 31, 2017 was impacted by a cash repatriation which increased earnings per diluted Class A Nonvoting Common Share by approximately $0.09, whereas the impact on income tax expense for the six-month period ended January 31, 2018 from tax charges primarily related to the enactment of U.S. tax legislation was a reduction of approximately $0.40 of earnings per diluted Class A Nonvoting Common Share.

Sales for the six-month period ended January 31, 2018 increased 5.4 percent to $577.9 million compared to $548.2 million in the same six-month period last year. By segment, sales increased 6.1 percent in Identification Solutions and 3.7 percent in Workplace Safety, which consisted of organic sales growth of 3.8 percent in Identification Solutions and an organic sales decline of 1.0 percent in Workplace Safety.

Commentary:

“Our investment in the development of innovative, high-quality products is paying off as we generated more than three percent organic sales growth this quarter, which was driven by our Identification Solutions business. This marks our tenth consecutive quarter of year-over-year pre-tax earnings improvement, which was a direct result of our focus on driving organic growth while achieving sustainable efficiency gains throughout our SG&A structure,” said Brady’s President and Chief Executive Officer, J. Michael Nauman. “We expect to continue this positive organic sales trend as we gain momentum in our research and development processes and through the execution of our strategy in our Workplace Safety business. Our focus is consistent and remains on the long-term by taking actions today that we believe will result in organic sales growth and profit improvements into the future.”

“Organic sales growth and our continued focus on efficiency opportunities throughout SG&A were the drivers of our profit improvement this quarter,” said Brady’s Chief Financial Officer, Aaron Pearce. “We used our

cash generation to return funds to our shareholders and to repay debt. We repaid $27.9 million in debt during the quarter and finished in a net cash position of $44.1 million as of January 31, 2018. Our balance sheet continues to provide significant flexibility for investments in growth opportunities to drive long-term value for our shareholders.”

Fiscal 2018 Guidance:

The Company is increasing its full year fiscal 2018 earnings per diluted Class A Nonvoting Common Share guidance from its previous range of $1.85 to $1.95 to a range of $1.90 to $2.00, exclusive of tax charges primarily related to the enactment of the U.S. Tax Cuts and Jobs Act of 2017. Included in this guidance is low-single digit organic sales growth, depreciation and amortization expense of approximately $26 million, and capital expenditures of approximately $20 million during the year ending July 31, 2018. The Company expects its full-year income tax rate, exclusive of charges primarily related to the enactment of the U.S. Tax Cuts and Jobs Act of 2017, to range from approximately 27 percent to 29 percent. This guidance is based upon foreign exchange rates as of January 31, 2018.

A webcast regarding Brady’s fiscal 2018 second quarter financial results will be available at www.bradycorp.com beginning at 9:30 a.m. Central Time today.

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect people, products and places. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Founded in 1914, the Company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, medical, aerospace and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin and as of July 31, 2017, employed approximately 6,300 people in its worldwide businesses. Brady’s fiscal 2017 sales were approximately $1.11 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available on the Internet at www.bradycorp.com.

###

In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations.

The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: our ability to compete effectively or to successfully execute our strategy; Brady’s ability to develop technologically advanced products that meet customer demands; difficulties in protecting our websites, networks, and systems against security breaches; decreased demand for our products; Brady’s ability to retain large customers; extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities; Brady’s ability to execute facility consolidations and maintain acceptable operational service metrics; litigation, including product liability claims; risks associated with the loss of key employees; divestitures and contingent liabilities from divestitures; Brady’s ability to properly identify, integrate, and grow acquired companies; foreign currency fluctuations; the impact of the Tax Reform Act and any other changes in tax legislation and tax rates; potential write-offs of Brady’s substantial intangible assets; differing interests of voting and non-voting shareholders; Brady’s ability to meet certain financial covenants required by our debt agreements; numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2017.

