Residential Segment Execution Delivered Above-Market Growth,

Strong Net Profit Margin and Record Adjusted EBITDA Margin

Initiatives Drove Mid-Single-Digit Residential Sell-Through

Growth and Double-Digit Deck, Rail & Accessories Sell-Through

Growth

THIRD QUARTER FISCAL 2024 FINANCIAL HIGHLIGHTS

- Consolidated Net Sales increased 12% year-over-year to $434.4

million; Adjusted Net Sales excluding results for Vycom increased

18% year-over-year

- Residential Segment Net Sales increased 18% year-over-year to

$416.0 million

- Gross profit margin expanded 380 basis points year-over-year to

37.8%; Adjusted Gross Profit Margin expanded 350 basis points

year-over to 38.7%

- Net Income increased 45% year-over-year to $50.1 million;

Adjusted Net Income increased 38% year-over-year to $62.0

million

- Net profit margin expanded 260 basis points year-over-year to

11.5%

- Adjusted EBITDA increased 24% year-over-year to $119.4 million;

Residential Segment Adjusted EBITDA increased 33% year-over-year to

$117.0 million

- Adjusted EBITDA Margin expanded 260 basis points year-over-year

to 27.5%

- EPS increased $0.11 year-over-year to $0.34 per share; Adjusted

Diluted EPS increased $0.12 year-over-year to $0.42 per share

RECENT COMPANY HIGHLIGHTS

- Delivered record fiscal third quarter financial results across

Net Sales, Gross Profit, Adjusted Gross Profit, Net Income and

Adjusted EBITDA

- Strong margin expansion driven by operating leverage,

productivity initiatives and materials savings

- Generated $195 million of cash provided by operating activities

and $178 million of Free Cash Flow

- Announced new $600 million share repurchase program and entered

into $50 million accelerated share repurchase program

- Recognized as one of the best composite decking brands by U.S.

News and World Report, Good Housekeeping Home Improvement &

Outdoor Lab evidencing strong brand momentum

The AZEK Company Inc. (NYSE: AZEK) (“AZEK” or the “Company”),

the industry-leading manufacturer of beautiful, low-maintenance and

environmentally sustainable outdoor living products, including

TimberTech® decking and railing, Versatex® and AZEK® Trim and

StruXure® pergolas, today announced preliminary financial results

for its fiscal third quarter ended June 30, 2024.

CEO COMMENTS

"The AZEK team delivered record financial results this quarter,

as we continued to execute our strategy to drive material

conversion, above-market growth and margin expansion,” said Jesse

Singh, CEO of The AZEK Company. “Our focus on manufacturing

productivity, cost reduction initiatives, including increasing the

amount of recycled content in our products, and operating leverage

enabled us to deliver net profit margin expansion of 260 basis

points year-over-year to 11.5% and Adjusted EBITDA Margin expansion

of 260 basis points year-over-year to a record 27.5%. We also

delivered strong cash generation this quarter, and our Board of

Directors recently authorized a $600 million expansion of our share

repurchase program. As a result of our performance, we are

reaffirming our outlook for the second half of the fiscal year and

raising the bottom end of our full-year guidance and outlook,

demonstrating our confidence in our ability to outperform the

market and deliver long-term margin expansion through AZEK-specific

initiatives,” continued Mr. Singh.

“During the fiscal third quarter, Residential segment net sales

increased approximately 18% year-over-year driven by strength in

Deck, Rail and Accessories which saw double-digit sell-through

growth to our professional dealer and retailer partners. Overall,

Residential segment sell-through grew mid-single-digits

year-over-year as our initiatives offset a down repair &

remodel market. Exteriors experienced some market-driven softness

in the quarter after delivering solid growth over the last five

years. We also saw our channel partners purchase approximately $35

million of product earlier this June than in the prior year to

ensure strong service levels throughout the building season, and we

are adjusting our fiscal fourth quarter assumptions given the

timing of these shipments,” said Mr. Singh.

“The benefit of our shelf space gains in recent years, combined

with AZEK-specific initiatives driving conversion, strong brand

momentum and new product innovations have enabled us to sustain our

growth. We are seeing great momentum in our 2024 new product

launches, including TimberTech Composite Terrain+™ decking and

TimberTech Aluminum Framing substructure. Most recently, we

initiated a regional launch of our first galvanized steel railing

solution, TimberTech Fulton Rail, which further expands our

multi-option railing portfolio across price points. We expect to

see the impact of new channel expansion in fiscal year 2025,

including our recently announced Doman Building Materials decking

distribution partnership, which we believe will enable us to more

aggressively expand in and convert the Canadian market,” stated Mr.

Singh.

“Once again, our TimberTech brand was recognized for its beauty,

innovation and performance by industry experts. TimberTech was

recognized by U.S. News and World Report as the composite decking

brand with the Best Natural Wood Look, by Good Housekeeping’s Home

Improvement & Outdoor Lab as the best overall engineered

decking pick, and by Architizer’s A+ Product Awards, receiving a

special mention in the Innovation Category as chosen by architects.

