Believes Shareholder-Driven Changes to AGCO’s

Board and Strategy are Necessary Following Strategic Missteps and

Execution Issues That Have Led to a Loss of Significant Market

Share

Reiterates TAFE’s Commitment to Unlocking

AGCO’s Full Potential as a Long-Term, Strategic Investor That is

Firmly Aligned With Fellow Shareholders

Tractors and Farm Equipment Limited (together with certain of

its affiliates, “TAFE” or “we”), is the largest shareholder of AGCO

Corporation (NYSE: AGCO) (“AGCO” or the “Company”) with a 16.3%

long-term strategic ownership interest in the Company. Today, TAFE

issued the following open letter to its fellow shareholders.

***

September 30, 2024

Fellow Shareholders,

Tractors and Farm Equipment Ltd. (together with certain of its

affiliates, “TAFE” or “we”) is the largest shareholder of AGCO

Corporation (NYSE: AGCO) (“AGCO” or the “Company”), with ownership

of approximately 16.3% of the Company’s outstanding shares. We are

also a long-term shareholder who has spent more than a decade

trying to enable the Company to grow and create enhanced value for

all stakeholders. We believe our significant shareholdings and

track record of constructive engagement demonstrate that our

interests are squarely aligned with your interests.

Given our experience allocating capital and operating businesses

within the agricultural machinery sector, we have firm conviction

in AGCO’s future growth potential. As the Company has struggled in

recent years to integrate acquisitions and expand into new markets,

we have drawn on our experience to provide leadership with

pragmatic suggestions. Unfortunately, AGCO has responded by

ignoring these ideas, taking measures to disenfranchise TAFE, and

isolating our representative on the Board of Directors (the

“Board”). This seemingly unjustifiable intransigence has resulted

in the deterioration of the Company’s competitive position and

financial performance versus peers and is now forcing us to deviate

from our preferred method of private engagement.

It should speak volumes about AGCO’s current state that TAFE, a

long-term, strategic investor with an extremely patient outlook and

no history of public activism, feels compelled to bring its

concerns to fellow shareholders. AGCO’s issues have also led us to

begin assessing the ways in which a strategic transformation can be

implemented, with new and independent directors who possess the

expertise required to lead a lasting turnaround. A thoughtfully

restructured and more empowered Board will be best positioned to

enhance governance practices, establish capital allocation and cost

containment guardrails, prioritize operational excellence, and

effectively supervise management.

There Is a Clear Need

for Shareholder-Driven Boardroom Change

Since Eric Hansotia began holding both the Chairman and CEO

roles in 2021, AGCO has suffered from strategic missteps and

ineffective execution. To make matters worse, combining these roles

appears to have compromised the current Board’s ability to

effectively oversee management and hold Mr. Hansotia accountable.

This is evidenced by the Company’s underperformance versus peers

and relevant indices over several time horizons:1

1-Year TSR

3-Year TSR

CEO Tenure TSR

AGCO Corp.

-29.97%

-25.58%

-0.80%

Deere & Co.

-17.47%

-1.55%

33.98%

CNH Industrial N.V.

-27.40%

-27.07%

-3.98%

Kubota Corp.

-17.15%

-18.37%

-17.24%

Proxy Peer Average

7.78%

15.58%

38.42%

Russell 1000 Index

16.80%

18.83%

40.58%

S&P Midcap 400 Index

8.68%

11.06%

31.20%

S&P 400 Industrials Sector GICS

Level 1 Index

10.41%

30.25%

55.98%

Against the backdrop of the agriculture industry’s latest

downcycle, the Company has seen its share price drop approximately

-19% year to date while its proxy peers’ shares have increased by

an average of 14%.2 This demonstrates AGCO’s structural inability

to deal with downcycles as well as a lack of confidence from the

market as the Company has trailed its peers in terms of revenue,

operating margin, and market share. The Company is clearly in

urgent need of a transformation based on the Board’s failings

related to its oversight of AGCO’s strategy, operations, and

capital allocation, as well as flaws within the Board’s governance

structure.

- Leadership’s short-sighted strategy is jeopardizing AGCO’s

competitiveness.

