false

0001360565

0001360565

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 8, 2024

WHERE

FOOD COMES FROM, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Colorado |

|

001-40314 |

|

43-1802805 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification No.) |

| 202

6th Street, Suite

400 |

|

|

| Castle

Rock, Colorado |

|

80104 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(303)

895-3002

(Registrant’s

Telephone Number, Including Area Code)

Not

applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

WFCF |

|

The

NASDAQ Stock Market LLC |

| Item

2.02 |

Results

of Operations and Financial Condition |

Reference

is made to the Where Food Comes From, Inc. (the “Company”) press release on August 8, 2024 and conference call transcript,

attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein (including, without limitation, the information

set forth in the cautionary statement contained in the press release and conference call transcript), relating to the Company’s

financial results for the three and six month period ended June 30, 2024.

| Item

9.01 |

Financial

Statements and Exhibits |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

WHERE

FOOD COMES FROM, INC.

|

| |

(Registrant) |

| |

|

| |

By:

|

/s/

Dannette Henning |

| Date:

August 12, 2024 |

|

Dannette

Henning |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Where

Food Comes From, Inc. Reports 2024 Second Quarter and Six-Month Financial Results

Second

Quarter Highlights – 2024 vs. 2023

| |

● |

Verification

and certification revenue up 10% to $5.3 million from $4.8 million |

| |

● |

Product

sales decline 13% to $0.8 million from $0.9 million |

| |

● |

Total

revenue up 4% to $6.4 million from $6.1 million |

| |

● |

Net

income down 8% to $489,000 from $532,000 |

| |

● |

Diluted

EPS flat at $0.09 |

| |

● |

Adjusted

EBITDA of $844,000 vs. $917,000 |

| |

● |

Company

buys back 33,347 shares of stock in second quarter |

Six

Month Highlights – 2024 vs. 2023

| |

● |

Verification

and certification revenue up 13% to $9.7 million from $8.6 million |

| |

● |

Product

sales decline 19% to $1.6 million from $1.9 million |

| |

● |

Total

revenue up 5% to $12.0 million from $11.4 million |

| |

● |

Net

income increases 2% to $667,000 from $653,000 |

| |

● |

Diluted

EPS of $0.12 vs. $0.11 |

| |

● |

Adjusted

EBITDA essentially flat at $1.3 million |

| |

● |

Cash

generated from operations increased to $1.9 million from $1.3 million |

| |

● |

Cash

& cash equivalents of $2.60 million vs. $2.64 million at December 31 year-end |

| |

● |

Year-to-date

stock buybacks and private repurchases total 149,419 shares |

CASTLE

ROCK, Colo., Aug. 08, 2024 (GLOBE NEWSWIRE) — Where Food Comes From, Inc. (WFCF) (Nasdaq: WFCF), the most trusted resource for

independent, third-party verification of food production practices in North America, today announced financial results for its second

quarter and six months ended June 30, 2024.

“Despite

ongoing inflationary effects and cyclical herd contraction that have impacted our beef-related services, we continued to profitably grow

our business for both the second quarter and year-to-date period,” said John Saunders, chairman and CEO. “Our ability to

successfully navigate these temporary challenges is attributable to a versatile business model that incorporates the industry’s

most diversified services portfolio. Over the first half of 2024 our new Upcycled Food Certification initiative has emerged as one of

our fastest growing standards. We’ve also seen growing demand for our biosecurity offerings as we help to position customers and

the industry to manage potential animal disease outbreaks.

“We

are the recognized leader in advocating for transparency and safety in the food supply chain and now audit to nearly 60 different standards

– far and away the most of any food certification body,” Saunders added. “This diversification not only reduces our

risk during challenging times for other service offerings, but it widens the moat around our business and positions us for accelerated

growth once headwinds related to inflation and cyclical cattle trends subside.”

Second

Quarter Results – 2024 vs. 2023

Total revenue in the second quarter ended June 30, 2024, increased 4% to $6.4 million from $6.1 million.

Revenue

mix:

| |

● |

Verification

and certification services, up 10% to $5.3 million from $4.8 million. |

| |

● |

Product

revenue declined 13% to $0.8 million from $0.9 million. |

| |

● |

Professional

services revenue of $0.3 million vs. $0.4 million. |

Gross

profit in the second quarter increased to $2.7 million from $2.5 million.