Our innovative product portfolio with premium characteristics,

coupled with our brand momentum accelerating from marketing

investments and recent channel expansion gains, continue to

differentiate us as the leader in sustainable outdoor living

building materials. I would once again like to thank AZEK’s

excellent team and partners for their continued commitment and

successful execution,” continued Mr. Singh.

THIRD QUARTER FISCAL 2024 CONSOLIDATED RESULTS

Net sales for the three months ended June 30, 2024 increased by

$46.8 million, or 12%, to $434.4 million from $387.6 million for

the three months ended June 30, 2023. The increase was primarily

due to higher sales volume in our Residential segment attributable

to key growth initiatives, including channel expansion, new

products and downstream sales and marketing investments, driving

demand for AZEK products, partially offset by the effect of the

sale of our Vycom business in our Commercial segment. Net sales for

the three months ended June 30, 2024 increased for our Residential

segment by $64.4 million, or 18%, and decreased for our Commercial

segment by $17.6 million, or 49%, respectively, as compared to the

prior year period. The decrease in our Commercial segment was

primarily due to the sale of our Vycom business. Vycom net sales

were $18.6 million for the three months ended June 30, 2023.

Gross profit increased by $32.4 million to $164.3 million for

the three months ended June 30, 2024, compared to $131.9 million

for the three months ended June 30, 2023. Gross profit margin

increased by 380 basis points to 37.8% for the three months ended

June 30, 2024 compared to 34.0% for the three months ended June 30,

2023.

Effective as of December 31, 2023, AZEK has revised the

definition of Adjusted Gross Profit to no longer exclude

depreciation expense and the prior period has been recast to

reflect the change. Adjusted Gross Profit increased by $31.7

million to $168.1 million for the three months ended June 30, 2024,

compared to $136.4 million for the three months ended June 30,

2023. Adjusted Gross Profit Margin increased by 350 basis points to

38.7% for the three months ended June 30, 2024 compared to 35.2%

for the three months ended June 30, 2023.

Net income increased by $15.5 million to $50.1 million, or $0.34

per share, for the three months ended June 30, 2024, compared to

$34.6 million, or $0.23 per share, for the three months ended June

30, 2023. Net profit margin expanded 260 basis points to 11.5% for

the three months ended June 30, 2024, as compared to net profit

margin of 8.9% for the three months ended June 30, 2023.

Adjusted EBITDA increased by $22.8 million to $119.4 million for

the three months ended June 30, 2024, compared to Adjusted EBITDA

of $96.7 million for the three months ended June 30, 2023. Adjusted

EBITDA Margin expanded 260 basis points to 27.5% from 24.9% for the

prior year period.

Adjusted Net Income increased by $17.2 million to $62.0 million,

or Adjusted Diluted EPS of $0.42 per share, for the three months

ended June 30, 2024, compared to Adjusted Net Income of $44.8

million, or Adjusted Diluted EPS of $0.30 per share, for the three

months ended June 30, 2023.

BALANCE SHEET, CASH FLOW and LIQUIDITY

As of June 30, 2024, AZEK had cash and cash equivalents of

$346.9 million and approximately $147.8 million available for

future borrowings under its Revolving Credit Facility. Total gross

debt, including finance leases, as of June 30, 2024, was $666.6

million.

Net Cash Provided by Operating Activities for the three months

ended June 30, 2024, increased by $23.3 million year-over-year to

$195.1 million. Free Cash Flow for the three months ended June 30,

2024, increased by $12.5 million year-over-year to $177.5

million.

During the quarter, AZEK repurchased approximately 0.9 million

initial shares of its Class A common stock under a $50 million

accelerated share repurchase agreement (“ASR”). The final

settlement of the ASR is based on the volume-weighted average price

of our Class A common stock over the repurchase period, subject to

certain adjustments. The ASR settled on August 5, 2024 and AZEK

received an additional 0.3 million shares of its Class A common

stock bringing the total ASR to approximately 1.2 million shares.

As of June 30, 2024, AZEK had approximately $625.3 million

available for repurchases under its existing share repurchase

program.

OUTLOOK

“As we look at the remainder of the year, we are reaffirming our

outlook for the second half of fiscal 2024 and raising the bottom

end of our full-year fiscal 2024 guidance. We continue to assume

Residential sell-through growth to be in the mid-single-digits in

the fiscal fourth quarter, as we see our initiatives driving

continued outperformance relative to anticipated softer trends in

the broader repair & remodel markets. Over the last few months,

we have seen some choppiness in the broader construction economy

and are assuming a down market for the remainder of fiscal year

2024. We expect our channel to end the fiscal year at or below

historical inventory days on hand. We continue to see strong growth

in our internal digital and engagement metrics and believe that

there is pent-up demand that will be realized as the broader market

improves. We remain confident in our ability to drive double-digit

growth over the long-term, as we continue to prove the resiliency

and growth potential that is an outcome of the AZEK business

model,” continued Mr. Singh.

AZEK provides certain of its outlook on a non-GAAP basis, as the

Company cannot predict some elements that are included in reported

GAAP results, including the impact of acquisition costs and other

costs. Refer to the Outlook section in the discussion of non-GAAP

financial measures below for more details.

