UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of April 2024

Commission

File Number 001-35991

AENZA

S.A.A.

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant’s name into English)

Av.

Petit Thouars 4957

Miraflores

Lima

34, Peru

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

In

accordance with the provisions set forth in article 30 of the Unified Text of the Securities Market Law (Texto Único

Ordenado de la Ley del Mercado de Valores) approved by Supreme Decree No. 020-2023-EF, and the Regulation of Relevant Events and

Reserved Information (Reglamento de Hechos de Importancia e Información Reservada), approved by SMV Resolution No.

005-2014-SMV-01, we hereby report as a Relevant Information Communication, that on the date hereof it has received the risk rating

report issued by Moody’s Investors Service, Inc. (“Moody’s”) and the press release issued by Fitch

Ratings Ltd. (“Fitch”) regarding its risk rating -which corresponding report has not been sent to the Company

yet-, in connection with a potential future issuance of corporate bonds by the Company within the scope of the decisions made in the

Company’s shareholders meeting conducted on November 2nd, 2020 -as reopened on November 3rd, 2020- and March 27th, 2024 and in

the meeting of the Board of Directors conducted on April 12th, 2024, which were duly informed as relevant information on the

above-referred dates. Moody’s report and Fitch’s press release are enclosed to this communication.

It

is hereby expressly stated that this communication does not constitute an offer for the sale or solicitation of an offer to buy the above-mentioned

securities in the United States of America or any other jurisdiction where such an offer is prohibited, and that the above-mentioned

securities may not be offered for sale in the United States of America without registration or an exemption from registration in accordance

with the Securities Act of 1933, as amended.

SIGNATURES

Pursuant

to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| AENZA S.A.A. |

|

| |

|

|

| By: |

/s/ CRISTIAN RESTREPO HERNANDEZ |

|

| Name: |

Cristian Restrepo Hernandez |

|

| Title: |

VP of Corporate Finance |

|

| Date: |

April 17, 2024 |

|

CORPORATES CREDIT OPINION 17 April 2024 New Issue RATINGS Aenza S.A.A. Domicile Lima, Peru Long Term Rating B1 Type LT Corporate Family Ratings Outlook Positive Please see the ratings section at the end of this report for more information . The ratings and outlook shown reflect information as of the publication date . Contacts Martina Gallardo Barreyro VP - Sr Credit Officer +54.11.5129.2643 martina.gallardobarreyro@moodys.com Benjamin Rosauer +54.11.5129.2746 Ratings Associate benjamin.rosauer@moodys.com Marcos Schmidt +55.11.3043.7310 Associate Managing Director marcos.schmidt@moodys.com CLIENT SERVICES 1 - 212 - 553 - 1653 Americas 852 - 3551 - 3077 Asia Pacific 81 - 3 - 5408 - 4100 Japan 44 - 20 - 7772 - 5454 EMEA Aenza S.A.A. New Issuer Summary On April 17th, 2024, Moody's assigned a B1 corporate family rating to Aenza S.A.A. (Aenza), with positive outlook. Moody’s also assigned a B1 rating to the proposed senior secured notes for up to $350 million. Aenza's B1 ratings reflect the company’s leading position in the Engineering & Construction (E&C) industry and leading concessions developer and operator in the infrastructure and energy segments in Peru, with long track record and expertise in Latin America. The ratings also reflect the company's business diversification across various sectors and clients, which fosters beneficial synergies among its different business divisions. Other factors embedded in the ratings include its robust portfolio of concessions in Peru and adequate liquidity profile. The plea agreement's homologation with the Peruvian Government in August 2023 signifies the resolution of the company's longstanding legal issues and is also factored into the ratings. Aenza's ratings are mainly constrained by its relatively modest revenue and size compared to international counterparts, as well as the inherent volatility of the construction industry. However, these limitations are somewhat balanced by the company's steady income from its concession portfolio. Also embedded in the rating is the company's high capital spending requirements related to the construction, real state and energy businesses; and execution risk related to its growth strategy. $450 $461 $459 $444 $642 $728 2.3x 3.2x 3.3x 5.0x 2.3x 4.9x 4.2x 4.1x 2.3x 3.5x 2.7x 2.8x 5.0x 4.5x 4.0x 3.5x 3.0x 2.5x 2.0x 1.5x 1.0x 0.5x $800 $700 $600 $500 $400 $300 $200 $100 $0 2020 2021 2022 2023 2024P 2025P Note: all metrics incorporate Moody's standard adjustments. Projections (“P”) represents Moody's forward view, not the view of the company. As of fiscal year ended in December of each year. Source: Moody's Financial Metrics and Moody's estimates Leverage and coverage USD millions Exhibit 1 Growth strategy rises debt but higher profitability keeps leverage in check in 2024 - 2025 Total Debt EBITA / Interest Expense Debt / EBITDA

