Current Report Filing (8-k)

October 29 2021 - 4:04PM

Edgar (US Regulatory)

false 0001618921 0001618921 2021-10-29 2021-10-29 0001618921 us-gaap:CommonStockMember 2021-10-29 2021-10-29 0001618921 wba:M3.600WalgreensBootsAllianceInc.NotesDue2025Member 2021-10-29 2021-10-29 0001618921 wba:M2.125WalgreensBootsAllianceInc.NotesDue2026Member 2021-10-29 2021-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2021

WALGREENS BOOTS ALLIANCE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36759

|

|

47-1758322

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

|

|

|

|

108 Wilmot Road, Deerfield, Illinois

|

|

60015

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (847) 315-2500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

WBA

|

|

The Nasdaq Stock Market LLC

|

|

3.600% Walgreens Boots Alliance, Inc. notes due 2025

|

|

WBA25

|

|

The Nasdaq Stock Market LLC

|

|

2.125% Walgreens Boots Alliance, Inc. notes due 2026

|

|

WBA26

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On October 29, 2021, Walgreens Boots Alliance Inc. (the “Company”) completed the previously announced purchase (the “Transaction”) pursuant to the Securities Purchase Agreement, dated September 17, 2021, by and among Walgreen Co. (“WAG”), certain equityholders of Shields Health Solutions Parent, LLC (“Shields”), certain stockholders of WCAS Shields Holdings, Inc. (“WCAS”), Shields, WCAS and WCAS XIII Associates, LLC, solely in its capacity as Sellers’ Representative thereunder (the “Securities Purchase Agreement”). Pursuant to the terms and subject to the conditions set forth in the Securities Purchase Agreement, WBA Acquisition 4, LLC, a subsidiary of the Company and assignee of WAG (“WBA LLC”), purchased additional outstanding equity interests of Shields, increasing the Company’s total beneficial ownership in Shields’ outstanding vested equity interests to approximately 70.1%, for a cash purchase price of approximately $968.5 million, subject to certain purchase price adjustments.

In connection with the closing of the Transaction, WAG, WBA LLC, Shields and certain other equityholders of Shields amended and restated in its entirety (such amendment and restatement, the “Second A&R LLCA”) the existing Amended and Restated Limited Liability Company Agreement of Shields, dated August 19, 2019 (the “Existing LLCA”). The Second A&R LLCA, among other things, contains certain put and call rights that may be exercised pursuant to which WAG or its designated affiliate would acquire up to the remaining then-vested outstanding equity interests of Shields for a purchase price calculated based on specified multiples of Shields’ annualized prior quarter’s Management Adjusted EBITDA (as defined in the Second A&R LLCA), subject to certain purchase price adjustments. The Company currently expects such purchase price to be between approximately $1 billion and $1.25 billion.

The foregoing description of the Second A&R LLCA does not purport to be complete and is qualified in its entirety by reference to the full text of the Second A&R LLCA, which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

*

|

Certain schedules and exhibits to this agreement have been omitted pursuant to Items 601(a)(5) of Regulation S-K, and Walgreens Boots Alliance, Inc. agrees to furnish supplementally to the Securities and Exchange Commission a copy of any omitted schedule and/or exhibit upon request.

|

Cautionary Note Regarding Forward-Looking Statements

All statements in this report that are not historical including, without limitation, those regarding the anticipated effects of the Transaction and the transactions contemplated by the Second A&R LLCA, are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “expect,” “likely,” “outlook,” “forecast,” “preliminary,” “pilot,” “project,” “intend,” “plan,” “goal,” “target,” “aim,” “continue,” “ “believe,” “seek,” “anticipate,” “upcoming,” “may,” “possible,” and variations of such words and similar expressions are intended to identify such forward-looking statements.

These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions, known or unknown, that could cause actual results to vary materially from those indicated or anticipated. These risks, assumptions and uncertainties include those described in Item 1A (Risk Factors) of our Annual Report on Form 10-K for the fiscal year ended August 31, 2021 and in other documents that we file or furnish with the Securities and Exchange Commission. If one or more of these risks or uncertainties materializes, or if underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. All forward-looking statements we make or that are made on our behalf are qualified by these cautionary statements. Accordingly, you should not place undue reliance on these forward-looking statements, which speak only as of the date they are made.

We do not undertake, and expressly disclaim, any duty or obligation to update publicly any forward-looking statement after the date of this release, whether as a result of new information, future events, changes in assumptions or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WALGREENS BOOTS ALLIANCE, INC.

|

|

|

|

|

|

|

Date: October 29, 2021

|

|

|

|

By:

|

|

/s/ Joseph B. Amsbary, Jr.

|

|

|

|

|

|

Title:

|

|

Vice President and Corporate Secretary

|

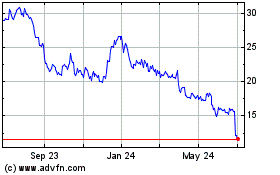

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Dec 2024 to Jan 2025

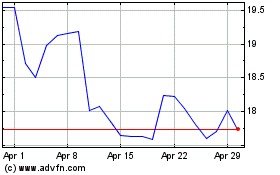

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Jan 2024 to Jan 2025