Filed Pursuant to Rule 424(b)(5)

Registration No. 333-267479

PROSPECTUS SUPPLEMENT

(to Prospectus dated October 14, 2022)

TMC THE METALS COMPANY INC.

$30,000,000

Common Shares

We have entered into an At-The-Market

Equity Distribution Agreement, or the Distribution Agreement, with Stifel, Nicolaus & Company, Incorporated and Wedbush

Securities Inc., as Sales Agents, relating to the sale of our common shares offered by this prospectus supplement. In accordance with

the terms of the Distribution Agreement, under this prospectus supplement we may offer and sell our common shares, without par value,

having an aggregate offering price of up to $30,000,000 from time to time through the Sales Agents.

Sales of our common shares

under this prospectus supplement, if any, may be made by any method deemed to be an “at the market offering” as defined in

Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act, including block trades and sales

made in ordinary brokers’ transactions on the Nasdaq Global Select Market, or Nasdaq, or otherwise at market prices prevailing at

the time of the sale, at prices related to prevailing market prices or at negotiated prices. The Sales Agents are not required to sell

any specific number or dollar amount of common shares. Each of the Sales Agents has agreed to use its commercially reasonable efforts

to sell on our behalf all of the common shares requested to be sold by us, consistent with its normal trading and sales practices, on

mutually agreed terms among the Sales Agents and us. There is no arrangement for funds to be received in any escrow, trust or similar

arrangement. We also may sell shares to each of the Sales Agents as principal for their own accounts, at a price agreed upon at the time

of sale. If we sell shares to the Sales Agents as principal, we will enter into a separate terms agreement with the Sales Agents setting

forth the terms of such transaction, and we will describe this agreement in a separate pricing supplement.

The Sales Agents will be

entitled to compensation under the terms of the Distribution Agreement at a commission rate equal to up to 3.0% of the gross sales price

per share sold. In connection with the sale of common shares on our behalf, each of the Sales Agents will be deemed to be an “underwriter”

within the meaning of the Securities Act, and the compensation of the Sales Agents will be deemed to be underwriting commissions or discounts.

We have agreed to provide indemnification and contribution to the Sales Agents with respect to certain liabilities, including liabilities

under the Securities Act.

The offering of common shares

pursuant to the Distribution Agreement will terminate upon the earlier of (1) the sale of common shares having an aggregate sales

price of $30,000,000, (2) the expiration date of the registration statement of which this prospectus supplement is a part and (3) the

termination by us or the Sales Agents of the Distribution Agreement pursuant to its terms. See “Plan of Distribution.”

The net proceeds from any

sales under this prospectus supplement will be used as described under the section entitled “Use of Proceeds.” See “Plan

of Distribution” for additional information regarding compensation to be paid to the Sales Agents. The proceeds we receive from

sales of our common shares, if any, will depend on the number of shares actually sold and the offering price of such shares.

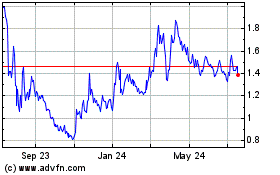

Our common shares and publicly

listed warrants to purchase common shares, or the Public Warrants, are listed on Nasdaq under the symbol “TMC” and “TMCWW”,

respectively. On December 21, 2022, the closing price of our common shares was $0.60 and the closing price for our Public Warrants

was $0.0501.

We are an “emerging

growth company” and “smaller reporting company” under the federal securities laws and, as such, are subject to reduced

public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company and Smaller

Reporting Company.”

Investing in our

common shares involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus

supplement and page 5 of the accompanying prospectus and in the other documents that are incorporated by reference in this

prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The securities offered

by this prospectus supplement have not been qualified for distribution in Canada and may not be offered or sold in Canada.

| Stifel |

Wedbush Securities |

The date of this prospectus supplement is December 22,

2022.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-267479) that we filed with the Securities and Exchange Commission, or SEC, on September 16, 2022, as amended, that was declared effective by the SEC on October 14,

2022. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the offering

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated October 14, 2022, including

the documents incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are

referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus

supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this

prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later

date - for example, a document incorporated by reference in the accompanying prospectus - the statement in the document having the later

date modifies or supersedes the earlier statement. You should read this prospectus supplement and the accompanying prospectus, including

the information incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering,

in their entirety before making an investment decision.

You should rely only on the

information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus, along with the information

contained in any free writing prospectus that we have authorized for use in connection with this offering. If the description of the offering

varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

We have not, and Stifel, Nicolaus & Company, Incorporated and Wedbush Securities Inc. have not, authorized anyone to provide

you with different or additional information. You should assume that the information appearing in this prospectus supplement, the accompanying

prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing

prospectus that we have authorized for use in connection with this offering is accurate only as of the respective dates of those documents.

Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in

this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made; therefore,

such representations, warranties and covenants should not be relied on as accurate representations of the current state of our affairs.

Unless the context otherwise

requires, “the Company,” “we,” “us,” “our” and similar terms refer to TMC the metals company

Inc. and our subsidiaries.

This prospectus supplement,

the accompanying prospectus and the information incorporated by reference includes trademarks, service marks and trade names owned by

us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement

or the accompanying prospectus are the property of their respective owners.

PROSPECTUS

SUPPLEMENT SUMMARY

The following is a summary

of what we believe to be the most important aspects of our business and the offering of our common shares under this prospectus supplement.

We urge you to read this entire prospectus supplement, the accompanying prospectus, including the more detailed consolidated financial

statements, notes to the consolidated financial statements and other information incorporated by reference from our other filings with

the SEC. Investing in our common shares involves risks. Therefore, carefully consider the risk factors set forth in our most recent annual,

quarterly and other filings with the SEC, as well as other information in this prospectus supplement and the accompanying prospectus and

the documents incorporated by reference herein or therein, before purchasing our common shares. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our common shares.

About TMC the metals company Inc.

We are a deep-sea minerals

exploration company focused on the collection and processing of polymetallic nodules found on the seafloor in international waters of

the Clarion Clipperton Zone, or the CCZ, about 1,300 nautical miles south-west of San Diego, California. The CCZ is a geological submarine

fracture zone of abyssal plains and other formations in the Eastern Pacific Ocean, with a length of around 7,240 km (4,500 miles) that

spans approximately 4,500,000 square kilometers (1,700,000 sq. mi). Polymetallic nodules are discrete rocks that sit unattached to the

seafloor, occur in significant quantities in the CCZ and have high concentrations of nickel, manganese, cobalt and copper in a single

rock.