These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited; Dollars in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| Three months ended January 31, | | Six months ended January 31, |

| 2018 | | 2017 | | 2018 | | 2017 |

Net sales | $ | 287,780 |

| | $ | 268,001 |

| | $ | 577,931 |

| | $ | 548,177 |

|

Cost of products sold | 144,088 |

| | 133,843 |

| | 288,174 |

| | 273,661 |

|

Gross margin | 143,692 |

| | 134,158 |

| | 289,757 |

| | 274,516 |

|

Operating expenses: | | | | | | | |

Research and development | 11,314 |

| | 9,481 |

| | 21,834 |

| | 18,627 |

|

Selling, general and administrative | 97,582 |

| | 94,715 |

| | 197,716 |

| | 192,719 |

|

Total operating expenses | 108,896 |

| | 104,196 |

| | 219,550 |

| | 211,346 |

|

| | | | | | | |

Operating income | 34,796 |

| | 29,962 |

| | 70,207 |

| | 63,170 |

|

| | | | | | | |

Other income (expense): | | | | | | | |

Investment and other income | 1,056 |

| | 596 |

| | 1,272 |

| | 107 |

|

Interest expense | (829 | ) | | (1,458 | ) | | (1,692 | ) | | (3,190 | ) |

| | | | | | | |

Earnings before income taxes | 35,023 |

| | 29,100 |

| | 69,787 |

| | 60,087 |

|

| | | | | | | |

Income tax expense | 30,750 |

| | 3,803 |

| | 39,678 |

| | 12,237 |

|

| | | | | | | |

Net earnings | $ | 4,273 |

| | $ | 25,297 |

| | $ | 30,109 |

| | $ | 47,850 |

|

| | | | | | | |

| | | | | | | |

Net earnings per Class A Nonvoting Common Share: | | | | | | | |

Basic | $ | 0.08 |

| | $ | 0.50 |

| | $ | 0.58 |

| | $ | 0.94 |

|

Diluted | $ | 0.08 |

| | $ | 0.49 |

| | $ | 0.57 |

| | $ | 0.93 |

|

Dividends | $ | 0.21 |

| | $ | 0.21 |

| | $ | 0.42 |

| | $ | 0.41 |

|

| | | | | | | |

Net earnings per Class B Voting Common Share: | | | | | | | |

Basic | $ | 0.08 |

| | $ | 0.50 |

| | $ | 0.57 |

| | $ | 0.93 |

|

Diluted | $ | 0.08 |

| | $ | 0.49 |

| | $ | 0.56 |

| | $ | 0.91 |

|

Dividends | $ | 0.21 |

| | $ | 0.21 |

| | $ | 0.40 |

| | $ | 0.39 |

|

| | | | | | | |

Weighted average common shares outstanding (in thousands): | | | | | | | |

Basic | 51,698 |

| | 51,054 |

| | 51,569 |

| | 50,844 |

|

Diluted | 52,719 |

| | 51,954 |

| | 52,551 |

| | 51,721 |

|

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited; Dollars in thousands)

|

| | | | | | | |

| January 31, 2018 | | July 31, 2017 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 115,327 |