For the full-year fiscal 2024, AZEK now expects consolidated net

sales in the range of $1.422 to $1.438 billion, representing an

increase from the outlook range of $1.407 to $1.438 billion and

Adjusted EBITDA in the range of $370 to $380 million, representing

an increase from the outlook range of $364 to $380 million.

Adjusted EBITDA Margin is expected to be in the range of 26.0% to

26.4%, an increase from approximately 25.8% to 26.4% from the prior

outlook.

AZEK expects Residential segment net sales in the range of

$1.351 to $1.365 billion, representing approximately 10% to 12%

year-over-year growth, and Segment Adjusted EBITDA in the range of

$358 to $367 million. AZEK expects the Commercial segment’s

Scranton Products business to deliver net sales in the range of $71

to $73 million and Adjusted EBITDA in the range of $12 to $13

million. Capital expenditures for fiscal year 2024 continue to be

expected in the range of $90 to $95 million.

For the fourth quarter of fiscal 2024, AZEK expects consolidated

net sales between $329 to $345 million and Adjusted EBITDA between

$82 to $92 million. Adjusted EBITDA Margin is expected to be in the

range of 24.9% to 26.7%. We expect that our fiscal fourth quarter

net sales will be impacted by approximately $35 million due to the

timing of purchases in the prior quarter to ensure strong in-season

service.

“We believe we are well positioned to win across any market

scenario and continue to see substantial opportunities for material

conversion to our types of low-maintenance, long-lasting materials.

From 2019 to 2023, our Deck, Rail & Accessories business has

experienced a 17% compounded annual growth rate (CAGR) and our

Exteriors business has grown at a 16% CAGR, demonstrating the

strength and resiliency of our business. Our fiscal year 2024

Residential segment guidance implies 10% to 12% year-over-year net

sales growth and 42% to 45% year-over-year Segment Adjusted EBITDA

growth. Consistent with our multi-year track record, we are well

positioned to drive above-market growth in fiscal year 2024, fiscal

year 2025 and over the long-term by continuing to execute our

growth strategy. We continue to see significant opportunity for

cost reduction, recycling and productivity, and we expect to build

upon the multi-year margin initiatives we have executed upon to

achieve our annual Adjusted EBITDA Margin target of 27.5%,”

concluded Mr. Singh.

CONFERENCE CALL AND WEBSITE INFORMATION

AZEK will hold a conference call to discuss the results today,

Wednesday, August 7, 2024, at 4:00 p.m. (CT). To access the live

conference call, please register for the call in advance by

visiting https://registrations.events/direct/Q4I108409.

Registration will also be available during the call. After

registering, a confirmation e-mail will be sent including dial-in

details and unique conference call codes for entry. To ensure you

are connected for the full call please register at least 10 minutes

before the start of the call.

Interested investors and other parties can also listen to a

webcast of the live conference call by logging onto the Investor

Relations section of the AZEK’s website at

investors.azekco.com/events-and-presentations/. AZEK uses its

investor relations website at investors.azekco.com as a means of

disclosing material non-public information and for complying with

its disclosure obligations under Regulation FD.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the AZEK website or by dialing (800)

770-2030 or (609) 800-9909. The conference ID for the replay is

10840. The replay will be available until 10:59 p.m. (CT) on August

20, 2024. In addition, an earnings presentation will be posted and

available on the AZEK investor relations website prior to the

conference call.

ABOUT THE AZEK® COMPANY

The AZEK Company Inc. (NYSE: AZEK) is the industry-leading

designer and manufacturer of beautiful, low maintenance and

environmentally sustainable outdoor living products, including

TimberTech® decking and railing, Versatex® and AZEK® Trim, and

StruXure® pergolas. Consistently awarded and recognized as the

market leader in innovation, quality, aesthetics and

sustainability, our products are made from up to 85% recycled

material and primarily replace wood on the outside of homes,

providing a long-lasting, eco-friendly, and stylish solution to

consumers. Leveraging the talents of its approximately 2,000

employees and the strength of relationships across its value chain,

The AZEK Company is committed to accelerating the use of recycled

material in the manufacturing of its innovative products, keeping

hundreds of millions of pounds of waste and scrap out of landfills

each year, and revolutionizing the industry to create a more

sustainable future. The AZEK Company has recently been named one of

America’s Climate Leaders by USA Today, a Top Workplace by the

Chicago Tribune and U.S. News and World Report, and a winner of the

2024 Real Leaders® Impact Awards. Headquartered in Chicago,

Illinois, the company operates manufacturing and recycling

facilities in Ohio, Pennsylvania, Idaho, Georgia, Nevada, New

Jersey, Michigan, Minnesota and Texas. For additional information,

please visit azekco.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This earnings release contains forward-looking statements within

the meaning of applicable securities laws. All statements other

than statements of historical facts, including statements regarding

future operations, are forward-looking statements. In some cases,

forward-looking statements may be identified by words such as

"believe," "may," "will," "estimate," "continue," "anticipate,"

