TScan Therapeutics, Inc. (Nasdaq: TCRX), a clinical-stage

biotechnology company focused on the development of T cell receptor

(TCR)-engineered T cell (TCR-T) therapies for the treatment of

patients with cancer, today reported financial results for the

second quarter ended June 30, 2024, and provided a corporate

update.

“We continue to make meaningful progress across

our pipeline and remain on track to provide a clinical update on

the ALLOHATM Phase 1 heme trial at the end of the year. We continue

to successfully manufacture our product candidates internally and

have now engaged a CDMO with global capabilities as we start to

prepare for commercial manufacturing. Receipt of RMAT designation

from the FDA is an important milestone that highlights the

transformative potential of TSC-100 and TSC-101, and we look

forward to working closely with the FDA to support the development

of these TCR-T therapy candidates,” said Gavin MacBeath, Ph.D.,

Chief Executive Officer. “In our solid tumor program, we are

currently enrolling patients across the first two dose levels. Our

goal is to start treating patients with multiplex therapy by the

end of the year, which should set us up to report meaningful

response data in 2025.”

Recent Corporate Highlights

- The Company recently received

Regenerative Medicine Advanced Therapy (RMAT) designation from the

U.S. Food and Drug Administration (FDA) for its two lead TCR-T

therapy candidates TSC-100 and TSC-101. The ALLOHA Phase 1 heme

trial is designed to evaluate the ability of TSC-100 and TSC-101 to

treat residual disease and prevent relapse in patients with acute

myeloid leukemia (AML), acute lymphoblastic leukemia (ALL), and

myelodysplastic syndrome (MDS) undergoing allogeneic hematopoietic

cell transplantation (HCT) with reduced intensity

conditioning.

- The Company signed a letter of

intent with a global contract development and manufacturing

organization (CDMO) to initiate manufacturing activities for

pivotal trials and commercialization.

- In June, the Company announced the

appointment of Garry A. Nicholson to its Board of Directors. In

addition, following the retirement of former Chairman Timothy

Barberich, Stephen Biggar, M.D., Ph.D., assumed the role of

Chair.

- Upon the U.S. market opening on

July 1, 2024, the Company joined the broad-market Russell 3000®

Index as a part of the annual reconstitution. The Russell U.S.

Index reconstitution captures the 4,000 largest U.S. stocks as of

April 30, 2024, ranking them by total market capitalization.

Membership in the U.S. all-cap Russell 3000® Index, which

remains in place for one year, means automatic inclusion in the

large-cap Russell 1000® Index or small-cap Russell

2000® Index as well as the appropriate growth and value style

indexes.

Upcoming Anticipated

Milestones

Heme Malignancies Program: TScan’s two lead

TCR-T therapy candidates, TSC-100 and TSC-101, are designed to

treat residual disease and prevent relapse in patients with AML,

ALL, or MDS undergoing allogeneic HCT (the ALLOHA trial,

NCT05473910).

- Opening of expansion cohorts at the

proposed recommended Phase 2 dose level to further characterize

safety and evaluate translational and efficacy endpoints is planned

for the third quarter of 2024.

- Reporting of one-year clinical and

translational data on initial patients is anticipated by the end of

2024.

- Initiation of a registration trial,

pending feedback from regulatory authorities, and reporting of

two-year clinical and translational data are anticipated in

2025.

Solid Tumor Program: TScan continues to expand

the ImmunoBank, a collection of therapeutic TCR-Ts that target

different cancer-associated antigens presented on diverse HLA

types. TScan’s strategy is to treat patients with multiple TCR-Ts

to overcome tumor heterogeneity and prevent resistance that may

arise from either target or HLA loss (screening

protocol: NCT05812027; treatment

protocol: NCT05973487).

- First patient dosed in early May,

with enrollment proceeding across the TCR-T therapy

candidates.

- Initial singleplex data expected by

the end of 2024.

- Additional investigational new drug

(IND) filings planned to continue to expand the ImmunoBank.

- Response data for multiplex therapy

anticipated in 2025.

Second Quarter 2024 Financial

Results

Revenue: Revenue for the

second quarter of 2024 was $0.5 million, compared to $3.1 million

for the second quarter of 2023. The decrease was primarily due to

the timing of research activities pursuant to the Company’s

collaboration agreement with Amgen which commenced in May 2023.

R&D Expenses: Research

and development expenses for the second quarter of 2024 were $26.9

million, compared to $21.2 million for the second quarter of 2023.

