0001174922false00011749222024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 8, 2024

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 000-50028 | 46-0484987 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| 3131 Las Vegas Boulevard South | | |

| Las Vegas, | Nevada | | 89109 |

| (Address of principal executive offices) | | (Zip Code) |

(702) 770-7555

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 | | WYNN | | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On February 8, 2024, Wynn Resorts, Limited (“Wynn Resorts”) issued a press release announcing that its indirect wholly-owned subsidiary, Wynn Las Vegas, LLC (“Wynn Las Vegas”), has commenced a cash tender offer to purchase up to $800 million in aggregate principal amount of Wynn Las Vegas and Wynn Las Vegas Capital Corp.’s outstanding 5.500% Senior Notes due 2025. A copy of the press release is attached hereto as Exhibit 99.1 and is hereby incorporated by reference.

Forward-Looking Statements

This Report, including Exhibit 99.1, contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based upon management’s current expectations, beliefs, assumptions and estimates, and on information currently available to us, all of which are subject to change, and are not guarantees of timing, future results or performance. These forward-looking statements involve certain risks and uncertainties and other factors that could cause actual results to differ materially from those indicated in such forward-looking statements, as discussed further in the attached press release.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | WYNN RESORTS, LIMITED |

| | |

| Dated: February 8, 2024 | | By: | | /s/ Julie Cameron-Doe |

| | | | Julie Cameron-Doe |

| | | | Chief Financial Officer |

Wynn Resorts Announces Commencement of Tender Offer for Cash by Wynn Las Vegas, LLC for its 5.500% Senior Notes due 2025

LAS VEGAS, February 8, 2024 (BUSINESS WIRE) — Wynn Resorts, Limited (NASDAQ:WYNN) (“Wynn Resorts”) announced today that its indirect wholly-owned subsidiary, Wynn Las Vegas, LLC (“Wynn Las Vegas”) has commenced a cash tender offer (the “Tender Offer”) to purchase a portion of Wynn Las Vegas and Wynn Las Vegas Capital Corp.’s (collectively, the “Issuers”) 5.500% Senior Notes due 2025 (the “Notes”) in a principal amount of up to $800 million, exclusive of any applicable premiums paid in connection with the Tender Offer and accrued and unpaid interest. The terms and conditions of the Tender Offer are set forth in an Offer to Purchase, dated February 8, 2024 (the “Offer to Purchase”), which is being sent to all registered holders (collectively, the “Holders”) of Notes.

| | | | | | | | | | | | | | | | | | | | | | | |

Title of Security

| Issuers

| CUSIP Numbers (1)

| Principal Amount Outstanding (2)

| Tender Cap

| Base Consideration (3)(4)

| Early Tender Premium (3)

| Total Consideration (3)(4)

|

5.500% Senior Notes due 2025

| Wynn Las Vegas, LLC

Wynn Las Vegas Capital Corp.

| 983130 AV7

U98347 AK0

| $1,400,001,000

| $800,000,000

| $972.17

| $30.00

| $1002.17

|

(1) No representation is made as to the correctness or accuracy of the CUSIP numbers listed in this press release, the Offer to Purchase or printed on the Notes. They are provided solely for the convenience of Holders of the Notes.

(2) Includes $20.0 million in principal balance of Notes held by Wynn Resorts. Wynn Resorts will not participate in this Offer.

(3) Per $1,000 principal amount of Notes.

(4) Excludes Accrued Interest, which will be paid in addition to the Base Consideration or the Total Consideration, as applicable.

Holders of Notes must validly tender and not validly withdraw their Notes on or before 5:00 p.m., New York City time, on February 22, 2024, unless extended (such date and time, as the same may be extended, the “Early Tender Time”) in order to be eligible to receive the Total Consideration. Holders of Notes who validly tender their Notes after the Early Tender Time and on or before the Expiration Time (as defined below) will be eligible to receive only the applicable Base Consideration, which is equal to the Total Consideration minus the Early Tender Premium, as set forth in the table above. In addition to the applicable consideration, Holders whose Notes are accepted for purchase in the Tender Offer will receive accrued and unpaid interest to, but excluding, the date on which the Tender Offer is settled (“Accrued Interest”). The settlement date for Notes validly tendered and accepted for purchase before the Early Tender Time (if Wynn Las Vegas, LLC elects to do so) is currently expected to be on or about February 23, 2024 and the final settlement date, if any, is expected to be March 11, 2024.

The Tender Offer is scheduled to expire at 5:00 P.M., New York City time, on March 8, 2024 unless extended or earlier terminated (such date and time, as the same may be extended, the “Expiration Time”). As set forth in the Offer to Purchase, validly tendered Notes may be validly withdrawn at any time on or before 5:00 p.m., New York City time, on February 22, 2024, unless extended (the “Withdrawal Deadline”).

