As Filed with the Securities and Exchange Commission

on February 7, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

XWELL, Inc.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

|

20-4988129 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

254 West 31st Street, 11th Floor

New York, New York 10001

(212) 750-9595

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Ezra T. Ernst

President and Chief Executive

Officer

XWELL, Inc.

254 West 31st Street, 11th Floor

New York, New York 10001

(212) 750-9595

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Rick A. Werner, Esq.

Alla Digilova, Esq.

Haynes and Boone, LLP

30 Rockefeller Plaza, 26th Floor

New York, New York 10112

(212) 659-7300

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities

being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is

a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

Emerging growth company |

¨ |

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange

Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus

is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated

February 7, 2025

PROSPECTUS

XWELL, Inc.

1,051,677 Shares of Common Stock

This prospectus relates to the resale by the selling

stockholders named in this prospectus from time to time of up to an aggregate of 1,051,677 shares of our common stock, par value $0.01

per share (the “Common Stock”), issuable upon (i) the conversion of shares of our newly designated Series G convertible

preferred stock (the “Preferred Shares”), and (ii) exercise of certain warrants (the “Warrants”). The Preferred

Shares were acquired by the applicable selling stockholders under the Securities Purchase Agreement (the “Purchase Agreement”),

dated January 14, 2025, by and among the Company and the investors party thereto (the “Investors”). The Warrants were

acquired by the selling stockholders under the Purchase Agreement. The shares of Common Stock issuable upon the conversion of the Preferred

Shares are herein referred to as “Conversion Shares,” and the shares of Common Stock issuable upon the exercise of the Warrants

are herein referred to as “Warrant Shares.”

The Conversion Shares and the Warrant Shares were

issued in reliance upon the exemption from the registration requirements in Section 4(a)(2) of the Securities Act of 1933, as

amended (the “Securities Act”) and Regulation D promulgated thereunder.

We are registering the resale of the Conversion

Shares and Warrant Shares covered by this prospectus as required by (i) the Registration Rights Agreement, dated January 14,

2025, by and among the Company and the Investors (the “Registration Rights Agreement”). The selling stockholders will receive

all of the proceeds from any sales of the shares offered hereby. We will not receive any of the proceeds, but we will incur expenses in

connection with the offering. To the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of the

Warrants. We intend to use those proceeds, if any, for general corporate purposes.

Our registration of the shares of Common Stock

covered by this prospectus does not mean that the selling stockholders will offer or sell any of such shares of Common Stock. The selling

stockholders named in this prospectus, or their donees, pledgees, transferees or other successors-in-interest, may resell the shares of

Common Stock covered by this prospectus through public or private transactions at prevailing market prices, at prices related to prevailing

market prices or at privately negotiated prices. For additional information on the possible methods of sale that may be used by the selling

stockholders, you should refer to the section of this prospectus entitled “Plan of Distribution.”

Any shares of Common Stock subject to resale hereunder

will have been issued by us and acquired by the selling stockholders prior to any resale of such shares pursuant to this prospectus.

No underwriter or other person has been engaged

to facilitate the sale of the Common Stock in this offering. We will bear all costs, expenses and fees in connection with the registration

of the Common Stock. The selling stockholders will bear all commissions and discounts, if any, attributable to their respective sales

of the Common Stock.

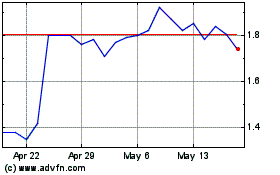

Our Common Stock is listed on the Nasdaq

Capital Market under the symbol “XWEL.” On February 6, 2025, the last reported sales price for our Common Stock was

$ 1.23 per share.

Investment

in our Common Stock involves risk. See “Risk Factors” contained in this prospectus, in our periodic reports

filed from time to time with the Securities and Exchange Commission, which are incorporated by reference in this prospectus and in any

applicable prospectus supplement. You should carefully read this prospectus and the accompanying prospectus supplement, together with

the documents we incorporate by reference, before you invest in our Common Stock.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025.

Table

of Contents

About

this Prospectus

This prospectus is part of the registration statement

that we filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the selling stockholders named herein

may, from time to time, offer and sell or otherwise dispose of the shares of our Common Stock covered by this prospectus. As permitted

by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in

this prospectus.

This prospectus and the documents incorporated

by reference into this prospectus include important information about us, the securities being offered and other information you should

know before investing in our securities. You should not assume that the information contained in this prospectus is accurate on any date

subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct

on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares of Common

Stock are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this

prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read and consider

the information in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

You should rely only on this prospectus and the

information incorporated or deemed to be incorporated by reference in this prospectus. We have not, and the selling stockholders have

not, authorized anyone to give any information or to make any representation to you other than those contained or incorporated by reference

in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does

not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

Unless otherwise indicated, information contained

or incorporated by reference in this prospectus concerning our industry, including our general expectations and market opportunity, is

based on information from our own management estimates and research, as well as from industry and general publications and research, surveys

and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry

and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of

our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described in “Risk

Factors” beginning on page 10 of this prospectus. These and other factors could cause our future performance to differ materially

from our assumptions and estimates.

Prospectus

Summary

This summary provides an overview of selected

information contained elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should

consider before investing in our securities. You should carefully read the prospectus, the information incorporated by reference and the

registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information

discussed under “Risk Factors” in this prospectus and the documents incorporated by reference and our financial statements

and related notes that are incorporated by reference in this prospectus. In this prospectus, unless the context indicates otherwise, “XWEL,”

the “Company,” the “registrant,” “we,” “us,” “our,” or “ours”

refer to XWELL, Inc. and its consolidated subsidiaries.

Overview

XWELL is a global wellness company operating multiple

brands and focused on bringing restorative, regenerative and reinvigorating products and services to travelers. XWELL currently has four

reportable operating segments: XpresSpa®, XpresTest®, Naples Wax Center and Treat™.

On October 25, 2022, we changed our name

to XWELL, Inc. (“XWELL” or the “Company”) from XpresSpa Group, Inc. Our Common Stock which had previously

been listed under the trading symbol “XSPA” on the Nasdaq Capital Market, now trades under the trading symbol “XWEL”.

