false

0000875657

0000875657

2024-02-15

2024-02-15

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

| |

| |

|

FORM 8-K

|

| |

| |

|

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

| |

|

February 15, 2024

|

|

Date of Report (Date of Earliest Event Reported)

|

| |

| |

|

ULTRALIFE CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

Delaware

|

000-20852

|

16-1387013

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

2000 Technology Parkway, Newark, New York 14513

|

|

(Address of principal executive offices) (Zip Code)

|

| |

|

(315) 332-7100

|

|

(Registrant’s telephone number, including area code)

|

| |

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Common Stock, $0.10 par value per share

|

ULBI

|

NASDAQ

|

|

(Title of each class)

|

(Trading Symbol)

|

(Name of each exchange on which registered)

|

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02 Results of Operations and Financial Condition

On February 15, 2024, Ultralife Corporation issued a press release regarding the financial results for its fourth quarter and full year ended December 31, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

Item 9.01 Financial Statements, Pro Forma Financials and Exhibits

(d) Exhibits.

|

Exhibit

Number

|

|

Exhibit Description

|

|

|

99.1

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: February 15, 2024

|

|

ULTRALIFE CORPORATION

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Philip A. Fain

|

| |

|

Philip A. Fain

|

| |

|

Chief Financial Officer and Treasurer

|

Exhibit 99.1

Ultralife Corporation Reports Fourth Quarter Results

NEWARK, N.Y. – February 15, 2024 -- Ultralife Corporation (NASDAQ: ULBI) reported operating results for the fourth quarter and full year ended December 31, 2023.

Fourth Quarter Highlights:

| |

●

|

Sales of $44.5 million representing a 23.4% year-over-year increase

|

| |

●

|

Highest medical sales quarter in Company’s history

|

| |

●

|

Operating income of $3.6 million versus $0.2 million for the 2022 fourth quarter

|

| |

●

|

Adjusted EPS of $0.18 compared to a loss of $0.03 for the 2022 fourth quarter

|

| |

●

|

Adjusted EBITDA of $4.8 million representing a 134.8% year-over-year increase

|

| |

●

|

Backlog of $103.5 million exiting 2023, a 2.4% sequential increase over third quarter

|

Fiscal Year 2023 Highlights:

| |

●

|

Sales of $158.6 million representing a 20.3% year-over-year increase

|

| |

●

|

Operating income of $9.5 million versus $0.1 million for 2022

|

| |

●

|

Adjusted EPS of $0.52 compared to a loss of $0.07 for 2022

|

| |

●

|

Adjusted EBITDA of $15.7 million representing a 138.8% year-over-year increase

|

“Ultralife performed exceedingly well in the fourth quarter, delivering higher Communications Systems revenue, a 360-basis point expansion of Battery & Energy Products’ gross margin and operating expense leverage. In addition, medical sales reached the highest quarterly level since we entered this market in 2012. With adjusted EBITDA more than doubling and inventory levels lower, we are well positioned to commence paying down our acquisition debt,” said Mike Manna, President and Chief Executive Officer.

“Our strong fourth quarter performance caps a year of accomplishment against our stated highest priority of recapturing gross margin through price realization activities, supply chain improvements, level-loaded production and lean manufacturing initiatives. These actions resulted in a 240-basis point expansion of gross margin for the year to 24.7% and a swing from a loss to adjusted EPS of $0.52. Finally, our efforts to strengthen our commercial relationships launching customer-driven new products into the market have been bearing fruit and sustained our backlog in excess of $100 million,” added Mr. Manna.

“As we enter 2024 with a healthy backlog and a significantly stronger balance sheet, we are focused on driving additional gross margin expansion, organic growth in our end markets and operating leverage. We will continue to invest in new product development for commercial expansion. Our focus in 2024 is to build upon our 2023 momentum, sustain profitable growth and generate incremental cash flow to reduce debt, and support strategic capital expenditures and accretive acquisitions,” concluded Mr. Manna.

Fourth Quarter 2023 Financial Results

Revenue was $44.5 million, an increase of $8.4 million, or 23.4%, as compared to revenue of $36.1 million for the fourth quarter of 2022. Overall, government/defense sales increased 28.8% and commercial sales increased 20.2% over the 2022 period. Battery & Energy Products sales increased 11.1% to $35.7 million compared to $32.1 million last year reflecting increases of 20.2% in commercial sales, including a 118.0% increase in medical battery sales, partially offset by decreases of 11.3% in oil & gas market sales and 11.4% in government/defense sales. Communications Systems sales increased by 121.9% to $8.8 million compared to $4.0 million for the same period last year, primarily attributable to shipments of vehicle-amplifier adaptors to a global defense contractor for the U.S. Army and of integrated systems of amplifiers and radio vehicle mounts to a major international defense contractor under an ongoing allied country government/defense modernization program. Our total backlog exiting the 2023 fourth quarter was $103.5 million representing a 2.4% sequential increase over that reported for the third quarter.

