GameStop (NYSE:GME) – GameStop

reported $1.79 billion in revenue for the fourth quarter, which is

less than the $2.23 billion earned in the same quarter of the

previous year. However, the company announced an adjusted earnings

per share of 22 cents, compared to the previous year’s 16 cents per

share. Shares of the video game retailer fell 19.7% in pre-market

trading.

Direct Digital Holdings (NASDAQ:DRCT) – The

advertising platform provider reported a net loss of $1.2 million

in the last quarter. This contrasts with the net profit of $1.4

million in the same period of the previous year. Revenue in the

fourth quarter reached $41 million, compared to $30.7 million in

the previous year. Shares fell 41.87% in pre-market trading.

Apple (NASDAQ:AAPL) – Apple

announced its Worldwide Developers Conference (WWDC) from June 10

to 14, revealing significant changes to iOS and partnerships in

artificial intelligence (AI). The online event will highlight

software updates for iPhones, iPads, and other devices, with some

attendees present at Apple Park. In other related news,

Apple‘s iPhone shipments in China fell about 33%

in February from the previous year, reflecting a continued decline

in demand for the device in its primary foreign market.

Nvidia (NASDAQ:NVDA) –

Nvidia‘s rapid growth, though based on solid

profits and revenues, is generating caution due to the possibility

of over-anticipation of future earnings, resulting in overly valued

shares. Nvidia has become one of the world’s

largest companies, adding $2 trillion in value over the past 15

months.

Dell Technologies (NYSE:DELL) –

Dell eliminated 13,000 jobs during the last fiscal

year, a deeper cut than initially expected. With 120,000 employees

as of February 2, the company reduced its global workforce by

almost 10%.

Adobe (NASDAQ:ADBE) – Adobe is

innovating in generative AI with GenStudio for advertising and

marketing, as well as a partnership with Microsoft

(NASDAQ:MSFT) to optimize workflows. A focus on productivity gains

is anticipated in 2024.

nCino (NASDAQ:NCNO) – The cloud software

company reported fourth-quarter results that exceeded those of the

previous year. Revenue reached $123.7 million, representing a 13%

increase compared to the same period last year. Shares of nCino

rose 11.73% in pre-market trading.

Concentrix (NASDAQ:CNXC) – The customer

experience technology company reported adjusted earnings of $2.57

per share and revenue of $2.4 billion in the first fiscal quarter.

In the same period of the previous year, the company recorded

earnings per share of $2.59 and revenue of $1.64 billion. In

addition, Concentrix reiterated its annual projections for the

current fiscal year. Shares of Concentrix fell -4.23% in pre-market

trading.

Progress Software (NASDAQ:PRGS) –

Progress Software had fiscal first-quarter revenue

that exceeded expectations but projected adjusted earnings for the

second quarter between 93 and 97 cents per share, with revenues

forecasted between $166 million and $170 million. The earnings and

revenue forecasts fell below Wall Street estimates, and shares

dropped 2% in pre-market trading.

Arista Networks (NYSE:ANET) – Andreas

Bechtolsheim, founder and former chairman of Arista

Networks, agreed to pay a civil fine of approximately $1

million to settle insider trading charges, as disclosed by the U.S.

Securities and Exchange Commission. In addition, he accepted a

five-year ban from serving as an executive or director at public

companies.

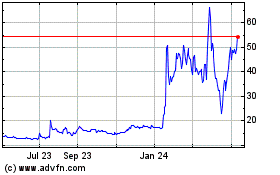

Trump Media & Technology Group (NASDAQ:DJT)

– Shares of Donald Trump’s publicly traded Truth Social company

rose 16% on their first trading day on Tuesday, following the

completion of the merger deal with Digital World Acquisition Corp.

Shares reached a high of 59%, closing at $57.99 each. This values

the company at $7.9 billion, providing Trump with a significant

potential gain, although his 60% stake is subject to a six-month

lock-up. The company faces financial and legal challenges but has

attracted retail investors due to its potential as a “meme

stock.”

Comcast (NASDAQ:CMCSA), Amazon

(NASDAQ:AMZN) – In the 2024 season, Comcast‘s

Peacock streaming service will exclusively showcase NFL Week 1

game, while rival Amazon.com will broadcast the NFL Wild Card. This

groundbreaking deal marks the first NFL game in South America and

promises a unique experience for fans.

Walt Disney (NYSE:DIS) – Proxy advisor

Egan-Jones endorsed the nominations of Nelson Peltz and Jay Rasulo

to the Walt Disney board, estimating they would

bring fresh perspectives. The report criticized

Disney in several areas, including management

succession and relationship with the Florida government.