These four metals contained

in the polymetallic nodules are critical for the transition to clean energy. Our resource definition work to date shows that nodules in

our contract areas represent the world’s largest estimated undeveloped source of critical battery metals. If we are able to collect

polymetallic nodules from the seafloor on a commercial scale, we plan to use such nodules to produce three types of metal products: (i) feedstock

for battery cathode precursors (nickel and cobalt sulfates, or intermediate nickel-copper-cobalt matte) for electric vehicles, or EVs,

and renewable energy storage markets, (ii) nickel-copper-cobalt matte and/or copper cathode for EV wiring, clean energy transmission

and other applications and (iii) manganese silicate for manganese alloy production required for steel production. Our mission is

to build a carefully managed shared stock of metal, which we refer to as a metals common, that can be used, recovered and reused for generations

to come. Significant quantities of newly mined metal are required because existing metal stocks are insufficient to meet rapidly rising

demand.

Exploration and exploitation

of seabed minerals in international waters is regulated by the International Seabed Authority, or the ISA, an intergovernmental organization

established pursuant to the 1994 Agreement Relating to the Implementation of the United Nations Convention on the Law of the Sea, or UNCLOS.

The ISA grants contracts to sovereign states or to private contractors who are sponsored by a sovereign state. The ISA requires that a

contractor obtains and maintains sponsorship by a host nation that is a member of the ISA and signatory to UNCLOS and such nation must

maintain effective supervision and regulatory control over such sponsored contractor. The ISA has issued a total of 19 polymetallic nodule

exploration contracts covering approximately 1.28 million km2, or 0.4% of the global seafloor, 17 of which are in the CCZ. We hold exclusive

exploration and commercial rights to three of the 17 polymetallic nodule contract areas in the CCZ: two based on the ISA exploration contracts

through our subsidiaries Nauru Ocean Resources Inc., or NORI, and Tonga Offshore Mining Limited, or TOML, sponsored by the Republic of

Nauru and the Kingdom of Tonga, respectively, and exclusive commercial rights through our subsidiary, DeepGreen Engineering Pte. Ltd.’s,

arrangement with Marawa Research and Exploration Limited, a company owned and sponsored by the Republic of Kiribati.

We have key strategic alliances

with (i) Allseas Group S.A., a leading global offshore contractor, which developed a pilot collection system, which is expected to

be modified into an initial smaller scale commercial production system and serve as the basis for the design of a full-scale commercial

production system and (ii) Glencore International AG, or Glencore, which holds offtake rights to 50% of nickel and copper production

from the NORI area. In addition, we have worked with an engineering firm Hatch Ltd. and consultants Kingston Process Metallurgy Inc. to

develop a near-zero solid waste flowsheet. The pyrometallurgical stages of the flowsheet were tested as part of our pilot plant program

at FLSmidth & Co. A/S’s and XPS Solutions’ (a Glencore subsidiary) facilities and bench-scale hydrometallurgical

refining work is being carried out at SGS SA. The near-zero solid waste flowsheet provides a design that is expected to serve as the basis

for our onshore processing facilities. In March 2022, we entered into a non-binding memorandum of understanding with Epsilon Carbon

Pvt, LTD., or Epsilon Carbon, in which Epsilon Carbon expressed its intent to conduct pre-feasibility work to potentially finance,

engineer, permit, construct and operate a commercial polymetallic nodule processing plant in India.

We are currently focused on

applying for our first exploitation contract from the ISA on the NORI Area D contract area and, subject to regulatory review and approval

by the ISA, intend to start commercial production in 2024. To reach our objective, we are: (i) defining our resource and project

economics, (ii) developing and testing an offshore nodule collection system, (iii) assessing the environmental, social and governance

impacts of offshore nodule collection, and (iv) developing and testing onshore technology and system to process collected polymetallic

nodules into a manganese silicate product, and an intermediate nickel-copper-cobalt matte product and/or end-products like nickel and

cobalt sulfates, and copper cathode. We will need additional funding to reach our expected commercial production in 2024.

We are still in the exploration

phase and have not yet declared mineral reserves. We have yet to obtain exploitation contracts from the ISA to commence commercial scale

polymetallic nodule collection in the CCZ and have yet to obtain the applicable environmental permits and other permits required to build

and operate commercial scale polymetallic nodule processing and refining plants on land.

Cautionary Statements Regarding the NORI

Initial Assessment and TOML Mineral Resource Statement

We have estimated the size

and quality of our resource in the NORI and TOML contracted areas in our SEC Regulation S-K (subpart 1300), referred to herein as the

SEC Mining Rules, compliant Technical Report Summary - Initial Assessment, of the NORI Property, Clarion-Clipperton Zone, Pacific Ocean

dated March 17, 2021, or the NORI Initial Assessment, and Technical Report Summary - TOML Mineral Resource, Clarion - Clipperton

Zone, Pacific Ocean dated March 26, 2021, or the TOML Mineral Resource Statement, respectively, prepared by AMC Consultants Ltd.,

or AMC, each of which is filed as an exhibit to the registration statement to which this prospectus supplement forms a part. We plan to

continue to refine our resource estimate for the NORI and TOML areas and better resolve the project economics. The initial assessment

included in the NORI Initial Assessment Report is a conceptual study of the potential viability of mineral resources in NORI Area D. This

initial assessment indicates that development of the mineral resource in NORI Area D is potentially technically and economically viable;

however, due to the preliminary nature of project planning and design, and the untested nature of the specific seafloor production systems

at a commercial scale, economic viability has not yet been demonstrated.

The NORI Initial Assessment

and TOML Mineral Resource Statement do not include the conversion of mineral resources to mineral reserves.

As used in this prospectus

supplement or in the applicable report summary, the terms “mineral resource,” “measured mineral resource,” “indicated

mineral resource” and “inferred mineral resource”, as applicable, are defined and used in accordance with the SEC Mining

Rules.

