Nike (NYSE:NKE) – Converse, a Nike subsidiary,

will cut jobs as part of its ongoing $2 billion cost reduction

plan. Nike, affected by cautious consumer spending, will reduce

product supply and management layers, along with facing job cuts in

its operations.

OpenAI – Ilya Sutskever, co-founder and chief

scientist of OpenAI, is leaving the company after losing his seat

on the board. He expressed confidence in the current leadership and

announced future plans. Jakub Pachocki steps in as chief scientist.

The departure comes after the unveiling of the GPT-4 model.

Warner Bros Discovery (NASDAQ:WBD) – Warner

Bros Discovery has increased its offer to repurchase investors’

debt by $750 million, totaling up to $2.5 billion. This move is

part of a plan to reduce its debt and interest costs. The company

is seeking cost reduction opportunities to meet its financial

goals.

Paramount Global (NASDAQ:PARA),

Sony (NYSE:SONY) – CNBC reported on Tuesday that

Sony Pictures is reconsidering its bid for Paramount Global.

Comcast (NASDAQ:CMCSA) – Comcast is planning to

launch StreamSaver, a streaming bundle combining Peacock, Netflix,

and Apple TV+, in an attempt to retain subscribers amid fierce

competition. CEO Brian Roberts emphasized that the price will be

highly competitive.

America Movil (NYSE:AMX) – The FCC has resolved

investigations into America Movil’s submarine cable connections

linking the US to Colombia and Costa Rica, made without necessary

approval, raising national security concerns. LATAM

Telecommunications and Puerto Rico Telephone will each pay fines of

$1 million and adhere to a compliance plan.

Verizon (NYSE:VZ) – Verizon Consumer CEO

Sowmyanarayan Sampath sees AI doubling traffic in the next five

years. The company is already integrating AI into its customer

service and anticipates automation in routine processes.

Amazon (NASDAQ:AMZN) – Amazon Web Services

(AWS) plans to invest around $8.44 billion (7.8 billion euros) by

2040 to develop cloud computing infrastructure in Germany,

specifically for the European market. AWS will open several data

centers in Brandenburg by the end of 2025.

Oracle (NYSE:ORCL) – Elon Musk’s artificial

intelligence startup, xAI, is in talks with Oracle to spend $10

billion on cloud servers. This would make it one of Oracle’s

largest clients as Musk seeks to compete with OpenAI and Google.

The negotiations are ongoing.

Alphabet (NASDAQ:GOOGL) – Alphabet has launched

Trillium, a new artificial intelligence chip for data centers that

is nearly five times faster than its predecessor. Sundar Pichai,

CEO of Alphabet, highlighted the exponential growth in demand for

AI computing, stating that Google has been a leader in this

technology for over a decade. Alphabet also emphasized the

integration of AI into its services, including an enhanced chatbot

called Gemini and updates to its search engine. Additionally,

YouTube complied with a court decision blocking 32 versions of the

protest song “Glory to Hong Kong” in response to an injunction.

Meta Platforms (NASDAQ:META) – Meta Platforms

announced it will discontinue its Workplace app in June 2026 to

focus on the development of artificial intelligence and metaverse

technologies. Workplace will continue to be used internally by Meta

and will remain available to customers until August 2025, with

migration options to Zoom’s Workvivo.

Nvidia (NASDAQ:NVDA) – Nvidia CEO Jensen Huang

saw a 60% increase in salary last year, with a total compensation

of $34.2 million in 2024. This increase was mainly driven by stock

awards and incentives from the compensation plan, including

expenses for private security.

ASML (NASDAQ:ASML), Taiwan

Semiconductor Manufacturing Co. (NYSE:TSM) – ASML Holding

NV’s advanced chip machines are raising concerns about their high

prices, according to TSMC. The cost of the new machines, capable of

printing semiconductors with 8 nanometers thickness, is $380

million each, highlighting financial challenges in the

industry.

