The Vita Coco Company, Inc. (NASDAQ:COCO) (“Vita Coco” or “the

Company”), a leading high-growth platform of better-for-you

beverage brands, today announced financial results for the second

quarter ended June 30, 2024.

Second Quarter and Year-To-Date 2024

Highlights

- Net sales grew 3% in the second quarter

to $144 million and 3% year-to-date to $256 million.

- Vita Coco Coconut

Water net sales growth of 4% in the second quarter and 3%

year-to-date.

- Gross profit was

$59 million in the second quarter, an increase of

$8 million and $106 million year-to-date, an increase of

$21 million.

- Gross Margin was

41% of net sales in the second quarter compared to 37% of net

sales, and 41% of net sales year-to-date as compared to 34% of net

sales.

- Net income was

$19 million, in the second quarter compared to net income of

$18 million, and year-to-date was $33 million compared to

$25 million.

- Net income per

diluted share was $0.32 in the second quarter compared to $0.31,

and was $0.57 per diluted share year-to-date compared to

$0.42.

- Non-GAAP Adjusted EBITDA1 was

$32 million compared to $24 million for the second

quarter. Year-to-date Non-GAAP Adjusted EBITDA1 was

$53 million, compared to $33 million.

Michael Kirban, the Company’s Co-Founder and Executive Chairman,

stated, “I am very proud of our team and the strong financial

performance that we delivered in the second quarter. Our focus and

investment to expand consumption occasions for coconut water

contributed to strong performance for the category and for our

flagship Vita Coco Coconut Water brand, which year-to-date has

grown 11% in dollar sales in Circana US MULO+C measured channels.

Importantly, during the quarter, we saw growth rate acceleration in

the US retail scan data for our brand which grew 14%. The

organization's ability to drive brand growth through strong retail

execution and creative marketing programs, while continuing to

improve profitability and cash generation at the same time, is

something that every member of the team should be proud of. The

coconut water category remains very healthy and one of the fastest

growing categories in US beverages. Our team continues to deliver

strong results at retail across our major markets. We remain

committed to continuing to grow the coconut water category, and I

could not be more excited for what is to come.”

Martin Roper, the Company’s Chief Executive Officer, said, “We

are pleased with this quarter’s results of 3% net sales growth and

with our scan data growth, despite inventory challenges due to

delays in product shipments caused by temporary headwinds in ocean

freight availability and transit times. Our second quarter branded

net sales were up, while private label was down slightly, as strong

private label coconut water growth was partially offset by the

previously communicated expected decrease in our private label

coconut oil shipments. Net income of $19 million, and Adjusted

EBITDA1 of $32 million, benefited from improved gross margins,

driven primarily by lower transportation costs than last year.

Based on a continuation of current trends, we are reaffirming our

full year guidance, and we expect the flow of product should allow

us to rebuild retail and distributor inventories to more normal

levels by the end of the year, which we believe sets us up for a

strong 2025. We remain focused on driving long term growth of the

coconut water category and our brands.”

Second Quarter 2024 Consolidated Results

Net sales increased $4 million, or 3%, to $144 million

for the second quarter ended June 30, 2024, compared to

$140 million in the prior year period. The increase in net

sales was driven by improved volume and net pricing of Vita Coco

Coconut Water and growth in private label case equivalent (“CE”)

volume, which were partially offset by price/mix impacts from

private label products.

Gross profit was $59 million for the second quarter of

2024, compared to $51 million in the prior year period. Gross

margin of 41% in the second quarter of 2024 increased from 37% in

the prior year period. Gross profit increase was driven by gross

margin improvement due primarily to decreased finished goods and

transportation costs, increased Vita Coco Coconut Water pricing,

price/mix effects in private label, and increased net sales.

Selling, general and administrative (“SG&A”) expenses in the

second quarter of 2024 were $29 million, compared to

$30 million in the prior year period. The decrease was largely

due to the timing of marketing investments which was partially

offset by higher year on year personnel expenses.

Net income was $19 million, or $0.32 per diluted share, for

the second quarter of 2024, compared to net income of

$18 million, or $0.31 per diluted share, in the prior year

period. Net income benefited from strong gross profit growth and

slightly lower SG&A expenses.

Non-GAAP Adjusted EBITDA1 for the second quarter of 2024 was

$32 million, compared to $24 million in the prior year

period. The increase in Adjusted EBITDA1 was primarily driven by

gross profit improvement resulting primarily from improved finished

goods and transportation costs, higher Vita Coco Coconut Water net

pricing, price/mix effects in private label, and increased net

sales.