You are specifically cautioned

not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves, as defined

by the SEC. You are also cautioned that mineral resources do not have demonstrated economic value. Information concerning our mineral

properties in the NORI and TOML Technical Report Summaries and in this prospectus supplement includes information that has been prepared

in accordance with the requirements of the SEC Mining Rules. Under SEC standards, mineralization, such as mineral resources, may not be

classified as a “reserve” unless the determination has been made that the mineralization would be economically and legally

produced or extracted at the time of the reserve determination. Inferred mineral resources have a high degree of uncertainty as to their

existence and to whether they can be economically or legally commercialized. Under the SEC Mining Rules, estimates of inferred mineral

resources may not form the basis of an economic analysis. It cannot be assumed that all or any part of an inferred mineral resource will

ever be upgraded to a higher category. A significant amount of exploration must be completed in order to determine whether an inferred

mineral resource may be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred

mineral resource exists, that it can be economically or legally commercialized, or that it will ever be upgraded to a higher category.

Approximately 97% of the NORI Area D resource is categorized as measured or indicated.

Likewise, you are cautioned

not to assume that all or any part of measured or indicated mineral resources will ever be upgraded to mineral reserves.

Our Corporate Information

The Company was originally

known as Sustainable Opportunities Acquisition Corp., or SOAC. On September 9, 2021, or the Closing Date, we consummated a business

combination, or the Business Combination, pursuant to the terms of the business combination agreement, or the Business Combination Agreement,

dated as of March 4, 2021, by and among SOAC, 1291924 B.C. Unlimited Liability Company, an unlimited liability company existing under

the laws of British Columbia, Canada, and DeepGreen Metals Inc., a company existing under the laws of British Columbia, Canada, or DeepGreen.

In connection with the closing of the Business Combination, or the Closing, SOAC changed its name to “TMC the metals company Inc.”

Our principal executive offices are located at 595 Howe Street, 10th Floor, Vancouver,

British Columbia V6C 2T5, and our telephone number is (574) 252-9333. We do not have a physical office in Vancouver, British Columbia,

our directors and executive officers work remotely in various countries around the world, and the Vancouver, British Columbia address

disclosed as our principal executive office has been provided because it is our records office required under the Business Corporations

Act (British Columbia). Our website address is www.metals.co. The information contained on, or that can be accessed through,

our website is not and shall not be deemed to be part of this prospectus supplement. We have included our website address in this prospectus

supplement solely as an inactive textual reference. Investors should not rely on any such information in deciding whether to purchase

our common shares or other securities.

All service marks, trademarks

and trade names appearing in this prospectus supplement are the property of their respective owners. We do not intend our use or display

of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by,

these other companies. Solely for convenience, trademarks and tradenames referred to in this prospectus supplement may appear without

the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent

under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Implications of Being an Emerging Growth Company

and a Smaller Reporting Company

We qualify as an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For so long as we remain an emerging

growth company, we may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally

to public companies. These provisions include:

| ● | reduced obligations with respect to financial data, including only being required to present two years

of audited financial statements, in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley

Act of 2002, as amended; |

| ● | reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements

and registration statements; |

| ● | exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden

parachute arrangements; and |

| ● | an exemption from compliance with the requirements of the Public Company Accounting Oversight Board regarding

the communication of critical audit matters in the auditor’s report on financial statements. |

We may take advantage of these

provisions until we no longer qualify as an emerging growth company. We will cease to qualify as an emerging growth company on the date

that is the earliest of: (i) December 31, 2026, (ii) the last day of the fiscal year in which we have more than $1.07 billion

in total annual gross revenues, (iii) the date on which we are deemed to be a “large accelerated filer” under the rules of

the SEC which means the market value of our common shares that is held by non-affiliates exceeds $700 million as of the prior June 30th,

or (iv) the date on which we have issued more than $1.0 billion of non-convertible debt over the prior three-year period. We may

choose to take advantage of some but not all of these reduced reporting burdens. We have taken advantage of certain reduced reporting

requirements in this prospectus supplement. Accordingly, the information contained herein may be different than you might obtain from

other public companies in which you hold equity interests.

In addition, under the JOBS

Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private

companies. We have elected to take advantage of the extended transition period to comply with new or revised accounting standards and

to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of the accounting standards

election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that

are not emerging growth companies, which may make comparison of our financials to those of other public companies more difficult. As a

result of these elections, the information that we provide in this prospectus supplement may be different than the information you may

receive from other public companies in which you hold equity interests. In addition, it is possible that some investors will find our

common shares less attractive as a result of these elections, which may result in a less active trading market for our common shares and

higher volatility in our share price.

We are also a “smaller

reporting company,” meaning that the market value of our shares held by non-affiliates is less than $700 million and our annual

revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company if

either (i) the market value of our shares held by non-affiliates is less than $250 million or (ii) our annual revenue was less

than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is less than

$700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on

exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting

company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K

and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

THE

OFFERING

| Common shares offered by us |

|

Common shares having an aggregate offering price of up to $30,000,000. |

| |

|

|

| Common shares to be outstanding after this offering |

|

Up to 315,529,989 common shares, assuming sales of 50,000,000 common shares in this offering at an offering price of $0.60 per share, the last reported sale price of our common shares on the Nasdaq on December 21, 2022. The actual number of common shares issued will vary depending on the sales price under this offering. |

| |

|

|

| Manner of offering |

|

“At the market offering” that may be made from time to time through our Sales Agents. We may also sell common shares to each of the Sales Agents as principal for its own account. See “Plan of Distribution” on page S-17. |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page S-14 of this prospectus supplement. |

| |

|

|

| Risk factors |

|

You should read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference herein for a discussion of factors to consider carefully before deciding to invest in our common shares. |

| |

|

|

| Nasdaq Global Select Market symbol |

|

“TMC” |

The number of common shares

to be outstanding after this offering is based on 265,529,989 common shares outstanding as of September 30, 2022. The number of outstanding

common shares does not include:

| ● | 25,140,263 common shares and 14,896,783 special shares, which are automatically convertible into common

shares on a one-for-one basis if certain price thresholds are met, issuable upon exercise of share options outstanding as of September 30,