3M (NYSE:MMM) – 3M announced on Tuesday that

the annual compensation of some executives, including former CEO

Mike Roman, did not receive sufficient support in a shareholder

advisory vote. Roman received $16.4 million in 2023, an increase

from $14 million in 2022, despite legal challenges and sales

slowdown. The vote, though non-binding, is considered by the board

in compensation reviews.

BHP (NYSE:BHP), Anglo American

(LSE:AAL) – BHP is considering expanding its $42.7 billion offer

for Anglo American or making a hostile bid, ahead of the imminent

May 22 deadline for a formal proposal. Anglo has rejected two

previous offers, planning to focus on copper and sell less

profitable businesses. Meanwhile, BHP defends the deal at a

conference in Miami, highlighting potential strategies to persuade

Anglo shareholders. The miner also mentions the risk of rejection

and the need for cooperation from Anglo’s management to overcome

regulatory challenges.

Petrobras (NYSE:PBR) – Petrobras CEO Jean Paul

Prates has offered his resignation amid political changes, with the

appointment of Magda Chambriard, former head of ANP, as his

replacement, indicating possible political interference. The

company’s shares fell after the announcement, reflecting investor

concerns about governance and the company’s future direction.

Chevron (NYSE:CVX) – In April, Chevron led US

stock sales, surpassing Tesla, due to the increase in bets on

weaker energy prices, according to Hazeltree. Although its

quarterly results were strong, the drop in energy prices affected

its refining margins.

TotalEnergies (NYSE:TTE),

Shell (NYSE:SHEL) – TotalEnergies CEO considers

switching the primary listing to the US due to the increase in

American shareholders and better valuations. However, it will

maintain a listing in Paris. Macron opposes the move. Shell’s CEO

also sees New York as an attractive option due to superior

valuations.

Boeing (NYSE:BA) – The US Department of Justice

has accused Boeing of violating a 2021 agreement related to the 737

MAX accidents. The failure was highlighted after an in-flight

explosion, threatening Boeing with criminal proceedings and

penalties. Boeing announced yesterday that it delivered 24

commercial aircraft in April, two fewer than the previous year,

partly attributed to the closure of Lynx Air operations. Production

of the 737 MAX has been reduced to improve quality. Boeing’s

competitor, Airbus, delivered 61 aircraft in April. Additionally,

the first manned mission of the Starliner was postponed to May 21

due to a helium leak. Additionally, the US Air Force has fined the

United Launch Alliance (ULA) for undisclosed amounts for delays in

launching military satellites.

Carvana (NYSE:CVNA) – Carvana CEO Ernest Garcia

III anticipates that used car sales will be boosted by early signs

of a possible oversupply of new cars. He notes an increase in new

car inventories in the US, which could benefit the online retailer

of used cars.

General Motors (NYSE:GM) – GM’s autonomous car

unit has agreed to pay between $8 million and $12 million to a

pedestrian hit by one of its vehicles in San Francisco. After the

incident, Cruise suspended its fleet in the US, but now plans to

resume testing in Phoenix.

Honda Motor (NYSE:HMC) – Honda is downsizing

its workforce in China, with 1,700 employees from GAC Honda

agreeing to voluntary layoffs.

Tesla (NASDAQ:TSLA) – After declines in the

previous week, Tesla’s shares have rebounded with consistent gains.

On Tuesday, they rose 3.3%, closing at $177.55, totaling a 5.4%

gain for the week. Shares are up 0.8% in pre-market trading,

heading for three consecutive days of gains. New tariffs on Chinese

cars may have influenced. Additionally, Tesla is seeking support

from its large retail investors for Elon Musk’s compensation

package, hiring consultants and creating the Vote Tesla website.

The advisory vote on June 13 could significantly influence the

future of Musk’s leadership and the company. In Sweden, the largest

union supports a six-month strike by Tesla mechanics, exacerbating

tensions between the automaker and workers. Elon Musk’s refusal to

sign a collective agreement is at the heart of the conflict. Other

unions have also joined the action, seeking to protect collective

agreements. Additionally, an environmental organization has sued

Tesla, accusing it of violating the Federal Clean Air Act at its

California factory by repeatedly emitting harmful pollutants. The

lawsuit seeks an injunction to stop excessive pollution and daily

fines of up to $121,275.