Zoetis (NYSE:ZTS) – Zoetis is

under EU antitrust investigation for allegedly blocking a rival dog

pain medication from entering the market. The European Commission

is examining whether there was unfair exclusion and may impose

substantial fines.

Clorox (NYSE:CLX) – A few years before a

cyberattack in 2023 halted production at Clorox,

one of the largest disinfectant producers in the U.S., an audit

highlighted cybersecurity flaws in the company’s production

systems. Clorox leaders delayed cybersecurity

improvements, affecting recovery after the attack, while the

company invested in a digital transformation initiative.

Hershey (NYSE:HSY), Mondelez

(NASDAQ:MDLZ) – Hershey,

Mondelez, and other confectionery manufacturers

are stepping up promotions and diversifying their Easter offerings

with non-chocolate treats, such as biscuit and cream bunnies. The

rise in cocoa prices is pressuring profits, while consumers resist

higher prices.

Krispy Kreme (NASDAQ:DNUT),

McDonald’s (NYSE:MCD) – Krispy

Kreme announced that its donuts will be available in

McDonald’s restaurants across the U.S. by the end

of 2026, expanding a pilot program. This caused its shares to jump

23% on Tuesday.

Canada Goose Holdings (NYSE:GOOS) –

Canada Goose will cut its global workforce by

about 17%, representing approximately 156 jobs, as part of efforts

to control costs amid pressure on luxury goods demand in the U.S.

The company will also realign executive functions to drive

growth.

Amazon (NASDAQ:AMZN) – Amazon

expanded same-day prescription drug delivery in New York and Los

Angeles. Using new facilities and AI, Amazon is

offering flu and diabetes medications within a few hours. Expansion

plans include more U.S. cities.

Walmart (NYSE:WMT), Capital

One (NYSE:COF) – A federal judge ruled on Tuesday that

Walmart may terminate its credit card partnership

with Capital One due to customer service failures.

The decision favored the clear terms of the 2018 agreement between

the parties.

Morgan Stanley (NYSE:MS) – Morgan

Stanley was ordered to pay over $3 million to a group of

financial advisors for improperly withholding their deferred

compensation upon leaving. The arbitration panel ruled in favor of

the 10 advisors, ordering payment of deferred compensation,

interest, and legal fees.

Citigroup (NYSE:C) – Citigroup

fired at least 10 equity research employees in Asia-Pacific, part

of a global overhaul. This move follows earlier cuts, aiming for

significant staff reduction to improve efficiency and save $1

billion annually.

Western Digital (NASDAQ:WDC) – Western

Digital rose 1.44% in pre-market trading after analysts at

Evercore ISI began covering the stock with an “Outperform” rating

and set a target price of $80.

Deutsche Bank (NYSE:DB) – Shares of

Deutsche Bank rose 3.8% in pre-market trading

following an upgrade from Morgan Stanley to

“Overweight”. The U.S. bank believes there is more growth

potential, highlighting improved revenue momentum and confidence in

cost reduction.

Nu Holdings (NYSE:NU) – Nu

Holdings will reduce the interest rate on its savings

account in Mexico by 25 basis points to 14.75%, following a rate

cut by the central bank. Intense competition in the fintech sector

keeps rates high.

Visa (NYSE:V), Mastercard

(NYSE:MA) – Visa and Mastercard

agreed to a historic $30 billion deal to limit card fees,

potentially reducing prices for consumers. Merchants have long

accused the companies of anti-competitive practices, while critics

question the durability of the resulting savings. Judicial approval

is awaited.

Robinhood Markets (NASDAQ:HOOD) – The online

trading platform Robinhood introduced a new credit

card on Tuesday, aiming to expand its presence in personal finance

and attract more subscribers to its premium service, complementing

its product diversification and partnership strategy.

Blackstone (NYSE:BX) –

Blackstone is considering selling Trilliant Food

& Nutrition, the maker of Victor Allen’s and Aspen Ridge coffee

brands, for about $600 million. Trilliant generates almost $60

million in annual profits. Bank of America

(NYSE:BAC) has been hired as a financial advisor.

BlackRock (NYSE:BLK) – In BlackRock’s annual

letter to shareholders, Larry Fink mentioned the financial security

of his retired parents, contrasting it with current concerns over

the sustainability of pension funds. He proposed solutions,

including a new investment product from

BlackRock.

