In the pre-market on Friday, U.S. index futures are rising,

extending the increase seen the day before, when the government

avoided a shutdown with funding through March. Today, investors

await earnings from major financial institutions, as well as data

on sales of existing homes and consumer sentiment.

At 05:43 AM, the Dow Jones futures (DOWI:DJI) rose 64 points, or

0.17%. S&P 500 futures were up 0.39%, and Nasdaq-100 futures

advanced 0.71%. The yield on 10-year Treasury notes was at

4.146%.

In the commodities market, West Texas Intermediate crude oil for

February rose 0.55% to $74.49 per barrel. Brent crude oil for March

rose 0.42%, near $79.43 per barrel. Iron ore with a concentration

grade of 62%, traded on the Dalian exchange, rose 2.63% to $134.53

per metric ton.

On Friday’s economic agenda, investors await the preliminary

reading of the Michigan/Reuters consumer sentiment index for

January at 10 AM. At the same time, data on December’s used home

sales will be released.

Asian markets showed mixed results. Highlights include Taiwan,

where the Taiex index rose 2.63%, driven by a 6.46% jump in TSMC

(NYSE:TSM) after announcing better-than-expected earnings and

positive projections. Meanwhile, indices in China and Hong Kong

fell, but Japan, South Korea, and Australia recorded gains.

European markets are up today, recovering from the initial

pessimism of the week. The Davos Forum concludes, with Christine

Lagarde, President of the ECB, speaking today, after having

moderated expectations of rate cuts on Wednesday. In the United

Kingdom, retail sales disappointed, falling 3.2% in December, the

biggest drop since January 2021.

On Thursday, U.S. markets had a positive day, with gains in

major indices, especially the Nasdaq. The Dow Jones rose 0.54% to

37,468.61 points. The S&P 500 advanced 0.88% to 4,780.93

points. The Nasdaq rose 1.35% to 15,055.65 points. Shares of

technology, semiconductors, and airlines led the gains, despite an

increase in Treasury yields due to an unexpected drop in

unemployment claims.

On Friday’s quarterly earnings front, financial reports are

scheduled from Schlumberger (NYSE:SLB),

Fifth Third Bank (NASDAQ:FITB),

Ally (NYSE:ALLY), Huntington

(NASDAQ:HBAN), Travelers (NYSE:TRV), State

Street (NYSE:STT), Comerica (NYSE:CMA),

Regions (NYSE:RF), among others.

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL) – Google plans to

invest $1 billion in building a data center outside London to meet

growing demand for internet services in the region. The British

government praised the investment as a “huge vote of confidence” in

the UK. The data center will also promote energy conservation and

job creation.

Meta Platforms (NASDAQ:META) – Meta CEO Mark

Zuckerberg reinforced the focus on generative AI and plans to

acquire about 350,000 H100 GPUs from Nvidia

(NASDAQ:NVDA) by the end of the year, making its system one of the

largest. Meta will also explore chips from AMD

(NASDAQ:AMD) and is developing a similar GPU chip. The goal is to

integrate generative AI into products after years of research and

launch AI tools, such as the Llama model and a “Meta AI” chatbot.

Zuckerberg linked these investments to the vision of an

AR/VR-driven metaverse, which will require new devices. In other

news, a Spanish court recognized that a former Facebook moderator’s

mental health was affected by his work, determining he is entitled

to extra compensation for medical leave. This case may have

implications for social media companies’ practices with

moderators.

Apple (NASDAQ:AAPL) – Apple’s mixed reality

headset Vision Pro is available for pre-order, with deliveries

expected on February 2. The starting price of $3,499 and the

requirement for precise fit, as well as the lack of streaming app

support, may limit initial adoption. YouTube and

Spotify (NYSE:SPOT) do not plan to launch apps for

the Apple Vision Pro, and their iPad apps will not work on the

device at launch. Netflix (NASDAQ:NFLX) also opted

not to support the Vision Pro. Apple hopes to expand the mixed

reality headset market in the long term. The Vision Pro is one of

the priciest offerings in the consumer headset market. Apple

expects areas like healthcare, technical training, and education to

become key areas for the product. It is Apple’s first major new

product category since the launch of the smartwatch in 2015.