MOODY'S INVESTORS SERVICE CORPORATES Credit strengths » Leading player in the infrastructure concessions and construction industry in Peru » Diversified operations in term of business segments, geographies, and industry clients. Beneficial synergies among business divisions » Robust portfolio of concessions in Peru which provide recurring revenue streams; supported by long term contracts » Adequate liquidity Credit challenges » Modest revenue and scale relative to global peers, partially offset by exposure to low - risk countries and steady revenue derived from its portfolio of concessions » High capital spending requirements derived from its operations in the infrastructure and energy industries » Execution risk related to its growth strategy Rating outlook The positive outlook mainly reflects Moody’s view that Aenza’s credit metrics will strengthen in the next 12 - 18 months aided by earnings and cash flow growth as the company expands operations in oil and gas, real state and infrastructure concession businesses, coupled with a maintenance of good profitability in the E&C business. The outlook also reflects Moody’s expectation that the company will be able to further enhance its liquidity profile. Factors that could lead to an upgrade » Moody's Ratings’ could upgrade the ratings if the company strengthens it liquidity and maintains strong credit metrics growing capital and working capital requirements to fund growth; quantitatively, if Aenza is able to sustain debt/EBITDA below 4.0x, EBITA to interest expense above 2.5x and FFO to debt above 15%. Factors that could lead to a downgrade » Moody's Ratings’ could downgrade the ratings if operating performance weakens or the company adds further debt for acquisitions, resulting in debt/EBITDA leverage of above 5 . 5 x, interest coverage below 2 . 0 x and FFO/debt below 10 % . A significant deterioration in liquidity could also trigger a negative rating action . Key indicators Exhibit 2 Dec - 25P Dec - 24P LTM (Dec - 23) Dec - 22 Dec - 21 Dec - 20 US Millions 1,289.0 1,141.0 1,130.0 1,144.0 1,019.0 901.1 Revenue (USD million) 238.0 164.0 168.0 93.0 97.0 69.0 EBITA (USD million) 2.8x 2.3x 5.0x 3.3x 3.2x 2.3x EBITA / Interest Expense 2.7x 3.5x 2.3x 4.1x 4.2x 4.9x Debt / EBITDA 23% 18% 31% 22% 13% 23% FFO / Debt Note: all metrics incorporate Moody's standard adjustments. Projections (“P”) represents Moody's forward view, not the view of the company. As of fiscal year ended in December of each year. Source: Moody's Financial Metrics and Moody's estimates This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the issuer/deal page on https://ratings.moodys.com for the most updated credit rating action information and rating history. 2 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES Profile Founded in 1933 and headquartered in Lima, Peru, Aenza S.A.A. is the largest Engineering & Construction (E&C) company in Peru and leading concessions developer and operator in the infrastructure and energy segments in the country with PEN4,301 million ($1.13 billion) of annual revenues and $1.6 billion assets as of December 2023. Aenza is composed by four complementary segments: (i) Engineering & Construction (E&C), “Cumbra”, (ii) Infrastructure, “Unna Infraestructura”; (iii) Energy, “Unna Energía”; and (iii) Real Estate, “Viva”. The E&C is the largest segment in terms of revenue (62% as of fiscal year 2023) and geographic diversification, with presence in Peru, Chile and Colombia. However, the infrastructure segment is typically the largest in terms of profit and EBITDA generation (41% of reported EBITDA contribution as of fiscal year 2023). Aenza has been listed in the Lima Stock Exchange since 1997, and in the NYSE since July 2013 (AENZ) from which it was delisted in December 2023. The company’s project backlog and recurrent business amounted to $2.0 billion as of December 2023, distributed among strategic projects in the mining, energy, water and sewage, transport, electricity and real state segments, of which 89% are located in Peru, 8% in Colombia, and 2% in Chile. Detailed credit considerations Modest revenue and size compared to international counterparts, partially offset by steady revenue in concessions Given the highly cyclical nature of the construction industry, Aenza’s modest scale ($1.1 billion revenues as December 2023) relative to global peers and limited country diversification exposes the company to higher revenue and margin volatility. We consider scale as an important factor for the rating because it is an indicator of the company’s ability to weather changing market conditions and economic cycles. Scale can also provide a broader platform for sustainable earnings and cash flow generation and typically enhances operating and financial flexibility. Aenza s relatively small size is partially offset by the company’s exposure to low - risk countries — Peru, Colombia and Chile — , and by steady revenue stream derived from its portfolio of concessions in the infrastructure segment. Moody’s views the diversification provided by long - term services contracts in the infrastructure and energy segments, which generate the bulk of the company’s reported EBITDA, as a counterbalancing factor to the cyclical component of E&C. As of December 2023, the company’s backlog considering recurring businesses was $2.0 billion, with Peru representing 89% of total, followed by Colombia (8%) and Chile (2%). Aenza’s backlog is diversified into several market segments, and over half of E&C projects are under unit budgeted price contracts, which improves accuracy of the cost and expenses projections; but it is limited in terms of geographic diversification, however, which reduces its flexibility to mitigate the effects of country and industry economic cycles. Also, Aenza’s high exposure to private clients (31% of backlog) and concessions (60%) is considered a positive factor, as it reduces its vulnerability to sudden changes in fiscal policies that may cause a delay or cancellation of projects under execution. Aenza's E&C contract backlog, valued at $704 million as of December 31, 2024, provides modest degree of revenue predictability. This backlog corresponds to a 1.0x ratio of the E&C revenue generated in 2023 and is spread across key projects in sectors such as mining, oil and gas, and airports, among others. Aenza's history of successfully obtaining new projects, while simultaneously prioritizing profit over revenue expansion, reinforces Moody's perspective on the company's cautious strategy towards E&C growth. Business segment and industry diversification: key synergies across business divisions Aenza is composed by four main segments: (i) Infrastructure, “Unna Infraestructura”; (ii) Energy, “Unna Energía”; (iii) Real Estate, “Viva”; and (iv) E&C, “Cumbra”. The E&C segment is the largest in terms of revenue (62%) and geographic diversification, with presence in Peru (Cumbra), Chile (Vial y Vives) and Colombia (Morelco). However, the infrastructure segment is the largest in terms of EBITDA, as reported by Aenza, representing 41% as of 2023, followed by the Energy segment (29%) and the E&C segment (22%). At the same time, the business segments within Aenza work in synergy, providing a unique advantage for the company. Specifically, the E&C segment significantly enhances Aenza's capabilities in executing projects within the infrastructure and real estate sectors in Peru. Aenza has a long track record in providing E&C services to a diverse range of end - markets, focusing on the mining, energy, transportation, real estate and other infrastructure sectors, and main activities are typically related to engineering, civil construction, electromechanics construction and building construction. The infrastructure segment provides operating and maintenance services in different infrastructure projects and at the same time is complemented by the E&C operations for the design and construction of these projects. This business line operates only in Peru and currently has three toll roads; a concessionaire for the Lima Metro, which 3 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES is the largest mass - transit rail system in Peru; and a wastewater treatment plant. Finally, Aenza s Real Estate main activities include affordable housing, housing and commercial real estate in Peru and is also complemented by the E&C division for the development of the real estate projects. The Energy segment activities include two oil fields for exploration, exploitation, production, treatment and sale of oil, separation and sale of natural gas and its derivatives in the gas processing plant, as well as the storage and dispatch of fuel and oil derivatives. The company’s $2.0 billion backlog as of December 2023 is diversified in terms of sectors. Most of the backlog is divided among the Infrastructure (35%) and E&C segments (32%); the remaining balance is distributed among Energy (31%) and Real Estate (7%). Also, the transportation sector, shaped by concessions under the Infrastructure segment and some E&C projects, represented 43% of backlog; followed by Oil and Gas operations (42%); mining in Chile and Perú (7%); real estate (7%), and others (1.4%). About 12% of backlog are projects for government related entities; while 54% is represented by the road, railway and oil & gas concessions; and 31% are contracts with private clients, which are mostly E&C contracts. Leveraging concessions to increase cash flow in coming years Aenza's strategic blueprint is focused on becoming a prominent player in Latin America's concession development sector. This strategy is aimed at capitalizing on the vast opportunities within the concession market, given the substantial infrastructure deficit in the region. A key element of this plan involves bolstering its portfolio through the inorganic growth of its infrastructure concession platform. Aenza's current position in Peru's infrastructure concessions landscape is robust, offering a steady source of revenue backed by long - term contracts. The company's concessions in toll roads, urban transportation, and water treatment, combined with its operating and maintenance (O&M) services for some of these assets, contributed to 41% of the company’s reported EBITDA in 2023. Two assets significantly contribute to this profitability: Norvial S.A. s highway (now Red Vial 5 S.A.), which ends in 2028 and yielded a 61% EBITDA margin in 2023; and the Line 1 Lima Metro concession, expiring in 2041 and generating a 46% reported EBITDA margin in 2023. The Linea 1 concession and Norvial accounted for 23% and 16% of the company's reported EBITDA, respectively, in 2023. There are additional opportunities for Aenza to expand its concession base and cash flow. For instance, if awarded the expansion plans for the Norvial highway, traffic and operations in the highway will be enhanced by the upcoming Chancay Megaport and other regional infrastructure in the north of Peru. Aenza is also considering measures to upgrade its Line 1 concession with infrastructure and rolling stock improvements to integrate Line 1 with Line 2, thereby improving train frequency. Moreover, a potential extension of the railway could also contribute to increased operations and profitability. $197 $238 $216 $349 $389 $413 $259 $289 $288 $60 $92 $93 30% 33% 33% 20% 22% 24% 26% 28% 30% 32% 34% $0 $100 $200 $300 $400 $500 $600 $700 2021 2022 2023 Ebitda margin (%) Revenue in PEN millions Exhibit 3 Infrastructure Concession portfolio provide more stable profitability Revenues in PEN millions; segment EBITDA as reported by Aenza as % of revenue Norvial Line 1 UNNA Transporte Survial/Canchaque Infra EBITDA % Source: Company filings The 2011 concession for Aenza to operate Lima Metro Line 1, Peru's sole urban railway, spans 30 years. The contract stipulates that Aenza handles operation and maintenance of government - provided trains, procures trains for the government, and constructs the railway maintenance yard. Revenue stems from a quarterly, inflation - adjusted fee from the Ministry of Transport and Communications. 4 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES The fee is based on distance travelled per train, with the rate, number of trains in operation, and required travel distance set by the concession's terms. Aenza has three toll road concessions through the subsidiaries Norvial, Survial (Carretera Andina del Sur S.A) and Canchaque (Carretera Sierra Piura S.A.C.), which are currently in operation and were developed by Aenza’s E&C services, while the roads O&M is performed by the subsidiary UNNA Transporte. » Under Norvial concession (2003 - 2028), the company is involved in the O&M of the only major highway that connects Lima to the northwest area of Peru. Revenue derives from the collection of tolls. The toll rate was set out in the Norvial concession agreement and adjusted in accordance with a contractual formula that considers the PEN/USD exchange rate and Peruvian and U.S. inflation. » The Survial concession (2007 - 2032),involves the O&M of a 750 km road from the San Juan de Marcona port to Urcos, Peru. Aenza owns 100% of Survial. Revenues consists of an annual fee paid by the Peruvian Ministry of Transport and Communications in consideration for the operation and maintenance of the road. » The Canchaque concession ( 2006 - 2025 ), 100 % owned by Aenza, perfomes O&M of a 78 km road . The concession obligation involved the construction of the road that was completed in 2009 . Revenues consist of an annual minimum fee paid by Peru's Ministry of Transportation and Communications ; the rate may vary depending on the amount of road maintenance required . Expansion strategy in oil and gas operations also support cash flow growth Aenza holds significant growth opportunities in its energy segment through its plans to expand production at its oil and gas production fields in Peru. Through its wholly owned subsidiary, UNNA Energía, Aenza provides hydrocarbon extraction services to Perupetro, a Peruvian state oil company, for the exploitation of hydrocarbons in blocks III and IV until 2045. The company also operates five fuel terminals (2014 - 2034) and a gas processing plant. As of 2023, the energy segment represented 28.9% of reported EBITDA, and for the 2021 - 2023 period EBITDA margins have remained at around 31%. Furthermore, Aenza’s growing upstream operation has allowed Aenza to raise the segment’s EBITDA by 32% to $64 million in 2023, from $48 million in 2022. In this regard, Aenza produced 1,489 thousand barrels of oil equivalent (Mboe) in 2023, up from 1,118 Mbbl in 2022; and plans to increases capital spending to ramp - up production to around 3,100 MMboe by 2026 and 3,600 MMboe by 2028, leading to EBITDA levels of around $100 - 120 million. Aenza's upstream activities, while modest in size in comparison to other regional companies, have a track record of providing a steady stream of cash flow given its low resource and execution risk. As of December 2023, Aenza possessed 33 MMboe in 2P oil and gas reserves, which equates to approximately 22.3 years of reserves, devoid of exploration risk. Furthermore, Aenza has demonstrated a low risk profile in terms of resource and execution; it has a reserve replacement ratio of 121% and a success rate of 98% over the past five years. The company adheres to a royalty payment system based on an international oil basket for both blocks. Unna Energía’s 44 million cubic feet gas processing plant located in Pariñas also supports the company’s natural gas operations; it produces natural gas liquids (NGL and condensates) and dry natural gas for electricity generation and residential gas supply through the project for the mass adoption of natural gas in Piura. Aenza will be able to accommodate higher production in 2024 - 2025 in the processing plant given spare capacity and the maturity of third - party contractual obligations over time. Aenza’s joint operation of five of Petroperú’s liquid hydrocarbon storage terminals strategically located throughout the country, in consortium with Oiltanking GmbH as Terminales del Perú, provide an additional source of steady cash flow. 5 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES $167 $102 $136 $166 $184 $233 $54 $30 $43 $48 $64 $79 33% 30% 32% 29% 35% 34% 26% 28% 27% 29% 30% 31% 33% 32% 35% 34% 36% $0 $50 $100 $150 $200 $250 2019 2020 2021 2022 2023 Forward view 12 - 18 months EBITDA Margin USD million Exhibit 4 UNNA Energia’s EBITDA and revenues increase as production grows in 2024 - 2025 Energy Revenues Energy EBITDA Energy EBITDA Margin % Source: Company filings and Moody's estimates E&C business's profitability has seen an enhancement compared to previous years Aenza’s corporate strategy also aims to strengthen profitability and focus on margin recovery of its E&C portfolio through the strategic selection of new contracts. As of December 2023, the company’s E&C backlog amounted to $704 million, down from $958 million a year before (see Exhibit 5), which represents only around 1.0 year of revenue. But the segment’s EBITDA margin improved to 6.8% in 2023, from a - 2.7% in 2022 — mainly because of certain losses and provisions related to the Talara and EGEMSA projects, finalized in prior years — , and higher than the 1.6% average in 2018 - 2021. Furthermore, the company will likely maintain EBITDA margins around 3% - 4% in the next 12 - 18 months (see Exhibit 6) based on the contracts currently in its backlog, but it will rely on its ability to secure new projects beyond that period. Exhibit 6 Strengthening EBITDA margin since 2023 $783 $910 $819 $844 $958 $704 4 1.3x 1.1x 1.4x 1.2x 1.4x 1.0x $83 1.2 x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x $0 $200 $400 $600 $800 $1,000 $1,200 2018 2019 2020 2021 2022 2023 Forward View 12 - 18 Months USD millions Exhibit 5 Moderate coverage of backlog to revenue ratio E&C Backlog E&C Backlog/Revenues Note: all metric s incorporate Moody's standard adjustments. Projections represents Moody's forward view, not the view of the company Sources: Company filings and Moody's estimates 2.2% 1.8% 0.7% 1.7% (2.7%) (5.0%) 3.1% $580 $843 $588 $689 $701 $715 6.8% $684 – 5.0% 10.0% 15.0% $300 $400 $500 $600 $700 $800 $900 $1,000 2018 2019 2020 2021 2022 2023 Forward View 12 - 18 Months USD millions E&C EBITDA % E&C Revenue Note: all metrics incorporate Moody's standard adjustments. Projections represent Moody's forward view, not the view of the company Sources: Company filings and Moody's estimates The company has a significant pipeline of potential projects under review, while at the same time new contracts recently awarded highlight the ability of Aenza to secure new contracts in a very competitive market. In this regard, in December 2023, Cumbra Perú S.A. and Mancoraland S.A.C., entered into a construction contract for the nautical and real estate project called “Marina Coast Homebeach Club Peru” worth Around $95 million (plus taxes). During the fourth quarter of 2022, Aenza’s Colombian subsidiary, Morelco, signed an EPC contract with Ecopetrol S.A. (Baa3 negative) for the development of the integral solution for the treatment facilities and auxiliary services of the Santa Monica plant worth $212.5 million (plus taxes), with an execution period of 22 months. Additionally, Lima Airport Partners S.R.L. and Consorcio Inti Punku (where Cumbra's participation amounts to 49%) signed an addendum to the contract worth 6 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES $350 million (plus taxes) for the execution of the works related to the new passenger terminal at Lima airport, with an execution period of 36 months. Aenza's E&C projects mainly operate under unit budgeted price contracts, accounting for 52% of backlog as of December 2023. This type of contract allows for a higher degree of cost and expense projection accuracy due to its nature of having predetermined pricing structures. In addition to unit budgeted price contracts, Aenza is also significantly engaged in Engineering, Procurement, and Construction (EPC) contracts, which constitute 30% of their total backlog. This figure is largely influenced by Aenza's EPC contracts with Ecopetrol in Colombia. In terms of client distribution, most of Aenza’s E&C backlog is associated with private clients, making up 74% of the total. This suggests a strong business relationship with non - governmental entities, which could potentially offer more flexibility and negotiation power for Aenza. The remaining 26% of the backlog is attributed to public clients, a portion of which also includes the project for Ecopetrol. ESG considerations Aenza S.A.A.'s ESG credit impact score is CIS - 4 Exhibit 7 ESG credit impact score Source: Moody's Ratings Aenza S.A.A. CIS - 4 indicates the rating is lower than it would have been if ESG risk exposures did not exist. Aenza is a holding company with operations in the construction, real state, oil and gas, and toll roads and transportation concessions, which exposes the company to environmental and socials risks in various sectors. Aenza’s environmental risks are mainly associated with its oil and gas operations. Social risks mainly stem from health and safety risks associated with it oil and gas and construction businesses. The governance structure of Aenza is characterized by the significant influence held by its primary shareholder, IG4 Capital Infrastructure Investments LP (IG4). As of April 2024, IG4 owns 28.8% of Aenza's shares. IG4's association with Aenza dates back to August 2021, and it has led the company's transformation using a conservative strategy. However, it's worth noting that its history with the company spans only a few years, indicating a relatively limited track record. Exhibit 8 ESG issuer profile scores Source: Moody's Ratings 7 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES Environmental Aenza’s exposure to environmental risk mainly reflects risks associated with oil and gas division and, to a lesser extent, its toll road division, which reflect the sectors’ inherent exposure to these risks in our environmental risk heat map. Exploration and production firms grapple with the impacts of rising environmental rules and restrictions on operational sites. Their main product, oil, is a high - carbon emitter, while natural gas emits less CO2. Regulatory burdens have increased costs, and although immediate product substitution isn't expected, long - term demand will decrease due to alternative energy adoption. This poses medium - term risks for reserve valuations and credit availability, especially for smaller, highly leveraged companies. However, carbon regulations could favor natural gas over coal and oil. The sector is vulnerable to industrial accidents and spills, particularly offshore, which can severely affect credit profiles. These firms handle large volumes of water, necessitating robust policies for safe disposal, recycling, and management. They are often legally obligated to restore the natural landscape post - operation. We include environmental compliance costs in our forward view of issuers' margins and returns. Toll roads face limited environmental risk, but rising awareness of car pollution could lead to traffic restrictions. Traffic volumes are tied to macroeconomic trends, population growth, and personal mobility needs. The growth of electric or hybrid cars presents a mitigant and potential revenue source. Governments often view toll roads as a means to divert traffic from suburban roads, supporting our low - risk assessment. Environmental policies, especially carbon reduction, are more advanced in Europe and are growing in Asia and Latin America. Toll road traffic may also be influenced by physical climate risks, with insurance policies, regulations, and state intervention serving as mitigating factors. Social Aenza's exposure to social risks mainly stems from health and safety and responsible production risks associated to its construction and oil and gas exploration and production businesses and its reliance on human capital mainly for its construction businesses, which reflect these sectors’ inherent exposure to these risks in our social risk heat map. Health and safety risk in the construction and oil and gas industries reflects risks associated with serious injuries, fatalities or long - term chronic health conditions related to the work environment. Companies in industries that involve heavy equipment and machinery, handling construction materials or hazardous materials, and dangerous operating conditions such as working at height or underground have high exposure to this risk factor. Construction and E&P companies must invest heavily to monitor and mitigate the risk of on - the - job accidents and ensure regulatory compliance. During 2023, Aenza was able to meet its goals with respect to the frequency index (FI) and the severity index (SI), achieving an FI of 0.19 and an SI of 8.6, at the corporate level, with goals set at 0.27 and 12, respectively. Human capital risk in the construction business is driven mainly by companies’ dependence on a skilled labor force necessary to carry out an array of technical tasks, and the labor intensity of operations. Also, construction companies face several responsible production risks: supply chain management such as human rights controversies and violations within the labor force in certain geographies; product quality assurance; and high but non - systemic bribery and corruption. If handled improperly, these risks can have significant regulatory, legal and reputational consequences. At the same time, supply chain practices designed to avoid human rights controversies and violations, and harmonious relationships with local communities are critical for oil and gas companies, both in their direct operations and those of contractors or joint ventures. Relationships with local and national regulators are also important, particularly where regulations can be subject to abrupt changes. Governance Aenza’s Governance risks reflects its concentrated influence exerted by its reference shareholder, IG4 Capital Infrastructure Investments LP (IG4), which holds 28.8% of Aenza’s shares. IG4 has been associated with the company since August 2021 and has led the company's transformation through a conservative approach, but track record is limited to a few years. Aenza is publicly traded and has been listed in the Lima Stock Exchange since 1997; pension funds hold 45.3% of Aenza’s shares (with no controlling rights because regulatory restrictions), Pacifico Corp S.A. 8.7%, Fratelli 9.3% and others 8.1%. Aenza’s Board of Directors has nine members, of which three are independent. The president and another three board members belong to IG4 and the remaining two board members belong to Pacifico and Fratelli. Mr Andre Mastrobuono is CEO, who has successfully led corporate restructuring projects for companies in special situations in the region, in sectors such as infrastructure, energy, real estate, and others. Regarding the company’s legal proceedings related to the original founding family (which no longer hold any participation or influence in the company), Aenza plea agreement with the Peruvian Government signed in September 2022 was homologated in August 2023 and entered into force in December 2023 with the initial payment of the Civil Compensation. As a result, there are no more contingencies outstanding related. 8 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES ESG Issuer Profile Scores and Credit Impact Scores for the rated entity/transaction are available on Moodys.com. In order to view the latest scores, please click here to go to the landing page for the entity/transaction on MDC and view the ESG Scores section. Liquidity analysis Aenza’s liquidity is adequate today and has improved consistently over the past few years and Moody’s expects the company will strengthen its liquidity during 2024 by raising funds to pursue liability management operations to refinance financial and supplier obligations and provide funding for capital expenditures and other corporate expenses . As of December 2023, Aenza's financial debt stood at $443 million, with a comfortable maturity profile. Cash and equivalents covered 168% of debt maturing within a year and 133% of two - year debt. But Aenza will require additional funding for its growing capital spending focused on growth mainly in its energy and infrastructure segments, and other corporate expenses in 2024 - 2025, which in turn will also keep free cash flow negative. The company retains the ultimate decision to disburse cash related to capital spending and working capital to preserve liquidity, however. In this regard, Moody’s expects an estimated $180 million EBITDA (Moody’s - adjusted) in 2024, but the company plans to increase capital and working capital spending aided by the new notes's proceeds, which will keep free cash flow negative at around $200 million. At the same time, the proposed notes’ issuance, which will only partially be used for liability management (mainly $100 million in outstanding bridge loan), will increase total debt to around $640 million by year - end 2024, rising gross debt to EBITDA (Moody’s adjusted) ratio to 3.5x in 2024, up from 2.3x in 2023, but still adequate for its rating positioning. Additionally, further expansion of business operations in 2025 financed through a combination of internal cash flow and borrowings will rise gross debt to around $730 million by year - end 2025; but this will be partially counterbalanced by higher EBITDA (as adjusted by Moody's) at around $260 million, leading to a gross leverage ratio of approximately 2.7x in 2025. Also, increased interest payments due to higher debt levels will lower the interest coverage ratio, calculated as EBITA to interest expenses, from 5.0x in 2023 to approximately 2.3x in 2024, rebounding to around 2.8x - 3.0x by the end of 2025. Exhibit 9 Adequate debt maturity profile In million US dollars as of December 2023 Exhibit 10 Improving credit metrics In million US dollars $270 $60 $43 $188 $100 $ - $50 $100 $150 $200 $250 $300 Cash & Equivalents 2024 2025 2026+ USD millions Cash & Equivalents Debt Maturities Refinancing of bridge loan Note: all metric s incorporate Moody's standard adjustments. Projections (“P”) represents Moody's forward view, not the view of the company.. Aenza plans to refinance its $100 million bridge loan through a new notes issuance in April 2024. Sources: Moody's Financial Metrics $450 $461 $459 $444 $642 $728 2.3x 3.2x 3.3x 5.0x 2.3x 2.8x 4.9x 4.2x 4.1x 2.3x 3.5x 2.7x 5.0x 4.5x 4.0x 3.5x 3.0x 2.5x 2.0x 1.5x 1.0x 0.5x $0 $100 $200 $300 $400 $500 $600 $700 $800 2020 2021 2022 2023 2024P 2025P Leverage and coverage USD millions Total Debt Debt / EBITDA EBITA / Interest Expense Note: all metrics incorporate Moody's standard adjustments. Projections represent Moody's forward view, not the view of the company Sources: Moody's Financial Metrics and Moody's estimates 9 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES Rating methodology and scorecard factors Aenza's scorecard indicated outcome using our Construction industry rating methodology maps to a Ba2 for fiscal year ended in December 2023, and our forward looking view over the next 12 - 18 months maps to Ba3 rating, compared to the B1 actual ratings assigned. Exhibit 11 Aenza S.A.A b) EBITA (USD Million) 170 B 238 B Moody's 12 - 18 month forward view Score Current FY Dec - 23 Measure Construction Industry Scorecard [1] [2] Factor 1 : Scale (25%) Measure Score 1.3 B B 1.1 a) Total Revenue (USD Billion) Factor 2 : Business Profile (25%) Baa Ba Baa Ba Baa Ba Baa Ba a) Diversity b) Expected Revenue & Margin Stability Factor 3 : Leverage and Coverage (30%) Baa 2.9x Baa 5.1x a) EBITA / Interest Expense Baa 2.7x Baa 2.3x b) Debt / EBITDA Ba 22.9% Ba 31.0% c) FFO / Debt Factor 4 : Financial Policy (20%) B B B B a) Financial Policy Rating: Ba3 Ba2 a) Scorecard - Indicated Outcome B1 b) Actual Rating Assigned All ratios are based on adjusted financial data and incorporate Moody’s Global Standard Adjustments for Non - Financial Corporations. [2] This represents our view; not the view of the issuer; and unless noted in the text, does not incorporate significant acquisitions and divestitures. Source: Moody's Financial Metrics Ratings Exhibit 12 Category Moody's Rating AENZA S.A.A. Outlook Positive B1 Corporate Family Rating Senior Secured B1 Source: Moody's Ratings 10 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES © 2024 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT - LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED OR OTHERWISE MADE AVAILABLE BY MOODY’S (COLLECTIVELY, “MATERIALS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS, NON - CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S MATERIALS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S MATERIALS MAY ALSO INCLUDE QUANTITATIVE MODEL - BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES OR OTHERWISE MAKES AVAILABLE ITS MATERIALS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND MATERIALS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR MATERIALS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT. FOR CLARITY, NO INFORMATION CONTAINED HEREIN MAY BE USED TO DEVELOP, IMPROVE, TRAIN OR RETRAIN ANY SOFTWARE PROGRAM OR DATABASE, INCLUDING, BUT NOT LIMITED TO, FOR ANY ARTIFICIAL INTELLIGENCE, MACHINE LEARNING OR NATURAL LANGUAGE PROCESSING SOFTWARE, ALGORITHM, METHODOLOGY AND/OR MODEL. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK. All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third - party sources. However, MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the credit rating process or in preparing its Materials. To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY’S. To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER. Moody’s Investors Service, Inc., a wholly - owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating, agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it. MCO and Moody’s Investors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service, Inc. and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading “Investor Relations — Corporate Governance — Charter Documents - Director and Shareholder Affiliation Policy.” Moody's SF Japan K.K., Moody's Local AR Agente de Calificación de Riesgo S.A., Moody’s Local BR Agência de Classificação de Risco LTDA, Moody’s Local MX S.A. de C.V, I.C.V., Moody's Local PE Clasificadora de Riesgo S.A., and Moody's Local PA Calificadora de Riesgo S.A. (collectively, the “Moody’s Non - NRSRO CRAs”) are all indirectly wholly - owned credit rating agency subsidiaries of MCO. None of the Moody’s Non - NRSRO CRAs is a Nationally Recognized Statistical Rating Organization. Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors. Additional terms for India only: Moody’s credit ratings, Assessments, other opinions and Materials are not intended to be and shall not be relied upon or used by any users located in India in relation to securities listed or proposed to be listed on Indian stock exchanges. Additional terms with respect to Second Party Opinions (as defined in Moody’s Investors Service Rating Symbols and Definitions): Please note that a Second Party Opinion (“SPO”) is not a “credit rating”. The issuance of SPOs is not a regulated activity in many jurisdictions, including Singapore. JAPAN: In Japan, development and provision of SPOs fall under the category of “Ancillary Businesses”, not “Credit Rating Business”, and are not subject to the regulations applicable to “Credit Rating Business” under the Financial Instruments and Exchange Act of Japan and its relevant regulation. PRC: Any SPO: (1) does not constitute a PRC Green Bond Assessment as defined under any relevant PRC laws or regulations; (2) cannot be included in any registration statement, offering circular, prospectus or any other documents submitted to the PRC regulatory authorities or otherwise used to satisfy any PRC regulatory disclosure requirement; and (3) cannot be used within the PRC for any regulatory purpose or for any other purpose which is not permitted under relevant PRC laws or regulations. For the purposes of this disclaimer, “PRC” refers to the mainland of the People’s Republic of China, excluding Hong Kong, Macau and Taiwan. REPORT NUMBER 1405427 11 17 April 2024 Aenza S.A.A.: New Issuer