We filed an amended and restated certificate of incorporation with the Delaware Secretary of State on October 24, 2022 (the “Amended

and Restated Certificate”) reflecting the name change. Rebranding to XWELL aligned our corporate strategy to build a pure-play wellness

services company, in both the airport and off airport marketplaces.

Although we recognize four segments of business,

we believe there is opportunity to leverage a segment of our products and services across the Company’s platform of brands. Additionally,

we are expanding our retail strategy, not only adding more products for sale but aligning those products more efficiently to our service

offerings. This product strategy includes, for example, adding muscle relaxation patches to a neck or back massage to continue treatment

after the delivery of the service. We are also continuing to add new service offerings to our in and out of airport locations.

We also plan to build our capability for delivering

health and wellness services outside of the airport. We believe operating outside of the airport complements our offering and represents

the fastest way to scale the XWELL family of brands.

We will be looking to further expand internationally.

With international travel returning to pre-pandemic levels, we continue to be opportunistic in our approach, by taking advantage of the

current market to growth. We believe a strategy for international expansion further advances our ability to expand our other brands including

bio surveillance outside of the United States.

XpresSpa

XWELL’s subsidiary, XpresSpa Holdings, LLC

(“XpresSpa”) has been a global airport retailer of spa services through our XpresSpa spa locations, offering travelers premium

spa services, including massage, nail and skin care, as well as spa and travel products.

As of September 30, 2024, there were 19 domestic

XpresSpa locations in total, 17 Company-owned locations and two franchises. We also had 10 international locations operating as of September 30,

2024, including two XpresSpa locations in Dubai International Airport in the United Arab Emirates, one XpresSpa location in Zayad International

Airport in Abu Dhabi, UAE, three XpresSpa locations in Schiphol Amsterdam Airport in the Netherlands and four XpresSpa locations in the

Istanbul Airport in Turkey.

XpresTest

We, in partnership with certain COVID-19 testing

partners, successfully launched its XpresCheck Wellness Centers, in June of 2020, through our XpresTest, Inc. subsidiary (“XpresTest”),

which offered COVID-19 and other medical diagnostic testing services to the traveling public, as well as airline, airport and concessionaire

employees, and TSA and U.S. Customs and Border Protection agents during the pandemic. During 2022 and 2023, as countries continued to

relax their testing requirements resulting in rapid decline of testing volumes at the Company’s XpresCheck Wellness locations, the

Company started to close XpresCheck Wellness Centers. As of December 31, 2023, we have closed all XpresCheck Wellness locations.

XpresTest began conducting bio surveillance monitoring

with the Centers for Disease Control and Prevention (CDC) in collaboration with Concentric by Ginkgo BioWorks in 2021 and on January 31,

2022, we announced the extension of our initial program, bringing the total contract to $5.5 million. In August 2022, the program

was renewed in partnership with Ginkgo BioWorks. A new two-year contract was initiated which represents approximately $7.3 million in

revenue (for the first year) for the XpresTest segment.

The program was further renewed in August 2023

through a new one-year contract. The revenue to XpresTest from such one-year extension totaled approximately $7 million. In March 2024,

the program funding and scope were expanded, a revenue increase of $4 million, to an estimated $11 million in revenue for XpresTest with

a new collection station located in Miami International Airport (MIA) and the roll out of multi-pathogen testing across the program. The

program was further renewed in August 2024.

HyperPointe

XWELL’s subsidiary, gcg Connect, LLC, operating

as HyperPointe, provides direct to business marketing support across a number of health and health-related channels. From the creation

of marketing campaigns for the pharmaceutical industry, to learning management systems to website and health related content creation,

HyperPointe is a complementary service provider to our health-focused brands as well as providing the majority of services to the external

community.

For reporting purposes, HyperPointe has been consolidated

into the XpresTest segment.

Treat

Treat, which is operating through our subsidiary

Treat, Inc. (“Treat”) is a wellness brand that provides access to wellness services for travelers at on-site centers

(currently located in JFK International Airport). In April 2024, the decision was made to close the location in the Salt Lake City

International Airport.

Treat offers a full retail product offering and

a suite of wellness and spa services. Travelers can purchase time blocks to use our wellness rooms to engage in interactive services like

self-guided yoga, meditation, and low impact weight exercises or to relax and unplug from the hectic pace of the airport and renew themselves

before or after their trip.

Naples Wax Center

On September 12, 2023, we acquired our subsidiary

Naples Wax, LLC d/b/a Naples Wax Centers (“Naples Wax Centers” or “Naples Wax”), a group of upscale hair removal

boutiques in Florida, for a purchase price of approximately $1.6 million. Aiming to provide a memorable customer experience, Naples Wax

Center operates three high-performing locations with core products and service offerings from face and body waxing to a range of skincare

and cosmetic products. The acquisition of Naples Wax Center is intended to enable us to move beyond our airport client base with a business

that can be adapted to a larger wellness platform while also growing our retail footprint to serve our long-term financial goals.

XWELL Studios

In Q4 of 2023, we began plans to open our first

XWELL Studios location in Jacksonville, Florida in 2025. XWELL Studios is an out-of-airport concept providing leased space to established

wellness service providers. Revenue will be derived from both lease payments received from the wellness practitioners and the sale of

retail at the wellness center.

We believe that these strategic imperatives will

be accomplished through development of an infrastructure specifically focused on enabling scalable and efficient growth.

Private Placement of Preferred Shares and Warrants

On January 14, 2025, we entered into the

Purchase Agreement with the Investors, pursuant to which we issued and sold on January 14, 2025 (the “Closing Date”),

in a private placement (the “Private Placement”), (i) an aggregate of 4,000 shares of the Company’s newly-designated

Series G Convertible Preferred Stock initially convertible into up to 2,673,797 Conversion Shares at a conversion price of $1.496

per share, (ii) Series A warrants (the “Series A Warrants”) to acquire up to an aggregate of 2,673,797 shares

of Common Stock at an exercise price of $1.496 per share, and (iii) Series B warrants to acquire up to an aggregate of 2,673,797

shares of Common Stock (the “Series B Warrants,” and collectively with the Series A Warrants, the “Warrants”)

at an exercise price of $1.7952 per share. Each Preferred Share and accompanying Warrants were sold together at a combined offering price

of $1,000.