Selling,

general and administrative expense increased to $2.1 million from $1.8 million, reflecting increased costs related to marketing, personnel

and travel.

Operating

income declined to $0.6 million from $0.7 million.

Net

income declined 8% to $489,000, or $0.09 per diluted share, from $532,000, or $0.09 per diluted share.

Adjusted

EBITDA in the second quarter was 8% lower at $0.8 million vs. $0.9 million.

The

Company bought back 33,347 shares of its common stock in the second quarter at a cost of $389,000.

Six

Month Results – 2024 vs. 2023

Total revenue for the six months ended June 30, 2024, increased 5% to $12.0 million from $11.4 million in the prior year.

Revenue

mix:

| |

● |

Verification

and certification services, up 13% to $9.7 million from $8.6 million. |

| |

● |

Product

revenue, down 19% to $1.6 million from $1.9 million. |

| |

● |

Professional

services revenue of $0.7 million compared to $0.9 million. |

Gross

profit at mid-year was $5.0 million, up 7% from $4.6 million a year ago.

Selling,

general and administrative expense increased 8% to $4.1 million from $3.8 million due primarily to the aforementioned increases in marketing,

personnel and travel expenses.

Operating

income was essentially flat at $0.8 million.

Net

income through six months increased slightly to $667,000, or $0.12 per diluted share, compared to net income of $653,000, or $0.11 per

diluted share, in the prior year period.

Adjusted

EBITDA was essentially flat at $1.3 million.

The

Company generated $1.9 million in cash from operations through six months compared to $1.3 million in the same period last year.

The

cash and cash equivalents balance at June 30, 2024, was $2.60 million vs. $2.64 million at December 31 year-end.

Through

the first six months of 2024 the Company bought back 149,419 shares of its stock.

The

Company will conduct a conference call today at 10:00 a.m. Mountain Time.

Call-in

numbers for the conference call:

Domestic Toll Free: 1-877-407-8289

International: 1-201-689-8341

Conference Code: 13748244

Phone

replay:

A telephone replay of the conference call will be available through August 22, 2024, as follows:

Domestic Toll Free: 1-877-660-6853

International: 1-201-612-7415

Conference Code: 13748244

About

Where Food Comes From, Inc.

Where

Food Comes From, Inc. is America’s trusted resource for third party verification of food production practices. Through proprietary

technology and patented business processes, the Company estimates that it supports more than 17,500 farmers, ranchers, vineyards, wineries,

processors, retailers, distributors, trade associations, consumer brands and restaurants with a wide variety of value-added services.

Through its IMI Global, Validus Verification Services, SureHarvest, WFCF Organic, and Postelsia units, Where Food Comes From solutions

are used to verify food claims, optimize production practices and enable food supply chains with analytics and data driven insights.

In addition, the Company’s Where Food Comes From® retail and restaurant labeling program uses web-based customer education

tools to connect consumers to the sources of the food they purchase, increasing meaningful consumer engagement for our clients.

*Note

on non-GAAP Financial Measures

This

press release and the accompanying tables include a discussion of EBITDA and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with generally accepted accounting principles (“GAAP”). The term “EBITDA”

refers to a financial measure that we define as earnings (net income or loss) plus or minus net interest plus taxes, depreciation and

amortization. Adjusted EBITDA excludes from EBITDA stock-based compensation and, when appropriate, other items that management does not

utilize in assessing WFCF’s operating performance (as further described in the attached financial schedules). None of these non-GAAP

financial measures are recognized terms under GAAP and do not purport to be an alternative to net income as an indicator of operating

performance or any other GAAP measure. We have reconciled Adjusted EBITDA to GAAP net income in the Consolidated Statements of Income

table at the end of this release. We intend to continue to provide these non-GAAP financial measures as part of our future earnings discussions

and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting.

CAUTIONARY

STATEMENT

This

news release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995, based on current expectations, estimates and projections that are subject to risk. Forward-looking statements are inherently

uncertain, and actual events could differ materially from the Company’s predictions. Important factors that could cause actual

events to vary from predictions include those discussed in our SEC filings. Specifically, statements in this news release about industry

leadership, expectations for offsetting industry headwinds, ability to continue expanding on the solutions set, widening the competitive

moat and providing customers with convenience and price advantages, and demand for, and impact and efficacy of, the Company’s products

and services on the marketplace are forward-looking statements that are subject to a variety of factors, including availability of capital,

personnel and other resources; competition; governmental regulation of the agricultural industry; the market for beef and other commodities;

and other factors. Financial results and the Company’s pace of stock buybacks are not necessarily indicative of future results.