Moody’s (NYSE:MCO), Boeing

(NYSE:BA) – Moody’s Investors Service is

considering downgrading Boeing‘s ratings,

including the “Prime-2” short-term rating and the “Baa2” senior

unsecured rating. This reflects concerns about the company’s

ability to deliver 737 aircraft in volumes necessary to improve its

cash flow. Regarding Boeing‘s search for a new

CEO, potential candidates include industry leaders and external

executives, with GE, Spirit, and former Boeing

leaders among the options.

Toyota Motor (NYSE:TM) –

Toyota plans to mass-produce an electric Hilux

pickup by the end of 2025, revealed by the president of its Thai

unit. This announcement follows Isuzu Motors‘

statement that it will manufacture its D-MAX battery-powered pickup

in Thailand by 2025.

Ford Motor (NYSE:F), Allego

(NYSE:ALLG), General Motors (NYSE:GM) –

Ford and Allego announced a

partnership to install ultra-fast chargers at Ford

dealerships in Europe, aiming to overcome the shortage of charging

infrastructure. The chargers, set to be installed starting from

2025, will be available to all electric vehicle owners.

Additionally, GM and Ford will

adjust shipments following the collapse of a bridge in Baltimore.

While they expect minimal impact, they are redirecting vehicle

shipments to other ports. The Port of Baltimore is vital to the

auto industry, handling thousands of vehicles annually.

Ferrari NV (NYSE:RACE) – Ferrari

NV has partnered with South Korea’s SK On to develop

batteries for its future electric supercars. CEO Benedetto Vigna is

committed to taking Ferrari into the electric

world, planning to launch its first fully electric car next

year.

Tesla (NASDAQ:TSLA) – Tesla

shares rose up to 1% in pre-market trading in response to the

announcement of free trials of its autonomous software. A driving

test is anticipated for all customers before purchase. Despite

previous declines, shares are rebounding this week.

VinFast (NASDAQ:VFS) – Electric vehicle maker

VinFast signed agreements with 15 dealers in

Thailand, seeking to expand its presence in Southeast Asia. This

initiative accompanies the Bangkok International Motor Show,

reflecting the growing demand for electric vehicles in the

region.

Li-Cycle (NYSE:LICY) –

Li-Cycle plans to cut 17% of its workforce,

including three senior executives, aiming to reduce costs and focus

on building a crucial facility in New York. The cuts reflect

technical challenges and excessive costs associated with the

company’s global expansion.

United Parcel Service (NYSE:UPS) –

UPS exceeded revenue forecasts for 2026 on

Tuesday, with a three-year plan focused on high-margin parcels and

cost cuts. UPS aims to boost growth through health

logistics and SME customers. With the “Network of the Future” plan,

it expects to save about $3 billion by 2026 through automation and

robotics. Capital expenditures from 2024 to 2026 are expected to

total between $17 billion and $18 billion.

International Paper (NYSE:IP), DS

Smith (USOTC:DSSMY) – DS Smith is in

talks with International Paper about a proposal to

acquire all shares of its U.S.-listed competitor, valuing the

British company at $7.2 billion.

Merck (NYSE:MRK) – The U.S. Food and Drug

Administration approved Merck‘s treatment for

pulmonary arterial hypertension. The drug, called Winrevair, is the

first in its class, targeting the activin protein. The approval is

based on a late-stage trial showing significant improvements in

patients. Merck paid $11.5 billion in 2021 for the

company that developed the drug.

Johnson & Johnson (NYSE:JNJ),

Shockwave Medical (NASDAQ:SWAV) – Johnson

& Johnson is in talks to acquire medical device

manufacturer Shockwave Medical, as revealed by the

Wall Street Journal on Tuesday. With a market capitalization of

about $11 billion, a deal could be finalized soon.

AstraZeneca (NASDAQ:AZN) –

AstraZeneca plans to establish an independent

production network to supply drugs to major markets, aiming to

reduce the pharmaceutical industry’s dependence on China. CEO

Pascal Soriot highlighted in an interview at the Bo’ao Forum the

importance of serving the U.S., Europe, and China

independently.

Rite Aid (NYSE:RAD) – The pharmacy chain

Rite Aid reached an agreement with creditors, the

U.S. Department of Justice, and McKesson Corp

(NYSE:MCK), paving the way to complete its bankruptcy process by

April. The deal was disclosed by a company attorney during a court

hearing.

Trump Media and Technology (NASDAQ:DJT)

Historical Stock Chart

From Oct 2024 to Nov 2024

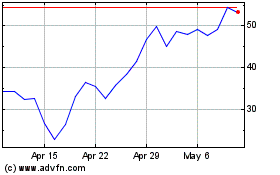

Trump Media and Technology (NASDAQ:DJT)

Historical Stock Chart

From Nov 2023 to Nov 2024