Net Sales of $2.5 Billion Compared to $2.3

Billion in the Year-Ago Quarter

Comparable Sales Increased 4.5%

Net Income of $249.5 Million or $5.07 Per

Diluted Share

Ulta Beauty, Inc. (NASDAQ: ULTA) today announced financial

results for the thirteen-week period (“third quarter”) and

thirty-nine-week period (“first nine months”) ended October 28,

2023 compared to the same periods ended October 29, 2022.

13 Weeks Ended

39 Weeks Ended

October 28,

October 29,

October 28,

October 29,

(Dollars in

millions, except per share data)

2023

2022

2023

2022

Net sales

$

2,488.9

$

2,338.8

$

7,653.0

$

6,981.8

Comparable sales

4.5%

14.6%

7.3%

15.6%

Gross profit (as a percentage of net

sales)

39.9%

41.2%

39.7%

40.6%

Selling, general and administrative

expenses

$

661.4

$

597.2

$

1,874.2

$

1,632.6

Operating income (as a percentage of net

sales)

13.1%

15.5%

15.2%

17.1%

Diluted earnings per share

$

5.07

$

5.34

$

17.99

$

17.35

New store openings, net

12

18

19

35

“The third quarter represented another strong performance by the

Ulta Beauty team, as sales, gross profit, and diluted EPS all

exceeded our internal expectations. Our traffic trends remained

healthy, our brand awareness increased, and we expanded our loyalty

program to a record 42.2 million members,” said Dave Kimbell, chief

executive officer. “As we look to the future, the outlook for the

Beauty category is bright, and I am confident Ulta Beauty has the

right plans in place to delight our guests this holiday season,

expand our leadership position in specialty beauty retail, and

deliver long-term shareholder growth.”

Third Quarter of Fiscal 2023 Compared to Third Quarter of

Fiscal 2022

- Net sales increased 6.4% to $2.5 billion compared to $2.3

billion, primarily due to increased comparable sales, strong new

store performance, and strong growth in other revenue.

- Comparable sales (sales for stores open at least 14 months and

e-commerce sales) increased 4.5% compared to an increase of 14.6%,

driven by a 5.9% increase in transactions and a 1.4% decrease in

average ticket.

- Gross profit increased 3.0% to $992.1 million compared to

$962.8 million. As a percentage of net sales, gross profit

decreased to 39.9% compared to 41.2%, primarily due to lower

merchandise margin, higher inventory shrink, and higher supply

chain costs, partially offset by strong growth in other

revenue.

- Selling, general and administrative (SG&A) expenses

increased 10.8% to $661.4 million compared to $597.2 million. As a

percentage of net sales, SG&A expenses increased to 26.6%

compared to 25.5%, primarily due to higher corporate overhead due

to strategic investments, higher store expenses, higher store

payroll and benefits, and higher marketing expenses, partially

offset by lower incentive compensation.

- Operating income was $327.2 million, or 13.1% of net sales,

compared to $361.9 million, or 15.5% of net sales.

- Net interest income increased to $2.5 million compared to $0.8

million, due to higher average interest rates on cash

balances.

- The tax rate remained flat at 24.3%.

- Net income was $249.5 million compared to $274.6 million.

- Diluted earnings per share was $5.07 compared to $5.34 (which

included a $0.02 benefit due to income tax accounting for

stock-based compensation).

First Nine Months of Fiscal 2023 Compared to First Nine

Months of Fiscal 2022

- Net sales increased 9.6% to $7.7 billion compared to $7.0

billion, primarily due to increased comparable sales, strong new

store performance, and strong growth in other revenue.

- Comparable sales increased 7.3% compared to an increase of

15.6%, driven by an 8.7% increase in transactions and a 1.4%

decrease in average ticket.

- Gross profit increased 7.4% to $3.0 billion compared to $2.8

billion. As a percentage of net sales, gross profit decreased to

39.7% compared to 40.6%, primarily due to lower merchandise margin,

higher inventory shrink, higher supply chain costs, and deleverage

of salon expenses, partially offset by strong growth in other

revenue and leverage of store fixed costs.