Masimo Corp (NASDAQ:MASI) – Masimo CEO Joe

Kiani stated that consumers would be better off without Apple’s

pulse oximetry technology, following the U.S. International Trade

Commission’s decision that Apple violated Masimo’s patents. Apple

disagrees, claiming its feature can save lives. Masimo argues that

its offering is FDA-approved and more accurate, while Apple

provides on-demand spot checks. The legal dispute continues.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro’s share value increased by 12.4% after the server and

computer product manufacturer announced it expects adjusted

earnings in the fiscal second quarter to be between $5.40 and $5.55

per share. This figure exceeds analysts’ estimates, which forecast

earnings of $4.51 per share, and is also better than the company’s

previous forecast, which was between $4.40 and $4.88 per share.

Additionally, the company forecasts sales in the range of $3.6

billion to $3.65 billion, also above Wall Street estimates. Super

Micro attributes this positive performance to “strong market and

end-customer demand for our rack-scale, AI, and total IT

solutions.”

Advanced Micro Devices (NASDAQ:AMD),

Nvidia (NASDAQ:NVDA) – AMD recorded a 2.2%

increase in pre-market trading on Friday while Nvidia also saw a

rise of 1.9%, following both chip companies reaching record closing

stock levels on Thursday. AMD saw a 10% increase in its share value

this year, while Nvidia experienced a 15% jump. These gains were

driven by investor interest in everything related to artificial

intelligence.

Amazon (NASDAQ:AMZN) – The European Union’s

competition regulator plans to block Amazon.com’s $1.4 billion

acquisition of iRobot (NASDAQ:IRBT), citing

competition concerns in the robotic vacuum cleaner market. Amazon

has not offered solutions to the antitrust concerns and is likely

to face rejection. The European Commission has until February 14 to

make a decision. In response, IRBT shares are down 36.3% in

Friday’s pre-market trading. Additionally, Amazon announced it is

laying off less than 5% of employees in its Buy with Prime unit,

which offers fulfillment and delivery services to retailers. About

30 employees were affected, but the company promises to support

them in finding new roles. Amazon has also conducted layoffs in

other areas, including streaming, studio, Twitch, and Audible.

FedEx (NYSE:FDX) – FedEx faces financial

challenges as it seeks a more lucrative contract with the U.S.

Postal Service and negotiates with its pilots. The failure to renew

the contract with the USPS could impact FedEx Express’s profits,

and impasses with the pilots could lead to layoffs for the first

time in its 52-year history.

Walmart (NYSE:WMT) – Walmart will raise the

average annual wages and bonuses of U.S. store managers starting in

February, raising the average hourly wage to over $18. The change

reflects solid sales growth and aims to retain employees.

Birkenstock (NYSE:BIRK) – Birkenstock warned

that its annual profits would be impacted by global expansion,

planning to increase the prices of its footwear due to inflation.

The company expects an adjusted EBITDA margin of about 30% in 2024,

down from 32.4% in 2023. Although revenue exceeded expectations,

adjusted earnings per share fell below estimates.

Reddit – Reddit is planning its IPO in March,

with an initial public offering of about 10% of the shares. This

would mark the first significant IPO of a social media company

since Pinterest (NYSE:PINS) in 2019. The company

plans to launch its roadshow in March and complete the IPO by the

end of the month. Reddit, valued at about $10 billion in 2021,

faces competition from platforms like TikTok and

Facebook (NASDAQ:META) for advertising

budgets.

Kaspi.kz (NASDAQ:KSPI) – Major shareholders of

Kaspi.kz, a mobile app company from Kazakhstan, raised

approximately $1 billion in an expanded public offering in the U.S.

They sold 11.3 million American Depositary Shares of Kaspi.kz at

$92 each, a 5.3% discount from the previous closing price in

London. The company has a market value of about $18 billion, and

the shares began trading on the New York Stock Exchange.

VF Corp (NYSE:VFC) – VF Corp, the maker of the

Vans brand, revealed that a cyber incident in December compromised

personal data of about 35.5 million consumers but does not

anticipate a significant financial impact. The company clarified it

did not collect sensitive information and has restored its affected

systems.

