U.S. index futures are registering a decline in pre-market

trading this Tuesday, suggesting that the enthusiasm generated by

the technology-driven recovery yesterday is losing steam.

At 05:46 AM, Dow Jones futures (DOWI:DJI) fell 119 points, or

0.31%. S&P 500 futures dropped 0.32%, and Nasdaq-100 futures

declined 0.45%. The 10-year Treasury bond yield stood at

4.044%.

In the commodity market, West Texas Intermediate crude oil for

February rose 1.81% to $72.04 per barrel. Brent crude oil for March

increased by 1.75%, nearing $77.44 per barrel. Iron ore with a

concentration of 62%, traded on the Dalian exchange, fell 0.25% to

$138.82 per metric ton.

The Stoxx 600 index is declining, with most sectors in negative

territory. Basic resources and technology led the losses, falling

0.8%, while oil and gas stocks rose 0.6%. Global investors are

awaiting US inflation data and results from major banks. German

industrial production fell 0.7% in November, surprising

negatively.

U.S. stocks closed higher on Monday, led by the Nasdaq with

strong performance in the technology sector. Falling bond yields

and optimism about the future of the stock market boosted indices.

The Dow Jones rose 0.58%, the S&P 500 1.41%, and the Nasdaq

2.20%. Shares of Boeing (NYSE:BA) pressured the

Dow Jones after a sharp pullback of 8% due to issues with the 737

Max 9.

For Tuesday’s quarterly earnings front, reports from

Tilray (NASDAQ:TLRY), Acuity

Brands (NYSE:AYI), TD Synnex (NYSE:SNX),

Albertsons (NYSE:ACI), Neogen

(NASDAQ:NEOG) are expected before the market opens. After the

close, numbers from AZZ (NYSE:AZZ),

WD-40 (NASDAQ:WDFC), PriceSmart

(NASDAQ:PSMT), SGH (NASDAQ:SGH), among others,

will be awaited.

Wall Street corporate highlights for today

Nvidia (NASDAQ:NVDA) – Nvidia

shares hit a record close on Monday, ending at $522.53, following

the announcement of the GeForce RTX 40 SUPER series of graphics

processors, focused on artificial intelligence.

Nvidia is a leader in AI processors, with a market

value of nearly $1.3 trillion. Additionally,

Nvidia has partnered with four Chinese electric

vehicle manufacturers, including Li Auto, Great Wall Motor, Zeekr,

and the EV unit of Xiaomi, to use its DRIVE technology in automated

driving systems, expanding its presence in China.

Apple (NASDAQ:AAPL) – Apple

challenged EU rules classifying its five App Stores as a single

platform service, stating that regulators misinterpreted the new

legislation and that each App Store is designed for a specific

Apple operating system and device. Apple also

questioned the designation of iMessage as a standalone

interpersonal communication service. Additionally, on Monday, it

was revealed that Apple‘s iPhone sales in China

fell 30% in the first week of 2024, due to growing competition from

Chinese rivals such as Huawei. Despite discounts, the drop reflects

competitive pressure, with Huawei gaining market share.

Additionally, Apple announced that it will launch

its Vision Pro mixed reality headset in the U.S. on February 2,

priced from $3,499. The device features advanced technology, but

its high price and need to be connected to a power source limit

initial adoption.

Apple (NASDAQ:AAPL), Alphabet

(NASDAQ:GOOGL) – A U.S. oversight plan targeting companies like

Apple and Alphabet, which offer

digital wallets and payment apps, was criticized by the technology

industry lobby group. The Consumer Financial Protection Bureau’s

(CFPB) proposal sought to impose supervision similar to that

applied to banks on these companies but was criticized for stifling

innovation and harming startups. The Financial Technology

Association also shared similar concerns and called for a halt to

the regulatory process.

