Overview

Utility services play a vital role in a nation’s economic progress

as cheap and abundant supply of power keeps the wheels of

development rolling. With development comes the need for more

power, as cities expand, and the use of new gadgets increases.

However, everything comes for a price. Greenhouse gas emitted by

large utilities cause immense damage to the environment.

Utilities have been under the scanner for a long time. However, the

recent climate action plan from President Obama, followed by the

U.S. Environmental Protection Agency's (EPA) proposal for granting

permission for setting up new power plants are putting immense

pressure on power producing units.

The utility operators are implementing new technologies in

generation and distribution of power. The introduction of smart

meters will benefit customers while the smart-grid technology is

likely to increase efficiency.

However, implementation of these new technologies, over vast

service territories, is a long, drawn-out process. In addition, the

cost involved in implementing the latest requirement from the

environmental agencies could make power plants run on coal more

costly than before. This is compelling power generators to install

more eco-friendly power units and develop more power from renewable

energy sources.

As per a U.S. Energy Information Administration (EIA) report,

global energy use will increase to 770 quadrillion Btu in 2035 from

505 quadrillion Btu in 2008. The majority of this usage is expected

to come from countries outside the Organization for Economic

Cooperation and Development (non-OECD nations). The energy market

of non-OECD nations has a larger scope for improvement compared to

the more mature OECD nations. The Asian market is expected to take

center stage in the global arena over the next four decades,

accounting for nearly 50% of global energy consumption by 2050.

In such a scenario, positive steps from the U.S. alone will not be

enough to counter the negative impact of global greenhouse gas

emissions. The variance in the socio-economic structure of

different countries and the quest for cheaper sources of

electricity are making the task difficult, if not impossible. In

fact, a recent study from International Energy Agency showed that

the greenhouse gas emitted from China in 2012 offset the positive

impact of lower emission from Europe and the U.S.

What is in the Climate Change Proposal?

The proposal from the EPA aims to strengthen the existing policies

on greenhouse gas emissions. Per the proposal, new large natural

gas-fired turbines would require to limit carbon emission of 1,000

pounds of CO2 per megawatt-hour, while new small natural gas-fired

turbines would need to meet a limit of 1,100 pounds of CO2 per

megawatt-hour.

A new coal-based power plant will have to limit carbon emission to

1,100 pounds of CO2 per megawatt-hour. In addition, coal based

power generators would have the option to meet a somewhat tighter

limit if they opt for an average emission over multiple years.

The new recommendation will make electricity generation from coal

units far more costlier than before. Increasing awareness about the

pitfalls of coal-based power generation will drive regulators to

formulate even more stringent laws on emission from coal-fired

generating units.

After this back to back announcement from the President and EPA,

most of the U.S. electric utilities that rely heavily on coal for

power generation will have to rethink their plant development

activities.

Zacks Rank

Within the Zacks Industry classification, Utilities are a

stand-alone sector, one of 16 Zacks sectors. The rural wire-line

telephone companies are also grouped within the Zacks Utility

sector, but the three major industries within this sector include

Electric Power, Gas Distribution and Water Supply.

The Utility sector’s defensive attributes reflect the group’s lack

of correlation with the broader market/economy. Of course, the

sector’s reputation as a dividend payer also adds to its perceived

defensiveness.

We rank all of the more than 260 industries in the 16 Zacks sectors

based on the earnings outlook for the constituent companies in each

industry. This ranking is available in the Zacks Industry Rank.

http://www.zacks.com/rank/industry.php

The way to look at the complete list of Zacks Industry Rank for the

260+ industries is that the outlook for industries with Zacks

Industry Rank of #88 and lower is 'Positive,’ between #89 and #176

is 'Neutral' and #177 and higher is 'Negative.’

Scanning the industries in the Utility sector, we find none in the

top 1/3rd. Gas Distribution and Water Supply both has a Zacks

Industry Rank #104, while Electric Power is at Zacks Industry Rank

#181.

Besides the Industry Rank, we also have ticker-wise rank allocation

for each ticker in our coverage universe. This indicates the

movement of the companies over a short timeframe (1 to 3

months).

We cover 77 electric utilities, out of which 11 tickers have a

Zacks Rank #2 (Buy), 48 tickers hold a Zacks Rank #3 (Hold) and the

remaining 18 tickers either have a Zacks Rank #4 (Sell) or a Zacks

Rank #5 (Strong Sell).