- Niche strategic positioning with insufficient full-line

play. The current strategy is not sustainable in the long run

across industry cycles. AGCO, when competing with full-line

players, does not offer a complete range of products across volume

segments, growth markets, and directly allied product segments –

including combines, which are crucial for success in large

agricultural markets. The Company’s concentrated and niche

strategic positioning has hurt revenue and market share growth and

does not protect shareholders from the negative impacts of a highly

cyclical industry.

- Missed market opportunities. The Company has

consistently lost market share in key markets that are core to its

current strategy. Its competitive position in Brazil has shrunk

sharply and remained stagnant despite hi-tech introductions because

the Company was slow to respond to shifting market trends. AGCO is

now a distant third in this market after losing its No.1 position

to Deere & Co. (NYSE: DE) (“Deere”) and has seen its presence

in volume segments diminish as well. The Company’s poor Q4 2023

performance as the market turned and its sharply reduced margins in

the first half of 2024 are reflective of this fragile competitive

position. In North America, the Company’s presence remains

sub-scale with limited success through premium product

introductions. Its ability to gain scale is severely restricted by

a lack of strength in allied segments and channel attractiveness.

In its largest market, Western Europe, AGCO’s competitive position

has weakened as it has lost share in key sub-markets and

geographies amidst concerns over weakening channel and the bridging

of its technological advantage. A clear flaw in AGCO’s strategy is

indicated by the absence of the full liner.3

- Poor investments. AGCO continues to be a marginal player

in combines despite eight years of effort and investment in its

in-house IDEAL combine program. Combines made up just 4% of AGCO’s

agriculture revenue in fiscal year 2023, compared with 22% for CNH

Industrial N.V. (NYSE: CNH) (“CNH”).4

- Weak financial performance. The Company has delivered

weaker than expected financial performance for four successive

quarters. AGCO’s revenue growth and margin improvement have trailed

peers since 2021, and its operating margin continues to be the

lowest among its competitors. Its Q2 2024 earnings fell

significantly short of Wall Street’s estimates for earnings per

share and sales. Further, management’s downward revision of

guidance reflects its inability to forecast or adapt in the face of

reduced demand.

- The Board has enabled poor capital allocation and dismal

business execution.

- Unsuccessful acquisitions. The Company has been overly

dependent on acquisitions that have failed to deliver returns or

growth. Management’s failure to effectively integrate acquisitions

has led to significant write-offs, including the Company’s recently

announced sale of the majority of its Grain & Protein business

(resulting in losses amounting to $670.6 million).5 AGCO has made a

number of unsuccessful technology investments that were seemingly

done in an effort to keep up with Deere and CNH. Leadership’s track

record with respect to integration of acquisitions does not inspire

confidence and instead raises concerns about risk assessment. While

we believe PTx Trimble is a good strategic fit, how can

shareholders have confidence in management’s ability to realize

value with its largest acquisition given its poor track

record?

- Ballooning costs. AGCO’s much higher cost of goods sold

and selling, general, and administrative expenses have resulted in

lower profits versus peers. While competitors foresaw the downcycle

and took early steps to prepare, AGCO failed to proactively

identify risks and was reactive and delayed in announcing

cost-saving initiatives.

- The Board has failed to adequately govern the Company and

hold management accountable.

- Ignoring shareholder feedback. Incumbent leadership has

not taken shareholders’ concerns seriously. For years, we have

repeatedly expressed our concerns regarding the Company’s

governance and strategy both privately through our Board

representative and publicly via previous Schedule 13D/A filings

dating back to 2020. However, many issues persist today, which is

one of the reasons why new leaders are needed in the

boardroom.

- Impeding shareholder rights. By prohibiting shareholders

from calling a special meeting, the Company does not allow

shareholders to take action to protect their investment or “break

glass in case of emergency.” Allowing shareholders the ability to

spur change outside of the standard annual meeting process is in

line with best governance practices.6

- Experience and leadership gaps in the boardroom. The

current Board lacks the skillsets and leadership necessary to lead

a strategic transformation at AGCO and effectively oversee

management. Specifically, we believe the Board needs directors who

possess expertise in corporate governance, capital allocation,

agricultural manufacturing, and strategic turnarounds – skills

which need strong augmentation or are currently missing from the

Board.

