TMC the metals company Inc. (Nasdaq: TMC) (“TMC” or “the Company”),

an explorer of lower-impact battery metals from seafloor

polymetallic nodules, today provided a corporate update and

financial results for the third quarter ending September 30, 2024.

Q3 2024 Financial Highlights

- Current liquidity available from our cash on hand and our

credit facilities of approximately $63 million as of date of

filing

- Borrowing capacity of our unsecured credit facilities increased

by $10.5 million as of date of filing:

- ERAS/Barron facility increased from $25 million to $38 million

($33.8 million available), and;

- Allseas Group SA affiliate facility reduced from $27.5 million

to $25.0 million (undrawn)

- $5.7 million cash used in operations for the quarter ended

September 30, 2024

- Net loss of $20.5 million and net loss per share of $0.06 for

the quarter ended September 30, 2024

Registered Direct Offering

- Registered Direct Offering resulting in expected minimum gross

proceeds of $17.5 million through equity issuance at $1.00 per

share

- The Registered Direct Offering is led by TMC’s largest

non-affiliate institutional shareholder

- The transaction includes warrant coverage of 50% (1 warrant for

every 2 common shares purchased) with a warrant strike price of

$2.00 per share

- Warrants contain a call provision which forces exercise if the

30-day volume weighted-average price (“VWAP”) of TMC common stock

exceeds $5.00

Gerard Barron, Chairman & CEO of The Metals Company

commented: “This week we announced June 27, 2025, as the date for

NORI to submit its exploitation application to the ISA. This

decision, made in close consultation with NORI’s Sponsoring State

Nauru, represents years of preparation, backed by the largest

dataset ever collected on the deep sea in international waters.

We’re excited to share our application with the ISA and

stakeholders and recognize the responsibility that comes with

submitting the world’s first application of this kind.

After years of conversations with shareholders, it’s clear that

the delivery of the Mining Code by the ISA is viewed as a key

catalyst for TMC. Recent discussions with Member States and the

incoming ISA Secretary-General give me confidence that there is no

change in the ISA’s commitment to deliver on its mandate. But until

we have sufficient regulatory progress—whether through delivery of

the Mining Code or clarity on the ISA’s application review

process—investors can rest assured we won’t be raising funds for

CAPEX for the Hidden Gem production system upgrades.

While getting the NORI-D Project permitted and into production

has been our strong focus, the TMC’s value goes beyond our first

project. With over half a billion dollars invested over the past

decade in building our project development capabilities in deepsea

minerals, we’re well-positioned to capitalize on new opportunities

as the world’s major economies turn to the seafloor for metals

essential to the energy transition, defense, infrastructure, and a

growing global population. I look forward to sharing more on how we

plan to capitalize on this shift.

In the meantime, we’re watching promising momentum in

Washington, with several initiatives expected to gain traction

post-election. One of Washington’s strongest nodule resource

development supporters, Rep. Elise Stefanik, has been tapped as UN

Ambassador, and Marco Rubio, another key supporter, is set to

become Secretary of State, which oversees the ISA file. We

anticipate the Pentagon’s long-awaited report on nodules to be

released soon, and we’re encouraged by the increased U.S. interest

in the ISA’s work. The world is moving toward responsible

development of seafloor metals—and TMC retains its substantial lead

in this industry.”

Operational HighlightsNovember 14, 2024

Registered Direct Offering$17.5 million minimum amount

raised through a registered direct offering, led by TMC's largest

non-affiliate institutional shareholder. Shares were issued at

$1.00 per share, with half warrant at $2.00 per share expiring in 5

years.

Application Submission and StrategyNORI has set

the date of June 27, 2025 for its expected submission of its ISA

exploitation application. According to the ISA Council's decisions

ISBA/28/C/24 and ISBA/28/C/25, if NORI submits an application for a

plan of work for exploitation before the RRPs have been adopted,

the ISA Council at its next meeting, as a matter of priority, will

consider the process for considering such an application. The ISA

Council is not scheduled to meet again until March 2025 and the

Company believes it is unlikely that the ISA Council would consider

an application for a plan of work for exploitation before this

session. In light of this, Nauru has formally requested that the

ISA clarify the submission and review process for such an

application at the March 2025 meetings before NORI submits the

Application and, therefore, has decided to submit the Application

after the March 2025 meetings on June 27, 2025.

