false

0000754811

0000754811

2025-02-12

2025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) Of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2025

U.S. GLOBAL INVESTORS, INC.

(Exact name of registrant as specified in its charter)

|

Texas

|

0-13928

|

74-1598370

|

|

(State of other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

7900 Callaghan Road, San Antonio, Texas 78229

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: 210-308-1234

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock, $0.25 par value per share

|

GROW

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2025, U.S. Global Investors, Inc. issued a press release reporting earnings and other financial results for its quarter ended December 31, 2024. A copy of the press release is attached and being furnished as Exhibit 99.1.

The information in this current report on Form 8-K, including the accompanying Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 — Financial Statement and Exhibits

(d) Exhibits

Exhibit 104 - Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

U.S. Global Investors, Inc.

By:/s/Lisa Callicotte

Lisa Callicotte

Chief Financial Officer

|

Dated: February 12, 2025

Exhibit 99.1

|

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

|

|

For Immediate Release

U.S. Global Investors Reports Results for the Second Quarter of 2025 Fiscal Year

******************************************************************************

SAN ANTONIO–February 12, 2025–U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm1 with longstanding experience in global markets and specialized sectors, today reported operating revenues of $2.2 million, with a net loss of $86,000, or a loss of $0.01 per share, for the quarter ended December 31, 2024.

Losses were reflective of market fluctuations and lower assets. At December 31, 2024, total assets under management (AUM) were approximately $1.5 billion, compared to $2.1 billion at December 31, 2023, a decrease of approximately $0.6 billion.

The shareholder yield as of December 31, 2024, was 10%, more than double the yield on the 10-year Treasury bond on the last trading day of 2024.2

A Smart Beta 2.0 Approach to Investing in Global Security and Advanced Technology

At the end of 2024, the Company released its fourth thematic ETF, the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR). Launched on December 30, 2024, WAR is the Company’s first actively managed ETF, giving investors access to companies involved in not just traditional defense manufacturing but also electronic warfare, semiconductors, cybersecurity and data centers. Like the Company’s other ETFs, WAR uses a Smart Beta 2.0 strategy, meaning portfolio construction is factor- and rules-based.

“WAR is all about defense, protection and security,” says Frank Holmes, the Company’s CEO and chief investment officer. “In today’s technologically advanced world, artificial intelligence (AI) and data centers are as crucial to protecting borders and defending against bad actors across the globe as mechanization was at the turn of the last century. Precedence Research estimates that global spending on AI in the aerospace and defense will expand from approximately $28 billion in 2025 to around $65 billion by 2034, representing a compound annual growth rate (CAGR) of just under 10%.”3

Global military expenditures reached a record $2.4 trillion in 2023 after increasing for nine consecutive years,4 driven by rising geopolitical tensions and modernization efforts across the globe. That’s especially true in Europe, where European Union (EU) member states are estimated to have spent a collective €326 billion ($342 billion) in 2024 on aerospace and defense, representing a record-breaking 1.9% of the bloc’s gross domestic product (GDP).5

1 Registration does not imply a certain level of skill or training.

2 The Company calculates shareholder yield by adding the percentage of change in shares outstanding to the dividend yield for the 12 months ending December 31, 2024. The Company did not have debt; therefore, no debt reduction was included.

3 Precedence Research. (2024, November 13). AI in aerospace and defense market size, share and trends 2024 to 2034. Precedence Research. https://www.precedenceresearch.com/ai-in-aerospace-and-defense-market

4 Tian, N., Lopes da Silva, D., Liang, X., & Scarazzato, L. (2024, April). Trends in world military expenditure, 2023. Stockholm International Peace Research Institute (SIPRI). https://doi.org/10.55163/BQGA2180

5 European Defence Agency. (2024). Coordinated annual review on defence (CARD) report 2024. https://eda.europa.eu/docs/default-source/documents/card-report-2024.pdf

Gold Demand at New All-Time High

The Company is pleased to share that total global gold demand hit a new record high in 2024, according to a report by the World Gold Council (WGC). Demand rose 1% year-over-year in the fourth quarter of 2024, pushing the total annual sum to 4,974 metric tons. Central banks contributed an outsized role to the buying spree, with combined purchases of the yellow metal exceeding 1,000 tons for the third straight year. This helped gold notch 40 new record high prices in 2024, according to the WGC.6 What’s more, the price of gold finished January 2025 at another all-time high in every major currency, including the U.S. dollar, euro, Japanese yen and British pound sterling.7

“It appears that investors are seeking a safe haven to some of the uncertainties in global markets and the economy right now—most notably the potential for a broad-based trade war. Tariffs are inflationary, and gold has historically done well when inflation fears were elevated,” says Mr. Holmes. “Against this backdrop, we’re very happy with how well our U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) performed in the fourth quarter of 2024 and in the entire calendar year. With tariff concerns persisting into the unforeseeable future, we have high hopes that GOAU will continue to spark interest from investors.”