"intend," "could," "would," "expect," "objective," "plan,"

"potential," "seek," "grow," "target," "if," or the negative of

these terms and similar expressions. Projected financial

information and performance, including our guidance and outlook as

well as statements about our future growth and margin expansion

goals and factors, assumptions and variables underlying these

projections and goals, are forward-looking statements. Other

forward-looking statements may include, without limitation,

statements with respect to our ability to meet the future targets

and goals we establish, including our environmental, social and

governance targets and the ultimate impact of our actions on our

business as well as the expected benefits to the environment, our

employees, and our communities; statements about our future

expansion plans, capital investments, capacity targets and other

future strategic initiatives; statements about any stock repurchase

plans, including the expected settlement date of the ASR;

statements about potential new products and product innovation;

statements regarding the potential impact of global events;

statements about future pricing for our products or our raw

materials and our ability to offset increases to our raw material

costs and other inflationary pressures; statements about the

markets in which we operate and the economy more generally,

including inflation and interest rates, supply and demand balance,

growth of our various markets and growth in the use of engineered

products as well as our ability to share in such growth; statements

about our production levels; and all other statements with respect

to our expectations, beliefs, plans, strategies, objectives,

prospects, assumptions or future events or performance contained in

this earnings release are forward-looking statements. These

forward-looking statements are subject to a number of risks,

uncertainties and assumptions, including those described in our

Annual Reports on Form 10-K and Form 10-K/A, Quarterly Reports on

Form 10-Q and in our other filings with the U.S. Securities and

Exchange Commission. Moreover, new risks emerge from time to time.

It is not possible for our management to predict all risks, nor can

we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual

results to differ materially and adversely from those contained in

any forward-looking statements we may make. You should read this

earnings release with the understanding that our actual future

results, levels of activity, performance and events and

circumstances may be materially different from what we expect and

should not place undue reliance on forward-looking statements.

These statements are based on information available to us as of

the date of this earnings release. While we believe that such

information provides a reasonable basis for these statements, such

information may be limited or incomplete. Our statements should not

be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all relevant information. We disclaim any

intention and undertake no obligation to update or revise any of

our forward-looking statements after the date of this release,

except as required by law.

NON-GAAP FINANCIAL MEASURES

To supplement our earnings release and consolidated financial

statements prepared and presented in accordance with generally

accepted accounting principles in the United States, or (“GAAP”),

we use certain non-GAAP financial measures, as described within

this earnings release, to provide investors with additional useful

information about our financial performance, to enhance the overall

understanding of our past performance and future prospects and to

allow for greater transparency with respect to important metrics

used by our management for financial and operational

decision-making. We are presenting these non-GAAP financial

measures to assist investors in seeing our financial performance

and liquidity from management’s view and because we believe they

provide an additional tool for investors to use in comparing our

core financial performance and liquidity over multiple periods with

other companies in our industry.

- Adjusted Gross Profit: Beginning for the three months

ended December 31, 2023, we define Adjusted Gross Profit as gross

profit before amortization, business transformation costs,

acquisition costs and certain other costs. Adjusted Gross Profit

Margin is equal to Adjusted Gross Profit divided by net sales.

Prior to the three months ended December 31, 2023, depreciation was

also excluded from Adjusted Gross Profit. We believe that including

depreciation expense in our Adjusted Gross Profit definition will

result in easier comparability to our peers. Presentations of

Adjusted Gross Profit and Adjusted Gross Profit Margin for prior

periods have been recast to conform to the current period

presentation for comparability.

- Adjusted Net Income: Defined as net income (loss) before

amortization, share-based compensation costs, business

transformation costs, acquisition costs, initial public offering

and secondary offering costs and certain other costs.

- Adjusted Diluted EPS: Defined as Adjusted Net Income

divided by weighted average common shares outstanding – diluted, to

reflect the conversion or exercise, as applicable, of all

outstanding shares of restricted stock awards, restricted stock

units and options to purchase shares of our common stock.

- Adjusted EBITDA: Defined as net income (loss) before

interest expense, net, income tax (benefit) expense and

depreciation and amortization and by adding to or subtracting

therefrom items of expense and income as described above. Adjusted

EBITDA Margin is equal to Adjusted EBITDA divided by net

sales.

- Net Leverage: Equal to gross debt less cash and cash

equivalents, divided by trailing twelve month Adjusted EBITDA.

- Free Cash Flow: Defined as net cash provided by (used

in) operating activities less purchases of property, plant and

equipment.

In addition, we provide Adjusted Net Sales excluding Vycom,

which is a non-GAAP measure that we define as Consolidated Net

Sales excluding the impact from the divested Vycom business. We

believe Adjusted Net Sales excluding Vycom is useful to investors

because it reflects the ongoing trends in our business following

the divestiture of Vycom.

These non-GAAP financial measures have limitations as analytical

tools, and you should not consider them in isolation or as a

substitute for analysis of our results as reported under GAAP.

Non-GAAP financial measures may be calculated differently from, and

therefore may not be directly comparable to, similarly titled

measures used by other companies. See the accompanying earnings

tables for a reconciliation of these non-GAAP measures to their

most directly comparable GAAP measures.

