false

--12-31

Q3

0000764195

VBI Vaccines Inc/BC

A1

00-0000000

Unlimited

Unlimited

0000764195

2023-01-01

2023-09-30

0000764195

2023-11-14

0000764195

2023-09-30

0000764195

2022-12-31

0000764195

2022-01-01

2022-12-31

0000764195

2023-07-01

2023-09-30

0000764195

2022-07-01

2022-09-30

0000764195

2022-01-01

2022-09-30

0000764195

us-gaap:CommonStockMember

2022-12-31

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000764195

us-gaap:RetainedEarningsMember

2022-12-31

0000764195

us-gaap:CommonStockMember

2023-03-31

0000764195

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000764195

us-gaap:RetainedEarningsMember

2023-03-31

0000764195

2023-03-31

0000764195

us-gaap:CommonStockMember

2023-06-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000764195

us-gaap:RetainedEarningsMember

2023-06-30

0000764195

2023-06-30

0000764195

us-gaap:CommonStockMember

2021-12-31

0000764195

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0000764195

us-gaap:RetainedEarningsMember

2021-12-31

0000764195

2021-12-31

0000764195

us-gaap:CommonStockMember

2022-03-31

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0000764195

us-gaap:RetainedEarningsMember

2022-03-31

0000764195

2022-03-31

0000764195

us-gaap:CommonStockMember

2022-06-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0000764195

us-gaap:RetainedEarningsMember

2022-06-30

0000764195

2022-06-30

0000764195

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000764195

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0000764195

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000764195

2023-01-01

2023-03-31

0000764195

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0000764195

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000764195

2023-04-01

2023-06-30

0000764195

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0000764195

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0000764195

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0000764195

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0000764195

2022-01-01

2022-03-31

0000764195

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0000764195

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0000764195

2022-04-01

2022-06-30

0000764195

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-09-30

0000764195

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0000764195

us-gaap:CommonStockMember

2023-09-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0000764195

us-gaap:RetainedEarningsMember

2023-09-30

0000764195

us-gaap:CommonStockMember

2022-09-30

0000764195

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0000764195

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0000764195

us-gaap:RetainedEarningsMember

2022-09-30

0000764195

2022-09-30

0000764195

2023-04-11

2023-04-12

0000764195

srt:MinimumMember

2023-04-03

2023-04-04

0000764195

srt:MaximumMember

2023-04-03

2023-04-04

0000764195

srt:MinimumMember

2023-01-01

2023-06-30

0000764195

srt:MaximumMember

2023-01-01

2023-06-30

0000764195

srt:MaximumMember

2022-08-25

2022-08-26

0000764195

VBIV:ATMProgramMember

srt:MaximumMember

2022-08-25

2022-08-26

0000764195

VBIV:ATMProgramMember

2023-07-01

2023-09-30

0000764195

VBIV:ATMProgramMember

2023-09-30

0000764195

2023-07-04

2023-07-05

0000764195

VBIV:DirectOfferingMember

2023-07-05

0000764195

2023-07-05

0000764195

VBIV:BriiBiosciencesLimitedMember

2023-07-05

0000764195

us-gaap:IPOMember

2023-07-01

2023-07-31

0000764195

us-gaap:IPOMember

2023-07-31

0000764195

us-gaap:CommonStockMember

2023-07-01

2023-07-31

0000764195

us-gaap:WarrantMember

2023-07-31

0000764195

2023-07-31

0000764195

VBIV:DirectOfferingMember

2023-07-01

2023-07-31

0000764195

VBIV:DirectOfferingMember

2023-07-31

0000764195

2023-07-01

2023-07-31

0000764195

us-gaap:WarrantMember

2023-09-30

0000764195

us-gaap:PropertyPlantAndEquipmentMember

2023-07-01

2023-09-30

0000764195

us-gaap:PropertyPlantAndEquipmentMember

2022-07-01

2022-09-30

0000764195

us-gaap:PropertyPlantAndEquipmentMember

2023-01-01

2023-09-30

0000764195

us-gaap:PropertyPlantAndEquipmentMember

2022-01-01

2022-09-30

0000764195

us-gaap:InProcessResearchAndDevelopmentMember

2023-07-01

2023-09-30

0000764195

us-gaap:InProcessResearchAndDevelopmentMember

2022-07-01

2022-09-30

0000764195

us-gaap:InProcessResearchAndDevelopmentMember

2023-01-01

2023-09-30

0000764195

us-gaap:InProcessResearchAndDevelopmentMember

2022-01-01

2022-09-30

0000764195

us-gaap:PropertyPlantAndEquipmentMember

2023-04-30

2023-04-30

0000764195

2023-04-30

0000764195

srt:MinimumMember

2023-01-01

2023-09-30

0000764195

srt:MaximumMember

2023-01-01

2023-09-30

0000764195

us-gaap:InProcessResearchAndDevelopmentMember

2023-04-01

2023-06-30

0000764195

us-gaap:InProcessResearchAndDevelopmentMember

2023-09-30

0000764195

VBIV:InprocessResearchAndDevelopmentAssetsMember

2023-09-30

0000764195

VBIV:InprocessResearchAndDevelopmentAssetsMember

2023-01-01

2023-09-30

0000764195

VBIV:InprocessResearchAndDevelopmentAssetsMember

2022-12-31

0000764195

VBIV:InprocessResearchAndDevelopmentAssetsMember

2022-01-01

2022-12-31

0000764195

srt:MinimumMember

2023-04-01

2023-06-30

0000764195

srt:MaximumMember

2023-04-01

2023-06-30

0000764195

us-gaap:OneTimeTerminationBenefitsMember

2022-12-31

0000764195

us-gaap:OneTimeTerminationBenefitsMember

2023-01-01

2023-09-30

0000764195

us-gaap:OneTimeTerminationBenefitsMember

2023-09-30

0000764195

us-gaap:WarrantMember

2023-01-01

2023-09-30

0000764195

us-gaap:WarrantMember

2022-01-01

2022-09-30

0000764195

VBIV:StockOptionsAndRestrictedStockUnitsMember

2023-01-01

2023-09-30

0000764195

VBIV:StockOptionsAndRestrictedStockUnitsMember

2022-01-01

2022-09-30

0000764195

VBIV:K2HVConversionFeatureMember

2023-01-01

2023-09-30

0000764195

VBIV:K2HVConversionFeatureMember

2022-01-01

2022-09-30

0000764195

us-gaap:LongTermDebtMember

2023-09-30

0000764195

us-gaap:LongTermDebtMember

2022-12-31

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:FirstTrancheMember

VBIV:K2HealthventuresLLCMember

2020-05-22

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

2020-05-21

2020-05-22

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

2020-05-22

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

2021-02-02

2021-02-03

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

2021-02-03

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:FirstAmendmentMember

2021-05-17

0000764195

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentMember

2022-09-14

0000764195

VBIV:LoanAgreementMember

2022-09-14

0000764195

VBIV:LoanAgreementMember