Microsoft (NASDAQ:MSFT) – South Korea’s Qcells

will supply 12 gigawatts of solar panels to

Microsoft by 2032, upping its initial commitment

of 2.5 gigawatts. The deal helps Microsoft achieve

its goal of 100% renewable energy by 2025 and Qcells to establish a

competitive solar supply chain in the U.S.

Hewlett Packard Enterprise (NYSE:HPE),

Juniper Networks (NYSE:JNPR) – Hewlett

Packard is in talks to acquire Juniper

Networks in a deal worth approximately $13 billion, aiming

to strengthen its artificial intelligence (AI) offerings. An

announcement may be made soon. HPE shares fell 7.7%, while

Juniper’s rose 22.6% following the announcement. HPE recently

launched a cloud computing service to support AI systems like

ChatGPT, while Juniper offers a wide range of high-performance

networking services.

Microchip Technology (NASDAQ:MCHP) – Shares of

Microchip Technology, a computer component developer, fell over 4%

in Tuesday’s pre-market due to third-quarter fiscal sales forecast

falling 22%, citing a weakening economic environment. The company

had expected a drop of 15% to 20%. CEO Ganesh Moorthy cited

challenges faced by customers and distributors due to the weak

economic environment and prolonged shutdowns at the end of the

December quarter. Full results will be released on February

1st.

Unity Software (NYSE:U) – Unity Software plans

to lay off 1,800 employees, about 25% of its workforce, in its

largest workforce reduction. This follows the company’s reset led

by interim CEO Jim Whitehurst to focus on its core business.

Match Group (NASDAQ:MTCH) – Activist investor

Elliott Investment Management acquired a stake of about $1 billion

in Match Group, owner of Tinder. Elliott aims to pressure the

company to improve performance and increase stock prices, but

specific demands have not yet been revealed.

Twilio (NYSE:TWLO) – Twilio announced a CEO

change, leading some analysts to speculate about a possible split

of the company. Founder Jeff Lawson stepped down, replaced by

Khozema Shipchandler. The company expects financial results above

previous expectations. Analysts see the change as a possible

catalyst for gains in stocks and debate whether it might indicate a

split of the company into two separate businesses.

JD.com (NASDAQ:JD) – JD.Com revealed that its

Dada Nexus unit found irregularities in internal auditing, raising

concerns about online advertising, marketing revenue, and operating

costs, possibly overstating by 500 million yuan. Dada’s shares

plummeted, while JD.Com’s also fell. Dada will conduct an

independent review with professional consultants.

Boeing (NYSE:BA), Alaska

Airlines (NYSE:ALK) – Alaska Air discovered loose parts in

the door plug area in some of its Boeing 737 MAX 9s after a forced

landing of an Alaska Airlines flight. United

Airlines (NASDAQ:UAL) also found loose screws in grounded

MAX 9 aircraft, raising concerns about the manufacturing of the

best-selling jet family. The NTSB is investigating whether the

cabin panel that caused an explosion in an Alaska Airlines Boeing

737 MAX 9 was properly secured. The FAA suspended 171 MAX 9

aircraft after findings of loose parts, raising concerns about

Boeing’s production and causing flight cancellations.

Delta Air Lines (NYSE:DAL) – Airbus is nearing

a potential order from Delta Air Lines for dozens of wide-body

jets, including A350-1000s, with a deal potentially being announced

during Delta’s quarterly earnings. Delta has been a major Airbus

customer, owning several Airbus widebodies. The order aims to

expand Delta’s Asia-Pacific network.

Ryanair (NASDAQ:RYAAY) – Ryanair expects to

face delays in Boeing deliveries, resulting in five to ten fewer

aircraft for the 2024 summer season. This will likely lead to a

downward revision of its traffic projections, with 200 million

passengers instead of the 205 million forecasted. Recent delays at

Boeing and Airbus highlight the need for quality control

improvements.

JetBlue Airways (NASDAQ:JBLU) – Joanna Geraghty

was named CEO of JetBlue Airways, succeeding Robin Hayes. Geraghty,

currently the company’s COO, will lead the airline following the

$3.8 billion acquisition of Spirit Airlines (NYSE:SAVE). The U.S.