Segment Adjusted EBITDA

Depending on certain circumstances, Segment Adjusted EBITDA and

Segment Adjusted EBITDA Margin may be calculated differently, from

time to time, than our Adjusted EBITDA and Adjusted EBITDA Margin,

which are further discussed under the heading “Non-GAAP Financial

Measures.” Segment Adjusted EBITDA and Segment Adjusted EBITDA

Margin represent measures of segment profit reported to our chief

operating decision maker for the purpose of making decisions about

allocating resources to a segment and assessing its performance.

For more information regarding how Segment Adjusted EBITDA and

Segment Adjusted EBITDA Margin are determined, see the section

titled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations—Segment Results of Operations” set forth

in Part II, Item 7 of our Annual Report on Form 10-K/A for fiscal

2023 and our Consolidated Financial Statements and related notes

included therein.

The AZEK Company Inc.

Consolidated Balance

Sheets

(In thousands of U.S. dollars,

except for share and per share amounts)

in thousands

June 30, 2024

September 30,

2023

(As Restated)

ASSETS:

Current assets:

Cash and cash equivalents

$

346,948

$

278,314

Trade receivables, net of allowances

67,619

57,660

Inventories

204,871

195,600

Prepaid expenses

9,736

13,595

Other current assets

27,519

16,123

Total current assets

656,693

561,292

Property, plant and equipment - net

459,369

501,023

Goodwill

967,816

994,271

Intangible assets - net

164,083

199,497

Other assets

92,767

87,793

Total assets

$

2,340,728

$

2,343,876

LIABILITIES AND STOCKHOLDERS'

EQUITY:

Current liabilities:

Accounts payable

$

64,131

$

56,015

Accrued rebates

59,203

60,974

Current portion of long-term debt

obligations

6,000

6,000

Accrued expenses and other liabilities

84,713

66,727

Total current liabilities

214,047

189,716

Deferred income taxes

46,919

59,509

Long-term debt—less current portion

576,804

580,265

Other non-current liabilities

109,946

104,073

Total liabilities

947,716

933,563

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value;

1,000,000 shares authorized and no shares issued or outstanding at

June 30, 2024 and September 30, 2023, respectively

—

—

Class A common stock, $0.001 par value;

1,100,000,000 shares authorized, 157,072,226 shares issued at June

30, 2024 and 155,967,736 shares issued at September 30, 2023,

respectively

157

156

Class B common stock, $0.001 par value;

100,000,000 shares authorized, 0 and 100 shares issued and

outstanding at June 30, 2024 and at September 30, 2023,

respectively

—

—

Additional paid‑in capital

1,684,739

1,662,322

Retained earnings (accumulated

deficit)

60,639

(64,377

)

Accumulated other comprehensive income

(loss)

927

1,878

Treasury stock, at cost, 12,377,929 and

8,268,423 shares at June 30, 2024 and September 30, 2023,

respectively

(353,450

)

(189,666

)

Total stockholders' equity

1,393,012

1,410,313

Total liabilities and stockholders'

equity

$

2,340,728

$

2,343,876

The AZEK Company Inc.

Consolidated Statements of

Comprehensive Income

(In thousands of U.S. dollars,

except for share and per share amounts)

Three Months Ended June

30,

Nine Months Ended June

30,

in thousands

2024

2023

2024

2023

(As Restated)

(As Restated)

Net sales

$

434,369

$

387,553

$

1,093,221

$

981,504

Cost of sales

270,045

255,639

681,174

696,529

Gross profit

164,324

131,914

412,047

284,975

Selling, general and administrative

expenses

88,598

72,490

249,042

220,211

Other general expenses

—

1,065

—

1,065

Loss (gain) on disposal of property, plant

and equipment

(49

)

95

2,049

278

Operating income

75,775

58,264

160,956

63,421

Other income and expenses:

Interest expense, net

7,863

10,408

24,453

30,481

Gain on sale of business

(90

)

—

(38,390

)

—

Total other (income) and expenses

7,773

10,408

(13,937

)

30,481

Income before income taxes

68,002

47,856

174,893

32,940

Income tax expense

17,892

13,216

49,877

9,810

Net income

$

50,110

$

34,640

$

125,016

$

23,130

Other comprehensive income (loss):

Unrealized gain (loss) due to change in

fair value of derivatives, net of tax

$

236

$

3,953

$

(951

)

$

691

Total other comprehensive income

(loss)

236

3,953

(951

)

691

Comprehensive income

$

50,346

$

38,593

$

124,065

$

23,821

Net income per common share:

Basic

$

0.34

$

0.23

$

0.86

$

0.15

Diluted

0.34

0.23

0.84

0.15

Weighted-average common shares

outstanding:

Basic

145,439,955

150,140,392

146,159,550

150,610,890

Diluted

147,495,902

151,069,954

148,011,393

151,056,199

The AZEK Company Inc.