MOODY'S INVESTORS SERVICE CORPORATES CLIENT SERVICES 1 - 212 - 553 - 1653 Americas 852 - 3551 - 3077 Asia Pacific 81 - 3 - 5408 - 4100 Japan 44 - 20 - 7772 - 5454 EMEA 12 17 April 2024 Aenza S.A.A.: New Issuer

17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable R A T I N G A C T I O N C O MM E N T A R Y F i t c h Ra t e s A e n z a ' BB - ' ; O u t l oo k S t a b l e W e d 17 A p r , 2024 - 9 : 35 E T Fitch Ratings - São Paulo - 17 Apr 2024: Fitch Ratings has assigned Aenza S.A.A. (Aenza) Foreign and Local Currency Long - Term Issuer Default Ratings (IDRs) of 'BB - ' with a Stable Outlook. Fitch has also assigned a 'BB - ' rating to Aenza's US dollar senior secured notes of up to USD350 million, maturing in 2029 or 2031. Proceeds will be used to refinance debt, increase economic stake in subsidiaries and for other corporate purposes. The ratings rehect Aenza's leading position as the largest infrastructure concessions conglomerate in Peru and one the main contractors in South America with long track record of operations. The company is diversified in terms of services and geography with subsidiaries in Chile and Colombia. The ownership of mature and liquid concessions, such as toll roads, a subway line, and water and waste water treatment, increases revenue and cash how visibility and attenuates the margin volatility of the Engineering and Construction (E&C) civil construction and Oil & Gas (O&G) segments. The ratings also incorporate the success of a bond issuance, which will contribute to improve the company's liquidity, to extend its debt maturity profile, and to support its growth strategy. T he S t a bl e O u t l oo k i n co r p o r a t e s t he ma i n t en a n c e o f c o n s e r v a t i ve c a p i t a l s t r u c t u r e , with net leverage below 2.0x over the next three years and considers that the company will be able to replenish its E&C backlog and increase oil production. K E Y R A T I N G D R I V E R S Medium - sized Diversiked Business Prokle: Leading infrastructure conglomerate in Peru, Aenza has a medium - sized scale and is diversified in terms of geography and services. Near 40% of its EBITDA comes from mature infrastructure concessions that will only expire in the medium to long term. The group owns majority stakes in toll roads, a subway line, and a wastewater treatment plant. Aenza also operates in three other complementary segments: Oil&Gas (29% of EBITDA), Engineering and Construction https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 1 /10