- SG&A expenses increased 14.8% to $1.9 billion compared to

$1.6 billion. As a percentage of net sales, SG&A expenses

increased to 24.5% compared to 23.4%, primarily due to higher

corporate overhead due to strategic investments, higher store

payroll and benefits, higher marketing expenses, and higher store

expenses, partially offset by lower incentive compensation.

- Operating income was $1.16 billion, or 15.2% of net sales,

compared to $1.19 billion, or 17.1% of net sales.

- Net interest income increased to $14.3 million compared to $0.6

million, due to higher average interest rates on cash

balances.

- The tax rate decreased to 23.7% compared to 24.3%, primarily

due to benefits from income tax accounting for stock-based

compensation.

- Net income was $896.6 million compared to $901.7 million.

- Diluted earnings per share was $17.99, including a $0.14

benefit due to income tax accounting for stock-based compensation,

compared to $17.35, including a $0.05 benefit due to income tax

accounting for stock-based compensation.

Balance Sheet

Cash and cash equivalents at the end of the third quarter of

fiscal 2023 totaled $121.8 million.

Merchandise inventories, net at the end of the third quarter of

fiscal 2023 increased 9.8% to $2.3 billion compared to $2.1 billion

at the end of the third quarter of fiscal 2022. The increase was

primarily due to inventory to support expected demand, 31 net new

stores, the new market fulfillment center in Greer, SC, new brand

launches, and product cost increases.

Short-term debt at the end of the third quarter of fiscal 2023

was $195.4 million, as the Company drew on its revolving credit

facility to support ongoing capital allocation priorities,

including share repurchases and capital expenditures, and

merchandise inventory growth.

Share Repurchase Program

During the third quarter of fiscal 2023, the Company repurchased

686,689 shares of its common stock at a cost of $281.5 million.

During the first nine months of fiscal 2023, the Company

repurchased 1.8 million shares of its common stock at a cost of

$840.5 million. As of October 28, 2023, $259.4 million remained

available under the $2.0 billion share repurchase program announced

in March 2022.

Store Update

Real estate activity in the third quarter of fiscal 2023

included 12 new stores located in Antioch, TN; Baraboo, WI;

Cornelius, NC; Cottage Grove, MN; El Paso, TX (2); Elizabethtown,

KY; Leominster, MA; Mesa, AZ; Parrish, FL; Pell City, AL; and

Rialto, CA. In addition, the Company relocated two stores and

remodeled 11 stores. During the first nine months of fiscal 2023,

the Company opened 20 new stores, relocated five stores, remodeled

16 stores, and closed one store.

At the end of the third quarter of fiscal 2023, the Company

operated 1,374 stores totaling 14.4 million square feet.

Fiscal 2023 Outlook

The Company has updated its outlook for fiscal 2023.

Prior FY23 Outlook

Updated FY23 Outlook

Net sales

$11.05 billion to $11.15

billion

$11.10 billion to $11.15

billion

Comparable sales

4.5% to 5.5%

5.0% to 5.5%

New stores, net

25-30

no change

Remodel and relocation projects

20-30

no change

Operating margin

14.6% to 14.8%

no change

Diluted earnings per share

$25.10 to $25.60

$25.20 to $25.60

Share repurchases

approximately $900 million

approximately $950 million

Interest income

approximately $17 million

no change

Effective tax rate

approximately 23.9%

no change

Capital expenditures

$400 million to $475 million

$400 million to $425 million

Depreciation and amortization expense

$245 million to $250 million

$240 million to $245 million

Conference Call Information

A conference call to discuss third quarter of fiscal 2023

results is scheduled for today, November 30, 2023, at 4:30 p.m. ET

/ 3:30 p.m. CT. Investors and analysts interested in participating

in the call are invited to dial (877) 704-4453. The conference call

will also be webcast live at https://ulta.com/investor. A replay of

the webcast will remain available for 90 days. A replay of the

conference call will be available until 11:59 p.m. ET on December

14, 2023 and can be accessed by dialing (844) 512-2921 and entering

conference ID number 13741934.