Balance Sheet

As of June 30, 2024, the Company had cash and cash

equivalents of $150 million, compared to $133 million as

of December 31, 2023. There was no debt as of June 30,

2024 and December 31, 2023. Inventories as of June 30,

2024 totaled $45 million. On June 30, 2024, there were

56,775,369 shares of common stock outstanding.

On October 30, 2023, the Company’s Board of Directors approved a

share repurchase program authorizing the Company to repurchase up

to $40 million of the Company’s common stock. As of June 30, 2024,

and to date, the Company has repurchased a total of 421,544 shares

for an aggregate value of $10 million at an average share price of

$23.72 with no shares repurchased during the most recent

quarter.

Fiscal Year 2024 Full Year Outlook

The Company is reaffirming its full year guidance:

- Expect 2024 net sales to be

between $500 million and $510 million, with projected Vita Coco

Coconut Water and private label coconut water volume growth, being

offset by expected decreases in private label coconut oil business

and price/mix effects.

- Full year gross margin expected to

be between 37% and 39%, with recent increases on certain ocean

freight routes expected to adversely affect gross margins in the

second half. This impact is expected to be most severe in the

fourth quarter.

- SG&A expenses

expected to be approximately flat to up slightly versus 2023.

- Forecasting Adjusted EBITDA in the

range of $76 million to $82 million.2

Uncertainty and instability of the current operating

environment, global economies, and geopolitical landscape could

affect this outlook and our future results.

Footnotes:

(1) Adjusted EBITDA represents earnings before interest, taxes,

depreciation, and amortization as adjusted for certain items as set

forth in the reconciliation table of U.S. GAAP to non-GAAP

information and is a measure calculated and presented on the basis

of methodologies other than in accordance with GAAP. Please refer

to the Non-GAAP Financial Measures herein for further discussion

and reconciliation of this measure to GAAP measures.

(2) GAAP Net Income 2024 outlook is not provided due to the

inherent difficulty in quantifying certain amounts due to a variety

of factors including the unpredictability in the movement in

foreign currency rates, as well as future charges or reversals

outside of the normal course of business.

Conference Call and Webcast DetailsThe Vita

Coco Company will host a conference call and webcast at 8:30 a.m.

ET today to discuss these results. To participate in the live

earnings call and question and answer session, please register at

https://register.vevent.com/register/BI8d315f452cbc496f9c6ab056102b481f

and dial-in information will be provided directly to you. A slide

presentation to support the webcast, and the live audio webcast

will be accessible in the “Events” section of the Company’s

Investor Relations website at

https://investors.thevitacococompany.com. An archived replay of the

webcast will be available shortly after the live event has

concluded.

About The Vita Coco Company

The Vita Coco Company is a family of brands on a mission to

reimagine what’s possible when brands deliver healthy, nutritious,

and great tasting products that are better for consumers and better

for the world. This includes its flagship coconut water brand Vita

Coco, sustainably packaged water Ever & Ever, and

protein-infused water PWR LIFT. The Company was co-founded in 2004

by Michael Kirban and Ira Liran and is a public benefit corporation

and Certified B Corporation. Vita Coco, the principal brand within

the Company’s portfolio, is the leading coconut water brand in the

U.S. With electrolytes, nutrients, and vitamins, coconut water has

become a top beverage choice among consumers after a workout, in

smoothies, as a cocktail mixer, after a night out, and more.

Contacts

Investor Relations: ICR,

Inc.investors@thevitacococompany.com

Non-GAAP Financial Measures

In addition to disclosing results determined in accordance

with U.S. GAAP, the Company also discloses certain

non-GAAP results of operations, including, but not limited to,

Adjusted EBITDA, that include certain adjustments or exclude

certain charges and gains that are described in the reconciliation

table of U.S. GAAP to non-GAAP information provided at

the end of this release. These non-GAAP measures are a key metric

used by management and our board of directors to assess our

financial performance across reporting periods on a consistent

basis by excluding items that we do not believe are indicative of

our core operating performance and because we believe it is useful

for investors to see the measures that management uses to evaluate

the Company. In addition, we believe the presentation of these

measures is useful to investors for period-to-period comparisons of

results as the items described below in the reconciliation tables

do not reflect ongoing operating performance.