Readers should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update its forward-looking

statements to reflect new information or developments. For a more extensive discussion of the Company’s business, please refer

to the Company’s SEC filings at www.sec.gov.

Company

Contacts:

John

Saunders

Chief Executive Officer

303-895-3002

Jay

Pfeiffer

Director, Investor Relations

303-880-9000

jpfeiffer@wherefoodcomesfrom.com

Where

Food Comes From, Inc.

Statements

of Operations (Unaudited)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| (Amounts in thousands, except per share amounts) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Verification and certification service revenue | |

$ | 5,252 | | |

$ | 4,779 | | |

$ | 9,686 | | |

$ | 8,585 | |

| Product sales | |

| 819 | | |

| 938 | | |

| 1,552 | | |

| 1,909 | |

| Professional services | |

| 324 | | |

| 409 | | |

| 739 | | |

| 899 | |

| Total revenues | |

| 6,395 | | |

| 6,126 | | |

| 11,977 | | |

| 11,393 | |

| Costs of revenues: | |

| | | |

| | | |

| | | |

| | |

| Costs of verification and certification services | |

| 3,028 | | |

| 2,736 | | |

| 5,543 | | |

| 4,932 | |

| Costs of products | |

| 469 | | |

| 555 | | |

| 903 | | |

| 1,123 | |

| Costs of professional services | |

| 240 | | |

| 329 | | |

| 544 | | |

| 689 | |

| Total costs of revenues | |

| 3,737 | | |

| 3,620 | | |

| 6,990 | | |

| 6,744 | |

| Gross profit | |

| 2,658 | | |

| 2,506 | | |

| 4,987 | | |

| 4,649 | |

| Selling, general and administrative expenses | |

| 2,075 | | |

| 1,833 | | |

| 4,143 | | |

| 3,821 | |

| Income from operations | |

| 583 | | |

| 673 | | |

| 844 | | |

| 828 | |

| Other income/(expense): | |

| | | |

| | | |

| | | |

| | |

| Dividend income from Progressive Beef | |

| 100 | | |

| 50 | | |

| 100 | | |

| 100 | |

| Gain on disposal of assets | |

| - | | |

| 5 | | |

| - | | |

| 5 | |

| Loss on foreign currency exchange | |

| (2 | ) | |

| (2 | ) | |

| (4 | ) | |

| (4 | ) |

| Other income, net | |

| 7 | | |

| 11 | | |

| 14 | | |

| 20 | |

| Interest expense | |

| (1 | ) | |

| (1 | ) | |

| (2 | ) | |

| (2 | ) |

| Income before income taxes | |

| 687 | | |

| 736 | | |

| 952 | | |

| 947 | |

| Income tax expense | |

| 198 | | |

| 204 | | |

| 285 | | |

| 294 | |

| Net income | |

$ | 489 | | |

$ | 532 | | |

$ | 667 | | |

$ | 653 | |

| | |

| | | |

| | | |

| | | |

| | |

| Per share - net income: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.09 | | |

$ | 0.09 | | |

$ | 0.12 | | |

$ | 0.12 | |

| Diluted | |

$ | 0.09 | | |

$ | 0.09 | | |

$ | 0.12 | | |

$ | 0.11 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 5,371 | | |

| 5,670 | | |

| 5,426 | | |

| 5,693 | |

| Diluted | |

| 5,388 | | |

| 5,735 | | |

| 5,444 | | |

| 5,760 | |

Where

Food Comes From, Inc.

