false

0001378992

0001378992

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

May 13, 2024

BERRY GLOBAL GROUP, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

1-35672 |

20-5234618 |

(State or other jurisdiction of

incorporation or organization) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

101 Oakley Street

Evansville, Indiana 47710

(Address of principal executive offices / Zip Code)

(812) 424-2904

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, $.001 par value per share |

|

BERY |

|

New York Stock Exchange |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

Berry Global Group, Inc. (“Berry”)

is disclosing under Item 7.01 of this Current Report on Form 8-K the information furnished as Exhibit 99.1 hereto, which is excerpted

from a preliminary offering memorandum that is being disseminated in connection with the offering described under Item 8.01 below. The

information in Exhibit 99.1 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be incorporated by reference

into any filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended (the “Securities

Act”), except as expressly set forth by specific reference in such a filing.

On May 13, 2024, Berry announced

the commencement of a private offering of first priority senior secured notes due 2031 (the “Notes”) to be issued by its wholly

owned subsidiary, Berry Global, Inc. (the “Issuer”). A copy of the press release announcing the commencement of the offering

is attached as Exhibit 99.2 hereto and incorporated in this Item 8.01 by reference.

The Notes are being offered

only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act, and outside

the United States, only to non-U.S. investors pursuant to Regulation S. The Notes have not been registered under the Securities Act or

any state or other securities laws and may not be offered or sold in the United States absent an effective registration statement or an

applicable exemption from registration requirements or a transaction not subject to the registration requirements of the Securities Act

or any state or other securities laws. This report shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of the Notes in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state.

Also on May 13, 2024, Berry

announced that the Issuer commenced a tender offer to purchase for cash up to $500,000,000 of its 4.875% First Priority Senior Secured

Notes due 2026 (the “Tender Offer”). The Tender Offer is being made exclusively pursuant to an offer to purchase, dated as

of May 13, 2024, which sets forth the terms and conditions of the Tender Offer, including a financing condition. A copy of the press release

announcing the commencement of the Tender Offer is attached as Exhibit 99.3 and incorporated in this Item 8.01 by reference.

Cautionary Statement Concerning Forward-Looking Statements

Statements in this communication that are not historical,

including statements relating to the expected timing, completion and effects of the proposed transaction between Berry Global Group, Inc.,

a Delaware corporation (“Berry”), and Glatfelter Corporation, a Pennsylvania corporation (“Glatfelter” or the

“Company”), are considered “forward-looking” within the meaning of the federal securities laws and are presented

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements

because they contain words such as “believes,” “expects,” “may,” “will,” “should,”

“would,” “could,” “seeks,” “approximately,” “intends,” “plans,”

“estimates,” “projects,” “outlook,” “anticipates” or “looking forward,” or

similar expressions that relate to strategy, plans, intentions, or expectations. All statements relating to estimates and statements about

the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, benefits

of the transaction, including future financial and operating results, executive and Board transition considerations, the combined company’s

plans, objectives, expectations and intentions, and other statements that are not historical facts are forward-looking statements. In

addition, senior management of Berry and Glatfelter, from time to time may make forward-looking public statements concerning expected

future operations and performance and other developments.

Actual results may differ materially from those

that are expected due to a variety of factors, including without limitation: the occurrence of any event, change or other circumstances

that could give rise to the termination of the proposed transaction; the risk that Glatfelter shareholders may not approve the transaction

proposals; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not

anticipated or may be delayed; risks that any of the other closing conditions to the proposed transaction may not be satisfied in a timely

manner; risks that the anticipated tax treatment of the proposed transaction is not obtained; risks related to potential litigation brought

in connection with the proposed transaction; uncertainties as to the timing of the consummation of the proposed transaction; unexpected

costs, charges or expenses resulting from the proposed transaction; risks and costs related to the implementation of the separation of

the business, operations and activities that constitute the global nonwovens and hygiene films business of Berry (the “HHNF Business”)

into Treasure Holdco, Inc., a Delaware corporation and a wholly owned subsidiary of Berry (“Spinco”), including timing anticipated

to complete the separation; any changes to the configuration of the businesses included in the separation if implemented; the risk that

the integration of the combined company is more difficult, time consuming or costly than expected; risks related to financial community

and rating agency perceptions of each of Berry and Glatfelter and its business, operations, financial condition and the industry in which

they operate; risks related to disruption of management time from ongoing business operations due to the proposed transaction; failure

to realize the benefits expected from the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction

on the ability of the parties to retain customers and retain and hire key personnel and maintain relationships with their counterparties,

and on their operating results and businesses generally; and other risk factors detailed from time to time in Glatfelter’s and Berry’s

reports filed with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. These risks, as well as other risks associated with

the proposed transaction, will be more fully discussed in the registration statements, proxy statement/prospectus and other documents

that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors may not contain all

of the material factors that are important to you. New factors may emerge from time to time, and it is not possible to either predict

new factors or assess the potential effect of any such new factors. Accordingly, readers should not place undue reliance on those statements.