The terms of the Preferred Shares are as set forth

in the Certificate of Designations of the Series G Convertible Preferred Stock of XWELL, Inc. (the “Certificate of Designations”),

which was filed and became effective with the Secretary of State of the State of Delaware on January 14, 2025. The Warrants are immediately

exercisable and expire five years from the date of issuance.

The Private Placement is exempt from the registration

requirements of the Securities Act pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of

the Securities Act and Rule 506 of Regulation D of the Securities Act and in reliance on similar exemptions under applicable state

laws. Each of the investors in the Private Placement has represented to us that it is an accredited investor within the meaning of Rule 501(a) of

Regulation D and that it is acquiring the securities for investment only and not with a view towards, or for resale in connection with,

the public sale or distribution thereof. The Preferred Shares and Warrants were offered without any general solicitation by us or our

representatives.

Registration Rights Agreements

In connection with the Private Placement, we entered

into the Registration Rights Agreement, pursuant to which we are obligated, among other things, to (i) file a resale registration

statement (the “Registration Statement”) with the SEC to register for resale 200% of the Conversion Shares and the Warrant

Shares promptly following the Closing Date, but in no event later than 30 calendar days after the Closing Date, (ii) have such Registration

Statement declared effective by the Effectiveness Deadline (as defined in the Registration Rights Agreement), and (iii) maintain

the registration until the earlier of (x) the date on which the selling stockholders may sell their Conversion Shares or Warrant

Shares without restriction pursuant to Rule 144 under the Securities Act, (y) the date on which the selling stockholders no

longer hold any Conversion Shares or Warrant Shares and (z) the five year anniversary of the Closing Date. The Company will be obligated

to pay certain liquidated damages to the Investors if the Company fails to file the Registration Statement when required, fails to cause

the Registration Statement to be declared effective by the SEC when required, or fails to maintain the effectiveness of the Registration

Statement pursuant to the terms of the Registration Rights Agreement.

Preferred Shares

All shares of capital stock of the Company rank

junior to the Preferred Shares, with respect to the preferences as to dividends, distributions and payments upon the liquidation, dissolution

and winding up of the Company.

The Preferred Shares are convertible into Common

Stock at the election of the holder at any time at an initial conversion price of $1.496 (the “Conversion Price”). The Conversion

Price is subject to customary adjustments for stock dividends, stock splits, reclassifications, stock combinations and the like. The Conversion

Price may also be voluntarily reduced by the Company to any amount and for any period of time deemed appropriate by the Board at any time

with the prior written consent of the holders of at least a majority of the outstanding Preferred Shares, subject to the rules and

regulations of Nasdaq.

We are required to redeem the Preferred Shares

in six (6) equal quarterly installments, commencing on February 1, 2025. The amortization payments due upon such redemption

are payable, at the Company’s election, in cash at 107% of the applicable Installment Redemption Amount (as defined in the Certificate

of Designations), or subject to certain limitations, in shares of Common Stock valued at the lower of (i) the Conversion Price then

in effect and (ii) the greater of (A) 80% of the average of the three lowest closing prices of the Company’s Common Stock

during the thirty consecutive trading day period ending and including the trading day immediately prior to the date the amortization payment

is due or (B) the lower of (x) $0.272 and (y) 20% of the “Minimum Price” (as defined in Nasdaq Stock Market

Rule 5635) on the date in which the Stockholder Approval (as defined herein) is obtained or, in any case, such lower amount as permitted,

from time to time, by the Nasdaq Capital Market, and, in each case, subject to adjustment for stock splits, stock dividends, stock combinations,

recapitalizations or other similar events, which amortization amounts are subject to certain adjustments as set forth in the Certificate

of Designations (the “Floor Price”).

The

holders of the Preferred Shares are entitled to dividends of 8% per annum, compounded each calendar quarter, which are payable in arrears

monthly in cash or shares of Common Stock at the Company’s option, in accordance with the terms of the Certificate of Designations.

Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations) including,

among other things, our failure to pay any amounts due to the holders of the Preferred Shares when due, the Preferred Shares accrue dividends

at the rate of 15% per annum. Upon conversion or redemption, the holders of the Preferred Shares are also entitled to receive a dividend

make-whole payment, assuming, for calculation purposes, that the stated value of such Preferred Shares remained outstanding through and

including the one-year anniversary of the applicable date of conversion. The holders of the Preferred Shares are entitled to vote with

holders of the Common Stock on as as-converted basis, with the number of votes to which each holder of Preferred Shares is entitled to

be calculated assuming a conversion price of $1.36 per share, which was the Minimum Price (as defined in Rule 5635 of the Rules of

the Nasdaq Stock Market) applicable immediately before the execution and delivery of the Purchase Agreement, subject to certain beneficial

ownership limitations as set forth in the Certificate of Designations.

Notwithstanding

the foregoing, our ability to settle conversions and make amortization and dividend make-whole payments using shares of Common Stock is

subject to certain limitations set forth in the Certificate of Designations, including a limit on the number of shares that may be issued

until the time, if any, that our stockholders have approved the issuance of more than 19.99% of our issued and outstanding shares of Common

Stock in accordance with Nasdaq listing standards (the “Stockholder Approval”). We have agreed to seek stockholder approval

of these matters at a meeting to be held no later than June 1, 2025. Further, the Certificate of Designations contains a certain

beneficial ownership limitation after giving effect to the issuance of shares of Common Stock issuable upon conversion of the Preferred

Shares or as part of any amortization payment or dividend make-whole payment under the Certificate of Designations.

Notwithstanding

the foregoing, our ability to settle conversions and make amortization and dividend make-whole payments using shares of Common Stock is

subject to certain limitations set forth in the Certificate of Designations, including a limit on the number of shares that may be issued

until the time, if any, that our stockholders have approved the issuance of more than 19.99% of our outstanding shares of Common Stock

in accordance with Nasdaq listing standards (the “Stockholder Approval”). We have agreed to seek stockholder approval of these

matters at a meeting to be held no later than June 1, 2025. Further, the Certificate of Designations contains a certain beneficial

ownership limitation after giving effect to the issuance of shares of Common Stock issuable upon conversion of the Preferred Stock or

as part of any amortization payment or dividend make-whole payment under the Certificate of Designations.