Gross profit was $11.4 million, or 25.6% of revenue, compared to $8.1 million, or 22.4% of revenue, for the same quarter a year ago. Battery & Energy Products gross margin was 25.2%, compared to 21.6% last year, primarily due to more efficiencies and higher cost absorption resulting from a concerted effort to level-load production more evenly across the 2023 quarter, as well as improved price realization. Communications Systems gross margin was 27.2% compared to 28.7% last year, primarily due to inefficiencies caused by component delays from suppliers, partially offset by higher factory volume.

Operating expenses were $7.8 million, compared to $7.9 million for the 2022 fourth quarter. Operating expenses were 17.4% of revenue compared to 21.8% of revenue for the year-earlier period.

The combination of higher sales leveraged by improved gross margin and operating expenses resulted in a $3.4 million increase in operating income to $3.6 million from $0.2 million last year.

Net income was $2.9 million or $0.17 per diluted share on a GAAP basis, compared to a net loss of $0.2 million or $0.01 per diluted share for the fourth quarter of 2022. Adjusted EPS was $0.18 on a diluted basis for the fourth quarter of 2023, compared to a loss of $0.03 for the 2022 period. Adjusted EPS excludes the provision for deferred taxes which primarily represents non-cash charges for U.S. taxes which we expect will be fully offset by net operating loss carryforwards and other tax credits for the foreseeable future.

Adjusted EBITDA, defined as EBITDA including non-cash, stock-based compensation expense, was $4.8 million for the fourth quarter of 2023, or 10.7% of sales, compared to $2.0 million, or 5.6% of sales, for the year-earlier period.

See the “Non-GAAP Financial Measures” section of this release for a reconciliation of adjusted EPS to EPS and adjusted EBITDA to net income attributable to Ultralife Corporation.

About Ultralife Corporation

Ultralife Corporation serves its markets with products and services ranging from power solutions to communications and electronics systems. Through its engineering and collaborative approach to problem solving, Ultralife serves government/defense and commercial customers across the globe.

Headquartered in Newark, New York, the Company's business segments include Battery & Energy Products and Communications Systems. Ultralife has operations in North America, Europe and Asia. For more information, visit www.ultralifecorporation.com.

Conference Call Information

Ultralife will hold its fourth quarter earnings conference call today at 8:30 AM ET.

To ensure a fast and reliable connection to our investor conference call, we now require participants dialing in by phone to register using the following link prior to the call: https://register.vevent.com/register/BI9f2b6fae66954f53b4517cbe89148738. This will eliminate the need to speak with an operator. Once registered, dial-in information will be provided along with a personal identification number. Should you register early and misplace your details, you can simply click back on this same link at any time to register and view this information again. A live webcast of the conference call will be available to investors in the Events & Presentations section of the Company's website at http://investor.ultralifecorporation.com. For those who cannot listen to the live broadcast, a replay of the webcast will be available shortly after the call at the same location.

This press release may contain forward-looking statements based on current expectations that involve a number of risks and uncertainties. The potential risks and uncertainties that could cause actual results to differ materially include the impact of COVID-19 and related supply chain disruptions, potential reductions in revenues from key customers, acceptance of our new products on a global basis and uncertain global economic conditions. The Company cautions investors not to place undue reliance on forward-looking statements, which reflect the Company's analysis only as of today's date. The Company undertakes no obligation to publicly update forward-looking statements to reflect subsequent events or circumstances. Further information on these factors and other factors that could affect Ultralife’s financial results is included in Ultralife’s Securities and Exchange Commission (SEC) filings, including the latest Annual Report on Form 10-K.