About Ulta Beauty

At Ulta Beauty (NASDAQ: ULTA), the possibilities are beautiful.

Ulta Beauty is the largest specialty U.S. beauty retailer and the

premier beauty destination for cosmetics, fragrance, skin care

products, hair care products and salon services. In 1990, the

Company reinvented the beauty retail experience by offering a new

way to shop for beauty – bringing together All Things Beauty, All

in One Place®. Today, Ulta Beauty operates 1,374 retail stores

across 50 states and also distributes its products through its

website, which includes a collection of tips, tutorials, and social

content. For more information, visit www.ulta.com.

Forward‑Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, which reflect the

Company’s current views with respect to, among other things, future

events and financial performance. These statements can be

identified by the use of forward-looking words such as “outlook,”

“believes,” “expects,” “plans,” “estimates,” “targets,”

“strategies” or other comparable words. Any forward-looking

statements contained in this press release are based upon the

Company’s historical performance and on current plans, estimates

and expectations. The inclusion of this forward-looking information

should not be regarded as a representation by the Company or any

other person that the future plans, estimates, targets, strategies

or expectations contemplated by the Company will be achieved. Such

forward-looking statements are subject to various risks and

uncertainties, which include, without limitation:

- macroeconomic conditions, including inflation, rising interest

rates and recessionary concerns, as well as ongoing labor

pressures, transportation and shipping cost pressures, and the

COVID-19 pandemic, have had, and may continue to have, a negative

impact on our business, financial condition, profitability, and

cash flows (including future uncertain impacts);

- changes in the overall level of consumer spending and

volatility in the economy, including as a result of the

macroeconomic conditions and geopolitical events;

- our ability to sustain our growth plans and successfully

implement our long-range strategic and financial plan;

- the ability to execute our operational excellence priorities,

including continuous improvement, Project SOAR (our replacement

enterprise resource planning platform), and supply chain

optimization;

- our ability to gauge beauty trends and react to changing

consumer preferences in a timely manner;

- the possibility that we may be unable to compete effectively in

our highly competitive markets;

- the possibility of significant interruptions in the operations

of our distribution centers, fast fulfillment centers, and market

fulfillment centers;

- the possibility that cybersecurity or information security

breaches and other disruptions could compromise our information or

result in the unauthorized disclosure of confidential

information;

- the possibility of material disruptions to our information

systems, including our Ulta.com website and mobile

applications;

- the failure to maintain satisfactory compliance with applicable

privacy and data protection laws and regulations;

- changes in the good relationships we have with our brand

partners and/or our ability to continue to offer permanent or

temporary exclusive products of our brand partners;

- changes in the wholesale cost of our products and/or

interruptions at our brand partners’ or third-party vendors’

operations;

- future epidemics, pandemics or natural disasters could

negatively impact sales;

- the possibility that new store openings and existing locations

may be impacted by developer or co-tenant issues;

- our ability to attract and retain key executive personnel;

- the impact of climate change on our business operations and/or

supply chain;

- our ability to successfully execute our common stock repurchase

program or implement future common stock repurchase programs;

- a decline in operating results may lead to asset impairment and

store closure charges; and

- other risk factors detailed in the Company’s public filings

with the Securities and Exchange Commission (the SEC), including

risk factors contained in its Annual Report on Form 10‑K for the

fiscal year ended January 28, 2023, as such may be amended or

supplemented in its subsequently filed Quarterly Reports on Form

10-Q.

The Company’s filings with the SEC are available at www.sec.gov.

Except to the extent required by the federal securities laws, the

Company does not undertake to publicly update or revise its

forward-looking statements, whether as a result of new information,

future events or otherwise.

Exhibit 1

Ulta Beauty, Inc.