Warrants

The Warrants are exercisable for shares of Common

Stock immediately, at an exercise price of $1.496 per share for the Series A Warrants and at an exercise price of $1.7952 per share

for the Series B Warrants and expire five years from the date of issuance. The exercise price of each Warrant is subject to customary

adjustments for stock dividends, stock splits, reclassifications, stock combinations and the like. Upon any such price-based adjustment

to the exercise price, the number of Warrant Shares issuable upon exercise of the Warrants will be increased proportionately. The exercise

price may also be voluntarily reduced by the Company to any amount and for any period of time with the prior written consent of the holders

of at least a majority of the outstanding Warrants, subject to the rules and regulations of Nasdaq. The Warrants may be exercised

for cash, provided that, if there is no effective registration statement available registering the exercise of the Warrants, the Warrants

may be exercised on a cashless basis.

Notwithstanding the foregoing, until such time

as we have received the Stockholder Approval, we cannot issue any Warrant Shares if the issuance of such Warrant Shares (taken together

with the issuance of any Conversion Shares or other shares of Common Stock issuable pursuant to the terms of the Certificate of Designations)

would exceed 19.99% of our issued and outstanding shares of Common Stock prior to the Private Placement, which amount is the aggregate

number of shares of Common Stock which we may issue under the rules or regulations of Nasdaq.

2023 Reverse Stock Split

On September 28, 2023, we effected a 1-for-20

reverse stock split (the “Reverse Stock Split”), whereby every twenty shares of our Common Stock were reduced to one share

of our Common Stock and the price per share of our Common Stock was multiplied by 20. All references to shares and per share amounts,

including shares of Common Stock underlying stock options, warrants, and applicable exercise prices, have been retroactively adjusted

for all periods presented herein to give effect to the Reverse Stock Split as required in accordance with US GAAP.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company”

and accordingly may provide less public disclosure than larger public companies. As a result, the information that we provide to our stockholders

may be different than you might receive from other public reporting companies in which you hold equity interests.

Corporate Information

We were incorporated in Delaware as a corporation

on January 9, 2006 and completed an initial public offering in June 2010. Our Common Stock which was previously listed since

January 8, 2018 under the trading symbol “XSPA” on The Nasdaq Capital Market, has been listed under the trading symbol

“XWEL” since October 25, 2022. Our principal executive offices are located at 254 West 31st Street, 11th Floor, New York,

New York 10001. Our telephone number is (212) 750-9595 and our website address is www.xwell.com. We also operate the websites www.xpresspa.com,

www.treat.com and www.xprescheck.com. Through our website, we will make available, free of charge, our annual report on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable

after such material is electronically filed with, or furnished to, the Securities and Exchange Commission, or SEC. Information contained

on, or that can be accessed through, our website is not and shall not be deemed to be a part of this prospectus.

The

Offering

| Common Stock to be Offered by the Selling Stockholders |

|

Up to an aggregate of 1,051,677 shares of Common

Stock, which are issuable to such selling stockholders pursuant to the terms of the Preferred Shares and Warrants. This amount is approximately

equal to 19.99% of our issued and outstanding shares of Common Stock immediately prior to the Private Placement, which amount is the aggregate

number of shares of Common Stock which we may currently issue upon conversion of the Preferred Shares and exercise of Warrants under the

rules or regulations of Nasdaq prior to obtaining the Stockholder Approval.

The terms of the Registration Rights Agreement

require us to register the number of shares of Common Stock equal to the sum of (i) 200% of the maximum number of Conversion Shares

issuable upon conversion of the Preferred Shares (assuming for purposes hereof that (x) the Preferred Shares are convertible at the

Floor Price, and (y) any such conversion shall not take into account any limitations on the conversion of the Preferred Shares set

forth in the Certificate of Designations, and (ii) 200% of the maximum number of Warrant Shares issuable upon exercise of the Warrants

issued to the Investors (without taking into account any limitations on the exercise of such Warrants set forth therein), in each case

subject to the adjustments set forth in the Certificate of Designations and Warrants.

If we obtain the Stockholder Approval, we intend

to amend the registration statement of which this prospectus is a part to increase the number of shares of Common Stock registered hereunder

to the extent necessary to comply with the terms of the Registration Rights Agreements. |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of the Conversion Shares and Warrant Shares by the selling stockholders. However, we will receive proceeds from the exercise of the Warrants if such warrants are exercised for cash. We currently intend to use such proceeds for general corporate purposes. |

| Plan of Distribution |

|

The selling stockholders named in this prospectus,

or their pledgees, donees, transferees, distributees, beneficiaries or other successors-in-interest, may offer or sell the shares of Common

Stock from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices

or at privately negotiated prices. The selling stockholders may also resell the shares of Common Stock to or through underwriters, broker-dealers

or agents, who may receive compensation in the form of discounts, concessions or commissions.

See “Plan of Distribution” beginning

on page 17 of this prospectus for additional information on the methods of sale that may be used by the selling stockholders. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “XWEL.” |

| |

|

|

| Risk Factors |

|

Investing in our Common

Stock involves significant risks. See “Risk Factors” beginning on page 10 of this prospectus and the documents

incorporated by reference in this prospectus. |

Risk

Factors

Investing in our securities involves a high

degree of risk. In addition to the other information contained in this prospectus and in the documents we incorporate by reference, you

should carefully consider the risks discussed below and under the heading “Risk Factors” in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, as well as any amendment or update to our risk factors reflected in subsequent filings

with the SEC, before making a decision about investing in our securities. The risks and uncertainties discussed below and in the documents

incorporated by reference are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently

see as immaterial, may also harm our business. If any of these risks occur, our business, financial condition and operating results could

be harmed, the trading price of our Common Stock could decline and you could lose part or all of your investment.