|

ULTRALIFE CORPORATION AND SUBSIDIARIES

|

|

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands)

|

|

(Unaudited)

|

|

ASSETS

|

|

| |

|

|

|

|

|

|

|

|

| |

|

December 31,

2023

|

|

|

December 31,

2022

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

10,278 |

|

|

$ |

5,713 |

|

|

Trade Accounts Receivable, Net

|

|

|

31,761 |

|

|

|

27,779 |

|

|

Inventories, Net

|

|

|

42,215 |

|

|

|

41,192 |

|

|

Prepaid Expenses and Other Current Assets

|

|

|

5,949 |

|

|

|

4,304 |

|

|

Total Current Assets

|

|

|

90,203 |

|

|

|

78,988 |

|

| |

|

|

|

|

|

|

|

|

|

Property, Plant and Equipment, Net

|

|

|

21,117 |

|

|

|

21,716 |

|

|

Goodwill

|

|

|

37,571 |

|

|

|

37,428 |

|

|

Other Intangible Assets, Net

|

|

|

15,107 |

|

|

|

15,921 |

|

|

Deferred Income Taxes, Net

|

|

|

10,567 |

|

|

|

12,069 |

|

|

Other Non-Current Assets

|

|

|

3,711 |

|

|

|

2,308 |

|

|

Total Assets

|

|

$ |

178,276 |

|

|

$ |

168,430 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

| |

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$ |

11,336 |

|

|

$ |

16,074 |

|

|

Current Portion of Long-Term Debt

|

|

|

2,000 |

|

|

|

2,000 |

|

|

Accrued Compensation and Related Benefits

|

|

|

3,115 |

|

|

|

2,890 |

|

|

Accrued Expenses and Other Current Liabilities

|

|

|

7,279 |

|

|

|

7,949 |

|

|

Total Current Liabilities

|

|

|

23,730 |

|

|

|

28,913 |

|

|

Long-Term Debt, Net

|

|

|

23,624 |

|

|

|

19,310 |

|

|

Deferred Income Taxes

|

|

|

1,714 |

|

|

|

1,917 |

|

|

Other Non-Current Liabilities

|

|

|

3,781 |

|

|

|

1,887 |

|

|

Total Liabilities

|

|

|

52,849 |

|

|

|

52,027 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' Equity:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

2,078 |

|

|

|

2,057 |

|

|

Capital in Excess of Par Value

|

|

|

189,160 |

|

|

|

187,405 |

|

|

Accumulated Deficit

|

|

|

(40,754 |

) |

|

|

(47,951 |

) |

|

Accumulated Other Comprehensive Loss

|

|

|

(3,660 |

) |

|

|

(3,750 |

) |

|

Treasury Stock

|

|

|

(21,492 |

) |

|

|

(21,484 |

) |

|

Total Ultralife Equity

|

|

|

125,332 |

|

|

|

116,277 |

|

|

Non-Controlling Interest

|

|

|

95 |

|

|

|

126 |

|

|

Total Shareholders’ Equity

|

|

|

125,427 |

|

|

|

116,403 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders' Equity

|

|

$ |

178,276 |

|

|

$ |

168,430 |

|

|

ULTRALIFE CORPORATION AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

(In Thousands Except Per Share Amounts)

|

|

(Unaudited)

|

| |

|

Three-Month Period Ended

|

|

|

Year Ended

|

|

| |

|

December

31,

|

|

|

December

31,

|

|

|

December

31,

|

|

|

December

31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Battery & Energy Products

|

|

$ |

35,703 |

|

|

$ |

32,122 |

|

|

$ |

129,953 |

|

|

$ |

119,995 |

|

|

Communications Systems

|

|

|

8,845 |

|

|

|

3,985 |

|

|

|

28,691 |

|

|

|

11,845 |

|

|

Total Revenues

|

|

|

44,548 |

|

|

|

36,107 |

|

|

|

158,644 |

|

|

|

131,840 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Products Sold:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Battery & Energy Products

|

|

|

26,711 |

|

|

|

25,185 |

|

|

|

99,178 |

|

|

|

93,841 |

|

|

Communications Systems

|

|

|

6,435 |

|

|

|

2,841 |

|

|

|

20,266 |

|

|

|

8,599 |

|

|

Total Cost of Products Sold

|

|

|

33,146 |

|

|

|

28,026 |

|

|

|

119,444 |

|

|

|

102,440 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

|

11,402 |

|

|

|

8,081 |

|

|

|

39,200 |

|

|

|

29,400 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and Development

|

|

|

1,852 |

|

|

|

1,656 |

|

|

|

7,531 |

|

|

|

7,081 |

|

|

Selling, General and Administrative

|

|

|

5,901 |

|

|

|

6,208 |

|

|

|

22,194 |

|

|

|

22,190 |

|

|

Total Operating Expenses

|

|

|

7,753 |

|

|

|

7,864 |

|

|

|

29,725 |

|

|

|

29,271 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income

|

|

|

3,649 |

|

|

|

217 |

|

|

|

9,475 |

|

|

|

129 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Expense

|

|

|

536 |

|

|

|

597 |

|

|

|

358 |

|

|

|

575 |

|

|

Income (Loss) Before Income Taxes

|

|

|

3,113 |

|

|

|

(380 |

) |

|

|

9,117 |

|

|

|

(446 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision (Benefit)