VBIV:FirstTrancheTermLoanMember

VBIV:SecondAmendmentMember

2022-09-15

0000764195

VBIV:LoanAgreementMember

VBIV:ThirdTrancheTermLoanMember

srt:MaximumMember

2022-09-15

0000764195

VBIV:LoanAgreementMember

VBIV:FourthTrancheTermLoanMember

srt:MaximumMember

2022-09-15

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentMember

2022-09-14

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentMember

VBIV:ConversionPriceOfFourtyThreePoinEightyPerShareMember

2022-09-14

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentMember

VBIV:ConversionPriceOfFourtyThreePoinEightyPerShareMember

2022-09-13

2022-09-14

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentMember

VBIV:ConversionPriceOfThirtyOnePointThreeZeroTwoPerShareMember

2022-09-14

0000764195

VBIV:LoanAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentMember

VBIV:ConversionPriceOfThirtyOnePointThreeZeroTwoPerShareMember

2022-09-13

2022-09-14

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:K2WarrantMember

2020-05-22

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:RestatedK2WarrantMember

2021-05-17

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:SecondAmendmentWarrantMember

2022-09-14

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

2022-09-14

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

2021-05-17

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:K2HealthventuresLLCMember

VBIV:FirstAmendmentMember

2021-05-17

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

2022-09-13

2022-09-14

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

srt:MinimumMember

2023-09-30

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

VBIV:PrimeRatePlusMember

2023-09-30

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

2023-09-30

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

2023-01-01

2023-09-30

0000764195

VBIV:ExtensionAgreementMember

VBIV:SecondAmendmentMember

2023-01-01

2023-09-30

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

2022-09-15

0000764195

VBIV:LoanAndGuarantyAgreementMember

VBIV:SecondAmendmentMember

2022-12-31

0000764195

us-gaap:FairValueInputsLevel3Member

2023-09-30

0000764195

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000764195

VBIV:TwoThousandAndSixPlanMember

2023-09-30

0000764195

VBIV:TwoThousandAndFourteenPlanMember

2023-09-30

0000764195

VBIV:TwoThousandAndSixteenPlanMember

2023-01-01

2023-09-30

0000764195

VBIV:TwoThousandAndSixteenPlanMember

2023-09-30

0000764195

us-gaap:StockOptionMember

2022-12-31

0000764195

us-gaap:StockOptionMember

2023-01-01

2023-09-30

0000764195

us-gaap:StockOptionMember

2023-09-30

0000764195

us-gaap:RestrictedStockUnitsRSUMember

2022-12-31

0000764195

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-09-30

0000764195

us-gaap:RestrictedStockUnitsRSUMember

2023-09-30

0000764195

us-gaap:ResearchAndDevelopmentExpenseMember

2023-07-01

2023-09-30

0000764195

us-gaap:ResearchAndDevelopmentExpenseMember

2022-07-01

2022-09-30

0000764195

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-09-30

0000764195

us-gaap:ResearchAndDevelopmentExpenseMember

2022-01-01

2022-09-30

0000764195

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0000764195

us-gaap:GeneralAndAdministrativeExpenseMember

2022-07-01

2022-09-30

0000764195

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-09-30

0000764195

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-09-30

0000764195

us-gaap:CostOfSalesMember

2023-07-01

2023-09-30

0000764195

us-gaap:CostOfSalesMember

2022-07-01

2022-09-30

0000764195

us-gaap:CostOfSalesMember

2023-01-01

2023-09-30

0000764195

us-gaap:CostOfSalesMember

2022-01-01

2022-09-30

0000764195

us-gaap:ProductMember

2023-07-01

2023-09-30

0000764195

us-gaap:ProductMember

2022-07-01

2022-09-30

0000764195

us-gaap:ProductMember

2023-01-01

2023-09-30

0000764195

us-gaap:ProductMember

2022-01-01

2022-09-30

0000764195

us-gaap:LicenseMember

2023-07-01

2023-09-30

0000764195

us-gaap:LicenseMember

2022-07-01

2022-09-30

0000764195

us-gaap:LicenseMember

2023-01-01

2023-09-30

0000764195

us-gaap:LicenseMember

2022-01-01

2022-09-30

0000764195

us-gaap:ServiceMember

2023-07-01

2023-09-30

0000764195

us-gaap:ServiceMember

2022-07-01

2022-09-30

0000764195

us-gaap:ServiceMember

2023-01-01

2023-09-30

0000764195

us-gaap:ServiceMember

2022-01-01

2022-09-30

0000764195

us-gaap:ProductMember

2023-09-30

0000764195

us-gaap:ProductMember

VBIV:CurrentPortionToSeptemberThirtyTwoThousandTwentyFourMember

2023-09-30

0000764195

us-gaap:ProductMember

VBIV:RemainingPortionThereAfterMember

2023-09-30

0000764195

us-gaap:ServiceMember

2023-09-30

0000764195

us-gaap:ServiceMember

VBIV:CurrentPortionToSeptemberThirtyTwoThousandTwentyFourMember

2023-09-30

0000764195

us-gaap:ServiceMember

VBIV:RemainingPortionThereAfterMember

2023-09-30

0000764195

VBIV:CurrentPortionToSeptemberThirtyTwoThousandTwentyFourMember

2023-09-30

0000764195

VBIV:RemainingPortionThereAfterMember

2023-09-30

0000764195

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

2018-12-04

0000764195

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

2018-12-03

2018-12-04

0000764195

VBIV:LicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

2018-12-04

0000764195

us-gaap:ServiceMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

2018-12-04

0000764195

VBIV:VBITwoThousandSixHundredAndOneMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

2018-12-04

0000764195

VBIV:CollaborationAndLicenseAgreementMember

us-gaap:ServiceMember

2023-07-01

2023-09-30

0000764195

VBIV:CollaborationAndLicenseAgreementMember

us-gaap:ServiceMember

2023-01-01

2023-09-30

0000764195

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:VBITwoThousandSixHundredAndOneMember

VBIV:NewLicensedTerritoryMember

2023-07-05

0000764195

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:VBITwoThousandSixHundredAndOneMember

VBIV:NewLicensedTerritoryMember

2023-07-05

2023-07-05

0000764195

us-gaap:ServiceMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:VBITwoThousandSixHundredAndOneMember

VBIV:NewLicensedTerritoryMember

2023-07-05

0000764195

VBIV:TechnologyTransferMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:VBITwoThousandSixHundredAndOneMember

VBIV:NewLicensedTerritoryMember

2023-07-05

0000764195

us-gaap:LicenseMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:VBITwoThousandSixHundredAndOneMember

VBIV:NewLicensedTerritoryMember

2023-07-05

0000764195

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:PreHevbriLicensedTerritoryMember

2023-07-05

0000764195

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:PreHevbriLicensedTerritoryMember

