WSFS Bank Offers Down Payment Assistance Through 2025 Mortgage Grant Program with $1.5 Million Commitment

February 12 2025 - 11:37AM

Business Wire

Program has provided more than $4 million in grants since launch

three years ago.

WSFS Bank, the primary subsidiary of WSFS Financial Corporation

(Nasdaq: WSFS), today announced the launch of its 2025 WSFS Down

Payment Grant Program, reaffirming its commitment to making the

dream of homeownership a reality for individuals and families in

the community. With $1.5 million in grants available for 2025, WSFS

continues its mission to help those with limited savings secure

safe and affordable housing.

Since the program’s launch three years ago, WSFS has provided

over $4 million in grants to assist homebuyers, significantly

reducing barriers to homeownership. This initiative has made a

lasting impact, helping countless families find a place to call

home.

“We understand that purchasing a home can be a challenging

process, especially for first-time buyers,” says Ron Dutton, Senior

Vice President, Director, Community Reinvestment for WSFS Bank.

“With initiatives like this, we aim to simplify the process and

empower more people to achieve their dreams of homeownership.”

The program offers qualified borrowers up to $5,0001 in

assistance for down payment and/or closing costs. Designed for

individuals and families with limited savings, the program provides

flexible guidelines and competitive mortgage rates tailored to meet

the needs of each Customer.

Key program features include:

- No required repayment for grant funds awarded.2

- Flexible guidelines to accommodate various borrower

needs.

- Homebuyer education programs to prepare first-time

homebuyers.

- 6% seller’s assist, depending on the borrower’s down

payment.

- Ability to combine with other programs, such as the WSFS

Neighborhood Opportunity Program.

- Competitive mortgage rates and exemplary customer

service.

- A complimentary financial plan and consultation from

Bryn Mawr Trust.

To be eligible for a WSFS Down Payment Grant, total household

income must be at 100% or below the Area Median Income (AMI)

and the property must be located in Majority-Minority Census Tracts

(MMCT) within the following counties in the Greater Philadelphia

and Delaware region:

- Delaware – Kent, New Castle and Sussex

- New Jersey – Burlington and Camden

- Pennsylvania – Bucks, Chester, Delaware, Montgomery and

Philadelphia

For more information, visit

https://www.wsfsbank.com/borrowing/mortgages/affordable-mortgage.

To speak with a WSFS representative about the Down Payment Grant

Program, call 855.901.9737 or call 888.456.0146 to discuss the

Neighborhood Opportunity Program.

1May vary based on program underwriting guidelines. Home must be

a primary residence located in a census tract where the population

is at least a 50% majority minority census tract and the total

household income cannot exceed 100% of the Area Median Income (AMI)

of the census tract as determined by the HUD published 1 to 4

household member Area Median Income.

21099-MISC will be issued to borrower on awarded funds. WSFS

Bank will leverage other down payment and/or closing costs Grant

programs prior to deployment (or use) of WSFS Grant Funds. WSFS

Grant funds awarded while funds last for the award program year.

Loan program is subject to change. Offer subject to credit

approval.

About WSFS Financial Corporation WSFS Financial

Corporation is a multibillion-dollar financial services company.

Its primary subsidiary, WSFS Bank, is the oldest and largest

locally headquartered bank and trust company in the Greater

Philadelphia and Delaware region. As of December 31, 2024, WSFS

Financial Corporation had $20.8 billion in assets on its balance

sheet and $89.4 billion in assets under management and

administration. WSFS operates from 114 offices, 88 of which are

banking offices, located in Pennsylvania (57), Delaware (39), New

Jersey (14), Florida (2), Nevada (1) and Virginia (1) and provides

comprehensive financial services including commercial banking,

consumer banking, treasury management and trust and wealth

management. Other subsidiaries or divisions include Arrow Land

Transfer, Bryn Mawr Capital Management, LLC, Bryn Mawr Trust® , The

Bryn Mawr Trust Company of Delaware, Cash Connect® , NewLane

Finance® , Powdermill® Financial Solutions, WSFS Institutional

Services® , WSFS Mortgage® , and WSFS Wealth® Investments. Serving

the Greater Delaware Valley since 1832, WSFS Bank is one of the ten

oldest banks in the United States continuously operating under the

same name. For more information, please visit www.wsfsbank.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212390635/en/

Media: Connor Peoples 215-864-5645

cpeoples@wsfsbank.com

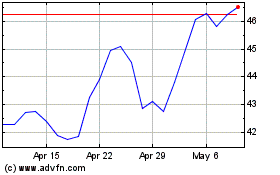

WSFS Financial (NASDAQ:WSFS)

Historical Stock Chart

From Jan 2025 to Feb 2025

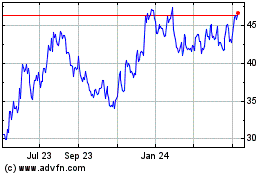

WSFS Financial (NASDAQ:WSFS)

Historical Stock Chart

From Feb 2024 to Feb 2025