true

Explanatory Note This Current Report on Form 8-K/A (this “Current Report”) amends the Current Report on Form 8-K filed by Virpax Pharmaceuticals, Inc. (the “Company”) with the Securities and Exchange Commission on October 7, 2024 (the “Original Report”) and is being filed in order to file as an exhibit the letter by Gerald Bruce regarding his resignation as a director of the Company. The Company disagrees and denies the allegations set forth in Mr. Bruce’s letter. The Original Report otherwise remains unchanged.

0001708331

0001708331

2024-10-04

2024-10-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 4, 2024

Virpax

Pharmaceuticals, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40064 |

|

82-1510982 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification

No.) |

1055

Westlakes Drive, Suite 300

Berwyn,

PA 19312

(Address

of principal executive offices, including zip code)

(610)

727-4597

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class: |

|

Trading

Symbol |

|

Name

of Each Exchange on which Registered |

| Common Stock, par

value $0.00001 per share |

|

VRPX |

|

The Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory Note

This Current Report on Form 8-K/A (this “Current

Report”) amends the Current Report on Form 8-K filed by Virpax Pharmaceuticals, Inc. (the “Company”) with the Securities

and Exchange Commission on October 7, 2024 (the “Original Report”) and is being filed in order to file as an exhibit the letter

by Gerald Bruce regarding his resignation as a director of the Company. The Company disagrees and denies the allegations set forth in

Mr. Bruce’s letter. The Original Report otherwise remains unchanged.

Item 3.01. Notice of Delisting or Failure to Satisfy

a Continued Listing Rule or Standard; Transfer of Listing.

On October 4, 2024, Virpax Pharmaceuticals,

Inc. (the “Company”) received a deficiency letter from the Nasdaq Listing Qualifications Department (the “Staff”)

of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, for the last 30 consecutive business days, the closing

bid price for the Company’s common stock had been below the minimum $1.00 per share required for continued listing on Nasdaq pursuant

to Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”). The Nasdaq deficiency letter has no immediate effect

on the listing of the Company’s common stock, and its common stock will continue to trade on The Nasdaq Capital Market under the

symbol “VRPX”.

In accordance with Nasdaq Listing

Rule 5810(c)(3)(A), the Company has been given 180 calendar days, or until April 2, 2025, to regain compliance with the Minimum Bid Price

Requirement. If at any time before April 2, 2025, the bid price of the Company’s common stock closes at $1.00 per share or more

for a minimum of 10 consecutive business days, the Staff will provide written confirmation that the Company has achieved compliance.

If the Company does not regain

compliance with the Minimum Bid Price Requirement by April 2, 2025, the Company may be afforded a second 180 calendar days period to regain.

The Company would be required to notify Nasdaq of its intent to cure the deficiency during the second compliance period. If the Company

does not regain compliance with the Minimum Bid Price Requirement by the end of the compliance period (or the second compliance period,

if applicable), the Company’s common stock will become subject to delisting. In the event that the Company receives notice that

its common stock is being delisted, the Nasdaq listing rules permit the Company to appeal a delisting determination by the Staff to a

hearings panel.

The Company intends to monitor

the closing bid price of its common stock and may, if appropriate, consider available options to regain compliance with the Minimum Bid

Price Requirement, including initiating a reverse stock split. However, there can be no assurance that the Company will be able to regain

compliance with the Minimum Bid Price Requirement or will otherwise be in compliance with other Nasdaq Listing Rules.

Item 5.02. Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

On October 5, 2024, Gerald Bruce, as Chief Executive Officer and member of

the Board of Directors (the “Board”), and Vinay Shah, as Chief Financial Officer, notified the Company of their resignation

from their respective positions, effective immediately. Messrs. Bruce and Shah expressed disagreements with the Board’s execution

of policies, practices, and procedures.

On October

6, 2024, the Board appointed Jatinder Dhaliwal, a member of the Board, to serve as Chief Executive Officer of the Company, effective immediately.

Mr. Dhaliwal will continue to serve on the Board and will be replaced by Katharyn Field on the Board’s audit committee.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Signature

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VIRPAX PHARMACEUTICALS, INC. |

| |

|

|

| Dated: October 9, 2024 |

By: |

/s/ Katharyn Field |

| |

|

Katharyn Field |

| |

|

Principal Executive Officer |

EXHIBIT 17.1

To,

10/5/2024

The Board of Directors

Virpax Pharmaceuticals, Inc.