Completion of the Tender Offer is subject to certain market and other conditions, including Wynn Resorts Finance, LLC and Wynn Resorts Capital Corp.’s (the “New Notes Issuers”) arranging their new debt financing on terms satisfactory to them and receipt of the net proceeds therefrom. Wynn Las Vegas reserves the right, in its sole discretion, to waive any and all conditions to the Tender Offer with respect to the Notes.

If any Notes are validly tendered and the principal amount of such tendered Notes exceeds the Tender Cap as set forth in the table above, any principal amount of the Notes accepted for payment and purchased, on the terms and subject to the conditions of the Tender Offer, will be prorated based on the principal amount of validly tendered Notes, subject to the Tender Cap and any prior purchase of Notes on any day following the Early Tender Date and prior to the Expiration Date.

Any Notes that are validly tendered at or prior to the Early Tender Date (and not validly withdrawn at or prior to the Withdrawal Deadline) will have priority over any Notes that are validly tendered after the Early Tender Date. Accordingly, if the principal amount of any Notes validly tendered at or prior to the Early Tender Date (and not validly withdrawn at or prior to the Withdrawal Deadline) and accepted for purchase equals or exceeds the Tender Cap, no Notes validly tendered after the Early Tender Date will be accepted for purchase.

This press release shall not constitute an offer to purchase or the solicitation of an offer to sell the Notes. The complete terms and conditions of the Tender Offer are described in the Offer to Purchase, a copy of which may be obtained from D.F. King & Co., Inc., the tender and information agent for the Tender Offer, at wynn@dfking.com, by telephone at (866) 796-3441 (U.S. toll free) and (212) 269-5550 (banks and brokers) or in writing at D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005, Attention: Michael Horthman.

Wynn Las Vegas has engaged Deutsche Bank Securities Inc. and Scotia Capital (USA) Inc. to act as the dealer managers in connection with the Tender Offer. Questions regarding the terms of the Tender Offer may be directed to Deutsche Bank Securities Inc. by telephone at (855) 287-1922 (U.S. toll-free) and (212) 250-7527 (collect) or Scotia Capital (USA) Inc. by telephone at (833) 498-1660.

Forward-Looking Statements

This release contains forward-looking statements, including those related to the tender for Notes and whether or not Wynn Las Vegas will consummate the Tender Offer. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those we express in these forward-looking statements, including, but not limited to, reductions in discretionary consumer spending, adverse macroeconomic conditions and their impact on levels of disposable consumer income and wealth, changes in interest rates, inflation, a decline in general economic activity or recession in the U.S. and/or global economies, extensive regulation of our business, pending or future legal proceedings, ability to maintain gaming licenses and concessions, dependence on key employees, general global political conditions, adverse tourism trends, travel disruptions caused by events outside of our control, dependence on a limited number of resorts, competition in the casino/hotel and resort industries, uncertainties over the development and success of new gaming and resort properties, construction and regulatory risks associated with current and future projects (including Wynn Al Marjan Island), cybersecurity risk and our leverage and ability to meet our debt service obligations. Additional information concerning potential factors that could affect Wynn Resorts’ financial results is included in Wynn Resorts’ Annual Report on Form 10-K for the year ended December 31, 2022, as supplemented by Wynn Resorts’ other periodic reports filed with the Securities and Exchange Commission from time to time. Neither Wynn Resorts nor Wynn Las Vegas are under any obligation to (and expressly disclaim any such obligation to) update or revise their forward-looking statements as a result of new information, future events or otherwise, except as required by law.

SOURCE:

Wynn Resorts, Limited

CONTACT:

Price Karr

702-770-7555

investorrelations@wynnresorts.com

v3.24.0.1

Document and Entity Information

|

Feb. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 08, 2024

|

| Entity Registrant Name |

WYNN RESORTS, LIMITED

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-50028

|

| Entity Tax Identification Number |

46-0484987

|

| Entity Address, Address Line One |

3131 Las Vegas Boulevard South

|

| Entity Address, City or Town |

Las Vegas,

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89109

|

| City Area Code |

702

|

| Local Phone Number |

770-7555

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

WYNN

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001174922

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

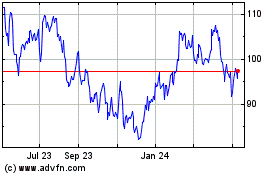

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Oct 2024 to Nov 2024

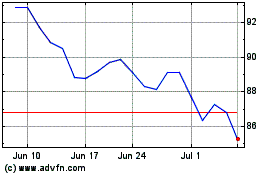

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Nov 2023 to Nov 2024