Apollo to Acquire Dutch Equipment Leasing Specialist Beequip from NIBC

September 05 2024 - 5:00AM

Apollo (NYSE: APO) today announced that balance sheet and other

investor capital managed under its Aligned Alternatives platform

have agreed to acquire Netherlands-based equipment leasing

specialist Beequip from NIBC.

Founded in 2015, Beequip has grown to become a

leading independent equipment financing company in the Netherlands,

serving small and medium enterprises (SMEs) across Europe and

internationally, with a current portfolio of €1.4 billion and €700

million of annual run-rate originations. Beequip offers financing

and leasing solutions for new and used heavy equipment spanning

transport, cranes, containers, maritime and more.

Beequip will further the build-out of Apollo’s

European equipment finance platform, established in 2018 with

UK-based Haydock Finance. The acquisition is consistent with

Apollo’s origination platform strategy focused on high-quality,

secured credit generation, diversified across corporate and

consumer categories, including asset-backed finance.

“Beequip has established itself as a leader in

the equipment finance space in its home market, with a strong team

and robust underwriting to serve a growing base of SMEs in the

Netherlands and beyond,” said Kevin Crowe,” Partner in Apollo’s

Financial Institutions Group.

“We are pleased to welcome the Beequip team to

Apollo’s origination ecosystem and to support the business as it

continues to scale, meeting vital demand from SMEs to facilitate

their business plans and fuel economic growth,” added Apollo’s

Mikhail Rychev.

Beequip co-founders Giel Claes and Peter Loef

said, “We are extremely proud of our team and the success we have

achieved. Leveraging our expertise in equipment, our focus on used

machinery, and our 'iron above numbers' philosophy, we have

consistently increased market share. With the help of our

self-developed fintech systems, we have provided entrepreneurs with

user-friendly and tailored financing solutions for heavy equipment.

We look forward to working in partnership with Apollo in this

exciting next chapter, with a solid foundation for growth

domestically and internationally alongside a steadfast commitment

to risk management.

The transaction is subject to customary closing

conditions and expected to be completed before the end of 2024.

Through the first half of 2024, Apollo reported

record debt origination volumes of $92 billion in aggregate across

the firm and its affiliate platforms, and for the 12-month period

ending June 30, 2024, Apollo reported $146 billion of debt

origination. Origination is integral to Apollo’s strategy seeking

excess spreads in private investment grade credit to serve its

retirement services businesses and other ratings-sensitive

liabilities.

About ApolloApollo is a

high-growth, global alternative asset manager. In our asset

management business, we seek to provide our clients excess return

at every point along the risk-reward spectrum from investment grade

to private equity with a focus on three investing strategies:

yield, hybrid, and equity. For more than three decades, our

investing expertise across our fully integrated platform has served

the financial return needs of our clients and provided businesses

with innovative capital solutions for growth. Through Athene, our

retirement services business, we specialize in helping clients

achieve financial security by providing a suite of retirement

savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of June 30, 2024, Apollo had

approximately $696 billion of assets under management. To learn

more, please visit www.apollo.com.

Contacts

Noah GunnGlobal Head of Investor RelationsApollo Global

Management, Inc.(212) 822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491communications@apollo.com /

EuropeanMedia@apollo.com

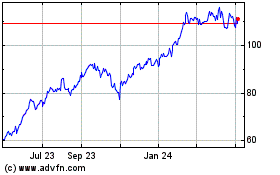

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Dec 2024 to Jan 2025

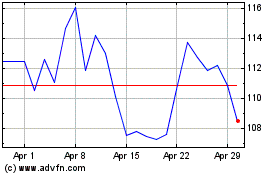

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Jan 2024 to Jan 2025