2023-07-05

2023-07-05

0000764195

us-gaap:ServiceMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:PreHevbriLicensedTerritoryMember

2023-07-05

0000764195

VBIV:TechnologyTransferMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:PreHevbriLicensedTerritoryMember

2023-07-05

0000764195

us-gaap:LicenseMember

VBIV:CollaborationAndLicenseAgreementMember

VBIV:BriiBiosciencesLimitedMember

VBIV:PreHevbriLicensedTerritoryMember

2023-07-05

0000764195

us-gaap:IPOMember

VBIV:SupplyAgreementsMember

VBIV:BriiBiosciencesLimitedMember

2023-07-05

2023-07-05

0000764195

VBIV:SupplyAgreementsMember

VBIV:BriiBiosciencesLimitedMember

2023-07-05

0000764195

VBIV:SupplyAgreementsMember

VBIV:BriiBiosciencesLimitedMember

2023-09-30

0000764195

VBIV:BriiCollaborationAgreementsAndSupplyAgreementsMember

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:NationalResearchCouncilMember

2023-07-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:NationalResearchCouncilMember

2022-07-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:NationalResearchCouncilMember

2023-01-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:NationalResearchCouncilMember

2022-01-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:CoalitionForEpidemicPreparednessInnovationsMember

2023-07-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:CoalitionForEpidemicPreparednessInnovationsMember

2022-07-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:CoalitionForEpidemicPreparednessInnovationsMember

2023-01-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:CoalitionForEpidemicPreparednessInnovationsMember

2022-01-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:AgenusIncMember

2023-07-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:AgenusIncMember

2022-07-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:AgenusIncMember

2023-01-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

VBIV:AgenusIncMember

2022-01-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

2023-07-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

2022-07-01

2022-09-30

0000764195

VBIV:CollaborationAgreementMember

2023-01-01

2023-09-30

0000764195

VBIV:CollaborationAgreementMember

2022-01-01

2022-09-30

0000764195

VBIV:StrategicInnovationFundMember

2023-07-01

2023-09-30

0000764195

VBIV:StrategicInnovationFundMember

2023-01-01

2023-09-30

0000764195

VBIV:StrategicInnovationFundMember

2023-09-30

0000764195

VBIV:StrategicInnovationFundMember

2022-07-01

2022-09-30

0000764195

VBIV:StrategicInnovationFundMember

2022-01-01

2022-09-30

0000764195

VBIV:StrategicInnovationFundMember

2022-09-30

0000764195

VBIV:SciBVacMember

2018-09-13

0000764195

VBIV:SciBVacMember

2018-09-11

2018-09-13

0000764195

country:IL

VBIV:ManufacturingFacilityLeaseAgreementMember

2023-01-01

2023-09-30

0000764195

country:CA

VBIV:LeaseAgreementMember

2023-01-01

2023-09-30

0000764195

country:US

2023-07-01

2023-09-30

0000764195

country:US

2022-07-01

2022-09-30

0000764195

country:US

2023-01-01

2023-09-30

0000764195

country:US

2022-01-01

2022-09-30

0000764195

country:IL

2023-07-01

2023-09-30

0000764195

country:IL

2022-07-01

2022-09-30

0000764195

country:IL

2023-01-01

2023-09-30

0000764195

country:IL

2022-01-01

2022-09-30

0000764195

VBIV:ChinaHongKongMember

2023-07-01

2023-09-30

0000764195

VBIV:ChinaHongKongMember

2022-07-01

2022-09-30

0000764195

VBIV:ChinaHongKongMember

2023-01-01

2023-09-30

0000764195

VBIV:ChinaHongKongMember

2022-01-01

2022-09-30

0000764195

srt:EuropeMember

2023-07-01

2023-09-30

0000764195

srt:EuropeMember

2022-07-01

2022-09-30

0000764195

srt:EuropeMember

2023-01-01

2023-09-30

0000764195

srt:EuropeMember

2022-01-01

2022-09-30

0000764195

country:CA

2023-01-01

2023-09-30

0000764195

country:CA

2022-01-01

2022-09-30

0000764195

VBIV:ATMProgramMember

us-gaap:SubsequentEventMember

2023-10-01

2023-11-13

0000764195

VBIV:ATMProgramMember

us-gaap:SubsequentEventMember

2023-11-13

0000764195

us-gaap:SubsequentEventMember

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:ILS

VBIV:Integer

xbrli:pure

iso4217:CAD

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended September 30, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _______ to _______

Commission

file number: 001-37769

VBI

VACCINES INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

N/A |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| 160

Second Street, Floor 3 |

|

|

| Cambridge,

Massachusetts |

|

02142 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 617-830-3031

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Shares, no par value per share |

|

VBIV |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| |

|

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

|

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Common

Shares, no par value per share |

|

23,687,695 |

| (Class) |

|

Outstanding

at November 14, 2023 |

VBI

VACCINES INC.

FORM

10-Q FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2023

TABLE

OF CONTENTS

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION

CONTAINED

IN THIS REPORT

This

quarterly report on Form 10-Q (this “Form 10-Q”) contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements give

our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly

to historical or current facts. You can find many (but not all) of these statements by looking for words such as “approximates,”

“believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,”

“intends,” “plans,” “would,” “should,” “could,” “will,” “may,”

or other similar expressions in this Form 10-Q. In particular, these include statements relating to future actions; prospective products,

applications, customers, and technologies; future performance or results of anticipated products; anticipated expenses; and projected

financial results. We have based these forward-looking statements largely on our current expectations and projections about future events

and financial trends that we believe may affect our business, financial condition, and results of operations. These forward-looking statements

speak only as of the date of this Quarterly Report on Form 10-Q and are subject to a number of risks, uncertainties, and assumptions

that could cause actual results to differ materially from our historical experience and our present expectations, or projections described

under the sections in this Quarterly Report on Form 10-Q entitled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and in the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our 2022 annual report on Form 10-K filed with the

Securities and Exchange Commission (the “SEC”) on March 13, 2023. Factors that could cause actual results to differ from

those discussed in the forward-looking statements include, but are not limited to:

| ● |

the

timing of, and our ability to, obtain and maintain regulatory approvals for our clinical trials, products, and pipeline candidates; |

| |

|

| ● |

our

ability to achieve and sustain commercial success of PreHevbrio in the United States (“U.S.”) and Canada and PreHevbri

in Europe; |

| |

|

| ● |

the

timing and results of our ongoing and planned clinical trials for products and pipeline candidates; |

| |

|

| ● |

the

amount of funds we require for our prophylactic and therapeutic pipeline candidates; |

| |

|

| ● |

the

potential benefits of strategic partnership agreements and our ability to enter into and successfully execute strategic partnership

arrangements; |

| |

|

| ● |

our

ability to manufacture, or to have manufactured, our 3-antigen hepatitis B vaccine and our pipeline candidates, at commercially viable