Calculation

of Adjusted EBITDA*

(Unaudited)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| (Amounts in thousands) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net income | |

$ | 489 | | |

$ | 532 | | |

$ | 667 | | |

$ | 653 | |

| Adjustments to EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 1 | | |

| 1 | | |

| 2 | | |

| 2 | |

| Income tax expense | |

| 198 | | |

| 204 | | |

| 285 | | |

| 294 | |

| Depreciation and amortization | |

| 156 | | |

| 163 | | |

| 311 | | |

| 335 | |

| EBITDA* | |

| 844 | | |

| 900 | | |

| 1,265 | | |

| 1,284 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| - | | |

| 17 | | |

| 11 | | |

| 32 | |

| Cost of acquisitions | |

| - | | |

| - | | |

| - | | |

| - | |

| ADJUSTED EBITDA* | |

$ | 844 | | |

$ | 917 | | |

$ | 1,276 | | |

$ | 1,316 | |

*Use

of Non-GAAP Financial Measures: Non-GAAP results are presented only as a supplement to the financial statements and for use within management’s

discussion and analysis based on U.S. generally accepted accounting principles (GAAP). The non-GAAP financial information is provided

to enhance the reader’s understanding of the Company’s financial performance, but non-GAAP measures should not be considered

in isolation or as a substitute for financial measures calculated in accordance with GAAP. Reconciliations of the most directly comparable

GAAP measures to non-GAAP measures are provided herein.

All

of the items included in the reconciliation from net income to EBITDA and from EBITDA to Adjusted EBITDA are either (i) non-cash items

(e.g., depreciation, amortization of purchased intangibles, stock-based compensation, etc.) or (ii) items that management does not consider

to be useful in assessing the Company’s ongoing operating performance (e.g., M&A costs, income taxes, gain on sale of investments,

loss on disposal of assets, etc.). In the case of the non-cash items, management believes that investors can better assess the Company’s

operating performance if the measures are presented without such items because, unlike cash expenses, these adjustments do not affect

the Company’s ability to generate free cash flow or invest in its business.

We

use, and we believe investors benefit from the presentation of, EBITDA and Adjusted EBITDA in evaluating our operating performance because

it provides us and our investors with an additional tool to compare our operating performance on a consistent basis by removing the impact

of certain items that management believes do not directly reflect our core operations. We believe that EBITDA is useful to investors

and other external users of our financial statements in evaluating our operating performance because EBITDA is widely used by investors

to measure a company’s operating performance without regard to items such as interest expense, taxes, and depreciation and amortization,

which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and

the method by which assets were acquired.

Because

not all companies use identical calculations, the Company’s presentation of non-GAAP financial measures may not be comparable to

other similarly titled measures of other companies. However, these measures can still be useful in evaluating the Company’s performance

against its peer companies because management believes the measures provide users with valuable insight into key components of GAAP financial

disclosures.

Where

Food Comes From, Inc.

Balance

Sheets

| | |

June 30, | | |

December 31, | |

| (Amounts in thousands, except per share amounts) | |

2024 | | |

2022 | |

| Assets | |

| (Unaudited) | | |

| (Audited) | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,600 | | |

$ | 2,641 | |

| Accounts receivable, net of allowance | |

| 2,221 | | |

| 2,128 | |

| Inventory | |

| 1,164 | | |

| 1,109 | |

| Prepaid expenses and other current assets | |

| 1,048 | | |

| 335 | |

| Total current assets | |

| 7,033 | | |

| 6,213 | |

| Property and equipment, net | |

| 791 | | |

| 844 | |

| Right-of-use assets, net | |

| 2,220 | | |

| 2,296 | |

| Equity investments | |

| 1,191 | | |

| 1,191 | |

| Intangible and other assets, net | |

| 2,127 | | |

| 2,303 | |

| Goodwill, net | |

| 2,946 | | |

| 2,946 | |

| Deferred tax assets, net | |

| 477 | | |

| 493 | |

| Total assets | |

$ | 16,785 | | |

$ | 16,286 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 695 | | |

$ | 567 | |

| Accrued expenses and other current liabilities | |

| 1,353 | | |

| 615 | |

| Deferred revenue | |

| 2,338 | | |

| 1,485 | |

| Current portion of finance lease obligations | |

| 14 | | |

| 14 | |

| Current portion of operating lease obligations | |

| 329 | | |

| 298 | |

| Total current liabilities | |

| 4,729 | | |

| 2,979 | |

| Finance lease obligations, net of current portion | |

| 33 | | |

| 41 | |

| Operating lease obligation, net of current portion | |

| 2,337 | | |

| 2,447 | |

| Total liabilities | |

| 7,099 | | |

| 5,467 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value; 5,000 shares authorized; none issued or outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value; 95,000 shares authorized; 6,446 (2024) and 6,516 (2023) shares issued, and 5,363 (2024) and

5,503 (2023) shares outstanding | |

| 7 | | |

| 7 | |

| Additional paid-in-capital | |

| 11,348 | | |

| 12,290 | |

| Treasury stock of 1,083 (2024) and 1,014 (2023) shares | |

| (12,077 | ) | |

| (11,219 | ) |

| Retained earnings | |

| 10,408 | | |

| 9,741 | |

| Total equity | |

| 9,686 | | |

| 10,819 | |

| Total liabilities and stockholders’ equity | |

$ | 16,785 | | |

$ | 16,286 | |

Exhibit

99.2

Where

Food Comes From, Inc.