Operating Expense Reductions and Deferral of Capital

ExpendituresFollowing the expected submission of the

Application by NORI, the Company expects quarterly cash use of less

than $5 million as the Application is reviewed. The Company has

already begun the process of reducing or eliminating certain

operating expenses to ensure the Company’s financial resiliency.

Further, the Company does not expect to raise funds for capital

expenditures related to the preparation of the Hidden Gem vessel

for commercial production until such time as the final Mining Code

is adopted, the Application is approved, or until other potential

non-dilutive strategic financing is in place. The Company expects

to provide further updates on the potential timing of the start of

commercial production following sufficient clarity on these

items.

Expanded Company StrategyGiven the significant

rise in seafloor resource exploration opportunities around the

globe and the Company’s leadership position and experience in this

industry, having invested over $500 million since inception to

achieve milestones in environmental research, resource definition,

test mining and test processing, the Company is exploring a new

strategy to (1) develop a services business for seafloor resource

development and (2) optimize and diversify its resource portfolio

within international waters and in national jurisdictions. We are

in discussions with several parties on services contracts to

provide our expertise in the areas of new exploration plans of

work, resource definition, environmental impact assessments, data

management and offshore campaign execution. We are also actively

evaluating opportunities for the Company to enter new exploration

contract areas, already permitted properties and producing

properties.

Global stakeholder webinar on NORI’s Cultural Heritage

Impact Assessment: In September, TMC subsidiary NORI held

a webinar with its technical expert, SEARCH Inc. to provide an

update on its Cultural Heritage Impact Assessment (CHIA) for the

NORI-D polymetallic nodule project in the Clarion-Clipperton Zone

in international waters. NORI reported on its baselining work and

recent consultations in Nauru and Tonga, both of which form

components of the cultural heritage assessment being studied as

part of the NORI-D Project.

Industry Update

Progress on ISA Mining Code: Council completed

a first reading of the consolidated text of the draft regulations

on exploitation of mineral resources in the Area, at the July 2024

Council meeting. It was agreed that a revised consolidated text

would be provided by the end of November 2024. TMC has engaged with

Secretary-General-Elect Carvalho and expects to work with her in a

constructive manner as the ISA continues to work to have the final

Mining Code adopted.

TMC CEO Testifies to U.S. House of Representatives on

Benefits of Nodules: In September, TMC CEO Gerard Barron

gave testimony during a meeting of the Critical Mineral Policy

Working Group for the House Select Committee on the Chinese

Communist Party to discuss the U.S.’ heavy reliance on Chinese

imports of critical minerals and policy solutions to incentivise

greater cooperation with allies to create alternative supplies. Mr

Barron spoke to the potential of seafloor nodules to secure U.S.

supplies of key minerals for the energy transition and defence

sectors.

Financial Results OverviewAt September 30,

2024, we held cash of approximately $0.4 million and short-term

debt of $9.2 million, with an affiliate of Allseas Group SA ($5

million) and with the Barron/ERAS unsecured credit facility ($4.2

million). We believe that our total liquidity including cash, the

committed proceeds from our latest financing and borrowing

availability under our credit facility with ERAS Capital LLC and

Mr. Barron, will be sufficient to meet our working capital and

capital expenditure commitments for at least the next twelve months

from today.

We reported a net loss of approximately $20.5 million, or $0.06

per share for the quarter ended September 30, 2024, compared to net

loss of $12.5 million, or $0.04 per share, for the quarter ended

September 30, 2023. Exploration and evaluation expenses during the

quarter ended September 30, 2024 were $11.8 million compared to

$7.9 million for the quarter ended September 30, 2023. The increase

in the exploration and evaluation expenses in the third quarter of

2024 was primarily due to an increase in share-based compensation

of $1.8 million due to the amortization of the fair value of RSUs

and options granted to the directors and officers in the second

quarter of 2024, increase in mining, technological and process

development of $1.0 million resulting from increased engineering

work by Allseas and higher personnel costs of $1.0 million.

General and administrative expenses were $8.1 million for the

quarter ended September 30, 2024 compared to $4.6 million for the

quarter ended September 30, 2023, reflecting an increase in

share-based compensation of $1.8 million due to the amortization of

the fair value of RSUs and options granted to the directors and

officers in the second quarter of 2024, an increase in legal and

consulting costs of $1.0 million and higher personnel costs of $0.5

million.