These measures are not in accordance with, or an alternative

to, U.S. GAAP, and may be different from non-GAAP

measures used by other companies. In addition, other companies,

including companies in our industry, may calculate such measures

differently, which reduces its usefulness as a comparative measure.

Investors should not rely on any single financial measure when

evaluating our business. This information should be considered as

supplemental in nature and is not meant as a substitute for our

operating results in accordance with U.S. GAAP. We

recommend investors review the U.S. GAAP financial

measures included in this earnings release. When viewed in

conjunction with our U.S. GAAP results and the

accompanying reconciliations, we believe these non-GAAP measures

provide greater transparency and a more complete understanding of

factors affecting our business than U.S. GAAP measures

alone.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including but not limited to,

statements regarding our future financial and operating

performance, including our GAAP and non-GAAP guidance, our

strategy, projected costs, prospects, expectations, plans,

objectives of management, supply chain predictions, customer and

supplier relationships, and expected net sales and category share

growth.

The forward-looking statements in this release are only

predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. Forward-looking statements

involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Forward-looking statements involve a

number of risks, uncertainties or other factors beyond the

Company’s control. These factors include, but are not limited to,

those discussed under the caption “Risk Factors” in our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and our other

filings with the U.S. Securities and Exchange Commission (“SEC”) as

such factors may be updated from time to time and which are

accessible on the SEC’s website at www.sec.gov and the Investor

Relations page of our website at

https://investors.thevitacococompany.com. Any forward-looking

statements contained in this press release speak only as of the

date hereof and accordingly undue reliance should not be placed on

such statements. We disclaim any obligation or undertaking to

update or revise any forward-looking statements contained in this

press release, whether as a result of new information, future

events or otherwise, other than to the extent required by

applicable law.

Website Disclosure

We intend to use our websites, vitacoco.com and

investors.thevitacococompany.com, as a means for disclosing

material non-public information and for complying with the SEC’s

Regulation FD and other disclosure obligations.

|

THE VITA COCO COMPANY, INC.CONSOLIDATED

BALANCE SHEETS(Amounts in thousands, except share

data) |

| |

| |

June 30,2024 |

|

December 31,2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

150,103 |

|

|

$ |

132,537 |

|

|

Accounts receivable, net of allowance of $2,992 at June 30,

2024, and $2,486 at December 31, 2023 |

|

78,891 |

|

|

|

50,086 |

|

|

Inventory |

|

45,457 |

|

|

|

50,757 |

|

|

Supplier advances, current |

|

1,381 |

|

|

|

1,521 |

|

|

Derivative assets |

|

140 |

|

|

|

3,876 |

|

|

Prepaid expenses and other current assets |

|

24,651 |

|

|

|

24,160 |

|

|

Total current assets |

|

300,623 |

|

|

|

262,937 |

|

| Property and equipment,

net |

|

2,231 |

|

|

|

2,136 |

|

| Goodwill |

|

7,791 |

|

|

|

7,791 |

|

| Supplier advances,

long-term |

|

2,907 |

|

|

|

2,820 |

|

| Deferred tax assets, net |

|

6,745 |

|

|

|

6,749 |

|

| Right-of-use assets, net |

|

897 |

|

|

|

1,406 |

|

| Other assets |

|

1,842 |

|

|

|

1,843 |

|

|

Total assets |

$ |

323,036 |

|

|

$ |

285,682 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

20,651 |

|

|

$ |

21,826 |

|

|

Accrued expenses and other current liabilities |

|

64,188 |

|

|

|

59,533 |

|

|

Notes payable, current |

|

10 |

|

|

|

13 |

|

|

Derivative liabilities |

|

5,965 |

|

|

|

1,213 |

|

|

Total current liabilities |

|

90,814 |

|

|

|

82,585 |

|

| Notes payable, long-term |

|

8 |

|

|

|

13 |

|

| Other long-term

liabilities |

|

208 |

|

|

|

647 |

|

|

Total liabilities |

$ |

91,030 |

|

|

$ |

83,245 |

|

| Stockholders’ equity: |

|

|

|

| Common stock, $0.01 par value;