Consolidated Statements of

Cash Flows

(In thousands of U.S.

dollars)

Nine Months Ended June

30,

2024

2023

(As Restated)

Operating activities:

Net income

$

125,016

$

23,130

Adjustments to reconcile net income to net

cash flows provided by (used in) operating activities:

Depreciation

66,135

63,504

Amortization of intangibles

29,876

35,035

Non-cash interest expense

1,236

1,236

Non-cash lease expense

(102

)

(188

)

Deferred income tax (benefit)

provision

(12,284

)

1,599

Non-cash compensation expense

20,684

13,608

Fair value adjustment for contingent

consideration

—

250

Loss on disposition of property, plant and

equipment

2,049

1,919

Gain on sale of business

(38,390

)

—

Changes in certain assets and

liabilities:

Trade receivables

(12,256

)

15,441

Inventories

(28,029

)

83,401

Prepaid expenses and other currents

assets

(10,012

)

(9,590

)

Accounts payable

5,696

11,308

Accrued expenses and interest

14,448

(5,803

)

Other assets and liabilities

(86

)

1,043

Net cash provided by operating

activities

163,981

235,893

Investing activities:

Purchases of property, plant and

equipment

(54,433

)

(54,059

)

Proceeds from disposition of fixed

assets

326

173

Divestiture, net of cash disposed

131,783

—

Acquisitions, net of cash acquired

(5,962

)

(161

)

Net cash provided by (used in) investing

activities

71,714

(54,047

)

Financing activities:

Payments on Term Loan Agreement

(4,500

)

(4,500

)

Proceeds under revolving credit

facility

—

25,000

Payments under revolving credit

facility

—

(25,000

)

Principal payments of finance lease

obligations

(2,132

)

(1,958

)

Payments of INTEX contingent

consideration

—

(5,850

)

Exercise of vested stock options

19,418

11,111

Cash paid for shares withheld for

taxes

(4,853

)

(1,381

)

Purchases of treasury stock

(174,994

)

(55,488

)

Net cash used in financing activities

(167,061

)

(58,066

)

Net increase in cash and cash

equivalents

68,634

123,780

Cash and cash equivalents – Beginning of

period

278,314

120,817

Cash and cash equivalents – End of

period

$

346,948

$

244,597

Supplemental cash flow

disclosure:

Cash paid for interest, net of amounts

capitalized

$

34,843

$

34,581

Cash paid for income taxes, net

70,338

21,003

Supplemental non-cash investing and

financing disclosure:

Capital expenditures in accounts payable

at end of period

$

7,648

$

14,299

Right-of-use operating and finance lease

assets obtained in exchange for lease liabilities

11,639

2,828

Segment Results from Operations

Residential Segment

The following table summarizes certain financial information

relating to the Residential segment results that have been derived

from our unaudited Consolidated Financial Statements for the three

and nine months ended June 30, 2024 and 2023.

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands)

2024

2023

$

Variance

%

Variance

2024

2023

$

Variance

%

Variance

(As Restated)

(As Restated)

Net sales

$

416,009

$

351,608

$

64,401

18.3

%

$

1,041,550

$

873,208

$

168,342

19.3

%

Segment Adjusted EBITDA(1)

116,965

87,887

29,078

33.1

%

279,330

160,124

119,206

74.4

%

Segment Adjusted EBITDA Margin

28.1

%

25.0

%

N/A

N/A

26.8

%

18.3

%

N/A

N/A

(1)

Effective as of December 31,

2023, Residential segment Adjusted EBITDA includes all corporate

expenses, such as selling, general and administrative costs related

to our corporate offices, including payroll and other professional

fees. The prior periods have been recast to reflect the change.

Commercial Segment

The following table summarizes certain financial information

relating to the Commercial segment results that have been derived

from our unaudited Consolidated Financial Statements for the three

and nine months ended June 30, 2024 and 2023.

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands)

2024

2023

%

Variance

2024

2023

%

Variance

Net sales

$

18,360

$

35,945

$

(17,585

)

(48.9

)%

$

51,671

$

108,296

$

(56,625

)

(52.3

)%

Segment Adjusted EBITDA

2,455

8,780

(6,325

)

(72.0

)%

8,257

21,763

(13,506

)

(62.1

)%

Segment Adjusted EBITDA Margin

13.4

%

24.4

%

N/A

N/A

16.0

%

20.1

%

N/A

N/A

Adjusted Net Sales Excluding Vycom Reconciliation

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands)

2024

2023

2024

2023

Net sales

$

434,369

$

387,553

$

1,093,221

$

981,504

Impact from sale of Vycom business

-

(18,591)

(3,319)

(59,572)

Adjusted net sales excluding Vycom

$

434,369

$

368,962

$

1,089,902

$

921,932

Adjusted EBITDA and Adjusted EBITDA Margin

Reconciliation

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands)

2024

2023

2024

2023

(As Restated)

(As Restated)

Net Income

$

50,110

$

34,640

$

125,016

$

23,130

Interest expense, net

7,863

10,408

24,453

30,481

Depreciation and amortization

31,871

33,063

96,012

98,539

Income tax expense

17,892

13,216

49,877

9,810

Stock-based compensation costs

5,828

4,164

20,595

13,747

Acquisition and divestiture costs(1)