| | $ | 133,944 |

|

Accounts receivable—net | 164,400 |

| | 149,638 |

|

Inventories: | | | |

Finished products | 72,629 |

| | 69,760 |

|

Work-in-process | 19,472 |

| | 18,117 |

|

Raw materials and supplies | 21,344 |

| | 19,147 |

|

Total inventories | 113,445 |

| | 107,024 |

|

Prepaid expenses and other current assets | 20,950 |

| | 17,208 |

|

Total current assets | 414,122 |

| | 407,814 |

|

Other assets: | | | |

Goodwill | 443,873 |

| | 437,697 |

|

Other intangible assets | 50,131 |

| | 53,076 |

|

Deferred income taxes | 9,899 |

| | 35,456 |

|

Other | 18,579 |

| | 18,077 |

|

Property, plant and equipment: | | | |

Cost: | | | |

Land | 7,535 |

| | 7,470 |

|

Buildings and improvements | 98,256 |

| | 98,228 |

|

Machinery and equipment | 265,640 |

| | 261,192 |

|

Construction in progress | 6,176 |

| | 4,109 |

|

| 377,607 |

| | 370,999 |

|

Less accumulated depreciation | 279,826 |

| | 272,896 |

|

Property, plant and equipment—net | 97,781 |

| | 98,103 |

|

Total | $ | 1,034,385 |

| | $ | 1,050,223 |

|

LIABILITIES AND STOCKHOLDERS’ INVESTMENT | | | |

Current liabilities: | | | |

Notes payable | $ | 585 |

| | $ | 3,228 |

|

Accounts payable | 64,365 |

| | 66,817 |

|

Wages and amounts withheld from employees | 49,679 |

| | 58,192 |

|

Taxes, other than income taxes | 7,997 |

| | 7,970 |

|

Accrued income taxes | 6,085 |

| | 7,373 |

|

Other current liabilities | 42,961 |

| | 43,618 |

|

Total current liabilities | 171,672 |

| | 187,198 |

|

Long-term obligations | 70,615 |

| | 104,536 |

|

Other liabilities | 60,125 |

| | 58,349 |

|

Total liabilities | 302,412 |

| | 350,083 |

|

Stockholders’ investment: | | | |

Common Stock: | | | |

Class A nonvoting common stock—Issued 51,261,487 and 51,261,487 shares, respectively, and outstanding 48,238,412 and 47,814,818 shares, respectively | 513 |

| | 513 |

|

Class B voting common stock—Issued and outstanding, 3,538,628 shares | 35 |

| | 35 |

|

Additional paid-in capital | 325,733 |

| | 322,608 |

|

Earnings retained in the business | 515,872 |

| | 507,136 |

|

Treasury stock—3,023,075 and 3,446,669 shares, respectively of Class A nonvoting common stock, at cost | (75,090 | ) | | (85,470 | ) |

Accumulated other comprehensive loss | (35,090 | ) | | (44,682 | ) |

Total stockholders’ investment | 731,973 |

| | 700,140 |

|

Total | $ | 1,034,385 |

| | $ | 1,050,223 |

|

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; Dollars in thousands)

|

| | | | | | | |

| Six months ended January 31, |

| 2018 | | 2017 |

Operating activities: | | | |

Net earnings | $ | 30,109 |

| | $ | 47,850 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 12,840 |

| | 14,102 |

|

Non-cash portion of stock-based compensation expense | 5,897 |

| | 5,394 |

|

Deferred income taxes | 26,028 |

| | (4,547 | ) |

Changes in operating assets and liabilities: | | | |

Accounts receivable | (10,945 | ) | | 3,407 |

|

Inventories | (4,150 | ) | | 224 |

|

Prepaid expenses and other assets | (3,153 | ) | | 220 |

|

Accounts payable and accrued liabilities | (12,695 | ) | | (9,384 | ) |

Income taxes | (1,471 | ) | | (3,932 | ) |

Net cash provided by operating activities | 42,460 |

| | 53,334 |

|

| | | |

Investing activities: | | | |

Purchases of property, plant and equipment | (8,469 | ) | | (7,235 | ) |

Other | (729 | ) | | 593 |

|

Net cash used in investing activities | (9,198 | ) | | (6,642 | ) |

| | | |

Financing activities: | | | |

Payment of dividends | (21,373 | ) | | (20,852 | ) |

Proceeds from exercise of stock options | 9,948 |

| | 14,659 |

|

Proceeds from borrowing on credit facilities | 17,439 |

| | 144,533 |

|

Repayment of borrowing on credit facilities | (57,314 | ) | | (195,002 | ) |

Income tax on equity-based compensation, and other | (2,342 | ) | | (640 | ) |

Net cash used in financing activities | (53,642 | ) | | (57,302 | ) |

| | | |

Effect of exchange rate changes on cash | 1,763 |

| | (5,410 | ) |

| | | |

Net decrease in cash and cash equivalents | (18,617 | ) | | (16,020 | ) |

Cash and cash equivalents, beginning of period | 133,944 |

| | 141,228 |

|

| | | |

Cash and cash equivalents, end of period | $ | 115,327 |

| | $ | 125,208 |

|

BRADY CORPORATION AND SUBSIDIARIES

SEGMENT INFORMATION

(Unaudited; Dollars in thousands)