Justice Department’s legal action aims to prevent the merger

between the two companies, alleging it would increase airfares.

Stellantis (NYSE:STLA), Amazon

(NASDAQ:AMZN), BlackBerry (NYSE:BB) – Stellantis

revealed a partnership with Amazon and BlackBerry technology to

create a “virtual cockpit” that allows car controls and systems to

be developed and tested in a day, instead of months, speeding up

the development cycle and enhancing the driver experience.

Honda (NYSE:HMC) – Honda is considering

building an electric vehicle factory in Canada, with meetings

between Canadian officials and representatives of the automaker to

discuss the project. A final decision is expected by the end of

2024, with planned operations starting in 2028. Honda seeks to

strengthen its presence in the electric vehicle market. Canada has

been courting companies to develop its electric vehicle supply

chain and reduce carbon emissions.

Tesla (NASDAQ:TSLA) – Drug use by Elon Musk

raises concerns for Tesla’s board, as it potentially exposes the

company to financial and legal risks. The directors have faced

previous challenges, including litigation and shareholder concerns

regarding the CEO.

Exxon Mobil (NYSE:XOM) – Exxon Mobil is

conducting a write-down of about $2.5 billion on troubled

properties in California, ending five decades of offshore oil

production in the state. The sale of these assets to Sable Offshore

is pending but faces regulatory challenges and litigation with

landowners. If the sale fails, costs for Exxon could significantly

increase.

NuScale Power (NYSE:SMR) – NuScale Power, a

utility service company, plans to lay off 28% of its full-time

employees, resulting in the removal of 154 workers. These

cost-cutting measures are expected to save about $50 million to $60

million annually. NuScale, which received design certification for

its Small Modular Reactor (SMR), has faced financial challenges,

including the cancellation of an SMR project in partnership with an

energy company in Utah.

GSK (NYSE:GSK) – GSK will acquire asthma drug

manufacturer Aiolos Bio for up to $1.4 billion, expanding its

respiratory disease portfolio. The deal includes an upfront payment

of $1 billion and additional payments based on regulatory

milestones. This will help GSK offset patent expirations and

declining revenue from existing products. In 2022, respiratory

drugs and vaccines generated about $14 billion in sales for the

company.

Johnson & Johnson (NYSE:JNJ),

Merck (NYSE:MRK) – Johnson & Johnson and Merck

announced the acquisition of cancer therapy developers, initiating

a potentially strong year for business in the pharmaceutical

industry. The combined deals were worth over $6 billion. This

follows about $25 billion in biotech deals in the U.S. last month.

In other news, J&J reached a provisional agreement to pay about

$700 million to resolve claims from over 40 U.S. states related to

the improper marketing of its baby powder. The settlement aims to

avoid potential lawsuits alleging the company concealed links

between the talc and various types of cancer. J&J is still

finalizing the specific terms of the agreement.

Merck & Co. (NYSE:MRK), Harpoon

Therapeutics (NASDAQ:HARP) – Merck & Co. announced the

acquisition of Harpoon Therapeutics, a cancer drug development

company, for approximately $680 million. This acquisition will

strengthen Merck’s oncology portfolio with immunotherapies, as they

seek to create future revenue streams ahead of the loss of key

patents for their drug Keytruda.

Bristol Myers Squibb (NYSE:BMY) – Bristol Myers

Squibb CEO Christopher Boerner revealed plans to add 16 new

products to the company’s portfolio by the end of the decade,

focusing on licensing, partnerships, and complementary purchases

rather than large acquisitions. The company reiterated its sales

forecast of over $10 billion in new products by 2026.

Moderna (NASDAQ:MRNA) – Moderna projects

Covid-19 vaccine sales of about $6.7 billion in 2023, confirming

its 2025 growth target. Revenue is expected to drop to about $4

billion in 2024 due to the end of pre-purchase agreements

overseas.