All forward-looking statements are based upon information available as of the date hereof. All forward-looking statements are made only

as of the date hereof and neither Berry nor Glatfelter undertake any obligation to update or revise any forward-looking statement as a

result of new information, future events or otherwise, except as otherwise required by law.

Additional Information and Where to Find It

This communication may be deemed to be solicitation

material in respect of the proposed transaction between Berry and Glatfelter. In connection with the proposed transaction, Berry and Glatfelter

intend to file relevant materials with the SEC, including a registration statement on Form S-4 by Glatfelter that will contain a proxy

statement/prospectus relating to the proposed transaction. In addition, Spinco expects to file a registration statement in connection

with its separation from Berry. This communication is not a substitute for the registration statements, proxy statement/prospectus or

any other document which Berry and/or Glatfelter may file with the SEC. STOCKHOLDERS OF BERRY AND GLATFELTER ARE URGED TO READ ALL RELEVANT

DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain copies of the registration statements

and proxy statement/prospectus (when available) as well as other filings containing information about Berry and Glatfelter, as well as

Spinco, without charge, at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Berry or Spinco will be made

available free of charge on Berry’s investor relations website at www.ir.berryglobal.com. Copies of documents filed with the SEC

by Glatfelter will be made available free of charge on Glatfelter's investor relations website at www.glatfelter.com/investors.

No Offer or Solicitation

This communication is for informational purposes

only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to sell, subscribe for or buy, or

a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction

in which such offer, sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such

jurisdiction. No offer or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in Solicitation

Berry and its directors and executive officers,

and Glatfelter and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders

of Glatfelter common stock and/or the offering of securities in respect of the proposed transaction. Information about the directors and

executive officers of Berry, including a description of their direct or indirect interests, by security holdings or otherwise, is set

forth under the caption “Security Ownership of Beneficial Owners and Management” in the definitive proxy statement for Berry’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on January 4, 2024 (www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm).

Information about the directors and executive officers of Glatfelter including a description of their direct or indirect interests, by

security holdings or otherwise, is set forth under the caption “Security Ownership of Certain Beneficial Owners and Management”

in the proxy statement for Glatfelter's 2024 Annual Meeting of Shareholders, which was filed with the SEC on March 26, 2024 (www.sec.gov/ix?doc=/Archives/edgar/data/0000041719/000004171924000013/glt-20240322.htm).

In addition, Curt Begle, the current President of Berry’s Health, Hygiene & Specialties Division, will be appointed as Chief

Executive Officer, James M. Till, the current Executive Vice President and Controller of Berry, will be appointed as Executive Vice President,

Chief Financial Officer & Treasurer, and Tarun Manroa, the current Executive Vice President and Chief Strategy Officer of Berry, will

be appointed as Executive Vice President, Chief Operating Officer, of the combined company. Investors may obtain additional information

regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it becomes

available.

| Item 9.01. |

“Financial Statements and Exhibits” |

(d) Exhibits: The

following exhibits are being filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BERRY GLOBAL GROUP, INC.

(Registrant) |

| |

|

|

| Date: May 13, 2024 |

By: |

/s/ Jason K. Greene |

| |

Name: |

Jason K. Greene |

| |

Title |

Executive Vice President, |

| |

|

Chief Legal Officer and Secretary |

Exhibit 99.1

On February 7, 2024, Berry Global

Group, Inc. (“Berry”) entered into certain definitive agreements with Glatfelter Corporation (“Glatfelter”) and

certain of their respective subsidiaries that for a series of transactions including the spinoff of the global nonwovens and hygiene films

business (the “HHNF Business”) of Berry and subsequent merger of the HHNF Business with and into a subsidiary of Glatfelter

(collectively, the “Spinoff Transaction”). The HHNF Business that Berry has agreed to spinoff generated net sales of $2,275

million for the fiscal year ended September 30, 2023, and had total assets of $3,027 million at September 30, 2023.