Macy’s (NYSE:M) – Macy’s is eliminating 2,350

jobs and closing five stores to optimize its operations,

representing 13% of the corporate staff and 3.5% of its overall

personnel. This comes as investors pressure for taking the company

private in a $5.8 billion offer, and the new CEO seeks to cut

expenses.

JM Smucker (NYSE:SJM) – JM Smucker Co.’s “core

weeks” policy, allowing employees to choose to come to the office

every two weeks during the Tuesday-to-Thursday week, has been

successful, resulting in lower attrition, higher productivity, and

successful recruitment.

Wendy’s (NASDAQ:WEN) – Wendy’s announced the

appointment of Kirk Tanner, formerly CEO of Beverages North America

at PepsiCo (NASDAQ:PEP), as the new president and

CEO of the third-largest burger chain in the United States.

Tilray (NASDAQ:TLRY) – Tilray President and CEO

Irwin D. Simon bought shares of the company on the open market for

the first time. Following the second-quarter results that beat

estimates, Tilray’s shares fell, continuing a downward trend in

share prices over the years. Simon acquired 53,700 shares for a

total of $101,000 and now owns 2.03 million shares. The company

plans to make more acquisitions in 2024, despite not yet being

profitable.

Tilray (NASDAQ:TLRY) – Tilray’s President and

CEO, Irwin D. Simon, made his first open-market purchase of the

company’s stock. Following the second quarter results that exceeded

estimates, Tilray’s shares fell, continuing a trend of declining

stock prices over the years. Simon acquired 53,700 shares for a

total of $101,000 and now owns 2.03 million shares. The company

plans to make more acquisitions in 2024, despite still being

unprofitable.

Coursera (NYSE:COUR) – Coursera experienced a

significant increase in demand for artificial intelligence (AI)

courses in 2023, adding a new user every minute on average. The

platform plans to collaborate with AI industry leaders like OpenAI

and Google’s DeepMind to offer AI courses. Generative AI has not

replaced education, but encouraged people to enhance their skills.

Coursera registered over 7.4 million enrollments in its 800 AI

courses, offering personalized assistance through its AI assistant

named “Coach”.

Spirit Airlines (NYSE:SAVE) – Spirit Airlines

is seeking to refinance its debt, denying a restructuring following

the block of its merger with JetBlue Airways (NASDAQ:JBLU). The

company denied restructuring and is focused on strengthening its

balance sheet while facing financial challenges and credit

pressure.

Boeing (NYSE:BA) – Indonesia authorized the

flight of three Boeing 737 MAX 9 planes, with configurations

different from the Alaska Airlines plane that made an emergency

landing in the US due to a cabin panel breakage. Lion Air’s planes

were inspected and cleared to fly from January 11. Differences

include a “type II emergency exit door” on Lion Air’s planes and a

“mid-exit door plug” on the Alaska Airlines plane.

Alaska Airlines (NYSE:ALK) – Alaska Airlines

will extend the suspension of Boeing 737 MAX 9 flights until Sunday

due to the ongoing review by the Federal Aviation Administration

(FAA) on inspections of 40 aircraft. The FAA requires reinspection

before authorizing resumption of flights after January 5.

JB Hunt (NASDAQ:JBHT) – JB Hunt reported a 9%

drop in fourth-quarter revenue, totaling $3.3 billion. This decline

was attributed to lower volumes in the truckload and integrated

capacity solutions units, and a reduction in revenue per load in

the truck unit. Profits also decreased to $1.47, compared to $1.92

the previous year, falling below analysts’ expectations of

$1.74.

Honda (NYSE:HMC) – Honda will continue focusing

on hybrid model and light truck sales in the US due to growing

demand. An annual sales increase of 10% to 15% is expected,

following the satisfaction of pent-up demand in 2023. Honda also

plans to launch three zero-emission vehicles in 2024.

Fisker (NYSE:FSR) – Fisker’s shares have been

undergoing a prolonged decline, being labeled as a “meme stock”.

Despite the company’s promotion in the electric vehicle market, it

failed to meet its production and delivery targets. Short interest

is high, and Fisker is reshaping its business model to boost sales

and deliveries. However, shares continue to fall, recently losing

its most optimistic analyst. Shares are up 2.6% in Friday’s

pre-market but have dropped 20% over the week.