2022 under our stock incentive plans, at a weighted average per option exercise price of $1.11; |

| ● | 5,021,783 common shares issuable upon the vesting of restricted stock units outstanding as of September 30,

2022; |

| ● | 31,789,503 common shares available as of September 30, 2022 for future grant under the TMC Incentive

Equity Plan; |

| ● | 5,211,898 common shares available as of September 30, 2022 for future issuance under the 2021 Employee

Stock Purchase Plan; |

| ● | 136,239,964 common shares reserved for issuance upon conversion of our outstanding special shares, which

are automatically convertible into common shares on a one-for-one basis if certain price thresholds are met; |

| ● | 36,078,620 common shares issuable upon exercise of outstanding warrants to purchase common shares, at

a weighted average per warrant exercise price of $7.81; and |

| ● | 10,850,000 common shares we intend to issue after September 30, 2022 at a price of $1.00 to Allseas

Group SA as the third and final $10 million milestone payment as described in the original and amended Pilot Mining Test Agreement with

Allseas and a $850,000 payment for additional costs related to the successful completion of pilot collection system trials. |

RISK

FACTORS

Investing in our common

shares involves a high degree of risk. Before you decide to invest in our common shares, you should carefully consider the risks and uncertainties

described below together with all other information contained in this prospectus supplement, the accompanying prospectus and in our filings

with the SEC that we have incorporated by reference into this prospectus supplement. See the sections of this prospectus supplement entitled

“Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” If any of the following

risks actually occurs, our business, prospects, operating results and financial condition could suffer materially. In such event, the

trading price of our common shares could decline and you might lose all or part of your investment.

Risks Related to the Company

There can be no assurance that we will be

able to comply with the continued listing standards of Nasdaq, including the Nasdaq’s

minimum closing bid price.

On September 10,

2021, our common shares and Public Warrants began trading on the Nasdaq Global Select Market under the symbols “TMC” and “TMCWW,” respectively.

The Nasdaq has qualitative and quantitative listing criteria. If we are unable to meet any of the Nasdaq listing requirements in the

future, including the $1.00 minimum closing bid price per share discussed below, Nasdaq could determine to delist our common shares.

If in the future Nasdaq delists our common shares from trading on its exchange for failure to meet the listing standards, we and our

shareholders could face significant material adverse consequences including:

| ● | a limited availability of market quotations for our securities; |

| ● | reduced liquidity for our securities; |

| ● | a deterrent for broker-dealers making a market in or otherwise seeking or generating interest in our securities; |

| ● | a deterrent for certain institutions and persons from investing in our securities at all; |

| ● | a determination that our common shares are “penny

stock” which will require brokers trading in our common shares

to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for

our securities; |

| ● | a limited amount of news and analyst coverage; and |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

On December 5,

2022, we received a written notice from Nasdaq because the closing bid price of our common shares has been below the minimum $1.00

closing bid price per share since October 21, 2022. To regain compliance, the closing bid price of our common shares must be at

least $1.00 per share (the “Minimum Bid Requirement”) for a minimum of 10 consecutive business days by June 5, 2023

(the “Grace Period”). If we do not achieve compliance with the Minimum Bid Requirement by the end of the Grace Period,

we may be eligible for an additional 180 calendar day period to regain compliance. To qualify, we would be required, among other

things, to meet the continued listing requirement for the market value of our publicly held shares and all other Nasdaq initial

listing standards, with the exception of the bid price requirement, and would need to provide written notice to Nasdaq of our

intention and plan to cure the deficiency during the second compliance period by effecting a reverse stock split if necessary.

However, if it appears to Nasdaq staff that we will not be able to cure the deficiency, or if we do not meet the other listing

standards, Nasdaq could provide notice that our common shares and Public Warrants will be subject to delisting. In the event we

receive notice that our common shares and Public Warrants are being delisted, we would be entitled to appeal the determination to a

Nasdaq Listing Qualifications Panel and request a hearing.

In the event that our common

shares and Public Warrants are delisted from Nasdaq and are not eligible for quotation or listing on another market or exchange, trading

of our common shares and warrants could be conducted only in the over-the-counter market or on an electronic bulletin board established

for unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of,

or obtain accurate price quotations for, our common shares and Public Warrants, and there would likely also be a reduction in our coverage

by securities analysts and the news media, which could cause the price of our common shares and Public Warrants to decline further.

Additional Risks Related to This Offering

Resales of our common shares in the public market during this

offering by our shareholders may cause the market price of our common shares to fall.

We may issue common shares from time to time in

connection with this offering. The issuance from time to time of these common shares, or our ability to issue these common shares in this

offering, could result in re-sales of our common shares by our current shareholders concerned about the potential dilution of their holdings.

In turn, these re-sales could have the effect of depressing the market price for our common shares.

We have broad discretion in how we use the net proceeds of this

offering, and we may not use these proceeds effectively or in ways with which you agree.

We have not designated any portion of the net proceeds

from this offering to be used for any particular purpose. Our management will have broad discretion as to the application of the net proceeds

of this offering and could use them for purposes other than those contemplated at the time of this offering. Our shareholders may not

agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net

proceeds for corporate purposes that may not increase the market price of our common shares.

If you purchase common shares in this offering, you may suffer

immediate dilution of your investment.

The offering price per share

in this offering may exceed the net tangible book value per common share outstanding prior to this offering. Because the sales of the

common shares offered hereby will be made directly into the market, the prices at which we sell these shares will vary and these variations

may be significant. Purchasers of the common shares we sell, as well as our existing shareholders, will experience significant dilution

if we sell shares at prices significantly below the price at which they invested.

Investors in this offering may experience

future dilution.

In order to raise additional

capital, we may in the future offer additional common shares or other securities convertible into, or exchangeable for, our common shares

at prices that may not be the same as the price per share in this offering. We cannot assure you that we will be able to sell our common

shares or other related securities in any other offering at a price per share that is equal to or greater than the price per share paid

by investors in this offering. If the price per share at which we sell additional common shares or related securities in future transactions

is less than the price per share in this offering, investors who purchase our common shares in this offering will suffer dilution in their

investment.

The actual number of common shares we will

issue under the Distribution Agreement, at any one time or in total, is uncertain.