Exhibit 99.2

FOR IMMEDIATE RELEASE

Berry Global Group, Inc. Announces Proposed Offering of First Priority

Senior Secured Notes

EVANSVILLE, Ind. – May 13, 2024 -- Berry Global Group, Inc. (NYSE:

BERY) (“Berry”) announced today that its wholly-owned subsidiary, Berry Global, Inc. (the “Issuer”), plans to

issue a new series of first priority senior secured notes (the “Notes”).

The net proceeds from the offering are intended to (i) repurchase the

Issuer’s 4.875% First Priority Senior Secured Notes due 2026 that are validly tendered and accepted for purchase in a concurrent

tender offer, (ii) to pay certain fees and expenses related to the offering and the concurrent tender offer and (iii) in the case of the

remainder, if any, to fund cash to the Issuer’s balance sheet which may be used for general corporate purposes including, among

other things, prepayment of the Issuer’s existing indebtedness.

The Notes are being offered only to persons reasonably believed to

be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”),

and outside the United States, only to non-U.S. investors pursuant to Regulation S. The Notes have not been registered under the Securities

Act or any state or other securities laws and may not be offered or sold in the United States absent an effective registration statement

or an applicable exemption from registration requirements or a transaction not subject to the registration requirements of the Securities

Act or any state securities laws.

This press release shall not constitute an offer to sell or the solicitation

of an offer to buy any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering, solicitation

or sale would be unlawful. Any offers of the Notes will be made only by means of a private offering memorandum.

About Berry Global

At Berry Global Group, Inc. (NYSE: BERY), we create innovative packaging

solutions that we believe make life better for people and the planet. We do this every day by leveraging our unmatched global capabilities,

sustainability leadership, and deep innovation expertise to serve customers of all sizes around the world. Harnessing the strength in

our diversity and industry-leading talent of over 40,000 global employees across more than 250 locations, we partner with customers to

develop, design, and manufacture innovative products with an eye toward the circular economy. The challenges we solve and the innovations

we pioneer benefit our customers at every stage of their journey. For more information, visit our website, or connect with us on LinkedIn or X.

Forward Looking Statements

Certain statements and information in this release that are not historical

may constitute “forward looking statements” within the meaning of the federal securities laws and are presented pursuant to

the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements because

they contain words such as “believes,” “expects,” “may,” “will,” “should,”

“would,” “could,” “seeks,” “approximately,” “intends,” “plans,”

“estimates,” “projects,” “outlook,” “anticipates” or “looking forward,” or

similar expressions that relate to our strategy, plans, intentions, or expectations. All statements we make relating to our estimated

and projected earnings, margins, costs, expenditures, cash flows, growth rates, and financial results or to our expectations regarding

future industry trends and other statements that are not historical facts are forward-looking statements. In addition, we, through our

senior management, from time to time make forward-looking public statements concerning our expected future operations and performance

and other developments.

These forward-looking statements are subject to risks and uncertainties

that may change at any time, and, therefore, our actual results may differ materially from those that we expected due to a variety of

factors, including without limitation: (1) risks associated with our substantial indebtedness and debt service; (2) changes in prices

and availability of resin and other raw materials and our ability to pass on changes in raw material prices to our customers on a timely

basis; (3) risks related to acquisitions or divestitures and integration of acquired businesses and their operations, and realization

of anticipated cost savings and synergies; (4) risks related to international business, including transactional and translational foreign

currency exchange rate risk and the risks of compliance with applicable export controls, sanctions, anti-corruption laws and regulations;

(5) increases in the cost of compliance with laws and regulations, including environmental, safety, and climate change laws and regulations;

(6) labor issues, including the potential labor shortages, shutdowns or strikes, or the failure to renew effective bargaining agreements;

(7) risks related to disruptions in the overall global economy, persistent inflation, supply chain disruptions, and the financial markets

that may adversely impact our business; (8) risk of catastrophic loss of one of our key manufacturing facilities, natural disasters, and

other unplanned business interruptions; (9) risks related to weather-related events and longer-term climate change patterns; (10) risks

related to the failure of, inadequacy of, or attacks on our information technology systems and infrastructure; (11) risks that our restructuring

programs may entail greater implementation costs or result in lower cost savings than anticipated; (12) risks related to future write-offs

of substantial goodwill; (13) risks of competition, including foreign competition, in our existing and future markets; (14) risks related

to market conditions associated with our share repurchase program; (15) risks related to market disruptions and increased market volatility;

and (16) the other factors and uncertainties discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K

filed on November 17, 2023 and subsequent filings with the Securities and Exchange Commission. We caution you that the foregoing list

of important factors may not contain all of the material factors that are important to you. New factors may emerge from time to time,

and it is not possible for us to predict new factors, nor can we assess the potential effect of any new factors on us. Accordingly, readers

should not place undue reliance on those statements. All forward-looking statements are based upon information available to us on the

date hereof. All forward-looking statements are made only as of the date hereof and we undertake no obligation to update or revise any

forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Investor Contact:

