BigBear.ai Holdings, Inc. (NYSE: BBAI) (“BigBear.ai” or the

“Company”) today announced that, on December 19, 2024, it has

entered into separate, privately negotiated exchange agreements

(the “Exchange Agreements”) with a limited number of holders of its

6.00% convertible senior notes due 2026 (the “Existing Convertible

Notes”). Pursuant to such Exchange Agreements, BigBear.ai will

exchange (the “Exchange Transactions”) approximately $182.3 million

in aggregate principal amount of the Existing Convertible Notes for

$182.3 million in aggregate principal amount of new 6.00%

convertible senior secured notes due 2029 (the “New Convertible

Notes”) and approximately $0.4 million in cash, with such cash

payment representing the accrued and unpaid interest on such

Existing Convertible Notes. The New Convertible Notes will be fully

and unconditionally guaranteed, on a senior, secured basis, by the

Company and certain of its existing and future direct and indirect

subsidiaries, subject to certain exceptions (the “guarantors”), and

will initially be secured on a first-priority basis by

substantially all assets of the Company and such guarantors,

subject to certain exceptions. The Exchange Transactions are

expected to settle on or about December 27, 2024, subject to

customary closing conditions.

Upon completion of the Exchange Transactions, the aggregate

principal amount of the Existing Convertible Notes outstanding will

be approximately $17.7 million. BigBear.ai will not receive any

cash proceeds from the issuance of the New Convertible Notes

pursuant to the Exchange Transactions.

The New Convertible Notes will be senior, secured obligations of

BigBear.ai and will accrue interest at a rate of (i) 6.00% per

annum, if interest is paid in cash and (ii) 7.00% per annum, if

BigBear.ai elects, subject to certain conditions, to pay interest

in kind with the shares of its common stock, in each case payable

semi-annually in arrears on June 15 and December 15 of each year,

beginning on June 15, 2025. Payment of interest in shares will be

at a price equal to 95% of the daily volume-weighted average price

per share of BigBear.ai's common stock over an agreed upon period.

The New Convertible Notes will mature on December 15, 2029, unless

earlier converted, redeemed or repurchased by BigBear.ai. At any

time before the close of business on the second scheduled trading

day immediately before the maturity date, noteholders may convert

their notes at their option into shares of BigBear.ai’s common

stock, together, if applicable, with cash in lieu of any fractional

share, at the then-applicable conversion rate. However, until

BigBear.ai has obtained the stockholder approval contemplated by

certain listing standards of the New York Stock Exchange (the

“Requisite Stockholder Approval”), the number of shares of common

stock deliverable upon conversion of the New Convertible Notes will

be limited to comply with these listing standards, and any shares

of common stock that would otherwise have been deliverable upon

conversion will instead be settled in cash. The initial conversion

price will be equal to 115% of the daily volume-weighted average

price per share of BigBear.ai’s common stock on the date of

execution of the Exchange Agreements, and the initial conversion

rate per $1,000 principal amount of New Convertible Notes will be a

number of shares of common stock equal to $1,000 divided by such

initial conversion price. The conversion rate and conversion price

will be subject to adjustment upon the occurrence of certain

events.

Holders who convert their New Convertible Notes will also be

entitled to an interest make-whole payment of up to 7.50% of the

aggregate principal amount of notes converted, subject to reduction

as further described in the indenture for the New Convertible

Notes. Interest make-whole payments are payable in cash or shares

of common stock at the Company’s election, subject to certain

limitations including a limitation on the number of shares of

common stock deliverable upon conversion of the New Convertible

Notes to comply with New York Stock Exchange listing standards.

Payment of the interest make-whole in shares will be at a price

equal to 95% of the average of the daily volume-weighted average

price per share of BigBear.ai’s common stock over an agreed upon

period.

The New Convertible Notes will not be redeemable at BigBear.ai’s

election before December 27, 2025. The New Convertible Notes will

be redeemable, in whole but not in part (subject to certain

limitations), for cash at BigBear.ai’s option at any time, and from

time to time, on or after December 27, 2025 and prior to the close

of business on November 16, 2029, but only if the last reported

sale price per share of BigBear.ai’s common stock exceeds 130% of

the conversion price for a specified period of time and certain

other conditions are satisfied. The redemption price will be equal

to the principal amount of the New Convertible Notes to be

redeemed, plus accrued and unpaid interest, if any, to, but

excluding, the redemption date.

If a “fundamental change” (as defined in the indenture for the

New Convertible Notes) occurs, then noteholders may require

BigBear.ai to repurchase their New Convertible Notes for cash. The

repurchase price will be equal to the principal amount of the New

Convertible Notes to be repurchased, plus accrued and unpaid

interest, if any, to, but excluding, the applicable repurchase

date, plus any remaining amounts that would be owed to, but

excluding, the maturity date.

The indenture for the New Convertible Notes will contain a

number of restrictive covenants and limitations, including

restrictions on the Company’s ability to incur indebtedness or

liens, make restricted payments, issue preferred stock or

disqualified stock, transact with affiliates, sell material

intellectual property, or make investments or dispositions, as

further described in the indenture for the New Convertible

Notes.