- Misaligned interests. Despite an average tenure of eight

years on the Board, enough time for at least some directors to

accumulate significant ownership in the Company, none of the

current directors – besides TAFE’s representative – owns more than

one percent of the Company’s shares.7 Such de minimis shareholdings

do not align their interests with AGCO’s shareholders.

TAFE Has a Clear

Vision for Value Creation at AGCO

In 2021, TAFE proposed a number of changes that have positively

impacted shareholders, including the globalization of key products,

a review and rationalization of the Company’s manufacturing

footprint – including a scale-down of its China operations – and

the ultimate sale of the Grain & Protein business. However, the

Company’s execution on many of these initiatives has been slow and

incomprehensive, while many of our recommendations remain

unaddressed.

One thing all AGCO stakeholders can agree on is that there

remains significant upside to the Company’s valuation today. TAFE,

with our more than six decades of experience and significant

presence in the farm machinery sector, has a clear understanding of

the strategic, execution, and governance levers that need to be

deployed to unleash this value creation story. The kind of changes

we are advocating for include:

- Capital Allocation & Risk Improvements

We see significant opportunities to more effectively allocate

the Company’s capital. AGCO should align its cost structure with

the targeted volumes to match its peers. We also believe the

Company should refrain from making additional large acquisitions,

which have so far been unsuccessful. All investments must adhere to

a coherent strategy and provide clear value to AGCO’s customers and

stakeholders.

A stronger Board could enhance the Company’s risk assessment and

mitigation efforts. In such a cyclical industry, AGCO must be able

to adequately prepare for downcycles and take preemptive

action.

AGCO urgently needs a strategic transformation in each of its

key markets. We believe the Company can go further with its

globalization initiatives. AGCO should re-imagine its product

strategy for Europe; invest to maintain its technological lead and

positioning of its products; build channel strength; and focus on

all growth and allied segments.

We believe the organization needs to be able to move fast across

multiple fronts simultaneously to enhance its competitive position.

AGCO needs a new approach in combines to close the substantial

strategic gap to peers. To realize the value of PTx Trimble, the

Company must reset its strategy, structure, and leadership to

enable growth with customer-focused value propositions as well as

improve its ability to integrate acquisitions to maximize value

creation. A stronger Board with the appropriate expertise would

provide the effective oversight and strategic vision necessary to

execute on these crucial steps.

- Corporate Governance Improvements

We believe a refreshed, stronger Board can more effectively

oversee management and ensure the Company develops a comprehensive

strategy that can generate sustainable, long-term growth. CEOs who

have led transformational strategies, individuals with previous

board leadership experience, and leaders with global experience at

scale would be valuable additions to the Board.

In order to deliver the kind of strategic transformation we

believe is needed at AGCO, the Board must be more involved in the

Company’s portfolio review, strategy, capital allocation, and

oversight of operations. In addition to a much-needed refreshment

of the Board, we are also advocating for the formation of a

Strategic Transformation Committee. The committee would ensure AGCO

formulates a holistic strategy focused on the long term and would

enhance the Board’s monitoring and mitigation of systemic

risks.

Finally, we would also like to see a separation of the roles of

Chair and CEO, both of which are currently held by Mr. Hansotia,

and the implementation of term limits for independent directors. A

separate Chair and CEO can provide a stronger balance of authority

and responsibility that is in both the Company’s and investors’

best interests. In addition, we believe the restriction of

independent directors to 10-year term limits will ensure fresh

perspectives in the boardroom, preventing stagnation and driving

ongoing efforts to improve shareholder value creation.

Shareholders Should

Not Trust the Company’s Disingenuous

& Misleading Statements

In recent weeks, AGCO’s leadership has attempted to confuse

shareholders and other stakeholders with misleading statements

regarding TAFE’s motives. In its August 7th press release, the

Company tried to paint TAFE’s recent 13D/A filing as retaliation

for the recent termination of our commercial agreement. This could

not be further from the truth. TAFE’s concerns about AGCO’s

strategy, performance, and governance and our ongoing engagement

with AGCO’s Board and management to attempt to address those

concerns have existed for years and stem from our position as the

Company’s largest shareholder. TAFE is an aligned, long-term

investor in AGCO and has had a governance agreement with the

Company for a decade, reflecting our commitment to enduring value

creation.