Subject to certain limitations

in the Distribution Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the Sales Agents

at any time throughout the term of the Distribution Agreement. The per share price of the common shares that are sold by the Sales Agents

after delivering a placement notice will fluctuate based on the market price of our common shares during the sales period and limits we

set with the Sales Agents. Because the price per share of each common share sold will fluctuate based on the market price of our common

shares during the sales period, it is not possible at this stage to predict the number of common shares that will be ultimately issued.

Sales of a significant number of common

shares in the public markets, or the perception that such sales could occur, could depress the market price of our common shares.

Sales of a substantial number

of our common shares in the public markets, or the perception that such sales could occur, could depress the market price of our common

shares and impair our ability to raise capital through the sale of additional equity or equity-based securities. We cannot predict the

effect that future sales of our common shares would have on the market price of our common shares.

The common shares offered hereby will be

sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase common

shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different

outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares

sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their common shares as a result

of share sales made at prices lower than the prices they paid.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and the documents incorporated by reference therein include forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, that relate to future events or our future financial performance and involve known and unknown

risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially

from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words

such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” “targets,” “likely,”

“will,” “would,” “could,” “should,” “continue,” and similar expressions or

phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. Although we believe that we have a reasonable basis for each forward-looking statement contained

in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference therein, we caution you that these

statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors

that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements,

to differ. The sections in our periodic reports, including our most recent Annual Report on Form 10-K, as revised or supplemented

by our subsequent Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K, entitled “Business,” “Risk

Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well

as other sections in this prospectus supplement, the accompanying prospectus and the other documents or reports incorporated by reference

therein, discuss some of the factors that could contribute to these differences. These forward-looking statements include, among other

things, statements about:

| ● | our use of the net proceeds from this offering; |

| ● | the commercial and technical feasibility of seafloor polymetallic nodule collection and processing; |

| ● | our and our partners’ development and operational plans, including with respect to the planned uses

of polymetallic nodules, where and how nodules will be obtained and processed, the expected environmental, social and governance impacts

thereof and our plans to assess these impacts and the timing and scope of these plans, including the timing and expectations with respect

to our receipt of exploitation contracts and our potential commercialization plans; |

| ● | the supply and demand for battery metals and battery cathode feedstocks, copper cathode and manganese

ores; |

| ● | the future prices of battery metals and battery cathode feedstocks, copper cathode and manganese ores; |

| ● | the timing and content of ISA’s final exploitation regulations that will create the legal and technical

framework for exploitation of polymetallic nodules in the CCZ; |

| ● | government regulation of mineral extraction from the deep seafloor and changes in mining laws and regulations; |

| ● | technical, operational, environmental, social and governance risks of developing and deploying equipment

to collect polymetallic nodules at sea and to process such nodules on land; |

| ● | the sources and timing of potential revenue as well as the timing and amount of estimated future production,

costs of production, other expenses, capital expenditures and requirements for additional capital; |

| ● | cash flow provided by operating activities; |

| ● | the expected activities of our partners under our key strategic relationships; |

| ● | the sufficiency of our cash on hand to meet our working capital and capital expenditure requirements and

the need for additional financing; |

| ● | our ability to raise financing in the future and the nature of such financings; |

| ● | any litigation to which we are a party; |

| ● | claims and limitations on insurance coverage; |

| ● | our plans to mitigate our material weaknesses in our internal control over financial reporting; |

| ● | the restatement of our financial statements; |

| ● | geological, metallurgical and geotechnical studies and opinions; |

| ● | mineral resource estimates; |

| ● | our status as an emerging growth company, non-reporting Canadian issuer and passive foreign investment

company; |

| ● | dependence on key management personnel and executive officers; |

| ● | political and market conditions beyond our control; |

| ● | COVID-19 and the impact of the COVID-19 pandemic on our business; and |

| ● | our financial performance. |

We may not actually achieve

the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking

statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking

statements we make. We have included important cautionary statements in this prospectus supplement, the accompanying prospectus and in

the documents incorporated by reference therein, particularly in the “Risk Factors” section, that we believe could cause actual

results or events to differ materially from the forward-looking statements that we make. For a summary of such factors, please refer to

the section entitled “Risk Factors” in this prospectus supplement and the accompanying prospectus, as updated and supplemented

by the discussion of risks and uncertainties under “Risk Factors” contained in any supplements to this prospectus supplement

and in our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q

or our Current Reports on Form 8-K, as well as any amendments thereto, as filed with the SEC and which are incorporated herein by

reference. The information contained in this document is believed to be current as of the date of this document. We do not intend to update

any of the forward-looking statements after the date of this document to conform these statements to actual results or to changes in our

expectations, except as required by law.

In light of these assumptions,

risks and uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus supplement, the

accompanying prospectus or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue

reliance on the forward-looking statements, which speak only as of the date of this prospectus supplement or the date of the document

incorporated by reference in this prospectus supplement. We are not under any obligation, and we expressly disclaim any obligation, to

update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking

statements attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section.

USE

OF PROCEEDS

We may issue and sell our

common shares having aggregate gross sales proceeds of up to $30.0 million from time to time pursuant to the Distribution Agreement. Because

there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions

and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any common shares under or

fully utilize the Distribution Agreement as a source of financing.

We currently intend to use

the net proceeds, if any, for working capital and general corporate purposes. Pending these uses, we intend to invest the net proceeds

in investment-grade, interest-bearing securities.

DILUTION

If you invest in this offering,

your ownership interest will be diluted to the extent of the difference between the public offering price per share and the as adjusted

net tangible book value per share after giving effect to this offering. We calculate net tangible book value per share by dividing the

net tangible book value, which is tangible assets less total liabilities, by the number of outstanding common shares. Dilution represents

the difference between the amount per share paid by purchasers of common shares in this offering and the as adjusted net tangible book

value per share immediately after giving effect to this offering. Our net tangible book value as of September 30, 2022 was approximately

$35.1 million, or $0.13 per share.