Creating Shareholder Value Through Dividends and Share Repurchases

The Company’s Board of Directors (the “Board”) approved payment of the $0.0075 per share per month dividend beginning in January 2025 and continuing through March 2025. The remaining payment dates will be February 24 and March 31 for record dates of February 10 and March 17.

In calendar year 2024, the Company repurchased 807,761 of its own shares, at a net cost of $2.1 million. That represents an approximately 19% increase over the number of shares that were repurchased the previous year.

6 World Gold Council. (2025, February 5). Gold demand trends: Full year 2024. World Gold Council. https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2024

7 World Gold Council. (2025, February 10). Gold market commentary: Snakes and ladders. World Gold Council. https://www.gold.org/goldhub/research/gold-market-commentary-january-2025

“U.S. Global Investors is committed to creating shareholder value by maintaining a disciplined capital allocation strategy,” says Mr. Holmes. “The Board’s approval of continued monthly dividends, combined with our increased share buybacks, underscores our confidence in the Company’s long-term growth and financial strength.”

Healthy Liquidity and Capital Resources

As of December 31, 2024, the Company had net working capital of approximately $38.0 million. With approximately $26.0 million in cash and cash equivalents, the Company has adequate liquidity to meet its current obligations, in addition to investments in our funds and convertible notes.

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Thursday, February 13, 2025, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| |

|

Three months ended

|

|

| |

|

12/31/2024

|

|

|

12/31/2023

|

|

|

Operating Revenues

|

|

$ |

2,231 |

|

|

$ |

2,818 |

|

|

Operating Expenses

|

|

|

2,770 |

|

|

|

2,626 |

|

|

Operating Income (Loss)

|

|

|

(539 |

) |

|

|

192 |

|

| |

|

|

|

|

|

|

|

|

|

Total Other Income (Loss)

|

|

|

423 |

|

|

|

1,473 |

|

|

Income (Loss) Before Income Taxes

|

|

|

(116 |

) |

|

|

1,665 |

|

| |

|

|

|

|

|

|

|

|

|

Income Tax Expense (Benefit)

|

|

|

(30 |

) |

|

|

436 |

|

|

Net Income (Loss)

|

|

$ |

(86 |

) |

|

$ |

1,229 |

|

| |

|

|

|

|

|

|

|

|

|

Net Income (Loss) Per Share (Basic and Diluted)

|

|

$ |

(0.01 |

) |

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

Avg. Common Shares Outstanding (Basic)

|

|

|

13,497,961 |

|

|

|

14,291,328 |

|

|

Avg. Common Shares Outstanding (Diluted)

|

|

|

13,498,306 |

|

|

|

14,291,396 |

|

| |

|

|

|

|

|

|

|

|

|

Avg. Assets Under Management (Billions)

|

|

$ |

1.5 |

|

|

$ |

1.9 |

|

####

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please carefully consider a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for WAR and GOAU by clicking here and here. Read it carefully before investing.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser. GOAU and WAR are distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU and WAR. Foreside Fund Services, LLC and Quasar Distributors, LLC are affiliated.

Investing involves risk including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Because the fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The fund is non-diversified, meaning it may concentrate more of its assets in a smaller number of issuers than a diversified fund. The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The fund may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

WAR is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

WAR’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

v3.25.0.1

Document And Entity Information

|

Feb. 12, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

U.S. GLOBAL INVESTORS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 12, 2025

|

| Entity, Incorporation, State or Country Code |

TX

|

| Entity, File Number |

0-13928

|

| Entity, Tax Identification Number |

74-1598370

|

| Entity, Address, Address Line One |

7900 Callaghan Road

|

| Entity, Address, City or Town |

San Antonio

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78229

|

| City Area Code |

210

|

| Local Phone Number |

308-1234

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock

|

| Trading Symbol |

GROW

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000754811

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

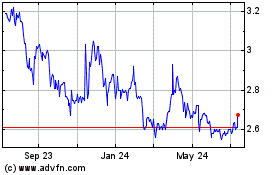

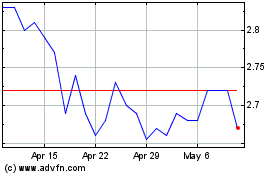

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Jan 2025 to Feb 2025

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Feb 2024 to Feb 2025