Presentation Details the Funds’ Significant

Long-Term Underperformance, BlackRock’s Attempts to Crush

Shareholder Rights and the Opportunity to Unlock $1.4 Billion in

Value for Investors

Join Saba’s Webinar on May 20th at 11AM EST Where Boaz Weinstein Will

Detail Why BlackRock and Its Hand-Picked Directors Must Be Held

Accountable, Unveil Saba’s Plans to Improve the Funds and Answer

Questions from the Audience

Visit www.HeyBlackRock.com to Download the Full

Presentation, Access the Webinar and Obtain Information on How to

Vote for Each of Saba’s Proposals on the GOLD Proxy

Saba Capital Management, L.P. (together with its affiliates,

“Saba” or “we”) today issued a presentation detailing its plan to

deliver shareholder value at 10 BlackRock Advisors, LLC

(“BlackRock”) closed-end funds (collectively, the “Funds”).1 The

presentation can be viewed here.

As a reminder, Saba has submitted proposals to (i.) elect new,

independent directors to each of the Funds’ Boards of Trustees, and

(ii.) terminate the management agreement between BlackRock and six

of the Funds at the upcoming 2024 Annual Meetings of

Shareholders.

Saba Founder and CIO Boaz Weinstein will be hosting a

live webinar today, Monday, May 20th at

11AM EST where he will detail why BlackRock and its

hand-picked directors must be held accountable, unveil Saba’s plans

to improve the Funds and take questions from the audience.

To gain access to the webinar and sign up for important campaign

updates, visit www.HeyBlackRock.com.

***

VOTE “FOR” BOTH OF

SABA’S PROPOSALS ON THE GOLD PROXY CARD:

- The election of Saba’s highly qualified and independent

nominees: Athanassios Diplas, Ilya Gurevich, Shavar Jeffries, David

Littlewood, David Locala, Jennifer Raab and Alexander

Vindman.

- The termination of BlackRock’s investment management

agreement at BFZ, BCAT, ECAT, BMEZ, BIGZ and BSTZ.

***

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, Saba is a pioneer of credit relative value strategies

and capital structure arbitrage. Saba is headquartered in New York

City. Learn more at www.sabacapital.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,”

“expects,” “intends,” “believes,” “anticipates,” “plans,”

“estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other

variations on such terms or comparable terminology. Similarly,

statements that describe our objectives, plans or goals are

forward-looking. Forward-looking statements relate to future events

or future performance and involve known and unknown risks,

uncertainties, and other factors that may cause actual results,

levels of activity, performance or achievements or those of the

industry to be materially different from those expressed or implied

by any forward-looking statements. Each of the BlackRock Funds (as

defined below) has also identified additional risks relating to its

business in its public filings with the Securities and Exchange

Commission (the “SEC”). Saba Capital Management, L.P. (“Saba

Capital”), and as applicable the other participants in the proxy

solicitation, have based these forward-looking statements on

current expectations, assumptions, estimates, beliefs, and

projections. While Saba Capital and the other participants, as

applicable, believe these expectations, assumptions, estimates, and

projections are reasonable, such forward-looking statements are

only predictions and involve known and unknown risks and

uncertainties, many of which involve factors or circumstances that

are beyond the participants’ control. There can be no assurance

that any idea or assumption herein is, or will be proven, correct.

If one or more of the risks or uncertainties materialize, or if the

underlying assumptions of Saba Capital or any of the other

participants described herein prove to be incorrect, the actual

results may vary materially from outcomes indicated by these

statements. Accordingly, forward-looking statements should not be

regarded as a representation by Saba Capital that the future plans,

estimates or expectations contemplated will ever be achieved. You

should not rely upon forward-looking statements as a prediction of

actual results and actual results may vary materially from what is

expressed in or indicated by the forward-looking statements. Except

to the extent required by applicable law, neither Saba Capital nor

any participant will undertake and specifically declines any

obligation to disclose the results of any revisions that may be

made to any projected results or forward-looking statements herein

to reflect events or circumstances after the date of such projected

results or statements or to reflect the occurrence of anticipated

or unanticipated events.