After giving effect to the

sale of our common shares in the aggregate amount of $30.0 million at an assumed offering price of $0.60 per share, which was the

last reported sale price of our common shares on the Nasdaq Global Select Market on December 21, 2022 and after deducting offering

commissions and estimated offering expenses payable by us, our net tangible book value as of September 30, 2022 would have been $63.9

million, or $0.20 per share. This represents an immediate increase in the net tangible book value of $0.07 per share to our

existing shareholders and an immediate dilution in net tangible book value of $0.40 per share to new investors. The following table

illustrates this per share dilution:

| Assumed offering price per share | |

| | | |

$ | 0.60 | |

| Net tangible book value per share as of September 30, 2022 | |

$ | 0.13 | | |

| | |

| Increase per share attributable to this offering | |

| 0.07 | | |

| | |

| As adjusted net tangible book value per share as of September 30, 2022 after this offering | |

| | | |

| 0.20 | |

| Dilution per share to new investors | |

| | | |

$ | 0.40 | |

The table above assumes

for illustrative purposes that an aggregate of 50,000,000 common shares are sold at a price of $0.60 per share, which was the last

reported sale price of our common shares on the Nasdaq Global Select Market on December 21, 2022, for aggregate gross proceeds

of $30.0 million. The shares sold in this offering, if any, will be sold from time to time at various prices. An increase of $0.25

per share in the price at which the common shares are sold from the assumed offering price of $0.60 per share shown in the table

above, assuming all of our common shares in the aggregate amount of $30.0 million during the term of the Distribution Agreement is

sold at that price, would increase our as adjusted net tangible book value per share after the offering to $0.21 per share and would

increase the dilution in net tangible book value per share to new investors in this offering to $0.64 per share, after

deducting offering commissions and estimated offering expenses payable by us. A decrease of $0.25 per share in the price at which

the common shares are sold from the assumed offering price of $0.60 per share shown in the table above, assuming all of our

common shares in the amount of $30.0 million during the term of the Distribution Agreement is sold at that price, would decrease our

as adjusted net tangible book value per share after the offering to $0.18 per share and would decrease the dilution in net

tangible book value per share to new investors in this offering to $0.17 per share, after deducting offering commissions and

estimated offering expenses payable by us. This information is supplied for illustrative purposes only and may differ based on the

actual offering price and the actual number of shares offered.

The above discussion is based

on 265,529,989 common shares outstanding as of September 30, 2022. It does not include:

| ● | 25,140,263 common shares and 14,896,783 special shares, which are automatically convertible into common

shares on a one-for-one basis if certain price thresholds are met, issuable upon exercise of share options outstanding as of September 30,

2022 under our stock incentive plans, at a weighted average per option exercise price of $1.11; |

| ● | 5,021,783 common shares issuable upon the vesting of restricted stock units outstanding as of September 30,

2022; |

| ● | 31,789,503 common shares available as of September 30, 2022 for future grant under the TMC Incentive

Equity Plan; |

| ● | 5,211,898 common shares available as of September 30, 2022 for future issuance under the 2021 Employee

Stock Purchase Plan; |

| ● | 136,239,964 common shares reserved for issuance upon conversion of our outstanding special shares, which

are automatically convertible into common shares on a one-for-one basis if certain price thresholds are met; |

| ● | 36,078,620 common shares issuable upon exercise of outstanding warrants to purchase common shares, at

a weighted average per warrant exercise price of $7.81; and |

| ● | 10,850,000 common shares we intend to issue after September 30, 2022 at a price of $1.00 to Allseas

Group SA as the third and final $10 million milestone payment as described in the original and amended Pilot Mining Test Agreement with

Allseas and a $850,000 payment for additional costs related to the successful completion of pilot collection system trials. |

PLAN

OF DISTRIBUTION

We have entered into the Distribution

Agreement with Stifel, Nicolaus & Company, Incorporated and Wedbush Securities Inc., collectively referred to as Sales Agents

and each individually a Sales Agent, under which we may, over a period of time and from time to time, offer and sell our common shares

having an aggregate sales price of up to $30.0 million through the Sales Agents or to the Sales Agents. A copy of the Distribution Agreement

will be filed as an exhibit to a Current Report on Form 8-K and will be incorporated by reference into this prospectus supplement.

The sales, if any, of our common shares made under the Distribution Agreement, and to which this prospectus supplement relates, will be

made in “at-the-market” offerings as defined in Rule 415 under the Securities Act, including sales made directly on the

Nasdaq Global Select Market, the existing trading market for our common shares, or sales made to or through a market maker or through

an electronic communications network. In addition, our common shares may be offered and sold by such other methods, including privately

negotiated transactions, as we and the Sales Agents agree to in writing. The sales may be made at market prices prevailing at the time

of the sale, at prices related to prevailing market prices or at negotiated prices.

We also may sell our common

shares to the Sales Agents, as principal for their own respective accounts, at a price per share agreed upon at the time of sale. If we

sell our common shares to the Sales Agents, as principal, we will enter into a separate terms agreement with the Sales Agents, and we

will describe the agreement in a separate prospectus supplement or pricing supplement.

From time to time during the

term of the Distribution Agreement, we may deliver a placement notice to a Sales Agent specifying the length of the selling period, the

amount of common shares to be sold and the minimum price below which sales may not be made.

The Sales Agents have agreed

that, upon receipt of a placement notice from us that is accepted by such Sales Agent, and is subject to the terms and conditions of the

Distribution Agreement, the applicable Sales Agent will use its commercially reasonable efforts consistent with its normal trading and

sales practices to sell such common shares on such terms. We or the applicable Sales Agent may suspend the offering of the common shares

at any time upon proper notice to the other party, upon which the selling period will immediately terminate. Settlement for sales of the

common shares is expected to occur on the second business day, that is also a trading day, following the date on which any sales were

made, or on some other date that is agreed upon by us and the applicable Sales Agent in connection with a particular transaction. The

obligation of the Sales Agents under the Distribution Agreement to sell common shares pursuant to any placement notice is subject to a

number of conditions, which the Sales Agents reserve the right to waive in their sole discretion.

If acting as a sales agent,

the applicable Sales Agent will provide to us written confirmation following the close of trading on the Nasdaq Global Select Market on

each trading day on which shares are sold under the Distribution Agreement. Each confirmation will include the number of shares sold on

that day, the aggregate gross sales proceeds of the shares, the net proceeds to us (after deduction of any transaction fees, transfer

taxes or similar taxes or fees imposed by any governmental entity or self-regulatory organization in respect of such sales) and the aggregate

compensation payable by us to the applicable Sales Agent with respect to such sales. We will report, on a quarterly basis, the number

of shares sold by or through the Sales Agents during such quarterly fiscal period, the net proceeds received by the Company and the aggregate

compensation paid by the Company to the Sales Agents with respect to such sales.