The increase of $5.7 million was primarily driven by an increase in

clinical studies expense associated with the ongoing enrollment of

our ALLOHA Phase 1 heme trial and start-up activities and initial

enrollment in our Phase 1 solid tumor clinical trial, as well as an

increase in personnel expenses due to additional headcount in

support of our expanded research and development activities.

Research and development expenses included non-cash stock

compensation expense of $1.2 million and $0.6 million for the

second quarter of 2024 and 2023, respectively.

G&A Expenses: General

and administrative expenses for the second quarter of 2024 were

$7.8 million, compared to $6.5 million for the second quarter of

2023. The increase of $1.2 million was primarily driven by an

increase in personnel expenses due to increased headcount to

support business activities. General and administrative expenses

included non-cash stock compensation expense of $1.1 million and

$0.6 million for the second quarter of 2024 and 2023,

respectively.

Net Loss: Net loss was

$31.7 million for the second quarter of 2024, compared to $24.0

million for the second quarter of 2023, and included net interest

income of $2.5 million and $0.6 million, respectively.

Cash Position: Cash, cash

equivalents, and marketable securities as of June 30, 2024, were

$297.7 million, excluding $5.0 million of restricted cash. The

Company believes that its existing cash resources will continue to

fund its current operating plan into the fourth quarter of

2026.

Share Count: As of June

30, 2024, the Company had issued and outstanding shares of

52,932,746, which consists of 48,656,158 shares of voting common

stock and 4,276,588 shares of non-voting common stock, and

outstanding pre-funded warrants to purchase 65,587,945 shares of

voting common stock at an exercise price of $0.0001 per share.

About TScan Therapeutics,

Inc.

TScan is a clinical-stage biotechnology company

focused on the development of T cell receptor (TCR)-engineered T

cell (TCR-T) therapies for the treatment of patients with cancer.

The Company’s lead TCR-T therapy candidates, TSC-100 and TSC-101,

are in development for the treatment of patients with hematologic

malignancies to prevent relapse following allogeneic hematopoietic

cell transplantation (the ALLOHA Phase 1 heme trial). The Company

is also developing TCR-T therapy candidates for the treatment of

various solid tumors. The Company has developed and continues to

expand its ImmunoBank, the Company’s repository of therapeutic TCRs

that recognize diverse targets and are associated with multiple HLA

types, to provide customized multiplex TCR-T therapies for patients

with a variety of cancers.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, express or implied

statements regarding the Company’s plans, progress, and timing

relating to the Company’s hematologic malignancies program,

including clinical updates of the ALLOHA Phase 1 heme trial,

presentation of data, opening of expansion cohorts, and initiation

of registrational trials; the Company’s plans, progress, and timing

relating to the Company’s solid tumor program, including,

enrollment, presentation of data, and submission of additional INDs

to expand the ImmunoBank; the progress of the hematologic

malignancies and solid tumor programs being indicative or

predictive of the success of each program; the engagement of CDMO

and execution of the letter of intent being indicative of

successful initiation or support of manufacturing activities or

execution of definitive agreements; expectations regarding the

Company’s inclusion in the broad-market Russell 3000 Index; the

Company’s current and future research and development plans or

expectations; the structure, timing and success of the Company’s

planned preclinical development, submission of INDs, and clinical

trials; the potential benefits of any of the Company’s proprietary

platforms, multiplexing, or current or future product candidates in

treating patients; the Company’s ability to fund its operating plan

with its existing cash and cash equivalents; and the Company’s

goals, strategy and anticipated financial performance. TScan

intends such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in

Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by terms such as, but not

limited to, “may,” “might,” “will,” “objective,” “intend,”

“should,” “could,” “can,” “would,” “expect,” “believe,”

“anticipate,” “project,” “target,” “design,” “estimate,” “predict,”

“potential,” “plan,” “on track,” or similar expressions or the

negative of those terms. Such forward-looking statements are based

upon current expectations that involve risks, changes in

circumstances, assumptions, and uncertainties. The express or

implied forward-looking statements included in this release are

only predictions and are subject to a number of risks,

uncertainties and assumptions, including, without limitation: the

beneficial characteristics, safety, efficacy, therapeutic effects

and potential advantages of TScan’s TCR-T therapy candidates;