scales to the standards and requirements of regulatory agencies; |

| |

|

| ● |

the

impact and continuing effects of the COVID-19 endemic on our clinical studies, research programs, manufacturing, business plan, regulatory

review including site inspections, and the global economy; |

| |

|

| ● |

our

ability to effectively execute and deliver our plans related to commercialization, marketing, manufacturing capabilities, and strategy; |

| |

|

| ● |

our

ability to retain and maintain a good relationship with our current employees, and our ability to competitively attract new employees

with relevant experience and expertise; |

| |

|

| ● |

the

suitability and adequacy of our office, manufacturing, and research facilities and our ability to secure term extensions or expansions

of leased space; |

| |

|

| ● |

the

ability of our vendors and suppliers to manufacture and deliver materials in a timely manner that meet regulatory agency and our

standards and requirements to meet planned timelines and milestones; |

| ● |

any

disruption in the operations of our Rehovot, Israel manufacturing facility where we manufacture all of our clinical and commercial

supplies of our 3-antigen hepatitis B vaccine and clinical supplies of our hepatitis B immunotherapeutic, VBI-2601; |

| |

|

| ● |

our

compliance with all laws, rules, and regulations applicable to our business and products; |

| |

|

| ● |

our

ability to continue as a going concern; |

| |

|

| ● |

our

history of losses; |

| |

|

| ● |

our

ability to generate revenues and achieve profitability; |

| |

|

| ● |

emerging

competition and rapidly advancing technology in our industry that may outpace our technology; |

| |

|

| ● |

customer

demand for our 3-antigen hepatitis B vaccine and pipeline candidates; |

| |

|

| ● |

the

impact of competitive or alternative products, technologies, and pricing; |

| |

|

| ● |

general

economic conditions and events and the impact they may have on us and our potential customers; |

| |

|

| ● |

our

ability to obtain adequate financing in the future on reasonable terms, if, as, and when we need it; |

| |

|

| ● |

our

ability to implement network systems and controls that are effective at preventing cyber-attacks, malware intrusions, malicious viruses,

and ransomware threats; |

| |

|

| ● |

our

ability to secure and maintain protection over our intellectual property; |

| |

|

| ● |

our

ability to maintain our existing licenses with licensors of intellectual property, or obtain new licenses for intellectual property; |

| |

|

| ● |

changes

to legal and regulatory processes for biosimilar approval and marketing that could reduce the duration of market exclusivity for

our products; |

| |

|

| ● |

our

ability to regain and maintain compliance with the NASDAQ Capital Market’s (“Nasdaq”) listing standards; |

| |

|

| ● |

our

success at managing the risks involved in the foregoing items; and |

| |

|

| ● |

other

factors discussed in this Form 10-Q. |

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some

of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events

and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially

from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties

may emerge from time to time, and it is not possible for us to predict all risk factors and uncertainties. Except as required by applicable

law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information,

future events, changed circumstances or otherwise.

Unless

otherwise stated or the context otherwise requires, the terms “VBI,” “we,” “us,” “our,”

and the “Company” refer to VBI Vaccines Inc. and its subsidiaries.

Unless

indicated otherwise, all references to the U.S. Dollar, Dollar, or $ are to the United States Dollar, the legal currency of the United

States of America and all references to € mean Euros, the legal currency of the European Union. We may also refer to NIS, which

is the New Israeli Shekel, the legal currency of Israel, and the Canadian Dollar or CAD, which is the legal currency of Canada.

Except

for share and per share amounts, or as otherwise specified to be in millions, amounts presented are stated in thousands.

PART

I—FINANCIAL INFORMATION

Item

1. Condensed Consolidated Financial Statements

VBI

Vaccines Inc. and Subsidiaries

Condensed

Consolidated Balance Sheets

(in

thousands, except share amounts)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

(unaudited) | | |

| |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 35,454 | | |

$ | 62,629 | |

| Accounts receivable, net | |

| 353 | | |

| 94 | |

| Inventory, net | |

| 7,540 | | |

| 6,599 | |

| Prepaid expenses | |

| 2,930 | | |

| 2,309 | |

| Other current assets | |

| 3,870 | | |

| 6,059 | |

| Total current assets | |

| 50,147 | | |

| 77,690 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS | |

| | | |

| | |

| Other long-term assets | |

| 1,094 | | |

| 1,355 | |

| Property and equipment, net | |

| 9,423 | | |

| 12,253 | |

| Right of use assets | |

| 2,396 | | |

| 3,316 | |

| Intangible assets, net | |

| 35,603 | | |

| 58,345 | |

| Goodwill | |

| 2,121 | | |

| 2,127 | |

| Total non-current assets | |

| 50,637 | | |

| 77,396 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 100,784 | | |

$ | 155,086 | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 7,008 | | |

$ | 12,973 | |

| Other current liabilities | |

| 11,923 | | |

| 22,588 | |

| Current portion of deferred revenues | |

| 6,970 | | |

| 409 | |

| Current portion of long-term debt, net of debt discount | |

| 50,299 | | |

| - | |

| Current portion of lease liability | |

| 994 | | |

| 972 | |

| Total current liabilities | |

| 77,194 | | |

| 36,942 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES | |

| | | |

| | |

| Deferred revenues, net of current portion | |

| 1,748 | | |

| 2,204 | |

| Long-term debt, net of debt discount | |

| - | | |

| 48,888 | |

| Lease liability, net of current portion | |

| 1,426 | | |

| 2,365 | |

| Liabilities for severance pay | |

| 530 | | |

| 524 | |

| Total non-current liabilities | |

| 3,704 | | |

| 53,981 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES (NOTE 14) | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Common shares (unlimited authorized; no par value) (September 30, 2023 - issued and outstanding 23,339,220; December 31, 2022 - issued and outstanding 8,608,539) | |

| 453,901 | | |

| 442,312 | |

| Additional paid-in capital | |

| 105,955 | | |

| 90,020 | |

| Accumulated other comprehensive income | |

| 42,462 | | |

| 21,440 | |

| Accumulated deficit | |

| (582,432 | ) | |

| (489,609 | ) |

| Total stockholders’ equity | |

| 19,886 | | |

| 64,163 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 100,784 | | |

$ | 155,086 | |

See

accompanying Notes to Condensed Consolidated Financial Statements

VBI

Vaccines Inc. and Subsidiaries

Condensed

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in

thousands, except share and per share amounts)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended

September 30 | | |

Nine

Months Ended

September 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues, net | |

$ | 6,624 | | |

$ | 317 | | |

$ | 7,829 | | |

$ | 789 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 2,525 | | |

| 2,672 | | |

| 9,564 | | |

| 7,948 | |

| Research and development | |

| 1,532 | | |

| 4,983 | | |

| 7,975 | | |

| 12,988 | |

| Sales, general and administrative | |

| 9,036 | | |

| 14,220 | | |

| 33,237 | | |

| 40,234 | |

| Impairment charges | |

| 3,600 | | |

| - | | |

| 23,600 | | |

| - | |

| Total operating expenses | |

| 16,693 | | |

| 21,875 | | |

| 74,376 | | |

| 61,170 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (10,069 | ) | |

| (21,558 | ) | |

| (66,547 | ) | |

| (60,381 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (1,543 | ) | |

| (958 | ) | |

| (4,680 | ) | |

| (2,799 | ) |

| Foreign exchange loss | |

| (8,832 | ) | |

| (2,693 | ) | |

| (21,596 | ) | |

| (28,982 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (20,444 | ) | |

$ | (25,209 | ) | |

| (92,823 | ) | |

$ | (92,162 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Deemed dividend on certain warrants | |

| (862 | ) | |

| - | | |

| (862 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS AVAILABLE TO COMMON STOCKHOLDERS | |

$ | (21,306 | ) | |

$ | (25,209 | ) | |

$ | (93,685 | ) | |

$ | (92,162 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| 7,753 | | |

| (494 | ) | |

| 21,022 | | |

| 23,845 | |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

$ | (12,691 | ) | |

$ | (25,703 | ) | |

$ | (71,801 | ) | |

$ | (68,317 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share of common shares, basic and diluted | |

$ | (1.01 | ) | |

$ | (2.93 | ) | |

$ | (7.30 | ) | |

$ | (10.71 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of common shares outstanding, basic and diluted | |

| 21,166,818 | | |

| 8,608,539 | | |

| 12,840,633 | | |

| 8,608,530 | |

See

accompanying Notes to Condensed Consolidated Financial Statements

VBI

Vaccines Inc. and Subsidiaries

Condensed

Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in

thousands, except share amounts)

| | |

Number | | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

of | | |

| | |

Additional | | |

Other | | |

| | |

Total | |

| | |

Common | | |

Share | | |

Paid-in | | |

Comprehensive | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Capital | | |