Dustin

Stilwell

VP,

Investor Relations

+1 812.306.2964

ir@berryglobal.com

Global Media Contact:

Anna Raben

+1 812.492.1387

mediarelations@berryglobal.com

Exhibit 99.3

Berry Global Announces Tender Offer

for Certain Outstanding 4.875% First Priority Senior Secured Notes Due 2026

EVANSVILLE, Ind. – May 13, 2024 – Berry Global

Group, Inc. (NYSE: BERY) (“Berry”), a leading supplier of packaging solutions for consumer goods and industrial products,

announced today the commencement by Berry Global, Inc., its wholly owned subsidiary (the “Company”), of an offer to purchase

for cash (the “Tender Offer”) up to $500,000,000 aggregate principal amount (the “Maximum Tender Amount”) of its

outstanding 4.875% First Priority Senior Secured Notes due 2026 (the “Notes”).

The Tender Offer is being made pursuant to the terms and subject to

the conditions, including a financing condition, set forth in the Offer to Purchase, dated as of May 13, 2024 (as may be amended

or supplemented, the “Offer to Purchase”), which sets forth a more detailed description of the Tender Offer. Holders of the

Notes are urged to read carefully the Offer to Purchase before making any decision with respect to the Tender Offer.

Up to $500,000,000 aggregate principal amount of the outstanding

Notes listed below:

| Title of Security | |

CUSIP Nos. | |

ISINs | | |

Principal Amount

Outstanding | | |

Maximum Tender

Amount | | |

U.S. Treasury

Reference

Security | |

Bloomberg

Reference Page | |

Fixed

Spread | |

Early Tender

Premium(1) | |

| 4.875% First Priority Senior Secured Notes due 2026 | |

085770 AA3 U0740VAA1 | |

| US085770AA31 USU0740VAA18 | | |

$ | 1,250,000,000 | | |

$ | 500,000,000 | | |

4.875% U.S. Treasury due April 30, 2026 | |

FIT1 | |

+60bps | |

$ | 30 | |

| (1) | Per $1,000 principal amount. |

Tender Offer details

Subject to the Maximum Tender Amount, proration (if applicable) and

the satisfaction or waiver of the conditions to the Tender Offer, including a financing condition, the Company will accept for purchase

on the Early Settlement Date or the Final Settlement Date (each as defined below), as applicable, Notes validly tendered in the Tender

Offer.

The Tender Offer will expire at 5:00 p.m., New York City time, on June 11,

2024, or any other date and time to which the Company extends the Tender Offer (such date and time, as it may be extended, the “Expiration

Time”), unless earlier terminated.

To be eligible to receive the Early Tender Consideration (as defined

below), which includes an early tender premium of $30 per $1,000 principal amount of Notes (the “Early Tender Premium”), holders

of Notes must validly tender their Notes at or prior to 5:00 p.m., New York City time, on May 24, 2024, unless extended or the Tender

Offer is earlier terminated by the Company (such date and time, as it may be extended, the “Early Tender Time”).

Holders of Notes that validly tender their Notes after the Early Tender

Time but at or prior to the Expiration Time, will only be eligible to receive the Late Tender Consideration (as defined below).

Priority of acceptance and proration

Notes validly tendered at or prior to the Early Tender Time will be

accepted for purchase in priority to other Notes validly tendered after the Early Tender Time. Accordingly, if the Maximum Tender Amount

is reached as a result of tenders of Notes made at or prior to the Early Tender Time, Notes tendered after the Early Tender Time will

not be accepted for purchase (unless the Maximum Tender Amount is increased by the Company, in its sole discretion, subject to applicable

law). If the aggregate principal amount of Notes validly tendered exceeds the Maximum Tender Amount on the applicable settlement date,

the amount of Notes purchased in the Tender Offer will be prorated as set forth in the Offer to Purchase.