We remain very open to reaching a negotiated resolution with the

Company that would set AGCO on the right course towards value

creation. However, should the Company continue to ignore our

concerns, we would have little choice but to consider all options

to reconstitute a portion of the Board.

Sincerely,

P. Krishnamurthy Tractors and Farm Equipment Ltd.

About TAFE

TAFE - Tractors and Farm Equipment Limited, is an Indian tractor

major incorporated in 1960 at Chennai, India. One of the largest

tractor manufacturers in the world and the second largest in India,

TAFE sells over 180,000 tractors annually.

TAFE has earned the trust of customers with its range of

high-quality products, low cost of operation and a strong

distribution network of over 1600+ dealers. TAFE exports tractors

to over 80 countries, powering farms in Asia, Africa, Europe, the

Americas, and Russia.

Besides tractors, TAFE and its subsidiaries have diverse

business interests in areas such as farm-machinery, diesel engines

and gensets, agro-industrial engines, engineering plastics, gears

and transmission components, hydraulic pumps and cylinders, vehicle

franchises and plantations.

TAFE is committed to Total Quality Management (TQM). In the

recent past, various manufacturing plants of TAFE have garnered

numerous ‘TPM Excellence’ awards from the Japan Institute of Plant

Maintenance (JIPM), as well as a number of other regional awards

for TPM excellence. TAFE's tractor plants are certified under

international standards ISO 9001 for efficient quality management

systems and under ISO 14001 for environment-friendly operations. In

2013, TAFE was presented the coveted ‘Agriculture Leadership Award'

by Agriculture Today Magazine and the ‘Corporate Citizen of the

Year Award’ by Public Relations Council of India (PRCI). TAFE was

also named the ‘Best Employer in India 2013’ by Aon Hewitt and has

the distinction of receiving commendation for ‘Significant

Achievement on the Journey Towards Business Excellence’ by the

CII-EXIM Bank - Business Excellence Award jury in 2012.

1 Bloomberg. TSR data includes dividends reinvested and is as of

August 5, 2024, the day before TAFE filed its 13D/A. AGCO’s proxy

peers are from the Company’s 2024 proxy statement and include

BorgWarner Inc., Cummins Inc., Dana Incorporated, Dover

Corporation, Flowserve Corporation, Illinois Tool Works Inc.,

Oshkosh Corporation, PACCAR Inc., Parker Hannifin Corporation,

Rockwell Automation, Inc., Stanley Black & Decker, Inc.,

Textron Inc., Thor Industries, Inc., Trane Technologies Plc,

Westinghouse Air Brake Technologies Corporation, and Xylem Inc. 2

Bloomberg. AGCO’s stock has fallen nearly -19% from market open on

January 2, 2024 through market close on September 27, 2024. 3

Company filings. 4 Company filings. 5 Total loss of $670.6 million

includes the first impairment charge of $176 million, plus the

latest impairment charge of $494.6 million, which AGCO disclosed in

its 2Q 2024 earnings. 6 “Boards should not unnecessarily limit the

rights of shareholders including, but not limited to, the right to

call special meetings and to nominate directors without onerous

hurdles.” Global Proxy Voting Policy for Vanguard-Advised Funds,

February 2024. 7 Company’s 2024 proxy statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930036577/en/

Longacre Square Partners Greg Marose / Charlotte Kiaie, (646)

386-0091 TAFE@longacresquare.com

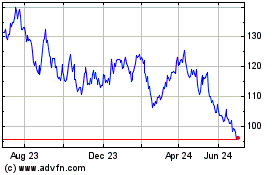

AGCO (NYSE:AGCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

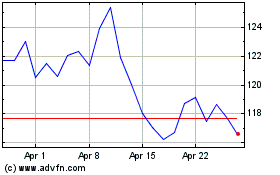

AGCO (NYSE:AGCO)

Historical Stock Chart

From Dec 2023 to Dec 2024