500,000,000 shares authorized; 63,403,113 and 63,135,453 shares

issued at June 30, 2024 and December 31, 2023,

respectively; 56,775,369 and 56,899,253 shares outstanding at

June 30, 2024 and December 31, 2023, respectively |

|

634 |

|

|

|

631 |

|

| Additional paid-in

capital |

|

166,863 |

|

|

|

161,414 |

|

| Retained earnings |

|

134,073 |

|

|

|

100,742 |

|

| Accumulated other

comprehensive loss |

|

(628 |

) |

|

|

(649 |

) |

| Treasury stock, 6,627,744

shares at cost as of June 30, 2024, and 6,236,200 shares at

cost as of December 31, 2023. |

|

(68,936 |

) |

|

|

(59,701 |

) |

|

Total stockholders’ equity |

|

232,006 |

|

|

|

202,437 |

|

|

Total liabilities and stockholders’ equity |

$ |

323,036 |

|

|

$ |

285,682 |

|

|

|

|

THE VITA COCO COMPANY, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(Amounts in thousands,

except for share and per share data) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net sales |

$ |

144,116 |

|

|

$ |

139,645 |

|

|

$ |

255,814 |

|

|

$ |

249,404 |

|

| Cost of goods sold |

|

85,379 |

|

|

|

88,551 |

|

|

|

149,900 |

|

|

|

164,649 |

|

|

Gross profit |

|

58,737 |

|

|

|

51,094 |

|

|

|

105,914 |

|

|

|

84,755 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

28,756 |

|

|

|

30,249 |

|

|

|

56,974 |

|

|

|

57,206 |

|

| Income (Loss) from

operations |

|

29,981 |

|

|

|

20,845 |

|

|

|

48,940 |

|

|

|

27,549 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

Unrealized gain/(loss) on derivative instruments |

|

(5,963 |

) |

|

|

988 |

|

|

|

(8,488 |

) |

|

|

2,201 |

|

|

Foreign currency gain/(loss) |

|

(136 |

) |

|

|

170 |

|

|

|

(78 |

) |

|

|

781 |

|

|

Interest income |

|

1,627 |

|

|

|

268 |

|

|

|

3,150 |

|

|

|

281 |

|

|

Interest expense |

|

— |

|

|

|

(15 |

) |

|

|

— |

|

|

|

(30 |

) |

|

Total other income (expense) |

|

(4,472 |

) |

|

|

1,411 |

|

|

|

(5,416 |

) |

|

|

3,233 |

|

| Income before income

taxes |

|

25,509 |

|

|

|

22,256 |

|

|

|

43,524 |

|

|

|

30,782 |

|

| Income tax expense |

|

(6,416 |

) |

|

|

(4,269 |

) |

|

|

(10,193 |

) |

|

|

(6,090 |

) |

| Net income |

$ |

19,093 |

|

|

$ |

17,987 |

|

|

$ |

33,331 |

|

|

$ |

24,692 |

|

| Net income per common

share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.34 |

|

|

$ |

0.32 |

|

|

$ |

0.59 |

|

|

$ |

0.44 |

|

|

Diluted |

$ |

0.32 |

|

|

$ |

0.31 |

|

|

$ |

0.57 |

|

|

$ |

0.42 |

|

| Weighted-average number of

common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

56,705,220 |

|

|

|

56,325,013 |

|

|

|

56,647,393 |

|

|

|

56,186,727 |

|

|

Diluted |

|

59,235,211 |

|

|

|

58,854,063 |

|

|

|

58,990,921 |

|

|

|

58,103,502 |

|

|

|

|

THE VITA COCO COMPANY, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(Amounts in

thousands) |

| |

| |

Six Months Ended June 30, |

| |

2024 |

|

2023 |

| Cash flows from

operating activities: |

|

|

|

|

Net income |

$ |

33,331 |

|

|

$ |

24,692 |

|

|

Adjustments required to reconcile net income to cash flows from

operating activities: |

|

|

|

|

Depreciation and amortization |

|

344 |

|

|

|

340 |

|

|

(Gain)/loss on disposal of equipment |

|

13 |

|

|

|

(1 |

) |

|

Bad debt expense |

|

(204 |

) |

|

|

177 |

|

|

Unrealized (gain)/loss on derivative instruments |

|

8,488 |

|

|

|

(2,201 |

) |

|

Stock-based compensation |

|

4,508 |

|

|

|

4,264 |

|

|

Noncash lease expense |

|

508 |

|

|

|

561 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(28,761 |

) |

|

|

(46,605 |

) |

|

Inventory |

|

5,254 |

|

|

|

27,253 |

|

|

Prepaid expenses, net supplier advances, and other assets |

|

(204 |

) |

|

|

2,769 |

|

|

Accounts payable, accrued expenses, and other liabilities |

|

3,375 |

|

|

|

14,822 |

|

|

Net cash provided by (used in) operating activities |

|

26,652 |

|

|

|

26,071 |

|

| Cash flows from

investing activities: |

|

|

|

|

Cash paid for property and equipment |

|

(414 |

) |

|

|

(487 |

) |

|

Proceeds from sale of property and equipment |

|

— |

|

|

|

5 |

|

|

Net cash used in investing activities |

|

(414 |

) |

|

|

(482 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Proceeds from exercise of stock awards |