Conference CallWe will hold a conference call

today at 4:30 p.m. EDT to provide an update on recent corporate

developments, third quarter 2024 financial results and upcoming

milestones.

|

Third Quarter 2024 Conference Call Details |

|

| |

|

| Date: |

Thursday, November 14, 2024 |

| Time: |

4:30 pm EDT |

| Audio-only Dial-in: |

Register Here |

| Virtual webcast w/ slides: |

Register Here |

| |

|

Please register with the links above at least ten minutes prior

to the conference call. The virtual webcast will be available for

replay in the ‘Investors’ tab of the Company’s website under

‘Investors’ > ‘Media’ > ‘Events and Presentations’,

approximately two hours after the event.

About The Metals CompanyThe Metals Company is

an explorer of lower-impact battery metals from seafloor

polymetallic nodules, on a dual mission: (1) supply metals for the

global energy transition with the least possible negative impacts

on planet and people and (2) trace, recover and recycle the metals

we supply to help create a metal commons that can be used in

perpetuity. The Company through its subsidiaries holds exploration

and commercial rights to three polymetallic nodule contract areas

in the Clarion Clipperton Zone of the Pacific Ocean regulated by

the International Seabed Authority and sponsored by the governments

of Nauru, Kiribati, and the Kingdom of Tonga. More information is

available at www.metals.co.

ContactsMedia | media@metals.coInvestors

| investors@metals.co

Forward Looking Statements

This press release contains “forward-looking” statements and

information within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements may be identified by words

such as “aims,” “believes,” “could,” “estimates,” “expects,”

“forecasts,” “may,” “plans,” “possible,” “potential,” “will” and

variations of these words or similar expressions, although not all

forward-looking statements contain these words. Forward-looking

statements in this press release include, but are not limited to,

statements with respect to [the potential impact of the Company’s

potential commercial operations, the Company’s expected application

to the ISA for an exploitation contract, the potential outcome of

actions of the U.S. government, the Company’s dialogue with members

of the U.S. government, the status and timing of adopting final

regulations, or Mining Code, for the exploitation of deep-sea

polymetallic nodules and the Company’s financial and operating

plans moving forward]. The Company may not actually achieve the

plans, intentions or expectations disclosed in these

forward-looking statements, and you should not place undue reliance

on these forward-looking statements. Actual results or events could

differ materially from the plans, intentions and expectations

disclosed in these forward-looking statements as a result of

various factors, including, among other things: the Company’s

strategies and future financial performance; the ISA's ability to

timely adopt the Mining Code and/or willingness to review and/or

approve a plan of work for exploitation under the United Nations

Convention on the Laws of the Sea (UNCLOS); the Company’s ability

to obtain exploitation contracts or approved plans of work for

exploitation for its areas in the Clarion Clipperton Zone;

regulatory uncertainties and the impact of government regulation

and political instability on the Company’s resource activities;