|

|

|

263 |

|

|

|

(155 |

) |

|

|

1,951 |

|

|

|

(326 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

|

|

|

2,850 |

|

|

|

(225 |

) |

|

|

7,166 |

|

|

|

(120 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Non-Controlling Interest

|

|

|

(23 |

) |

|

|

(1 |

) |

|

|

(31 |

) |

|

|

(1 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Ultralife Corporation

|

|

$ |

2,873 |

|

|

$ |

(224 |

) |

|

$ |

7,197 |

|

|

$ |

(119 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Per Share Attributable to Ultralife Common Shareholders – Basic

|

|

$ |

.18 |

|

|

$ |

(.01 |

) |

|

$ |

.44 |

|

|

$ |

(.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Per Share Attributable to Ultralife Common Shareholders – Diluted

|

|

$ |

.17 |

|

|

$ |

(.01 |

) |

|

$ |

.44 |

|

|

$ |

(.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding – Basic

|

|

|

16,338 |

|

|

|

16,135 |

|

|

|

16,214 |

|

|

|

16,125 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding – Diluted

|

|

|

16,479 |

|

|

|

16,135 |

|

|

|

16,226 |

|

|

|

16,125 |

|

Non-GAAP Financial Measures

Adjusted EBITDA

In evaluating our business, we consider and use adjusted EBITDA, a non-GAAP financial measure, as a supplemental measure of our operating performance in addition to U.S. Generally Accepted Accounting Principles (“GAAP”) financial measures. We define adjusted EBITDA as net income attributable to Ultralife Corporation before net interest expense, provision (benefit) for income taxes, depreciation and amortization, and stock-based compensation expense, plus/minus expense/income that we do not consider reflective of our ongoing continuing operations. We reconcile adjusted EBITDA to net income attributable to Ultralife Corporation, the most comparable financial measure under GAAP. Neither current nor potential investors in our securities should rely on adjusted EBITDA as a substitute for any GAAP measures and we encourage investors to review the following reconciliation of adjusted EBITDA to net income attributable to Ultralife Corporation.

|

ULTRALIFE CORPORATION AND SUBSIDIARIES

|

|

CALCULATION OF ADJUSTED EBITDA

|

|

(Dollars in Thousands)

|

|

(Unaudited)

|

| |

|

Three-Month Period Ended

|

|

|

Year Ended

|

|

| |

|

December

31, 2023

|

|

|

December

31, 2022

|

|

|

December

31, 2023

|

|

|

December

31, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Ultralife Corporation

|

|

$ |

2,873 |

|

|

$ |

(224 |

) |

|

$ |

7,197 |

|

|

$ |

(119 |

) |

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense, Net

|

|

|

566 |

|

|

|

368 |

|

|

|

2,016 |

|

|

|

951 |

|

|

Income Tax Provision (Benefit)

|

|

|

263 |

|

|

|

(155 |

) |

|

|

1,951 |

|

|

|

(326 |

) |

|

Depreciation Expense

|

|

|

740 |

|

|

|

727 |

|

|

|

3,022 |

|

|

|

3,177 |

|

|

Amortization Expense

|

|

|

226 |

|

|

|

313 |

|

|

|

889 |

|

|

|

1,282 |

|

|

Stock-Based Compensation Expense

|

|

|

104 |

|

|

|

224 |

|

|

|

528 |

|

|

|

776 |

|

|

Cyber-Insurance Policy Deductible

|

|

|

- |

|

|

|

- |

|

|

|

100 |

|

|

|

- |

|

|

Non-Cash Purchase Accounting Adjustment

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

55 |

|

|

Severance to Former President & CEO

|

|

|

- |

|

|

|

779 |

|

|

|

- |

|

|

|

779 |

|

|

Adjusted EBITDA

|

|

$ |

4,772 |

|

|

$ |

2,032 |

|

|

$ |

15,703 |

|

|

$ |

6,575 |

|

Adjusted Earnings Per Share

In evaluating our business, we consider and use adjusted EPS, a non-GAAP financial measure, as a supplemental measure of our business performance. We define adjusted EPS as net income attributable to Ultralife Corporation excluding the provision (benefit) for deferred income taxes divided by our weighted average shares outstanding on both a basic and diluted basis. We believe that this information is useful in providing period-to-period comparisons of our results by reflecting the portion of our tax provision that we expect will be predominantly offset by our U.S. net operating loss carryforwards and other tax credits for the foreseeable future. We reconcile adjusted EPS to EPS, the most comparable financial measure under GAAP. Neither current nor potential investors in our securities should rely on adjusted EPS as a substitute for any GAAP measures and we encourage investors to review the following reconciliation of adjusted EPS to EPS and net income attributable to Ultralife Corporation.