We track 25 gas utilities, out of which 7 tickers have a Zacks Rank

#2 (Buy), 12 tickers hold a Zacks Rank #3 (Hold) while 6 tickers

aren't doing well with a Zacks Rank #4 (Sell) or a Zacks Rank #5

(Strong Sell).

We presently cover 12 water utilities, out of which 1 each have a

Zacks Rank #1 (Strong Buy) and Zacks Rank#2 (Buy), 8 tickers carry

a Zacks Rank #3 (Hold) and 2 tickers either have a Zacks Rank #4

(Sell) or Zacks Rank #5 (Strong Sell).

We would recommend investors to concentrate on Strong Buy, Buy or

Hold Ranked stocks. The reason is simple: the tickers with a Zacks

Rank #1 to 3 will have a higher probability to report strong

earnings results and outpace market expectation, compared to the

tickers in the bottom half having either a Zacks Rank #4 and 5.

Earnings Trends

The utilities on the whole reflected growth of 0.7% year over year

in the second quarter of 2013 compared to 3.1% registered by the

S&P 500 companies. As per the current standing, the utilities

are expected to improve upon their previous quarter's performance.

The utilities are expected to register a 2.4% year-over-year

increase in the third quarter, outpacing the S&P 500 beat of

0.5% over the same period.

Electric Utilities

The EIA reported that electricity consumption in the U.S. will

increase from 3,841 billion kilowatt hours in 2011 to 4,930 billion

kilowatt hours in 2040, increasing at an average annual rate of

0.9%. For the fuel type in energy generation, renewables and

natural gas will play an increasing role while coal and nuclear

power will gradually fall out of favor.

As per EIA, the increasing demand for electricity and retirement of

nearly 103 gigawatts (GW) of existing capacity will result in an

addition of 340 GW of power production units from 2012 to 2040.

Natural gas-fired plants will provide 63% of the projected

capacity, while 31% will come from renewables, 3% from coal and 3%

from nuclear. This proves that natural gas will continue to play a

vital role in energy solutions in the coming three decades.

The electric utilities expected to play an important role in

meeting this increased demand for power are

Alliant Energy

Corporation (LNT),

American Electric Power

Inc. (AEP),

Duke Energy Corp. (DUK),

Entergy Corp. (ETR),

NextEra Energy

Inc. (NEE),

PPL Corporation (PPL) and

Southern Company (SO) among others.

Natural Gas Utilities

Among the utility services, natural gas usage is increasing due to

its abundance, cheap price and clean-burning nature. The EIA

forecasts the use of natural gas in the U.S. to increase from 24.37

trillion cubic feet in 2011 to 29.54 trillion cubic feet in 2040,

increasing at an average annual rate of 0.7%.

New fracking technology has multiplied natural gas production from

rock and rock structures previously considered uncommercial.

A study from NaturalGas.org pointed out that the natural gas

reserve in the U.S. increased by 39% from 2006 levels, thanks to

the implementation of new exploration techniques.

The natural gas utilities are not only expected to benefit from the

steady increase in domestic demand but also from exports that are

expected to rise significantly. The new techniques used to drill

natural gas will enable natural gas operators to export large

volumes after meeting domestic demand.

The positive dynamics are going to benefit natural gas utilities

like

AGL Resources Inc. (GAS),

Atmos

Energy Corporation (ATO),

New Jersey Resources

Corp. (NJR),

Southwest Gas Corporation

(SWX),

Questar Corp. (STR),

Sempra

Energy (SRE) and

MDU Resources Group

Inc. (MDU), among others. As per an EIA release, for the

week ending Oct 9, 2013, U.S. natural gas hub prices grew

moderately over the one-week period. The Henry Hub spot price

closed at $3.70 per million British thermal units (MMBtu), on Oct

9, up 9 cents per MMBtu from the beginning of the report week.

The recovery in natural gas prices will benefit the numerous

operators in the sector. With more than 71 million domestic natural

gas customers, the industry has enough room for nearly 1,200

natural gas utilities presently operating in the country.

In addition, the U.S. Department of Energy (“DOE”) nod for LNG

exports will open up new market opportunity for the U.S. gas

utilities. In Sep 2013, electric and natural gas supplier Dominion

Resources Inc. (D) received an approval from the DOE to export 770

million cubic feet of natural gas a day (mmcf/d) for 20 years.

The DOE is being cautious in granting permission for LNG exports.

At present 21 applications are pending with the regulator for LNG

export permission. Given the huge natural gas reserve in the U.S.

and ever increasing global demand for natural gas, the natural gas

export permission will help to unlock greater value of this natural

resource. This could be a potential game changer for the natural

gas sector.