Certain statements and information included herein have been

sourced from third parties. Saba Capital does not make any

representations regarding the accuracy, completeness or timeliness

of such third party statements or information. Except as may be

expressly set forth herein, permission to cite such statements or

information has neither been sought nor obtained from such third

parties. Any such statements or information should not be viewed as

an indication of support from such third parties for the views

expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Saba Capital, Saba Capital Master Fund, Ltd. (“SCMF”), Boaz R.

Weinstein (“Mr. Weinstein,” and together with Saba Capital and

SCMF, “Saba”) and the Nominees (as defined below, and together with

Saba, the “Participants”) have filed definitive proxy statements

and accompanying GOLD proxy cards (collectively, the “Proxy

Statements”) with the SEC to be used in conjunction with the

solicitation of proxies in connection with the 2024 annual meeting

of shareholders of each of BlackRock Innovation and Growth Term

Trust (“BIGZ”); BlackRock Capital Allocation Term Trust (“BCAT”);

BlackRock ESG Capital Allocation Term Trust (“ECAT”); BlackRock

Health Sciences Term Trust (“BMEZ”); BlackRock California Municipal

Income Trust (“BFZ”); BlackRock Science and Technology Term Trust

(“BSTZ”); BlackRock MuniYield Pennsylvania Quality Fund (“MPA”);

BlackRock MuniYield New York Quality Fund, Inc. (“MYN”); BlackRock

New York Municipal Income Trust (“BNY”); and BlackRock MuniHoldings

New York Quality Fund, Inc. (“MHN” and together with BIGZ, BCAT,

ECAT, BMEZ, BFZ, BSTZ, MPA, MYN and BNY, collectively, the

“BlackRock Funds”). Shareholders of the BlackRock Funds are advised

to read the applicable Proxy Statements, including any supplements

thereto, and other documents related to the solicitation of proxies

with respect to such BlackRock Funds by the Participants because

they contain important information, including additional

information related to the Participants and a description of their

direct or indirect interests by security holdings or otherwise.

Such materials will be made available at no charge on the SEC’s

website, https://www.sec.gov.

The “Nominees” refer to (i) with respect to BIGZ, ECAT and MPA,

Ilya Gurevich (“Mr. Gurevich”), Shavar Jeffries (“Mr. Jeffries”),

Jennifer Raab (“Ms. Raab”), Athanassios Diplas (“Mr. Diplas”),

David Littlewood (“Mr. Littlewood”), David Locala (“Mr. Locala”)

and Alexander Vindman (“Mr. Vindman”); (ii) with respect to BCAT,

Mr. Jeffries, Ms. Raab and Mr. Vindman; (iii) with respect to BMEZ,

Mr. Gurevich, Mr. Jeffries and Mr. Locala; (iv) with respect to

BFZ, Mr. Gurevich and Mr. Jeffries; (v) with respect to BSTZ, Mr.

Diplas, Mr. Locala and Mr. Vindman; (vi) with respect to MYN, Ms.

Raab and Mr. Vindman; (vii) with respect to BNY, Mr. Gurevich and

Ms. Raab; and (viii) with respect to MHN, Mr. Jeffries and Ms.

Raab.

_________________ 1 The Funds include: the BlackRock California

Municipal Income Trust (NYSE: BFZ), BlackRock Capital Allocation

Term Trust (NYSE: BCAT), BlackRock ESG Capital Allocation Term

Trust (NYSE: ECAT), BlackRock Health Sciences Term Trust (NYSE:

BMEZ), BlackRock Innovation and Growth Term Trust (NYSE: BIGZ),

BlackRock MuniHoldings New York Quality Fund (NYSE: MHN), BlackRock

MuniYield New York Quality Fund (NYSE: MYN), BlackRock MuniYield

Pennsylvania Quality Fund (NYSE: MPA), BlackRock New York Municipal

Income Trust (NYSE: BNY) and BlackRock Science and Technology Term

Trust (NYSE: BSTZ).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520606568/en/

Longacre Square Partners Charlotte Kiaie / Kate Sylvester,

646-386-0091 ckiaie@longacresquare.com /

ksylvester@longacresquare.com

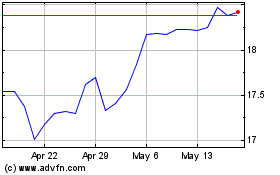

BlackRock Science and Te... (NYSE:BSTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

BlackRock Science and Te... (NYSE:BSTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024