Abaxx Technologies Inc. (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software and market

infrastructure company, majority shareholder of the

Abaxx

Commodity Exchange (“Abaxx Singapore”), and producer of

the

SmarterMarkets™ Podcast, summarizes

development activities over the past quarter and the general

progress of the Company’s business plans.

Highlights:

- Completed full

systems integration and commenced operational readiness testing;

completed first user acceptance testing (“UAT”) and progressed

systems toward final completion of regulatory requirements in

Q2.

-

Completed commercial onboarding of first clearinghouse settlement

bank; signed collateral management services agreement with South

East Asia’s largest bank by assets.

-

Continued to expand our engagement with commercial participants and

clearing members across our first three futures product verticals:

LNG, Carbon, and Battery Metals; LNG and Carbon contracts product

development is complete.

-

Continued progress on the third and final stage of product

development work on our first battery metals contract (consisting

of industry comments, risk modeling, regulatory document

submission, and filing); progressed precious metals contracts

toward the third stage of product development.

-

Completed all key executive and senior management level hiring in

Abaxx Singapore, and appointed remaining governance board members

as announced on April 26, 2023.

-

Continued to finalize the development of the ID++ protocol and

Abaxx Console Apps (Verifier, Sign, and Drive) for internal use

within the Exchange and identified advanced use cases externally

with key partners.

-

Continued progress on the strategic partner financing process for a

non-brokered equity financing at Abaxx Singapore Pte. Ltd., the

parent company of Abaxx Exchange Pte. Ltd. and Abaxx Clearing Pte.

Ltd., with the goal of completion before submitting applications to

draw down all final regulatory licenses.

The Company plans to host an investor call and

presentation in conjunction with final US listing preparations over

the coming weeks, to be announced separately.

Dear Shareholders,

Over the past quarter, the Company made significant progress

toward a 2023 launch of the Abaxx Exchange and Clearinghouse in

Singapore. Member engagement accelerated with key industry events

in Q1 and the increased focus on solutions for problematic market

structures across the European and Asian LNG markets, voluntary

carbon markets, and global battery metals. We continue to work with

market participants (trading, broker, and clearing firms) and our

market infrastructure partners to prepare systems and complete

regulatory requirements to ensure a successful launch. Onboarding

of clearing firms is actively underway.

The Company remains on track to complete the final licensing

application requirements at or near the end of Q2, subject to the

successful completion of the Abaxx Singapore strategic financing

for required reserve capital and regulatory approval.

Abaxx Exchange and Clearing Developments

Risk and Regulatory: The Company appointed a new Chief Risk

Officer and appointed key governance board members of Abaxx

Singapore and Abaxx Clearing in anticipation of the launch. As a

result, all critical path elements of enterprise risk management,

financial risk management, and technology risk management are

expected to be completed within the first half of 2023. The Company

maintains active engagement with the Monetary Authority of

Singapore (“MAS”) to obtain Approved Clearing House (ACH), Approved

Holding Company (AHC), and Recognised Market Operator (RMO)

licenses once all remaining licensing conditions are met. Estimated

timelines to complete the remaining processes have been shared with

MAS.

Commercial: In addition to the close collaboration with global

commodity trading firms, the Exchange is closely engaged with a

core group of Clearing members at various stages of the onboarding

process in anticipation of being exchange launch partners with

Abaxx.

During the quarter, Abaxx Clearing entered into

a collateral management services agreement with DBS Bank Limited

(DBS), South East Asia’s largest bank by assets. The Agreement

mandates DBS as the financial institution to provide collateral

management services, including the establishment of bank accounts

for (a) clearing members of Abaxx Clearing, and (b) Abaxx Clearing,

and the collection of cash deposits, margins, and any other funds

which constitute collateral movement between Abaxx Clearing and its

clearing members. DBS was voted ‘World’s Best Bank’ by Euromoney,

‘Best Bank in the World’ by Global Finance, and ‘Global Bank of the

Year’ by The Banker on multiple occasions, will provide critical

services in managing collateral requirements, minimizing settlement

risk, providing liquidity, and managing the settlement process.