Pfizer (NYSE:PFE) – After a challenging 2023,

Pfizer is looking to boost its growth by focusing on the cancer

area with the acquisition of Seagen (NASDAQ:SGEN).

Despite stock falls due to Covid-19-related challenges, CEO Albert

Bourla expects to restore the company’s leadership position in the

pharmaceutical sector.

Bank of America (NYSE:BAC) – Bank of America

will record an expense of approximately $1.6 billion in the fourth

quarter due to the phased discontinuation of a Bloomberg interest

rate reference. Bloomberg will stop publishing the short-term bank

yield index in 2024, affecting the accounting of transactions. The

impact will be recognized in interest income in subsequent periods,

mainly until 2026.

JPMorgan Chase (NYSE:JPM), Wells

Fargo (NYSE:WFC) – Deutsche Bank

(NYSE:DB) upgraded its buy recommendation for JPMorgan Chase,

raising the target price to $190, while downgrading Wells Fargo to

Hold from Buy, with a target price of $51. They highlighted three

main themes for 2024: lower interest rates, credit quality, and

regulatory and political context. Bank of America had its target

price raised from $29 to $35, Citigroup (NYSE:C)

from $46 to $54, Goldman Sachs (NYSE:GS) from $305

to $385, and Morgan Stanley (NYSE:MS) from $80 to

$92.

Jefferies Financial Group (NYSE:JEF) –

Jefferies Financial Group reported lower-than-expected earnings for

the fourth quarter, due to economic uncertainty that hurt trading.

However, the firm recorded an increase in investment banking

revenues in 2023. Profit fell 53%, to $65.6 million, or 29 cents

per share, compared to the average estimate of 34 cents per

share.

KKR and Company (NYSE:KKR) – KKR plans to

notify European Union antitrust authorities by the end of January

about its planned acquisition of Telecom Italia’s fixed access

network, in a deal worth up to $24 billion.

Ericsson (NASDAQ:ERIC) – Ericsson, known for

its 5G networks, is expanding its fintech business, supporting

mobile payments in developing countries. Its software already

supports over 400 million mobile wallet accounts in 24 countries,

focusing on growth in Africa and potential expansion in Europe and

the U.S.

Abercrombie and Fitch (NYSE:ANF),

Lululemon (NASDAQ:LULU), American Eagle

Outfitters (NYSE:AEO), Urban Outfitters

(NASDAQ:URBN) – Fashion retailers, including Lululemon, Abercrombie

& Fitch, Crocs, and American Eagle Outfitters, raised their

fourth-quarter sales projections, indicating a

stronger-than-expected U.S. Christmas shopping season, driven by

discounts and resilient demand. Urban Outfitters reported a 10%

increase in sales in November and December. Additionally, Shea

Jensen was appointed president of the Urban Outfitters brand in

North America.

Starbucks (NASDAQ:SBUX) – Starbucks is focusing

on India, planning to open 1,000 stores by 2028 and doubling its

workforce to 8,600 employees. Currently, Starbucks operates over

390 stores in partnership with Tata Starbucks. The international

strategy now focuses on India, in addition to China, aiming for

55,000 stores globally by 2030.

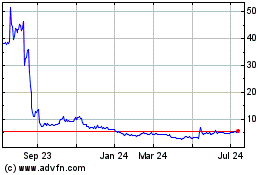

AMC Entertainment (NYSE:AMC) – AMC’s shares saw

a 2.3% gain on Monday, marking its largest percentage increase in

almost a month, following a five-day losing streak. The stock

recovery reflected the end of its meme stock status, after a 84.7%

drop in the last 52 weeks.

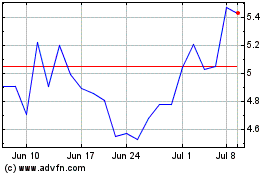

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Nov 2023 to Nov 2024