changes to any of the laws, rules, regulations or policies to which

the Company is subject, including the terms of the final Mining

Code, if any, adopted by ISA and the potential timing thereof; the

impact of extensive and costly environmental requirements on the

Company’s operations; environmental liabilities; the impact of

polymetallic nodule collection on biodiversity in the Clarion

Clipperton Zone and recovery rates of impacted ecosystems; the

Company’s ability to develop minerals in sufficient grade or

quantities to justify commercial operations; the lack of

development of seafloor polymetallic nodule deposit; the Company’s

ability to successfully enter into binding agreements with Allseas

Group S.A. and other parties in which it is in discussions, if any,

including Pacific Metals Company of Japan; uncertainty in the

estimates for mineral resource calculations from certain contract

areas and for the grade and quality of polymetallic nodule

deposits; risks associated with natural hazards; uncertainty with

respect to the specialized treatment and processing of polymetallic

nodules that the Company may recover; risks associated with

collective, development and processing operations, including with

respect to the development of onshore processing capabilities and

capacity and Allseas Group S.A.’s expected development efforts with

respect to the Project Zero offshore system; the Company’s

dependence on Allseas Group S.A.; fluctuations in transportation

costs; fluctuations in metals prices; testing and manufacturing of

equipment; risks associated with the Company’s limited operating

history, limited cash resources and need for additional financing

and risk that such financing may not be available on acceptable

terms, or at all; risks associated with the Company’s intellectual

property; Low Carbon Royalties’ limited operating history; the

sufficiency of our cash on hand and the borrowing ability under our

credit facility with a company related to Allseas Group S.A., as we

expect it to be amended, and credit facility with ERAS Capital

LLC/Gerard Barron to meet our working capital and capital

expenditure requirements, the need for additional financing and our

ability to continue as a going concern; our agreement in principle

to amend our credit facility with a company related to Allseas

Group S.A.; any litigation to which we are a party; and other risks

and uncertainties, any of which could cause the Company’s actual

results to differ from those contained in the forward-looking

statements, that are described in greater detail in the section

entitled “Risk Factors” in the Company’s Annual Report on Form 10-K

and subsequent Quarterly Reports on Form 10-Q filed with the

Securities and Exchange Commission (SEC), including the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the SEC on March 25, 2024, as amended. Any

forward-looking statements contained in this press release speak

only as of the date hereof, and the Company expressly disclaims any

obligation to update any forward-looking statements contained

herein, whether because of any new information, future events,

changed circumstances or otherwise, except as otherwise required by

law.