|

ULTRALIFE CORPORATION AND SUBSIDIARIES

|

|

CALCULATION OF ADJUSTED EPS

|

|

(In Thousands Except Per Share Amounts)

|

|

(Unaudited)

|

| |

|

Three-Month Period Ended

|

|

| |

|

December 31, 2023

|

|

|

December 31, 2022

|

|

| |

|

Amount

|

|

|

Per

Basic

Share

|

|

|

Per

Diluted

Share

|

|

|

Amount

|

|

|

Per

Basic

Share

|

|

|

Per

Diluted

Share

|

|

|

Net Income (Loss) Attributable to Ultralife Corporation

|

|

$ |

2,873 |

|

|

$ |

.18 |

|

|

$ |

.17 |

|

|

$ |

(224 |

) |

|

$ |

(.01 |

) |

|

$ |

(.01 |

) |

|

Deferred Tax Provision (Benefit)

|

|

|

56 |

|

|

|

- |

|

|

|

.01 |

|

|

|

(279 |

) |

|

|

(.02 |

) |

|

|

(.02 |

) |

|

Adjusted Net Income (Loss)

|

|

$ |

2,929 |

|

|

$ |

.18 |

|

|

$ |

.18 |

|

|

$ |

(503 |

) |

|

$ |

(.03 |

) |

|

$ |

(.03 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding

|

|

|

|

|

|

|

16,338 |

|

|

|

16,479 |

|

|

|

|

|

|

|

16,135 |

|

|

|

16,135 |

|

| |

|

Year Ended

|

|

| |

|

December 31, 2023

|

|

|

December 31, 2022

|

|

| |

|

Amount

|

|

|

Per

Basic

Share

|

|

|

Per

Diluted

Share

|

|

|

Amount

|

|

|

Per

Basic

Share

|

|

|

Per

Diluted

Share

|

|

|

Net Income (Loss) Attributable to Ultralife Corporation

|

|

$ |

7,197 |

|

|

$ |

.44 |

|

|

$ |

.44 |

|

|

$ |

(119 |

) |

|

$ |

(.01 |

) |

|

$ |

(.01 |

) |

|

Deferred Tax Provision (Benefit)

|

|

|

1,301 |

|

|

|

.08 |

|

|

|

.08 |

|

|

|

(962 |

) |

|

|

(.06 |

) |

|

|

(.06 |

) |

|

Adjusted Net Income (Loss)

|

|

$ |

8,498 |

|

|

$ |

.52 |

|

|

$ |

.52 |

|

|

$ |

(1,081 |

) |

|

$ |

(.07 |

) |

|

$ |

(.07 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding

|

|

|

|

|

|

|

16,214 |

|

|

|

16,226 |

|

|

|

|

|

|

|

16,125 |

|

|

|

16,125 |

|

|

Company Contact:

|

|

Ultralife Corporation

|

|

Philip A. Fain

|

|

(315) 210-6110

|

|

pfain@ulbi.com

|

|

Investor Relations Contact:

|

|

LHA

|

|

Jody Burfening

|

|

(212) 838-3777

|

jburfening@lhai.com

v3.24.0.1

Document And Entity Information

|

Feb. 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ULTRALIFE CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-20852

|

| Entity, Tax Identification Number |

16-1387013

|

| Entity, Address, Address Line One |

2000 Technology Parkway

|

| Entity, Address, City or Town |

Newark

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

14513

|

| City Area Code |

315

|

| Local Phone Number |

332-7100

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ULBI

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000875657

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

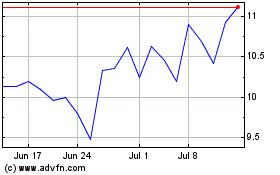

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

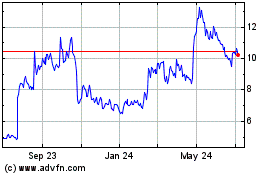

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Nov 2023 to Nov 2024