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 2 /10 17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable (E&C, 23%), and Real Estate (7%). Activities are concentrated in Peru, while Chile and Colombia represent 18% of sales. Exposure to public clients is low, at around 9% of sales. Concessions Provides Revenues Visibility: Aenza's infrastructure concessions segment contributes to improve revenues and cash how visibility and reduces operating margin volatility. The ownership of mature concessions that stream up dividends help to attenuate the intrinsic volatility of the E&C and O&G sectors. Aenza is in the process of shifting the focus to concessions, from E&C, and the strategy is to use part of the proceeds of the new issuance to expand the economic stakes in infrastructure subsidiaries, namely Norvial and Linea 1 subway. If Aenza is unable to increase the stake in current concessions, Fitch believes the group can use proceeds to acquire other concessions in Latin America. Aenza operates in the Exploration & Production (E&P) from blocks III and IV in Talara basin nearby the second largest refinery of the country. Proven reserves have reached 27.2 million barrels. These fields are mature with limited exploration risk and are operated under long - term contracts with Petroperu. The E&C segment is cyclical and volatile, as it depends in most cases on economic growth of the regions it operates. The company has already bided for USD1.1 billion in projects and is preparing proposals for an additional USD3.5 billion in contracts. Aenza reported a backlog in E&C of USD700 million in December 2023. Nearly half of Aenza's contracts is related to the other three business segments of the group. FCF Pressured by Capex and WCN: Aenza is expected to generate adjusted EBITDA of PEN641 million in 2024 and PEN665 million in 2025, considering 67% of Norvial, which is broadly in line with the PEN639 million registered in 2023, as per Fitch's criteria. Cash how from operations (CFFO) should be negative at PEN310 million in 2024 on high working capital needs, turning to positive PEN304 million in 2025. Capex is expected to reach PEN251 million in 2024 and PEN315 million in 2025, boosted by E&P investments to increase oil production. Free cash how (FCF) is expected to average a negative at PEN282 million from 2024 until 2026, to be funded with the bond issuance. Base case also considers the acquisition of 48.8p.p. stake in Norvial in 2024.Fitch forecasts interest covered ratios on the bond varying from 2.1x in 2025 to 3.3x in 2028. coverage ratios tend to increase from larger economic stake in Norvial and an acceleration of oil extraction and backlog execution in E&C. Adequate Capital Structure: Aenza is expected to maintain an adequate capital structure, in the absence of material debt - funded acquisitions. In 2023, net debt/EBITDA was 1.1x, compared to an average of 3.9x between 2019 and 2022, as per Fitch's calculations. On March 31, 2022, bondholders of USD90 million (PEN356 million) convertible bonds accepted the exchange for equity, benefiting the company's