Systems and Operations: In Q1 2023, the Company completed full

integration of Exchange and Clearing applications and commenced

final testing. Major exchange and clearing ISVs have progressed

with integration and conformance testing. Details on approved ISVs

will be shared at the operational readiness milestone. Staff

resourcing and training are on track with operational readiness

goals. All key roles in Operations and Risk have been filled, and

the hiring and training of junior staff is in line with launch

targets.

Infrastructure: In Q1 2023, significant

milestones were achieved related to the testing of rapid deployment

and configuration capabilities for the exchange stack, leveraging

modern, automated, cloud-native processes. Abaxx’s Digital Product

team has focused on implementing upgrades and improvements

identified during integration testing, and feature roadmaps for

post-launch have been defined. Infrastructure development has

focused on hardening integrations, (enterprise-hardening) network

and infrastructure, and IT processes. Quality engineering

capabilities have been scaled to expand capacity for customer

engagement and support inquiries during launch.

Exchange Product Development: Abaxx Exchange

product development is typically managed in 3 stages: Stage 1:

Problem identification and industry consultation; Stage 2: Scoping,

designing, and drafting comprehensive delivery contracts; and Stage

3: Industry comments, risk modeling, regulatory document

submission, and filing. Metals market development has progressed to

Stage 3 for our first precious and battery metal contracts. The

initial battery metals contract, subject to ongoing development

work and regulatory review, is progressing at pace to include at

launch along with our Carbon contract and three LNG contracts.

Abaxx Console Apps and ID++ Protocol: In Q1 2023, our product

and engineering team launched Version 2 of the ID++ protocol.

Version 2 introduces enhanced interoperability with stateless UTXO

Distributed Ledger Technologies (DLTs), while maintaining robust

support for stateful account models such as the Ethereum Virtual

Machine (EVM). The updated protocol incorporates integrations for

zero-knowledge Know Your Customer (KYC) procedures, refined

peer-to-peer messaging, and cross-compatibility with existing OAuth

standards; these features equip ID++ to tackle the complexities of

securing digital identity and permissions in environments that

utilize both centralized and decentralized networks. Integration

into Verifier, Sign, and Drive is underway, as is the development

of a new product, Issuer, designed to facilitate enterprise-client

integrations.

Abaxx Corporate Update

Strategic Financing Process: The Company has continued progress

on its strategic equity financing process with market partners at

the Abaxx Singapore subsidiary level. We remain engaged with

multiple institutions and are progressing through due diligence,

finalizing terms, and finalizing timelines in preparation for a

formal equity offering in Abaxx Singapore. The potential equity

placement is described by the Company as “reserve capital” that

will remain in separate accounts of Abaxx subsidiaries to meet

minimum regulatory and runway capital requirements and future Abaxx

Clearing risk-waterfall needs.

Secondary U.S. Listing Application: The Company also continued

progressing in several aspects of preparation for a secondary

listing application of Company shares on a U.S. stock exchange,

subject to meeting all regulatory requirements.

The Corporation’s management team has been studying the

potential benefits of an additional listing on a U.S. stock

exchange. Based on the Corporation’s stage of development, certain

developments in its industry, its observations regarding the market

for its peers whose securities are listed on a U.S. stock

exchanges, and also from discussions with both U.S.-based

investment banks and other advisers, the Corporation believes that

there may be potential benefits of a listing on a U.S. stock

exchange, including:

• A significantly larger pool of available capital• A greater

average daily trading volume• A greater number of U.S. retail and

institutional investors• A potential increase in market

valuation

At-the-Market Equity Program: In April, Abaxx established an ATM

Program which allows the Company to issue, at its discretion,

common shares (the “Common Shares”) of the Company having an

aggregate offering price of up to C$30 million to the public from

time to time through the Agent.

The Company intends to use the net proceeds from the ATM Program

for general corporate and working capital requirements, including

to fund ongoing operations and/or working capital requirements, to

repay indebtedness outstanding from time to time and to complete

future acquisitions or for other corporate purposes. For more

information about the ATM Program, please refer to our April 26th

Press Release.