2024

Second Quarter Conference Call

Call

date: Thursday August 8, 2024

Call

time: 10:00 a.m. Mountain Time

Jay

Pfeiffer – Investor Relations

Good

morning and welcome to the Where Food Comes From 2024 second quarter earnings call.

Joining

me on the call today are CEO John Saunders, President Leann Saunders, and Chief Financial Officer Dannette Henning.

During

this call we’ll make forward-looking statements based on current expectations, estimates and projections that are subject to risk.

Statements about current and future financial performance, growth strategy, customers, business opportunities, market acceptance of our

products and services, and potential acquisitions are forward looking statements. Listeners should not place undue reliance on these

statements as there are many factors that could cause actual results to differ materially from our forward-looking statements. We encourage

you to review our publicly filed documents as well as our news releases and website for more information. Today we’ll also discuss

Adjusted EBITDA, a non-GAAP financial measure provided as a complement to GAAP results. Please refer to today’s earnings release

for important disclosures regarding non-GAAP measures.

I’ll

now turn the call over to John Saunders.

John

Saunders

Good

morning and thanks for joining the call today.

Total

revenue in the second quarter increased 4% to $6.4 million from $6.1 million.

That

included a 10% increase in verification and certification services, which grew to $5.3 million from $4.8 million year over year.

Product

revenue declined 13% to $0.8 million from $0.9 million, reflecting a trend that began last year when the impact of cyclical cattle trends

resulting in smaller herd sizes began manifesting in lower volumes of RFID tag sales.

Professional

services revenue also declined – to $0.3 million from $0.4 million year over year.

Gross

profit in the second quarter increased to $2.7 million from $2.5 million.

Selling,

general and administrative expense increased to $2.1 million from $1.8 million, reflecting increased costs related to marketing, personnel

and travel. On the subject of personnel costs, we continue to navigate a tight, competitive labor market that is impacting us at both

the gross profit and SG&A levels.

The

higher SG&A more than offset improved gross profit and resulted in a decline in operating income to $0.6 million from $0.7 million.

That,

in turn, led to an 8% decline in net income to $489,000 from $532,000. Diluted EPS remained at 9 cents per share.

Adjusted

EBITDA in the second quarter was 8% lower at $0.8 million vs. $0.9 million.

And

finally, we continued our share buyback program in the second quarter, repurchasing 33,347 shares of stock at a cost of $389,000.

Turning

to six month results…

Total

revenue through six months increased 5% to $12.0 million from $11.4 million in the prior year.

Revenue

mix included:

Verification

and certification services, up 13% to $9.7 million from $8.6 million.

Product

revenue, down 19% to $1.6 million from $1.9 million.

And

professional services revenue of $0.7 million compared to $0.9 million.

Gross

profit at mid-year was $5.0 million, up 7% from $4.6 million a year ago.

Due

to reasons previously mentioned, SG&A expense increased 8% to $4.1 million from $3.8 million.

Operating

income was essentially flat at $0.8 million.

Net

income through six months increased slightly to $667,000, or $0.12 per diluted share, compared to net income of $653,000, or $0.11 per

diluted share, in the prior year period.

Adjusted

EBITDA was essentially flat at $1.3 million.

The

Company generated $1.9 million in cash from operations through six months compared to $1.3 million in the same period last year.

Our

cash and cash equivalents balance at mid-year was $2.6 million, which was down just slightly from the December 31 year-end cash balance.

Through

the first six months of 2024 we bought back 149,419 shares of stock – a total that included 69,218 shares as part of our ongoing

buyback program and another 80,201 shares in a single private purchase. We continue to believe that buybacks at these prices levels are

a good investment for the Company and great way to return value to our stockholders on a regular basis.