The New Convertible Notes are entitled to the benefits of

certain registration rights. Pursuant to the Exchange Agreements,

BigBear.ai agrees to register the resale of the New Convertible

Notes and the shares of common stock issuable upon conversion of

the New Convertible Notes under the Securities Act of 1933 (the

“Securities Act”).

In connection with the Exchange Transactions, BigBear.ai will

obtain consents from certain holders of its Existing Convertible

Notes sufficient to amend certain terms of the indenture governing

the Existing Convertible Notes prior to or concurrently with the

closing of the Exchange Transactions. BigBear.ai expects that

concurrently with the closing of the Exchange Transactions,

BigBear.ai, the guarantors and the trustee of the Existing

Convertible Notes will enter into the Third Supplemental Indenture

(the “Third Supplemental Indenture”) to the indenture governing the

Existing Convertible Notes to effect such amendments, including

amendments to eliminate certain restrictive covenants and

limitations, as further described in the Third Supplemental

Indenture.

In connection with the Exchange Transactions, BigBear.ai intends

to enter into an agreement to terminate the existing senior secured

revolving credit facility established under the credit agreement

entered into on December 7, 2021, as amended from time to time, by

and among BigBear.ai, the other borrowers party thereto from time

to time, the lenders from time to time party thereto and Bank of

America N.A. as administrative agent and collateral agent for the

lenders. Such termination will be effective substantially

concurrently with the closing of the Exchange Transactions. There

were no outstanding borrowings under the existing senior secured

revolving credit facility prior to its termination.

The Exchange Transactions and the guarantees have not been, and

will not be, registered under the Securities Act or any other

securities laws. The shares of common stock issuable upon

conversion of the New Convertible Notes have not been registered

under the Securities Act or any other securities laws, and the New

Convertible Notes and such shares cannot be offered or sold except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and any other

applicable securities laws. This press release does not constitute

an offer to sell, or the solicitation of an offer to buy, the

Existing Convertible Notes, the New Convertible Notes or the shares

of common stock issuable upon conversion of the New Convertible

Notes, nor will there be any sale of the New Convertible Notes or

such shares of common stock in any state or other jurisdiction in

which such offer, sale or solicitation would be unlawful.

About BigBear.ai

BigBear.ai is a leading provider of AI-powered decision

intelligence solutions for national security, digital identity, and

supply chain management. Customers and partners rely on

BigBear.ai’s artificial intelligence and predictive analytics

capabilities in highly complex, distributed, mission-based

operating environments. Headquartered in Columbia, Maryland,

BigBear.ai is a public company traded on the NYSE under the symbol

BBAI.

Forward-Looking Statements

This press release contains “forward-looking statements.” Such

statements include, but are not limited to, statements regarding

the intended use of proceeds from the private placement and may be

preceded by the words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “should,” “would,”

“plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook,” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

Forward-looking statements are not guarantees of future

performance, are based on certain assumptions and are subject to

various known and unknown risks and uncertainties, many of which

are beyond the Company’s control, and cannot be predicted or

quantified and consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements.

These forward-looking statements are subject to a number of risks

and uncertainties, including changes in domestic and foreign

business, market, financial, political, and legal conditions; risks

related to the uncertainty of the projected financial information

(including on a segment reporting basis); risks related to delays

caused by factors outside of our control, including changes in

fiscal or contracting policies or decreases in available government

funding; changes in government programs or applicable requirements;

budgetary constraints, including automatic reductions as a result

of “sequestration” or similar measures and constraints imposed by

any lapses in appropriations for the federal government or certain

of its departments and agencies; influence by, or competition from,

third parties with respect to pending, new, or existing contracts

with government customers; our ability to successfully compete for

and receive task orders and generate revenue under indefinite

delivery/indefinite quantity contracts; potential delays or changes

in the government appropriations or procurement processes,

including as a result of events such as war, incidents of

terrorism, natural disasters, and public health concerns or

epidemics; and increased or unexpected costs or unanticipated

delays caused by other factors outside of our control, such as

performance failures of our subcontractors; risks related to the

rollout of the business and the timing of expected business

milestones; the effects of competition on our future business; our

ability to issue equity or equity-linked securities in the future,

and those factors discussed in the Company’s reports and other

documents filed with the SEC, including under the heading “Risk

Factors.” More detailed information about the Company and the risk

factors that may affect the realization of forward-looking

statements is set forth in the Company’s filings with the SEC,

including the Company’s Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q. Investors and security holders are

urged to read these documents free of charge on the SEC’s web site

at http://www.sec.gov. The Company assumes no obligation to

publicly update or revise its forward-looking statements as a

result of new information, future events or otherwise, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219303853/en/

General/Sales: info@bigbear.ai Investors: investors@bigbear.ai

Media: media@bigbear.ai

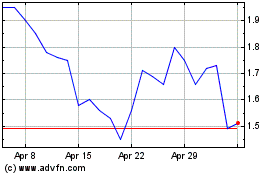

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

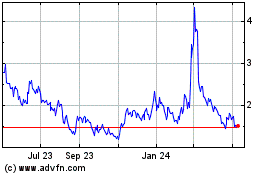

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Dec 2023 to Dec 2024