|

TMC the metals company Inc. |

|

Condensed Consolidated Balance Sheets(in

thousands of US Dollars, except share

amounts)(Unaudited) |

|

|

|

ASSETS |

|

|

As atSeptember

30,2024 |

As atDecember

31,2023 |

|

Current |

|

|

|

|

|

Cash |

|

|

$ |

360 |

|

$ |

6,842 |

|

|

Receivables and prepayments |

|

|

|

2,557 |

|

|

1,978 |

|

|

|

|

|

|

2,917 |

|

|

8,820 |

|

|

Non-current |

|

|

|

|

|

Exploration contracts |

|

|

|

43,150 |

|

|

43,150 |

|

|

Right of use asset |

|

|

|

4,291 |

|

|

5,721 |

|

|

Equipment |

|

|

|

854 |

|

|

1,133 |

|

|

Software |

|

|

|

1,868 |

|

|

1,643 |

|

|

Investment |

|

|

|

8,232 |

|

|

8,429 |

|

|

|

|

|

|

58,395 |

|

|

60,076 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

|

$ |

61,312 |

|

$ |

68,896 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

Current |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

|

48,065 |

|

|

31,334 |

|

|

Short-term debt |

|

|

|

9,175 |

|

|

- |

|

|

|

|

|

|

57,240 |

|

|

31,334 |

|

|

Non-current |

|

|

|

|

|

Deferred tax liability |

|

|

|

10,675 |

|

|

10,675 |

|

|

Royalty liability |

|

|

|

14,000 |

|

|

14,000 |

|

|

Warrants liability |

|

|

|

866 |

|

|

1,969 |

|

|

|

|

|

|

25,541 |

|

|

26,644 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

$ |

82,781 |

|

$ |

57,978 |

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

Common shares (unlimited shares, no par value – issued: 324,131,896

(December 31, 2023 – 306,558,710)) |

|

|

|

463,366 |

|

|

438,239 |

|

|

Class A - J Special Shares |

|

|

|

- |

|

|

- |

|

|

Additional paid in capital |

|

|

|

131,152 |

|

|

122,797 |

|

|

Accumulated other comprehensive loss |

|

|

|

(1,203 |

) |

|

(1,216 |

) |

|

Deficit |

|

|

|

(614,784 |

) |

|

(548,902 |

) |

|

TOTAL EQUITY |

|

|

|

(21,469 |

) |

|

10,918 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

|

$ |

61,312 |

|

$ |

68,896 |

|

|

TMC the metals company Inc. |

|

Condensed Consolidated Statements of Loss and Comprehensive

Loss(in thousands of US Dollars, except share and

per share amounts)(Unaudited) |

|

|

|

|

|

|

Three months ended September 30, |

Nine months ended September

30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

Exploration and evaluation expenses |

|

|

$ |

11,813 |

|

$ |

7,905 |

|

$ |

42,339 |

|

$ |

23,172 |

|

|

General and administrative expenses |

|

|

|

8,149 |

|

|

4,613 |

|

|

22,600 |

|

|

15,958 |

|

|

Operating loss |

|

|

|

19,962 |

|

|

12,518 |

|

|

64,939 |

|

|

39,130 |

|

|

|

|

|

|

|

|

|

|

Other items |

|

|

|

|

|

|

|

Equity-accounted investment loss |

|

|

|

58 |

|

|

119 |

|

|

197 |

|

|

475 |

|

|

Change in fair value of warrant liability |

|

|

|

(1,054 |

) |

|

(117 |

) |

|

(1,103 |

) |

|

1,214 |

|

|

Foreign exchange loss (gain) |

|

|

|

946 |

|

|

14 |

|

|

596 |

|

|

66 |

|

|

Interest income |

|

|

|

(7 |

) |

|

(319 |

) |

|

(125 |

) |

|

(1,092 |

) |

|

Fees and interest on borrowings and credit facilities |

|

|

|

615 |

|

|

252 |

|

|

1,378 |

|

|

529 |

|

|

|

|

|

|

|

|

|

|

Net loss for the period |

|

|

$ |

20,520 |

|

$ |

12,467 |

|

$ |

65,882 |

|

$ |

40,322 |

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

|

- Basic and diluted |

|

|

$ |

0.06 |

|

$ |

0.04 |

|

$ |

0.21 |

|

$ |

0.14 |

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding –

basic and diluted |

|

|

|

323,663,607 |

|

|

294,636,496 |

|

|

318,710,622 |

|

|

282,745,892 |

|

|

TMC the metals company Inc. |

|

Condensed Consolidated Statements of Changes in

Equity(in thousands of US Dollars, except share

amounts)(Unaudited) |

|

Three months ended September 30,

2024 |

Common Shares |

Preferred Shares |

Special Shares |

Additional Paid in Capital |

Accumulated Other Comprehensive Loss |

Deficit |

Total |

|

Shares |

Amount |

|

|

|

|

|

|

|

July 1, 2024 |

322,241,883 |

$ |

460,573 |

$ |

- |

$ |

- |

$ |

125,300 |

|

$ |

(1,216 |

) |

$ |

(594,264 |

) |

$ |

(9,607 |

) |

|

Conversion of restricted share units, net of shares withheld for

taxes |

188,293 |

|

384 |

|

- |

|

- |

|

(384 |

) |

|

- |

|

|

- |

