AB InBev 2Q Hit By Impairment Charge Against African Business

July 30 2020 - 1:51AM

Dow Jones News

By Ian Walker

Anheuser-Busch InBev SA on Thursday reported a fall in

second-quarter net profit--missing analysts' forecasts--as it

booked an impairment charge against its African business, but said

the fundamental strengths of the company remain unchanged.

The world's largest brewer--with brands such as Budweiser,

Stella Artois and Corona--said volumes fell 17.1% in the second

quarter.

For the quarter ended June 30, AB InBev made a net profit of

$351 million compared with a profit of $2.48 billion a year earlier

and a consensus of $1.14 billion taken from FactSet and based on

five analysts' forecasts. It booked a $2.5 billion non-cash

impairment charge, which is partially offset by a $1.9 billion

profit on the sale of its Australian operations.

Normalized earnings before interest, taxes, depreciation and

amortization--one of the company's preferred metrics which strips

out exceptional and other one-off items--was $3.41 billion compared

with $5.64 billion for the second quarter of 2019 and a consensus

of $3.15 billion, taken from FactSet and based on six analysts'

forecasts.

Revenue for the quarter was $10.29 billion, down from $13.60

billion and forecasts of $9.57 billion, taken from FactSet and

based on 10 analysts' estimates.

No dividend has been declared. On April 14, the company halved

its final dividend for 2019 to 50 European cents (54 U.S. cents)

because of the uncertainty and volatility caused by the new

coronavirus.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 30, 2020 01:36 ET (05:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

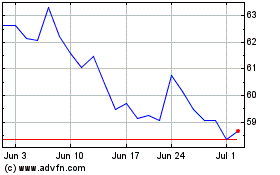

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Sep 2024 to Oct 2024

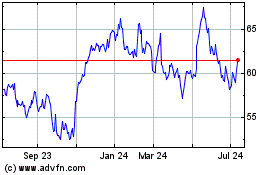

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Oct 2023 to Oct 2024