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 3 /10 17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable leverage. As the company aims to use around USD250 million of the new bond issuance in acquisitions, growth capex, and working capital needs, Fitch projects net adjusted l e ve r a g e t o r e a ch 2 . 1 x i n 2024 a n d 1 . 9 x i n 2025 . D E R I V A T I O N S U MM A R Y Aenza's rating is weaker than larger contractors such as Ferrovial SE (BBB/Stable), KAEFER SE & Co. KG (BB+/Stable), and Webuild S.p.A. (BB/Stable) that benefit from t he i r s ubs t a n t i a ll y l a r g e r a n d g l o bal s ca l e , c o n s e r v a t i ve c a p i t a l s t r u c t u r e a n d m o d e r a t e to strong liquidity. The company's credit profile is however materially stronger than Andrade Gutierrez Engenharia S.A. ('CCC - ') and OEC S.A. (CC), which are facing liquidity pressures to service their bonds. K E Y A SS U M P T I O N S Fitch's Key Assumptions Within Our Rating Case for the Issuer -- Infrastructure revenues being benefited by tariff readjustments in line with inhation and recovery of the traffic; -- Average oil production of 5.4k barrels per day (bpd) in 2024, 7.3k in 2025, and 9.5k in 2026, with in average oil prices of USD75, USD65, and USD60 per barrel, respectively; -- E&C backlog of USD760 million in 2024 and USD800 million in 2025, executed on average in 1.2 year; -- Annual Real Estate units delivered of 1,000 in 2024 and 731 in 2025; -- Consolidated Adjusted EBITDA margins of 15% in 2024 and 2025, and 17% in 2026, as per Fitch's criteria; -- Capex of PEN251 million in 2024 and PEN315 million in 2025; -- No dividends in the rating horizon paid from Aenza to its shareholders. R A T I N G S E N S I T I V I T I E S Developments That May, Individually or Collectively, Lead to Positive Rating Action -- Stronger diversification into concessions and to other countries in Latin America; -- Net adjusted leverage below 1.5x, sustainably; Developments That May, Individually or Collectively, Lead to Negative Rating Action