Water Utilities

The major challenge ahead for water utility operators is the aging

water and sewer infrastructure. Maintenance and development of

facilities play a crucial role and will test the financial

capabilities of the water utilities.

A report from Economic Development Research Group Inc. suggests an

alarming gap between the water infrastructural requirement and

actual investments planned for the coming years. The gap is

expected to reach $84 billion in 2020 and widen to $144 billion in

2040. The report also revealed that without proper renewal or

replacement, nearly 44% of the existing pipelines will become too

poor for operation by 2020.

The utility operators have begun to invest in their ageing

infrastructure, but it appears the initiatives are inadequate to

bridge the gap. The government should consider taking adequate

measures before things blow out of proportion.

Among the water utilities,

American States Water

Company (AWR),

Aqua America, Inc. (WTR),

Connecticut Water Service, Inc. (CTWS) and

Consolidated Water Co. Ltd. (CWCO) registered

positive earnings surprises in their latest reported quarters. The

performance of these water utilities indicates that these will

register sequential growth in the third quarter of 2013 as

well.

What Keeps the Utilities Going?

The biggest positive for the utilities is that there is hardly any

viable substitute for utility services. This is the most

fundamental strength of the industry. Moreover, increasing demand

drives this industry forward.

Another inherent advantage of these utilities is their size and the

requirement of huge initial capital outlay. For this reason,

we generally do not find many new entrants in the market. Also,

stringent government regulations and the hard toil for new entrants

to establish a loyal consumer base put existing players in an

advantageous position.

Finally, utilities have been known to pay dividends consistently,

thereby retaining investor confidence. This was evident during the

economic crisis of 2008-2009 when these operators continued to pay

out dividends without fail.

In Conclusion

Despite the assured demand for services, the utilities have to

constantly meet the high expectations of its wide customer base,

adapt to a changing global economic scenario, and upgrade

technologies to meet stringent environmental norms.

Utility operations globally depend on weather patterns that

determine the extent of demand. Erratic weather patterns thereby

impact the profitability of these operators, so much so that their

operational goals remain unmet.

Moreover, hurricanes, storms and blizzards disrupt the normal

operation of the utility operators. American weather tracking body,

National Oceanic and Atmospheric Administration ("NOAA") has

projected a very active hurricane season in the second half of

2013, and storms are expected to exceed the seasonal averages.

The majority of new electricity in the next two decades in the U.S.

will be generated from natural gas and renewable sources. Besides

the abundance of natural gas, as many as 30 U.S. states and the

District of Columbia have enforceable renewable portfolio standards

or other renewable generation policies. We expect this count to go

up, compelling producers to generate more green power to meet the

renewable standards fixed by the states.

At the ongoing 22nd World Energy Congress in Daegu, South Korea,

the difficulties of providing sustainable energy to a growing

global population at a minimal environmental impact were debated.

In the same venue, World Energy Council released a note pointing

out the challenges resulting from population growth.

To sum up, a more prompt permission for LNG export will increase

the profitability of the U.S. natural gas operators. At the same

time a concerted effort will have to be made to remove the funding

requirement in the water utility sector. Otherwise the aging water

infrastructure will lead to more wastage, leading to a hike in cost

of operation and a related increase in the price of water supplied.

As for the electric utilities, these are venturing more and more

into grid scale solar and wind projects, wrenching the initiative

from the pure-play solar companies.

ATMOS ENERGY CP (ATO): Free Stock Analysis Report

AMER STATES WTR (AWR): Free Stock Analysis Report

CONN WATER SVC (CTWS): Free Stock Analysis Report

CONSOLTD WATER (CWCO): Free Stock Analysis Report

DOMINION RES VA (D): Free Stock Analysis Report

AGL RESOURCES (GAS): Free Stock Analysis Report

MDU RESOURCES (MDU): Free Stock Analysis Report

NEXTERA ENERGY (NEE): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

QUESTAR (STR): Free Stock Analysis Report

SOUTHWEST GAS (SWX): Free Stock Analysis Report

AQUA AMER INC (WTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

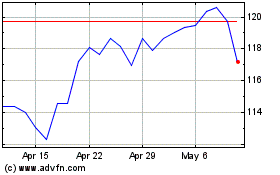

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Dec 2024 to Jan 2025

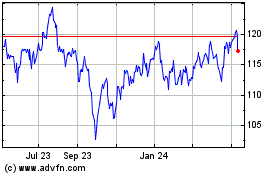

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jan 2024 to Jan 2025