|

| | | | | | | | | | | | | | | |

| Three months ended January 31, | | Six months ended January 31, |

| 2018 | | 2017 | | 2018 | | 2017 |

SALES TO EXTERNAL CUSTOMERS | | | | | | | |

ID Solutions | $ | 206,432 |

| | $ | 190,962 |

| | $ | 416,137 |

| | $ | 392,226 |

|

Workplace Safety | 81,348 |

| | 77,039 |

| | 161,794 |

| | 155,951 |

|

Total | $ | 287,780 |

| | $ | 268,001 |

| | $ | 577,931 |

| | $ | 548,177 |

|

| | | | | | | |

SALES INFORMATION | | | | | | | |

ID Solutions | | | | | | | |

Organic | 4.7 | % | | 1.9 | % | | 3.8 | % | | 1.3 | % |

Currency | 3.4 | % | | (1.3 | )% | | 2.3 | % | | (0.9 | )% |

Total | 8.1 | % | | 0.6 | % | | 6.1 | % | | 0.4 | % |

Workplace Safety | | | | | | | |

Organic | (0.5 | )% | | (0.2 | )% | | (1.0 | )% | | (1.3 | )% |

Currency | 6.1 | % | | (2.1 | )% | | 4.7 | % | | (1.8 | )% |

Total | 5.6 | % | | (2.3 | )% | | 3.7 | % | | (3.1 | )% |

Total Company | | | | | | | |

Organic | 3.2 | % | | 1.3 | % | | 2.4 | % | | 0.5 | % |

Currency | 4.2 | % | | (1.5 | )% | | 3.0 | % | | (1.1 | )% |

Total | 7.4 | % | | (0.2 | )% | | 5.4 | % | | (0.6 | )% |

| | | | | | | |

SEGMENT PROFIT | | | | | | | |

ID Solutions | $ | 34,088 |

| | $ | 28,961 |

| | $ | 69,925 |

| | $ | 62,035 |

|

Workplace Safety | 7,055 |

| | 6,059 |

| | 13,500 |

| | 12,504 |

|

Total | $ | 41,143 |

| | $ | 35,020 |

| | $ | 83,425 |

| | $ | 74,539 |

|

SEGMENT PROFIT AS A PERCENT OF SALES | | | | | | | |

ID Solutions | 16.5 | % | | 15.2 | % | | 16.8 | % | | 15.8 | % |

Workplace Safety | 8.7 | % | | 7.9 | % | | 8.3 | % | | 8.0 | % |

Total | 14.3 | % | | 13.1 | % | | 14.4 | % | | 13.6 | % |

|

| | | | | | | | | | | | | | | |

| Three months ended January 31, | | Six months ended January 31, |

| 2018 | | 2017 | | 2018 | | 2017 |

Total segment profit | $ | 41,143 |

| | $ | 35,020 |

| | $ | 83,425 |

| | $ | 74,539 |

|

Unallocated amounts: | | | | | | | |

Administrative costs | (6,347 | ) | | (5,058 | ) | | (13,218 | ) | | (11,369 | ) |

Investment and other income | 1,056 |

| | 596 |

| | 1,272 |

| | 107 |

|

Interest expense | (829 | ) | | (1,458 | ) | | (1,692 | ) | | (3,190 | ) |

Earnings before income taxes | $ | 35,023 |

| | $ | 29,100 |

| | $ | 69,787 |

| | $ | 60,087 |

|

This regulatory filing also includes additional resources:

f18q2conferencecallprese.pdf

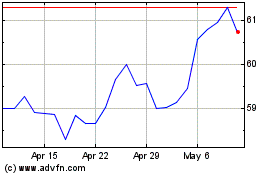

Brady (NYSE:BRC)

Historical Stock Chart

From Oct 2024 to Oct 2024

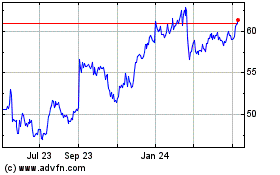

Brady (NYSE:BRC)

Historical Stock Chart

From Oct 2023 to Oct 2024