Tesla (NASDAQ:TSLA), Ford

(NYSE:F), Charter Communications (NASDAQ:CHTR) –

U.S. hedge funds focused on short bets against Tesla, Ford, and

Charter Communications last year, according to Hazeltree. In terms

of industrial sectors, technology sectors led short positions in

the U.S., while consumer products and healthcare companies were the

most sold in mid and small caps.

JPMorgan Chase (NYSE:JPM) – The CEO of JPMorgan

Chase, Jamie Dimon, saw a 4.3% increase in compensation in 2023,

reaching $36 million. His package included a base salary of $1.5

million and a performance bonus of $34.5 million, comprising cash

and stocks. The raise reflects the bank’s solid performance,

including its highest annual profit and the completion of the

acquisition of First Republic Bank. Jamie Dimon is estimated to

have a net worth of $1.7 billion. In other news, JPMorgan forecasts

that the Bank of England will cut interest rates in August, due to

a possible drop in inflation. They project a 75 basis-point cut by

the end of 2024, bringing the rate to 4.5%. The reduction in

inflation might lead them to reach the BoE’s 2% target sooner than

anticipated. JPMorgan also raised its UK economic growth forecast

to 0.3% in 2024, up from 0.2%. Additionally, JPMorgan Chase

appointed Sollo Cho as head of investment banking in South Korea.

Cho, who joined the bank in 2018, has helped organize notable IPOs,

including Kakao Pay and Hybe Co., and has experience with Deutsche

Bank and ABN Amro Bank.

Citigroup (NYSE:C) – Citigroup has partnered

with LuminArx Capital to create a private lending vehicle named

Cinergy, investing over $2 billion. Traditional banks are

collaborating with private equity firms due to increased

regulation, anticipating growing demand for risky loans.

Additionally, Citigroup’s CEO, Jane Fraser, held a conference call

to discuss the bank’s restructuring and announced layoffs,

including managers in markets, risk, and investment banking. Some

positions will be eliminated starting February 1st. The bank plans

to cut 20,000 jobs over the next two years.

Wells Fargo (NYSE:WFC) – Employees at a Wells

Fargo branch in Atwater, California, rejected forming a union,

becoming the first Wells Fargo location to do so. Other locations,

such as Bethel, Alaska, have joined the union. Some employees

claimed pressure, while others denied it. Wells Fargo acknowledged

the vote and thanked the employees.

Morgan Stanley (NYSE:MS), Carlyle

Group (NASDAQ:CG) – Wall Street heads, including Ted Pick

of Morgan Stanley and David Rubenstein of Carlyle Group, foresee an

increase in mergers and acquisitions, driven by the Federal

Reserve’s reduction of interest rates. They believe interest rates

will soon fall, spurring more M&A and private equity activity.

The optimism contrasts with the previous year, when recession

concerns slowed activity. Infrastructure is seen as an attractive

asset class for investors, driving more acquisitions.

Moody’s (NYSE:MCO) – The default rate of

low-credit-grade companies in the U.S. is expected to rise in the

first quarter of 2024, reaching 5.8%, up from 5.3% in November,

before stabilizing at 4.1% by the end of the year, according to

Moody’s. Healthcare companies lead the risk list.

ArcelorMittal (NYSE:MT) – Italy will place the

steel plant Ilva under special administration to ensure its

continuous operation, following conflicts between the government

and ArcelorMittal, the majority shareholder of Acciaierie d’Italia,

formerly Ilva. ArcelorMittal, holding 62%, may legally contest the

decision.

PPG Industries (NYSE:PPG) – PPG announced an

adjusted profit of $1.53 per share in the fourth quarter, beating

estimates by 4 cents. Sales also saw a 4% increase, totaling $4.35

billion during the period. However, the paint and coatings

company’s forecasts for the first quarter did not meet

expectations. PPG stated it expected moderate economic conditions

in the U.S. during the first half of 2024 but predicted an

improvement in demand in China.

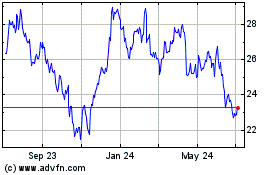

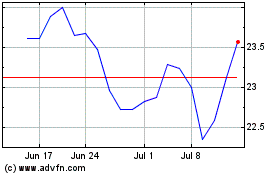

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Nov 2023 to Nov 2024