We will pay the Sales Agents

an aggregate commission of up to 3.0% of the gross sales price per share for any shares sold through it as an agent under the Distribution

Agreement. We have agreed to reimburse the Sales Agents for certain fees and expenses in connection with this offering, including the

fees and disbursements of counsel to the Sales Agents, in an amount not to exceed $75,000 in the aggregate. We estimate that the total

expenses of this offering payable by us, excluding commissions and reimbursements payable to the Sales Agents under the Distribution Agreement,

will be approximately $275,000.

In connection with the sale

of our common shares on our behalf, either Sales Agent may be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation paid to the Sales Agents may be deemed to be underwriting commissions or discounts. We have agreed in the Distribution

Agreement to provide indemnification and contribution to the Sales Agents against certain civil liabilities, including liabilities under

the Securities Act.

Sales of the common shares

as contemplated by this prospectus supplement will be settled through the facilities of the Depository Trust Company or by such other

means as we and the Sales Agents may agree upon. The offering of the common shares pursuant to the Distribution Agreement will terminate

upon the earliest of (1) the sale of the maximum aggregate amount of our common shares subject to the Distribution Agreement, (2) the

expiration date of the registration statement of which this prospectus supplement is a part, and (3) the termination of the Distribution

Agreement by any party at any time upon three days’ notice, or by the Sales Agents, upon notice to us, in certain circumstances,

including certain bankruptcy events relating to us or any material subsidiary, our failure to maintain a listing of our common shares

on the Nasdaq Global Select Market or the occurrence of a material adverse effect on our Company, as defined in the Distribution Agreement.

The Sales Agents and their

affiliates are full service financial institutions engaged in various activities, which may include sales and trading, commercial and

investment banking, advisory, investment management, investment research, principal investment, hedging, market making, brokerage and

other financial and non-financial activities and services. The Sales Agents and their affiliates have provided, and may in the future

provide, a variety of these services to us and to persons and entities with relationships with us, for which they received or will receive

customary fees and expenses.

In the ordinary course of

their various business activities, the Sales Agents and their affiliates, officers, directors and employees may purchase, sell or hold

a broad array of investments and actively trade securities, derivatives, loans, commodities, currencies, credit default swaps and other

financial instruments for their own accounts and for the accounts of their customers, and such investment and trading activities may involve

or relate to our assets, securities and/or instruments (directly, as collateral securing other obligations or otherwise) and/or persons

and entities with relationships with us. The Sales Agents and their affiliates may also communicate independent investment recommendations,

market color or trading ideas and/or publish or express independent research views in respect of such assets, securities or instruments

and may at any time hold, or recommend to clients that they should acquire, long and/or short positions in such assets, securities and

instruments.

Selling Restrictions

Other than in the United States,

no action has been taken by us or the Sales Agents that would permit a public offering of the common shares offered by this prospectus

supplement in any jurisdiction where action for that purpose is required. The common shares offered by this prospectus supplement may

not be offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements in

connection with the offer and sale of any such shares be distributed or published in any jurisdiction, except under circumstances that

will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus

supplement comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution

of this prospectus supplement. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy any

common shares offered by this prospectus supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

You should be aware that the

laws and practices of certain countries require investors to pay stamp taxes and other charges in connection with purchases of securities.

Notice to Prospective Investors in the European

Economic Area

In relation to each Member

State of the European Economic Area (each a “Relevant State”), none of our common shares have been offered or will be offered

pursuant to the offering to the public in that Relevant State prior to the publication of a prospectus in relation to the shares which

has been approved by the competent authority in that Relevant State or, where appropriate, approved in another Relevant State and notified

to the competent authority in that Relevant State, all in accordance with the Prospectus Regulation, except that offers of shares may

be made to the public in that Relevant State at any time under the following exemptions under the Prospectus Regulation:

| a. | to any legal entity which is a qualified investor as defined under the Prospectus Regulation; |

| b. | to fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus

Regulation), subject to obtaining the prior consent of representatives for any such offer; or |

| c. | in any other circumstances falling within Article 1(4) of the Prospectus Regulation,

provided that no such offer of shares shall require the Issuer or the Sales Agents to publish a prospectus pursuant to Article 3

of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation. |

Each person in a Relevant

State who initially acquires any shares or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and

with us and the Sales Agents that it is a qualified investor within the meaning of the Prospectus Regulation.

In the case of any shares

being offered to a financial intermediary as that term is used in Article 5(1) of the Prospectus Regulation, each such financial

intermediary will be deemed to have represented, acknowledged and agreed that the shares acquired by it in the offer have not been acquired

on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances

which may give rise to an offer to the public other than their offer or resale in a Relevant State to qualified investors, in circumstances

in which the prior consent of the Sales Agent has been obtained to each such proposed offer or resale.

We, the Sales Agents and our

respective affiliates will rely upon the truth and accuracy of the foregoing representations, acknowledgements and agreements.

For the purposes of this provision,

the expression an “offer to the public” in relation to any shares in any Relevant State means the communication in any form

and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide

to purchase or subscribe for any shares, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

The above selling restriction

is in addition to any other selling restrictions set out below.

Notice to Prospective Investors in the United

Kingdom

In relation to the United

Kingdom (“UK”), no shares have been offered or will be offered pursuant to the offering to the public in the UK prior to the

publication of a prospectus in relation to the shares which has been approved by the Financial Conduct Authority in the UK in accordance

with the UK Prospectus Regulation and the FSMA, except that offers of shares may be made to the public in the UK at any time under the

following exemptions under the UK Prospectus Regulation and the FSMA:

| a. | to any legal entity which is a qualified investor as defined under the UK Prospectus Regulation; |

| b. | to fewer than 150 natural or legal persons (other than qualified investors as defined under the UK Prospectus

Regulation), subject to obtaining the prior consent of representatives for any such offer; or |

| c. | at any time in other circumstances falling within section 86 of the FSMA, provided that no such offer

of shares shall require the Issuer or the Sales Agents to publish a prospectus pursuant to Section 85 of the FSMA or Article 3

of the UK Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the UK Prospectus Regulation. |

Each person in the UK who

initially acquires any shares or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and with us

and the Sales Agents that it is a qualified investor within the meaning of the UK Prospectus Regulation.