|

681 |

|

|

|

2,717 |

|

|

Cash received (paid) on notes payable |

|

(8 |

) |

|

|

(12 |

) |

|

Cash paid to acquire treasury stock |

|

(9,235 |

) |

|

|

— |

|

|

Net cash provided by (used in) financing activities |

|

(8,562 |

) |

|

|

2,705 |

|

|

Effects of exchange rate changes on cash and cash equivalents |

|

(106 |

) |

|

|

371 |

|

|

Net increase/(decrease) in cash and cash equivalents |

|

17,570 |

|

|

|

28,665 |

|

| Cash, cash equivalents and

restricted cash at beginning of the period (1) |

|

132,867 |

|

|

|

19,629 |

|

| Cash, cash equivalents and

restricted cash at end of the period (1) |

|

150,437 |

|

|

|

48,294 |

|

| |

1 Includes $334 and $326 of restricted cash as of June 30,

2024 and 2023, respectively, that were included in other current

assets.

RECONCILIATION FROM GAAP NET INCOME

TO NON-GAAP ADJUSTED EBITDA

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(in thousands) |

|

(in thousands) |

|

Net income |

|

19,093 |

|

|

|

17,987 |

|

|

$ |

33,331 |

|

|

$ |

24,692 |

|

| Depreciation and

amortization |

|

182 |

|

|

|

175 |

|

|

|

344 |

|

|

|

340 |

|

| Interest income |

|

(1,627 |

) |

|

|

(268 |

) |

|

|

(3,150 |

) |

|

|

(281 |

) |

| Interest expense |

|

— |

|

|

|

15 |

|

|

|

— |

|

|

|

30 |

|

| Income tax expense |

|

6,416 |

|

|

|

4,269 |

|

|

|

10,193 |

|

|

|

6,090 |

|

| EBITDA |

|

24,064 |

|

|

|

22,178 |

|

|

|

40,718 |

|

|

|

30,871 |

|

| Stock-based compensation

(a) |

|

2,399 |

|

|

|

2,102 |

|

|

|

4,508 |

|

|

|

4,264 |

|

| Unrealized (gain)/loss on

derivative instruments (b) |

|

5,963 |

|

|

|

(988 |

) |

|

|

8,488 |

|

|

|

(2,201 |

) |

| Foreign currency (gain)/loss

(b) |

|

136 |

|

|

|

(170 |

) |

|

|

78 |

|

|

|

(781 |

) |

| Secondary Offering Costs

(c) |

|

(324 |

) |

|

|

856 |

|

|

|

(324 |

) |

|

|

856 |

|

|

Adjusted EBITDA |

$ |

32,238 |

|

|

$ |

23,978 |

|

|

$ |

53,468 |

|

|

$ |

33,009 |

|

|

|

|

(a) |

Non-cash

charges related to stock-based compensation, which vary from period

to period depending on volume and vesting timing of awards and

forfeitures. We adjusted for these charges to facilitate comparison

from period to period. |

| (b) |

Unrealized gains or losses on derivative instruments and

foreign currency gains or losses are not considered in our

evaluation of our ongoing performance. |

| (c) |

Reflects other non-recurring expense/(income) related to costs

associated with two secondary offerings in which Verlinvest

Beverages SA sold shares of the Company in an underwritten public

offering that closed on May 26, 2023 and a block trade that was

executed on November 9, 2023. The amounts for the three and six

months ended June 30, 2023 relate to costs for the May 26, 2023

offering. The amounts for the three and six months ended June 30,

2024 relate to an expense waiver of certain costs incurred during

the November 9, 2023 block trade. The Company did not receive any

proceeds from the sale of the shares. |

| |

|

SUPPLEMENTAL INFORMATION

| |

NET SALES |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in

thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Americas

segment |

|

|

|

|

|

|

|

|