Risks Related to this Offering and Our Common

Stock

The issuance of the shares of Common Stock

covered by this prospectus could significantly increase the total number of shares of Common Stock issued and outstanding and thereby

cause our existing stockholders to experience substantial dilution.

The shares of Common Stock being offered pursuant

to this prospectus represent Conversion Shares issuable upon the conversion of our Preferred Shares and Warrant Shares issuable upon the

exercise of the Warrants. As of February 7, 2025 there were 5,261,024 shares of Common Stock issued and outstanding (prior to any

deemed issuance of any Conversion Shares or Warrant Shares). If we are required to issue the maximum number of Conversion Shares and Warrant

Shares that are being registered hereunder, the number of shares of Common Stock issued and outstanding after such issuance would represent

approximately 120% of the number of shares of Common Stock issued and outstanding as of the date of this prospectus. As a result, an existing

stockholder’s proportionate interest in us will be substantially diluted. The actual number of shares of Common Stock that we issue

to the selling stockholders may be less than the aggregate number of shares covered by this prospectus.

The Certificate of Designations provides

for amortization payments to be issued in the form of shares of Common Stock at a conversion price that varies with the trading price

of our Common Stock. This feature may result in a greater number of shares of Common Stock being issued upon conversions than if the conversions

were effected at the conversion price in effect as of the date of this prospectus. Sales of these shares will dilute the interests of

other security holders and may depress the price of our Common Stock and make it difficult for us to raise additional capital.

The Certificate of Designations for our Preferred

Shares provides for the payment of amortization payments to the holder of our Preferred Shares in cash or shares of Common Stock, or a

combination thereof, at the Company’s option. If the Company elects to pay any dividends in shares of Common Stock, the conversion

price used to calculate the number of shares issuable will equal to the greater of (A) 80% of the average of the three lowest closing

prices of our Common Stock during the thirty consecutive trading day period ending and including the trading day immediately prior to

the date the amortization payment is due or (B) the lower of (x) $0.272 and (y) 20% of the Minimum Price on the Stockholder

Approval Date or, in any case, such lower amount as permitted, from time to time, by the Nasdaq Capital Market. The potential for such

additional issuances below the Conversion Price as of the date of this prospectus may depress the price of our Common Stock regardless

of our business performance. We may find it more difficult to raise additional equity capital while any of our Preferred Shares is outstanding.

The Certificate of Designations provides

for the payment of dividends in cash or in shares of our Common Stock, or a combination thereof, and we may not be permitted to pay such

dividends in cash, which will require us to have shares of Common Stock available to pay the dividends.

Each share of the Preferred Shares is entitled

to receive cumulative dividends at the rate per share of 8% per annum of the stated value per share, compounded each calendar quarter.

The dividends are payable in cash, out of any funds legally available for such purpose, or shares of Common Stock in the case of an Installment

Conversion (as defined in the Certificate of Designations). We will not be permitted to pay the amortization in cash unless we are legally

permitted to do so under Delaware law. As such, we may rely on having available shares of Common Stock to pay such amortization, which

will result in dilution to our shareholders. If we do not have such available shares, we may not be able to satisfy our amortization obligations.

Substantial future sales or other issuances

of our Common Stock could depress the market for our Common Stock.

Sales of a substantial number of shares of our

Common Stock and any future sales of a substantial number of shares of Common Stock in the public market, including the issuance of shares

or any shares issuable upon conversion of the Preferred Shares or exercise of the Warrants, or the perception by the market that those

sales could occur, could cause the market price of our Common Stock to decline or could make it more difficult for us to raise funds through

the sale of equity and equity-related securities in the future at a time and price that our management deems acceptable, or at all. In

addition, as opportunities present themselves, we may enter into financing or similar arrangements in the future, including the issuance

of debt securities, preferred stock or Common Stock, which could also depress the market for our Common Stock. We cannot predict the effect,

if any, that market sales of those shares of Common Stock or the availability of those shares for sale will have on the market price of

our Common Stock.

You may experience future dilution as a

result of future equity offerings and other issuances of our securities.

In order to raise additional capital, we may in

the future offer additional shares of Common Stock or other securities convertible into or exchangeable for our Common Stock prices that

may not be the same as the price per share paid by the investors in this offering. We may not be able to sell shares or other securities

in any other offering at a price per share that is equal to or greater than the price per share paid by the investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share

at which we sell additional shares of Common Stock or securities convertible into shares of Common Stock in future transactions may be

higher or lower than the price per share paid to the selling stockholders. Our stockholders will incur dilution upon exercise of any outstanding

stock options, warrants or other convertible securities or upon the issuance of shares of Common Stock under our stock incentive programs.

Any additional capital raised through the sale

of equity or equity-backed securities may dilute our stockholders’ ownership percentages and could also result in a decrease in

the market value of our equity securities.

The terms of any securities issued by us in future

capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants

or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then outstanding.

In addition, we may incur substantial costs in

pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing

and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities

we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Special

Note Regarding Forward-Looking Statements

This prospectus and the information incorporated

by reference in this prospectus contain “forward-looking statements,” which include information relating to future events,

future financial performance, strategies, expectations, competitive environment and regulation. Our use of the words “may,”

“will,” “would,” “could,” “should,” “believes,” “estimates,” “projects,”

“potential,” “expects,” “plans,” “seeks,” “intends,” “evaluates,”

“pursues,” “anticipates,” “continues,” “designs,” “impacts,” “forecasts,”

“target,” “outlook,” “initiative,” “objective,” “designed,” “priorities,”

“goal” or the negative of those words or other similar expressions is intended to identify forward-looking statements that

represent our current judgment about possible future events. Forward-looking statements should not be read as a guarantee of future performance

or results and will probably not be accurate indications of when such performance or results will be achieved. All statements included

or incorporated by reference in this prospectus, and in related comments by our management, other than statements of historical facts,

including without limitation, statements about future events or financial performance, are forward-looking statements that involve certain

risks and uncertainties.

These statements are based on certain assumptions

and analyses made in light of our experience and perception of historical trends, current conditions and expected future developments

as well as other factors that we believe are appropriate in the circumstances. While these statements represent our judgment on what the

future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results.