Consideration and accrued interest

The consideration (the “Early Tender Consideration”) offered

per $1,000 principal amount of Notes validly tendered at or prior to the Early Tender Time, and accepted for purchase pursuant to the

Tender Offer, will be determined in the manner described in the Offer to Purchase by reference to the fixed spread for the Notes specified

in the table above, plus the yield to maturity based on the bid-side price of the U.S. Treasury Reference Security specified in the table

above, calculated as of 10:00 a.m., New York City time, on May 28, 2024 (the “Price Determination Time”), unless extended

or the Tender Offer is earlier terminated by the Company.

The Early Tender Time is the last date and time for holders to tender

their Notes in order to be eligible to receive the Early Tender Consideration. Holders of any Notes that are validly tendered after the

Early Tender Time but at or prior to the Expiration Time, and that are accepted for purchase, will receive an amount equal to the Early

Tender Consideration minus the Early Tender Premium (the “Late Tender Consideration”).

In addition to the Early Tender Consideration or the Late Tender Consideration,

as applicable, holders whose Notes are purchased in the Tender Offer will receive accrued and unpaid interest from the last interest payment

date up to, but not including, the applicable settlement date.

Settlement

Except as set forth in the paragraph below, payment for the Notes that

are validly tendered at or prior to the Expiration Time, and that are accepted for purchase, will be made on the date referred to as the

“Final Settlement Date.” The Company anticipates that the Final Settlement Date will be June 13, 2024, the second business

day after the Expiration Time, subject to all conditions to the Tender Offer, including a financing condition, having been satisfied or

waived by the Company.

The Company reserves the right, in its sole discretion, to pay for

Notes that are validly tendered at or prior to the Early Tender Time, and that are accepted for purchase, on a date following the Early

Tender Time and prior to the Expiration Time (the “Early Settlement Date”). The Company anticipates that the Early Settlement

Date will be May 29, 2024, the second business day after the Early Tender Time, subject to all conditions to the Tender Offer, including

a financing condition, having been satisfied or waived by the Company.

Withdrawal conditions

Notes tendered pursuant to the Tender Offer may be withdrawn at any

time prior to 5:00 p.m., New York City time, on May 24, 2024, unless extended or the Tender Offer is earlier terminated by the Company

(such date and time, as it may be extended, the “Withdrawal Deadline”), but not thereafter.

After the Withdrawal Deadline, holders may not withdraw their tendered

Notes unless the Company amends the Tender Offer in a manner that is materially adverse to the tendering holders, in which case withdrawal

rights may be extended to the extent required by law, or as the Company otherwise determines is appropriate to allow tendering holders

a reasonable opportunity to respond to such amendment. Additionally, the Company, in its sole discretion, may extend the Withdrawal Deadline

for any purpose. Notes withdrawn prior to the Withdrawal Deadline may be tendered again at or prior to the Expiration Time, in accordance

with the procedures set forth in the Offer to Purchase.

If a holder holds their Notes through a custodian bank, broker, dealer

or other nominee, such nominee may have an earlier deadline or deadlines for receiving instructions to participate or withdraw tendered

Notes in the Tender Offer.

The Company’s obligation to accept for payment and to pay for

the Notes validly tendered in the Tender Offer is subject to the satisfaction or waiver of a number of conditions described in the Offer

to Purchase, including a financing condition. The Tender Offer may be terminated or withdrawn, subject to applicable law. The Company

reserves the right, subject to applicable law, to (i) waive any and all conditions to the Tender Offer, (ii) extend or terminate

the Tender Offer, (iii) increase or decrease the Maximum Tender Amount, or (iv) otherwise amend the Tender Offer in any respect.

Dealer Manager and Depositary and Information Agent

The

Company has appointed Goldman Sachs & Co. LLC as dealer manager (the “Dealer Manager”) for the Tender Offer. The

Company has retained Global Bondholder Services Corporation as the depositary and information agent for the Tender Offer. For additional

information regarding the terms of the Tender Offer, please contact: Goldman Sachs & Co. LLC at (800) 828-3182 (toll-free) or

(212) 357-1452 (collect). Requests for documents and questions regarding the tendering of securities may be directed to Global Bondholder

Services Corporation by telephone at (212) 430-3774 (for banks and brokers only), (855) 654-2015

(toll-free) or 001-212-430-3774

(international), by email at contact@gbsc-usa.com or at www.gbsc-usa.com/berry/ or to the Dealer Manager at its telephone numbers.

This press release shall not constitute, or form part of, an offer

to sell, a solicitation to buy or an offer to purchase or sell any securities. The Tender Offer is being made only pursuant to the Offer

to Purchase and only in such jurisdictions as is permitted under applicable law.