Aiways – The Chinese electric vehicle

manufacturer Aiways will merge with the American company Hudson

Acquisition Corp, in a deal valued at about $400 million. The

merger represents a turning point for Aiways, which had paused

production due to intense price wars in the Chinese electric

vehicle market.

MSCI Inc (NYSE:MSCI),

MicroStrategy (NASDAQ:MSTR) – MSCI will include

MicroStrategy and 41 other companies in its global index, with

notable additions also in emerging and frontier markets indices.

The revisions reflect changes in the market capitalization of

constituents and impact billions of dollars in investments in ETFs

that follow these indices. The changes will be effective at the

close of market on May 31.

Citigroup (NYSE:C) – Titi Cole, a key executive

at Citigroup responsible for leading a broad restructuring plan, is

leaving the bank, according to an internal memo. As head of old

franchises, Cole played a crucial role in simplifying the bank,

completing the sale of consumer banking operations in nine

markets.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase’s

new co-heads of global sales and research, Claudia Jury and Scott

Hamilton, highlight the dual impact of artificial intelligence on

the economy, initially driving inflation with investments in

infrastructure and later promoting deflation with business

efficiency.

Nomura Holdings (NYSE:NMR) – Nomura Holdings

Inc. aims to nearly double its profits by 2030, boosting its

wholesale division to finance its own operations and expanding into

strategic areas. CEO Kentaro Okuda outlined plans to achieve over

$3.2 billion in pretax profit by 2031, approximately 1.8 times its

result in the last fiscal year, driving growth and efficiency.

New York Community Bancorp (NYSE:NYCB) – NYCB

announced the sale of approximately $5 billion in mortgage loans to

JPMorgan Chase (NYSE:JPM), a move aimed at

strengthening the bank’s liquidity and capital as it works to

return to profitability over the next two years. The transaction is

expected to significantly improve NYCB’s capital ratio and

liquidity profile.

GameStop (NYSE:GME), AMC

Entertainment (NYSE:AMC) – Shares of GameStop, AMC, and

other meme stocks surged in recent days, driven by the return of

“Roaring Kitty” Keith Gill to social media. Gill, central to the

meme stock frenzy of 2021, posted a clip of “Braveheart” associated

with GameStop, reigniting investor interest and speculation. AMC

Entertainment’s shares specifically rose over 140% this week and

completed a stock sale initiated in March. The company, while

outperforming many competitors, faces significant debts that may

limit its ability to pay and attract new investors. GameStop and

AMC rose 12% and 11.4% in Wednesday’s pre-market trading,

respectively.

Procter & Gamble (NYSE:PG) – Procter &

Gamble surprised by foregoing its traditional emotional campaign

for the Paris 2024 Olympics, opting to highlight individual brands

such as Pampers and Gillette. Reducing its spending on Olympic

advertising, the company focuses on over 30 brands, aiming to serve

athletes and families globally.

Yum! Brands (NYSE:YUM) – Pizza Hut is launching

the Cheeseburger Melt, a new addition to its Melts sandwich line,

featuring beef, bacon, onions, mozzarella, and cheddar between two

thin pizza crusts. Despite sales challenges, Pizza Hut follows the

industry trend of diversifying its menu.

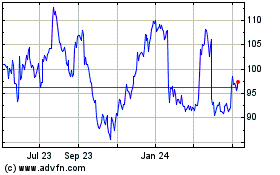

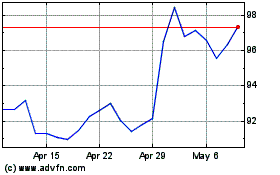

3M (NYSE:MMM)

Historical Stock Chart

From Sep 2024 to Oct 2024

3M (NYSE:MMM)

Historical Stock Chart

From Oct 2023 to Oct 2024