Whether actual future results and developments will conform with our expectations and predictions is subject to a number of risks and

uncertainties, including the risks and uncertainties discussed in this prospectus, any prospectus supplement and the documents incorporated

by reference under the captions “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and elsewhere

in those documents.

Consequently, all of the forward-looking statements

made in this prospectus as well as all of the forward-looking statements incorporated by reference to our filings under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), are qualified by these cautionary statements and there can be no assurance

that the actual results or developments that we anticipate will be realized or, even if realized, that they will have the expected consequences

to or effects on us and our subsidiaries or our businesses or operations. We caution investors not to place undue reliance on forward-looking

statements. We undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new

information, future events, or other such factors that affect the subject of these statements, except where we are expressly required

to do so by law.

Use

of Proceeds

All shares of our Common Stock offered by this

prospectus are being registered for the accounts of the selling stockholders and we will not receive any proceeds from the sale of these

shares. However, we will receive proceeds from the exercise of the Warrants if the Warrants are exercised for cash. We intend to use those

proceeds, if any, for general corporate purposes. The holders of the Warrants are not obligated to exercise their Warrants for cash, and

we cannot predict whether holders of the Warrants will choose to exercise all or any of their Warrants for cash.

Selling

Stockholders

Unless the context otherwise requires, as used

in this prospectus, “selling stockholders” includes the selling stockholders listed below and donees, pledgees, transferees

or other successors-in-interest selling shares received after the date of this prospectus from the selling stockholders as a gift, pledge

or other non-sale related transfer.

We have prepared this prospectus to allow the

selling stockholders or their successors, assignees or other permitted transferees to sell or otherwise dispose of, from time to time,

up to 1,051,677 shares of our Common Stock.

The Common Stock being offered by the selling

stockholders are those issuable to the selling stockholders upon conversion of the Preferred Shares and exercise of the Warrants. For

additional information regarding the issuance of the Preferred Shares and the Warrants, see “Private Placement of Preferred Shares

and Warrants” above. We are registering the Conversion Shares and Warrant Shares in order to permit the selling stockholders to

offer the shares for resale from time to time. The selling stockholders may also sell, transfer or otherwise dispose of all or a portion

of their shares in transactions exempt from the registration requirements of the Securities Act, or pursuant to another effective registration

statement covering those shares.

Relationships with the Selling Stockholders

Except for the ownership of the Preferred Shares

and the Warrants issued pursuant to the Purchase Agreement and, except as disclosed in our periodic reports and current reports filed

with the SEC from time to time, the selling stockholders have not had any material relationship with us within the past three years.

Information About Selling Stockholders Offering

The table below lists the selling stockholders

and other information regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act and the rules and

regulations thereunder) of the shares of Common Stock held by each of the selling stockholders. The second column (titled “Number

of Shares of Common Stock Owned Prior to Offering”) lists the number of shares of Common Stock beneficially owned by the selling

stockholders, based on their respective ownership of shares of Common Stock, Preferred Shares and Warrants as of February 7, 2025,

assuming conversion of the Preferred Shares and exercise of the Warrants and any other warrants held by each such selling stockholder

on that date, but taking account of any limitations on conversion and exercise set forth therein.

The third column (titled “Maximum Number

of Shares of Common Stock to be Sold Pursuant to this Prospectus”) lists the shares of Common Stock being offered by this prospectus

by the selling stockholders and does not take in account any limitations on (i) conversion of the Preferred Shares set forth therein

or (ii) exercise of the Warrants set forth therein.

The third, fourth and fifth columns (titled “Number

of Shares of Common Stock Owned After Offering” and “Percentage of Common Stock Owned After Offering”) assume the conversion

of the Preferred Shares at the Conversion Price and exercise of the Warrants at the exercise price and the sale of all of the shares offered

by the selling stockholders pursuant to this prospectus. Because the Conversion Price of the Preferred Shares and the exercise price of

the Warrants may be adjusted, the number of shares that will actually be issued may be more or less than the number of shares being offered

by this prospectus.

This prospectus covers the resale of approximately

19.99% of our issued and outstanding shares of Common Stock immediately prior to the Private Placement, which amount is the aggregate

number of shares of Common Stock which we may currently issue upon conversion of the Preferred Shares and exercise of Warrants under the

rules or regulations of Nasdaq prior to obtaining the Stockholder Approval.

The terms of the Registration Rights Agreement

require us to register the number of shares of Common Stock equal to the sum of (i) 200% of the maximum number of Conversion Shares

issuable upon conversion of the Preferred Shares (assuming for purposes hereof that (x) the Preferred Shares are convertible at the

Floor Price, and (y) any such conversion shall not take into account any limitations on the conversion of the Preferred Shares set

forth in the Certificate of Designations, and (ii) 200% of the maximum number of Warrant Shares issuable upon exercise of the Warrants

issued to the Investors (without taking into account any limitations on the exercise of such Warrants set forth therein), in each case

subject to the adjustments set forth in the Certificate of Designations and Warrants.

If we obtain the Stockholder Approval, we intend

to amend the registration statement of which this prospectus is a part to increase the number of shares of Common Stock registered hereunder

to the extent necessary to comply with the terms of the Registration Rights Agreements.

Under the terms of the Certificate of Designations

and the Warrants, a selling stockholder, may not convert the Preferred Shares or exercise the Warrants to the extent (but only to the

extent) such selling stockholder or any of its affiliates would beneficially own a number of shares of our shares of Common Stock which

would exceed 4.99%, of the outstanding shares of the Company. The number of shares in the second column reflects these limitations. The

selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling

Stockholder |

|

Number of

Shares of

Common

Stock Owned

Prior to

Offering (1) |

|

|

Maximum

Number

of

Shares of

Common

Stock to be

Sold

Pursuant to

this Prospectus |

|

|

Number of

shares of

Common

Stock Owned

After

Offering |

|

|

Percentage of

Common

Stock Owned

After

Offering |

| Iroquois Capital Investment Group, LLC (2) |

|

|

758,392 |

|

|

|

729,601 |

|

|

|

28,791 |

|

|

* |

| Iroquois Master Fund Ltd. (3) |

|

|

322,076 |

|

|

|

322,076 |

|

|

|

- |

|

|

* |

* Less than 1%

| (1) | This table and the information in the notes below are based upon information available to the Company

and upon 5,261,024 shares of Common Stock issued and outstanding as of February 7, 2025 (prior to any deemed issuance of any Conversion