Given

the ongoing headwinds in our beef business in the form of smaller herd sizes, we are overall pleased with our financial results for both

the quarter and six-month period. We are consistently growing our top line – and doing so in a profitable manner while generating

strong cash flows.

Years

ago, we committed to building the industry’s most comprehensive solutions portfolio as a means of better serving our customers

with a one-stop-shop approach that simplifies their vendor structure and affords them favorable pricing through our bundling program.

At the same time, our broad solutions set gives us multiple revenue streams that have enabled us to grow overall revenue when one or

more of our business lines comes under pressure. In this case our beef business, which traditionally has dominated our revenue mix, is

facing temporary challenges that underscore the value of our diversified model.

Today

I’d like to highlight two specific examples of how we continue to advance this strategy.

The

first is Upcycled Certified, which as you may know is a standard we acquired in Q4 last year after serving as the exclusive certification

body since the program’s inception in 2021.

Upcycled

food – which is the use of nutritional food ingredients that would otherwise go to waste – is an up-and-coming national consumer

trend, and we’re pleased to announce that Upcycled Certified has recently emerged as one of the fastest growing certification standards

in our portfolio. Given the early momentum of this trend – and the compelling economic and environmental arguments in favor of

it – we think our Upcycled business has the potential to become a very meaningful contributor to growth over the long term.

What

began as a modest program that attracted smaller niche players has blossomed into an international program that includes major food producers

and retailers. In July, Walmart rolled out a new line of upcycled sauces as a continuation of its ‘bettergoods’ product launch

in April – Walmart’s largest private label food brand launch in 20 years.

So,

we think the upcycled trend has its best growth ahead of it, and here are a few data points to support that.

| ● | An

estimated 40% of food grown annually in the US goes unsold or uneaten. ReFED, a leading food

waste research organization, estimates that 80 million tons of food that is wasted annually

in the U.S. with a financial loss of $310 billion. |

| | |

| ● | A

Future Market Insights report estimates the value of the upcycled food industry to be more

than $46 billion and growing. |

| | |

| ● | Over

the last three years upcycling consistently topped food trends lists, including Food Tank,

Kroger, Forbes and Whole Foods Market. |

| | |

| ● | An

Innova Market Insights survey showed 62% of consumers are willing to pay more for a product

that fights food waste. |

| | |

| ● | A

Hartman Group survey showed 70% of consumers had increased intent to buy Upcycle Certified®

foods when the seal was displayed on packaging. |

| | |

| ● | According

to Project Drawdown, decreasing food waste is the number one solution to reducing

the need for land and resources used to produce food as well as the greenhouse gases released

in the process. |

The

second example of emerging revenue streams for us is our biosecurity business. Over the years, our work in building traceability systems

and conducting on-ranch animal welfare audits has made biosecurity services a logical next step service offering for us.

Whether

its avian influenza, swine flu, hoof-and-mouth disease, mad cow disease, e-coli, or even Covid-type issues involving farm, ranch and

dairy workers, the agricultural industry and the USDA are constantly working to prevent potentially catastrophic outbreaks that disrupt

operations and supply chains and put the public at risk.

Where

Food Comes From has a massive amount of expertise in this area, and we have developed a variety programs and standards to reduce risks

of infectious disease transmission among livestock, workers and customers.

For

example:

| |

● |

Our Secure Food Supply plans

help beef, dairy, pork, poultry and egg operations prepare before an outbreak to limit exposure of animals and accelerate re-entry

into commercial operations after an outbreak. |

| |

|

|

| |

● |

Our On-Farm Security Reviews

verify site-specific compliance to a stringent set of on-farm biosecurity procedures. |

| |

|

|

| |

● |

Our SQF (Safe Quality Food)

on-farm audit program is a rigorous food safety program designed to meet industry, customer and regulatory requirements from the farm

to retail stores. |

These

are just three of eight programs that address the risks associated with animal disease outbreak. In the aggregate, they serve to protect

our customers and strengthen their relationships with the USDA and state-level animal health officials in order to build resilience into

the agricultural community and protect consumers.

So,

hopefully that gives you a little insight into how our strategy of constantly expanding our product and services portfolio is strengthening

our business. At the same time, I want to emphasize that beef verification remains a core strength for us, and we fully expect it to

bounce back as herd sizes normalize. When that happens, we believe we’ll be positioned to accelerate revenue growth and profits.