364

—

1,012

4,535

Gain on sale of business(2)

(90

)

—

(38,390

)

—

Secondary offering costs

—

1,065

—

1,065

Other costs(3)

5,582

111

9,012

580

Total adjustments

69,310

62,027

162,571

158,757

Adjusted EBITDA

$

119,420

$

96,667

$

287,587

$

181,887

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

(As Restated)

(As Restated)

Net Profit Margin

11.5

%

8.9

%

11.4

%

2.4

%

Interest expense, net

1.8

%

2.7

%

2.2

%

3.1

%

Depreciation and amortization

7.4

%

8.5

%

8.8

%

9.9

%

Income tax expense

4.1

%

3.4

%

4.6

%

1.0

%

Stock-based compensation costs

1.3

%

1.1

%

1.9

%

1.4

%

Acquisition and divestiture costs

0.1

%

—

%

0.1

%

0.5

%

Gain on sale of business

—

%

—

%

(3.5

)%

—

%

Secondary offering costs

—

%

0.3

%

—

%

0.1

%

Other costs

1.3

%

—

%

0.8

%

0.1

%

Total adjustments

16.0

%

16.0

%

14.9

%

16.1

%

Adjusted EBITDA Margin

27.5

%

24.9

%

26.3

%

18.5

%

______________________

(1)

Acquisition and divestiture costs

reflect costs related to acquisitions of $0.4 million in the three

months ended June 30, 2024, and $0.5 million and $3.9 million in

the nine months ended June 30, 2024 and 2023, respectively, and

costs related to divestiture of $0.5 million and $0.7 million in

the nine months ended June 30, 2024 and 2023, respectively.

(2)

Gain on sale of business relates

to the sale of the Vycom business.

(3)

Other costs include costs related

to the restatement of the AZEK’s consolidated financial statements

and condensed consolidated interim financial information for each

of the quarters within fiscal years ended September 30, 2023 and

2022, and for the fiscal quarter ended December 31, 2023 (the

“Restatement”) of $4.9 million in the three and nine months ended

June 30, 2024, costs related to removal of dispensable equipment

resulting from a modification of the Company's manufacturing

process of $2.4 million in the nine months ended June 30, 2024,

reduction in workforce costs of $0.1 million in the three months

ended June 30, 2023, and $0.3 million and $0.3 million in the nine

months ended June 30, 2024 and 2023, respectively, costs for legal

expenses of $0.7 million in the three months ended June 30, 2024,

and $1.1 million and $0.2 million in the nine months ended June 30,

2024 and 2023, respectively, and other costs of $0.3 million and

$0.1 million for the nine months ended June 30, 2024 and 2023,

respectively.

Adjusted Gross Profit Reconciliation

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands)

2024

2023

2024

2023

(As Restated)

(As Restated)

Gross Profit

$

164,324

$

131,914

$

412,047

$

284,975

Amortization(1)

3,778

4,515

11,439

13,737

Other costs(2)

—

—

—

116

Adjusted Gross Profit

$

168,102

$

136,429

$

423,486

$

298,828

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

(As Restated)

(As Restated)

Gross Margin

37.8

%

34.0

%

37.7

%

29.0

%

Amortization

0.9

%

1.2

%

1.0

%

1.4

%

Other costs

0.0

%

0.0

%

0.0

%

0.0

%

Adjusted Gross Profit Margin

38.7

%

35.2

%

38.7

%

30.4

%

______________________

(1)

Effective as of December 31,

2023, AZEK revised the definition of Adjusted Gross Profit to no

longer exclude depreciation expense. The prior periods have been

recast to reflect the change.

(2)

Other costs include costs related

to a reduction in workforce of $0.1 million in the nine months

ended June 30, 2024.

Adjusted Net Income and Adjusted Diluted EPS

Reconciliation

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands, except per

share amounts)

2024

2023

2024

2023

(As Restated)

(As Restated)

Net Income

$

50,110

$

34,640

$

125,016

$

23,130

Amortization

9,840

11,578

29,876

35,035

Stock-based compensation costs(1)

475

1,062

4,188

3,422

Acquisition and divestiture costs(2)

364

—

1,012

4,535

Gain on sale of business(3)

(90

)

—

(38,390

)

—

Secondary offering costs

—

1,065

—

1,065

Other costs(4)

5,582

111

9,012

580

Tax impact of adjustments(5)

(4,269

)

(3,646

)

4,650

(11,764

)

Adjusted Net Income

$

62,012

$

44,810

$

135,364

$

56,003

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

(As Restated)

(As Restated)

Net Income

$

0.34

$

0.23

$

0.84

$

0.15

Amortization

0.07

0.07

0.20

0.23

Stock-based compensation costs

—

0.01

0.03

0.02

Acquisition and divestiture costs

—

—

0.01

0.03

Gain on sale of business

—

—

(0.26

)

—

Secondary offering costs

—

0.01

—

0.01

Other costs

0.04

—

0.06

0.01

Tax impact of adjustments

(0.03

)

(0.02

)

0.03

(0.08

)

Adjusted Diluted EPS(6)

$

0.42

$

0.30

$

0.91

$

0.37

______________________

(1)

Stock-based compensation costs

reflect expenses related to AZEK’s initial public offering.