About Abaxx Technologies

Abaxx is a development-stage financial software and market

infrastructure company creating proprietary technological

infrastructure for both global commodity exchanges and digital

marketplaces. The company’s formative technology increases

transaction velocity, data security, and facilitates improved risk

management in the majority-owned Abaxx Commodity Exchange (Abaxx

Singapore Pte. Ltd.) - a commodity futures exchange seeking final

regulatory approvals as a Recognized Market Operator (“RMO”) and

Approved Clearing House (“ACH”) with the Monetary Authority of

Singapore (“MAS”). Abaxx is a founding shareholder in Base Carbon

Inc. and the creator and producer of the SmarterMarkets™

podcast.

For more information please visit abaxx.tech, abaxx.exchange and

smartermarkets.media.

Media and investor inquiries:

Abaxx Technologies Inc.Investor Relations TeamTel: +1 246 271

0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain "forward-looking statements"

which do not consist of historical facts. Forward-looking

statements include estimates and statements that describe Abaxx or

the Company’s future plans, objectives, or goals, including words

to the effect that Abaxx expects a stated condition or result to

occur. Forward-looking statements may be identified by such terms

as “seeking”, “believes”, “anticipates”, “expects”, “estimates”,

“may”, “could”, “would”, “will”, or “plan”. Since forward-looking

statements are based on assumptions and address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Although these statements are based on information

currently available to Abaxx, Abaxx does not provide any assurance

that actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

information could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking information.

Forward-looking information in this news release includes but is

not limited to, Abaxx’s objectives, goals or future plans,

statements, timing of the commencement of operations, and estimates

of market conditions. Such factors include, among others: risks

relating to the global economic climate; dilution; the Company’s

limited operating history; future capital needs and uncertainty of

additional financing; the competitive nature of the industry;

currency exchange risks; the need for Abaxx to manage its planned

growth and expansion; the effects of product development and need

for continued technology change; protection of proprietary rights;

the effect of government regulation and compliance on Abaxx and the

industry; network security risks; the ability of Abaxx to maintain

properly working systems; reliance on key personnel; global

economic and financial market deterioration impeding access to

capital or increasing the cost of capital; and volatile securities

markets impacting security pricing unrelated to operating

performance. In addition, particular factors which could impact

future results of the business of Abaxx include but are not limited

to: operations in foreign jurisdictions, protection of intellectual

property rights, contractual risk, third-party risk; clearinghouse

risk, malicious actor risks, third-party software license risk,

system failure risk, risk of technological change; dependence of

technical infrastructure, an inability to predict and counteract

the effects of COVID-19 on the business of the Company, including

but not limited to the effects of COVID-19 on the price of

commodities, capital market conditions, restriction on labor and

international travel and supply chains. Abaxx has also assumed that

no significant events occur outside of Abaxx’s normal course of

business.

Abaxx cautions that the foregoing list of material factors is

not exhaustive. In addition, although Abaxx has attempted to

identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated, or intended. When relying on

Abaxx's forward-looking statements and information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Abaxx has assumed that the material factors referred to in the

previous paragraph will not cause such forward-looking statements

and information to differ materially from actual results or events.

However, the list of these factors is not exhaustive and is subject

to change and there can be no assurance that such assumptions will

reflect the actual outcome of such items or factors. The

forward-looking information contained in this press release

represents the expectations of Abaxx as of the date of this press

release and, accordingly, is subject to change after such date.

Readers should not place undue importance on forward-looking

information and should not rely upon this information as of any

other date. Abaxx does not undertake to update this information at

any particular time except as required in accordance with

applicable laws. The NEO Exchange does not accept responsibility

for the adequacy or accuracy of this press release.

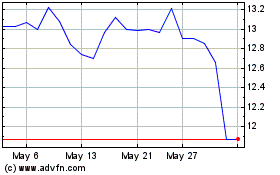

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Jan 2024 to Jan 2025