Capital | | |

Income

(Loss) | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| BALANCE

AS OF DECEMBER 31, 2022 | |

| 8,608,539 | | |

$ | 442,312 | | |

$ | 90,020 | | |

$ | 21,440 | | |

$ | (489,609 | ) | |

$ | 64,163 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based

compensation | |

| - | | |

| 10 | | |

| 2,001 | | |

| - | | |

| - | | |

| 2,011 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (27,751 | ) | |

| (27,751 | ) |

| Currency

translation adjustments | |

| - | | |

| - | | |

| - | | |

| 6,599 | | |

| - | | |

| 6,599 | |

| BALANCE

AS OF MARCH 31, 2023 | |

| 8,608,539 | | |

$ | 442,322 | | |

$ | 92,021 | | |

$ | 28,039 | | |

$ | (517,360 | ) | |

$ | 45,022 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE

AS OF APRIL 1, 2023 | |

| 8,608,539 | | |

$ | 442,322 | | |

$ | 92,021 | | |

$ | 28,039 | | |

$ | (517,360 | ) | |

$ | 45,022 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based

compensation | |

| - | | |

| - | | |

| 1,674 | | |

| - | | |

| - | | |

| 1,674 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (44,628 | ) | |

| (44,628 | ) |

| Currency

translation adjustments | |

| - | | |

| - | | |

| - | | |

| 6,670 | | |

| - | | |

| 6,670 | |

| BALANCE

AS OF JUNE 30, 2023 | |

| 8,608,539 | | |

$ | 442,322 | | |

$ | 93,695 | | |

$ | 34,709 | | |

$ | (561,988 | ) | |

$ | 8,738 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE

AS OF JULY 1, 2023 | |

| 8,608,539 | | |

$ | 442,322 | | |

$ | 93,695 | | |

$ | 34,709 | | |

$ | (561,988 | ) | |

$ | 8,738 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common

shares issued in financing transactions, net of issuance costs | |

| 14,730,681 | | |

| 22,339 | | |

| - | | |

| - | | |

| - | | |

| 22,339 | |

| Warrants

issued in connection with financing transactions | |

| - | | |

| (10,760 | ) | |

| 10,760 | | |

| - | | |

| - | | |

| - | |

| Stock-based

compensation | |

| - | | |

| - | | |

| 1,500 | | |

| - | | |

| - | | |

| 1,500 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (20,444 | ) | |

| (20,444 | ) |

| Currency

translation adjustments | |

| - | | |

| - | | |

| - | | |

| 7,753 | | |

| - | | |

| 7,753 | |

| BALANCE

AS OF SEPTEMBER 30, 2023 | |

| 23,339,220 | | |

$ | 453,901 | | |

$ | 105,955 | | |

$ | 42,462 | | |

$ | (582,432 | ) | |

$ | 19,886 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE

AS OF DECEMBER 31, 2021 | |

| 8,608,298 | | |

$ | 442,235 | | |

$ | 81,583 | | |

$ | (1,565 | ) | |

$ | (378,371 | ) | |

$ | 143,882 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjustments

for prior periods from adoption of ASU 2020-06 | |

| - | | |

| - | | |

| (2,746 | ) | |

| - | | |

| 2,065 | | |

| (681 | ) |

| Common

shares issued upon exercise of options | |

| 241 | | |

| 12 | | |

| - | | |

| - | | |

| - | | |

| 12 | |

| Stock-based

compensation | |

| - | | |

| 25 | | |

| 2,477 | | |

| - | | |

| - | | |

| 2,502 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (21,254 | ) | |

| (21,254 | ) |

| Currency

translation adjustments | |

| - | | |

| - | | |

| - | | |

| 5,103 | | |

| - | | |

| 5,103 | |

| BALANCE

AS OF MARCH 31, 2022 | |

| 8,608,539 | | |

$ | 442,272 | | |

$ | 81,314 | | |

$ | 3,538 | | |

$ | (397,560 | ) | |

$ | 129,564 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE

AS OF APRIL 1, 2022 | |

| 8,608,539 | | |

$ | 442,272 | | |

$ | 81,314 | | |

$ | 3,538 | | |

$ | (397,560 | ) | |

$ | 129,564 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based

compensation | |

| - | | |

| 14 | | |

| 2,443 | | |

| - | | |

| - | | |

| 2,457 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (45,699 | ) | |

| (45,699 | ) |

| Currency

translation adjustments | |

| - | | |

| - | | |

| - | | |

| 19,236 | | |

| - | | |

| 19,236 | |

| BALANCE

AS OF JUNE 30, 2022 | |

| 8,608,539 | | |

$ | 442,286 | | |

$ | 83,757 | | |

$ | 22,774 | | |

$ | (443,259 | ) | |

$ | 105,558 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE

AS OF JULY 1, 2022 | |

| 8,608,539 | | |

$ | 442,286 | | |

$ | 83,757 | | |

$ | 22,774 | | |

$ | (443,259 | ) | |

$ | 105,558 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance | |

| 8,608,539 | | |

$ | 442,286 | | |

$ | 83,757 | | |

$ | 22,774 | | |

$ | (443,259 | ) | |

$ | 105,558 | |

| Warrant

issued in connection with debt amendment | |

| - | | |

| - | | |

| 1,550 | | |

| - | | |

| - | | |

| 1,550 | |

| Stock-based

compensation | |

| - | | |

| 14 | | |

| 2,398 | | |

| - | | |

| - | | |

| 2,412 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (25,209 | ) | |

| (25,209 | ) |

| Currency

translation adjustments | |

| - | | |

| - | | |

| - | | |

| (494 | ) | |

| - | | |

| (494 | ) |

| BALANCE

AS OF SEPTEMBER 30, 2022 | |

| 8,608,539 | | |

$ | 442,300 | | |

$ | 87,705 | | |

$ | 22,280 | | |

$ | (468,468 | ) | |

$ | 83,817 | |

| Balance | |

| 8,608,539 | | |

$ | 442,300 | | |

$ | 87,705 | | |

$ | 22,280 | | |

$ | (468,468 | ) | |

$ | 83,817 | |

See

accompanying Notes to Condensed Consolidated Financial Statements

VBI

Vaccines Inc. and Subsidiaries

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

(in

thousands)

| | |

2023 | | |

2022 | |

| | |

For the Nine Months Ended September 30 | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (92,823 | ) | |

$ | (92,162 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,516 | | |

| 1,541 | |

| Stock-based compensation | |

| 5,185 | | |

| 7,371 | |

| Amortization of debt discount | |

| 1,411 | | |

| 1,237 | |

| Loss on extinguishment of long-term debt | |

| - | | |

| 172 | |

| Impairment charges | |

| 23,600 | | |

| - | |

| Inventory reserve | |

| 1,547 | | |

| 1,401 | |

| Change in operating right of use assets | |

| 975 | | |

| 1,010 | |

| Unrealized foreign exchange loss | |

| 21,891 | | |

| 28,410 | |

| Net change in operating working capital items: | |

| | | |

| | |

| Change in accounts receivable | |

| (264 | ) | |

| (127 | ) |

| Change in inventory | |

| (3,026 | ) | |

| (5,174 | ) |

| Change in prepaid expenses | |

| (649 | ) | |

| (407 | ) |

| Change in other current assets | |

| 2,120 | | |

| (667 | ) |

| Change in other long-term assets | |

| 151 | | |

| (174 | ) |

| Change in accounts payable | |

| (5,923 | ) | |

| 7,606 | |

| Change in deferred revenues | |

| 6,485 | | |

| 30 | |

| Change in other current liabilities | |

| (10,051 | ) | |

| (3,715 | ) |

| Payments made on operating lease liabilities | |

| (971 | ) | |

| (1,001 | ) |

| Net cash flows used in operating activities | |

| (48,826 | ) | |

| (54,649 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of property and equipment | |

| (697 | ) | |

| (2,892 | ) |

| Net cash flows used in investing activities | |

| (697 | ) | |

| (2,892 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from issuance of commons shares for cash | |

| 23,908 | | |

| - | |

| Share issuance costs | |

| (1,482 | ) | |

| - | |

| Proceeds from debt financing | |

| - | | |

| 20,000 | |

| Debt issuance costs | |

| - | | |

| (563 | ) |

| Proceeds from issuance of common shares for cash, upon exercise of options | |

| - | | |

| 12 | |

| Net cash flows provided by financing activities | |

| 22,426 | | |

| 19,449 | |

| | |

| | | |

| | |

| Effect of exchange rates on cash | |

| (78 | ) | |

| (52 | ) |

| | |

| | | |

| | |

| CHANGE IN CASH FOR THE PERIOD | |

| (27,175 | ) | |

| (38,144 | ) |

| | |

| | | |

| | |

| CASH, BEGINNING OF PERIOD | |

| 62,629 | | |

| 121,694 | |

| | |

| | | |

| | |

| CASH, END OF PERIOD | |

$ | 35,454 | | |

$ | 83,550 | |

| | |

| | | |

| | |

| Supplementary information: | |

| | | |

| | |

| Interest paid | |

$ | 4,550 | | |

$ | 2,067 | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Adjustments for prior periods from adoption of ASU 2020-06 | |

| - | | |

| 681 | |

| Warrant issued in connection with financing transactions | |

| 10,760 | | |

| - | |

| Warrants issued in connection with debt amendment | |

| - | | |

| 1,550 | |

| Capital expenditures included in accounts payable and other current liabilities | |

| 67 | | |

| 283 | |

| Share issuance costs included in other current liabilities | |

| 154 | | |

| 67 | |

See

accompanying Notes to Condensed Consolidated Financial Statements

VBI

Vaccines Inc. and Subsidiaries

Notes

to Condensed Consolidated Financial Statements

(Unaudited)

September

30, 2023 and 2022

(in

thousands, except share and per share amounts)

1.

NATURE OF BUSINESS AND CONTINUATION OF BUSINESS

Corporate

Overview

VBI

Vaccines Inc. (the “Company” or “VBI”) was incorporated under the laws of British Columbia, Canada on April 9,

1965.

The

Company and its wholly owned subsidiaries, VBI Vaccines (Delaware) Inc., a Delaware corporation (“VBI DE”); VBI DE’s

wholly owned subsidiary, Variation Biotechnologies (US), Inc., a Delaware corporation (“VBI US”); Variation Biotechnologies,

Inc. a Canadian company and the wholly owned subsidiary of VBI US (“VBI Cda”); SciVac Ltd. an Israeli company (“SciVac”);

SciVac Hong Kong Limited (“SciVac HK”); and VBI Vaccines B.V, a Netherlands company (“VBI BV”), are collectively

referred to as the “Company”, “we”, “us”, “our”, or “VBI”.

The

Company’s registered office is located at Suite 1700, Park Place, 666 Burrard Street, Vancouver, BC V6C 2X8 with its principal

office located at 160 Second Street, Floor 3, Cambridge, MA 02142. In addition, the Company has manufacturing facilities located in Rehovot,

Israel and research facilities located in Ottawa, Ontario, Canada.

Reverse

Stock Split

The

Company effected a 1-for-30 reverse stock split (the

“Reverse Stock Split”) of its issued and outstanding common shares effective as of April 12, 2023, pursuant to which every

30 of the Company’s issued and outstanding common shares were automatically converted into one common share without any change

in the par value per share. All share and per share amounts, including common shares underlying

stock options, restricted stock units, and warrants, and applicable exercise prices, have been retroactively adjusted for all periods

presented herein to give effect to the Reverse Stock Split as required in accordance with

United States of America generally accepted accounting principles (“U.S. GAAP”). Per the requirements of the Business

Corporations Act (British Columbia), under which the Company is regulated, if fractional shares held by registered shareholders were

to be converted into whole shares, each fractional share remaining after the completion of the Reverse Stock Split

that was less than half of a share was cancelled and each fractional share that was at least half of a share was rounded up to one whole

share. No shareholders received cash in lieu of fractional shares.