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 4 /10 17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable -- Net adjusted leverage above 3.0x, consistently; -- Fail to issue long - term bond and improve liquidity; -- Deterioration of the E&C backlog in terms of size and quality (i.e. profitability) of the contracts; -- W e a k e r li qu i di t y p r o fi l e . L I Q U I D I T Y A ND D E B T S T R U C TU R E Liquidity to Improve: Aenza's liquidity is expected to improve with the USD350 million seven - year senior secured bond issuance. Proceeds will be used to refinance the USD100 million bridge loan that expires in October 2024, while the rest will support growth capex; and fund working capital needs. In 2023, readily available cash of USD197 million was enough to cover debt maturities over the next three years. Total and net debt are estimated to reach PEN2.1 billion and PEN 1.4 billion in 2024 (USD555 million and USD376 million, respectively), as most of the issuance will be directed to foster organic and inorganic growth. As of 2023, Aenza's total debt of USD355 million, after deconsolidating 81.8% of Norvial's debt as per Fitch's criteria. The debt was composed of bonds of USD178 million (or 50% of total), a bridge loan of USD102 million (29%) including accrued interests, term loans of USD59 million (17%), and working capital lines and other debts of USD16 million (4%). At the same time, 52% of the group's debt was allocated in infrastructure, 9% in energy, 3% in E&C, 6% in Real Estate, and the remaining 30% at the holding level. Approximately 50% of the total debt is in USD and is naturally hedged. Fitch excludes the debt from Norvial's dividend monetization (also known as IASA) from the total debt calculation. I SS U E R P R O F I LE Aenza S.A.A. is one of the largest engineering and infrastructure conglomerates in South America, operating mainly in Peru ('BBB'/Negative) and also in Chile ('A - '/Stable) and Colombia ('BB+'/ Stable). In 2023, infrastructure concessions represented 41% of the group's EBITDA, while energy (oil & gas), engineering & construction, and real estate, contributed with 29%, 23% and 7%, respectively. S U MM A R Y O F F I N A N C I A L A D J U S T M E NT S Fitch has deconsolidated 81.8% of Norvial's results from Aenza's consolidated figures. If Aenza manages to buyback the 48.8p.p. economic interest in the subsidiary from BCI Peru, the agency will deconsolidate 33% of Norvial. Fitch also excludes IASA's debt (debt

17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable from dividend monetization). Net hedge positions on the balance sheet are added to the total debt. Fitch also excludes assets sales and impairments from the EBITDA. Linea 1 EBITDA incorporates the financial expenses, as well as the capital amortization applied to the corresponding long - term account receivable of the train acquisition. D A T E O F R ELE V A NT C O MM I TT EE 27 M a r ch 2024 REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING The principal sources of information used in the analysis are described in the Applicable Criteria. E S G C O N S I D E R A T I O N S Aenza S.A.A. has an ESG Relevance Score of '4' for Group Structure due to its complexity, related party transactions, and other joint operations, which has a negative impact on the credit profile, and is relevant to the rating in conjunction with other factors. The highest level of ESG credit relevance is a score of '3', unless otherwise disclosed in this section. A score of '3' means ESG issues are credit - neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch's ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch's ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg - relevance - scores . R A T I N G A C T I O N S E N T I T Y / D E B T R A T I N G A en z a S . A . A . L T I D R BB - R a tin g O u tlo o k S ta b l e N e w R a tin g L C L T I D R BB - R a tin g O u tlo o k S ta b l e N e w R a tin g L T BB - N e w R a tin g https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 5 /10 s en i o r s e c u r e d

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 6 /10 17/4/24, 15:46 V I E W A DD I T I O N A L R A T I N G D E T A I L S F I T C H R A T I N G S A N A L Y S T S Fitch Rates Aenza 'BB - '; Outlook Stable A l e x a n d r e G a r c i a Director P r i ma r y R a t i n g A n a l y s t + 55 11 4504 2616 alexandre.garcia@fitchratings.com F i t ch R a t i n g s B r a s il L t da. Alameda Santos, nº 700 – 7º andar Edifício Trianon Corporate - Cerqueira César São Paulo, SP SP Cep 01.418 - 100 A n d r e s C o rr e a Director S e co n dar y R a t i n g A n a l y s t + 1 212 908 0559 andres.correa@fitchratings.com M a rt h a R o c h a M a n a g i n g D i r e ct o r C o mm i tt ee C h a i r pe r s o n + 1 212 908 0591 martha.rocha@fitchratings.com M E D I A C O N T A C T S E li z a be t h F o g e rt y N e w Y o r k + 1 212 908 0526 elizabeth.fogerty@thefitchgroup.com Additional information is available on www.fitchratings.com P A R T I C I P A T I O N S T A TU S The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure. A PP L I C A B LE C R I T E R I A Corporate Rating Criteria (pub. 03 Nov 2023) (including rating assumption sensitivity) Sector Navigators – Addendum to the Corporate Rating Criteria (pub. 03 Nov 2023)