Shares or Warrant Shares). Except as expressly noted in the footnotes below, beneficial ownership has been determined in accordance with

Rule 13d-3 under the Exchange Act. The amounts set forth in this column reflect the application of various limitations on the issuance

of Conversion Shares and Warrant Shares in the Certificate of Designations and the Warrants, respectively, including beneficial ownership

limitations and limitations under the rules or regulations of Nasdaq. |

| (2) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common

Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially

owned by the selling stockholder. |

The shares are held directly by Iroquois

Capital Investment Group, LLC, a limited liability company (“ICIG”). Richard Abbe is the managing member of ICIG. Mr. Abbe

has voting control and investment discretion over securities held by ICIG. As such, Mr. Abbe may be deemed to be the beneficial owner

(as determined under Section 13(d) of the Exchange Act) of the securities held by ICIG. Mr. Abbe disclaims beneficial ownership

over the securities listed except to the extent of his pecuniary interest therein. ICIG’s address is 2 Overhill Road, Suite 400,

Scarsdale, NY 10583.

| (3) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common

Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially

owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of 28,791 shares of common

stock |

The shares are held directly by Iroquois

Master Fund Ltd. (“IMF”). Iroquois Capital Management L.L.C. is the investment manager of IMF. Iroquois Capital Management,

LLC has voting control and investment discretion over securities held by IMF. As Managing Members of Iroquois Capital Management, LLC,

Richard Abbe and Kimberly Page make voting and investment decisions on behalf of Iroquois Capital Management, LLC in its capacity

as investment manager to IMF. As a result of the foregoing, Mr. Abbe and Mrs. Page may be deemed to have beneficial ownership

(as determined under Section 13(d) of the Exchange Act) of the securities held by Iroquois Capital Management and IMF. Each

of Iroquois Capital Management, LLC, Mr. Abbe and Ms. Page disclaims beneficial ownership over the securities listed except

to the extent of their pecuniary interest therein. IMF’s address is 2 Overhill Road, Suite 400, Scarsdale, NY 10583

Plan

of Distribution

We are registering the shares of Common Stock

issuable upon conversion of the Preferred Shares and exercise of the Warrants to permit the resale of these shares of Common Stock by

the holders of the Preferred Shares and Warrants from time to time after the date of this prospectus. We will not receive any of the proceeds

from the sale by the selling stockholders of the shares of Common Stock, although we will receive the exercise price of any Warrants not

exercised by the selling stockholders on a cashless exercise basis. We will bear all fees and expenses incident to our obligation to register

the shares of Common Stock.

Each selling stockholder of the securities and

any of their pledgees, assignees and successors-in-interest may sell all or a portion of the shares of Common Stock held by them and offered

hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold

through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s

commissions. The shares of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time

of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which

may involve crosses or block transactions, pursuant to one or more of the following methods:

| · |

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| |

|

| · |

in the over-the-counter market; |

| |

|

| · |

in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| |

|

| · |

through the writing or settlement of options, whether such options are listed on an options exchange or otherwise; |

| |

|

| · |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

| · |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

| · |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

| · |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

| · |

privately negotiated transactions; |

| |

|

| · |

short sales made after the date the Registration Statement is declared effective by the SEC; |

| |

|

| · |

broker-dealers may agree with a selling security holder to sell a specified number of such shares at a stipulated price per share; |

| |

|

| · |

a combination of any such methods of sale; and |

| |

|

| · |

any other method permitted pursuant to applicable law |

The selling stockholders may also sell securities

under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

In addition, the selling stockholders may transfer

the securities by other means not described in this prospectus. If the selling stockholders effect such transactions by selling securities

to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form

of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the securities for whom they

may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers

or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the securities or otherwise,

the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the securities

in the course of hedging in positions they assume. The selling stockholders may also sell securities short and deliver securities covered

by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders

may also loan or pledge securities to broker-dealers that in turn may sell such securities.

The selling stockholders may pledge or grant a

security interest in some or all of the securities owned by them and, if they default in the performance of their secured obligations,

the pledgees or secured parties may offer and sell the securities from time to time pursuant to this prospectus or any amendment to this

prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling

stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling

stockholders also may transfer and donate the securities in other circumstances in which case the transferees, donees, pledgees or other

successors in interest will be the selling beneficial owners for purposes of this prospectus.

To the extent required by the Securities Act and

the rules and regulations thereunder, the selling stockholders and any broker-dealer participating in the distribution of the securities

may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or

concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At

the time a particular offering of securities is made, a prospectus supplement, if required, will be distributed, which will set forth

the aggregate amount of securities being offered and the terms of the offering, including the name or names of any broker-dealers or agents,

any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions

allowed or re-allowed or paid to broker-dealers.

Under the securities laws of some states, the

securities may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the securities

may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification

is available and is complied with.

There can be no assurance that any selling stockholder

will sell any or all of the securities registered pursuant to the registration statement of which this prospectus forms a part.

The selling stockholders and any other person

participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder,

including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and

sales of any of the shares of securities by the selling stockholders and any other participating person. To the extent applicable, Regulation

M may also restrict the ability of any person engaged in the distribution of the securities to engage in market-making activities with

respect to such securities. All of the foregoing may affect the marketability of the securities and the ability of any person or entity

to engage in market-making activities with respect to the securities.

We will pay all expenses of the registration

of the securities pursuant to the Registration Rights Agreements, estimated to be $ 42,193 in total, including, without limitation,

SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, a selling

stockholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the selling stockholders against

liabilities, including some liabilities under the Securities Act in accordance with the Registration Rights Agreements or the

selling stockholders will be entitled to contribution. We may be indemnified by the selling stockholders against civil liabilities,

including liabilities under the Securities Act that may arise from any written information furnished to us by the selling

stockholder specifically for use in this prospectus, in accordance with the related registration rights agreements or we may be

entitled to contribution.