TScan’s expectations regarding its preclinical studies being

predictive of clinical trial results; TScan’s recently approved

INDs being indicative or predictive of bringing TScan closer to its

goal of providing customized TCR-T therapies to treat patients with

cancer; the timing of the launch, initiation, progress, expected

results and announcements of TScan’s preclinical studies, clinical

trials and its research and development programs; TScan’s ability

to enroll patients for its clinical trials within its expected

timeline; TScan’s plans relating to developing and commercializing

its TCR-T therapy candidates, if approved, including sales

strategy; estimates of the size of the addressable market for

TScan’s TCR-T therapy candidates; TScan’s manufacturing

capabilities and the scalable nature of its manufacturing process;

TScan’s estimates regarding expenses, future milestone payments and

revenue, capital requirements and needs for additional financing;

TScan’s expectations regarding competition; TScan’s anticipated

growth strategies; TScan’s ability to attract or retain key

personnel; TScan’s ability to establish and maintain development

partnerships and collaborations; TScan’s expectations regarding

federal, state and foreign regulatory requirements; TScan’s ability

to obtain and maintain intellectual property protection for its

proprietary platform technology and our product candidates; the

sufficiency of TScan’s existing capital resources to fund its

future operating expenses and capital expenditure requirements; and

other factors that are described in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of TScan’s most recent Annual

Report on Form 10-K and any other filings that TScan has made or

may make with the SEC in the future. Any forward-looking statements

contained in this release represent TScan’s views only as of the

date hereof and should not be relied upon as representing its views

as of any subsequent date. Except as required by law, TScan

explicitly disclaims any obligation to update any forward-looking

statements.

Contacts

Heather SavelleTScan Therapeutics, Inc.VP, Investor

Relations857-399-9840hsavelle@tscan.com

Maghan MeyersArgot

Partners212-600-1902TScan@argotpartners.com

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Balance Sheet Data |

|

(unaudited, in thousands, except share

amount) |

|

|

|

|

|

|

|

| |

June 30, 2024 |

|

|

December 31, 2023 |

|

| Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

242,159 |

|

|

$ |

133,359 |

|

|

Other assets |

|

132,712 |

|

|

|

138,790 |

|

|

Total assets |

$ |

374,871 |

|

|

$ |

272,149 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

Total liabilities |

$ |

119,650 |

|

|

$ |

121,282 |

|

|

Total stockholders' equity |

|

255,221 |

|

|

|

150,867 |

|

|

Total liabilities and stockholders' deficit |

$ |

374,871 |

|

|

$ |

272,149 |

|

|

Common stock and pre-funded warrants outstanding(1) |

|

118,520,691 |

|

|

|

94,840,055 |

|

| |

|

|

|

|

|

| (1)Both periods

include outstanding pre-funded warrants to purchase shares of

voting common stock at an exercise price of $0.0001 per share;

65,587,945 and 47,010,526 pre-funded warrants issued and

outstanding at June 30, 2024 and December 31, 2023,

respectively. |

|

| |

|

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited, in thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

| |

Three Months EndedJune 30, |

|

| |

2024 |

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

Collaboration and license revenue |

$ |

536 |

|

|

$ |

3,148 |

|

| Operating expenses: |

|

|

|

|

|

|

Research and development |

|

26,877 |

|

|

|

21,227 |

|

|

General and administrative |

|

7,773 |

|

|

|

6,531 |

|

|

Total operating expenses |

|

34,650 |

|

|

|

27,758 |

|

| Loss from operations |

|

(34,114 |

) |

|

|

(24,610 |

) |

|

Interest and other income, net |

|

3,405 |

|

|

|

1,534 |

|

|

Interest expense |

|

(952 |

) |

|

|

(969 |

) |

| Net loss |

$ |

(31,661 |

) |

|

$ |

(24,045 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.28 |

) |

|

$ |

(0.51 |

) |

| Weighted average common shares

outstanding—basic and diluted(2) |

|

113,425,357 |

|

|

|

47,208,664 |

|

| |

|

|

|

|

|

| (2)For the three

months ended June 30, 2024 and 2023, 65,587,945 and 47,010,526

shares of the Company's voting common stock issuable upon exercise

of the pre-funded warrants are included as outstanding common stock

in the calculation of basic and diluted net loss per share. |

|

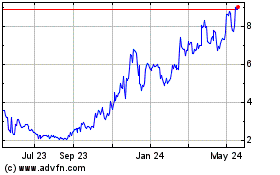

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

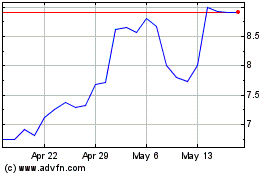

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Jan 2024 to Jan 2025