Principal

Operations

VBI

is a commercial-stage biopharmaceutical company driven by immunology in the pursuit of prevention and treatment of disease. Through

its innovative approach to virus-like particles (“VLPs”), including a proprietary enveloped VLP (“eVLP”)

platform technology and a proprietary mRNA-launched eVLP (“MLE”) platform technology, VBI develops vaccine candidates that mimic the natural presentation of viruses, designed to elicit the innate

power of the human immune system. VBI is committed to targeting and overcoming significant infectious diseases, including hepatitis

B (“HBV”), COVID-19 and coronaviruses, and cytomegalovirus (“CMV”), as well as aggressive cancers including

glioblastoma (“GBM”). VBI is headquartered in Cambridge, Massachusetts, with research operations in Ottawa, Canada, and

a research and manufacturing site in Rehovot, Israel.

2023

Organizational Changes

As

announced on April 4, 2023, the Company reduced its internal workforce by 30-35%, which began in April and was completed by the end of

September 2023. As a result of this and other reductions in spend, VBI expects its operating expenses from normal business to be 30-35%

lower in the second half of 2023 as compared with the second half of 2022.

COVID-19

Endemic

In

May 2023, the World Health Organization determined that COVID-19 no longer fit the definition of a public health emergency and the U.S.

government announced its plan to let the declaration of a public health emergency associated with COVID-19 expire on May 11, 2023. COVID-19

is expected to remain a serious endemic threat for an indefinite future period and may continue to adversely affect the global economy,

and we are unable to predict the full extent of potential delays or impacts on our business, our clinical studies, our research programs,

the recoverability of our assets, and our manufacturing. The effects of the COVID-19 endemic, including but not limited to supply chain

issues, global shortages of supplies, material and products, volatile market conditions and rising global inflation may continue to disrupt

or delay our business operations, including with respect to efforts relating to potential business development transactions, and it could

continue to disrupt the marketplace which could have an adverse effect on our operations.

Liquidity

and Going Concern

The

Company faces a number of risks, including but not limited to, uncertainties regarding the success of the development and commercialization

of its products, demand and market acceptance of the Company’s products, and reliance on major customers. The Company anticipates

that it will continue to incur significant operating costs and losses in connection with the development and commercialization of its

products.

The

Company has an accumulated deficit of $582,432 and cash of $35,454 as of September 30, 2023. Cash outflows from operating activities

were $48,826 for the nine months ended September 30, 2023.

The

Company will require significant additional funds to conduct clinical and non-clinical trials, achieve and maintain regulatory approvals,

and commercially launch and sell our approved products. Additional financing may be obtained from the issuance of equity securities,

the issuance of additional debt, government or non-governmental organization grants or subsidies, and/or revenues from potential business

development transactions, if any. There is no assurance the Company will manage to obtain these sources of financing, if required. If we are unable to obtain additional financing, we may be required to

pursue a reorganization proceeding, including under applicable bankruptcy or insolvency laws. The

above conditions raise substantial doubt about the Company’s ability to continue as a going concern. The condensed consolidated

financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of

assets or the amounts and classifications of liabilities that may result from this uncertainty.

On

August 26, 2022, we 1) filed a registration statement on Form S-3 (File No. 333-267109), which included a base prospectus which covers

the offering, issuance and sale of up to $300,000 of common shares, warrants, units and/or subscription rights; and 2) entered into an

Open Market Sale Agreement with Jefferies LLC (“Jefferies”), pursuant to which we may offer and sell our common shares having

an aggregate price of up to $125,000 from time to time through Jefferies, acting as agent or principal (the “ATM Program”).

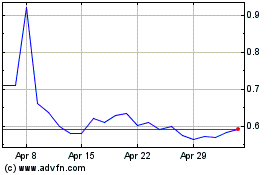

During the third quarter of 2023, the Company issued 467,045 common shares under the ATM Program, for total gross proceeds of $373 at

a weighted average price of $0.80 per share. The Company incurred $54 in sales agent commissions and share issuance costs related to

the common shares issued in the quarter ended September 30, 2023, resulting in net proceeds of $319. As of September 30, 2023, approximately

$124,627 of common shares remained available for issuance under the ATM Program.

On

July 5, 2023, the Company announced the expansion of its hepatitis B partnership with Brii Bio. Through (i) a Collaboration and

License Agreement (the “Collaboration Agreement”), dated July 5, 2023, by and between the Company and Brii Bio, and (ii)

the Amended and Restated Collaboration and License Agreement (the “A&R Collaboration Agreement, and together with the

Collaboration Agreement, the “Brii Collaboration Agreements”), dated July 5, 2023, by and between the Company and Brii

Bio, Brii Bio expanded its exclusive license to VBI-2601 to global rights and acquired an exclusive license for PreHevbri in Asia

Pacific (“APAC”), excluding Japan. As part of this collaboration, Brii Bio paid the Company an upfront payment of $15,000

consisting of a $3,000 equity

investment in a concurrent registered direct offering (discussed below), $5,000 as

an advance payment for the clinical and commercial manufacture and supply of VBI-2601 and PreHevbri and any related manufacturing

expenditures pursuant to a supply agreement (the “Supply Agreement”) dated July 5, 2023, by and between the Company and Brii Bio, and $7,000 as

a non-refundable upfront payment pursuant to the Brii Collaboration Agreements. In addition, pursuant to the Letter Agreement (the

“Letter Agreement”), dated July 5, 2023, by and among the Company, SciVac, and Brii Bio, the Company also granted to

Brii Bio a security interest, subject to a Subordination Agreement between Brii Bio and K2 HealthVentures LLC (“K2HV”),

in all of its respective right, title, and interest in and to all intellectual property, know-how, and licenses to the extent

related to PreHevbri and VBI-2601, and all proceeds of the foregoing, in order to secure performance of all of the Company’s

obligations under the Brii Collaboration Agreements, the Supply Agreement, and the Loan Agreement (each as defined

herein).

The

Company is also eligible to receive up to an additional $422,000 in potential regulatory and commercial milestone payments (combined

under the Brii Collaboration Agreements), and royalties in the licensed territories, which is worldwide for VBI-2601 and APAC, excluding

Japan, for PreHevbri. Brii Bio will be responsible for all development, regulatory, and commercial activities and costs for the two programs

in their respective licensed territories. There is no assurance that Brii Bio will achieve any of the milestones as specified in the

Brii Collaboration Agreements and that we will receive any or all of these potential payments pursuant to the Brii Collaboration Agreements.