From time to time after completion of the Tender Offer, the Company

or its affiliates may purchase additional Notes in the open market, in privately negotiated transactions, through tender or exchange offers

or other methods, or the Company may redeem Notes pursuant to their terms. Any future purchases may be on the same terms or on terms that

are more or less favorable to holders of the Notes than the terms of the Tender Offer.

About Berry

At Berry Global Group, Inc. (NYSE: BERY), we create innovative

packaging solutions that we believe make life better for people and the planet. We do this every day by leveraging our unmatched global

capabilities, sustainability leadership, and deep innovation expertise to serve customers of all sizes around the world. Harnessing the

strength in our diversity and industry-leading talent of over 40,000 global employees across more than 250 locations, we partner with

customers to develop, design, and manufacture innovative products with an eye toward the circular economy. The challenges we solve and

the innovations we pioneer benefit our customers at every stage of their journey. For more information, visit our website, or connect

with us on LinkedIn or X.

Forward-Looking Statements

Certain statements and information in this release that are not

historical, including statements relating to the Tender Offer and the Offer to Purchase, may constitute “forward looking statements”

within the meaning of the federal securities laws and are presented pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. You can identify forward-looking statements because they contain words such as “believes,” “expects,”

“may,” “will,” “should,” “would,” “could,” “seeks,” “approximately,”

“intends,” “plans,” “estimates,” “projects,” “outlook,” “anticipates”

or “looking forward,” or similar expressions that relate to our strategy, plans, intentions, or expectations. All statements

we make relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates, and financial results

or to our expectations regarding future industry trends and other statements that are not historical facts are forward-looking statements.

In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future

operations and performance and other developments.

These forward-looking statements are subject to risks and uncertainties

that may change at any time, and, therefore, our actual results may differ materially from those

that we expected due to a variety of factors, including without limitation: (1) risks associated with our substantial indebtedness

and debt service; (2) changes in prices and availability of resin and other raw materials and our ability to pass on changes in raw

material prices to our customers on a timely basis; (3) risks related to acquisitions or divestitures and integration of acquired

businesses and their operations, and realization of anticipated cost savings and synergies; (4) risks related to international business,

including transactional and translational foreign currency exchange rate risk and the risks of compliance with applicable export controls,

sanctions, anti-corruption laws and regulations; (5) increases in the cost of compliance with laws and regulations, including environmental,

safety, and climate change laws and regulations; (6) labor issues, including the potential labor shortages, shutdowns or strikes,

or the failure to renew effective bargaining agreements; (7) risks related to disruptions in the overall global economy, persistent

inflation, supply chain disruptions, and the financial markets that may adversely impact our business; (8) risk of catastrophic loss

of one of our key manufacturing facilities, natural disasters, and other unplanned business interruptions; (9) risks related to weather-related

events and longer-term climate change patterns; (10) risks related to the failure of, inadequacy of, or attacks on our information

technology systems and infrastructure; (11) risks that our restructuring programs may entail greater implementation costs or result in

lower cost savings than anticipated; (12) risks related to future write-offs of substantial goodwill; (13) risks of competition, including

foreign competition, in our existing and future markets; (14) risks related to market conditions associated with our share repurchase

program; (15) risks related to market disruptions and increased market volatility; and (16) the other factors and uncertainties discussed

in the section titled “Risk Factors” in our Annual Report on Form 10-K filed on November 17, 2023 and subsequent

filings with the Securities and Exchange Commission. We caution you that the foregoing list of important factors may not contain all of

the material factors that are important to you. New factors may emerge from time to time, and it is not possible for us to predict new

factors, nor can we assess the potential effect of any new factors on us. Accordingly, readers should not place undue reliance on those

statements. All forward-looking statements are based upon information available to us on the date hereof. All forward-looking statements

are made only as of the date hereof and we undertake no obligation to update or revise any forward-looking statement as a result of new

information, future events or otherwise, except as otherwise required by law.

Investor Contact:

Dustin Stilwell

VP, Investor Relations

+1 (812) 306 2964

ir@berryglobal.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

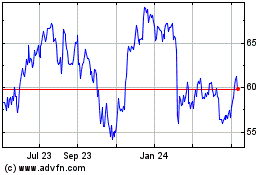

Berry Global (NYSE:BERY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Berry Global (NYSE:BERY)

Historical Stock Chart

From Nov 2023 to Nov 2024