|

|

- |

|

|

Shares issued as per At-the-Market Equity Distribution

Agreement |

1,617,000 |

|

2,279 |

|

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

2,279 |

|

|

Exercise of stock options |

84,720 |

|

130 |

|

- |

|

- |

|

(76 |

) |

|

- |

|

|

- |

|

|

54 |

|

|

Share-based compensation and expenses settled with equity |

- |

|

- |

|

- |

|

- |

|

6,312 |

|

|

- |

|

|

- |

|

|

6,312 |

|

|

Foreign currency translation adjustment |

- |

|

- |

|

- |

|

- |

|

- |

|

|

13 |

|

|

- |

|

|

13 |

|

|

Net loss for the period |

- |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

|

(20,520 |

) |

|

(20,520 |

) |

|

September 30, 2024 |

324,131,896 |

$ |

463,366 |

$ |

- |

$ |

- |

$ |

131,152 |

|

$ |

(1,203 |

) |

$ |

(614,784 |

) |

$ |

(21,469 |

) |

|

Three months ended September 30,

2023 |

Common Shares |

Preferred Shares |

Special Shares |

Additional Paid in Capital |

Accumulated Other Comprehensive Loss |

Deficit |

Total |

|

Shares |

Amount |

|

|

|

|

|

|

|

July 1, 2023 |

281,136,415 |

$ |

345,775 |

$ |

- |

$ |

- |

$ |

188,722 |

|

$ |

(1,216 |

) |

$ |

(502,976 |

) |

$ |

30,305 |

|

|

Exercise of stock options |

120,000 |

|

144 |

|

- |

|

- |

|

(67 |

) |

|

- |

|

|

- |

|

|

77 |

|

|

Exercise of warrant by Allseas |

11,578,620 |

|

70,016 |

|

- |

|

- |

|

(69,900 |

) |

|

- |

|

|

- |

|

|

116 |

|

|

Shares issued to Allseas |

4,150,000 |

|

6,516 |

|

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

6,516 |

|

|

Conversion of restricted share units, net of shares withheld for

taxes |

183,281 |

|

299 |

|

- |

|

- |

|

(299 |

) |

|

- |

|

|

- |

|

|

- |

|

|

Issuance of shares and warrants under Registered Direct Offering,

net of expenses |

7,961,540 |

|

11,349 |

|

- |

|

- |

|

3,179 |

|

|

- |

|

|

- |

|

|

14,528 |

|

|

Share-based compensation and expenses settled with equity |

- |

|

- |

|

- |

|

- |

|

2,533 |

|

|

- |

|

|

- |

|

|

2,533 |

|

|

Net loss for the period |

- |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

|

(12,467 |

) |

|

(12,467 |

) |

|

September 30, 2023 |

305,129,856 |

$ |

434,099 |

$ |

- |

$ |

- |

$ |

124,168 |

|

$ |

(1,216 |

) |

$ |

(515,443 |

) |

$ |

41,608 |

|

|

TMC the metals company Inc. |

|

Condensed Consolidated Statements of Changes in

Equity(in thousands of US Dollars, except share

amounts)(Unaudited) |

|

Nine months ended September 30,

2024 |

Common Shares |

Preferred Shares |

Special Shares |

Additional Paid in Capital |

Accumulated Other Comprehensive Loss |

Deficit |

Total |

|

Shares |

Amount |

|

January 1, 2024 |

306,558,710 |

$ |

438,239 |

$ |

- |

$ |

- |

$ |

122,797 |

|

$ |

(1,216 |

) |

$ |

(548,902 |

) |

$ |

10,918 |

|

| Issuance of shares and warrants under Registered Direct

Offering, net of expenses |

4,500,000 |

|

7,447 |

|

- |

|

- |

|

1,553 |

|

|

- |

|

|

- |

|

|

9,000 |

|

| Conversion of restricted share units, net of shares withheld

for taxes |

9,078,432 |

|

10,869 |

|

- |

|

- |

|

(10,869 |

) |

|

- |

|

|

- |

|

|

- |

|

| Shares issued as per At-the-Market Equity Distribution

Agreement |

3,251,588 |

|

4,866 |

|

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

4,866 |

|

| Exercise of stock options |

715,772 |

|

1,891 |

|

- |

|

- |

|

(1,428 |

) |

|

- |

|

|

- |

|

|

463 |

|

| Share purchase under Employee Share Purchase Plan |

27,394 |

|

54 |

|

- |

|

- |

|

(30 |

) |

|

- |

|

|

- |

|

|

24 |

|

| Share-based compensation and expenses settled with equity |

- |

|

- |

|

- |

|

- |

|

19,129 |

|

|

- |

|

|

- |

|

|

19,129 |

|

| Foreign currency translation adjustment |

- |

|

- |

|

- |

|

- |

|

- |

|

|

13 |

|

|

- |

|

|

13 |

|

| Net loss for the period |

- |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

|

(65,882 |

) |

|

(65,882 |

) |

|

September 30, 2024 |

324,131,896 |

$ |

463,366 |

$ |

- |

$ |

- |

$ |

131,152 |

|

$ |

(1,203 |

) |

$ |

(614,784 |

) |

$ |

(21,469 |

) |

|

Nine months ended September 30,

2023 |

Common Shares |

Preferred Shares |

Special Shares |

Additional Paid in Capital |

Accumulated Other Comprehensive Loss |

Deficit |

Total |

|

