Telefonica Brasil Misses Overall - Analyst Blog

July 26 2012 - 1:45PM

Zacks

Brazilian telecom carrier

Telefonica Brasil SA (VIV)

reported second quarter 2012 net income of R$1,085.5 million

($554.7 million), down 5.6% year over year. Earnings per ADS came

in at 49 cents, considerably lagging the Zacks Consensus Estimate

of 56 cents.

Revenue dipped 0.2% year over year

to R$8.24 billion ($4.2 billion), and also missed the Zacks

Consensus Estimate of $4.37 billion, mainly due to the slowdown in

fixed-line customer base.

Consolidated EBITDA inched up 1%

year over year to R$3.1 billion ($1.6 billion) with EBITDA margin

increasing 40 basis points (bps) to 37.5%. Operating expenses

dropped 0.9% year over year to R$5.15 billion ($2.63 billion).

Revenue

Segments

Mobile

revenue climbed 8.4% year over year to R$5.12 billion ($2.62

billion), driven primarily by data and VAS, and access and usage

revenues. Telefonica Brasil added 0.93 million customers in the

quarter, thus taking its total subscriber base to 75.72 million (up

18.2% year over year). Post-paid and prepaid subscribers grew 20.6%

and 17.5% year over year to 17.17 million and 58.54 million,

respectively.

Average revenue per user (ARPU)

fell 7% to R$21.9 ($11.2) as lower voice ARPU fully mitigated the

growth in data ARPU. As a result of higher termination of 1.6

million inactive prepaid subscribers, customer churn upped 1% year

over year to 3.8%.

Fixed

revenue fell 11.7% year over year to R$3.11 billion ($1.6 billion).

Pay TV performed the worst with revenue decline of 20.2% followed

by declines of 17%, 13.5% and 3.2% in fixed voice and access, other

services and interconnection revenues, respectively. However, data

transmission revenue increased 2.2%.

Total fixed access lines reached

15.13 million at the end of the reported quarter, reflecting a 0.9%

year-over-year decrease. Telefonica Brasil added 32,000 fixed

broadband service customers, bringing the total subscriber base to

roughly 3.72 million (up 7.1% year over year) during the quarter.

The Pay TV subscriber base dropped 4.6% year over year to 650,000

customers. Fixed voice lost 113,000 customers and the subscriber

base stood at 10.77 million at the end of the second quarter.

Liquidity

Telefonica Brasil, a subsidiary of

Telefonica SA (TEF), exited the second quarter

with cash and cash equivalents of R$2.11 billion compared with

R$2.67 billion in the year-ago quarter. Net debt decreased to

R$3.17 billion from R$3.21 billion in the year-ago quarter. Net

debt-to-EBITDA ratio improved to 0.26 times from 0.27 times in the

year-ago quarter.

Capital expenditures decreased

38.2% year over year to R$1.14 billion ($0.58 billion) in the

reported quarter.

Our Take

Despite the expansion of video,

broadband Internet and Pay TV services, we remain skeptical about

the company’s ability to regain lost profitability in the

fixed-line segment. Tariff cuts, intense inflationary pressure,

stiff competition from rivals like America Movil

S.A.B. de C.V. (AMX) and Telecom Italia

S.P.A. (TI), and excessive government intervention would

put added pressure. All these factors might restrict potential

synergies derived from the mobile business and restrain top and

bottom-line growth.

We are currently maintaining our

long-term Underperform recommendation on the stock. For the short

term (1-3 months), Telefonica Brasil holds a Zacks # 5 (Strong

Sell) Rank.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

TELECOM ITA-ADR (TI): Free Stock Analysis Report

TELEF BRASIL SA (VIV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

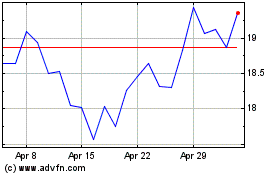

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2024 to Jul 2024

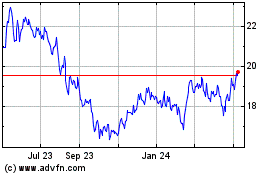

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jul 2023 to Jul 2024