Re: Resignation

Dear Sirs:

I hereby resign from my position of Director

of Virpax Pharmaceuticals, Inc., effective immediately. The individuals currently purporting to serve as Virpax’s board of directors

are illegally holding those positions. I cannot continue acting as a board member in good faith with people acting in such a manner. Accordingly,

I resign.

As I told you almost two weeks ago,

Corbo Capital, Inc., Virpax’s lender, appointed the four Virpax directors who were appointed to its board. The agreement that provided

Corbo the right to appoint those four directors – the July 5, 2024 Securities Purchase Agreement between Virpax and Corbo –

states that all four of those directors must resign from Virpax’s board immediately if Corbo (or another appropriate entity) does

not provide at least $5 million in additional financing to Virpax by not later than September 30, 2024. Virpax received no financing.

We are well past the September 30 deadline. Accordingly, those four directors should have all resigned from their board positions weeks

ago.

But they did not. Instead, in a self-interested

manner, these four directors purported to act for Virpax in having Virpax agree to continue to let these same four individuals serve as

Virpax’s directors. This self-interested transaction was unfair and unreasonable to Virpax and is void.

Beyond this, Virpax’s board

| ● | caused Virpax to breach employment agreements by slashing contractually- guaranteed salaries in half; |

| | | |

| ● | took actions that caused all of Virpax’s employees to resign; |

| | | |

| ● | planned Virpax to commit, without any due diligence, to an exorbitant digital marketing agreement to

a specific firm that Virpax cannot afford (without considering other, far more reasonably priced, alternatives); |

| | | |

| ● | fired Virpax’s corporate counsel without basis in the middle of an attempted financing; |

| | | |

| ● | caused Virpax’s auditors to resign due to the unacceptably high risk created by these actions; |

| | | |

| ● | refused, in bad faith, to consider alternative investors to help keep the company alive; and |

| | | |

| ● | eliminated Virpax’s directors and officers insurance, which creates very high risk to anyone who

dares to serve as a Virpax director; |

These actions, in sum, make it impossible for me to continue to

serve as a director.

Accordingly, I resign immediately.

Sincerely,

Gerald Bruce

Copy to:

Virpax Pharmaceuticals, Inc.

1055 Westlakes Drive, Suite 300

Berwyn, PA 19312

Attention: Chief Financial Officer

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

Attention: Leslie Marlow

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

Attention: Ross D. Carmel

Katharyn Field

22210 Woodset Lane

Boca Raton, FL 33428

Gary Herman

9499 Collins Avenue #611

Surfside, FL 33154

Jatinder Dhaliwal

102-1102 Hornby Street

Vancouver, BC V6Z1V8

Judy Su

4226 Dundas Street

Burnaby, BC, V5C 1B1

v3.24.3

Cover

|

Oct. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

Explanatory Note This Current Report on Form 8-K/A (this “Current Report”) amends the Current Report on Form 8-K filed by Virpax Pharmaceuticals, Inc. (the “Company”) with the Securities and Exchange Commission on October 7, 2024 (the “Original Report”) and is being filed in order to file as an exhibit the letter by Gerald Bruce regarding his resignation as a director of the Company. The Company disagrees and denies the allegations set forth in Mr. Bruce’s letter. The Original Report otherwise remains unchanged.

|

| Document Period End Date |

Oct. 04, 2024

|

| Entity File Number |

001-40064

|

| Entity Registrant Name |

Virpax

Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001708331

|

| Entity Tax Identification Number |

82-1510982

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1055

Westlakes Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Berwyn

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19312

|

| City Area Code |

(610)

|

| Local Phone Number |

727-4597

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par

value $0.00001 per share

|

| Trading Symbol |

VRPX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

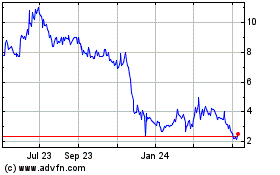

Virpax Pharmaceuticals (NASDAQ:VRPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

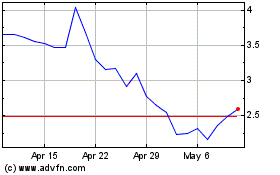

Virpax Pharmaceuticals (NASDAQ:VRPX)

Historical Stock Chart

From Dec 2023 to Dec 2024