Once sold under the registration statement, of

which this prospectus forms a part, the securities will be freely tradable in the hands of persons other than our affiliates.

Legal

Matters

The validity of the securities offered by this

prospectus will be passed upon for us by Haynes and Boone, LLP, New York, New York.

Experts

The consolidated balance sheets of XWELL, Inc.

and subsidiaries as of December 31, 2023 and 2022, and the related consolidated statements of operations and comprehensive loss,

equity and cash flows for each of the two years in the period ended December 31, 2023, and the related notes have been audited by

Marcum LLP, independent registered public accounting firm, as stated in their report which is incorporated herein by reference. Such consolidated

financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts

in accounting and auditing.

Where

You Can Find More Information

We have filed with the SEC a registration statement

on Form S-3 under the Securities Act with respect to the securities offered by this prospectus. This prospectus, filed as part of

the registration statement, does not contain all the information set forth in the registration statement and its exhibits and schedules,

portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us, we refer

you to the registration statement and to its exhibits and schedules.

We file annual, quarterly and current reports

and other information with the SEC. The SEC maintains an internet website at www.sec.gov that contains periodic and current reports, proxy

and information statements, and other information regarding registrants that are filed electronically with the SEC.

These documents are also available, free of charge,

through the Investors section of our website, which is located at www.xwell.com. Information contained on our website is not incorporated

by reference into this prospectus and you should not consider information on our website to be part of this prospectus.

Incorporation

of Certain Information by Reference

The SEC allows us to “incorporate by reference”

the information we have filed with it, which means that we can disclose important information to you by referring you to those documents.

The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will

automatically update and supersede this information. We incorporate by reference the documents listed below and any future documents (excluding

information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we file with the SEC pursuant to Sections 13(a), 13(c), 14 or

15(d) of the Securities Exchange Act of 1934, as amended, subsequent to the date of this prospectus and prior to the termination

of the offering:

| · |

our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 16, 2024, as amended by our report on Form 10-K/A, filed with the SEC on April 17, 2024, and as amended by our report on Form 10-K/A, filed with the SEC on April 29, 2024; |

| |

|

| · |

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 15, 2024, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 14, 2024 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 14, 2024; |

| |

|

| · |

our Current Reports on Form 8-K and Form 8-K/A filed with the SEC on February 2, 2024, March 12, 2024, April 12, 2024, May 21, 2024, July 22, 2024, August 7, 2024, August 16, 2024, September 5, 2024, September 23, 2024, January 7, 2025 and January 15, 2025; and |

| |

|

| · |

the description of our common stock contained in our Form 8-A filed with the SEC on June 16, 2010, as amended by Exhibit 4.15 to our Annual Report on Form 10-K, as amended, for the fiscal year ended December 31, 2023, as amended, including any amendments thereto or reports filed for the purposes of updating this description. |

All filings filed by us pursuant to the Securities

Exchange Act of 1934, as amended, after the date of the initial filing of this registration statement and prior to the effectiveness of

such registration statement (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) shall also be deemed to

be incorporated by reference into the prospectus.

You should rely only on the information incorporated

by reference or provided in this prospectus. We have not authorized anyone else to provide you with different information. Any statement

contained in a document incorporated by reference into this prospectus will be deemed to be modified or superseded for the purposes of

this prospectus to the extent that a later statement contained in this prospectus or in any other document incorporated by reference into

this prospectus modifies or supersedes the earlier statement. Any statement so modified or superseded will not be deemed, except as so

modified or superseded, to constitute a part of this prospectus. You should not assume that the information in this prospectus is accurate

as of any date other than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

We will provide without charge to each person

to whom a copy of this prospectus is delivered, upon written or oral request, a copy of any or all of the reports or documents that have

been incorporated by reference in this prospectus but not delivered with this prospectus (other than an exhibit to these filings, unless

we have specifically incorporated that exhibit by reference in this prospectus). Any such request should be addressed to us at:

XWELL, Inc.

254 West 31st Street,

11th Floor

New York, New York 10001

(212) 750-9595

You may also access the documents incorporated

by reference in this prospectus through our website at www.xwell.com. Except for the specific incorporated documents listed above, no

information available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of

which it forms a part.

1,051,677 Shares

XWELL, Inc.

COMMON STOCK

PROSPECTUS

Part II:

Information

Not Required in Prospectus

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the various costs

and expenses payable by us in connection with the sale of the securities being registered. All such costs and expenses shall be borne

by us. Except for the Securities and Exchange Commission registration fee, all the amounts shown are estimates.

| Securities and Exchange Commission Registration Fee |

| |

$ |

193 | |

| Printing and engraving costs |

| |

|

- | |

| Legal fees and expenses |

| |

|

25,000 | |

| Accounting fees and expenses |

| |

|

15,000 | |

| Miscellaneous Fees and Expenses |

| |

|

2,000 | |

| Total |

| |

$ |

42,193 | |

Item 15. Indemnification of Directors and Officers

Section 102 of the Delaware General Corporation

Law (“DCGL”) allows a corporation to eliminate the personal liability of directors of a corporation to the corporation or

its stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his duty of loyalty,

failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved

a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit.

Section 145 of the DCGL provides that a corporation

has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving at the request

of the corporation in related capacities against amounts paid and expenses incurred in connection with an action or proceeding to which

he is or is threatened to be made a party by reason of such position, if such person shall have acted in good faith and in a manner he

reasonably believed to be in, or not opposed to, the best interests of the corporation, and, in any criminal proceeding, if such person

had no reasonable cause to believe his conduct was unlawful; provided that, in the case of actions brought by or in the right of the corporation,

no indemnification shall be made with respect to any matter as to which such person shall have been adjudged to be liable to the corporation

unless and only to the extent that the adjudicating court determines that such indemnification is proper under the circumstances.

Our amended and restated certificate of incorporation

contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently,

our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors,

except liability for:

| • | any breach of the director’s duty of loyalty to us or our stockholders; |

| • | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of

law; |

| • | unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174

of the DGCL; or |

| • | any transaction from which the director derived an improper personal benefit. |