In

July 2023, the Company closed (i) an underwritten public offering of 12,445,454

common shares and accompanying common warrants to purchase up to 12,545,454

common shares (which included 1,536,363

common shares and common warrants to purchase up to 1,636,363

common shares issued pursuant to the underwriters’ partial exercise of their option to purchase additional common shares and

common warrants) at a combined public offering price of $1.65

per common share and accompanying common warrant, and (ii) a concurrent registered direct offering, pursuant to the expanded

hepatitis B partnership with Brii Bio, of 1,818,182

common shares and accompanying common warrants to purchase up to 1,818,182

common shares, at a combined purchase price of $1.65

per share and accompanying common warrant. The accompanying common warrants issued and sold in each of the underwritten public

offering and the registered direct offering have an initial exercise price of $1.65

per share, which, pursuant to certain anti-dilution provisions of the warrants, was reduced to $0.6749

per share, as of September 30, 2023, and expire five

years from the date of issuance. The aggregate gross proceeds from the underwritten public offering, including aggregate

gross proceeds from the underwriters’ exercise of their option to purchase additional securities, were $20,500.

The aggregate gross proceeds from the concurrent registered direct offering were $3,000.

As

of September 30, 2023, the Company had outstanding warrants to purchase up to an aggregate of 14,363,636 common shares, issued in July

2023. Pursuant to certain anti-dilution provisions of the warrants, as the consideration paid per common share under the ATM Program

was less than the exercise price of such warrants in effect immediately prior to such issuance (“New Issuance Price”), the

exercise price of the warrants (the “Exercise Price”) was reduced to the New Issuance Price. As of September 30, 2023, the

Exercise Price in effect was $0.6749 per share, which resulted in a deemed dividend of $862 as the fair value of the warrants was greater

subsequent to the reduction in Exercise Price than it was immediately prior to such reduction in Exercise Price. The fair values were

determined using the Black-Scholes option pricing model.

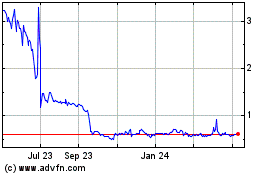

On November 1, 2023, the Company received a letter

from the Listing Qualifications Department of the Nasdaq Stock Market (“Nasdaq”) indicating that, based upon the closing bid

price of the Company’s common shares for the 30 consecutive business day period between September 19, 2023 through October 31, 2023,

it did not meet the minimum bid price of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2).

The letter also indicated that the Company will be provided with a compliance period of 180 calendar days, or until April 29, 2024 (the

“Compliance Period”), in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A).

In order to regain compliance with Nasdaq’s minimum bid price requirement,

the common shares must maintain a minimum closing bid price of $1.00 for a minimum of ten consecutive business days during the Compliance

Period. In the event that the Company does not regain compliance by the end of the Compliance Period, it may be eligible for additional

time to regain compliance. To qualify, the Company will be required to meet the continued listing requirement for the market value of

our publicly held shares and all other initial listing standards for Nasdaq, with the exception of the bid price requirement, and will

need to provide written notice of our intention to cure the deficiency during the second compliance period, by effecting a reverse stock

split if necessary. If we meet these requirements, the Company may be granted an additional 180 calendar days to regain compliance. The

Company has not regained compliance as of the date of this Form 10-Q, and if it fails to regain compliance during the Compliance Period

or any subsequent grace period granted by Nasdaq, its common shares will be subject to delisting by Nasdaq, which could seriously decrease

or eliminate the value of an investment in the common shares and result in significantly increased uncertainty as to the Company’s

ability to raise additional capital.

Financial

instruments recognized in the condensed consolidated balance sheet consist of cash, accounts receivable, other current assets, accounts

payable, and other current liabilities. The Company believes that the carrying value of its current financial instruments approximates

their fair values due to the short-term nature of these instruments. The Company does not hold any derivative financial instruments.

2.

SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation and Consolidation

The

Company’s fiscal year ends on December 31 of each calendar year. The accompanying unaudited condensed consolidated financial statements

have been prepared in U.S. dollars (“USD”) and pursuant to the rules and regulations of the SEC, for interim reporting. Accordingly,

certain information and footnote disclosures normally included in the financial statements prepared in accordance with U.S. GAAP, have

been condensed or omitted pursuant to such rules and regulations. The December 31, 2022 condensed consolidated balance sheet in this

document was derived from the audited consolidated financial statements. The condensed consolidated financial statements and notes included

in this quarterly report on this Form 10-Q does not include all of the disclosures required by U.S. GAAP and should be read in conjunction

with the financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022

(the “2022 10-K”), as filed with the SEC on March 13, 2023.

The

condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries: VBI DE, VBI US, VBI

Cda, SciVac, SciVac HK, and VBI BV. Intercompany balances and transactions between the Company and its subsidiaries are eliminated in

the condensed consolidated financial statements. Certain items previously reported in specific financial statement captions have been

reclassified to conform to the current presentation.

In

the opinion of management, these condensed consolidated financial statements include all adjustments and accruals of a normal and recurring

nature necessary to fairly state the results of the periods presented. The results for the periods presented are not necessarily indicative

of results to be expected for the full year or for any future periods.

Significant

Accounting Policies

The

significant accounting policies used in the preparation of these condensed consolidated financial statements are disclosed in the 2022

10-K, and there have been no changes to the Company’s significant accounting policies during the nine months ended September 30,

2023, other than the polices discussed below.

Restructuring

charges

Restructuring

costs include charges associated with exit or disposal activities that meet the definition of restructuring under FASB ASC Topic 420,

Exit or Disposal Cost Obligations (“ASC 420”). The Company’s restructuring plans are typically completed within a one-year

period or less. Restructuring costs incurred under these plans may include (i) one-time termination benefits related to employee separations,

(ii) contract termination costs, and (iii) other related costs associated with exit or disposal activities including, but not limited

to, costs for consolidating or closing facilities.

3.

NEW ACCOUNTING PRONOUNCEMENTS

Recently

Adopted Accounting Pronouncements

In

June 2016, the FASB issued ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on

Financial Instruments (“ASU 2016-13”). The amendments in ASU 2016-13, among other things, require the measurement of all

expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable

and supportable forecasts. Financial institutions and other organizations will now use forward-looking information to better inform their

credit loss estimates. Many of the loss estimation techniques applied today will still be permitted, although the inputs to those techniques

will change to reflect the full amount of expected credit losses. Our adoption of this ASU, effective January 1, 2023, did not have a

material impact on our condensed consolidated financial statements and the related footnote disclosures.

4.

INVENTORY, NET

Inventory

consists of the following:

SCHEDULE OF INVENTORY

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Finished goods | |

$ | 1,940 | | |

$ | 893 | |

| Work-in-process | |

| 2,136 | | |

| 1,869 | |

| Raw materials | |

| 3,464 | | |

| 3,837 | |

| Inventory, net | |

$ | 7,540 | | |

$ | 6,599 | |

5.

OTHER CURRENT ASSETS

Other

current assets consisted of the following:

SCHEDULE OF OTHER CURRENT ASSETS

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Government receivables | |

$ | 3,470 | | |

$ | 4,033 | |

| Other current assets | |

| 400 | | |

| 2,026 | |

| Total other current assets | |

$ | 3,870 | | |