And,

with that, I’ll thank you again for joining the call today and open the call to questions.

Question

and Answer Session:

Question

1: Chris Brown, Oake Financial

Thank

you very much. Back in – I think it was about the end of 2022, you talked about the USDA’s intention to mandate the RFID

tags associated with the ADT program. It’s my understanding that the final rule passed this spring and implementation is happening

this fall. I was wondering, three kind of general questions: 1) How it’s impacting your business to-date? 2) What you are kind

of doing internally to take advantage or adapt to that new environment and 3) Then kind of how you see it playing out over the next year

or so? Thank you.

John

Saunders

Great

question. You are correct, the final rule came into play this spring, and this fall is when the implementation will begin. We have already

seen a lot of the impacts of this, Chris. Some of them have been related to transition of existing customers to use what we call 840

identification devices, which are compliant on a country code and compliant with ADT. So, we have had a strong migration of a lot of

our customers to the 840 tags, as we call them. So, probably the only real impact that we have seen so far, and this has been compounding

with the smaller herd sizes, is that there has been a great deal of subsidizing of tags to the industry. So, either through animal health

officials or through other government or state affiliations, producers are able to get tags for free.

As

I am sure have seen, in lieu of or in spite of the fact that the ruling has come into place, our tag revenue continues to stay flat or

to decline a little bit. And that is relative to two things, as we talked about. One is the decline in the herd sizes. But also, the

government is giving quite a few tags away to producers, which is why you also see our verification revenue continuing to increase.

So,

the way that we have been adjusting to it, Chris, is we have been preparing for a wave of free tags that were going to go into the industry,

where we are actually charging those ranchers and farmers for those tags. They were going to have an opportunity to get those tags for

free. So, what we are allowing our producers to do is to bring those tags into our system for a fee, and we are maintaining those tags

in the system. It does create more work for us, so we have had to adapt some of our technology to make sure that it was easy for producers

to get their tags if they weren’t coming directly from us into the system.

The

way it affects us long-term is, I believe is most of the programs like it happened with the organic program several decades ago, where

there was a lot of opportunity for government-subsidized funding that would go to states or counties or universities, where they could

implement their own organic certification program. And over the years, what we have seen is a consolidation in almost all of those programs

that were funded initially, are no longer funded. So, I think our belief is that there will be a point when this funding dries up. And

these producers that have come into the program and now are required to use electronic identification tags, will have to go somewhere

to get them. So, it will probably be at least a 3-year to 5-year process of all of these new producers, which are converting to electronic

tags, which is, again, great for us because that gives us more opportunity, more producers are able to become part of our verification

programs while we are losing out on some of that tag revenue.

So

all-in-all, the program has been, I think a good success, and it’s gone in line with the way that we thought. And we have a whole

bunch of new producers that are really excited about getting involved. So, it’s been an overall positive, but it is something that

we have had to prepare for, for quite a while.

Operator

Thank

you. There are no further questions at this time. I would like to turn the floor back over to John for any closing remarks.

John

Saunders

Once

again, I want to thank you for your time and your support, and we look forward to talking to you in three months. Have a great day.

Operator

This

concludes today’s conference. You may disconnect your lines at this time. Thank you for your participation.

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity File Number |

001-40314

|

| Entity Registrant Name |

WHERE

FOOD COMES FROM, INC.

|

| Entity Central Index Key |

0001360565

|

| Entity Tax Identification Number |

43-1802805

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity Address, Address Line One |

202

6th Street

|

| Entity Address, Address Line Two |

Suite

400

|

| Entity Address, City or Town |

Castle

Rock

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80104

|

| City Area Code |

(303)

|

| Local Phone Number |

895-3002

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

WFCF

|

| Security Exchange Name |

NASDAQ

|

| Entity Information, Former Legal or Registered Name |

Not

applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

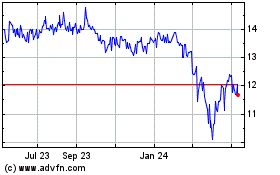

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Nov 2024 to Dec 2024

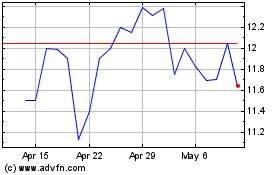

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Dec 2023 to Dec 2024