American Electric Boosts Dividend - Analyst Blog

April 24 2013 - 1:30PM

Zacks

American Electric Power Co. (AEP) has announced

that its Board of Directors has increased its quarterly dividend by

4.3%, bringing the annualized dividend to $1.96 per share from the

previous payout of $1.88 per share. The board commented that the

company is well-positioned for earnings growth in the range of 4%

to 6%.

Following the hike, the company will now pay a quarterly dividend

of 49 cents as against the 47 cents paid earlier. The said dividend

will be paid on Jun 10, 2013, to shareholders of record as of the

close of business on May 10, 2013. The current dividend generates a

dividend yield of 3.87%.

American Electric had made its last dividend increase in Oct 2011.

It had increased its quarterly dividend by 2.2% from 46 cents per

share to 47 cents per share. It has been paying dividends for the

last 412 consecutive quarters.

The trend of dividend increase indicates the company’s financial

strength. As of Dec 31, 2012, the company had cash and cash

equivalents of $279 million, up from $221 million as of Dec 31,

2011. In 2012, net cash flow from operating activities was $3,804.0

million, up from $3,788.0 million in 2011.

At the meeting, the company also announced that it will increase

its capital investments to approximately $3.6 billion in 2013, up

from $3.1 billion in 2012. It intends to invest in the development

and operation of transmission assets and modernize its generating

fleet to comply with new environmental regulations.

The utility sector is known for its defensive nature and its

reputation as a dividend payer adds to its defensive stance. In Feb

2013, Public Service Enterprise Group’s (PEG)

Board of Directors announced a 1.4% increase in the dividend

bringing the quarterly payout to 36 cents per share from the prior

level of 35.5 cents. On an annual basis, the common stock dividend

offering comes to $1.44 per share, up from the prior payment of

$1.42 per share.

In Jan 2013, another stock in the space, ALLETE

Inc. (ALE) announced that its Board of Directors has

approved an increase in the quarterly dividend rate by 1.5 cents.

The annualized dividend rate of the company will come to $1.90, up

3.3% from the prior rate of $1.84.

American Electric is expected to release its first quarter 2013

results on Apr 26, 2013. The Zacks Consensus Estimate for first

quarter 2013 is currently at 81 cents per share, up an estimated

0.6% year over year.

American Electric is one of the largest investor-owned utility

holding companies in the country, catering to over 5 million

customers spread over 11 states. Going forward, the company offers

stable earnings through consistent performance in core regulated

operations, growth through transmission network expansion and an

above-average dividend yield. The company presently retains a

short-term Zacks Rank #2 (Buy).

Pike Electric Corporation (PIKE) also looks good

in the space carrying a Zacks Rank #1 (Strong Buy).

AMER ELEC PWR (AEP): Free Stock Analysis Report

ALLETE INC (ALE): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

PIKE ELECTRIC (PIKE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

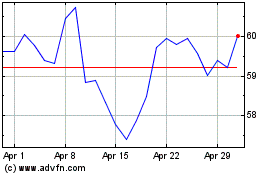

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jul 2023 to Jul 2024