Vita Coco Coconut Water |

$ |

98,494 |

|

$ |

95,004 |

|

$ |

168,016 |

|

$ |

164,142 |

|

Private Label |

|

23,135 |

|

|

24,059 |

|

|

47,408 |

|

|

49,109 |

|

Other |

|

2,873 |

|

|

2,200 |

|

|

5,169 |

|

|

4,784 |

|

Subtotal |

$ |

124,502 |

|

$ |

121,263 |

|

$ |

220,593 |

|

$ |

218,035 |

| International

segment |

|

|

|

|

|

|

|

|

Vita Coco Coconut Water |

$ |

13,952 |

|

$ |

12,720 |

|

$ |

23,617 |

|

$ |

22,278 |

|

Private Label |

|

4,816 |

|

|

5,053 |

|

|

9,968 |

|

|

7,719 |

|

Other |

|

846 |

|

|

609 |

|

|

1,636 |

|

|

1,372 |

|

Subtotal |

$ |

19,614 |

|

$ |

18,382 |

|

$ |

35,221 |

|

$ |

31,369 |

|

Total net sales |

$ |

144,116 |

|

$ |

139,645 |

|

$ |

255,814 |

|

$ |

249,404 |

|

|

COST OF GOODS SOLD & GROSS PROFIT |

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in

thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Cost of goods

sold |

|

|

|

|

|

|

|

|

Americas segment |

$ |

72,295 |

|

|

$ |

76,155 |

|

|

$ |

127,514 |

|

|

$ |

143,777 |

|

|

International segment |

|

13,084 |

|

|

|

12,396 |

|

|

|

22,386 |

|

|

|

20,872 |

|

|

Total cost of goods sold |

$ |

85,379 |

|

|

$ |

88,551 |

|

|

$ |

149,900 |

|

|

$ |

164,649 |

|

| Gross

profit |

|

|

|

|

|

|

|

|

Americas segment |

$ |

52,208 |

|

|

$ |

45,109 |

|

|

$ |

93,080 |

|

|

$ |

74,258 |

|

|

International segment |

|

6,529 |

|

|

|

5,985 |

|

|

|

12,834 |

|

|

|

10,497 |

|

|

Total gross profit |

$ |

58,737 |

|

|

$ |

51,094 |

|

|

$ |

105,914 |

|

|

$ |

84,755 |

|

| Gross

margin |

|

|

|

|

|

|

|

|

Americas segment |

|

41.9 |

% |

|

|

37.2 |

% |

|

|

42.2 |

% |

|

|

34.1 |

% |

|

International segment |

|

33.3 |

% |

|

|

32.6 |

% |

|

|

36.4 |

% |

|

|

33.5 |

% |

|

Consolidated |

|

40.8 |

% |

|

|

36.6 |

% |

|

|

41.4 |

% |

|

|

34.0 |

% |

| |

VOLUME (CE) |

| |

Percentage Change - Three Months Ended June 30, 2024 vs.

2023 |

| |

Americas |

|

International |

|

Total |

|

Vita Coco Coconut Water |

1.3 |

|

% |

|

5.0 |

|

% |

|

1.9 |

|

% |

|

Private Label |

10.6 |

|

% |

|

13.7 |

|

% |

|

11.2 |

|

% |

|

Other |

14.0 |

|

% |

|

7.2 |

|

% |

|

13.5 |

|

% |

| Total volume (CE) |

3.4 |

|

% |

|

7.3 |

|

% |

|

4.0 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

Percentage Change - Six Months Ended June 30, 2024 vs.

2023 |

|

|

Americas |

|

International |

|

Total |

|

Vita Coco Coconut Water |

(0.6 |

) |

% |

|

(1.2 |

) |

% |

|

(0.7 |

) |

% |

|

Private Label |

7.1 |

|

% |

|

34.7 |

|

% |

|

11.7 |

|

% |

|

Other |

(7.0 |

) |

% |

|

(8.5 |

) |

% |

|

(7.1 |

) |

% |

| Total volume (CE) |

1.0 |

|

% |

|

7.5 |

|

% |

|

2.0 |

|

% |

| |

Note: A CE is a standard volume measure used by management which

is defined as a case of 12 bottles of 330ml liquid beverages or the

same liter volume of oil.

*International Other excludes minor volume that is treated as

zero CE

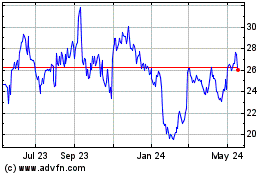

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

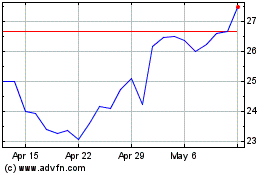

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Nov 2023 to Nov 2024