Expenses related to AZEK’s recurring awards granted each fiscal

year are excluded from the Adjusted Net Income reconciliation.

(2)

Acquisition and divestiture costs

reflect costs related to acquisitions of $0.4 million in the three

months ended June 30, 2024, and $0.5 million and $3.9 million in

the nine months ended June 30, 2024 and 2023, respectively, and

costs related to divestiture of $0.5 million and $0.7 million in

the nine months ended June 30, 2024 and 2023, respectively.

(3)

Gain on sale of business relates

to the sale of the Vycom business.

(4)

Other costs include costs related

to the Restatement of $4.9 million in the three and nine months

ended June 30, 2024, costs related to removal of dispensable

equipment resulting from a modification of AZEK’s manufacturing

process of $2.4 million in the nine months ended June 30, 2024,

reduction in workforce costs of $0.1 million in the three months

ended June 30, 2023, and $0.3 million and $0.3 million in the nine

months ended June 30, 2024 and 2023, respectively, costs for legal

expenses of $0.7 million in the three months ended June 30, 2024,

and $1.1 million and $0.2 million in the nine months ended June 30,

2024 and 2023, respectively, and other costs of $0.3 million and

$0.1 million for the nine months ended June 30, 2024 and 2023,

respectively.

(5)

Tax impact of adjustments, except

for gain on sale of business, are based on applying a combined U.S.

federal and state statutory tax rate of 26.5% for the three and

nine months ended June 30, 2024 and 2023, respectively. Tax impact

of adjustment for gain on sale of business is based on applying a

combined U.S. federal and state statutory tax rate of 42.1% for the

three and nine months ended June 30, 2024, respectively.

(6)

Weighted average common shares

outstanding used in computing diluted net income per common share

of 147,495,902 and 151,069,954 for the three months ended June 30,

2024 and 2023, respectively, and 148,011,393 and 151,056,199 for

the nine months ended June 30, 2024 and 2023, respectively.

Free Cash Flow Reconciliation

Three Months Ended June

30,

Nine Months Ended June

30,

(U.S. dollars in thousands)

2024

2023

2024

2023

(As Restated)

(As Restated)

Net cash provided by operating

activities

$

195,075

$

171,751

$

163,981

$

235,893

Less: Purchases of property, plant and

equipment

(17,554

)

(6,775

)

(54,433

)

(54,059

)

Free Cash Flow

$

177,521

$

164,976

$

109,548

$

181,834

Net cash provided by (used in) investing

activities

$

(23,453

)

$

(6,701

)

$

71,714

$

(54,047

)

Net cash used in financing activities

$

(52,073

)

$

(46,712

)

$

(167,061

)

$

(58,066

)

Net Leverage Reconciliation

Twelve Months Ended

June 30,

(In thousands)

2024

Net income

$

164,247

Interest expense, net

33,265

Depreciation and amortization

130,017

Income tax expense

62,205

Stock-based compensation costs

25,552

Acquisition and divestiture costs

3,367

Secondary offering costs

—

Gain on sale of business

(38,390

)

Other costs

9,275

Total adjustments

225,291

Adjusted EBITDA

$

389,538

Long-term debt — less current portion

$

576,804

Current portion

6,000

Unamortized deferred financing fees

3,460

Unamortized original issue discount

3,236

Finance leases

77,111

Gross debt

$

666,611

Cash and cash equivalents

(346,948

)

Net debt

$

319,663

Net leverage

0.8x

OUTLOOK

We have not reconciled either of Adjusted EBITDA or Adjusted

EBITDA Margin guidance to its most comparable GAAP measure as a

result of the uncertainty regarding and the potential variability

of, reconciling items such as the costs of acquisitions, which are

a core part of our ongoing business strategy, and other costs. Such

reconciling items that impact Adjusted EBITDA and Adjusted EBITDA

Margin have not occurred, are outside of our control or cannot be

reasonably predicted. Accordingly, a reconciliation of each of

Adjusted EBITDA and Adjusted EBITDA Margin to its most comparable

GAAP measure is not available without unreasonable effort. However,

it is important to note that material changes to these reconciling

items could have a significant effect on our Adjusted EBITDA and

Adjusted EBITDA Margin guidance and future GAAP results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807977254/en/

Investor Relations Contact: Eric Robinson 312-809-1093

ir@azekco.com

Media Contact: Amanda Cimaglia 312-809-1093 media@azekco.com

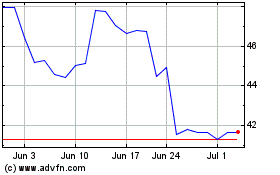

AZEK (NYSE:AZEK)

Historical Stock Chart

From Oct 2024 to Nov 2024

AZEK (NYSE:AZEK)

Historical Stock Chart

From Nov 2023 to Nov 2024