Consolidated Statements of

Income

(In thousands, except per

share data)

13 Weeks Ended

October 28,

October 29,

2023

2022

(Unaudited)

(Unaudited)

Net sales

$

2,488,933

100.0

%

$

2,338,793

100.0

%

Cost of sales

1,496,866

60.1

%

1,375,976

58.8

%

Gross profit

992,067

39.9

%

962,817

41.2

%

Selling, general and administrative

expenses

661,380

26.6

%

597,164

25.5

%

Pre-opening expenses

3,460

0.1

%

3,797

0.2

%

Operating income

327,227

13.1

%

361,856

15.5

%

Interest income, net

(2,497

)

(0.1

%)

(849

)

(0.0

%)

Income before income taxes

329,724

13.2

%

362,705

15.5

%

Income tax expense

80,241

3.2

%

88,120

3.8

%

Net income

$

249,483

10.0

%

$

274,585

11.7

%

Net income per common share:

Basic

$

5.09

$

5.37

Diluted

$

5.07

$

5.34

Weighted average common shares

outstanding:

Basic

49,007

51,131

Diluted

49,226

51,418

Exhibit 2

Ulta Beauty, Inc.

Consolidated Statements of

Income

(In thousands, except per

share data)

39 Weeks Ended

October 28,

October 29,

2023

2022

(Unaudited)

(Unaudited)

Net sales

$

7,653,005

100.0

%

$

6,981,807

100.0

%

Cost of sales

4,612,469

60.3

%

4,149,800

59.4

%

Gross profit

3,040,536

39.7

%

2,832,007

40.6

%

Selling, general and administrative

expenses

1,874,201

24.5

%

1,632,593

23.4

%

Pre-opening expenses

5,396

0.1

%

8,422

0.1

%

Operating income

1,160,939

15.2

%

1,190,992

17.1

%

Interest income, net

(14,294

)

(0.2

%)

(556

)

(0.0

%)

Income before income taxes

1,175,233

15.4

%

1,191,548

17.1

%

Income tax expense

278,597

3.6

%

289,891

4.2

%

Net income

$

896,636

11.7

%

$

901,657

12.9

%

Net income per common share:

Basic

$

18.08

$

17.45

Diluted

$

17.99

$

17.35

Weighted average common shares

outstanding:

Basic

49,592

51,663

Diluted

49,846

51,962

Exhibit 3

Ulta Beauty, Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

October 28,

January 28,

October 29,

2023

2023

2022

(Unaudited)

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

121,811

$

737,877

$

250,628

Receivables, net

202,868

199,422

200,304

Merchandise inventories, net

2,321,306

1,603,451

2,114,669

Prepaid expenses and other current

assets

117,282

130,246

137,642

Prepaid income taxes

28,773

38,308

42,572

Total current assets

2,792,040

2,709,304

2,745,815

Property and equipment, net

1,117,874

1,009,273

967,039

Operating lease assets

1,578,316

1,561,263

1,556,940

Goodwill

10,870

10,870

10,870

Other intangible assets, net

591

1,312

844

Deferred compensation plan assets

38,371

35,382

31,529

Other long-term assets

56,946

43,007

18,512

Total assets

$

5,595,008

$

5,370,411

$

5,331,549

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

597,373

$

559,527

$

647,117

Accrued liabilities

405,443

444,278

462,773

Deferred revenue

350,937

394,677

312,132

Current operating lease liabilities

287,786

283,293

275,749

Short-term debt

195,400

—

—

Total current liabilities

1,836,939

1,681,775

1,697,771

Non-current operating lease

liabilities

1,616,747

1,619,883

1,621,252

Deferred income taxes

56,874

55,346

38,627

Other long-term liabilities

55,906

53,596

51,644

Total liabilities

3,566,466

3,410,600

3,409,294

Commitments and contingencies

Total stockholders’ equity

2,028,542

1,959,811

1,922,255

Total liabilities and stockholders’

equity

$

5,595,008

$

5,370,411

$

5,331,549

Exhibit 4

Ulta Beauty, Inc.