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 7/10 17/4/24, 15:46 A PP L I C A B LE M O D EL S Fitch Rates Aenza 'BB - '; Outlook Stable Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s). Corporate Monitoring & Forecasting Model (COMFORT Model), v8.1.0 ( 1 ) A DD I T I O N A L D I S C L O S U R E S Dodd - Frank Rating Information Disclosure Form S o li ci t a t i o n S t a t u s E n do r s e m en t P o li cy E ND O R S E M E NT S T A TU S A en z a S . A . A . D I S C L A I M E R & D I S C L O S U R E S All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings . In addition, the following https://www.fitchratings.com/rating - definitions - document details Fitch's rating definitions for each rating scale and rating categories, including definitions relating to default. ESMA and the FCA are required to publish historical default rates in a central repository in accordance with Articles 11(2) of Regulation (EC) No 1060/2009 of the European Parliament and of the Council of 16 September 2009 and The Credit Rating Agencies (Amendment etc.) (EU Exit) Regulations 2019 respectively. Published ratings, criteria, and methodologies are available from this site at all times. Fitch's code of conduct, confidentiality, conhicts of interest, affiliate firewall, compliance, and other relevant policies and procedures are also available from the Code of Conduct section of this site. Directors and shareholders' relevant interests are available at https://www.fitchratings.com/site/regulatory . Fitch may have provided another permissible or ancillary service to the rated entity or its related third parties. Details of permissible or ancillary service(s) for which the lead analyst is based in an ESMA - or FCA - registered Fitch Ratings company (or branch of such a company) can be found on the entity summary page for this issuer on the Fitch Ratings website. In issuing and maintaining its ratings and in making other reports (including forecast information), Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with E U E n d o r s e d , U K E n d o r s e d

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 8 /10 17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable its ratings methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of Fitch's factual investigation and the scope of the third - party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre - existing third - party verifications such as audit reports, agreed - upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent third - party verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of Fitch's ratings and reports should understand that neither an enhanced factual investigation nor any third - party verification can ensure that all of the information Fitch relies on in connection with a rating or a report will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings and its reports, Fitch must rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings and forecasts of financial and other information are inherently forward - looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings and forecasts can be affected by future events or conditions that were not anticipated at the time a rating or forecast was issued or affirmed. Fitch Ratings makes routine, commonly - accepted adjustments to reported financial data in accordance with the relevant criteria and/or industry standards to provide financial metric consistency for entities in the same sector or asset class. The complete span of best - and worst - case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'. Fitch also provides information on best - case rating upgrade scenarios and worst - case rating downgrade scenarios (defined as the 99th percentile of rating transitions, measured in each direction) for international credit ratings, based on historical performance. A simple average across asset classes presents best - case upgrades of 4 notches and worst - case downgrades of 8 notches at the 99th percentile. For more details on sector - specific best - and worst - case scenario credit ratings, please see Best - and Worst - Case Measures under the Rating Performance page on Fitch’s website. The information in this report is provided “as is” without any representation or warranty of any kind, and Fitch does not represent or warrant that the report or any of its contents will meet any of the requirements of a recipient of the report. A Fitch rating is

https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 9 /10 17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable an opinion as to the creditworthiness of a security. This opinion and reports made by Fitch are based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore, ratings and reports are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating or a report. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or withdrawn at any time for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax - exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of the United Kingdom, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier than to print subscribers. For Australia, New Zealand, Taiwan and South Korea only: Fitch Australia Pty Ltd holds an Australian financial services license (AFS license no. 337123) which authorizes it to provide credit ratings to wholesale clients only. Credit ratings information published by Fitch is not intended to be used by persons who are retail clients within the meaning of the Corporations Act 2001.Fitch Ratings, Inc. is registered with the U.S. Securities and Exchange Commission as a Nationally Recognized Statistical Rating Organization (the “NRSRO”). While certain of the NRSRO's credit rating subsidiaries are listed on Item 3 of Form NRSRO and as such are authorized to issue credit ratings on behalf of the NRSRO (see https://www.fitchratings.com/site/regulatory ), other credit rating subsidiaries are not listed on Form NRSRO (the “non - NRSROs”) and therefore credit ratings issued by those subsidiaries are not issued on behalf of the NRSRO. However, non - NRSRO

17/4/24, 15:46 Fitch Rates Aenza 'BB - '; Outlook Stable personnel may participate in determining credit ratings issued by or on behalf of the NRSRO. dv01, a Fitch Solutions company, and an affiliate of Fitch Ratings, may from time to time serve as loan data agent on certain structured finance transactions rated by Fitch Ratings. Copyright © 2024 by Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Telephone: 1 - 800 - 753 - 4824, (212) 908 - 0500. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved. R E A D LE SS S O L I C I T A T I O N S T A TU S The ratings above were solicited and assigned or maintained by Fitch at the request of the rated entity/issuer or a related third party. Any exceptions follow below. E ND O R S E M E NT P O L I C Y Fitch’s international credit ratings produced outside the EU or the UK, as the case may be, are endorsed for use by regulated entities within the EU or the UK, respectively, for regulatory purposes, pursuant to the terms of the EU CRA Regulation or the UK Credit Rating Agencies (Amendment etc . ) (EU Exit) Regulations 2019 , as the case may be . Fitch’s approach to endorsement in the EU and the UK can be found on Fitch’s Regulatory Affairs page on Fitch’s website. The endorsement status of international credit ratings is provided within the entity summary page for each rated entity and in the transaction detail pages for structured finance transactions on the Fitch website. These disclosures are updated on a daily basis. https:// www.fitchratings.com/research/corporate - finance/fitch - rates - aenza - bb - outlook - stable - 17 - 04 - 2024 10/10

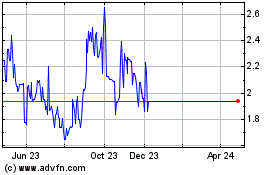

Aenza SAA (NYSE:AENZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

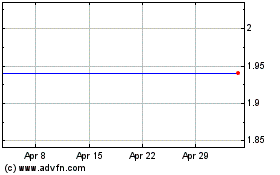

Aenza SAA (NYSE:AENZ)

Historical Stock Chart

From Jul 2023 to Jul 2024