Shares |

Amount |

|

January 1, 2023 |

266,812,131 |

$ |

332,882 |

$ |

- |

$ |

- |

$ |

184,960 |

|

$ |

(1,216 |

) |

$ |

(475,121 |

) |

$ |

41,505 |

|

| Exercise of stock options |

120,000 |

|

144 |

|

- |

|

- |

|

(67 |

) |

|

- |

|

|

- |

|

|

77 |

|

| Exercise of warrant by Allseas |

11,578,620 |

|

70,016 |

|

- |

|

- |

|

(69,900 |

) |

|

- |

|

|

- |

|

|

116 |

|

| Shares issued to Allseas |

15,000,000 |

|

15,910 |

|

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

15,910 |

|

| Conversion of restricted share units, net of shares withheld

for taxes |

3,573,993 |

|

3,704 |

|

- |

|

- |

|

(3,674 |

) |

|

- |

|

|

- |

|

|

30 |

|

| Issuance of shares and warrants under Registered Direct

Offering, net of expenses |

7,961,540 |

|

11,349 |

|

- |

|

- |

|

3,179 |

|

|

- |

|

|

- |

|

|

14,528 |

|

| Share purchase under Employee Share Purchase Plan |

83,572 |

|

94 |

|

- |

|

- |

|

(45 |

) |

|

- |

|

|

- |

|

|

49 |

|

| Share-based compensation and expenses settled with equity |

- |

|

- |

|

- |

|

- |

|

9,715 |

|

|

- |

|

|

- |

|

|

9,715 |

|

| Net loss for the period |

- |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

|

(40,322 |

) |

|

(40,322 |

) |

|

September 30, 2023 |

305,129,856 |

$ |

434,099 |

$ |

- |

$ |

- |

|

124,168 |

|

$ |

(1,216 |

) |

$ |

(515,443 |

) |

$ |

41,608 |

|

|

|

|

|

|

|

|

|

|

|

|

TMC the metals company Inc. |

|

Condensed Consolidated Statements of Cash

Flows(in thousands of US

Dollars)(Unaudited) |

|

|

|

|

Nine months endedSeptember

30, |

Nine months endedSeptember

30, |

|

|

2024 |

2023 |

|

Cash provided by (used in) |

|

|

|

|

|

|

|

Operating activities |

|

|

|

Loss for the period |

$ |

(65,882 |

) |

$ |

(40,322 |

) |

|

Items not affecting cash: |

|

|

|

Amortization |

|

280 |

|

|

262 |

|

|

Lease Expense |

|

1,430 |

|

|

318 |

|

|

Accrued interest on credit facilities |

|

150 |

|

|

- |

|

|

Share-based compensation and expenses settled with equity |

|

19,129 |

|

|

9,715 |

|

|

Equity-accounted investment loss |

|

197 |

|

|

475 |

|

|

Change in fair value of warrants liability |

|

(1,103 |

) |

|

1,214 |

|

|

Unrealized foreign exchange |

|

(334 |

) |

|

(24 |

) |

|

Changes in working capital: |

|

|

|

Receivables and prepayments |

|

(580 |

) |

|

(2,393 |

) |

|

Accounts payable and accrued liabilities |

|

17,036 |

|

|

(13,633 |

) |

|

Net cash used in operating activities |

|

(29,677 |

) |

|

(44,388 |

) |

|

|

|

|

|

Investing activities |

|

|

|

Acquisition of equipment and software |

|

(465 |

) |

|

(175 |

) |

|

Net cash used in investing activities |

|

(465 |

) |

|

(175 |

) |

|

|

|

|

|

Financing activities |

|

|

|

Proceeds from registered direct offering |

|

9,000 |

|

|

15,723 |

|

|

Expenses paid for registered direct offering |

|

(142 |

) |

|

(779 |

) |

|

Proceeds from Shares issued from ATM |

|

4,866 |

|

|

- |

|

|

Proceeds from Drawdown of Credit Facilities |

|

4,175 |

|

|

- |

|

|

Proceeds from Drawdown of Loan with Allseas Affiliate |

|

2,000 |

|

|

- |

|

|

Repayment of Loan with Allseas Affiliate |

|

(2,000 |

) |

|

- |

|

|

Proceeds from Drawdown of Loan with Allseas |

|

5,000 |

|

|

- |

|

|

Interest paid on amounts drawn from credit facilities |

|

(73 |

) |

|

- |

|

|

Proceeds from Low Carbon Royalties Investment |

|

- |

|

|

5,000 |

|

|

Proceeds from employee stock plans |

|

24 |

|

|

49 |

|

|

Proceeds from exercise of stock options |

|

463 |

|

|

77 |

|

|

Proceeds from exercise of warrants by Allseas |

|

- |

|

|

116 |

|

|

Proceeds from issuance of shares |

|

- |

|

|

30 |

|

|

Net cash provided by financing activities |

|

23,313 |

|

|

20,216 |

|

|

|

|

|

|

Decrease in cash |

$ |

(6,829 |

) |

$ |

(24,347 |

) |

|

Impact of exchange rate changes on cash |

|

347 |

|

|

24 |

|

|

Cash - beginning of period |

|

6,842 |

|

|

46,876 |

|

|

Cash - end of period |

$ |

360 |

|

$ |

22,553 |

|

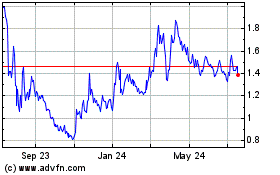

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Jan 2025 to Feb 2025

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Feb 2024 to Feb 2025