Condensed Consolidated

Statements of Cash Flows

(In thousands)

39 Weeks Ended

October 28,

October 29,

2023

2022

(Unaudited)

(Unaudited)

Operating activities

Net income

$

896,636

$

901,657

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

181,273

182,182

Non-cash lease expense

232,772

222,548

Deferred income taxes

1,528

(1,066

)

Stock-based compensation expense

33,477

32,554

Loss on disposal of property and

equipment

6,310

3,892

Change in operating assets and

liabilities:

Receivables

(3,446

)

33,378

Merchandise inventories

(717,855

)

(615,451

)

Prepaid expenses and other current

assets

12,964

(26,828

)

Income taxes

9,535

(49,446

)

Accounts payable

41,817

94,214

Accrued liabilities

(34,955

)

64,164

Deferred revenue

(43,740

)

(41,447

)

Operating lease liabilities

(248,469

)

(246,988

)

Other assets and liabilities

(9,836

)

20,063

Net cash provided by operating

activities

358,011

573,426

Investing activities

Capital expenditures

(311,030

)

(203,961

)

Other investments

(4,870

)

(3,068

)

Net cash used in investing activities

(315,900

)

(207,029

)

Financing activities

Borrowings from credit facility

195,400

—

Repurchase of common shares

(840,551

)

(571,908

)

Stock options exercised

9,302

31,319

Purchase of treasury shares

(22,328

)

(6,740

)

Net cash used in financing activities

(658,177

)

(547,329

)

Net decrease in cash and cash

equivalents

(616,066

)

(180,932

)

Cash and cash equivalents at beginning of

period

737,877

431,560

Cash and cash equivalents at end of

period

$

121,811

$

250,628

Exhibit 5

Ulta Beauty, Inc.

Store Update

Total stores open

Number of stores

Number of stores

Total stores

at beginning of the

opened during the

closed during the

open at

Fiscal 2023

quarter

quarter

quarter

end of the quarter

1st Quarter

1,355

5

1

1,359

2nd Quarter

1,359

3

0

1,362

3rd Quarter

1,362

12

0

1,374

Gross square feet for

Total gross square

stores opened or

Gross square feet for

Total gross square

feet at beginning of

expanded during the

stores closed

feet at end of the

Fiscal 2023

the quarter

quarter

during the quarter

quarter

1st Quarter

14,200,403

54,495

9,984

14,244,914

2nd Quarter

14,244,914

27,530

0

14,272,444

3rd Quarter

14,272,444

133,421

0

14,405,865

Exhibit 6

Ulta Beauty, Inc.

Sales by Category

The following tables set forth the

approximate percentage of net sales by primary category:

13 Weeks Ended

October 28,

October 29,

2023

2022

Cosmetics

42

%

44

%

Haircare products and styling tools

19

%

21

%

Skincare

19

%

16

%

Fragrance and bath

13

%

12

%

Services

4

%

4

%

Accessories and other

3

%

3

%

100

%

100

%

39 Weeks Ended

October 28,

October 29,

2023

2022

Cosmetics

42

%

43

%

Haircare products and styling tools

20

%

21

%

Skincare

19

%

17

%

Fragrance and bath

12

%

12

%

Services

4

%

4

%

Accessories and other

3

%

3

%

100

%

100

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231130337622/en/

Investor Contacts: Kiley Rawlins, CFA Vice President, Investor

Relations krawlins@ulta.com

Media Contact: Crystal Carroll Senior Director, Public Relations

ccarroll@ulta.com

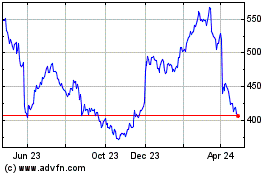

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

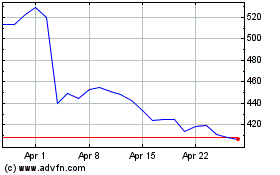

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Nov 2023 to Nov 2024