In the case of any shares

being offered to a financial intermediary as that term is used in Article 5(1) of the UK Prospectus Regulation, each such financial

intermediary will be deemed to have represented, acknowledged and agreed that the shares acquired by it in the offer have not been acquired

on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances

which may give rise to an offer to the public other than their offer or resale in the UK to qualified investors, in circumstances in which

the prior consent of the Sales Agents has been obtained to each such proposed offer or resale.

We, the Sales Agents and our

respective affiliates will rely upon the truth and accuracy of the foregoing representations, acknowledgements and agreements.

For the purposes of this provision,

the expression an “offer to the public” in relation to any in the UK means the communication in any form and by any means

of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide to purchase or

subscribe for any shares, the expression “UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic

law by virtue of the European Union (Withdrawal) Act 2018, and the expression “FSMA” means the Financial Services and Markets

Act 2000.

This document is for distribution

only to persons who (i) have professional experience in matters relating to investments and who qualify as investment professionals

within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended,

the “Financial Promotion Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high

net worth companies, unincorporated associations etc.”) of the Financial Promotion Order, (iii) are outside the United Kingdom,

or (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of

the Financial Services and Markets Act 2000, as amended (“FSMA”)) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”).

This document is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any

investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with

relevant persons.

Notice to Prospective Investors in Switzerland

The shares may not be publicly

offered in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any other stock exchange or regulated

trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses

under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of

the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither

this document nor any other offering or marketing material relating to the shares or the offering may be publicly distributed or otherwise

made publicly available in Switzerland.

Neither this document nor

any other offering or marketing material relating to the offering, the Company, the shares have been or will be filed with or approved

by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of shares will not be supervised

by, the Swiss Financial Market Supervisory Authority FINMA (FINMA), and the offer of shares has not been and will not be authorized under

the Swiss Federal Act on Collective Investment Schemes (“CISA”). The investor protection afforded to acquirers of interests

in collective investment schemes under the CISA does not extend to acquirers of shares.

Notice to Prospective Investors in the Dubai

International Financial Centre

This prospectus relates to

an Exempt Offer in accordance with the Offered Securities Rules of the Dubai Financial Services Authority (“DFSA”). This

prospectus is intended for distribution only to persons of a type specified in the Offered Securities Rules of the DFSA. It must

not be delivered to, or relied on by, any other person. The DFSA has no responsibility for reviewing or verifying any documents in connection

with Exempt Offers. The DFSA has not approved this prospectus nor taken steps to verify the information set forth herein and has no responsibility

for the prospectus. The shares to which this prospectus relates may be illiquid and/or subject to restrictions on their resale. Prospective

purchasers of the shares offered should conduct their own due diligence on the shares. If you do not understand the contents of this prospectus

you should consult an authorized financial advisor.

Notice to Prospective Investors in Australia

No placement document, prospectus,

product disclosure statement or other disclosure document has been lodged with the Australian Securities and Investments Commission (“ASIC”),

in relation to the offering. This prospectus does not constitute a prospectus, product disclosure statement or other disclosure document

under the Corporations Act 2001 (the “Corporations Act”), and does not purport to include the information required for a prospectus,

product disclosure statement or other disclosure document under the Corporations Act.

Any offer in Australia of

the shares may only be made to persons (the “Exempt Investors”) who are “sophisticated investors” (within the

meaning of section 708(8) of the Corporations Act), “professional investors” (within the meaning of section 708(11) of

the Corporations Act) or otherwise pursuant to one or more exemptions contained in section 708 of the Corporations Act so that it is lawful

to offer the shares without disclosure to investors under Chapter 6D of the Corporations Act.

The shares applied for by

Exempt Investors in Australia must not be offered for sale in Australia in the period of 12 months after the date of allotment under the

offering, except in circumstances where disclosure to investors under Chapter 6D of the Corporations Act would not be required pursuant

to an exemption under section 708 of the Corporations Act or otherwise or where the offer is pursuant to a disclosure document which complies

with Chapter 6D of the Corporations Act. Any person acquiring shares must observe such Australian on-sale restrictions.

This prospectus contains general

information only and does not take account of the investment objectives, financial situation or particular needs of any particular person.

It does not contain any securities recommendations or financial product advice. Before making an investment decision, investors need to

consider whether the information in this prospectus is appropriate to their needs, objectives and circumstances, and, if necessary, seek

expert advice on those matters.

Notice to Prospective Investors in Hong Kong

The securities have not been

offered or sold and will not be offered or sold in Hong Kong, by means of any document, other than (a) to “professional investors”

as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (b) in

other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32)

of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance. No advertisement, invitation or document

relating to the securities has been or may be issued or has been or may be in the possession of any person for the purposes of issue,

whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public of

Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to securities which are or are

intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities

and Futures Ordinance and any rules made under that Ordinance.

Notice to Prospective Investors in Japan

The securities have not been

and will not be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948, as amended) and, accordingly,

will not be offered or sold, directly or indirectly, in Japan, or for the benefit of any Japanese Person or to others for re-offering

or resale, directly or indirectly, in Japan or to any Japanese Person, except in compliance with all applicable laws, regulations and

ministerial guidelines promulgated by relevant Japanese governmental or regulatory authorities in effect at the relevant time. For the

purposes of this paragraph, “Japanese Person” shall mean any person resident in Japan, including any corporation or other

entity organized under the laws of Japan.

Notice to Prospective Investors in Singapore

This prospectus has not been

registered as a prospectus with the Monetary Authority of Singapore. Accordingly, the securities were not offered or sold or caused to

be made the subject of an invitation for subscription or purchase and will not be offered or sold or caused to be made the subject of

an invitation for subscription or purchase, and this prospectus or any other document or material in connection with the offer or sale,

or invitation for subscription or purchase, of the securities, has not been circulated or distributed, nor will it be circulated or distributed,